DeFi yield farming has entered a new era in 2024, with AI trading agents transforming the landscape for both retail and institutional investors. As of October 2025, these AI-powered bots are no longer just experimental tools; they have become essential infrastructure for anyone seeking to automate, optimize, and scale their DeFi yield strategies. The latest generation of AI crypto trading bots leverages real-time data, predictive analytics, and cross-chain interoperability to deliver smarter returns with less manual oversight.

AI Agents for Cross-Chain Yield Optimization

The proliferation of DeFi protocols across chains like Ethereum, Arbitrum, and BNB Chain has made manual yield optimization nearly impossible for most investors. Enter autonomous trading bots such as Fetch. ai and Morpheus. These AI agents constantly scan liquidity pools on platforms like Aave, Curve, and Uniswap, reallocating your capital in real time to wherever the highest yields are available. This approach minimizes opportunity cost and helps you capture fleeting APYs that would otherwise be missed.

For example, when a lucrative pool appears on Arbitrum but quickly fills up, an AI agent can detect the spike in APY and move funds from a lower-yielding Ethereum pool within seconds. This level of speed and precision is simply unattainable through manual management. Cross-chain optimization also reduces exposure to single-chain risks by spreading assets across multiple ecosystems.

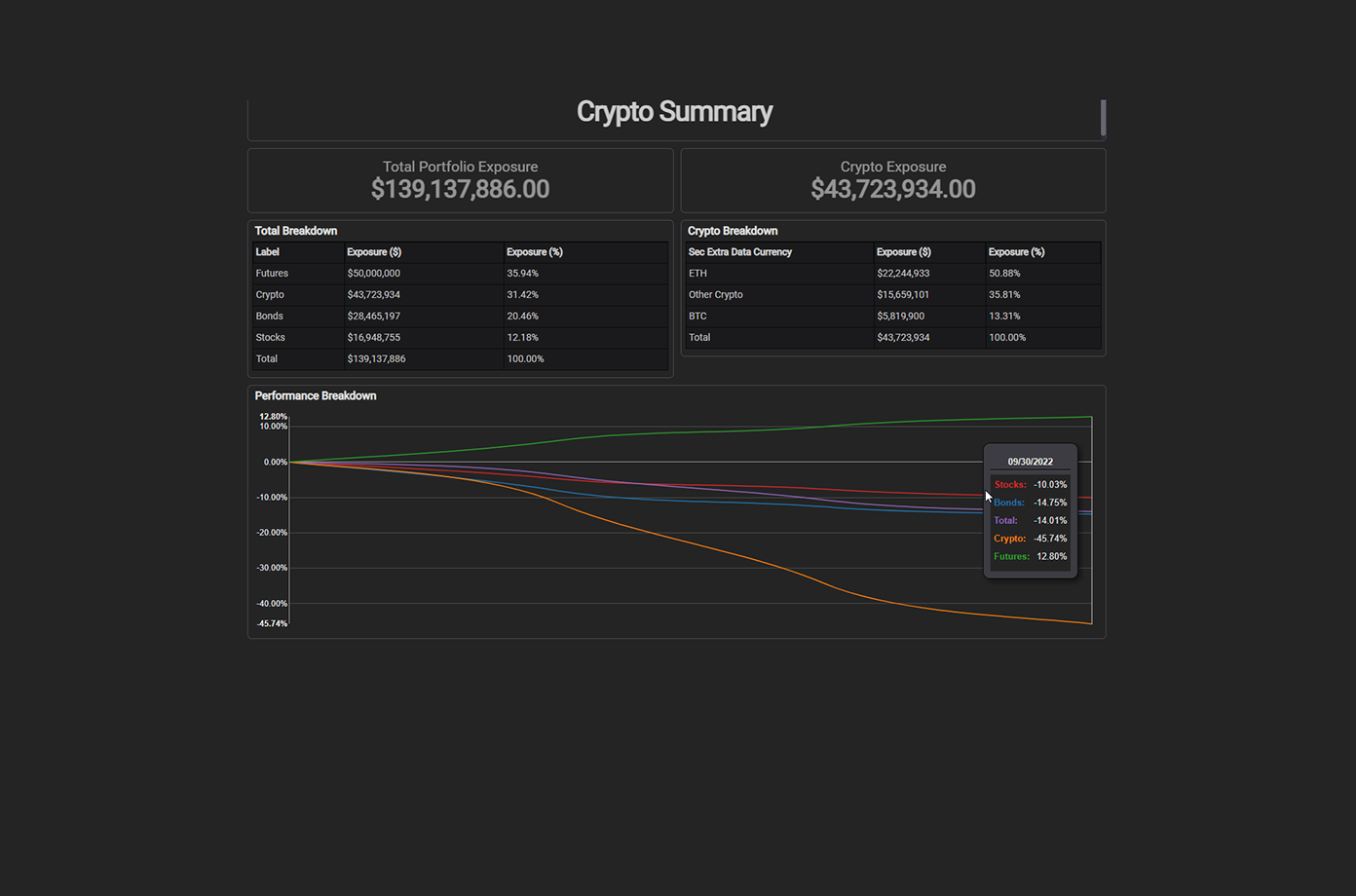

Automated Risk Management Using Machine Learning

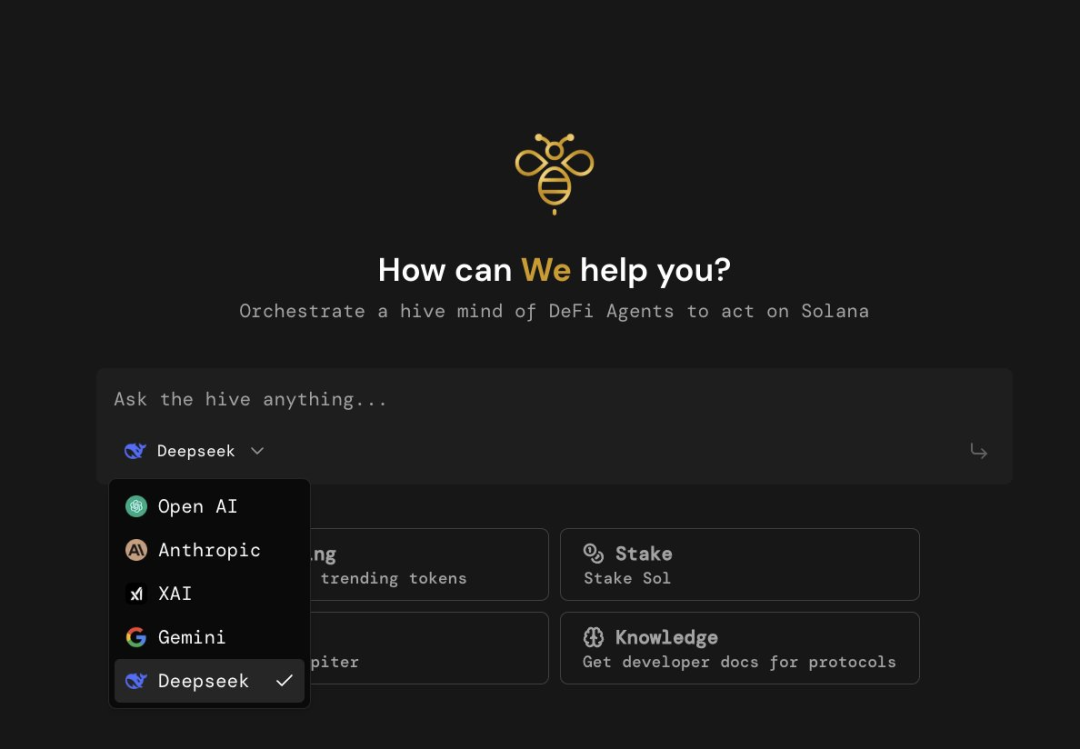

The volatility of DeFi protocols – from smart contract exploits to stablecoin de-peggings – demands vigilant risk management. Platforms like Hive AI, built on Solana, are at the forefront here. These agents use advanced machine learning models to monitor protocol health metrics (such as TVL changes or audit alerts) and market volatility indicators in real time. If a protocol becomes risky or a de-pegging event is detected (for example, USDC briefly losing its peg), the agent can automatically withdraw or rebalance funds to safer assets or platforms.

This automated risk mitigation is invaluable during periods of market stress when human reaction times lag behind algorithmic execution. By integrating predictive analytics directly into your yield farming workflow, you significantly reduce exposure to catastrophic losses while maintaining access to high-yield opportunities.

5 Advanced AI Strategies for DeFi Yield Farming

-

Leverage AI Agents for Cross-Chain Yield Optimization: Deploy autonomous trading bots like Fetch.ai or Morpheus to scan multiple DeFi protocols (e.g., Aave, Curve, Uniswap) across chains such as Ethereum, Arbitrum, and BNB Chain. These AI agents reallocate liquidity in real-time to the highest-yielding pools, maximizing returns by exploiting cross-chain opportunities.

