The AI crypto trading bot landscape for automated DeFi yield farming is evolving at breakneck speed. As of October 2025, traders are no longer content with simple automation or basic rebalancing. Instead, the market is demanding agentic bots that leverage advanced machine learning, on-chain analytics, and cross-protocol optimization to squeeze every last basis point from decentralized finance. But with a dizzying array of options, how do you separate signal from noise?

Below, I dissect the seven best AI-powered crypto trading bots for automated DeFi yield farming in 2024. These platforms stand out for their technical sophistication, real-world performance, and the degree to which they actually deliver on the promise of AI-driven yield optimization. Expect a candid, technical analysis, no marketing fluff, just the facts and the math.

Why AI Crypto Trading Bots Dominate DeFi Yield Farming in 2024

Yield farming in DeFi has always been a game of cat-and-mouse: protocols change, incentives shift, and smart contract risks lurk beneath the surface. Manual strategies are slow, error-prone, and often leave yield on the table. AI crypto trading bots offer a different paradigm, one where algorithms can analyze thousands of data points, react to market conditions in milliseconds, and dynamically allocate capital across protocols with surgical precision.

In 2024, the best AI trading bots for DeFi yield farming don’t just automate basic tasks. They incorporate reinforcement learning, sentiment analysis, and predictive modeling to anticipate market shifts. Some even use cross-chain routing and real-time MEV detection to protect and enhance returns. If you’re still farming manually, you’re not just inefficient, you’re exposed.

