Building and monetizing no-code AI trading agents for DeFi automation is no longer the realm of advanced programmers. The rise of intuitive platforms means anyone with a strategy and an appetite for automation can deploy sophisticated trading bots in minutes. As decentralized finance (DeFi) matures, these tools are transforming how individuals approach yield optimization, liquidity management, and autonomous crypto trading.

Why No-Code AI Trading Agents Are Reshaping DeFi

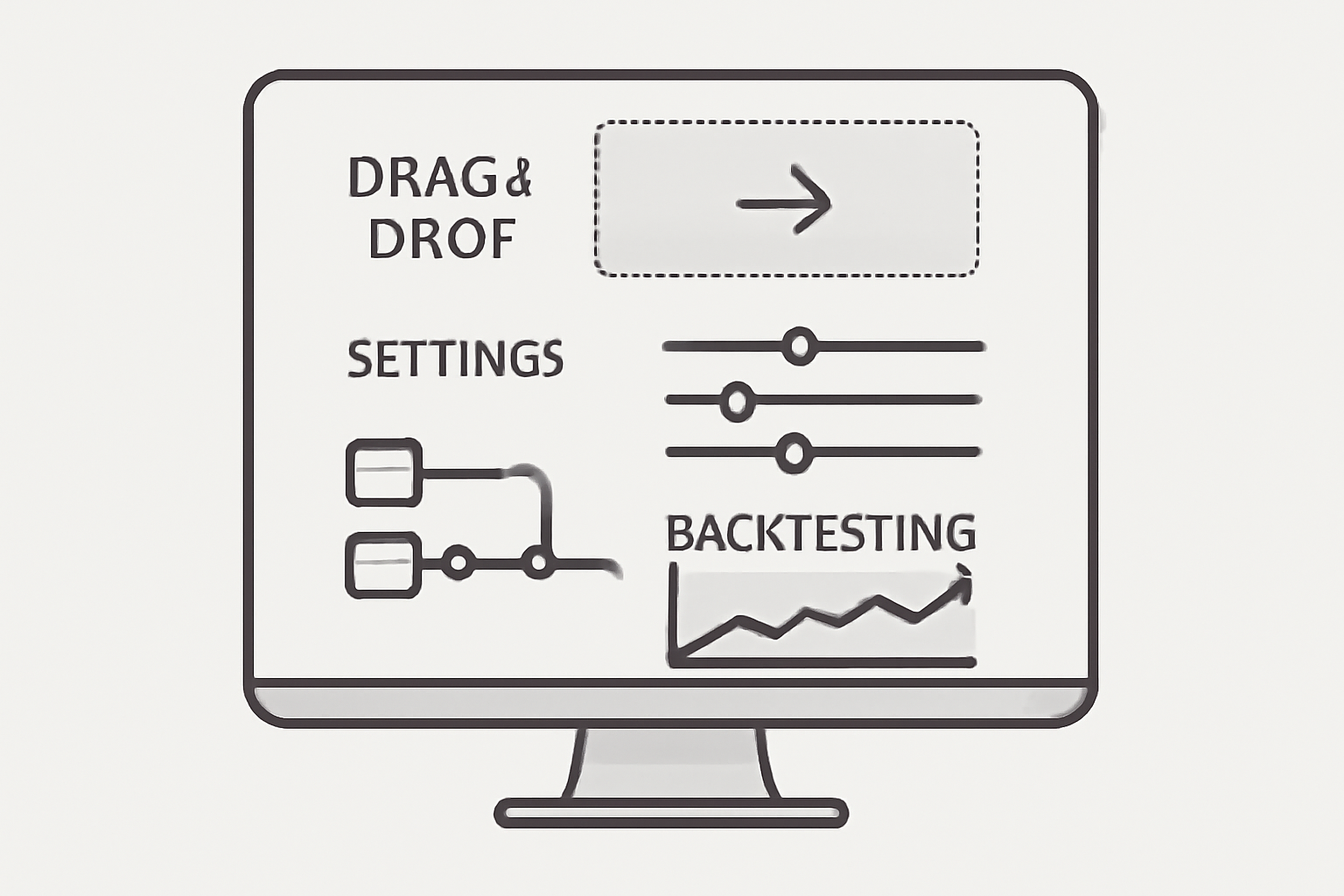

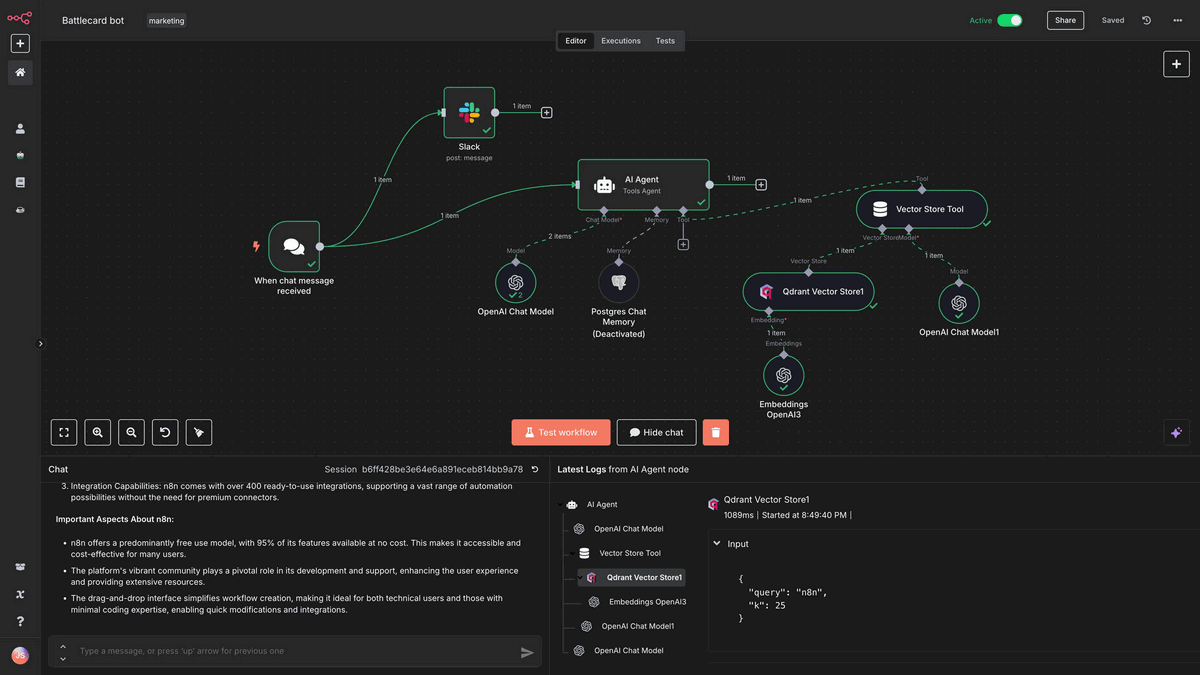

The evolution of DeFi automation tools has been swift. Early DeFi required manual interaction with protocols, staking, swapping, or yield farming all demanded time and technical know-how. Now, platforms like Griffin AI’s Agent Builder, Cod3x, Agentics, and Crestal Network offer drag-and-drop interfaces to build AI-powered agents that execute trades, optimize yields, or manage risk autonomously.

This democratization comes at a critical moment. With the proliferation of cross-chain protocols and rapid-fire market dynamics, human traders struggle to keep pace. No-code AI agents fill this gap by running 24/7 strategies based on real-time data feeds and customizable parameters, without requiring a single line of code.

Choosing the Right No-Code Platform for Your Crypto Agent

Your first step is selecting a platform that aligns with your goals and technical comfort level. Consider:

- User Experience: Does the interface make it easy to set up strategies?

