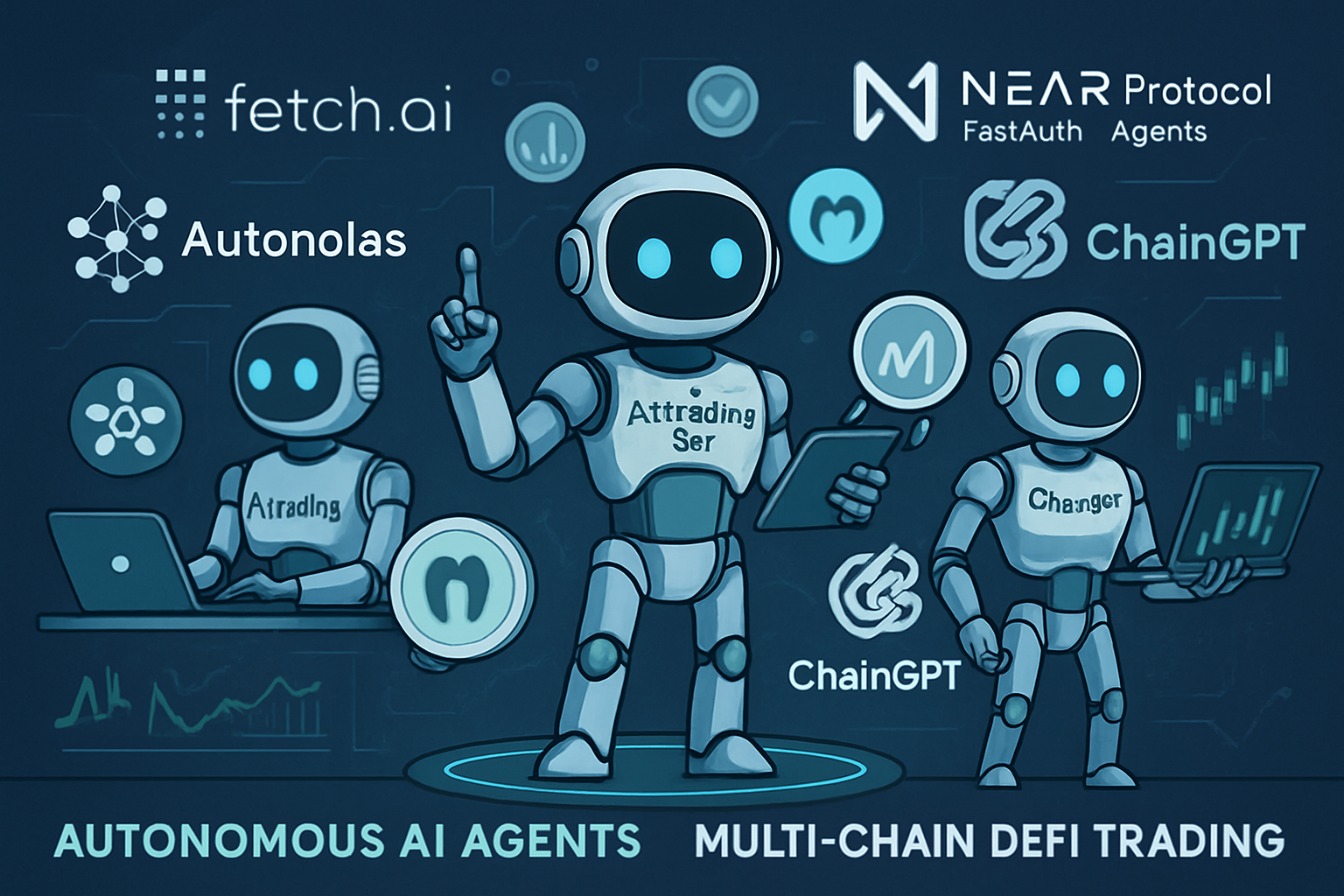

In 2024, the landscape of decentralized finance is being radically reshaped by autonomous AI trading agents that operate seamlessly across multiple blockchains. These aren’t just incremental upgrades to legacy bots – they’re a leap forward for agentic DeFi automation, blending machine learning, real-time data analysis, and cross-chain interoperability to unlock strategies that were science fiction just a year ago. With Ethereum (ETH) currently priced at $3,844.09, the demand for smarter, faster, and more adaptive trading infrastructure has never been higher.

