2024 has been a watershed year for cross-chain DeFi automation, with AI trading agents taking the spotlight as the new power tools for sophisticated, multi-network strategies. Forget the days of juggling endless dashboards and bridges – today’s agentic DeFi platforms are making it possible to execute complex trades, optimize yield, and manage risk across Ethereum, Sui, Solana, and more, all with minimal user intervention. The result? A seismic shift in how both retail and institutional traders approach decentralized finance.

AI Trading Agents: The Brains Behind Autonomous DeFi Strategies

At their core, AI trading agents are specialized bots designed to analyze real-time market data, identify opportunities, and autonomously execute trades or liquidity moves. But what sets 2024’s crop apart is their ability to operate across multiple blockchains simultaneously. Thanks to infrastructure breakthroughs from teams like Talus Network, who recently secured over $10M in strategic backing, these agents can now natively interact with protocols on different chains without requiring users to manually bridge assets or monitor dozens of pools.

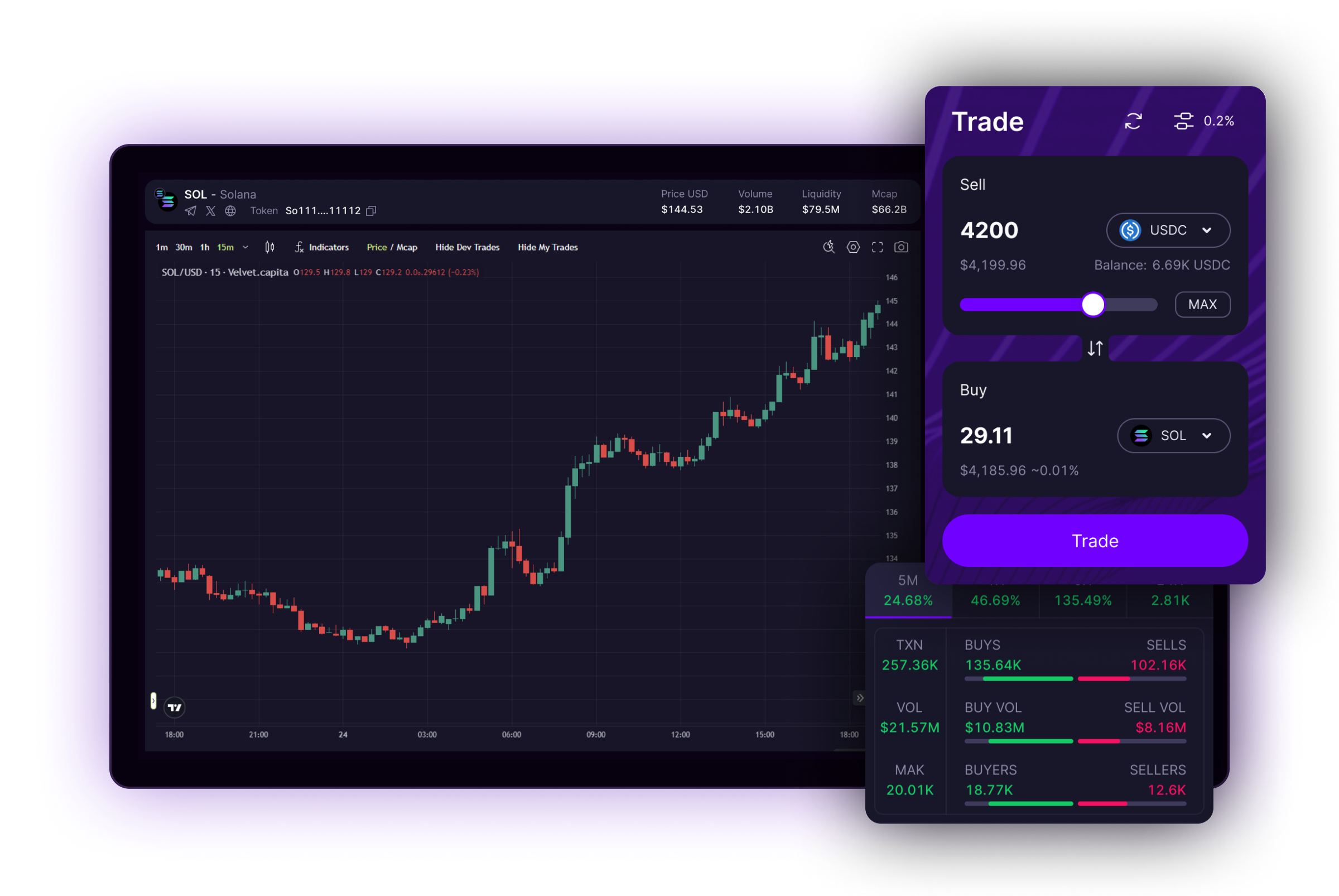

This means arbitrage between DEXs on Ethereum and Cosmos becomes seamless; liquidity can be dynamically reallocated from a low-yield pool on Polygon to a hot opportunity on Sui, all while the user enjoys a single unified interface. As highlighted by Velvet Capital’s EthCC talk, the chaos of DeFi is being tamed into actionable alpha through multi-agent coordination and intent-driven execution.

Cross-Chain Arbitrage and Yield Optimization: Next-Level Efficiency

The most immediate impact of these advances is in cross-chain arbitrage and DeFi yield optimization. Platforms like ChainGPT have rolled out agents that scan order books across multiple exchanges in real time, spotting price discrepancies and executing trades at lightning speed. Meanwhile, protocols such as Yearn Finance have integrated AI-powered algorithms that constantly rebalance liquidity positions for maximum returns, moving assets between pools based on ever-shifting APYs and risk metrics.

The upshot? Traders no longer need to babysit their positions or chase fleeting yield farms; AI agents do the heavy lifting around the clock. For more details on how these automations work under the hood (and how you can plug into them), check out our guide on how cross-chain AI agents automate DeFi strategies.

The Agentic DeFi Platform Boom: Who’s Leading?

