Automated DeFi yield farming has evolved rapidly in 2024, as AI trading agents move from experimental tools to core components of sophisticated crypto portfolio management. With the proliferation of agentic DeFi technologies, both institutional and retail investors now leverage AI-driven bots to optimize yields, manage risk, and simplify the complex landscape of decentralized finance. Here’s how you can deploy AI trading agents for yield farming, using five actionable strategies that reflect the latest advancements and market realities.

Dynamic Yield Optimization Using Real-Time Data

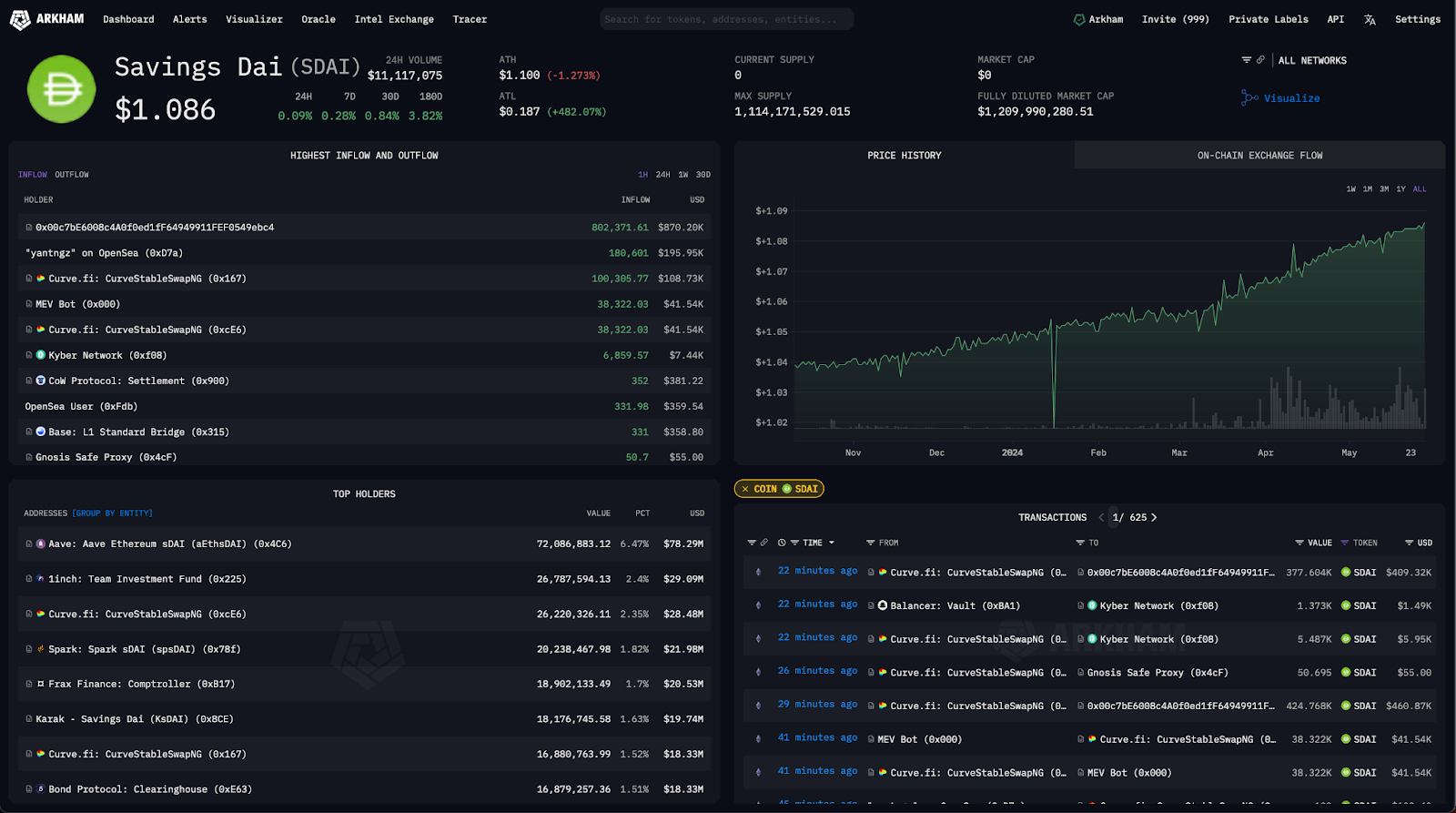