The Multi-Chain AI Agent Revolution: Why 2024 Is Different

This year marks a turning point as autonomous agents move beyond single-chain limitations. Instead of being siloed to one ecosystem, today’s top platforms empower AI bots to execute trades, rebalance portfolios, and optimize yield across Ethereum, Layer-2s, and alt-L1 networks without manual intervention. The result? Unprecedented efficiency, risk management, and access to liquidity wherever it resides.

Let’s spotlight the top 5 platforms pioneering this movement. Each is pushing boundaries in no-code crypto trading bots, real-time DeFi strategies, and agent-driven portfolio automation:

Top 5 Platforms Leading Autonomous AI Agents in Multi-Chain DeFi (2024)

-

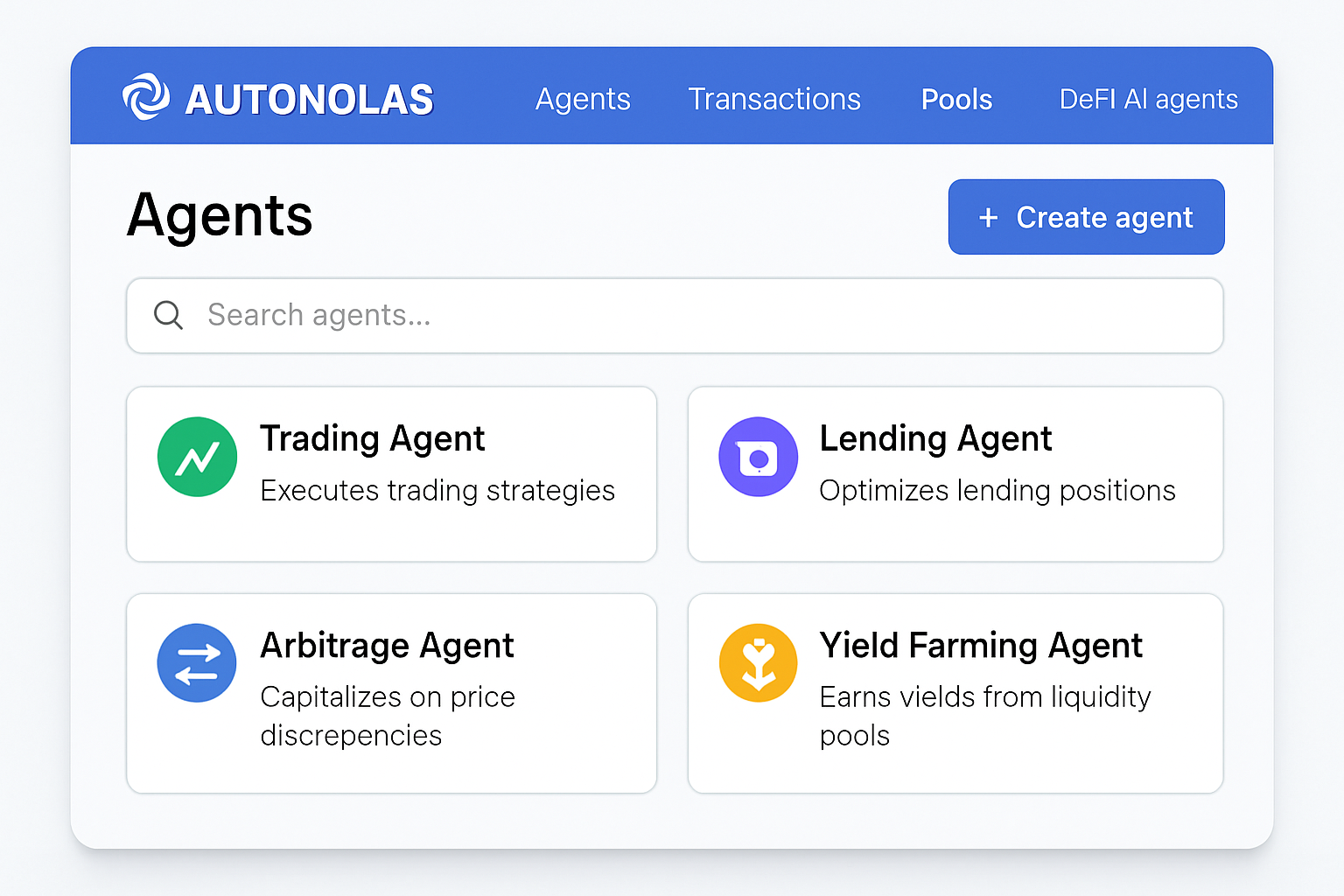

Autonolas: A decentralized platform specializing in autonomous AI agents for DeFi. Autonolas enables secure on-chain and off-chain computations, powering bots that manage DAO treasuries, execute trades, and rebalance portfolios across chains. Its integration with Gnosis Chain demonstrates robust cross-chain automation.

