Decentralized finance is evolving at warp speed, and AI-powered DeFi agents are quickly becoming the backbone of next-generation crypto strategies. For traders and investors who crave both performance and simplicity, these autonomous bots are transforming how we approach cross-chain yield farming and portfolio management. Instead of wrestling with endless dashboards, bridges, and manual rebalancing, users can now deploy intelligent agents that work around the clock to optimize returns across multiple blockchains with minimal intervention.

AI Agents: The New Architects of Cross-Chain Yield Farming

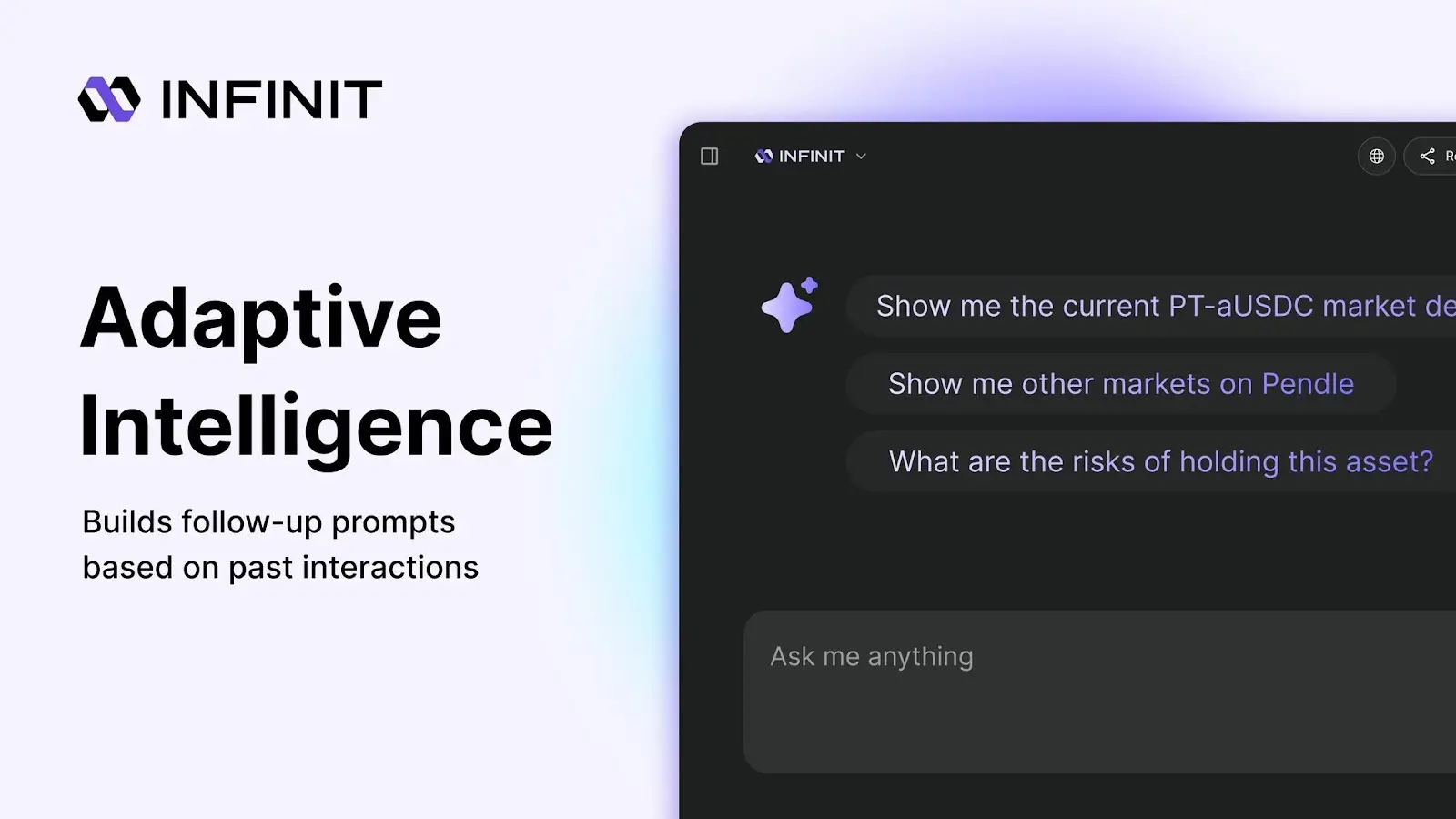

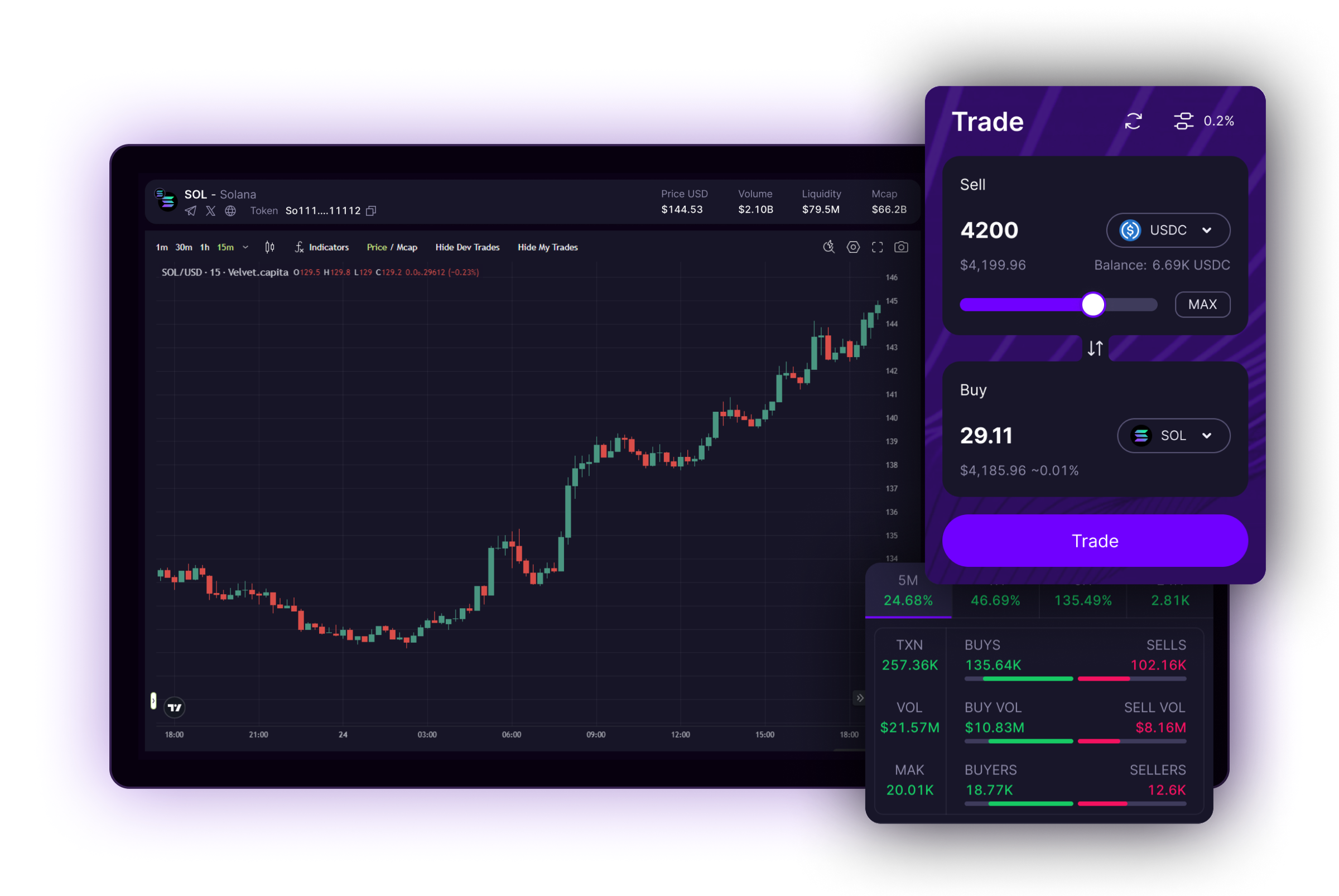

If you’ve ever tried to maximize your DeFi yields manually, you know the grind: tracking dozens of protocols, calculating APYs, timing swaps to avoid gas spikes, and constantly bridging assets between networks. AI DeFi agents like those developed by INFINIT Labs and Velvet Capital are rewriting this playbook. Platforms such as INFINIT deploy swarms of specialized AI bots that coordinate everything from staking to lending to liquidity provision, often in a single click.