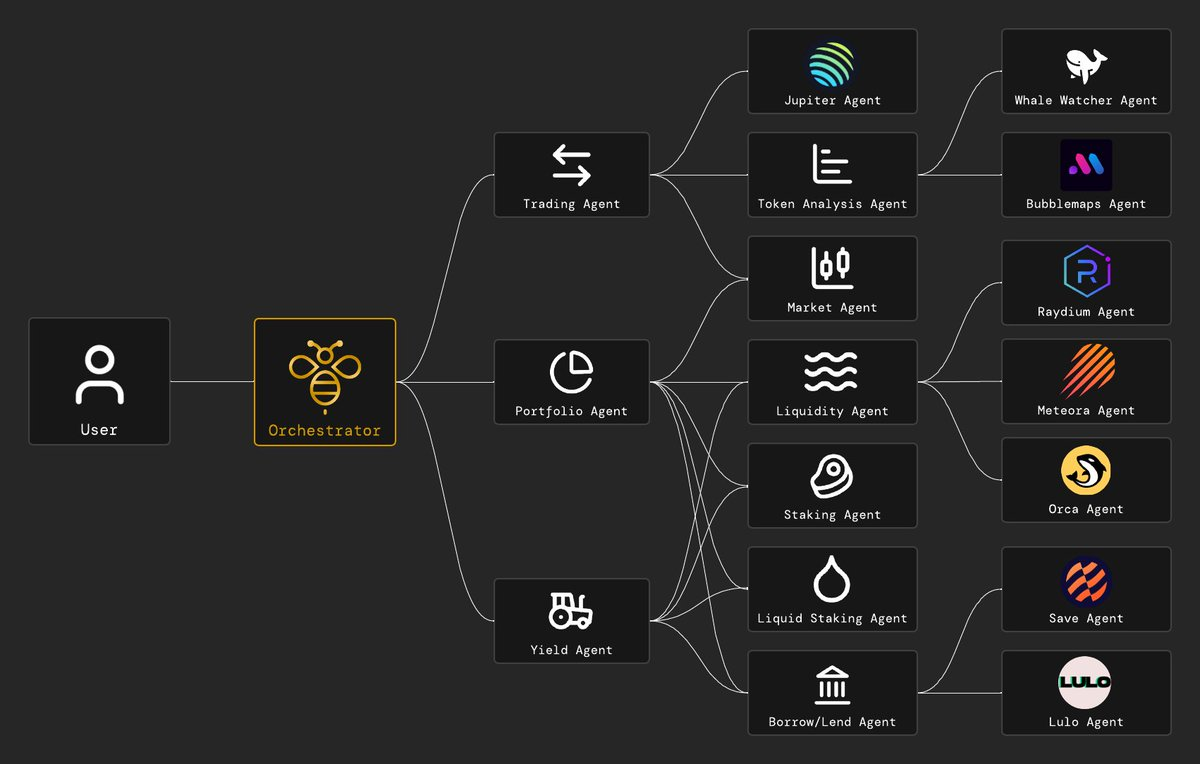

The arms race for smarter agentic DeFi platforms is heating up fast. Talus Network has emerged as a frontrunner with its Nexus framework, allowing developers to define modular agent workflows hosted on decentralized infrastructure. Their recent partnership with Sui brings next-gen AI agent capabilities directly into one of Web3’s most innovative Layer 1 ecosystems.

Meanwhile, Infinit Labs has doubled down on intent-based automation by launching swarms of specialized AI bots that handle everything from asset bridging to token swaps across chains. Hive AI takes another approach by letting users express high-level intentions (like “maximize my yield with minimal risk”) which its modular agents then translate into executable strategies spanning Solana and beyond.

If you want a deep dive into this rapidly evolving landscape, including hands-on tutorials for deploying your own autonomous strategies, don’t miss our feature on agentic DeFi platforms using AI agents for cross-chain crypto trading automation.

As these platforms mature, the competitive edge is shifting toward DeFi automation tools that can adapt in real time to market volatility and protocol changes. The days of static smart contracts are numbered; instead, we’re entering an era where multi-chain DeFi bots learn from every transaction, refine their strategies, and even collaborate with other agents to unlock fresh sources of alpha.