-

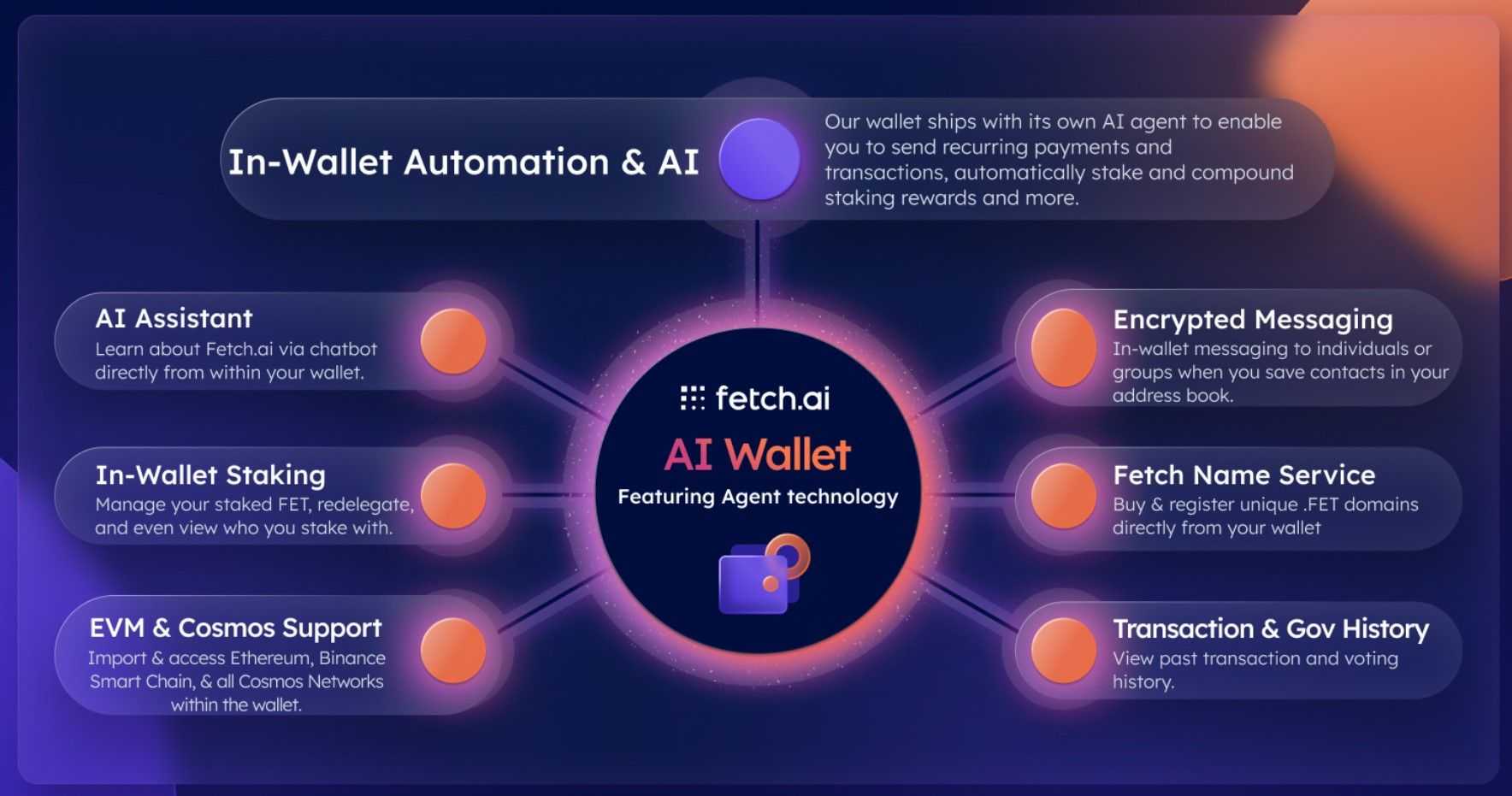

Fetch.ai: Renowned for its autonomous economic agents, Fetch.ai leverages AI to automate trading, data gathering, and liquidity optimization across multiple blockchains. Its agent-based infrastructure is widely used for decentralized trading strategies and supply chain automation.