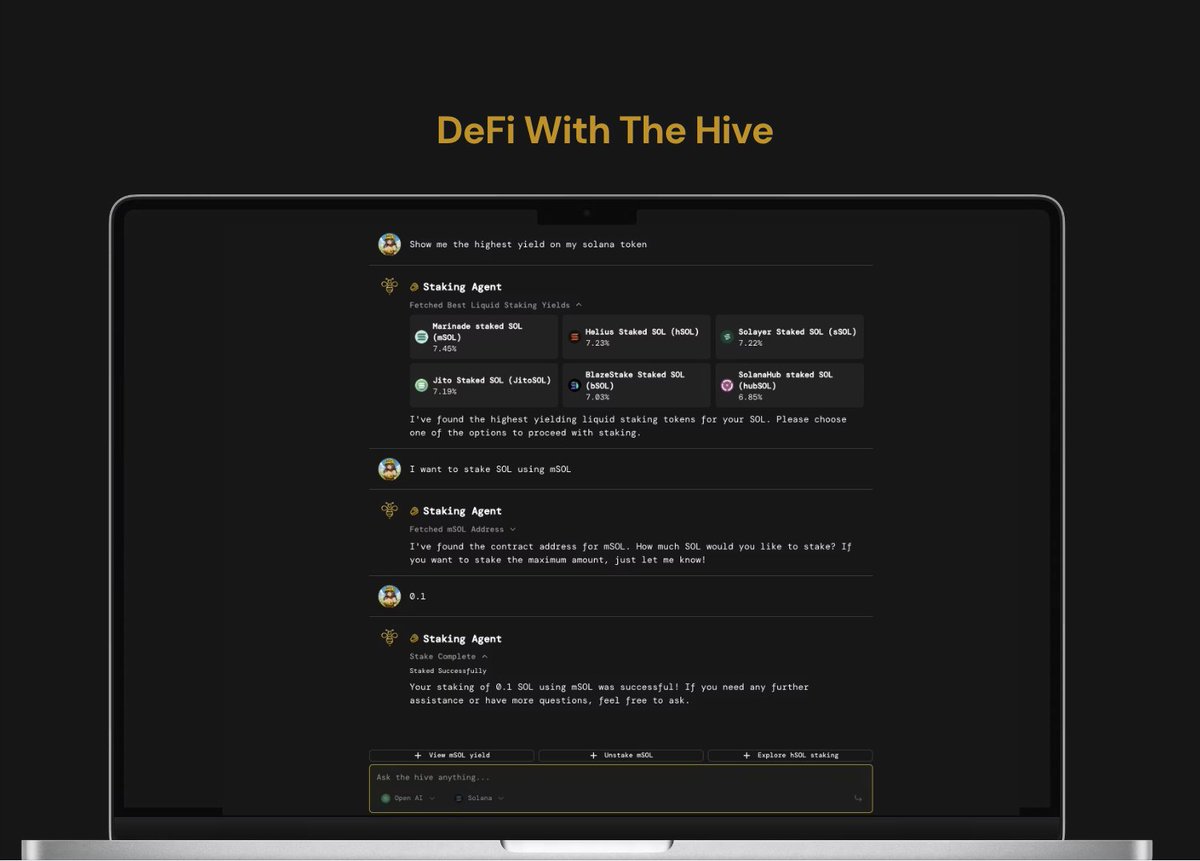

What sets these agents apart is their ability to analyze real-time on-chain data, historical market trends, and even off-chain signals. For example, The Hive’s automation network lets users create personalized AI agents that execute transactions based on user-defined goals, think maximizing stablecoin yields with low risk or chasing the hottest new farming pool before it fills up. These bots don’t just follow static rules; they adapt dynamically as market conditions shift.

