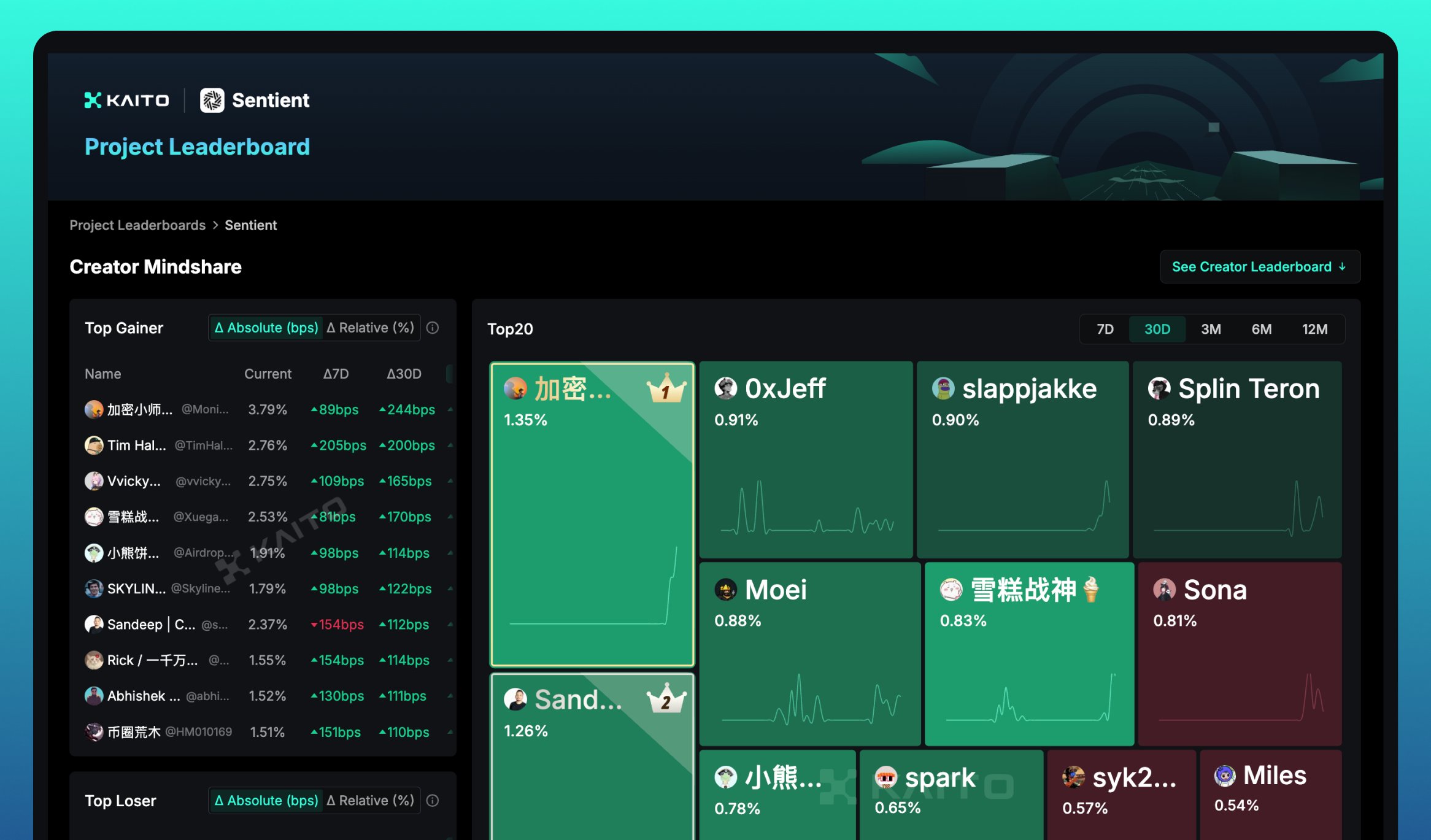

In 2024, DeFi yield farming automation has undergone a seismic shift. What started as manual, spreadsheet-driven strategies has evolved into a landscape dominated by AI trading agents capable of scanning, reallocating, and compounding across dozens of protocols in real time. The promise is clear: smarter bots, less manual work, and higher net returns. But the reality is more nuanced. Not all AI agents are created equal, and the arms race between protocol complexity and automation sophistication is accelerating.