-

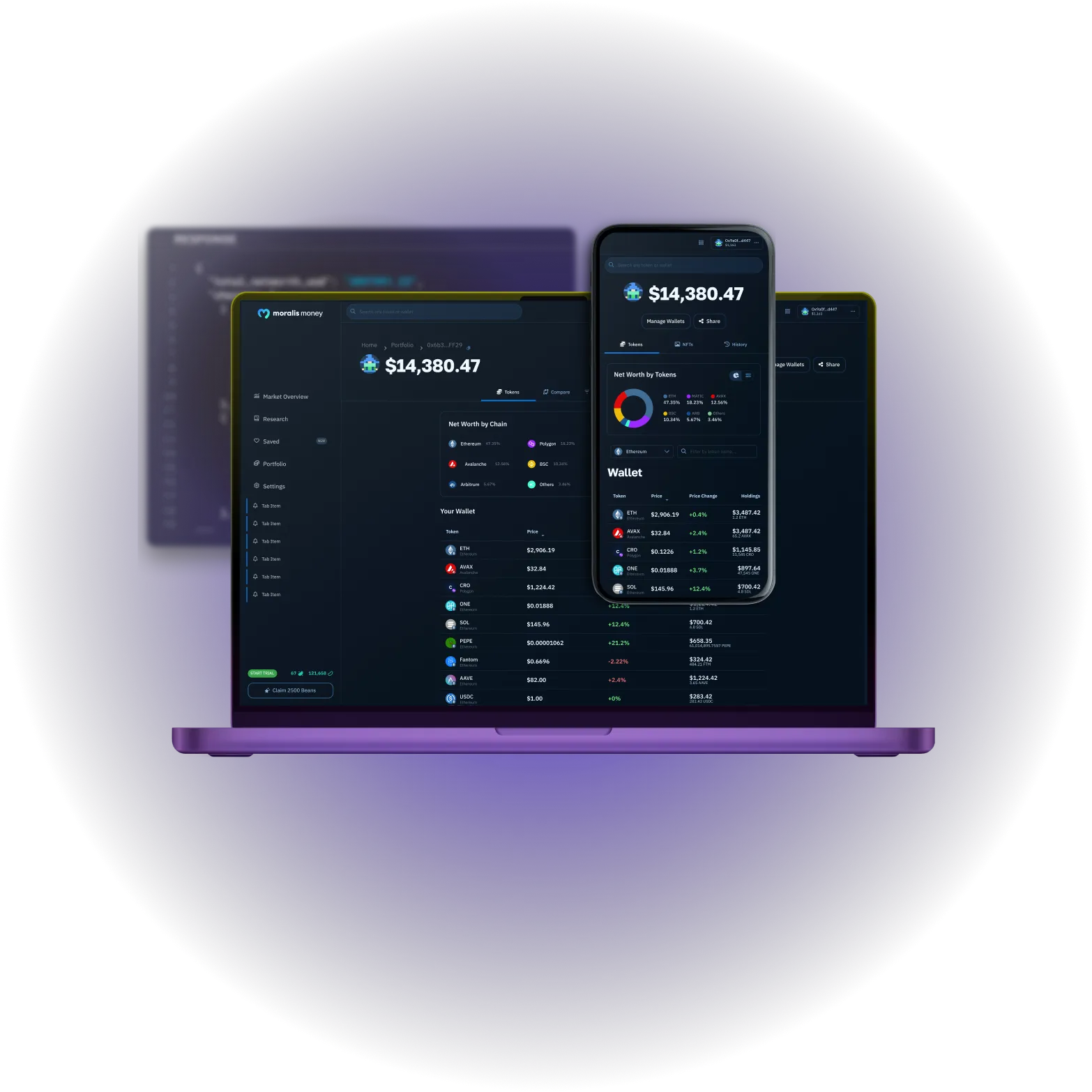

Moralis Money AI: Moralis Money AI offers no-code, AI-powered crypto trading bots that operate seamlessly across multiple chains. The platform empowers users to deploy custom strategies, monitor real-time market data, and automate portfolio management with advanced AI analytics.

