Decentralized finance has always promised open, permissionless access to powerful financial tools, but let’s be honest: the learning curve for onchain strategies is steep. Complexities like yield optimization, cross-chain arbitrage, and risk management have kept many users on the sidelines. That’s changing fast with the rise of agentic DeFi: a new breed of AI-powered agents that can autonomously manage and simplify intricate DeFi strategies, making advanced crypto investing accessible to everyone.

What Are Agentic DeFi AI Agents?

At their core, AI DeFi agents are autonomous software entities designed to perceive market conditions, plan optimal actions, and execute transactions directly onchain, without manual input. They’re built from a stack of interlocking components:

- On-Chain Perception Layer: Monitors smart contract states and price feeds using RPC endpoints, indexers like The Graph, and oracles such as Chainlink.

- AI Reasoning and Planning: Uses language models or reinforcement learning to simulate outcomes and select the best strategy based on current network conditions.

- Execution Engine: Interacts with smart contracts to perform swaps, staking, bridging assets cross-chain, or even voting in DAOs.

- Memory and Feedback Loop: Logs every action and result for ongoing improvement via machine learning.

This modular design enables agents to tackle multi-step DeFi automation, think rebalancing a portfolio across Ethereum and BNB Chain while dynamically chasing the best yields, all without human babysitting. For a deep dive into how these building blocks work together in real-world protocols, check out this detailed breakdown from GoCodeo: How Autonomous Agents Are Revolutionizing Blockchain and Decentralized Finance.

Simplifying Complex Onchain Strategies

The beauty of agentic DeFi isn’t just in automation, it’s in how these agents make advanced strategies user-friendly. Here’s how they’re reshaping the landscape:

Key Benefits of Onchain AI Agents for DeFi Users

-

Automated Portfolio Management: Onchain AI agents like those integrated in Talisman Wallet and Zerion can autonomously rebalance portfolios, claim staking rewards, and optimize asset allocations—saving users time and reducing manual errors.

-

Smarter Yield Optimization: Platforms such as Yearn Finance and Ocean Protocol leverage AI agents to scan multiple protocols, dynamically allocate funds, and maximize yields while factoring in risks like impermanent loss and token inflation.