- Supported Protocols: Can you access your preferred chains (Ethereum, Solana, etc. )?

- Customization: Are there robust options for backtesting and parameter tuning?

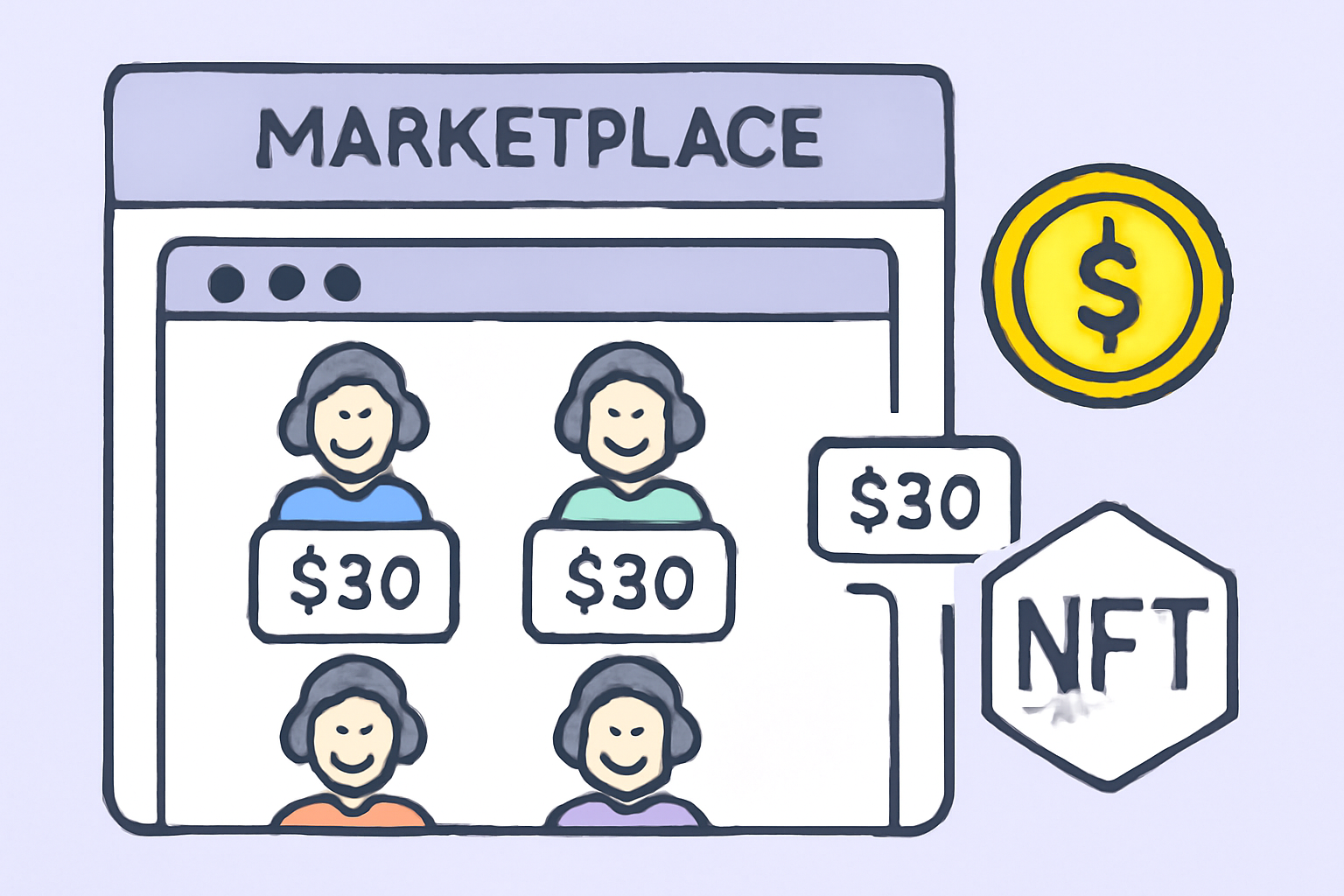

- Community and Support: Is there an active user base or marketplace for sharing agents?