How Autonomous Bots Optimize Portfolio Management

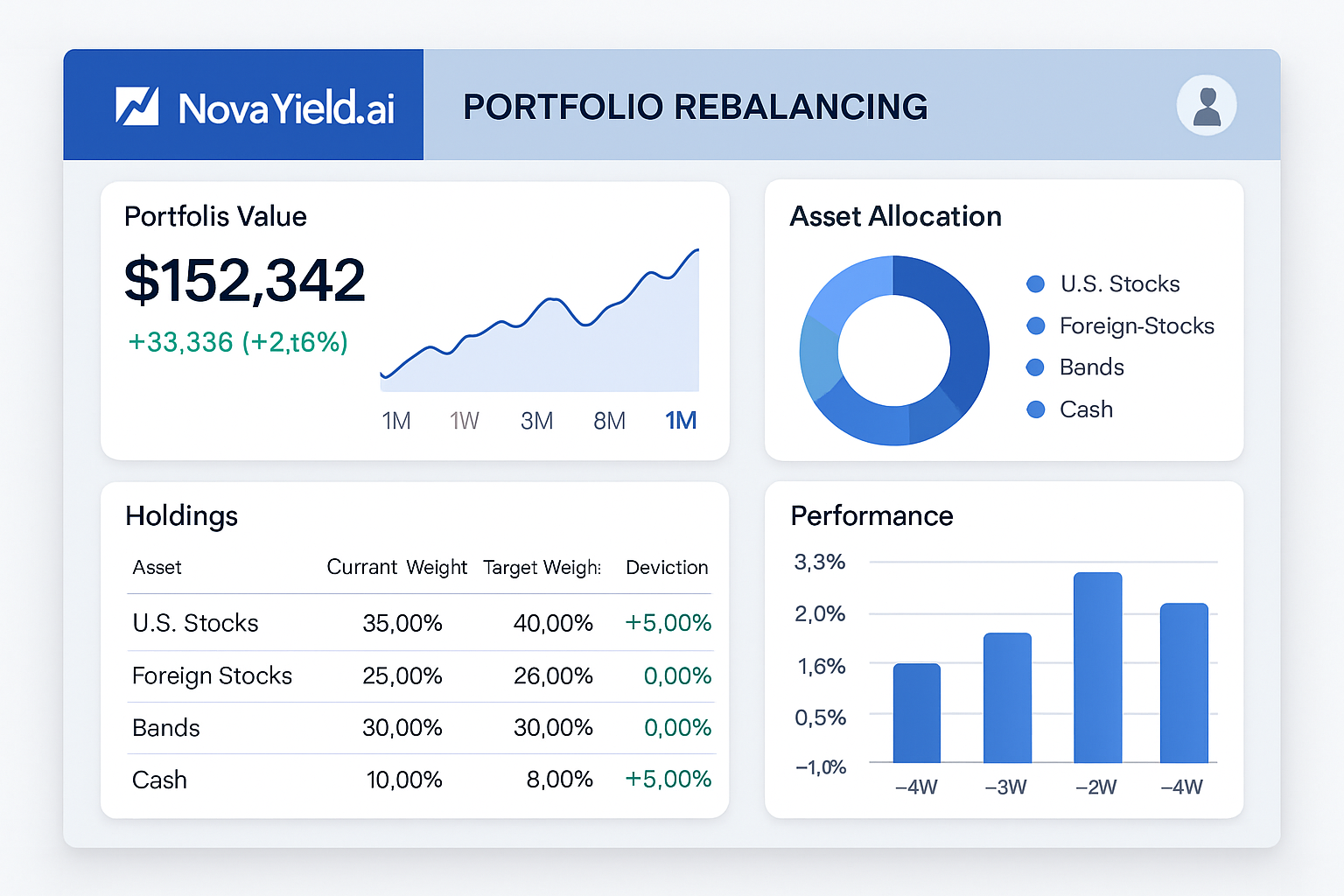

The days of spreadsheet-driven portfolio tracking are fading fast. Modern AI crypto portfolio management solutions handle everything from risk analysis to rebalancing in real time. NovaYield. ai and SparkleX have taken this a step further by integrating machine learning directly into their smart contracts. Their autonomous managers continuously monitor DEX prices, arbitrage opportunities, staking rewards, and even volatility spikes, moving funds between pools or chains when it makes sense.

This isn’t just about squeezing out a few extra basis points; it’s about democratizing access to sophisticated strategies once reserved for institutional desks. With platforms like Velvet Capital’s Intent Operating System for DeFi (backed by a recent $3.7 million raise), even newcomers can tap into institution-grade portfolio management without needing to code or micromanage every trade.