-

Automate Risk Management with Machine Learning Models: Use AI agents equipped with predictive analytics—such as Hive AI on Solana—to monitor market volatility and protocol health. These agents can automatically withdraw or rebalance funds when smart contract risks or de-pegging events are detected, protecting your capital from sudden losses.

-

Utilize Gas Fee Optimization Algorithms: Implement bots that analyze network congestion and dynamically schedule transactions for optimal gas costs. This approach is especially valuable on high-fee networks like Ethereum, helping you maximize net yield by reducing unnecessary expenses.

-

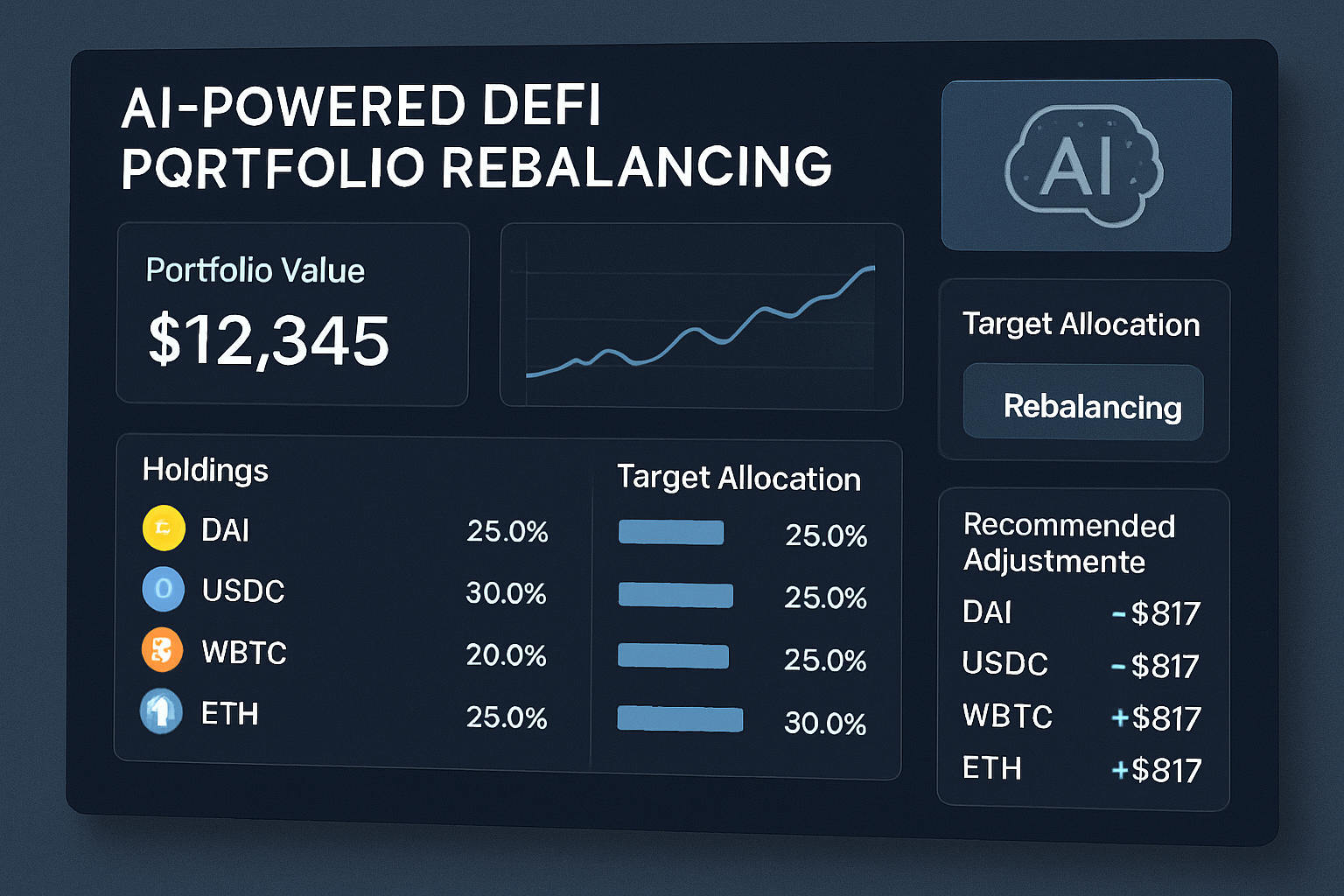

Integrate AI-Powered Portfolio Rebalancing: Set up trading agents to continuously rebalance your DeFi portfolio based on changing APYs, token prices, and risk parameters. This ensures your capital is always allocated to the most efficient strategies, adapting in real-time as market conditions evolve.