-

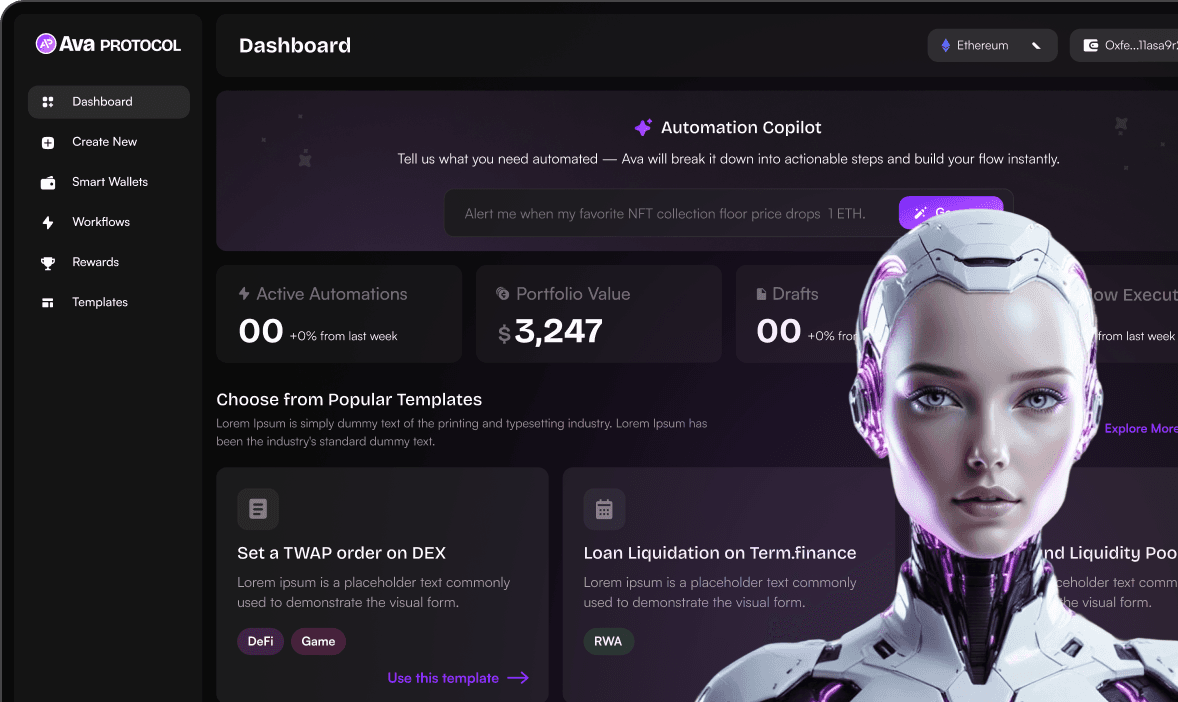

Real-Time Security Monitoring: AI-powered agents monitor for suspicious activity, contract vulnerabilities, and flash loan attacks. Solutions like Ava Protocol and Chainlink help users respond instantly to threats, enhancing wallet and protocol security.

-

Transparent and Trustless Operations: By leveraging verifiable infrastructure (e.g., Ava Protocol), onchain AI agents provide full audit trails and operate according to user-defined rules, increasing trust and transparency for both beginners and seasoned users.

Autonomous trading bots, for example, can now scan dozens of decentralized exchanges (DEXs) like Uniswap or Balancer in real time. Instead of just reacting to price differences (as old-school bots did), today’s agents factor in gas fees, latency risks like MEV (miner extractable value), and network congestion before executing trades. This level of nuance means higher returns with less risk, and no manual monitoring required.

Talisman Wallet‘s integration of built-in crypto AI agents is a great example. Users can automate cross-chain strategies with a few clicks, agents handle everything from bridging assets between blockchains to optimizing yield positions based on real-time APYs. Even security is upgraded: wallet-based agents monitor for suspicious activity or contract vulnerabilities and can pull liquidity or pause interactions if threats emerge (source).

The New Era of Automated Yield Strategies

No more spreadsheets or late-night Discord alerts provides DeFi automation tools now let you set your risk preferences once and let an agent do the rest. These onchain AI agents continuously rebalance portfolios by moving stablecoins between lending pools or switching LP pairs when better rates appear elsewhere. They also consider factors like impermanent loss or token inflation that would trip up most manual traders.