The 7 Best AI Crypto Trading Bots for Automated DeFi Yield Farming

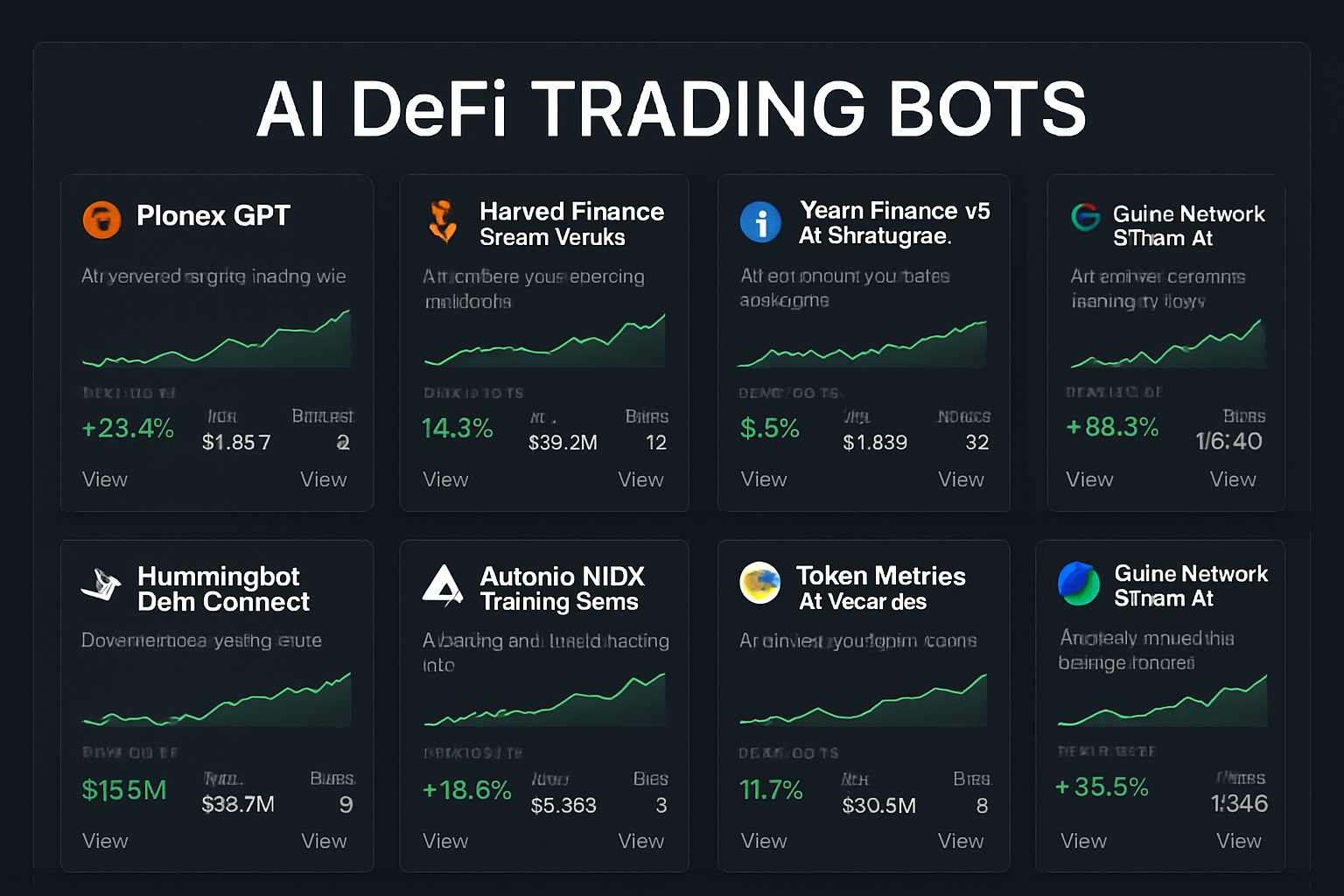

Top 7 AI Crypto Trading Bots for DeFi Yield Farming (2024)

-

Pionex GPT: Pionex GPT integrates advanced AI models with Pionex’s renowned suite of 16 built-in trading bots. It leverages GPT-powered analytics to automate yield farming strategies, optimize grid trading, and manage risk in real time. The platform is beginner-friendly, with low fees and no need for external API connections.

