DeFi yield farming has rapidly evolved from a manual, high-touch process into a sophisticated, data-driven landscape where AI trading agents for DeFi are now leading the charge. The rise of open-source frameworks and modular protocols is enabling both retail and institutional investors to automate yield optimization strategies, minimize human error, and respond to volatile market conditions in real time. But which tools actually deliver on the promise of hands-free, intelligent yield farming? Let’s dissect the most relevant frameworks, setup guides, and critical considerations shaping automated DeFi yield farming in 2025.

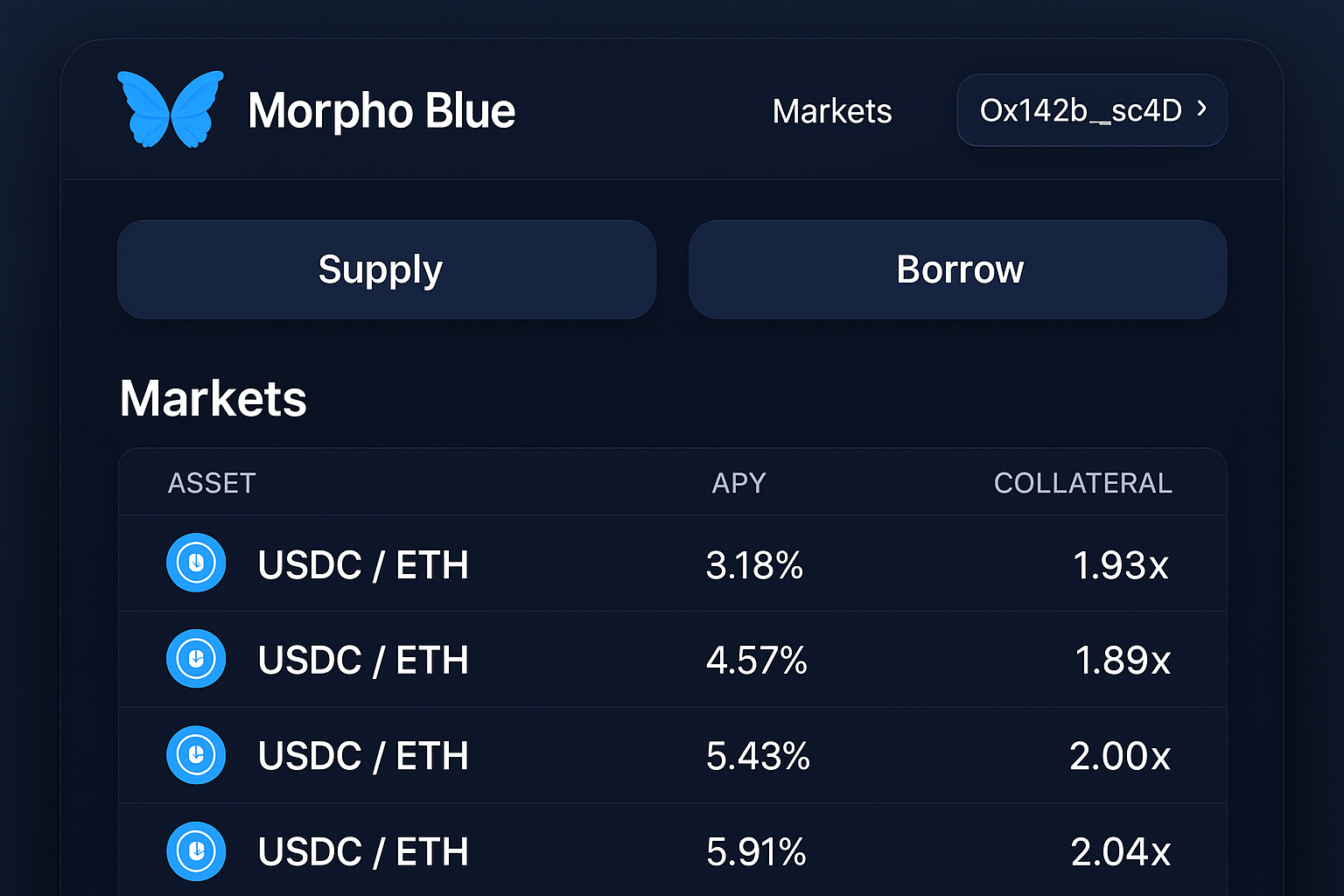

Leveraging Morpho Blue: Modular Protocols with AI Agent Integrations

Morpho Blue stands out as a next-generation open-source protocol purpose-built for lending and yield farming automation. Its modular architecture is designed to facilitate seamless integration with AI agents, allowing users to deploy advanced trading logic directly onto decentralized markets. Unlike monolithic DeFi platforms, Morpho Blue enables developers to plug in custom agent modules that monitor liquidity pools, rebalance portfolios, and execute complex strategies based on live market data.

This flexibility empowers users to:

- Dynamically allocate assets across lending pools based on changing APYs

- Utilize reinforcement learning agents for optimizing collateralization ratios and minimizing liquidation risks

- Automate cross-protocol arbitrage by integrating external data feeds and on-chain analytics

If you’re seeking a deep dive into how agentic DeFi protocols like Morpho Blue are transforming yield farming workflows, explore our related analysis at How Autonomous Trading Agents Are Transforming DeFi Yield Farming in 2024.