-

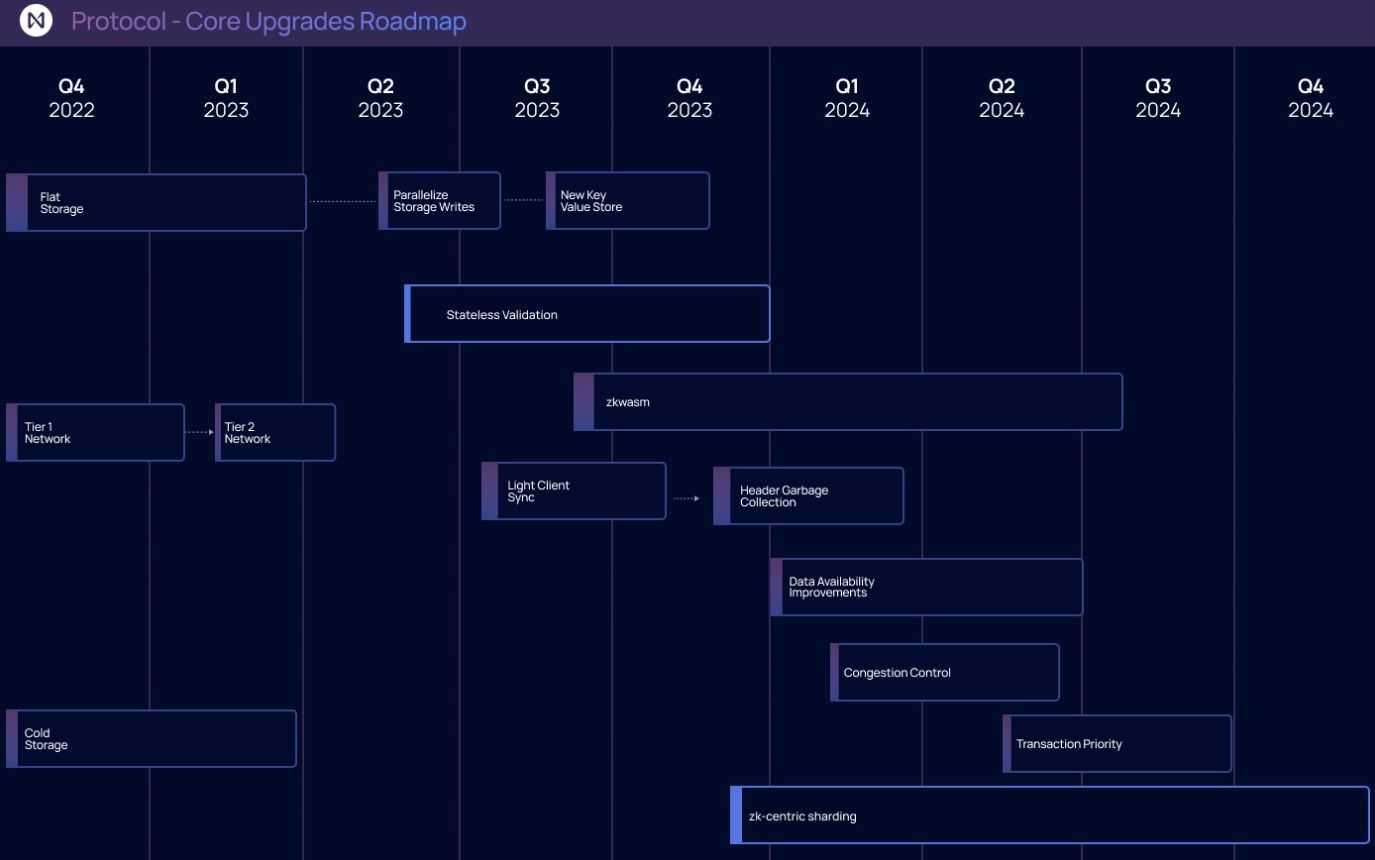

NEAR Protocol FastAuth Agents: NEAR Protocol’s FastAuth Agents provide secure, user-owned AI agents designed for DeFi trading and portfolio management. These agents simplify multi-chain operations, enabling users to outsource complex trading goals and interact with DeFi protocols effortlessly.