Crestal Network exemplifies this new wave, its “society of self-employed AI agents” lets users deploy bots or lease them out to others for passive income. Similarly, StockHero focuses on preset strategies but allows customization through visual workflows. The most advanced platforms even facilitate tokenization of your agent’s performance or access rights.

The Anatomy of an Effective No-Code AI Trading Agent

No matter which platform you choose, successful deployment hinges on clear strategy definition. Start by breaking down your core objectives:

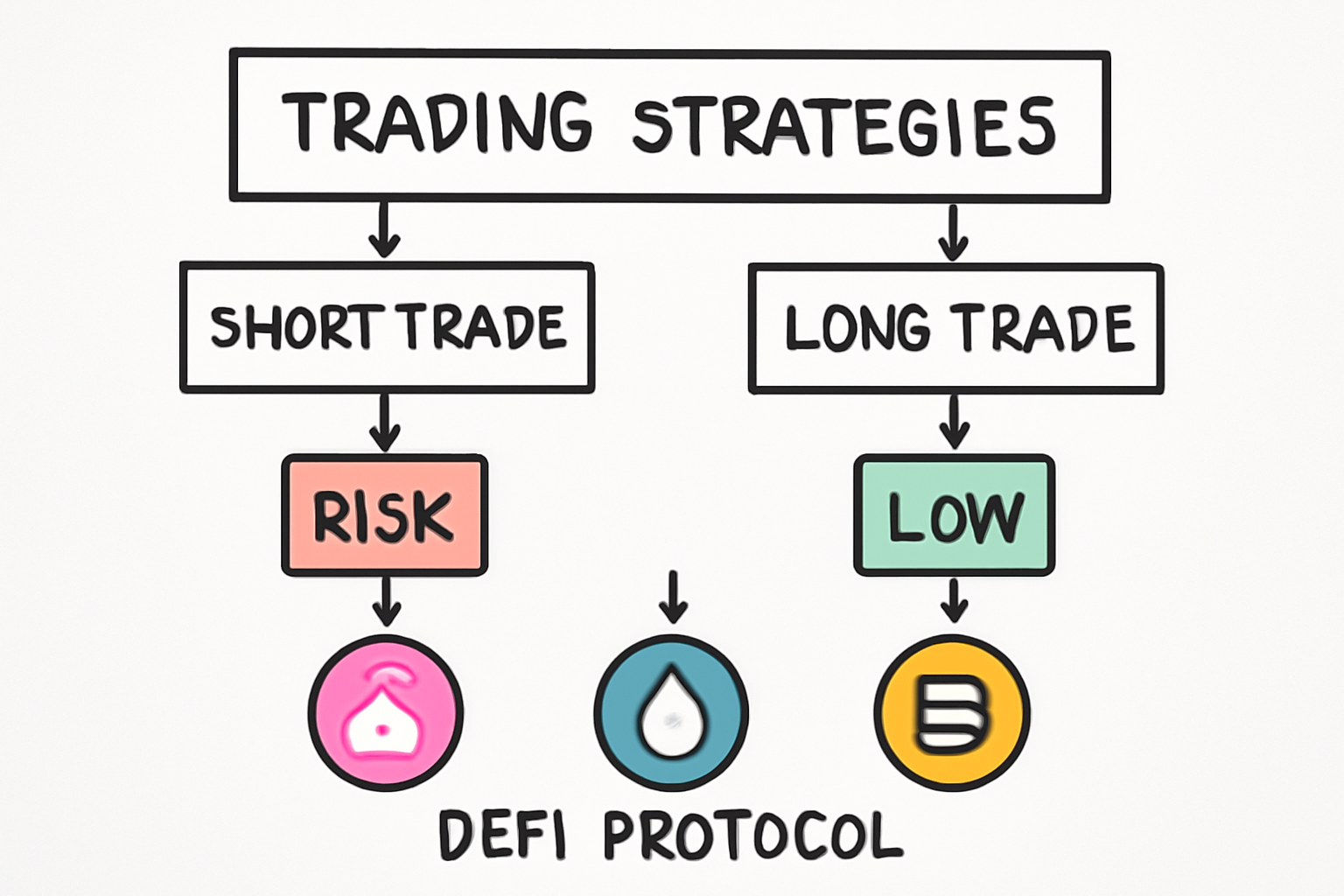

- Automated Trading: Do you want your bot to buy/sell on price action or technical indicators?

- Yield Farming Automation: Should it move funds between protocols chasing best APYs?

- Liquidity Provisioning: Will it rebalance assets between pools to maximize fees?

The best practice is to simulate (backtest) these strategies using historical data before going live. Most no-code platforms provide built-in analytics so you can evaluate drawdowns, win rates, and volatility exposure, crucial metrics for any disciplined trader.

The Pathway to Monetizing Your Crypto Agents

The true power of these tools lies not just in automating your own portfolio but in creating new revenue streams through crypto agent monetization. Once your agent demonstrates consistent returns in backtests or live markets, you can:

- Lease Your Agent: Platforms like Griffin AI allow you to share agents with other traders for a fee.

- Create Access Tokens: Tokenize usage rights so others can pay for access or governance over your agent’s logic.

- Syndicate Strategies: Build communities around high-performing bots, earning commissions based on assets managed by your agent.

This modular approach is rapidly becoming the standard in autonomous crypto trading, and offers both seasoned traders and newcomers unprecedented leverage over their time and capital. For more on how these agentic systems are revolutionizing on-chain trading automation, see our guide: How Agentic DeFi Agents Are Revolutionizing On-Chain Trading Automation.