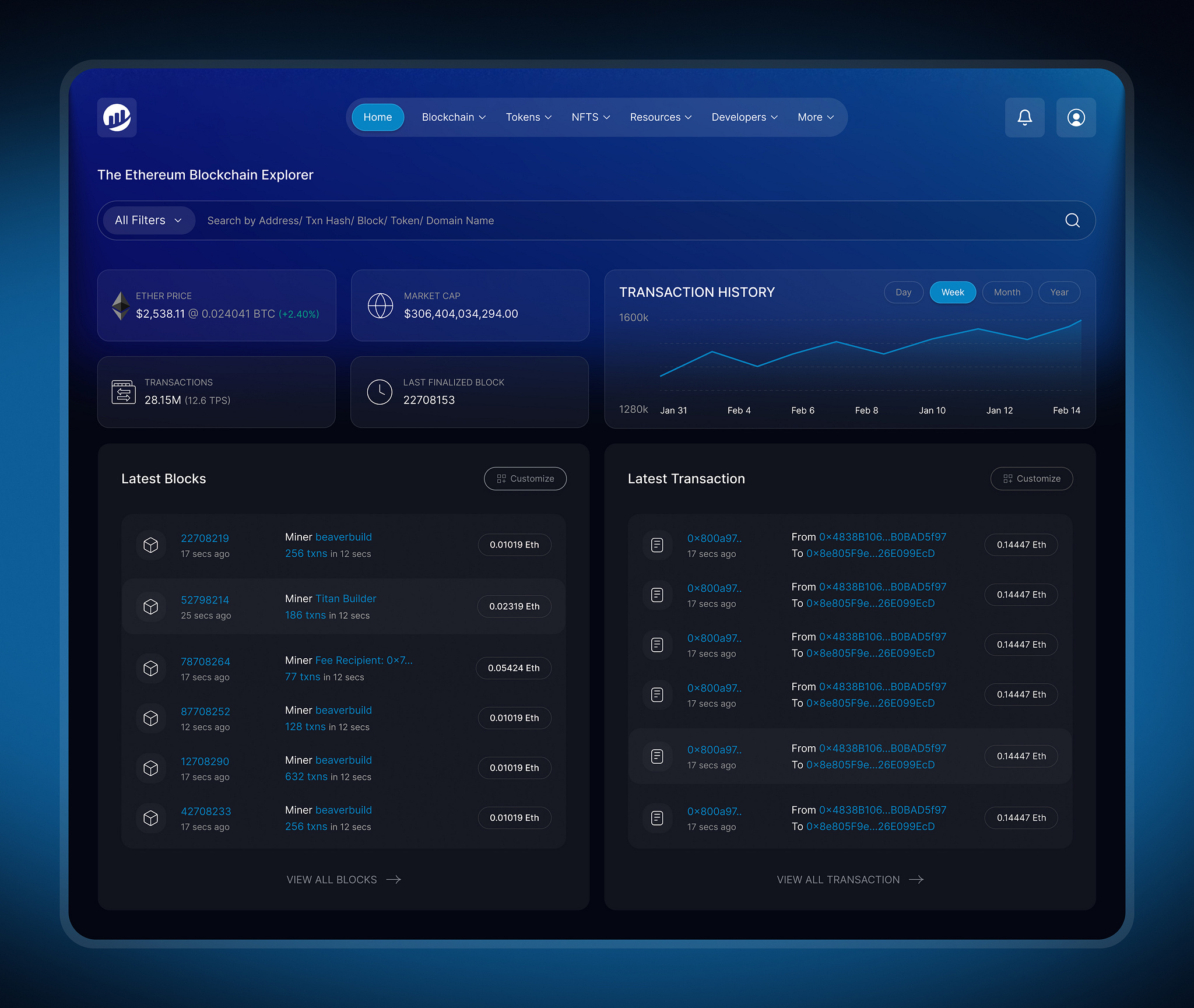

At the heart of modern AI trading agents for yield farming is their ability to process real-time, on-chain data. These agents continuously scan protocol APYs, liquidity pool metrics, and macro market trends to identify the highest-yielding opportunities at any given moment. Unlike manual farming, which is slow to react to shifting incentives, AI bots can autonomously shift liquidity between pools such as Aave, Compound, or Curve, maximizing returns while minimizing missed opportunities. This data-driven agility is especially vital in 2024, as DeFi yields fluctuate rapidly across protocols and chains.