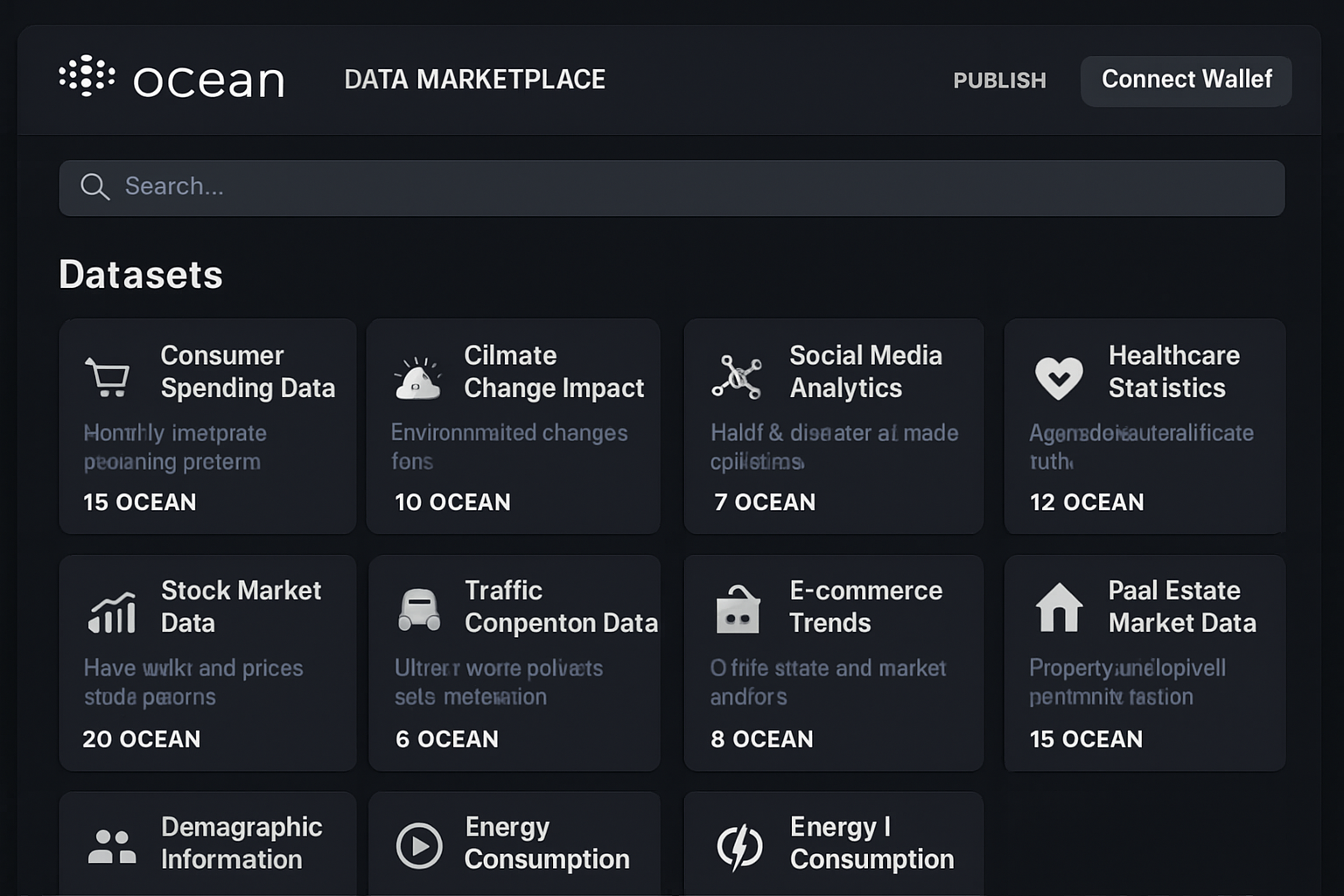

The result? Even passive investors can capture sophisticated opportunities that were previously reserved for whales or full-time quants. As highlighted by projects like Ocean Protocol and Fetch. ai, these intelligent ecosystems reward both data providers and consumers through seamless agent interactions (see more here).

But the transformation goes even deeper. Smart wallet agents are ushering in a new paradigm for DeFi user experience. Forget about having to manually claim staking rewards, convert dust, or keep up with governance proposals. Modern wallets now embed AI agents that do all this autonomously, providing full transparency and granular control over your preferences. This lets users participate in multi-step DeFi automation with minimal friction, whether they’re just starting out or actively managing a diversified portfolio.

Security is another area where agentic DeFi shines. Onchain AI agents can monitor for flash loan attacks, rug pulls, or abnormal wallet activity in real time. If a threat is detected, the agent can swiftly pull liquidity or execute emergency measures, far faster than any human could react. This proactive defense layer gives retail users institutional-grade protection without extra hassle.

Challenges and the Road Ahead

Of course, integrating AI into financial automation isn’t without hurdles. Security risks remain top of mind: autonomous agents must be robustly secured to prevent exploitation or unintended behavior. Frameworks like Aegis Protocol are leading the way by combining decentralized identifiers (DIDs), post-quantum cryptography (PQC), and zero-knowledge proofs (ZKPs) for verifiable security (read more here). Transparency and trust are equally vital, users need to understand how their assets are being managed and have recourse if something goes awry.

