The world of automated crypto trading has entered a new era in 2024, driven by the rapid evolution of agentic DeFi protocols and AI-powered trading agents. These systems are no longer just simple bots following static instructions; they are autonomous entities capable of analyzing vast amounts of market data, learning from outcomes, and executing complex strategies across multiple blockchains. The result? A seismic shift in how both institutional and retail traders approach the decentralized finance (DeFi) landscape.

What Sets Agentic DeFi Protocols Apart?

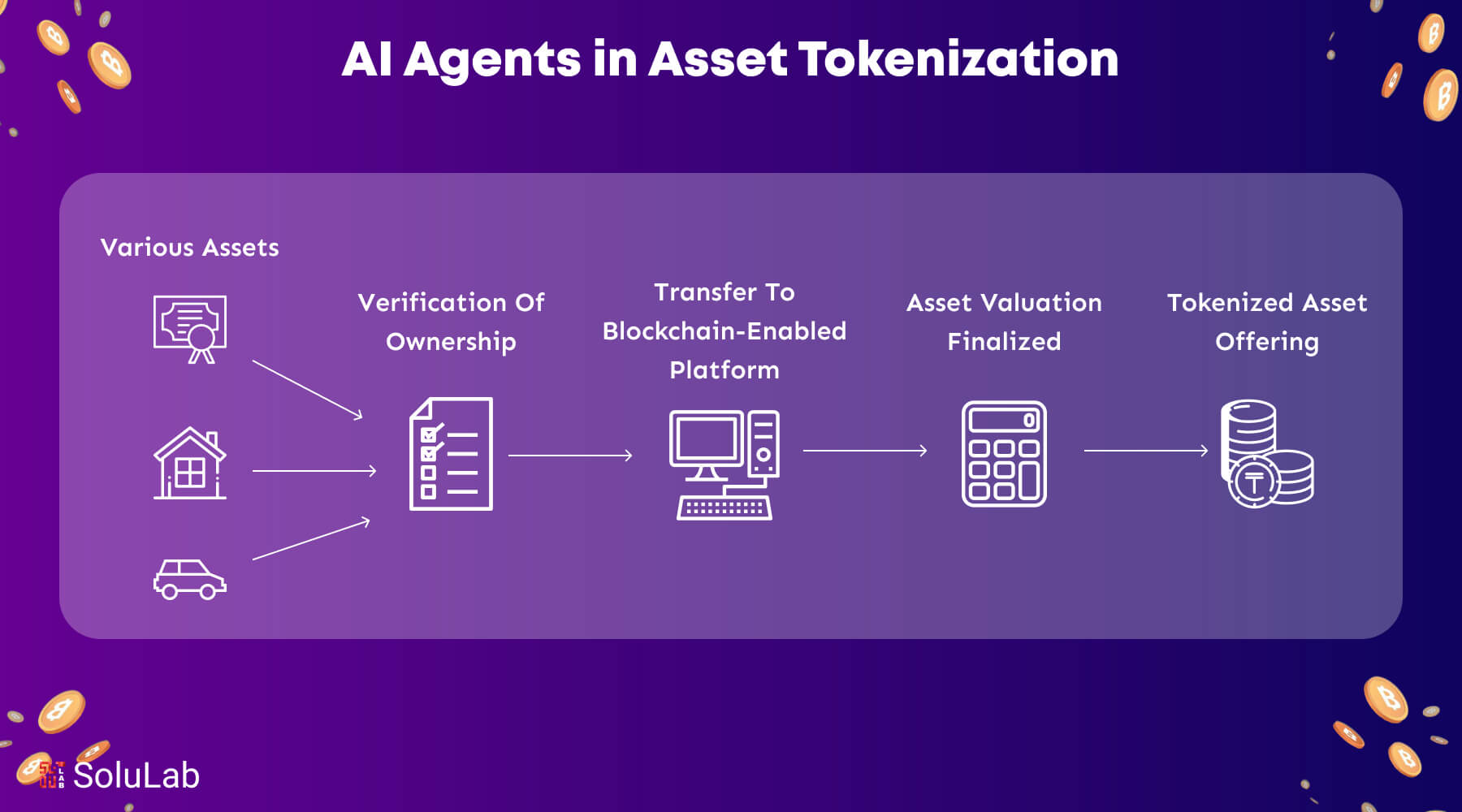

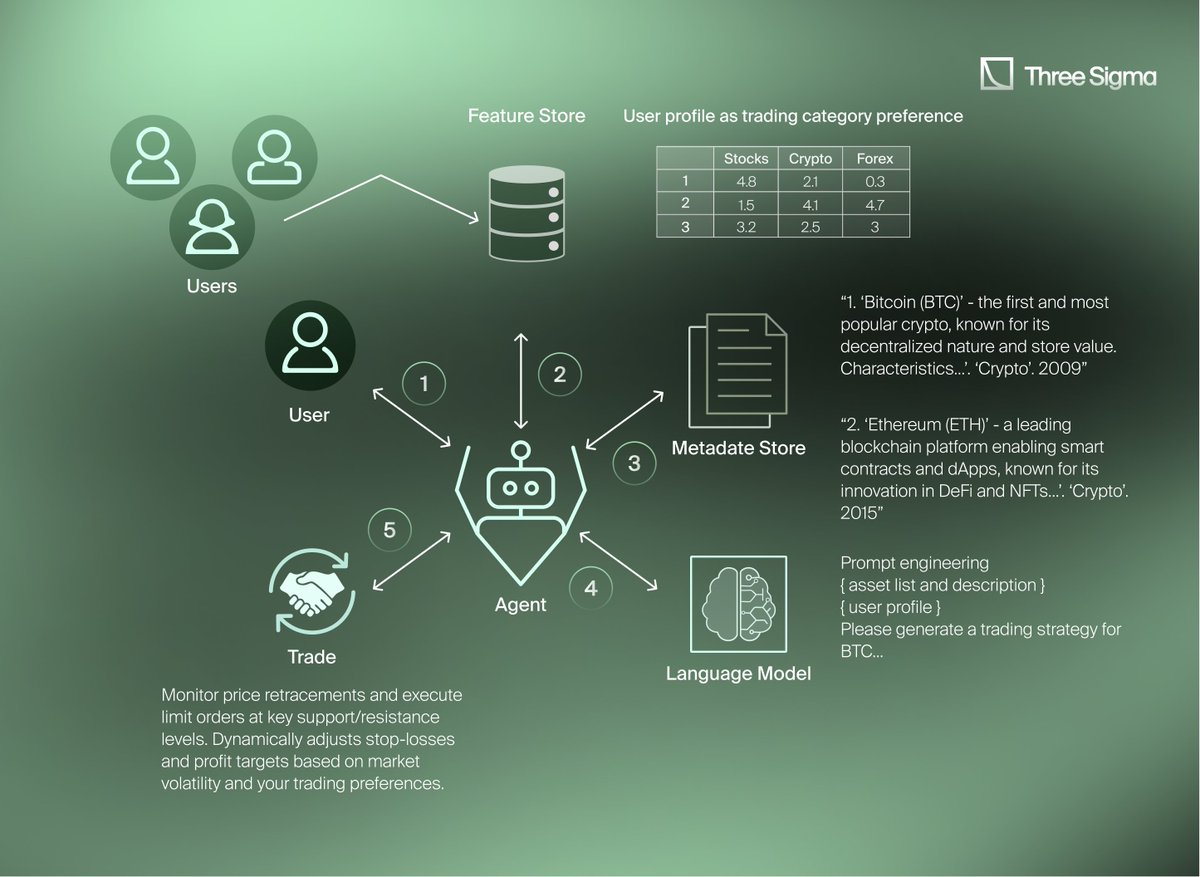

Traditional DeFi trading bots were rule-based and reactive. In contrast, agentic DeFi protocols leverage advanced machine learning to adapt strategies in real time. These AI agents monitor liquidity pools, arbitrage opportunities, price spreads, and even on-chain governance proposals, making judgment calls that previously required a team of human analysts.

Autonomous execution is a game changer. Platforms like IAESIR deploy self-learning algorithms that not only execute trades with precision but also dynamically adjust risk parameters based on shifting market conditions. According to recent research, these agents process complexity at speeds unattainable by humans, optimizing for both yield and safety without emotional bias or fatigue.

Key Players Redefining Automated Crypto Trading in 2024

- IAESIR: Blending AI with blockchain infrastructure, IAESIR’s hedge fund model continuously adapts its strategy using live data feeds and predictive analytics to outperform traditional funds.

- Autonolas: A decentralized network powering autonomous Web3 agents that interact with both on-chain and off-chain sources for seamless automated trading and governance participation.

