Crypto never sleeps, and neither do the markets. For DeFi enthusiasts, this means opportunity is always just a block away, but also that missing a key moment can be costly. Enter MEXC’s AI-powered trading bots: a new breed of autonomous agents that are fundamentally changing how traders engage with 24/7 crypto markets. Built on advanced machine learning and real-time data analytics, these bots are rapidly gaining traction among both seasoned traders and the next generation of digital asset investors.

What Sets MEXC AI Bots Apart From Traditional Crypto Trading Automation?

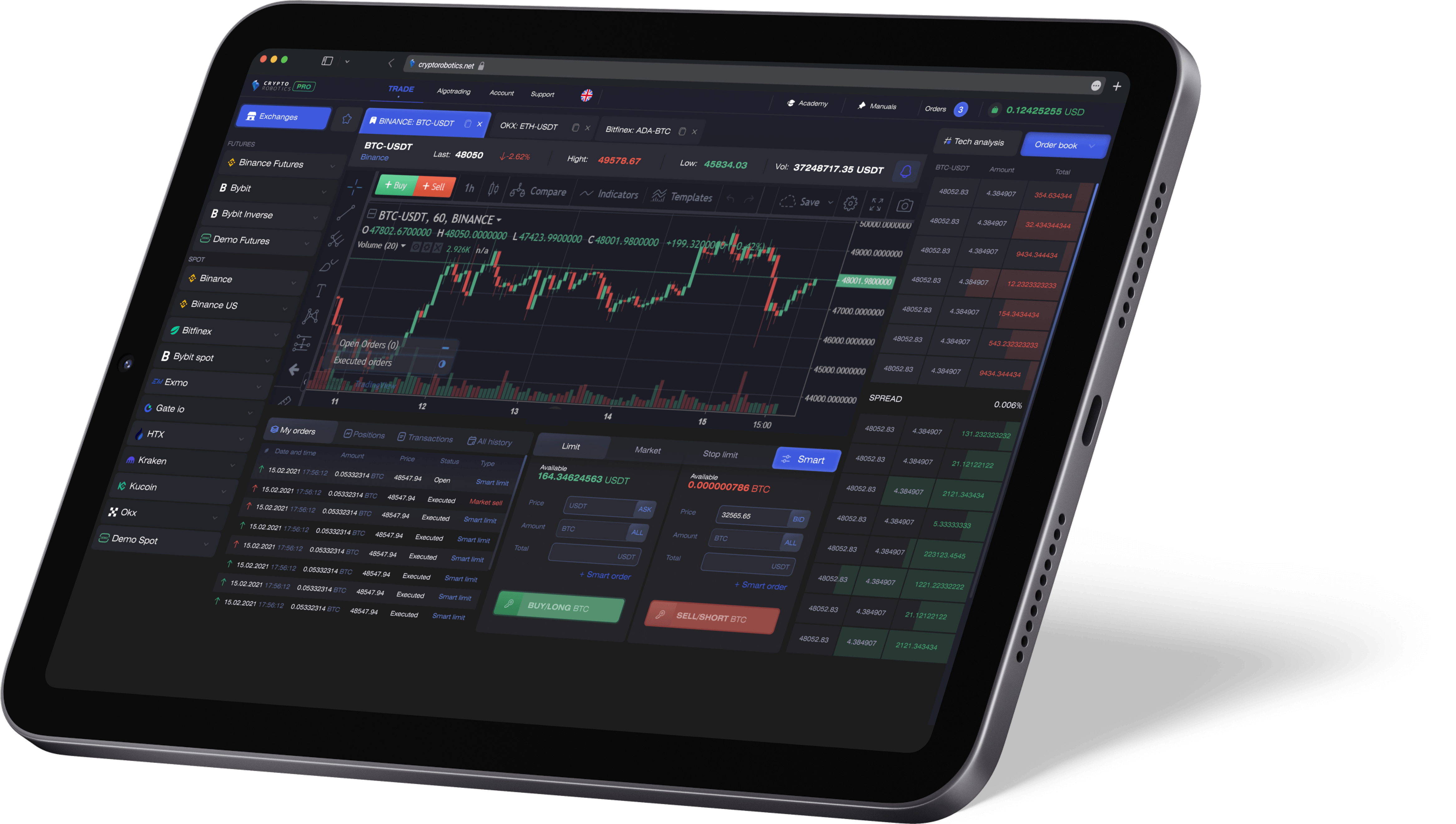

Unlike legacy trading bots that follow rigid, pre-programmed rulesets, MEXC’s AI agents are designed to learn, adapt, and evolve with the market. They continuously ingest diverse streams of data, from historical price action and live order books to on-chain metrics and even social media sentiment, building a holistic picture of market dynamics in real time. This enables them to generate predictive trade signals and execute strategies far more nuanced than static grid or DCA scripts.

