Automated yield farming isn’t just a trend – it’s the engine powering next-level returns for crypto traders who want to maximize every opportunity in DeFi. The days of manually chasing APYs and shuffling liquidity between protocols are over. In 2024, AI-powered DeFi trading bots and smart contract automation tools are leading the charge, transforming passive income into a truly hands-off experience.

Why 2024 Is the Breakout Year for AI Yield Farming Bots

The DeFi landscape has matured. Security is tighter, yields are more competitive, and the sheer number of protocols can overwhelm even seasoned traders. Enter AI-driven trading agents and automation platforms: these bots scan, calculate, and deploy capital faster than any human could. They’re not just about speed – they’re about precision, risk management, and squeezing out hidden alpha from complex ecosystems like Uniswap, Aave, and Curve.

This year’s best DeFi trading bots don’t just automate basic tasks – they run advanced strategies like auto-compounding rewards, dynamic rebalancing based on market conditions, and cross-chain liquidity optimization. Let’s dive into the seven best solutions that are defining what it means to farm yield in 2024.

The Top 7 DeFi Trading Bots for Automated Yield Farming

Top 7 DeFi Trading Bots for Automated Yield Farming

-

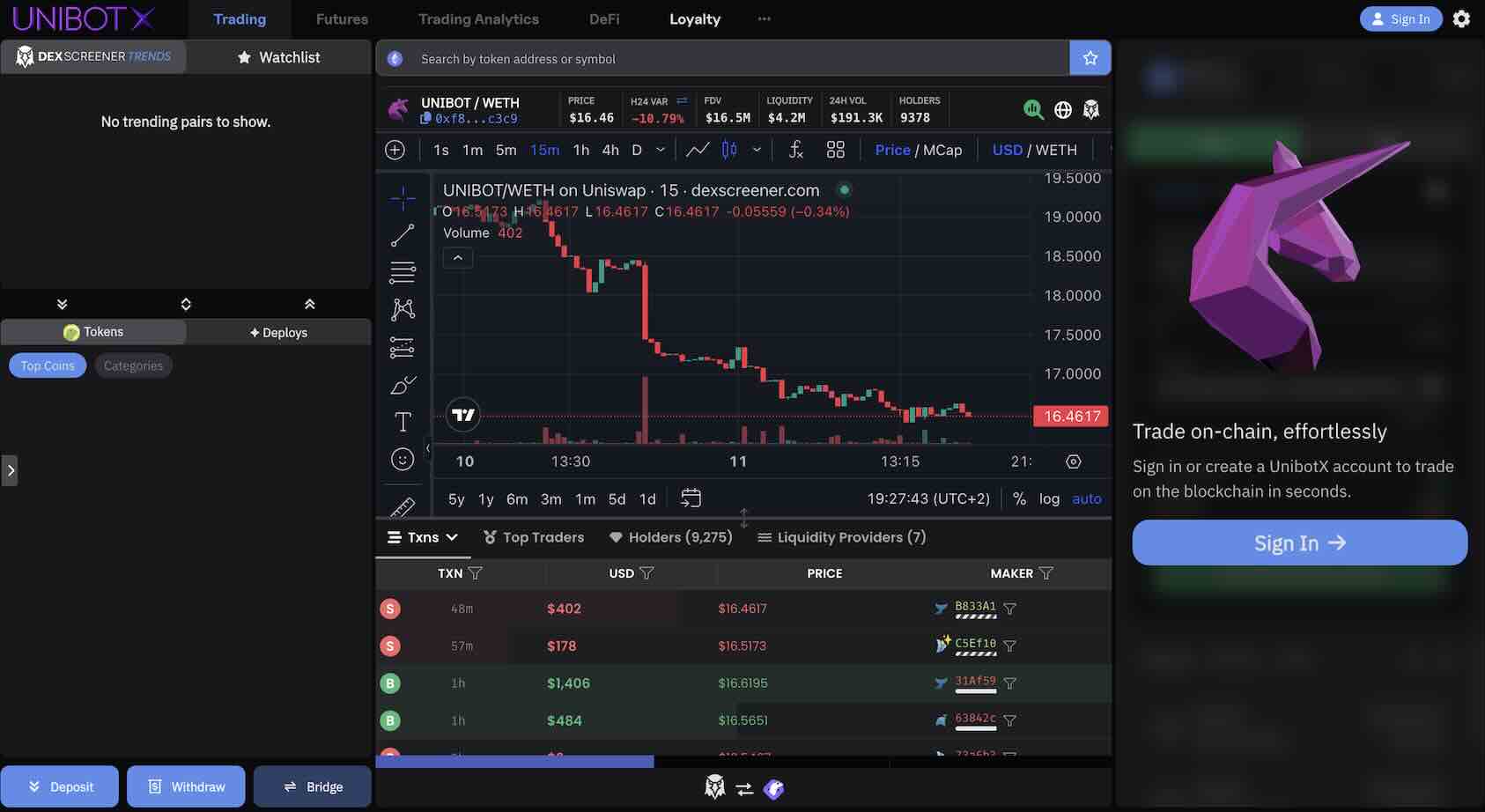

Unibot is a leading DeFi trading bot that has achieved over $994.93M in lifetime trading volume, ranking 7th among all DEX trading bots. It excels in automating trades and yield farming strategies on decentralized exchanges, offering fast execution and a user-friendly interface.

-

Autonio NIOX leverages AI-driven algorithms to automate trading and yield farming across multiple DeFi protocols. Its NIOX Suite provides customizable strategies, analytics, and integration with top DEXs, making it a practical tool for both novice and advanced users.

-

Harvest Finance Smart Vaults automate yield optimization by deploying user funds into the most profitable DeFi strategies. The platform’s Smart Vaults regularly rebalance assets to maximize returns, supporting a wide range of tokens and protocols.

-

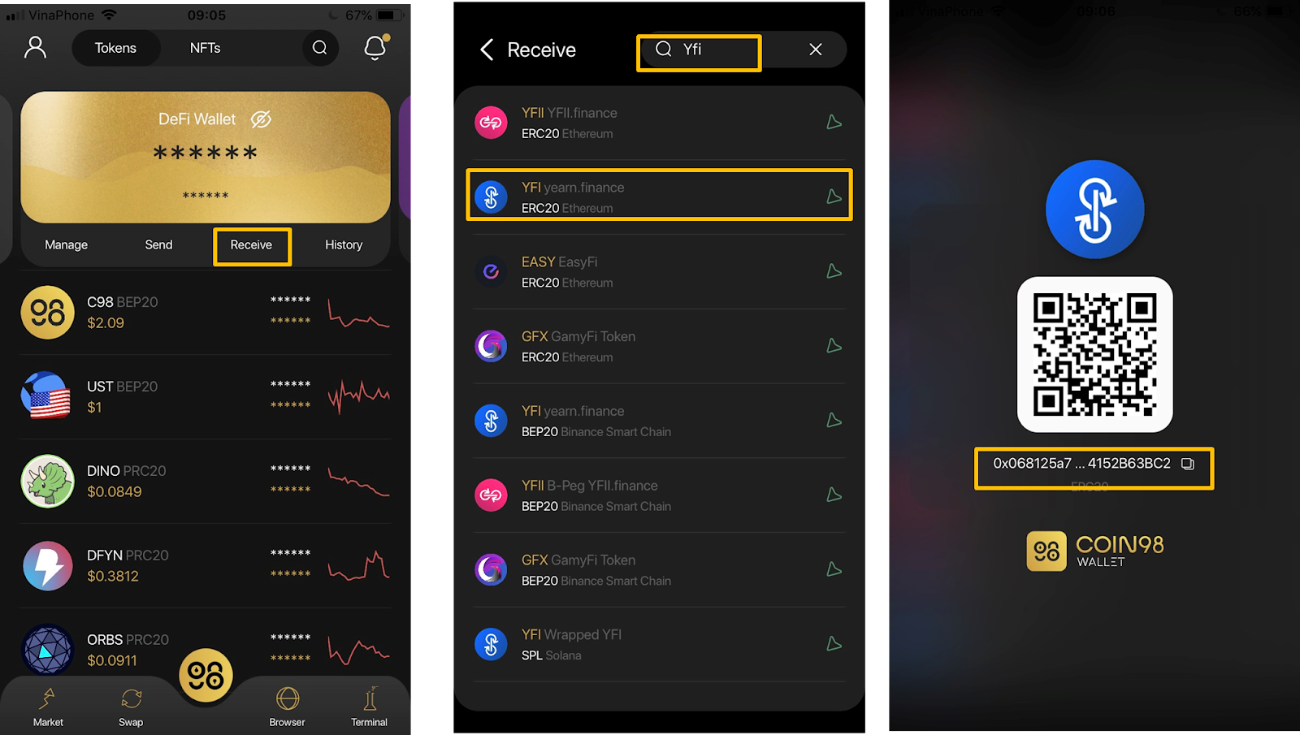

Yearn Finance yVaults are industry-leading yield aggregators that automatically move user assets between DeFi protocols to capture the best returns. yVaults simplify yield farming with automated compounding and risk management.