Automated Risk Assessment and Diversification

Yield optimization is only effective if paired with robust risk management. Advanced crypto yield farming bots now incorporate AI-powered risk assessment engines. These systems evaluate smart contract vulnerabilities, monitor liquidity depth, and estimate impermanent loss in real time. By autonomously diversifying assets across multiple platforms, AI agents reduce single-protocol exposure and systematically rebalance portfolios to align with evolving risk profiles. The result: greater resilience against protocol exploits or market shocks, and a smoother yield curve for investors.

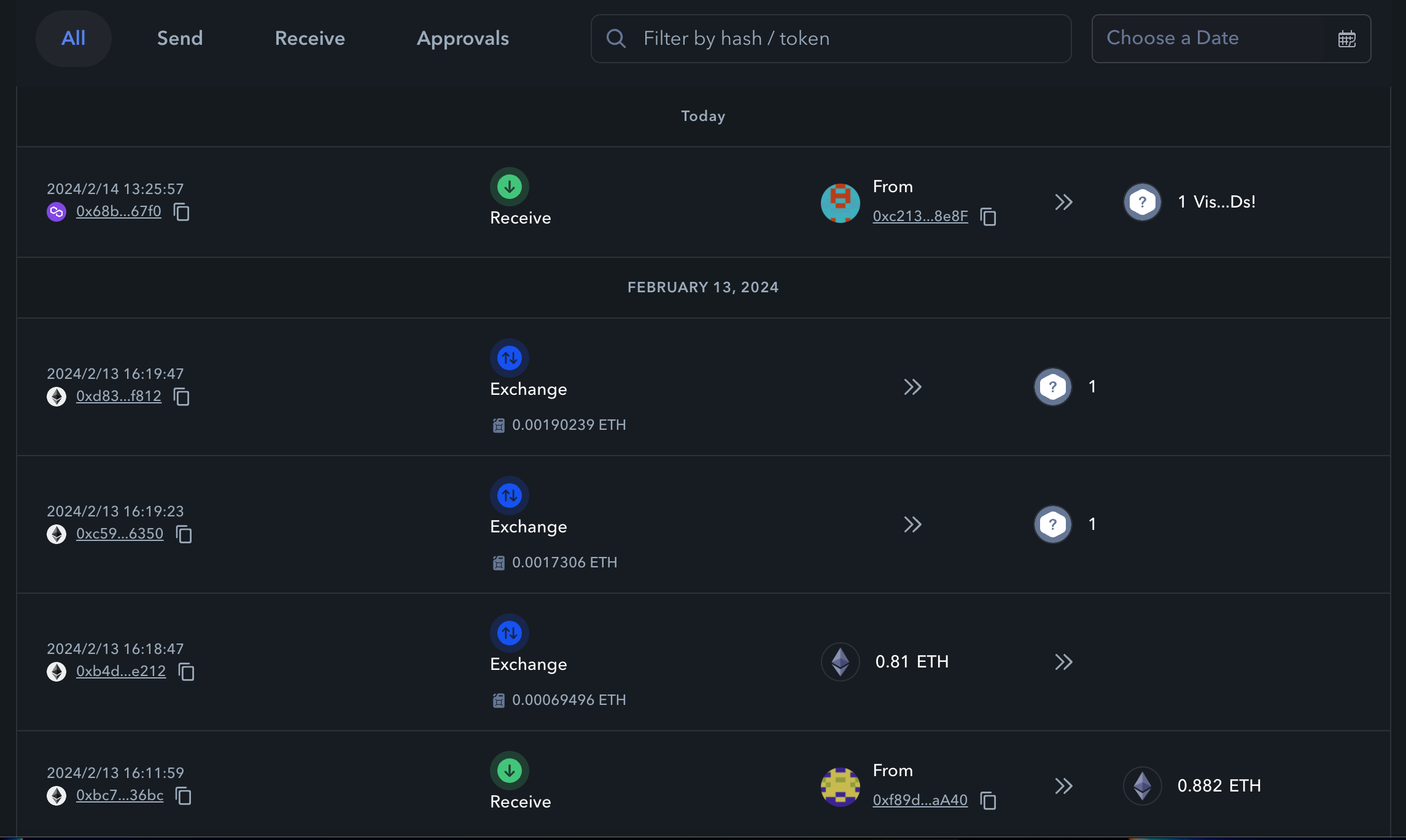

Gas Fee Optimization and Transaction Scheduling

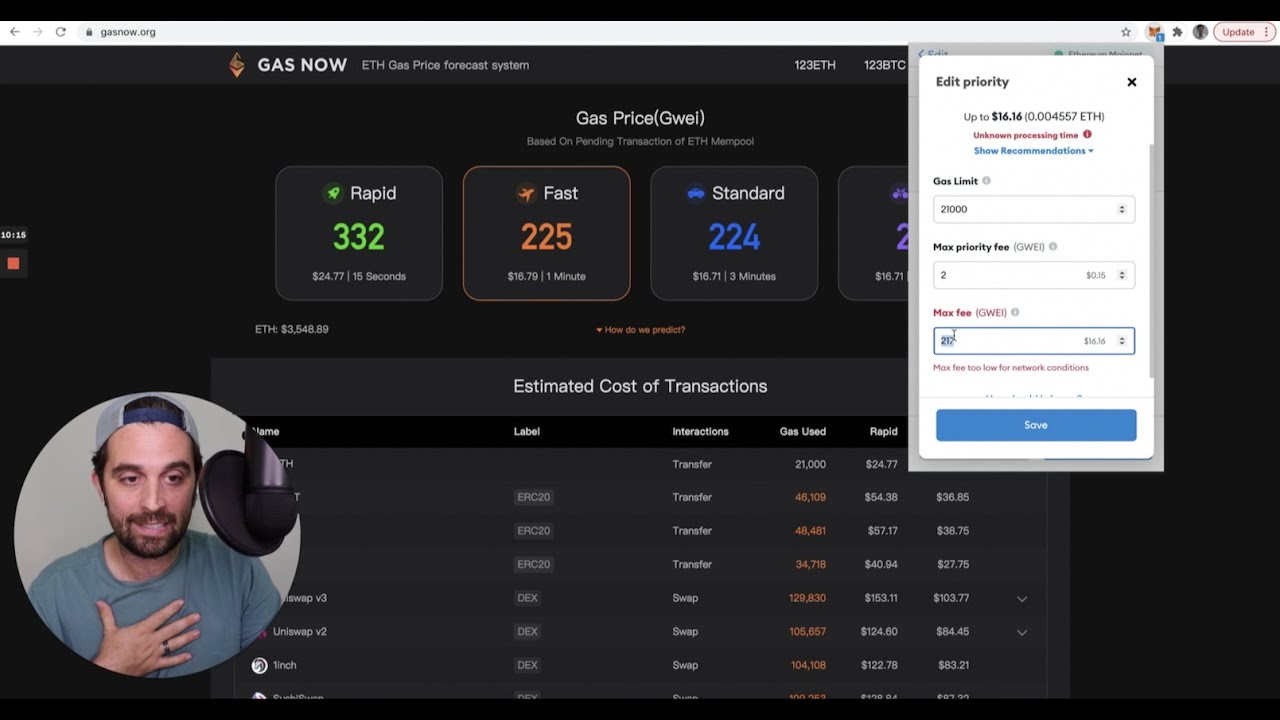

Ethereum mainnet and Layer 2 networks remain highly sensitive to gas price volatility. In 2024, AI DeFi portfolio management tools are equipped with modules that monitor network congestion and predict optimal transaction windows. By batching transactions or executing yield farming moves during low-fee periods, these agents help maximize net returns by minimizing operational costs. For users farming across multiple chains, this automation is indispensable for maintaining profitability as gas dynamics shift throughout the day.

5 Actionable AI Strategies for DeFi Yield Farming

-

Dynamic Yield Optimization Using Real-Time Data: Deploy AI agents that continuously analyze on-chain data, protocol APYs, and market trends to automatically shift liquidity between top-performing DeFi pools. Platforms like Yearn.finance and Harvest Finance use AI-driven algorithms to maximize yield by reallocating funds based on live market conditions.

-

Automated Risk Assessment and Diversification: Utilize AI bots to assess protocol risks—such as smart contract vulnerabilities, liquidity depth, and impermanent loss—and autonomously diversify assets across multiple platforms. Tools like DeFiSafety and DeFiYield provide risk analytics that can be integrated into AI-driven diversification strategies.