The Tech Stack: Multi-Agent Swarms and Intent-Based Execution

Diving under the hood reveals some serious innovation. INFINIT’s three-layered Agent Infrastructure includes an “Agent Swarm”: over 28 specialized bots working in tandem across swaps, lending markets, bridges, and more. This swarm coordinates complex workflows that would be nearly impossible for a human trader to replicate at scale or speed. Velvet Capital’s multi-agent approach focuses on intent-driven execution: users state their goals (like maximizing ETH yield with moderate risk), then the system routes funds through optimal protocols automatically.

The result? Frictionless trading experiences where users set parameters, and let AI handle discovery, evaluation, execution, and monitoring across chains like Ethereum and Solana.

But the magic isn’t just in automation, it’s in optimization. These AI-powered agents are constantly searching for alpha, scanning liquidity pools, staking platforms, and lending markets across dozens of blockchains. When a better opportunity arises, funds are bridged and redeployed instantly. This agility is especially critical in DeFi, where yield rates can evaporate within hours and gas fees fluctuate wildly. By predicting optimal transaction times and routing assets through the most cost-efficient paths, AI agents minimize slippage and maximize net returns.

Platforms like TrustStrategy are leveraging machine learning to crunch historical and real-time data, identifying not only the highest-yielding opportunities but also managing risk exposure with surgical precision. Their systems can dynamically adjust portfolio allocations based on market volatility or sudden spikes in protocol risk, something that would take a human trader hours (if not days) to react to. NovaYield. ai’s fully autonomous manager even executes stop-loss mechanisms when conditions turn sour, safeguarding your capital without constant oversight.

Democratizing Advanced DeFi Strategies

The real promise of autonomous trading bots is accessibility. In the past, only whales or professional managers with dev teams could run sophisticated cross-chain yield strategies. Now, platforms like SparkleX let anyone deposit assets and have an AI Copilot manage everything, lending, staking, farming, hedging, on their behalf. This shift is flattening the playing field for retail users while giving pros new tools to scale capital across fragmented liquidity landscapes.

Top AI DeFi Agent Features Powering Cross-Chain Automation

-

Real-Time Portfolio Rebalancing: Platforms like NovaYield.ai use AI agents to autonomously monitor and rebalance DeFi portfolios, dynamically shifting assets between staking, farming, and liquidity pools based on live market data.

-

Cross-Chain Execution: INFINIT Intelligence and SparkleX deploy specialized AI agents to seamlessly execute trades and manage assets across multiple blockchains, unlocking yield opportunities beyond single-chain limitations.

-

Gas Fee Optimization: TrustStrategy leverages machine learning to predict optimal transaction times and routes, reducing gas costs for yield farming and portfolio adjustments across networks like Ethereum and Solana.

-

Personalized Risk Controls: The Hive enables users to set custom risk parameters, with AI agents automatically adjusting allocations and executing stop-losses to protect assets during volatile market swings.

-

Intent-Driven Strategy Automation: Velvet Capital offers an Intent Operating System for DeFi, where users define their financial goals and AI agents handle discovery, execution, and ongoing management—making advanced DeFi strategies accessible with a single click.

Risk management is another area where these bots shine. Instead of relying on static allocation models or gut feel, today’s AI agents monitor on-chain metrics 24/7: tracking protocol health scores, detecting rug-pull risks early, and adjusting exposure automatically if a pool’s safety deteriorates. The Hive’s network exemplifies this approach by blending predictive analytics with automated liquidity management, delivering robust returns while minimizing downside surprises.

If you’re curious how these systems actually work in practice, or want to see live workflows from platforms like INFINIT or Velvet Capital, check out our deep dives on real-world examples of automated DeFi yield farming or explore more about AI-driven cross-chain strategies here.

What’s Next? The Future of Agentic DeFi

This wave of non-custodial DeFi automation isn’t slowing down. As agentic infrastructures mature, with more transparent algorithms and user-friendly interfaces, we’ll see even broader adoption among both crypto natives and tradfi newcomers seeking passive income streams. Expect swarms of interoperable AI agents coordinating across chains and protocols in real time, not just optimizing for yield but factoring in tax efficiency, ESG considerations, and user-defined ethical constraints.

The bottom line: AI-powered DeFi agents are making sophisticated portfolio management accessible to all while setting new standards for efficiency and risk-adjusted returns. Whether you’re a seasoned trader looking to scale your edge or a newcomer eager to automate your first vault deposit, this technology is rapidly becoming your most valuable ally in the decentralized economy.