-

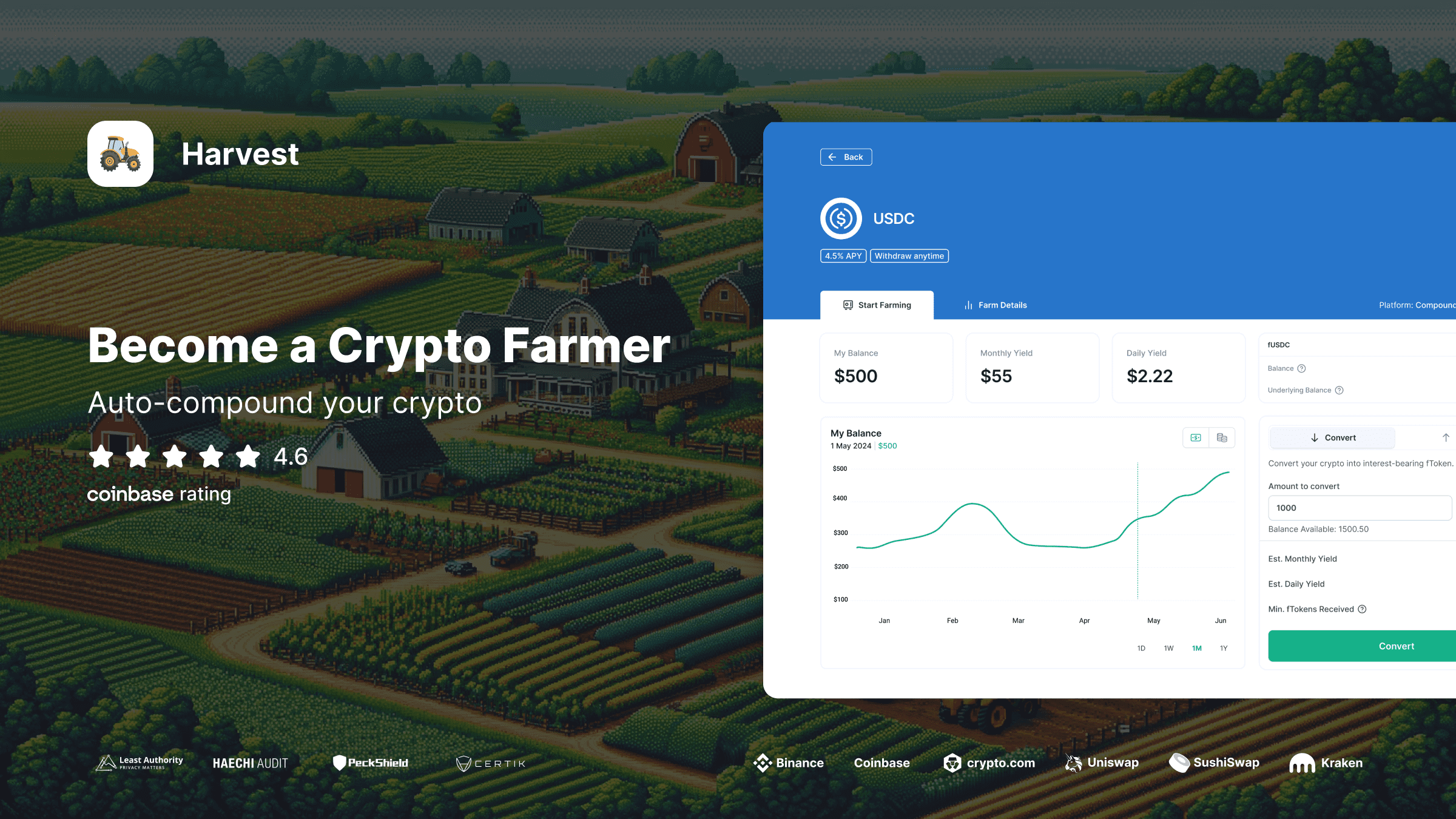

Harvest Finance Smart Vaults: Harvest Finance’s Smart Vaults use AI-driven optimization to allocate capital across multiple DeFi protocols. The system automatically identifies the best yield opportunities, compounds rewards, and minimizes impermanent loss, making it a trusted choice for passive income seekers.

-

Yearn Finance v3 AI Strategies: Yearn Finance v3 introduces AI-enhanced strategies that dynamically rebalance user funds across DeFi protocols. The vaults autonomously adapt to market conditions, maximizing yield while minimizing risk, all with a transparent and decentralized approach.

-

Hummingbot DeFi Connect: Hummingbot DeFi Connect is an open-source platform allowing users to build and deploy AI-powered market-making and arbitrage bots. It features integrations with major DEXs and supports custom strategy development for automated yield optimization.

-

Autonio NIOX Trading Suite: The Autonio NIOX Trading Suite offers modular, AI-powered tools for designing, backtesting, and deploying custom DeFi trading strategies. Its bots automate liquidity mining, rebalancing, and arbitrage, catering to both novice and advanced users.

-

Token Metrics AI Yield Bot: Token Metrics AI Yield Bot utilizes proprietary machine learning algorithms to analyze on-chain data and forecast optimal yield farming opportunities. The platform delivers actionable insights and automates position management to maximize DeFi returns.

-

Gains Network gTrade AI: Gains Network’s gTrade AI integrates artificial intelligence for leveraged trading and automated yield farming. It optimizes trade execution, manages liquidation risks, and provides users with advanced analytics for DeFi strategies.

Deep Dive: Platform Features and Technical Analysis

Let’s break down why each of these bots deserves a spot on this list, and where skepticism is warranted.

1. Pionex GPT

Pionex GPT is the next evolution of the exchange’s automation suite, integrating GPT-driven AI for real-time strategy adaptation. Unlike traditional grid bots, Pionex GPT can interpret on-chain events, macro trends, and even social sentiment to adjust grid parameters and risk exposure. Its tight integration with Pionex’s exchange infrastructure means no API headaches or latency issues. However, while the AI layer is impressive, the platform still caters more to beginners, advanced users may find the customization options limiting.

2. Harvest Finance Smart Vaults

Harvest Finance Smart Vaults deploy AI-optimized strategies that automatically migrate capital to the highest-yielding pools across multiple protocols. The vaults use reinforcement learning to adapt to shifting APRs and can even detect unsustainable yield spikes (often a sign of protocol risk or impending rug pulls). While Harvest’s smart vaults have a solid track record, users should scrutinize fee structures and smart contract audit history before committing significant capital.