Top Cross-Chain AI Agent Projects in 2024

-

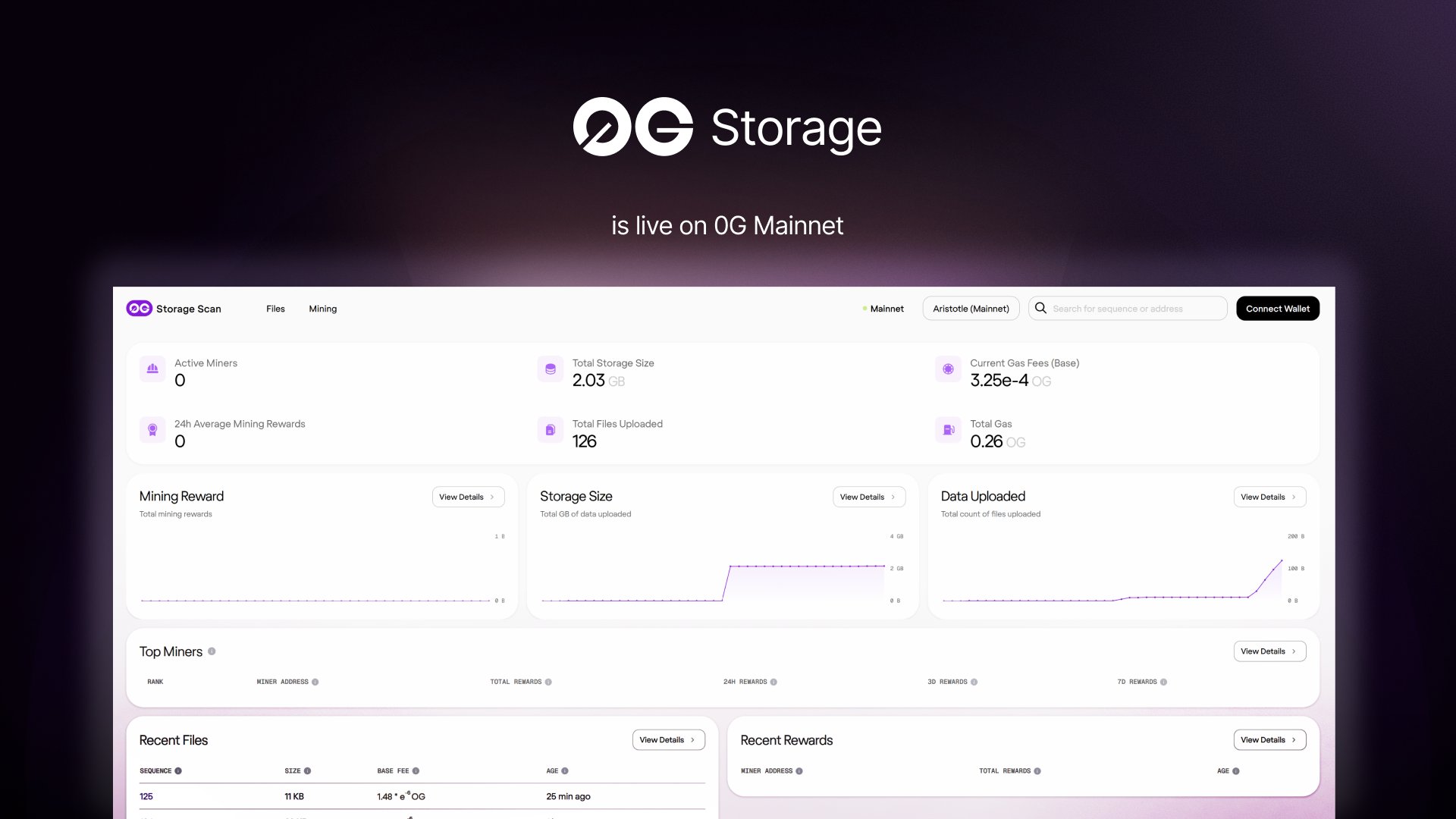

Talus Network: A leading decentralized AI agent infrastructure, Talus empowers cross-chain AI agents to interact seamlessly across multiple blockchain ecosystems. Their recent $10M+ funding and partnerships with Sui and Walrus highlight their rapid growth and innovation in agent-driven DeFi strategies.

-

Velvet Capital: Velvet leverages multi-agent AI and intent-driven execution to simplify complex DeFi strategies. Their platform enables users to automate yield optimization and cross-chain asset management with advanced AI agents.

-

Infinit Labs: Infinit Labs stands out for its intent-based DeFi platform powered by a swarm of AI agents. These agents automate asset bridging, token swaps, and yield optimization across multiple blockchains, making DeFi more accessible and efficient.

-

Virtuals Protocol: Operating on the Base network, Virtuals Protocol enables the creation and tokenization of AI agents that perform diverse tasks, from content posting to meme generation, expanding AI applications within DeFi.

-

Hive AI: Built on Solana, Hive AI uses modular AI agents to transform user intentions into automated DeFi strategies. This allows users to execute complex financial workflows with simple instructions, enhancing cross-chain usability.

This collaborative intelligence is especially evident in recent partnerships like Talus x Union, where AI agents now coordinate across disparate blockchains, breaking down long-standing silos between ecosystems. By leveraging shared intent and decentralized communication protocols, these agents are not just executing trades but actively negotiating optimal routes for liquidity and arbitrage, delivering results that would be impossible through manual intervention alone.

Security and Risk Management: AI as DeFi’s Guardian

