AI agents are rapidly transforming DeFi yield farming, bringing a new era of autonomous portfolio management and intelligent, data-driven decision-making. Instead of manually chasing shifting APYs or constantly rebalancing pools, traders can now rely on AI-powered crypto trading bots to automate workflows, optimize returns, and actively manage risk in real time. But how do these systems actually work under the hood? And what are some real-world examples you can use today?

How AI Agents Are Powering Automated DeFi Strategies

Unlike traditional bots that follow static rules, modern AI agents for DeFi yield farming leverage machine learning to analyze vast streams of on-chain data. They factor in gas fees, liquidity shifts, impermanent loss calculations, and even subtle market signals. The result: smarter fund allocations and reduced manual overhead for users.

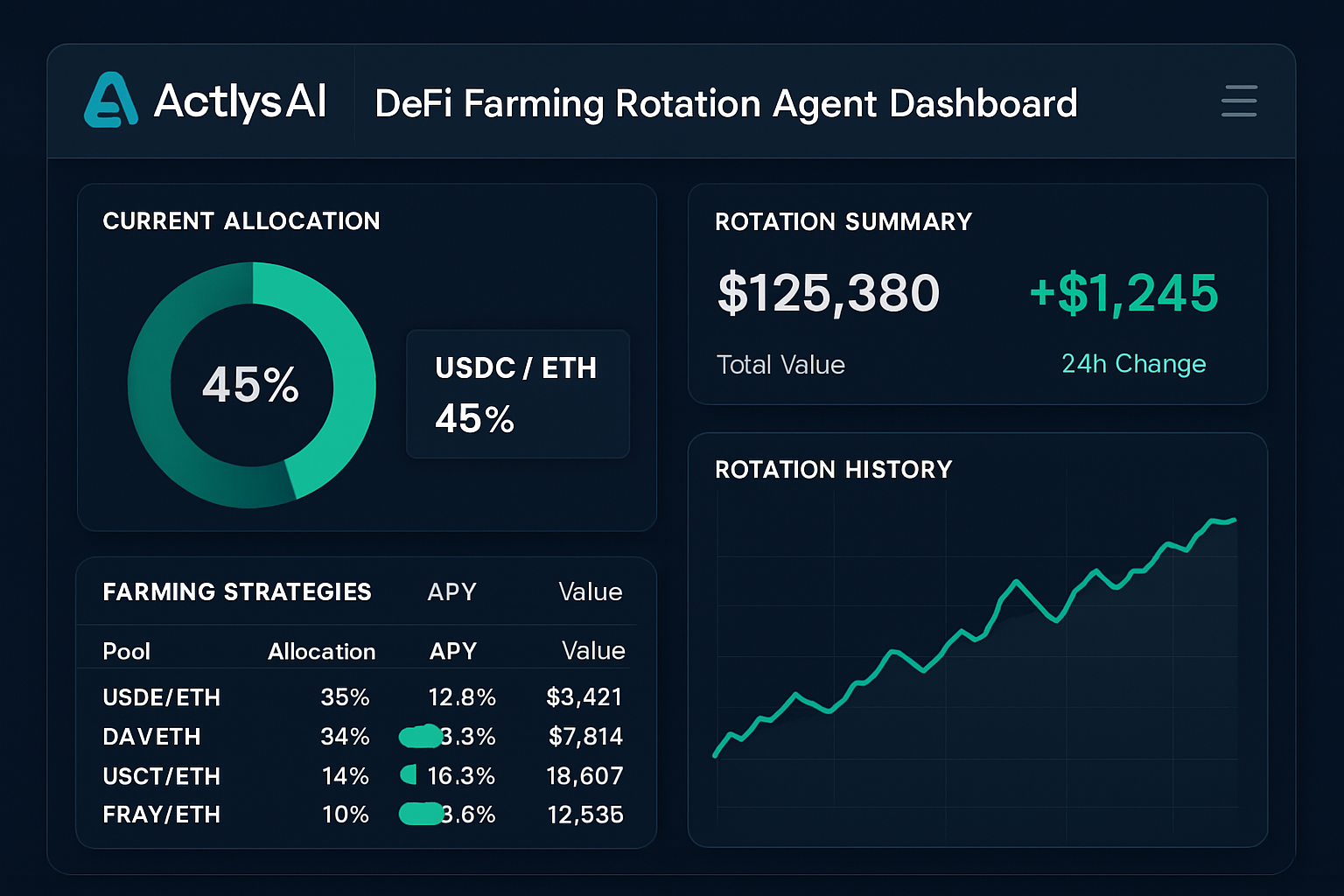

For example, the ActlysAI DeFi Farming Rotation Agent monitors APYs across top protocols like Beefy Finance and Yearn Finance. It continuously recalculates expected returns versus risks such as impermanent loss. When a better opportunity arises within a user’s risk profile, the agent automatically rotates funds to the optimal pool, no human intervention required. Users receive notifications when major changes occur or when funds are reallocated. You can see more about this workflow at actlys.ai.