3. Yearn Finance v3 AI Strategies

Yearn’s v3 AI Strategies are the gold standard for dynamic yield optimization. These strategies employ machine learning models to allocate capital across lending, liquidity provision, and even cross-chain bridges. The AI layer continuously backtests performance and rebalances positions with minimal slippage. Yearn’s open governance and rigorous audits provide some peace of mind, but it’s important to remember that even AI can’t eliminate all smart contract or protocol risk.

4. Hummingbot DeFi Connect

Hummingbot DeFi Connect brings open-source ethos to AI-driven market making and yield strategies. Its modular architecture lets advanced users deploy custom bots that leverage on-chain data feeds, arbitrage opportunities, and even real-time gas analytics. The key differentiator here is transparency, users can inspect every line of code and run bots locally for maximum control. However, Hummingbot’s learning curve is steep, and less technical users may struggle to harness its full power.

Ready to compare these bots head-to-head? See our full technical breakdown at Best AI Crypto Trading Bots for Automated DeFi Yield Farming in 2024.

5. Autonio NIOX Trading Suite

Autonio’s NIOX Trading Suite is a modular platform engineered for power users who demand granular control. Its AI-powered agents can be configured for liquidity mining, cross-DEX arbitrage, and dynamic portfolio rebalancing. The suite’s standout feature is its robust backtesting engine, allowing traders to simulate strategies across historical data before risking capital. While Autonio’s automation is technically impressive, the interface can be daunting for beginners, and real-world performance will ultimately depend on the user’s ability to fine-tune AI modules to volatile DeFi conditions.

6. Token Metrics AI Yield Bot

Token Metrics AI Yield Bot stands out for its integration of proprietary AI signals and on-chain analytics. The bot scans hundreds of DeFi protocols for yield opportunities, factoring in real-time risk metrics, protocol health, and even governance changes. Its edge lies in predictive modeling: the AI attempts to forecast which pools will outperform based on historical patterns and market sentiment. However, the platform’s black-box nature means users must trust the AI’s decision-making process without full transparency. If you value explainability, this could be a sticking point.

7. Gains Network gTrade AI

Gains Network’s gTrade AI is purpose-built for leveraged DeFi trading, but its agentic bots also optimize yield farming by routing collateral through the most capital-efficient protocols. The platform’s AI modules factor in volatility, liquidity depth, and risk-adjusted returns, enabling sophisticated strategies that go beyond simple yield chasing. For traders comfortable with leverage and complex DeFi primitives, gTrade AI offers a compelling, if risky, toolset. As always, leverage amplifies both gains and losses, so risk management is non-negotiable.

Key Considerations Before Deploying AI DeFi Trading Bots

Even the best AI crypto trading bots are not magic bullets. Security remains paramount: scrutinize smart contract audits, review the project’s history, and never expose more capital than you can afford to lose. Transparency is another critical factor. Open-source platforms like Hummingbot offer code-level assurance, while black-box bots require a leap of faith. Finally, strategy alignment matters: some bots excel at passive yield harvesting, others at active trading or cross-chain arbitrage. Choose a solution that matches your risk tolerance and technical proficiency.

For a comprehensive workflow guide on deploying these bots in real-world scenarios, see How to Use AI Trading Agents for Automated DeFi Yield Farming in 2024.

Which AI crypto trading bot do you trust most for DeFi yield farming in 2024?

With so many advanced AI-powered bots optimizing yield farming strategies, we’re curious which platform you trust the most for maximizing returns and managing risk. Vote for your top pick below!

Bottom Line: Do AI Bots Actually Deliver in 2024?

The hype around AI-powered DeFi trading bots is justified only when backed by rigorous data and transparent results. While platforms like Yearn v3 and Harvest Finance Smart Vaults have demonstrated consistent outperformance, even the most advanced AI cannot fully mitigate the risks inherent to decentralized finance. The real winners in 2024 are traders who combine automation with skepticism, using AI as a tool, not a crutch.

If you’re serious about maximizing yield and minimizing risk, start small, demand transparency, and keep your expectations grounded in math, not marketing. For ongoing coverage and up-to-date rankings, visit our Best DeFi Trading Bots for Automated Yield Farming in 2024 resource.