In 2025, the decentralized finance (DeFi) landscape is being radically reshaped by the rise of DeFAI agents: AI-powered, autonomous bots that seamlessly automate multi-chain trading and portfolio management. Gone are the days when users had to manually navigate complex cross-chain bridges, chase yield opportunities across fragmented ecosystems, or rely solely on static trading algorithms. Instead, DeFAI agents now orchestrate intricate DeFi strategies in real time, learning from massive datasets and adapting on the fly to market shifts.

The Evolution: From Manual DeFi to Agentic Automation

Let’s rewind for a moment. Early DeFi required hands-on management: bridging assets from Ethereum to Solana, manually rebalancing liquidity pools, and watching gas fees like a hawk. With every new chain and protocol, the complexity multiplied. In 2025, DeFAI agents have flipped this paradigm. By integrating advanced machine learning with decentralized infrastructure, these agents can:

- Automate cross-chain transactions, moving funds between networks like Arbitrum, Base, Sonic, Solana, and Ethereum Layer 2s without user intervention.

- Analyze real-time data from on-chain activity, social sentiment feeds, and macroeconomic indicators to spot asymmetric trading opportunities.

- Rebalance portfolios autonomously, adjusting allocations and claiming rewards based on user-defined risk parameters and evolving market conditions.

This isn’t just automation – it’s agentic intelligence at work. Platforms like Cod3x are already offering code-free environments for building custom trading bots that operate across multiple chains with minimal friction. Meanwhile, projects like Hey Anon let users issue natural language commands (“Swap my highest-yielding LP tokens for USDC if volatility spikes above 10%”) that trigger complex multi-step actions in seconds.

The Core Functionalities Powering Multi-Chain Autonomy

The secret sauce? It’s a potent blend of cross-chain interoperability protocols and AI-driven decision-making engines. Here’s what sets top-tier DeFAI agents apart in 2025:

- Cross-Chain Transaction Automation: Agents facilitate seamless asset swaps and liquidity migrations between chains – no more juggling wallets or bridge interfaces.

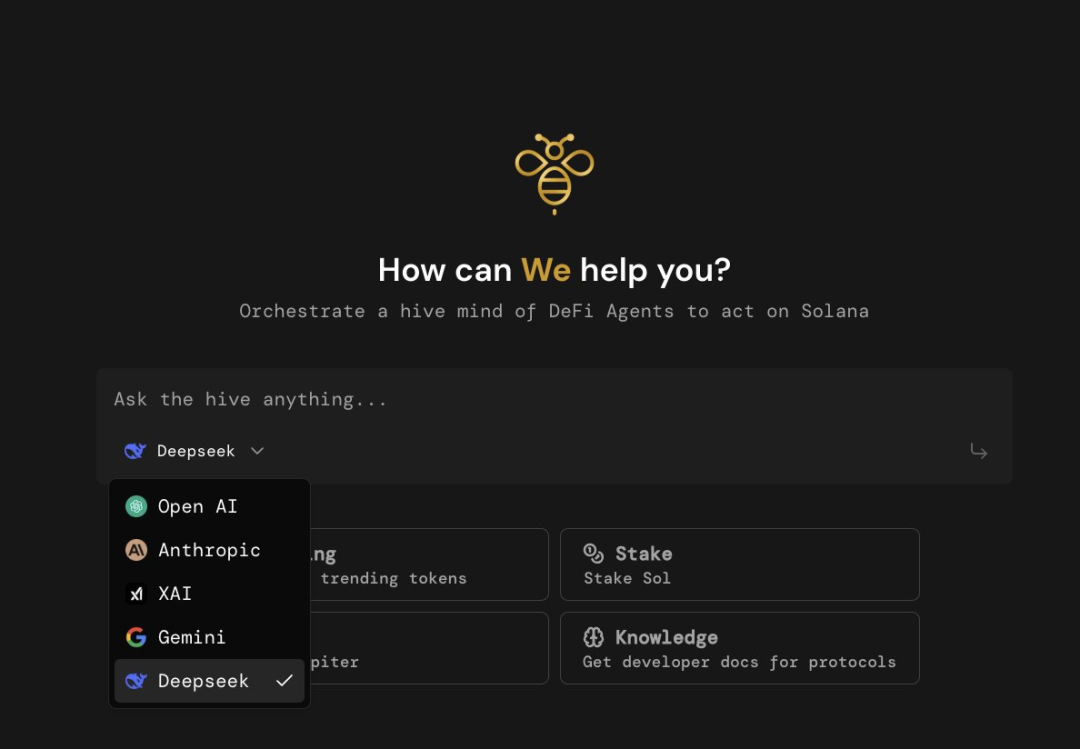

- NLP Interfaces: With natural language processing (NLP), users can manage complex strategies through simple voice or text prompts. Hey Anon leads here with its conversational DeFi interface spanning Sonic, Solana, Base, and Arbitrum.