Guide: Setting Up Automated Yield Farming Bots with Freqtrade and Hyperopt

No conversation about automated yield farming bots is complete without mentioning Freqtrade, an open-source crypto trading bot framework that has gained traction among algorithmic traders for its extensibility and active community. What makes Freqtrade especially compelling for DeFi enthusiasts is its compatibility with custom strategy scripts and optimization plugins like Hyperopt.

The typical workflow involves:

- Connecting Freqtrade to decentralized exchanges (DEXs): Using web3 connectors or custom APIs to access liquidity pools.

- Coding or importing AI-driven strategies: These can include machine learning models trained on historical pool performance or real-time price action.

- Tuning parameters with Hyperopt: This plugin leverages Bayesian optimization or genetic algorithms to fine-tune strategy variables, such as staking thresholds or rebalancing intervals, for maximum risk-adjusted returns.

- Piloting bots in simulation mode before mainnet deployment: Ensuring safety by stress-testing against historical data sets.

This approach allows for rapid iteration and continuous improvement, a must in today’s fast-moving DeFi markets. For more hands-on tutorials about integrating Freqtrade bots into your portfolio management stack, see our guide at How to Automate DeFi Yield Farming with AI Trading Agents in 2024.

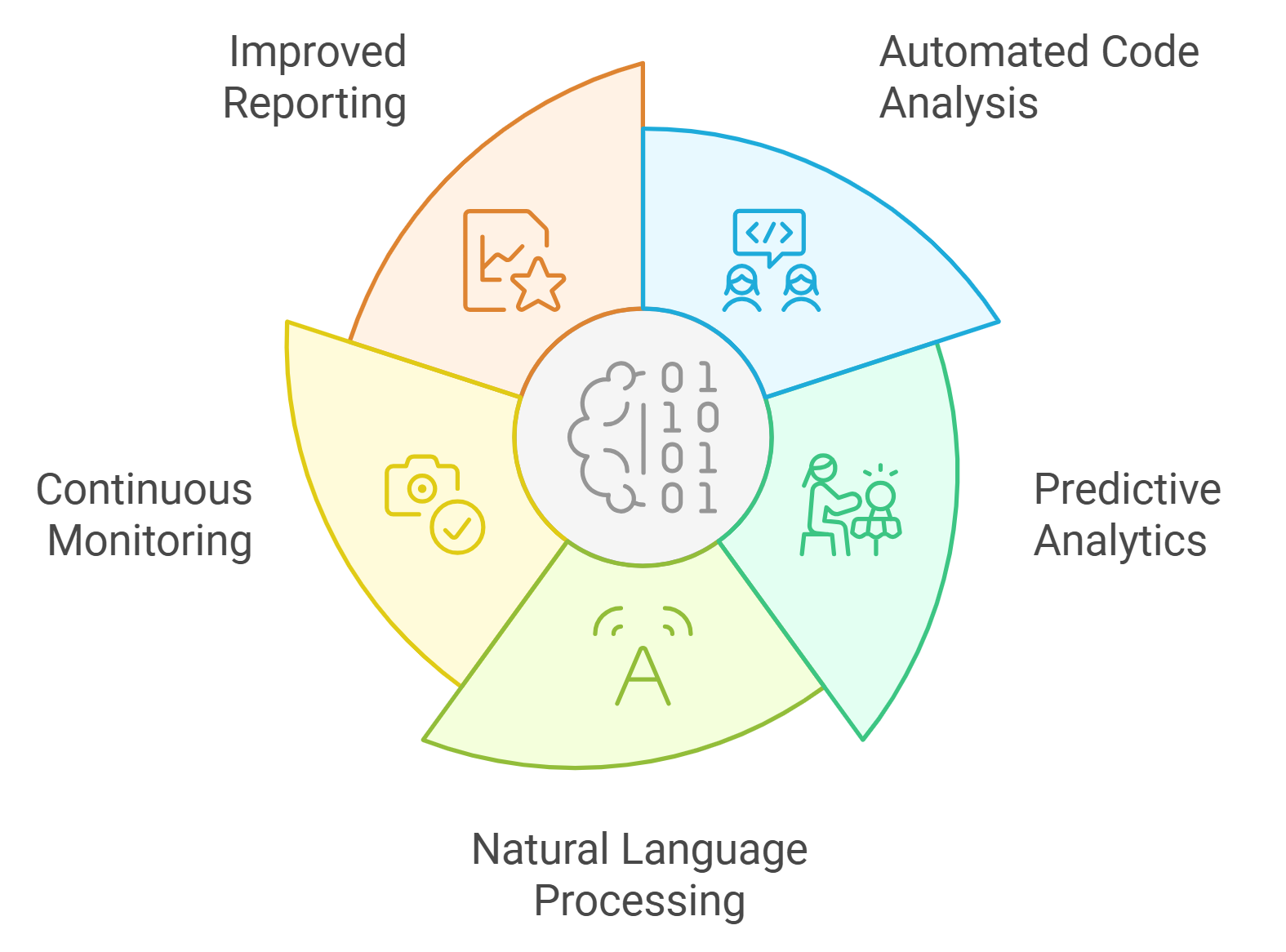

Security and Risk Management: Audits Are Non-Negotiable

The promise of open-source DeFi trading bots comes tethered to significant security considerations. Deploying autonomous AI agents into smart contracts without rigorous due diligence can expose your capital to exploits, flash loan attacks, or protocol bugs. That’s why seasoned practitioners emphasize three pillars:

- Comprehensive Smart Contract Audits: Engage reputable third-party auditors before deploying any new integration or strategy module onto mainnet.