-

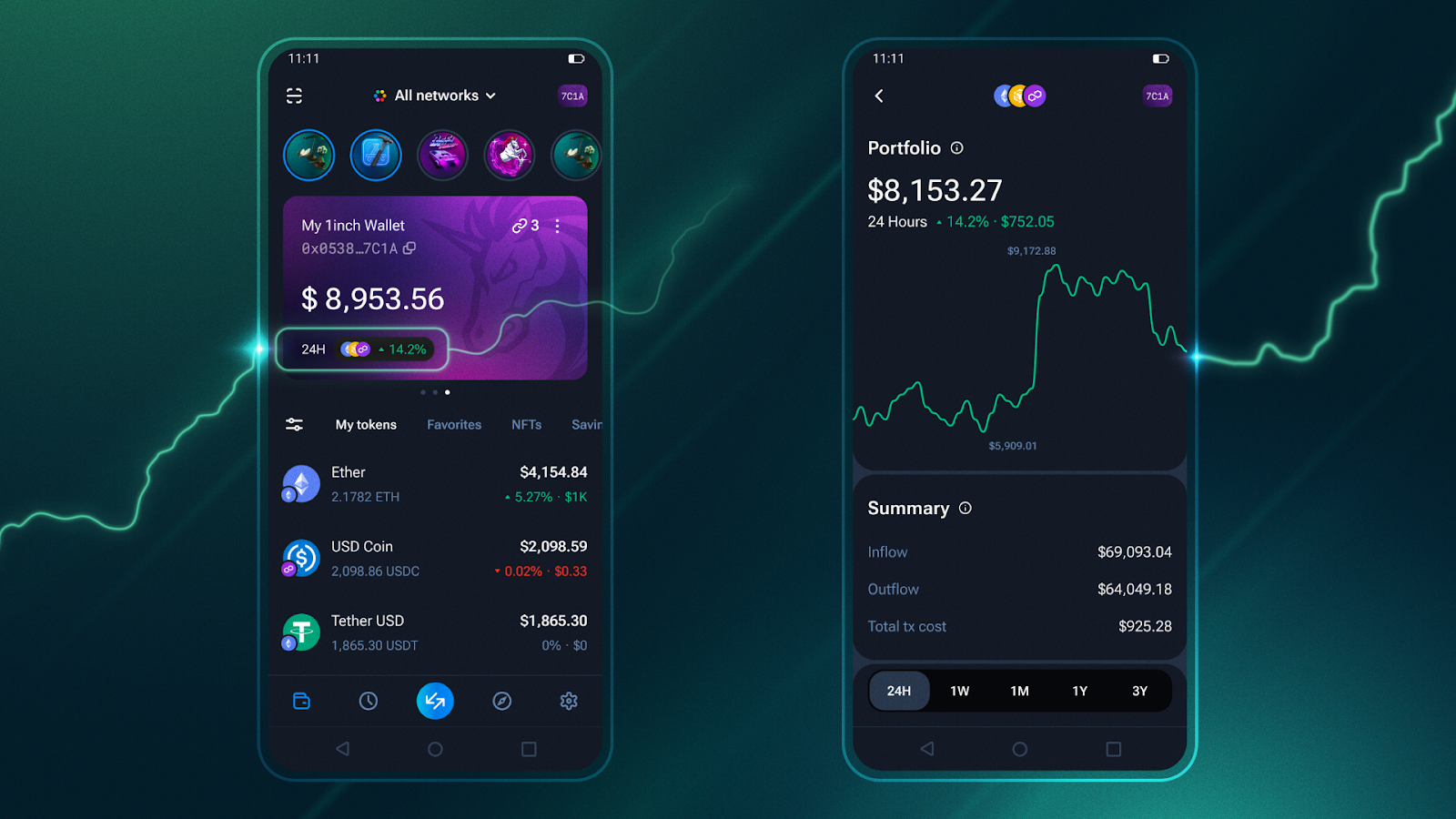

1inch Fusion Mode Bot enables automated, gas-efficient trading and yield farming on the 1inch DEX aggregator. Fusion Mode optimizes swaps and liquidity provision, helping users maximize yield with minimal manual intervention.

-

Gelato Automate is a powerful automation protocol that lets users schedule and execute DeFi strategies, including yield farming, without manual oversight. Its automation bots support a wide range of protocols and smart contract tasks.

-

RoboVault offers automated yield optimization across multiple DeFi platforms. Its smart strategies dynamically allocate assets to the highest-yielding opportunities, providing hands-off compounding and risk-adjusted returns.