Why AI Trading Agents Dominate DeFi Yield Farming in 2024

Yield farming in DeFi is an optimization problem with hundreds of moving parts: shifting APYs, liquidity pool depth, gas fees, token volatility, and ever-present smart contract risk. Human traders simply can’t react fast enough to market changes or monitor the cross-chain landscape 24/7. This is where AI yield farming bots have proven their worth. Today’s leading agents aren’t just executing scripts – they’re using machine learning to analyze on-chain data, news sentiment, and even regulatory signals to make dynamic allocation decisions.

Let’s dive into the top 5 AI-powered trading agents and strategies that are shaping the future of automated DeFi yield farming in 2024. Each brings a distinct approach to maximizing returns and managing risk in an increasingly complex environment.

Top 5 AI-Powered DeFi Yield Farming Agents (2024)

-

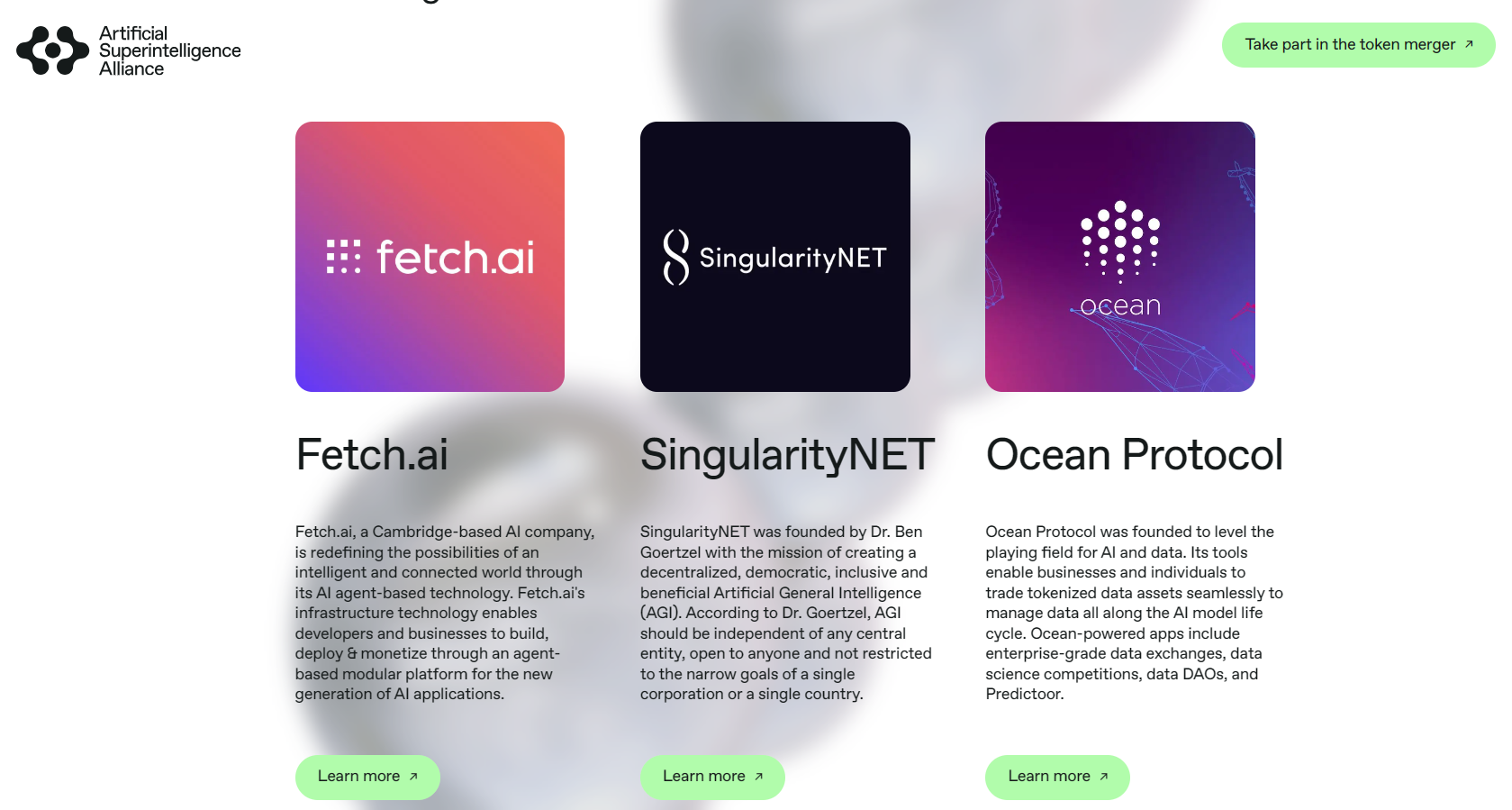

Fetch.ai Autonomous DeFi Agents: Fetch.ai deploys autonomous AI agents that interact with DeFi protocols to optimize yield, manage risk, and minimize gas fees. These agents analyze real-time data and execute trades across multiple blockchains, offering hands-off yield farming for users.

-

Yearn Finance V3 AI-Optimized Vaults: The latest Yearn Finance V3 vaults use AI-driven strategies to automatically allocate assets, harvest rewards, and rebalance portfolios. Their smart contract integrations adapt to changing market conditions, maximizing returns with minimal manual intervention.

-