- Yield Seeker and Mamo: Both focus on yield optimization for stablecoins through conversational interfaces, users simply state their goals while the AI agent handles allocation, rebalancing, and reporting.

- Stoic AI and ARMA: These platforms specialize in adaptive trading strategies that minimize emotional decisions while maximizing consistency across volatile crypto markets.

This new breed of AI-powered trading agents is making it easier than ever for users to tap into sophisticated strategies without deep technical expertise. For a closer look at how these systems automate cross-chain yield strategies, check out our guide: How Agentic DeFi AI Agents Automate Cross-Chain Yield Strategies in 2024.

The Impact: Efficiency Meets Accessibility

The integration of agentic DeFi protocols is not just about speed or scale, it’s about accessibility and optimization. Here’s how these advancements are transforming the landscape:

- Continuous Monitoring and Execution: Agents can rebalance portfolios or route orders across exchanges around the clock, eliminating manual oversight.

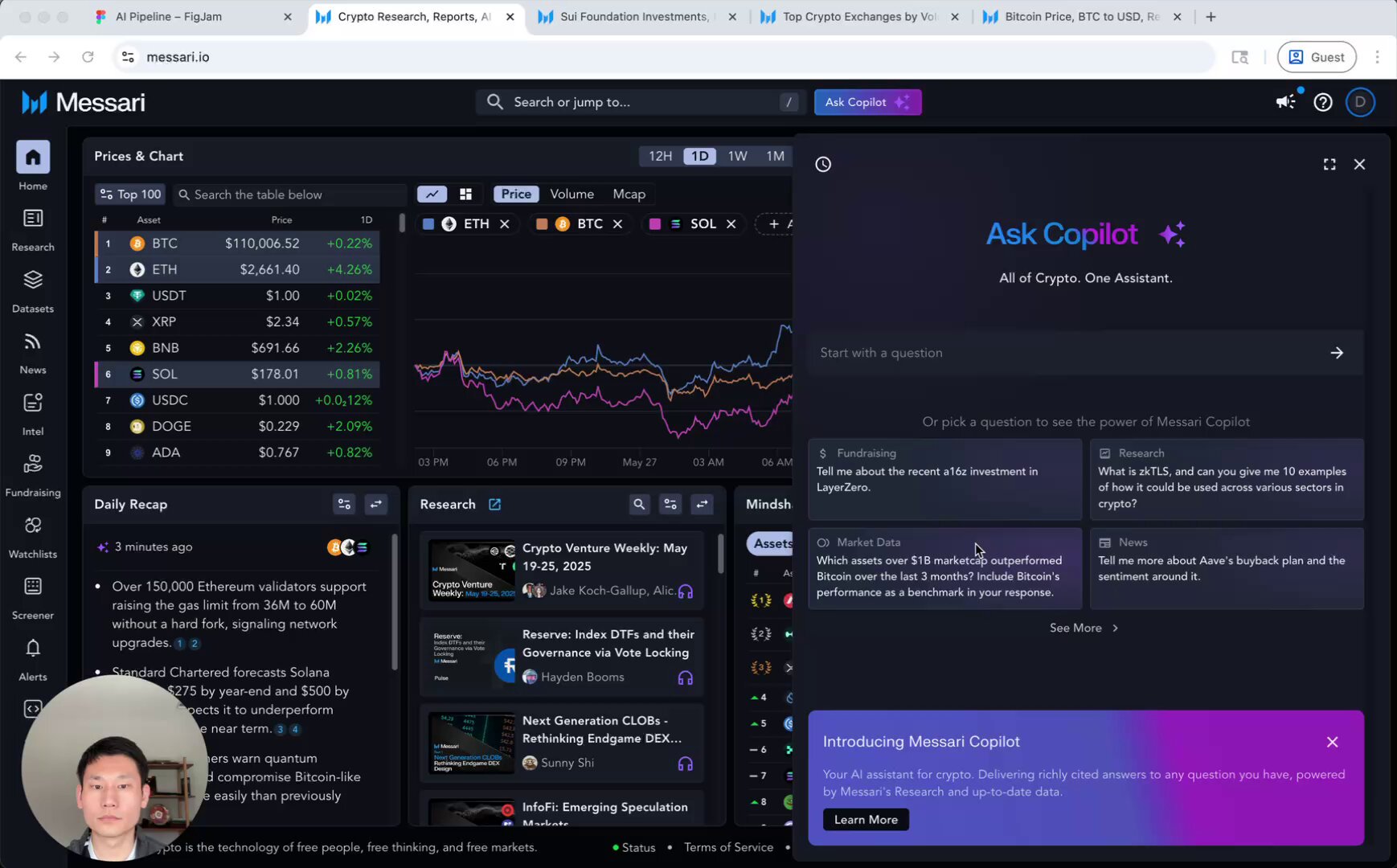

- User-Friendly Interfaces: Natural language commands allow even non-technical users to participate in advanced DeFi strategies via chatbots or voice assistants.