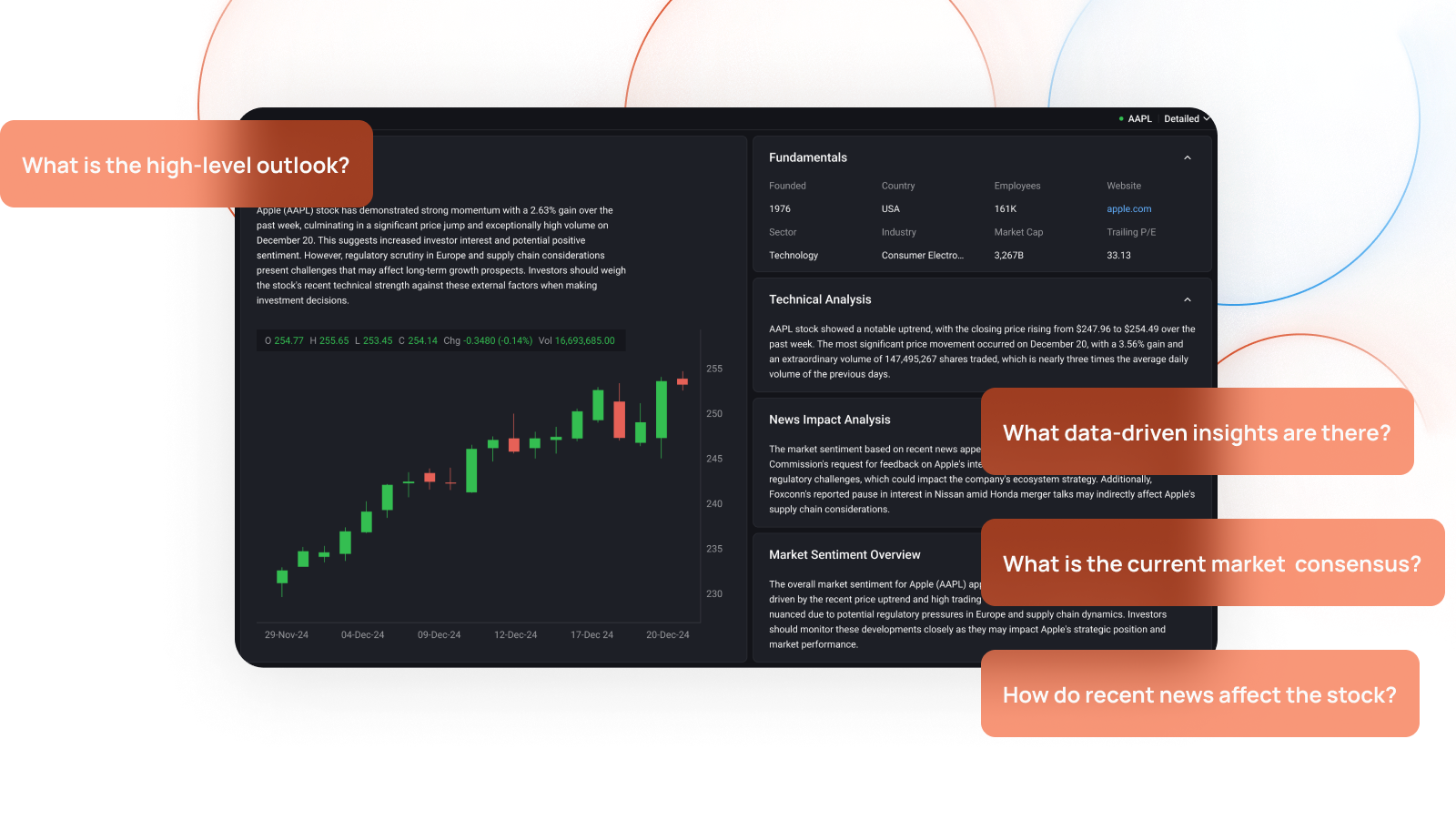

- Real-Time Market Analysis: Agents crunch terabytes of blockchain data alongside Twitter trends and macro news feeds to identify micro-arbitrage windows or sudden liquidity shifts before humans can react.

- Autonomous Portfolio Management: These bots continuously monitor risk metrics and rebalance positions, executing trades or harvesting yield without manual oversight.

This leap in functionality is why we’re seeing explosive growth in multi-chain DeFAI adoption among both pro traders seeking an edge and casual users craving simplicity.