With great power comes greater risk, and here’s where AI shines brightest. Modern agentic DeFi platforms deploy advanced AI-driven monitoring systems that continuously audit smart contracts and flag suspicious activity in real time. This proactive approach dramatically reduces the likelihood of exploits or rug pulls, giving both users and institutional players renewed confidence in on-chain strategies.

It’s not just about defense either. Autonomous wallet management is another frontier: AI agents now handle everything from scheduled rebalancing to automated staking reward reinvestment, freeing users from tedious maintenance tasks while ensuring optimal performance across all connected chains.

What’s Next? The Road Ahead for Cross-Chain DeFi Agents

The rapid pace of innovation shows no signs of slowing. With over $10M recently raised by Talus Labs (with backing from Sui Foundation and Polychain), expect to see even more sophisticated agent frameworks rolling out through 2025, especially as prediction markets like AvA Markets launch on Sui. Meanwhile, platforms such as Velvet Capital continue to push the boundaries of multi-agent coordination, aiming to turn DeFi’s notorious chaos into a wellspring of actionable alpha.

For traders eager to ride this next wave, it’s critical to stay informed about which protocols offer true cross-chain automation versus those still stuck in single-network silos. If you’re ready to take your portfolio management up a notch, or just want a smarter way to automate yield farming, explore our hands-on guides on how agentic DeFi AI agents are simplifying complex onchain strategies or learn how to automate DeFi yield farming with AI trading agents in 2024.

The bottom line? Agentic DeFi is no longer science fiction. It’s here now, turning intent into action, risk into opportunity, and complexity into clarity across every major blockchain network. As always: see the pattern, seize the trade.