Unibot: The DEX Automation Powerhouse

Unibot has cemented its reputation as one of the most reliable DEX trading bots on the market. With over $994.93M in lifetime volume, it ranks seventh among all decentralized exchange (DEX) trading bots by volume – a testament to both its popularity and robust performance (source: Coinlaunch). Unibot thrives on automating swaps across leading DEXs like Uniswap and PancakeSwap while integrating real-time analytics to optimize entry and exit points for yield farmers.

The secret sauce? Its AI-powered algorithms that monitor gas fees, slippage tolerance, and pool volatility so users can move fast when lucrative farming windows open up. Whether you’re looking to snipe new token launches or rotate liquidity between pools for maximum APY capture, Unibot delivers both speed and control.

Autonio NIOX: Your Modular AI Trading Suite

Autonio NIOX is more than a bot – it’s an entire ecosystem tailored for algorithmic traders who want full customization without coding headaches. Its flagship SmartDEX bot allows users to deploy advanced market-making strategies or follow pre-built templates optimized by the Autonio community. What sets NIOX apart is its modularity; plug into different yield farming protocols or tweak risk parameters on-the-fly as markets shift.

NIOX’s AI modules analyze order book depth and liquidity flows across major DEXs so you can automate everything from arbitrage to complex liquidity provision strategies. For hands-off farmers seeking a competitive edge with granular control over every parameter, Autonio NIOX is a top contender in 2024.

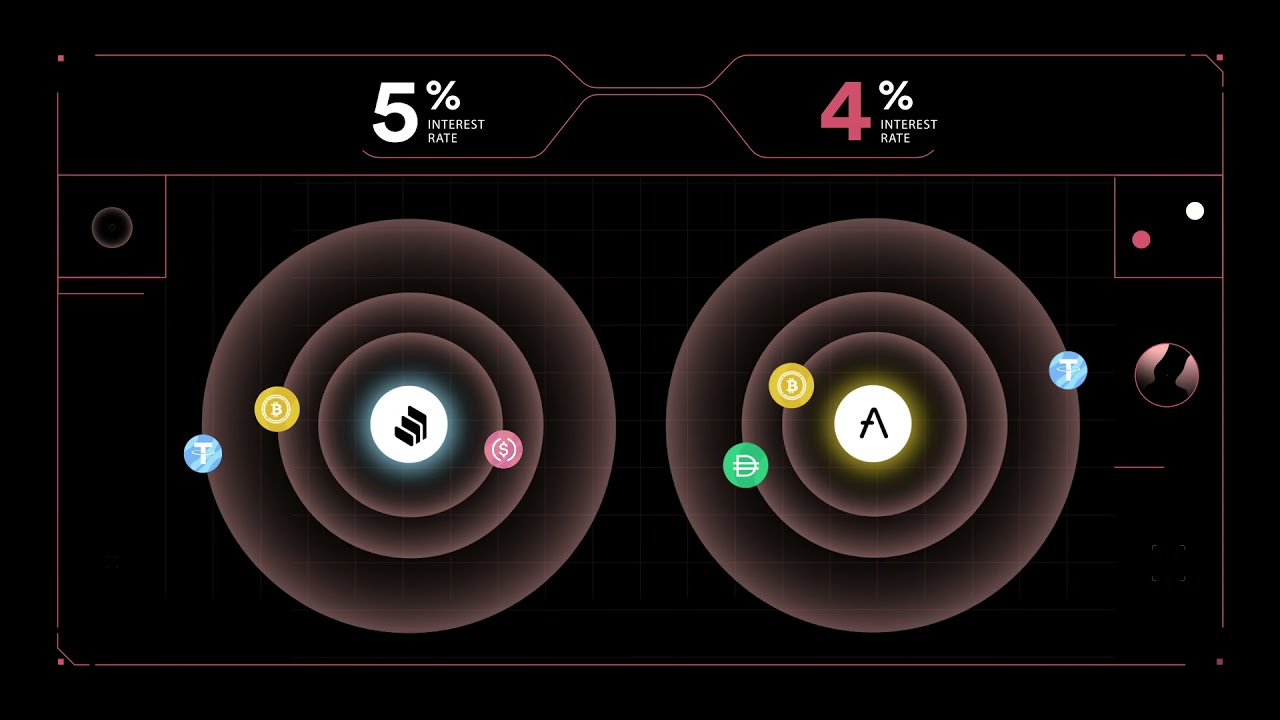

The New Era of Automated Vaults and Protocol Integrations

The evolution of smart vaults has been nothing short of revolutionary for passive income seekers. Today’s top vault platforms automatically harvest rewards from high-yield pools, reinvest proceeds at optimal intervals, and dynamically adjust allocations based on real-time protocol data – all without manual intervention.

