Imagine a world where you can move assets between Ethereum, Solana, and Layer2s without ever opening a bridge UI, writing a script, or worrying about timing your trades. That world is arriving, fast, thanks to agentic DeFi platforms and the rise of AI-driven cross-chain crypto trading automation.

At their core, agentic DeFi platforms leverage autonomous AI agents to handle the heavy lifting of decentralized finance. These agents don’t just automate simple swaps or staking, they analyze real-time market data across dozens of blockchains, identify arbitrage and yield opportunities, manage risk, and execute complex strategies that would overwhelm even the most seasoned trader. The result? Smarter, faster, and more accessible portfolio management for everyone from professional funds to solo DeFi enthusiasts.

AI Agents: The Brains Behind Cross-Chain Trading Automation

The heart of this revolution lies in how these AI agents operate. Unlike traditional trading bots that follow static rules or require constant human tweaking, agentic DeFi platforms deploy intelligent agents capable of learning and adapting in real time. Here’s how they’re transforming cross-chain crypto trading:

- Real-Time Market Analysis: By constantly monitoring decentralized exchanges (DEXs) and liquidity pools on networks like Ethereum, Solana, Arbitrum, and more, AI agents spot arbitrage gaps and optimal trading conditions as soon as they emerge.

- Automated Execution: When an opportunity arises, say a price discrepancy between USDC on two chains, the agent autonomously executes swaps or liquidity moves without waiting for human approval.

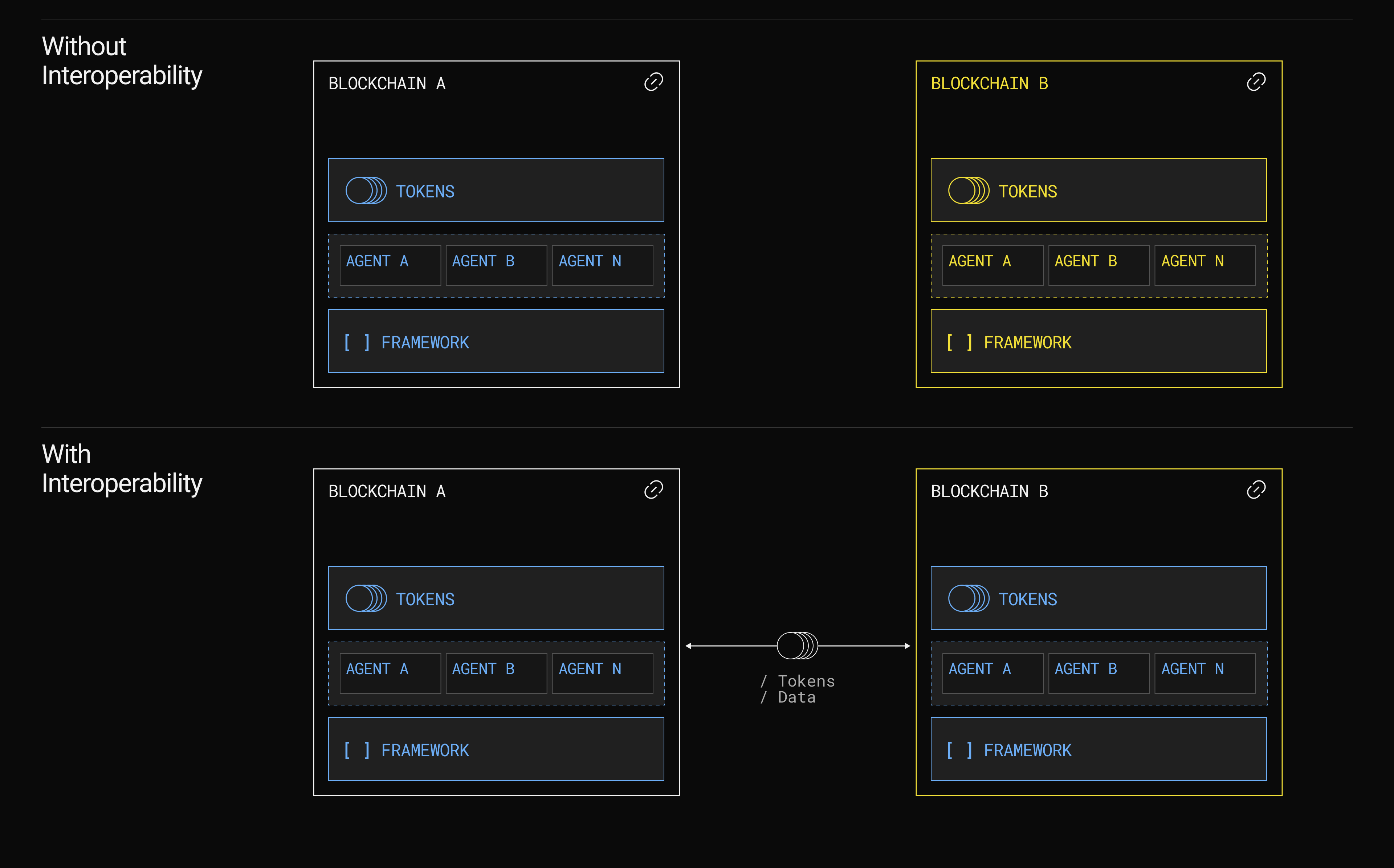

- Interoperability Management: Gone are the days of manual bridging. With protocols like LayerZero or Axelar under the hood, AI agents seamlessly move assets cross-chain with minimal user input.

This level of automation is not just about speed; it’s about unlocking new strategies that were previously too complex or time-consuming for most traders to execute manually. For a deeper dive into real-world use cases and architecture diagrams behind these systems, check out our guide on how agentic DeFi AI agents simplify complex onchain strategies.