Hive AI Yield Farming Bot (Solana-based): Hive AI is a Solana-native bot that leverages machine learning to execute complex yield farming strategies. It continuously monitors liquidity pools, APYs, and protocol risks to move assets for optimal yield, making sophisticated DeFi accessible to everyday users.

-

Autonolas Modular Yield Aggregator: Autonolas offers a modular AI-powered aggregator that integrates with multiple DeFi protocols. Its autonomous agents analyze historical and real-time data, predict optimal farming opportunities, and automate execution to enhance yield and reduce risk.

-

1inch Fusion AI Smart Order Router: The 1inch Fusion platform utilizes AI-powered smart order routing to optimize trade execution and liquidity provision across DeFi protocols. Its algorithms find the best routes for swaps and yield strategies, minimizing slippage and maximizing returns for users.

1. Fetch. ai Autonomous DeFi Agents: Multi-Protocol Intelligence

Fetch. ai’s autonomous agents have set a new benchmark for cross-protocol automation. These bots aren’t limited to a single chain or yield aggregator. Instead, they deploy multi-agent systems that negotiate, optimize for gas, and dynamically rebalance capital across Ethereum, Arbitrum, and BNB Chain. What’s unique is their use of decentralized AI models that learn from both on-chain metrics and off-chain sentiment. The result: adaptive strategies that can exit underperforming pools in seconds, not hours. Still, the complexity of their agent networks introduces new attack surfaces, so rigorous monitoring is non-negotiable.