- Real-Time Adaptation: Machine learning enables these agents to pivot instantly as volatility spikes or liquidity shifts, turning market uncertainty into opportunity.

The days of spreadsheet-driven portfolio management are fading fast as more traders embrace the flexibility offered by AI-driven automation. For an in-depth analysis on how these tools are transforming portfolio automation at scale, see our feature: How Agentic DeFi Bots Are Transforming Crypto Portfolio Automation in 2025.

Yet, with this leap in automation, a new set of questions emerges: how do these AI-powered trading agents maintain security and transparency in an environment often plagued by exploits and rug pulls? The answer lies in the decentralized nature of agentic DeFi protocols. By operating on open-source smart contracts and leveraging real-time audit trails, these agents provide users with unprecedented visibility into every trade, allocation, and strategy shift. This transparency is not just a feature, it’s a fundamental requirement for trust in the next generation of DeFi trading bots.

Risks, Limitations, and the Path Forward

Despite their sophistication, agentic DeFi protocols are not immune to risk. Model drift, where an AI’s predictive accuracy degrades over time due to changing market dynamics, remains a challenge. Additionally, smart contract vulnerabilities can be exploited if not rigorously tested and updated. However, platforms like Autonolas are tackling these issues head-on by employing multi-layered security audits and enabling community-driven governance to oversee protocol upgrades.

The real breakthrough is how these platforms democratize access to complex strategies previously reserved for institutional desks. Now, anyone can deploy an AI agent that continuously scans for arbitrage opportunities or optimizes stablecoin yields, no PhD in quantitative finance required. This shift is already visible in user adoption metrics across leading protocols.

Top Features Users Love About AI-Powered Trading Agents

-

24/7 Automated Market Monitoring: AI agents like those in IAESIR and Stoic AI continuously scan global crypto markets, executing trades and responding to opportunities instantly—no sleep required.

-

Instant Adaptation to Market Volatility: Advanced protocols such as Autonolas and Stoic AI use real-time data and machine learning to adjust trading strategies on the fly, helping users capitalize on rapid price swings and minimize risk.