-

Gas Fee Optimization and Transaction Scheduling: Leverage AI to monitor Ethereum and L2 gas prices, batching transactions or executing yield farming moves during low-fee periods. Services like GasNow and Blocknative Gas Estimator help automate transaction timing for optimal cost efficiency.

-

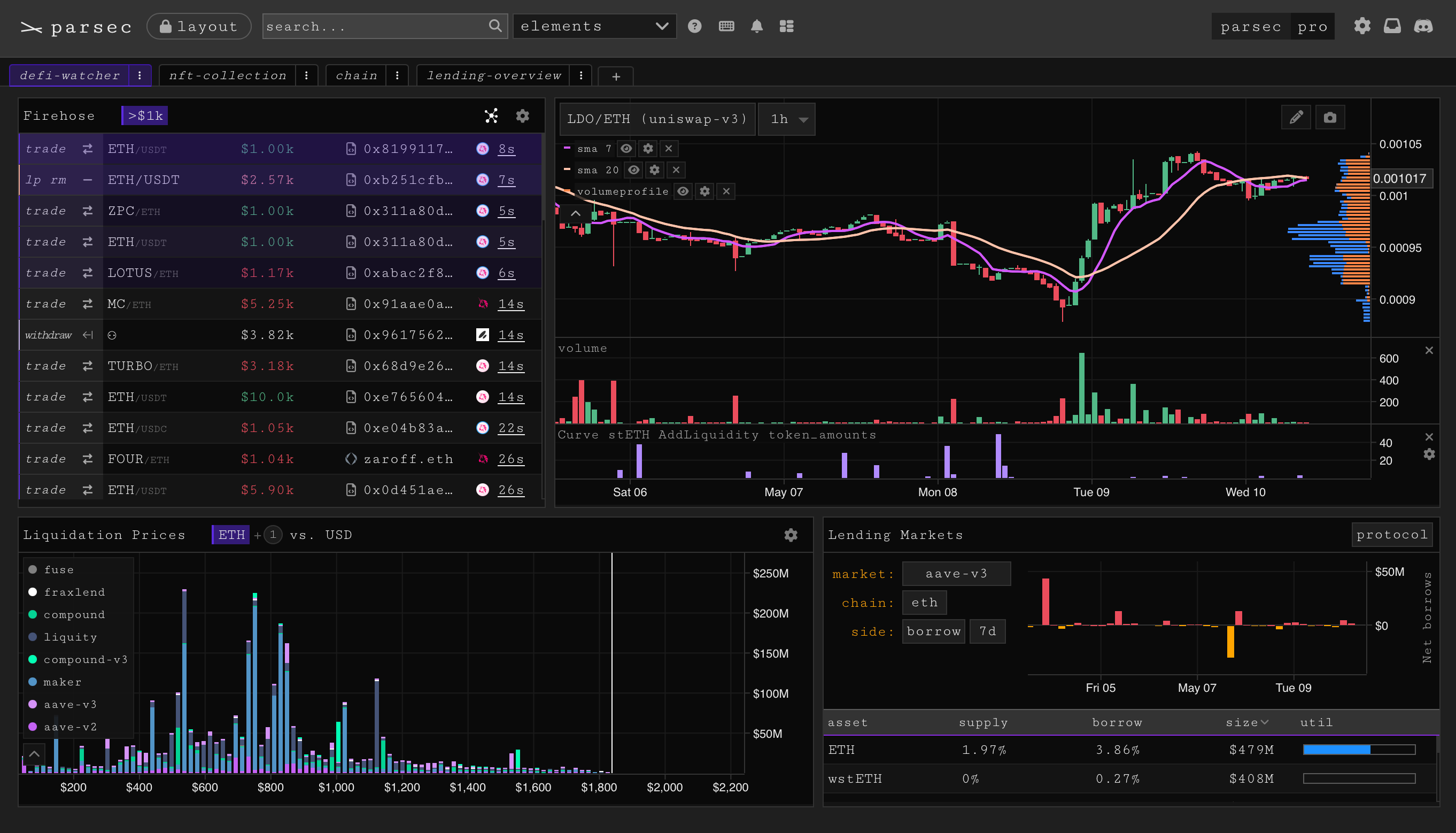

Adaptive Rebalancing Based on Market Volatility: Program AI agents to detect market volatility or protocol-specific events, triggering automatic rebalancing or withdrawal from unstable pools. Parsec Finance and ParaSwap offer real-time analytics and execution tools that can be integrated with AI for dynamic portfolio management.