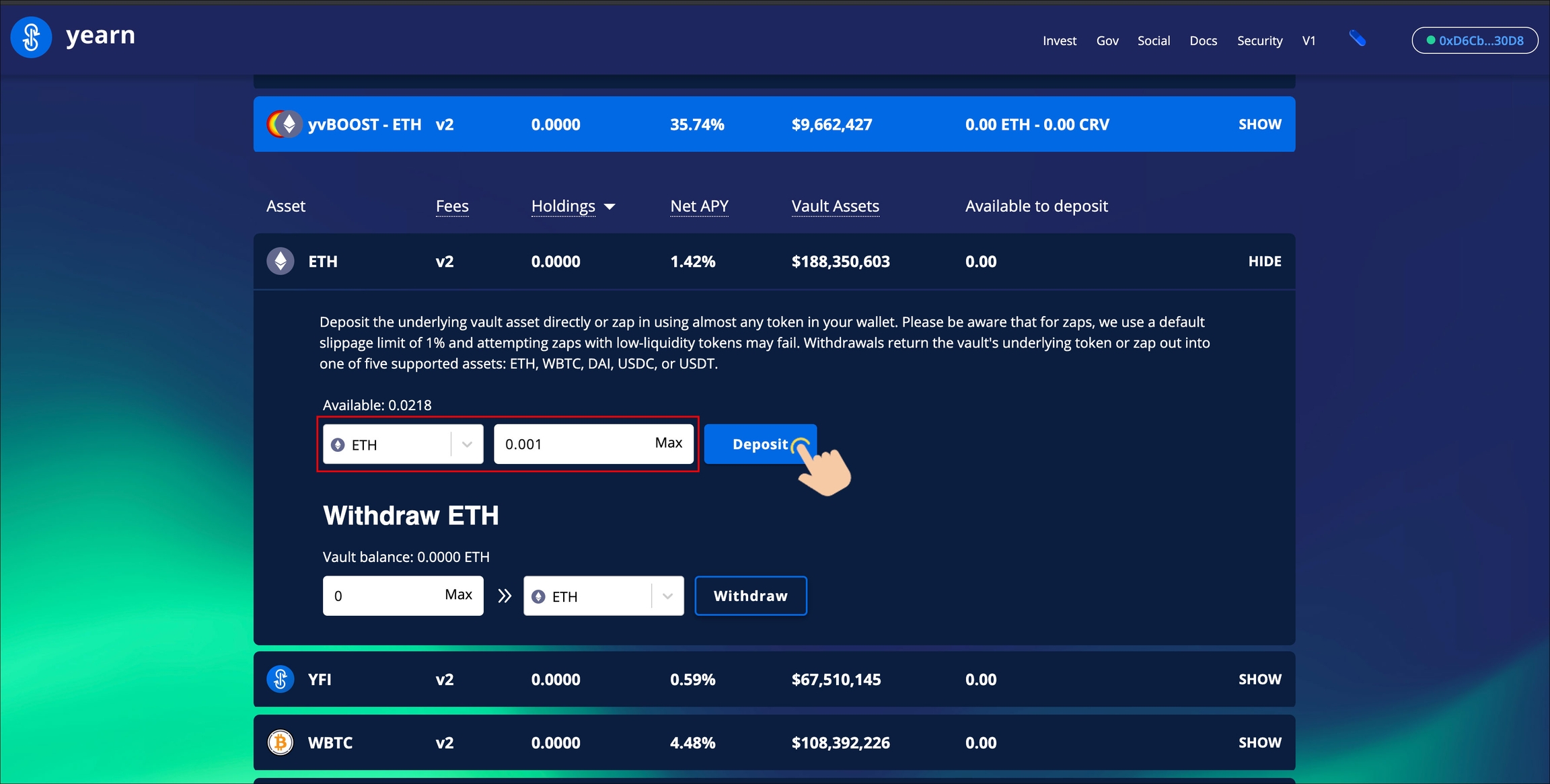

2. Yearn Finance V3 AI-Optimized Vaults: Smarter Compounding

Yearn’s V3 vaults have taken the original yield aggregator model and layered on AI-driven strategy selection. Each vault now leverages real-time data feeds and reinforcement learning to pick and weight underlying strategies – not just at deployment, but continuously. This means the vault can shift allocations between lending, LP farming, and even liquid staking derivatives as market conditions evolve. For users, it’s largely set-and-forget, but the underlying AI logic is anything but simple. Transparency into model decision-making is limited, so users must trust both the code and the data pipelines feeding it. For more details on how these vaults automate complex workflows, see our deep dive.

3. Hive AI Yield Farming Bot: Solana’s High-Speed Automation

Solana’s low-latency environment has enabled the Hive AI Yield Farming Bot to operate at a speed and scale that’s hard to match on EVM chains. Hive’s agent is built for everyday investors – it scans Solana-based DEXs and lending protocols, then reallocates capital based on predictive APY modeling and liquidity risk. The bot’s edge comes from its use of Solana’s parallel transaction architecture, allowing for near-instant rebalancing. Yet, like all Solana-native tools, it’s not immune to network instability and the occasional chain halt. Still, for those seeking aggressive compounding on Solana, Hive AI is at the front of the pack.

Key Takeaways So Far

- Fetch. ai delivers cross-chain intelligence but at the cost of added complexity.

- Yearn V3 vaults use AI to automate and optimize compounding, though transparency is limited.

- Hive AI leverages Solana’s speed for rapid, predictive yield farming – but network risk remains a factor.

Up next, we’ll examine Autonolas’s modular approach to yield aggregation and how 1inch’s Fusion AI Smart Order Router is redefining capital efficiency for automated DeFi portfolios. For a broader look at the best AI crypto trading bots for DeFi in 2024, visit our updated guide.