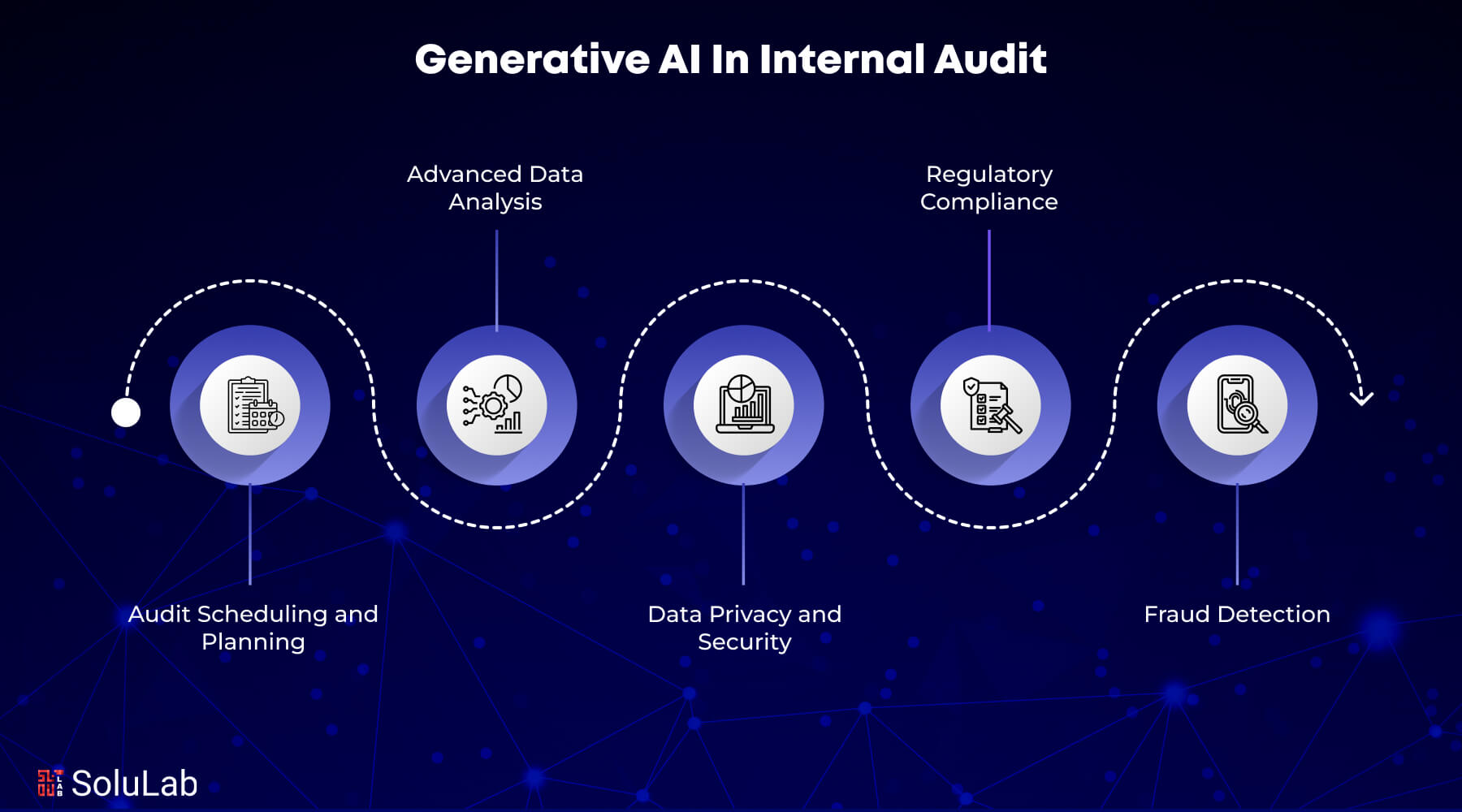

Regulatory compliance is another fast-evolving frontier. As AI DeFi agents take on more responsibility, from executing trades to participating in DAOs, they must adhere to shifting global standards around privacy and data protection. Privacy-preserving technologies like ZKPs offer promising solutions for maintaining compliance while safeguarding user data (see details here).

This convergence of AI with decentralized finance is democratizing access to sophisticated strategies once reserved for pros. Whether you’re optimizing cross-chain DeFi strategies or simply want automated yield harvesting with peace of mind, agentic DeFi is making it possible, no spreadsheets required.

Real-World Examples of Agentic DeFi Agents in Action

-

Autonomous Trading on 1inch and SushiSwap: AI agents now scan decentralized exchanges like 1inch and SushiSwap in real time, identifying arbitrage opportunities and executing trades instantly. These agents factor in gas fees, slippage, and market volatility, making complex trading strategies accessible to everyday investors—no coding or constant monitoring required.

-

Yield Optimization with Yearn Finance: Platforms such as Yearn Finance use AI-powered agents to automatically move user funds between lending protocols and liquidity pools. The agents analyze APYs, risk factors, and market trends, ensuring users always earn the best possible yield on their assets—without manual intervention.

-

Smart Wallet Automation by Talisman: The Talisman wallet integrates built-in AI agents that can rebalance portfolios, claim staking rewards, and convert small balances (“dust”) automatically. This empowers users to passively grow their crypto holdings, while maintaining full transparency and control over their assets.

-

Security Monitoring with Ava Protocol: Ava Protocol deploys agentic AI for real-time monitoring of wallet activity, contract vulnerabilities, and suspicious transactions. These agents can automatically trigger defensive actions, like pausing contracts or withdrawing funds, helping users avoid potential exploits or losses.

-

AI-Powered Data Marketplaces on Ocean Protocol: Ocean Protocol leverages AI agents to curate, evaluate, and price data sets within its decentralized marketplace. These agents autonomously match buyers and sellers, optimize pricing, and ensure data quality—making complex data trading seamless for users and projects alike.

The bottom line: As onchain AI agents become smarter and more secure, expect an explosion of innovation in both user experience and strategy design. The future of crypto investing will be less about technical wizardry, and more about setting your goals while intelligent agents handle the rest.