-

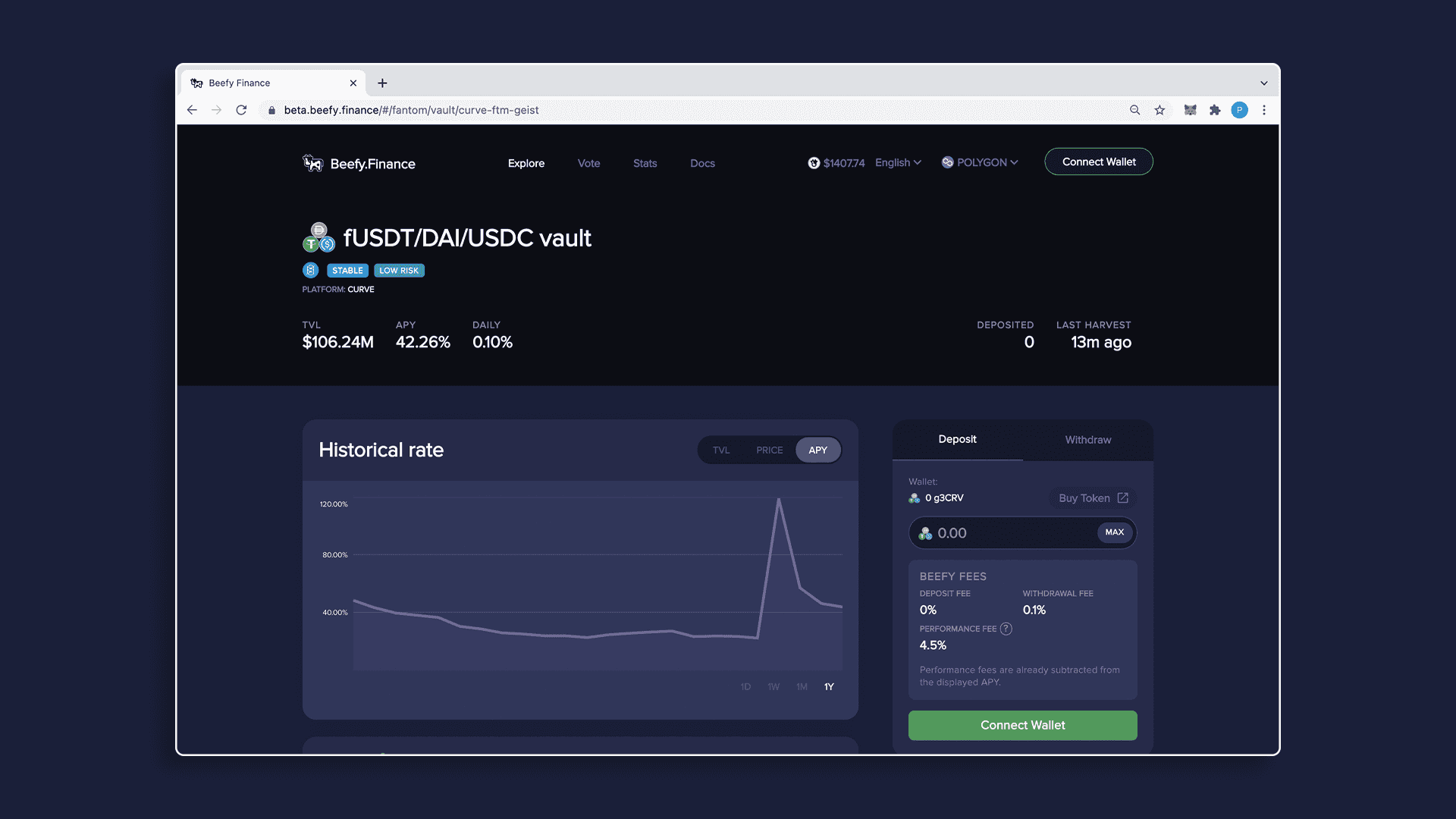

Auto-Compounding and Reward Harvesting: Implement AI-driven strategies that automatically claim, convert, and reinvest yield farming rewards at optimal intervals. Autofarm and Beefy Finance are leading platforms offering automated compounding to enhance returns.

To see how these strategies are deployed in practice, explore our deep-dive on real-world AI agent workflows in DeFi yield farming. The next section will cover adaptive rebalancing and auto-compounding techniques that further boost efficiency and returns.