-

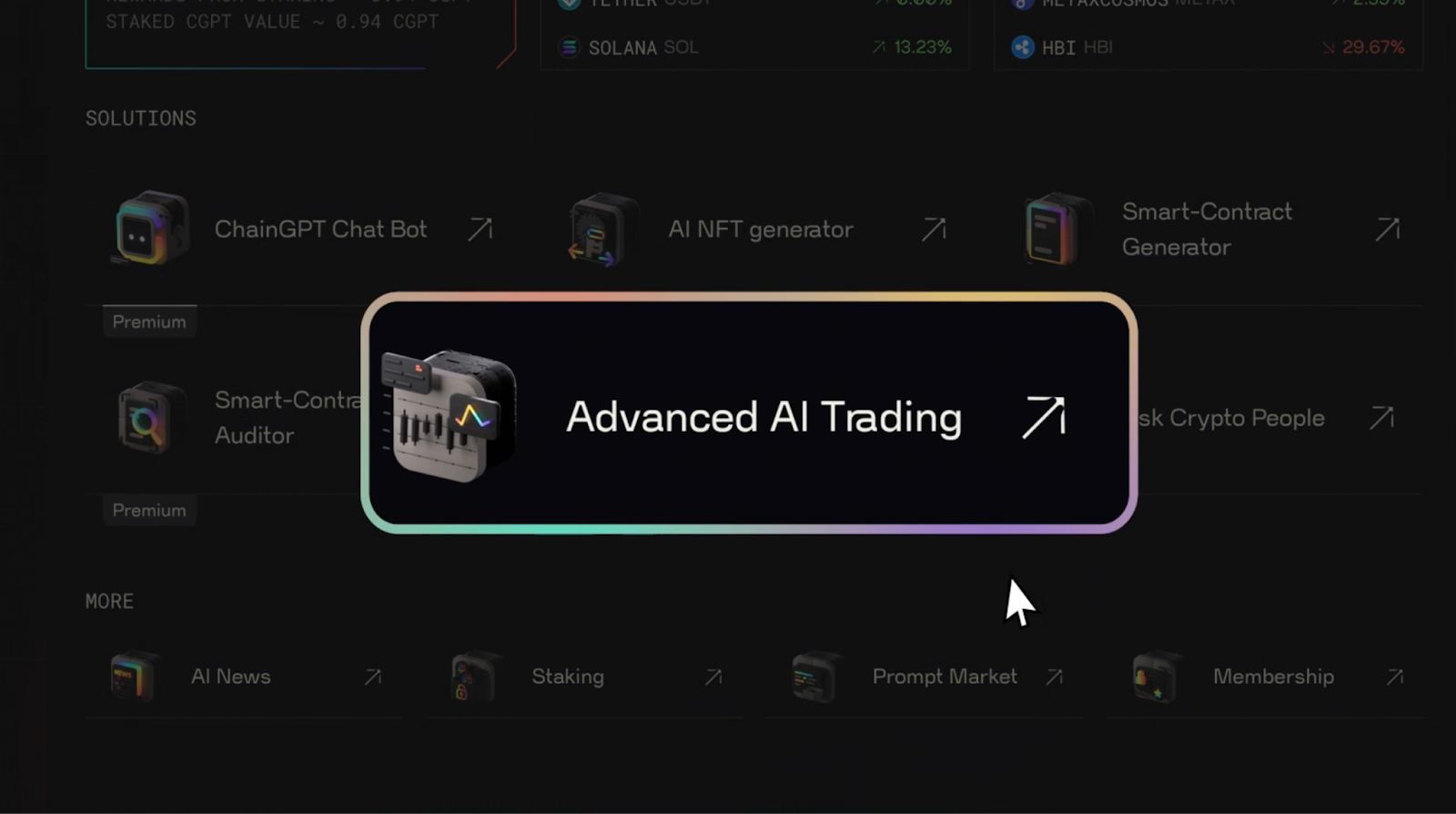

ChainGPT AI Trading Bot: ChainGPT’s AI Trading Bot delivers advanced, autonomous trading solutions for DeFi. Utilizing real-time data analysis and machine learning, it executes trades, manages risks, and adapts strategies across multiple blockchain networks, making AI-driven DeFi accessible to a broad user base.