Harvest Finance Smart Vaults, Yearn Finance yVaults, 1inch Fusion Mode Bot, Gelato Automate, and RoboVault each bring their own spin on DeFi automation:

- Harvest Finance Smart Vaults: Specialize in auto-harvesting rewards from diverse farms (including Curve and SushiSwap) with built-in risk management filters.

- Yearn Finance yVaults: Pioneer automated strategy deployment across blue-chip protocols like Aave and Compound; famous for their seamless compounding logic.

- 1inch Fusion Mode Bot: Aggregates liquidity sources to optimize swaps while minimizing slippage during large trades – perfect for high-volume farmers chasing best-in-class rates.

- Gelato Automate: Brings no-code task scheduling to DeFi; set up recurring actions like harvesting or rebalancing with simple triggers tied to chain events or price thresholds.

- RoboVault: Uses machine learning models to actively manage stablecoin pools for low-risk yet consistent yield generation; ideal for conservative portfolios seeking steady returns regardless of market swings.

This new breed of automation tools lets you stack protocols – combining vaults with swap aggregators or auto-compounders – creating layered strategies that were previously only possible with constant manual oversight.

As DeFi matures, the synergy between AI-driven bots and smart contract vaults is unlocking yield streams that were once reserved for the most technical traders. Now, anyone can access sophisticated strategies with just a few clicks – or even automate the entire process end-to-end.

Harvest Finance Smart Vaults: Maximizing Rewards With Minimal Effort

Harvest Finance Smart Vaults have become a staple for hands-off yield farmers who value both flexibility and security. These vaults auto-harvest rewards from a wide range of pools – including Curve, SushiSwap, and more – then reinvest them according to algorithmically optimized strategies. What separates Harvest from the pack is its risk management layer: each vault is audited and monitored for protocol exploits or sudden APY drops, giving users peace of mind as they chase returns in an ever-shifting landscape.

Yearn Finance yVaults: The OG of Automated Yield Optimization

Yearn Finance yVaults are legendary for good reason. As one of the first platforms to automate yield farming at scale, Yearn’s yVaults deploy user assets across blue-chip protocols like Aave and Compound, constantly seeking out the highest yields available. The magic lies in Yearn’s strategy pipeline: it automatically compounds earnings, rebalances allocations as market conditions shift, and even integrates new protocols as soon as they prove themselves in the wild. For DeFi veterans and newcomers alike, Yearn remains a go-to for set-and-forget passive income.

1inch Fusion Mode Bot: Liquidity Aggregation Meets Automation

If you’re tired of losing out on optimal swap rates due to fragmented liquidity, 1inch Fusion Mode Bot is your answer. This bot aggregates liquidity from multiple sources in real-time and executes trades with minimal slippage – ideal for high-volume farmers who need efficiency at scale. Fusion Mode also enables automated routing based on current pool depths and gas fees, so your capital is always working overtime without manual babysitting.

Gelato Automate: No-Code Automation for Every DeFi User

Gelato Automate democratizes DeFi automation by letting users schedule actions like harvesting rewards or rebalancing portfolios using simple triggers – no coding required. Want to auto-harvest whenever APY crosses a certain threshold? Or rebalance when prices hit your targets? Gelato makes it possible with intuitive workflows tied directly to on-chain events. This level of customization empowers both casual farmers and power users to optimize returns without constant monitoring.

RoboVault: Machine Learning-Driven Yield Farming

RoboVault takes things a step further by harnessing machine learning models to dynamically manage stablecoin pools for consistent yield generation. Its algorithms assess market volatility in real-time, adjusting allocations across multiple protocols to minimize risk while maintaining steady returns. For those seeking low-risk exposure with reliable performance regardless of market turbulence, RoboVault stands out as an essential tool in 2024’s DeFi arsenal.

The Power of Layered Automation: Building Smarter Yield Strategies

The true magic happens when you combine these bots and vaults into layered strategies: imagine using Unibot or Autonio NIOX to monitor DEX pools for fresh opportunities while letting Harvest or Yearn handle compounding behind the scenes. Add Gelato Automate’s no-code triggers or RoboVault’s adaptive risk management into the mix, and you’ve got a portfolio that works around-the-clock – optimizing every move based on real-time data rather than gut instinct.

This approach isn’t just about chasing higher APYs; it’s about managing downside risk through diversification and automated rebalancing. In 2024, successful yield farmers are those who let AI do the heavy lifting while they focus on big-picture strategy.

If you’re ready to join the ranks of hands-free farmers capturing alpha across every corner of DeFi, now is the time to experiment with these advanced tools. They’re not just reshaping portfolio management – they’re defining what “smart money” looks like in decentralized finance today.