The Building Blocks: Key Components Powering Agentic DeFi Platforms

A modern agentic DeFi platform isn’t just a fancy interface over existing protocols, it’s an orchestration layer made up of several advanced components:

- On-Chain Perception Layer: This module gives AI agents visibility into real-time blockchain data using RPC endpoints and oracle feeds. It’s how they know what’s happening across various ecosystems at any given moment.

- AI Reasoning and Planning Module: Here’s where the magic happens: machine learning algorithms simulate potential outcomes and select optimal strategies based on current market conditions.

- Execution Layer via Smart Contracts: Agents interact directly with smart contracts to perform actions like token swaps or staking, no centralized custody required.

- Cross-Chain Logic and Interoperability: By integrating with interoperability protocols (think LayerZero or Axelar), these platforms make asset transfers between blockchains feel as easy as moving money between bank accounts.

- Memory and Feedback Loop: Every action is logged so that the agent can learn from successes (and failures), continuously improving its future performance.

This modular approach allows for rapid innovation while ensuring security and transparency remain at the forefront, a must in today’s volatile crypto landscape.

Pioneering Platforms: Real-World Examples in Action

The theoretical is quickly becoming practical thanks to leading-edge projects already live in production. Here are three you should watch closely:

- Bankr: An intent-based assistant where users issue natural language commands like “Swap my ETH for SOL at the best rate” and let the AI handle routing across multiple chains behind the scenes.

- Griffain: Built on Solana but chain-agnostic at heart, Griffain lets users interact with their entire portfolio via chat, querying balances, executing swaps, even managing NFTs, all powered by autonomous agents.

- INFINIT: This platform uses personalized recommendation engines to suggest multi-step yield farming strategies spanning several protocols; users approve with one click while the underlying AI handles execution from start to finish.

If you’re curious about how these tools stack up for portfolio management or want to see live demos in action, explore our resource hub on agentic DeFi bots transforming crypto portfolio automation in 2025.

Beyond convenience, the real promise of agentic DeFi platforms lies in their ability to democratize advanced trading strategies. Where once only elite funds could afford the infrastructure and expertise to run complex cross-chain arbitrage or multi-protocol yield farming, AI trading agents now level the playing field for individuals and small teams. The days of missing opportunities due to slow manual bridging or clunky UI navigation are fading fast.

Top Benefits of Agentic DeFi Platforms for Everyday Traders

-

Lightning-Fast Cross-Chain Trades: AI agents automate the entire process, executing trades across multiple blockchains in real time—much faster than manual trading ever could.

-

Smarter Trading Decisions: By analyzing vast datasets from various decentralized exchanges and liquidity pools, AI agents identify the best trading opportunities and reduce the risk of human error.

-

Seamless Interoperability: Agentic DeFi platforms leverage protocols like LayerZero and Axelar to enable effortless asset transfers between blockchains, eliminating the need for manual bridging.

-

Hands-Off Portfolio Management: Platforms such as Bankr and INFINIT let users automate complex strategies like swaps, yield farming, and multi-step trades using natural language commands or one-click execution.

-

Continuous Learning & Optimization: AI agents keep logs and feedback loops, learning from past trades to continually refine and improve strategies for better results over time.

-

Increased Accessibility for All Users: By simplifying advanced DeFi operations, agentic platforms make cross-chain trading and portfolio management approachable—even for those without technical expertise.

Security gets a boost as well. By executing trades directly from user-controlled wallets and leveraging smart contract automation, these agents minimize exposure to centralized risks and reduce common errors from manual intervention. The feedback loop built into modern AI agents means strategies become more refined over time, adapting not just to market volatility but also to evolving user preferences and risk tolerances.

Getting Started: How to Harness Agentic DeFi for Cross-Chain Automation

Ready to put these innovations to work? Here’s a practical framework for integrating AI-powered cross-chain automation into your DeFi workflow:

For those new to the space, start by exploring platforms that offer natural language interfaces or pre-built strategies, this removes much of the technical friction. As you gain confidence, experiment with customizing agent parameters or plugging in your own data feeds. If you’re a developer or power user, dive deeper into protocol documentation and open-source SDKs that allow you to build bespoke automations tailored to your portfolio goals.

The rapid pace of innovation means new features are rolling out monthly, think intent-driven swaps, automated rebalancing across chains, or even governance participation via autonomous agents. To stay ahead of these trends, and avoid pitfalls, follow reputable research hubs and communities dedicated to DeFi automation. For an even deeper technical breakdown (including code samples), check our guide on how AI trading agents automate cross-chain DeFi strategies without code.

What’s Next? The Future of Autonomous Trading Bots in DeFi

The next wave will see even tighter integration between agentic DeFi platforms and emerging blockchain ecosystems. Expect greater interoperability as standards mature, smarter portfolio management through collaborative AI swarms, and enhanced privacy through zero-knowledge proofs embedded within agent workflows.

Perhaps most exciting is the rise of intent-based protocols, where users simply state what they want (“Maximize my stablecoin yield across Ethereum L2s this week”) and let autonomous bots handle every layer beneath the surface. As these systems become more transparent and auditable, trust in fully automated asset management will only grow.

If you’re considering taking your first steps into this new era, or want a strategic edge as a seasoned trader, the time is now. The convergence of AI reasoning, cross-chain composability, and intuitive design is reshaping what’s possible in crypto portfolio management.

Stay tuned as we continue tracking breakthroughs in agentic DeFi, autonomous trading bots, and smart portfolio automation. For more hands-on guides and market analysis on this rapidly evolving landscape, explore our latest research at how autonomous AI agents are transforming multi-chain DeFi trading in 2024.