1. Autonolas: Orchestrating DAO Treasuries and Cross-Chain Execution

Autonolas is at the vanguard of agentic DeFi automation. Their bots aren’t simple script runners – they blend on-chain logic with secure off-chain computation to manage DAO treasuries on Gnosis Chain and beyond. Whether it’s executing scheduled trades or rebalancing assets across multiple networks based on market signals (like ETH’s current dip to $3,844.09), Autonolas agents act autonomously with minimal latency.

Their integration with multi-chain protocols means these agents can chase yield opportunities wherever they arise – not just on Ethereum but across emerging L2s and alternative chains. For DAOs and sophisticated investors alike, Autonolas is making hands-off portfolio management not just possible but optimal.

2. Fetch. ai: Autonomous Economic Agents for Decentralized Markets

Fetch. ai is building a decentralized ecosystem where autonomous economic agents can trade assets, gather off-chain data feeds, and even optimize logistics – all powered by advanced AI models. In DeFi specifically, Fetch. ai’s agents can execute arbitrage trades across DEXs on different chains or optimize lending positions in real time.

The beauty here is adaptability: Fetch. ai’s architecture enables agents to learn from market events (such as sudden volatility in ETH or new liquidity pools) and self-evolve their strategies without user micromanagement.

3. Moralis Money AI: No-Code Bots for Real-Time Alpha

If you’re looking for an accessible entry point into AI crypto trading 2024, Moralis Money AI delivers no-code bots that scan for asymmetric opportunities across dozens of chains – think new token launches or sudden spikes in TVL that might otherwise go unnoticed.

The platform leverages crowd sentiment analysis alongside on-chain analytics to surface real-time alpha signals for users who want an edge but lack coding skills or time to monitor markets 24/7. In a world where ETH can swing from $4,106.47 to $3,831.43 in a single day, speed of execution is everything.

Ethereum (ETH) Price Prediction Table: 2026–2031 (AI Agent & Multi-Chain DeFi Era)

Forecast based on 2025 market context, AI agent adoption trends, and multi-chain DeFi advancements impacting Ethereum and crypto AI agent tokens.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,250 | $5,100 | +10.6% | AI agent integration matures, regulatory clarity improves |

| 2027 | $3,700 | $5,100 | $6,450 | +20.0% | Cross-chain DeFi volumes surge, ETH staking increases |

| 2028 | $4,200 | $6,200 | $8,100 | +21.6% | AI agents dominate DeFi trading, mainstream adoption grows |

| 2029 | $4,850 | $7,650 | $10,200 | +23.4% | On-chain AI governance and L2 scaling boost utility |

| 2030 | $5,600 | $9,200 | $12,800 | +20.3% | ETH as settlement layer for AI-powered DeFi |

| 2031 | $6,250 | $10,800 | $15,500 | +17.4% | Decentralized AI agents reach mass adoption, ETH market cap expansion |

Price Prediction Summary

Ethereum is positioned to benefit significantly from the rise of autonomous AI agents in multi-chain DeFi. Over the next six years, ETH is projected to see steady price appreciation, with average prices rising from $4,250 in 2026 to $10,800 by 2031. The bullish scenario could see ETH reaching as high as $15,500 if AI-driven DeFi achieves mass adoption and Ethereum remains the dominant smart contract platform. However, volatility and regulatory risks may result in lower-bound outcomes, with minimum prices reflecting potential bearish cycles or competitive pressures.

Key Factors Affecting Ethereum Price

- Adoption rate of autonomous AI agents in DeFi

- Ethereum’s role as a multi-chain settlement layer

- Layer 2 scaling solutions and network upgrades (e.g., Danksharding, Verkle Trees)

- Competition from alternative AI agent platforms (e.g., Fetch.ai, Olas, AgentLayer)

- Regulatory developments impacting DeFi and AI applications

- Market sentiment and overall crypto cycle (macro environment)

- Security and resilience of AI agent infrastructure on Ethereum

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Competitive Edge: Cross-Chain Interoperability and Security

The best part? These AI agents are not just fast – they’re secure by design. Platforms like Autonolas and Fetch. ai leverage zero-knowledge proofs and robust off-chain computation to ensure both privacy and accuracy in execution across chains.