Security and risk management should never be afterthoughts when deploying or monetizing AI-powered DeFi agents. Automated bots act on your behalf 24/7, so a single misconfigured parameter or overlooked protocol risk can have outsized consequences. Always review the permissions your agent requests, set strict loss thresholds, and use platforms with robust auditing and incident response practices. Many top-tier no-code AI trading platforms now offer real-time monitoring dashboards and emergency kill-switches, features that are non-negotiable for serious users.

Staying Ahead: Iteration, Community, and Compliance

Once live, the work is far from over. The most successful builders treat their agents as living products: regularly refining logic based on market feedback, integrating new data feeds (such as on-chain analytics or sentiment signals), and adapting to emerging DeFi primitives. Participating in platform communities can accelerate your learning curve, many marketplaces allow you to benchmark your agent’s performance against others or collaborate on advanced strategies.

Regulatory compliance is another evolving frontier. As DeFi matures, expect more scrutiny around automated trading activities and agent monetization models. Stay informed about KYC/AML updates from both your chosen platform and relevant jurisdictions to safeguard your operation’s legitimacy.

The Future of No-Code AI Agents in DeFi

The trajectory is clear: no-code AI agents will soon underpin much of the day-to-day activity in decentralized finance. As composability between protocols improves and platforms continue to abstract away technical barriers, we’ll see an explosion of user-generated agents, each competing for capital with increasingly sophisticated logic.

This new landscape rewards those who combine domain expertise with creative automation. Whether you’re seeking passive yield, building a SaaS-like subscription business for your bots, or pioneering novel cross-chain arbitrage strategies, the tools are finally within reach, no programming required.

If you’re ready to go deeper into how agentic platforms simplify complex on-chain strategies or want to explore real-world workflows for automated yield farming and portfolio management, browse our curated guides:

- How Agentic DeFi AI Agents Are Simplifying Complex Onchain Strategies

- How AI Agents Automate DeFi Yield Farming: Real Examples and Workflows

The age of autonomous crypto trading isn’t just coming, it’s here for anyone willing to build smartly and iterate relentlessly.