- Continuous Monitoring: Use automated alert systems to track abnormal contract behaviors or sudden drops in liquidity, early detection is key.

- Diversified Risk Controls: Implement circuit breakers within your agent logic (e. g. , auto-withdrawal if APY drops below a certain threshold), alongside insurance protocols where available.

The bottom line: robust risk management isn’t optional, it’s foundational if you want sustainable returns from AI-driven automation. For more insights on building secure workflows with open-source tools, check out our resource at How AI Agents Are Revolutionizing Automated Yield Farming in DeFi.

As the DeFi landscape matures, the convergence of modular protocols like Morpho Blue with open-source automation frameworks is driving a new era of yield optimization. However, successful deployment of AI crypto trading automation requires not only technical prowess but also a relentless focus on operational security and adaptability. Here’s how practitioners are putting these frameworks and guides into real-world practice.

Essential Frameworks and Guides for DeFi AI Automation

-

Framework: Morpho Blue – A modular, open-source lending and yield farming protocol that supports AI agent integrations. Morpho Blue enables automated optimization of lending and farming strategies, offering composability and security for DeFi developers and users.

-

Guide: Setting Up and Customizing DeFi Yield Farming Bots Using Freqtrade and Hyperopt for Strategy Optimization – This step-by-step guide details how to deploy Freqtrade (an open-source crypto trading bot) and use Hyperopt for AI-driven strategy optimization, enabling automated, data-driven yield farming on decentralized platforms.

-

Consideration: Security, Smart Contract Audits, and Risk Management When Deploying Autonomous AI Agents in DeFi – Prioritize robust security practices, including comprehensive smart contract audits and dynamic risk management frameworks, to safeguard assets and ensure reliability when automating DeFi yield farming with AI agents.

From Theory to Practice: Real-World Automation Workflows

Combining Morpho Blue’s modular lending pools with Freqtrade’s strategy engine enables traders to construct highly customized, AI-driven workflows. For example, an advanced setup might use:

- Morpho Blue as the backbone for lending and borrowing operations, leveraging its AI agent integrations to dynamically rebalance exposure.

- Freqtrade bots orchestrating yield farming moves across multiple protocols, with Hyperopt continuously tuning parameters based on live APY and risk signals.

- Automated triggers that withdraw or shift liquidity in response to on-chain events or sudden volatility, minimizing downside while capturing new opportunities.

This synergy allows for DeFi yield optimization at a scale and speed that manual strategies simply can’t match. With the right configuration, users can automate everything from stablecoin farming to cross-chain arbitrage, all while maintaining granular control over risk exposure.

Critical Consideration: Security and Audits in Autonomous AI Agents

Even the most sophisticated AI trading agents are only as secure as the contracts and infrastructure they interact with. The 2025 market has seen a surge in exploits targeting poorly-audited DeFi bots and protocols. To mitigate these risks, leading practitioners recommend:

- Mandatory third-party audits for both protocol code (e. g. , Morpho Blue modules) and custom agent scripts.

- Active monitoring dashboards that track agent transactions and flag anomalies in real time.

- Redundant withdrawal logic to ensure funds can be safely extracted if an exploit or market crash is detected.

- Participation in bug bounty programs and community-driven security reviews to crowdsource vulnerability detection.

For a deeper look at best practices in DeFi bot security, including smart contract audit workflows and post-deployment monitoring, refer to How Agentic DeFi AI Agents Are Simplifying Complex Onchain Strategies.

Continuous Evolution: Staying Ahead in AI-Powered Yield Farming

The intersection of AI and DeFi is dynamic; frameworks like Morpho Blue and Freqtrade are updated frequently, and new attack vectors emerge as quickly as new yield strategies. To maintain an edge, practitioners should:

- Subscribe to protocol and bot framework updates to patch vulnerabilities promptly.

- Engage with developer communities and forums to stay informed on emerging threats and optimization techniques.

- Regularly backtest and retrain AI agents with the latest data to avoid model drift and performance decay.

The future of open-source DeFi trading bots is agentic, modular, and deeply data-driven. By leveraging Morpho Blue’s AI integrations, optimizing strategies with Freqtrade and Hyperopt, and prioritizing robust security measures, you can automate yield farming at scale without sacrificing control or safety. For more actionable guides on building your own AI-powered DeFi automation stack, explore our curated resources at Best AI Crypto Trading Bots for Automated DeFi Yield Farming in 2024.