Adaptive Rebalancing Based on Market Volatility

Volatility is a constant in DeFi, and static yield farming approaches often leave portfolios exposed during sudden market swings or protocol-specific events. Modern AI trading agents for yield farming are engineered to detect abnormal volatility, liquidity drain, or governance changes in real time. When these signals trigger, the agent can automatically rebalance allocations, shifting funds out of unstable pools or protocols and reallocating to safer, higher-liquidity options. This adaptive response not only helps preserve capital but also positions your assets for recovery or new opportunities as soon as stability returns. In 2024, this kind of proactive risk mitigation is no longer optional; it’s a core feature of any serious automated DeFi yield strategy.

Auto-Compounding and Reward Harvesting

One of the most powerful advantages of automated DeFi yield strategies is the ability to auto-compound rewards with precision timing. AI agents can monitor reward accrual rates and transaction costs, then execute harvesting and reinvestment at intervals that maximize compounding efficiency while minimizing unnecessary gas expenditure. This means your protocol rewards, whether in governance tokens or stablecoins, are continually claimed, swapped if needed, and redeployed into high-yield pools. Over weeks and months, this continuous compounding effect can significantly outperform manual strategies or set-and-forget vaults.

For those looking to build a robust, future-proof DeFi portfolio in 2024, integrating auto-compounding routines via AI is a must. Not only does it boost returns by capturing every available yield cycle, but it also frees users from the tedious task of manual claim-and-reinvest operations.

5 Actionable AI Strategies for DeFi Yield Farming

-

Dynamic Yield Optimization Using Real-Time Data: Deploy AI agents that continuously analyze on-chain data, protocol APYs, and market trends to automatically shift liquidity between top-performing DeFi pools for maximized yield. Platforms like Yearn.finance and Harvest Finance employ AI-driven algorithms to adaptively allocate assets, ensuring your capital is always working in the most lucrative pools.

-

Automated Risk Assessment and Diversification: Utilize AI bots to assess protocol risks—such as smart contract vulnerabilities, liquidity depth, and impermanent loss—and autonomously diversify assets across multiple platforms to minimize exposure. Tools like DeFiSafety and DeFi Rate offer risk analytics that can be integrated with AI agents for smarter, safer diversification.

-

Gas Fee Optimization and Transaction Scheduling: Leverage AI to monitor Ethereum and L2 gas prices, batching transactions or executing yield farming moves during low-fee periods to maximize net returns. Solutions like GasNow and Etherscan Gas Tracker can be integrated with AI agents for automated, cost-efficient transaction scheduling.

-

Adaptive Rebalancing Based on Market Volatility: Program AI agents to detect market volatility or protocol-specific events, triggering automatic rebalancing or withdrawal from unstable pools to safeguard capital. Platforms such as Parsec Finance provide real-time DeFi analytics that can inform AI-driven rebalancing strategies.

-

Auto-Compounding and Reward Harvesting: Implement AI-driven strategies that automatically claim, convert, and reinvest yield farming rewards at optimal intervals, ensuring continuous compounding and higher overall returns. Services like Beefy Finance and Autofarm offer automated compounding features powered by smart algorithms.

Practical Considerations and Risks

While these strategies unlock new levels of efficiency and risk management, it’s crucial to vet any AI trading agent or platform before deploying significant capital. Review audits, community feedback, and transparency around algorithms, especially for tools promising dynamic rebalancing or gas fee optimization. Remember that even the most advanced AI cannot eliminate all risks; smart contract bugs and black swan events remain part of the DeFi landscape.

To see these principles in action, and learn how top-performing bots are navigating 2024’s volatile markets, check out our hands-on analysis at How AI Agents Are Revolutionizing Automated Yield Farming in DeFi.

The Road Ahead: Smarter Automation for Smarter Yields

The evolution of AI-powered DeFi automation has dramatically lowered the barrier to sophisticated crypto portfolio management. By combining dynamic yield optimization, automated risk diversification, gas fee intelligence, adaptive rebalancing, and relentless auto-compounding, today’s leading bots are reshaping what’s possible for both individual investors and DAOs alike.

If you’re ready to automate your strategy, and let data drive your edge, make sure to explore our comprehensive guides on using AI trading agents for automated DeFi yield farming. The future belongs to those who automate intelligently.