Ready to see how these innovations are simplifying complex onchain strategies? Explore our deep dive at How Agentic DeFi AI Agents Are Simplifying Complex Onchain Strategies.

4. NEAR Protocol FastAuth Agents: Frictionless, User-Owned Automation

NEAR Protocol’s FastAuth Agents are a game changer for onboarding and usability in multi-chain DeFi trading. By leveraging FastAuth, users can deploy AI agents that manage their crypto goals, think auto-compounding yields, liquidity migration, or even tax-loss harvesting, without ever touching a seed phrase. The magic lies in NEAR’s focus on account abstraction and seamless authentication, letting anyone spin up an agent that operates across EVM and non-EVM chains with a single click.

This approach democratizes access to DeFi automation: you own the agent, set your parameters, and let it handle the complexities of cross-chain execution. As protocols race to attract new liquidity, FastAuth Agents are quietly making sophisticated portfolio management accessible to everyone, not just power users. For a breakdown of how these agents automate strategies across chains, check out our case studies here.

5. ChainGPT AI Trading Bot: AI-Driven Execution Meets Deep Market Intelligence

ChainGPT’s AI Trading Bot stands out for its ability to process massive volumes of on-chain and off-chain data, news, social sentiment, whale wallet movements, and translate them into actionable trades in real time. Unlike legacy bots that follow rigid scripts, ChainGPT’s model adapts its logic based on evolving market conditions, optimizing for both speed and risk-adjusted returns.

What’s particularly innovative is ChainGPT’s integration with multi-chain DEXs and CEXs, allowing it to arbitrage price differences or rebalance portfolios regardless of where the opportunity emerges. With Ethereum’s price range swinging between $4,106.47 and $3,831.43 over 24 hours, this level of agility is critical for capturing edge in volatile markets.

Why This Matters: The New Standard for Agentic DeFi Automation

The platforms above aren’t just riding the AI hype, they’re setting new standards for what’s possible in decentralized finance. With no-code crypto trading bots, real-time cross-chain execution, and self-improving agent frameworks, traders can now outsource complexity while retaining control over their assets and strategies.

This shift is also rewriting the rules around transparency and security. By leveraging zero-knowledge proofs (as seen with Autonolas) or decentralized agent ownership (as with NEAR Protocol), users gain peace of mind alongside performance. And as more protocols adopt these architectures, expect composability, the ability for agents to interact with any protocol or asset, to become the norm rather than the exception.

“Spotting alpha before the crowd is no longer about staring at charts all night, it’s about deploying smarter agents that never sleep. ”

If you’re ready to build your own multi-chain AI trading agent, or just want to see how these platforms work under the hood, explore our hands-on guide at How to Build a Multi-Chain AI Crypto Trading Bot in 2024.

Top 5 Platforms Leading Autonomous AI Agents in DeFi

-

Autonolas: A decentralized platform enabling co-ownership and deployment of autonomous AI agents for on-chain DeFi tasks like DAO treasury management, scheduled trades, and cross-chain portfolio rebalancing. Autonolas agents are live on networks such as Gnosis Chain, combining secure off-chain computation with on-chain execution.

-

Fetch.ai: This platform specializes in building autonomous economic agents that trade, gather data, and optimize DeFi strategies across multiple blockchains. Fetch.ai’s agent framework powers decentralized automation for trading, logistics, and data exchange in the crypto ecosystem.

-

Moralis Money AI: Leveraging Moralis’s robust blockchain infrastructure, Moralis Money AI offers no-code, AI-powered trading bots that scan and execute cross-chain DeFi strategies in real time. Users can automate portfolio management and discover new opportunities with advanced analytics.

-

NEAR Protocol FastAuth Agents: NEAR Protocol’s FastAuth Agents are pioneering autonomous, user-owned AI agents that manage DeFi activities across chains. These agents handle complex tasks like liquidity routing and yield optimization, allowing users to outsource trading goals securely and efficiently.

-

ChainGPT AI Trading Bot: ChainGPT provides advanced AI-powered trading bots designed for DeFi markets. These bots analyze on-chain data, execute multi-chain trades, and adapt strategies in real time, empowering users with automated, data-driven portfolio management.