For example, when a sudden spike in token mentions ripples across Twitter or Farcaster, MEXC’s AI can parse the signal from the noise, correlating crowd sentiment with technical indicators to anticipate momentum shifts before they hit mainstream charts. The result? Emotionless crypto trading that reacts within milliseconds, not minutes or hours, capturing fleeting arbitrage opportunities and swing setups that human traders often miss.

The Power of 24/7 Autonomous Crypto Trading

The most immediate advantage for DeFi enthusiasts is true hands-off automation. MEXC’s bots don’t just run after you clock out; they thrive in the always-on environment of digital assets. Whether it’s 3 AM or during a major global event, these agents watch every tick across CEXs and DEXs alike, scanning for volatility spikes, liquidity gaps, or news-driven breakouts.

This round-the-clock vigilance is especially crucial for DeFi tokens whose price moves can be swift and dramatic outside traditional market hours. With AI trading bots for DeFi, users can finally seize opportunities without being chained to their screens or losing sleep over missed entries.

Data-Driven Decisions Without Emotional Baggage

If you’ve ever panic sold during a flash crash or FOMO’d into a pump only to get dumped on minutes later, you know how emotions sabotage even the best-laid plans. MEXC’s AI bots operate on pure logic: every decision is backed by statistical analysis rather than gut feeling or social pressure. This discipline translates into more consistent returns over time by eliminating common psychological pitfalls like revenge trading or hesitation during volatile swings.

The impact isn’t just anecdotal, according to a recent behavioral intelligence report from MEXC itself, 67% of Gen Z users activated at least one AI-powered bot in Q2 2025. This generational shift toward automation signals growing trust in algorithmic execution over manual intervention.

MEXC Trading Bot Features: Beyond Simple Automation

The current wave of MEXC trading bot features goes far beyond basic buy/sell triggers:

- Real-time AI trade ideas: Get actionable signals based on live data fusion across technicals, fundamentals, news feeds, and sentiment analysis.

- Strategy backtesting: Test new approaches using historical data before risking capital live.

- Risk controls and rapid execution: Automated stop-losses and take-profits ensure disciplined exits while millisecond-level reaction times capture even micro-arbitrage windows.

- DCA and Grid strategies powered by AI: Let smart algorithms dynamically adjust order sizes and spacing according to evolving volatility conditions.

This suite empowers traders to move beyond “set-and-forget” automation toward adaptive portfolio management tailored for today’s complex DeFi landscape.

What’s truly exciting is how these AI bots are lowering the barrier for sophisticated trading. Instead of requiring years of experience or coding skills, MEXC’s intuitive interface lets users deploy advanced AI strategies with just a few clicks. Want to automate a DCA plan that only triggers after a major whale moves on-chain? Or set up a grid strategy that pivots when news sentiment flips bullish? The toolkit is robust enough for power users, yet accessible for anyone ready to dip their toes into agentic DeFi.

These innovations aren’t happening in a vacuum. They’re part of a larger movement toward 24/7 autonomous crypto trading, where intelligent agents act as tireless portfolio managers, adapting to market shocks and emerging narratives faster than any human could. As DeFi protocols become more interoperable and data-rich, the synergy between MEXC’s AI bots and decentralized liquidity venues is only set to deepen. If you’re curious about integrating these tools with DEXs, check out our practical guide on bridging AI bots with decentralized exchanges.

Real-World Results: Smarter Investing With Less Stress

The feedback loop between bot performance and user confidence is clear: as more traders witness consistent results, be it from catching overnight breakouts or sidestepping sudden dumps, adoption accelerates. The emotional relief alone is worth noting; knowing your trades are handled by unemotional logic frees up mental bandwidth for research or just living life.

And the numbers don’t lie. According to MEXC’s latest research, not only are younger traders embracing AI-powered execution, but overall platform engagement has ticked higher as users automate repetitive tasks and focus on creative strategy development instead. This marks a subtle but profound shift from reactive trading to proactive portfolio management.

What’s Next for AI Trading Bots in DeFi?

The evolution of AI trading bots for DeFi is far from over. As machine learning models grow more sophisticated, factoring in complex cross-chain flows, NFT activity, and even macroeconomic data, the potential for edge compounds exponentially. We’re already seeing early prototypes that can execute multi-leg arbitrage across CEXs and DEXs or adjust risk parameters in real time based on regulatory news flashes.

For traders who want to stay ahead of the curve, now is the time to experiment with these tools while the competitive advantage still exists. Whether you’re optimizing yield farming rotations or simply seeking emotionless crypto trading on autopilot, MEXC’s ecosystem offers one of the most comprehensive starting points available today.

If you’re ready to take your crypto game beyond manual chart-watching and into the realm of intelligent automation, explore how agentic DeFi protocols are reshaping what’s possible for individual investors in our deep dive: How Agentic DeFi Protocols Are Transforming Automated Crypto Trading in 2024.