Pioneering Projects: Who’s Leading the Charge?

A handful of innovative teams have emerged as early leaders in this agentic revolution:

- GRIFFAIN (Solana): Streamlines token trading and NFT creation using AI-powered natural language commands, no coding required.

- Hey Anon: Multi-chain by design with cutting-edge NLP capabilities for managing assets across Sonic, Solana, Base, Arbitrum, and beyond, with conversational ease.

- Cod3x: Empowers users to build customizable multi-chain trading agents using drag-and-drop tools plus integrated machine learning models for advanced strategy deployment.

If you want a deeper dive into how these platforms enable secure wallet integration while optimizing automated DeFi strategies across chains, check out our guide on agentic DeFi platforms using AI agents for cross-chain crypto trading automation.

The Impact: Efficiency Meets Intelligence in Multi-Chain Trading

The integration of AI with decentralized finance isn’t just about speed, it’s about smarter decision-making at scale. Imagine an agent that not only executes your trade instantly but also predicts impermanent loss risks on your LP positions based on real-time DEX analysis or migrates your stablecoins to the safest yield farm when market turbulence spikes. The result? More efficient capital deployment across ecosystems, and far less time spent glued to dashboards or Discord channels hunting alpha manually.

What’s truly game-changing is how DeFAI agents are democratizing access to advanced trading strategies that were once reserved for quant desks or bots with significant development resources. Now, anyone can deploy an agent that leverages predictive price modeling, aggregates liquidity across dozens of DEXs, and even reacts to breaking news or whale wallet movements, all with a few clicks or a simple phrase. The learning curve has flattened dramatically.

Top Real-World DeFAI Agent Use Cases in 2025

-

Automated Cross-Chain Arbitrage: DeFAI agents like those on Cod3x autonomously scan multiple blockchains (Ethereum L2s, Solana, and more) to identify and execute profitable price discrepancies in real time, maximizing returns without manual intervention.

-

Dynamic Yield Farming Optimization: Platforms such as Hey Anon empower AI agents to continuously analyze yield opportunities across protocols, reallocating assets instantly for the highest possible APYs while minimizing risk.

-

Sentiment-Driven Trading Strategies: Advanced DeFAI agents leverage real-time social and on-chain sentiment analysis to inform trading decisions, as seen in Gekko AI, reacting to market mood shifts faster than any human trader.

-

Natural Language DeFi Management: With projects like GRIFFAIN, users can deploy AI agents to execute complex DeFi tasks—like token swaps or NFT minting—simply by typing or speaking natural language commands.

-

Autonomous Portfolio Rebalancing: DeFAI agents on platforms such as Cod3x monitor user portfolios 24/7, automatically adjusting allocations in response to market changes and predefined risk parameters, ensuring optimal performance.

Security remains paramount as these agents handle increasingly complex operations. The best projects integrate secure wallet management, often using multi-signature schemes and hardware wallet compatibility, so users maintain full custody while delegating execution to their AI. This is a crucial step forward from the risky days of handing off private keys to opaque bots. As a result, trustless automation is now possible at scale.

From an efficiency standpoint, DeFAI agents have slashed transaction costs and latency by routing trades through optimal bridges and liquidity pools. For example, when volatility spikes on Solana but liquidity dries up on Arbitrum, your agent can instantly rebalance exposure without you ever lifting a finger, capitalizing on fleeting opportunities across networks that would be impossible to catch manually.

Looking Ahead: The Next Frontier for DeFAI Agents

The pace of innovation shows no signs of slowing down. With the launch of agent marketplaces and plug-and-play modules (think app stores for AI trading bots), users in 2025 can now mix-and-match specialized agents: one for cross-chain arbitrage, another for lending protocol optimization, and yet another for NFT strategy, all working in concert from a single dashboard.

This modularity is unlocking new collaborative potential between traders and developers. Open-source communities are rapidly iterating on agent templates that anyone can fork or customize. And as more protocols standardize their APIs for agentic access, expect even deeper integration between AI agents and the core infrastructure of DeFi itself.

If you’re curious about how these advances are simplifying complex onchain strategies, and want actionable tips on leveraging DeFAI in your own portfolio, see our resource on how agentic DeFi AI agents are simplifying complex onchain strategies.

Ultimately, the rise of DeFAI agents marks a pivotal shift: from manually managed chaos to intelligent automation where every user can deploy sophisticated multi-chain strategies with confidence. The line between pro trader and casual participant is blurring, and as these systems continue to learn and adapt in real time, the future of autonomous crypto trading looks brighter (and smarter) than ever.