Real Examples of AI Agents in Action

The explosion in TVL (Total Value Locked) managed by autonomous agents underscores their growing adoption:

Real-World AI Agents Automating DeFi Yield Farming

-

ActlysAI’s DeFi Farming Rotation Agent: This AI agent monitors APYs across top protocols like Beefy Finance, Yearn Finance, and DeFiLlama, calculates impermanent loss, and automatically rotates funds to the best-performing pools within set risk parameters. Users receive email notifications for fund rotations and significant APY changes, optimizing returns with minimal manual effort. Learn more

-

Autonoly’s DeFi Yield Farming Automation: Autonoly leverages AI-powered workflow automation to streamline DeFi yield farming. Its agent tracks APYs, assesses yield opportunities and risks, executes fund allocations and rebalancing, and generates detailed performance reports, all automatically. This boosts efficiency and accuracy while reducing operational costs. Learn more

-

Questflow and StakeKit Integration: By combining Questflow’s AI agents with StakeKit’s live staking and yield data, this solution enables real-time portfolio aggregation and intelligent yield optimization. The agent fetches yields across chains, suggests optimal strategies, reallocates assets, claims rewards, and sends alerts for risks like slashing events or APY changes. Learn more

Autonoly’s Yield Farming Automation, for instance, provides workflow automation that tracks APYs across multiple platforms, analyzes yields and risks using proprietary AI models, then executes fund allocations or rebalancing strategies automatically. The system also generates performance reports and transaction logs for transparency, helping users reduce errors and operational costs while maximizing efficiency. Learn more at autonoly.com.

Questflow x StakeKit takes it a step further by integrating live staking data from multiple chains. Their collaborative agent aggregates portfolio positions, discovers new staking or vault opportunities with higher yields, handles reward claims automatically, and sends real-time alerts if slashing events or major APY changes occur. This seamless workflow lets users optimize returns without constantly monitoring dozens of protocols themselves (blog.questflow.ai).

The Anatomy of an Automated DeFi Yield Farming Workflow

The typical workflow for an AI-powered DeFi agent includes several distinct stages:

- Data Collection: Real-time gathering of APY rates, liquidity metrics, token prices (using live feeds), and risk factors from various protocols.

- Analysis: Machine learning models predict optimal strategies based on historical performance and current market conditions.

- Decision-Making: The agent weighs potential allocations against user-defined risk tolerance and investment goals.

- Execution: Transactions are batched and executed autonomously, allocating or reallocating capital as needed.

- Monitoring and Rebalancing: Continuous surveillance ensures that portfolios remain optimized as market dynamics shift.

- Reporting and Notifications: Detailed reports keep users informed about performance metrics and significant events.

This holistic approach not only frees up time but also helps investors capture fleeting opportunities, something nearly impossible to do manually at scale.

What’s truly innovative is how AI agents can personalize DeFi yield farming at scale. By ingesting user preferences, risk appetite, target returns, preferred blockchains, these agents can construct bespoke strategies that would otherwise require a full-time quant desk. For instance, some users may want to avoid pools with high impermanent loss or only farm stablecoin pairs. The AI agent encodes these parameters and adapts its execution in real time.

Consider the evolving landscape of AI crypto trading bots. Unlike the first-gen bots that simply followed price signals, today’s autonomous agents incorporate advanced analytics: they scan social sentiment, monitor governance proposals that might impact yields, and even account for gas fee spikes on congested chains. This allows for dynamic workflow automation, where every step, from opportunity detection to capital reallocation, is handled without user micromanagement.

Risks and Limitations: What to Watch Out For

No system is foolproof. While AI-driven automation reduces manual errors and emotional decision-making, it introduces new risks unique to DeFi:

- Smart contract vulnerabilities: If an underlying protocol is exploited, the AI agent’s funds could be at risk.

- Data quality issues: Garbage in, garbage out; inaccurate or delayed data feeds can lead to suboptimal decisions.

- Unexpected market events: Black swan events or regulatory shocks may disrupt even the most robust models.

- Overfitting: Machine learning models trained on limited historical data may fail when conditions change dramatically.

This means due diligence remains critical. Users should vet both the AI agent’s algorithms and the protocols it interacts with, and always start with small allocations before scaling up.

Getting Started: How to Deploy an AI Agent for Yield Farming

If you’re ready to experiment with automated DeFi workflows, start by defining your risk appetite and research platforms like ActlysAI or Autonoly. Many solutions offer testnet environments so you can simulate strategies before committing real capital. And always keep security top-of-mind: use hardware wallets, limit permissions granted to smart contracts, and monitor activity logs closely.

The bottom line: Automated DeFi strategies powered by AI agents are no longer science fiction, they’re live today and reshaping how digital assets are managed in real time. The winners will be those who harness these tools early while staying vigilant about evolving risks in this fast-moving ecosystem.