-

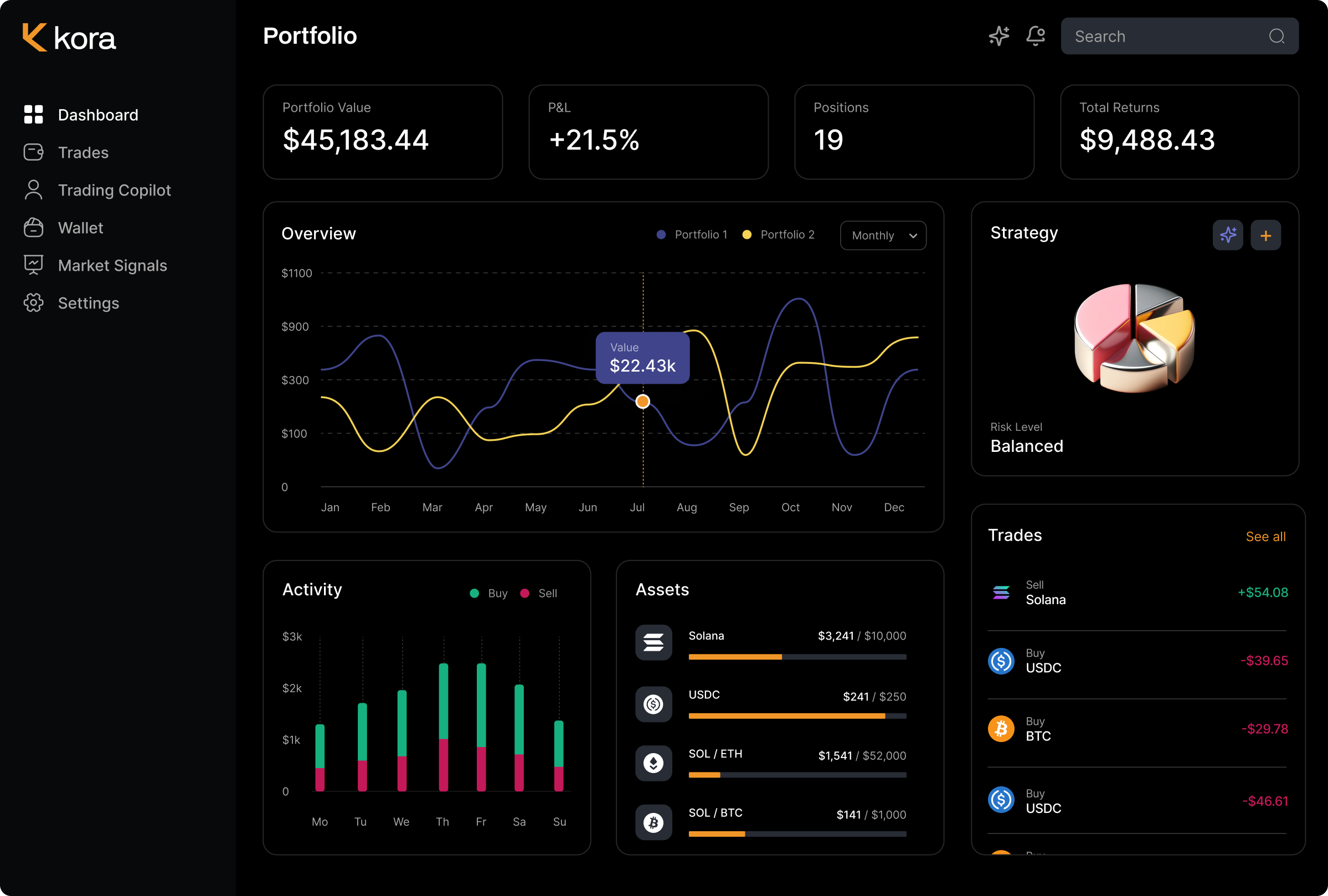

Unified, User-Friendly Dashboards: Platforms like Yield Seeker and Mamo offer intuitive dashboards that aggregate portfolio data, performance metrics, and yield opportunities across DeFi, making complex trading accessible to everyone.

-

Seamless Cross-Chain Execution: AI agents in protocols such as Autonolas facilitate trades and portfolio management across multiple blockchains, breaking down ecosystem silos and maximizing efficiency.

-

Personalized Yield Optimization: Services like ARMA and Yield Seeker leverage AI to dynamically allocate assets, rebalance portfolios, and optimize stablecoin yields based on individual risk preferences and market conditions.

-

Conversational Interfaces for Easy Control: With platforms such as Mamo, users can interact with their AI trading agents using natural language commands, simplifying complex DeFi actions into everyday conversation.

As more capital flows into automated crypto trading in 2024, we’re seeing fierce competition between protocol teams to deliver faster execution times and smarter risk controls. The best DeFi trading bots now integrate cross-chain operability as standard, allowing users to chase yield or hedge exposure across Ethereum, Solana, Arbitrum, and beyond, all from a single dashboard.

What’s Next for Crypto Portfolio Management AI?

The next frontier for agentic DeFi protocols is hyper-personalization. Imagine an AI agent that not only learns your risk tolerance but also adapts your portfolio as your financial goals evolve, whether you’re stacking stablecoin yield or swing-trading altcoins during periods of high volatility. With conversational interfaces like those offered by Mamo and Yield Seeker gaining traction, interacting with your crypto portfolio could soon be as intuitive as texting a friend.

For traders seeking deeper insights into how cross-chain strategies are being automated by today’s smartest bots, and what this means for their bottom line, our deep dive on How Cross-Chain AI Agents Automate DeFi Strategies: Real-World Use Cases offers actionable examples from live markets.

Final Thoughts: Turning Volatility Into Opportunity

The rise of agentic DeFi protocols marks more than just another evolution in automated crypto trading, it signals a paradigm shift toward more resilient portfolios and accessible wealth-building strategies. As these autonomous agents continue learning at scale and integrating new data sources with lightning speed, they empower both pros and newcomers alike to turn market volatility into opportunity rather than fear.