4. Autonolas Modular Yield Aggregator: Composable Automation at Scale

Autonolas is the dark horse of 2024’s AI yield farming bots, offering a modular, plug-and-play architecture that lets users assemble custom automation stacks. Unlike rigid, monolithic bots, Autonolas supports a library of agent modules, each tuned for tasks like APY hunting, impermanent loss mitigation, or risk scoring. Users can compose these modules to match their risk appetite and target protocols, then let the system’s AI orchestrator rebalance and optimize continuously. The real innovation here is interoperability: Autonolas agents can coordinate across multiple blockchains and DeFi primitives, sidestepping the siloed limitations of most yield aggregators. However, the system’s flexibility introduces a steep learning curve, and the open module ecosystem means code quality varies. For power users who demand granular control, it’s a compelling, if not always beginner-friendly, solution.

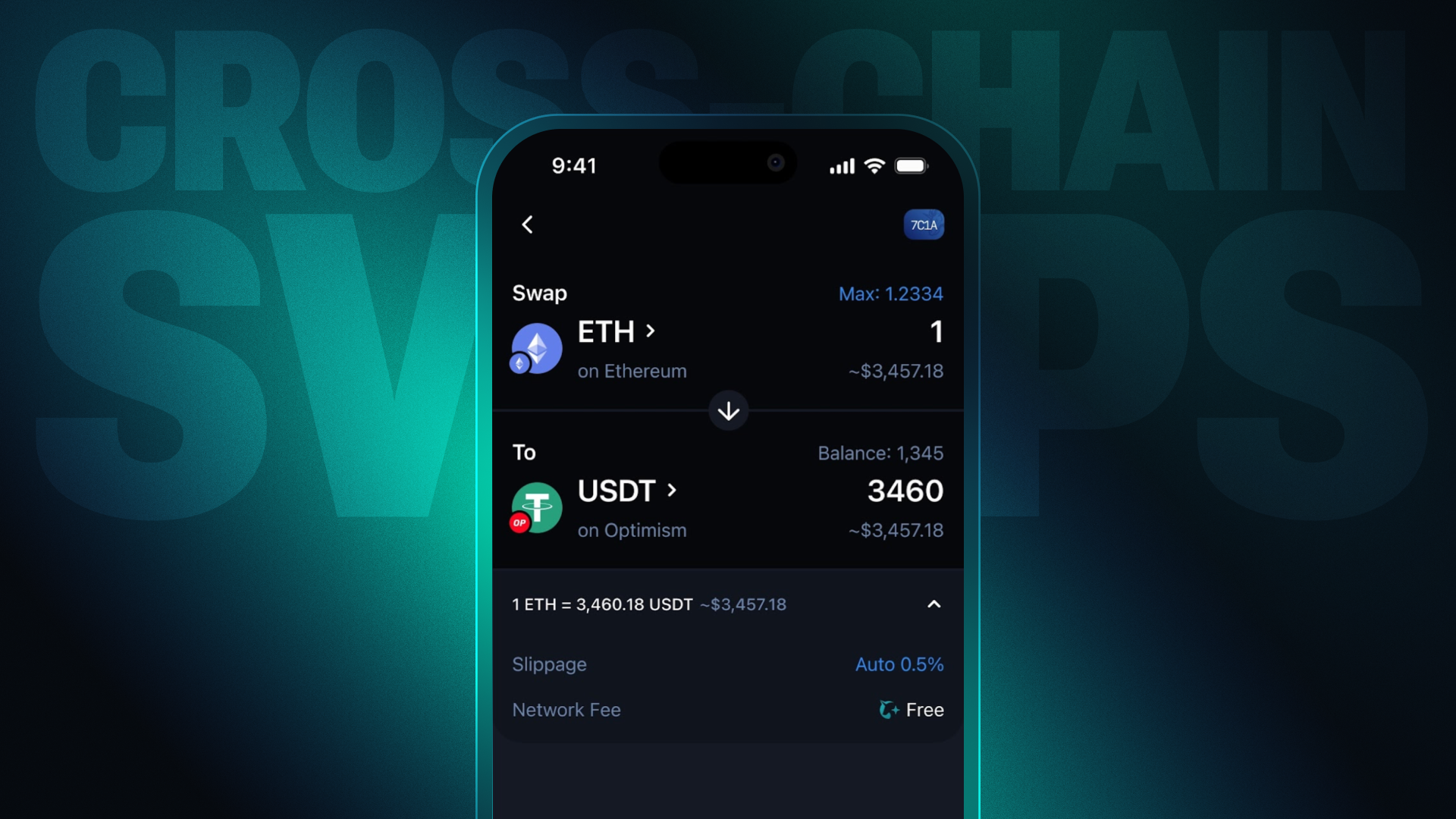

5.1inch Fusion AI Smart Order Router: Optimizing Execution for Yield Chasers

While not a yield aggregator in the classic sense, the 1inch Fusion AI Smart Order Router has become an essential tool for automated DeFi strategies. Yield farming returns are often eroded by poor execution, slippage, suboptimal routing, and gas inefficiency. Fusion AI addresses this by using machine learning to predict liquidity shifts, route orders across dozens of DEXs, and minimize costs in real time. For AI-powered yield farming agents, this means more reliable exits and entries into pools, less value lost to MEV, and tighter tracking of target allocations. The caveat: Fusion’s effectiveness depends on the quality of its data feeds and the health of the underlying DEX landscape. In thin or volatile markets, even the best routing AI can struggle. Still, as a backbone for automated capital deployment, it’s hard to ignore its impact in 2024.

Pros & Cons of Top AI DeFi Yield Farming Agents (2024)

-

Fetch.ai Autonomous DeFi AgentsPros: Advanced automation for trading, gas optimization, and risk management across multiple DeFi protocols. Cons: Complex setup and potential smart contract vulnerabilities; requires trust in agent algorithms.

-

Yearn Finance V3 AI-Optimized VaultsPros: Automated yield strategies that adapt to market changes, minimizing manual intervention. Cons: Protocol risk persists, and performance is highly dependent on underlying DeFi pools and AI model accuracy.

-

Hive AI Yield Farming Bot (Solana-based)Pros: Solana’s high throughput enables fast, low-cost transactions; AI-driven trade execution for complex strategies. Cons: Exposure to Solana ecosystem risks and relatively new AI models with limited track record.

-

Autonolas Modular Yield AggregatorPros: Composable AI agents that can be tailored for specific yield strategies; cross-chain support enhances diversification. Cons: Integration complexity and reliance on emerging standards may increase operational risk.

-

1inch Fusion AI Smart Order RouterPros: Optimized trade routing for best execution across DEXs; AI-enhanced order matching can improve yield capture. Cons: Subject to DEX liquidity fragmentation and potential for increased slippage in volatile markets.

What to Watch: Risks, Rewards, and the Road Ahead

The rise of autonomous DeFi strategies is not without pitfalls. Smart contract exploits, data feed manipulation, and unpredictable protocol incentives remain persistent threats. Even the most sophisticated AI trading agents are only as good as the data and code they rely on. For every headline about triple-digit APYs, there’s a cautionary tale of impermanent loss or rug pulls. The best agents now incorporate on-chain risk scoring, insurance integrations, and even social sentiment analysis, but none can eliminate risk entirely. Diversification across agents and strategies, combined with rigorous backtesting, is non-negotiable for anyone serious about capital preservation.

For those willing to embrace the complexity, the payoff is clear: DeFi yield farming automation in 2024 is more powerful, customizable, and (potentially) profitable than ever before. Whether you’re leveraging Fetch. ai’s cross-chain intelligence, Yearn’s AI vaults, Solana-native Hive bots, Autonolas’s modular agents, or 1inch’s execution layer, the key is skepticism and due diligence. Trust the math, not the marketing. For further reading on how agentic DeFi AI agents are simplifying complex onchain strategies, check out our latest analysis.

Which AI-powered DeFi yield farming agent do you trust most in 2024?

With the rise of advanced AI trading agents, DeFi yield farming has become more efficient and accessible. Which of these top AI-powered agents or strategies is your go-to for maximizing returns and managing risk this year?

As the arms race in crypto trading bots 2024 accelerates, one thing is certain: the winners will be those who combine automation with vigilance. The future of DeFi isn’t just autonomous, it’s adversarial. Stay skeptical, stay informed, and let the agents do the heavy lifting, just don’t turn your back on them.