-

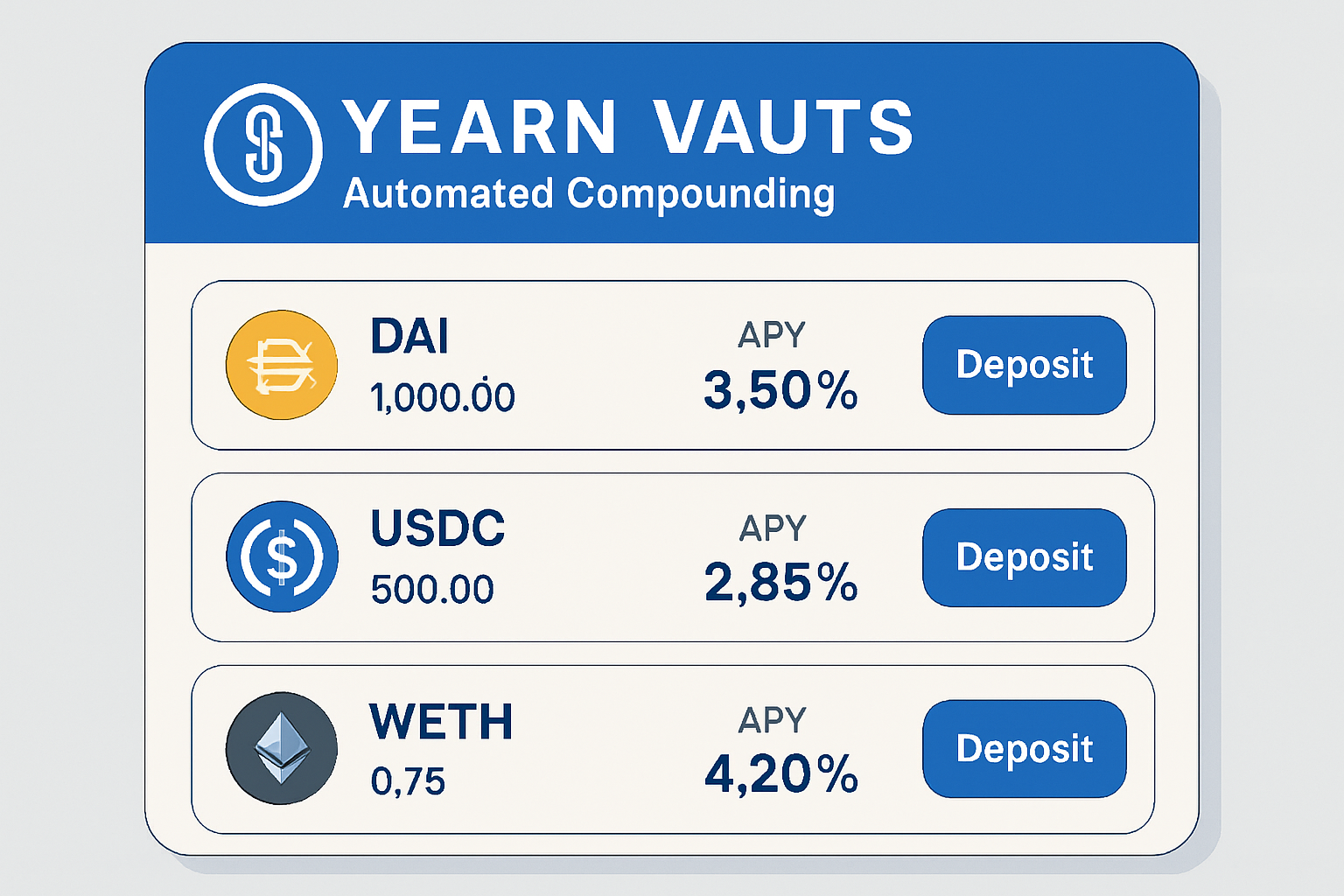

Employ Automated Compounding Strategies: Use DeFi automation tools like Yearn Vaults or Beefy Finance enhanced with AI triggers to harvest and reinvest rewards at optimal intervals. This compounds your returns without manual intervention, leveraging AI to time compounding for maximum effect.

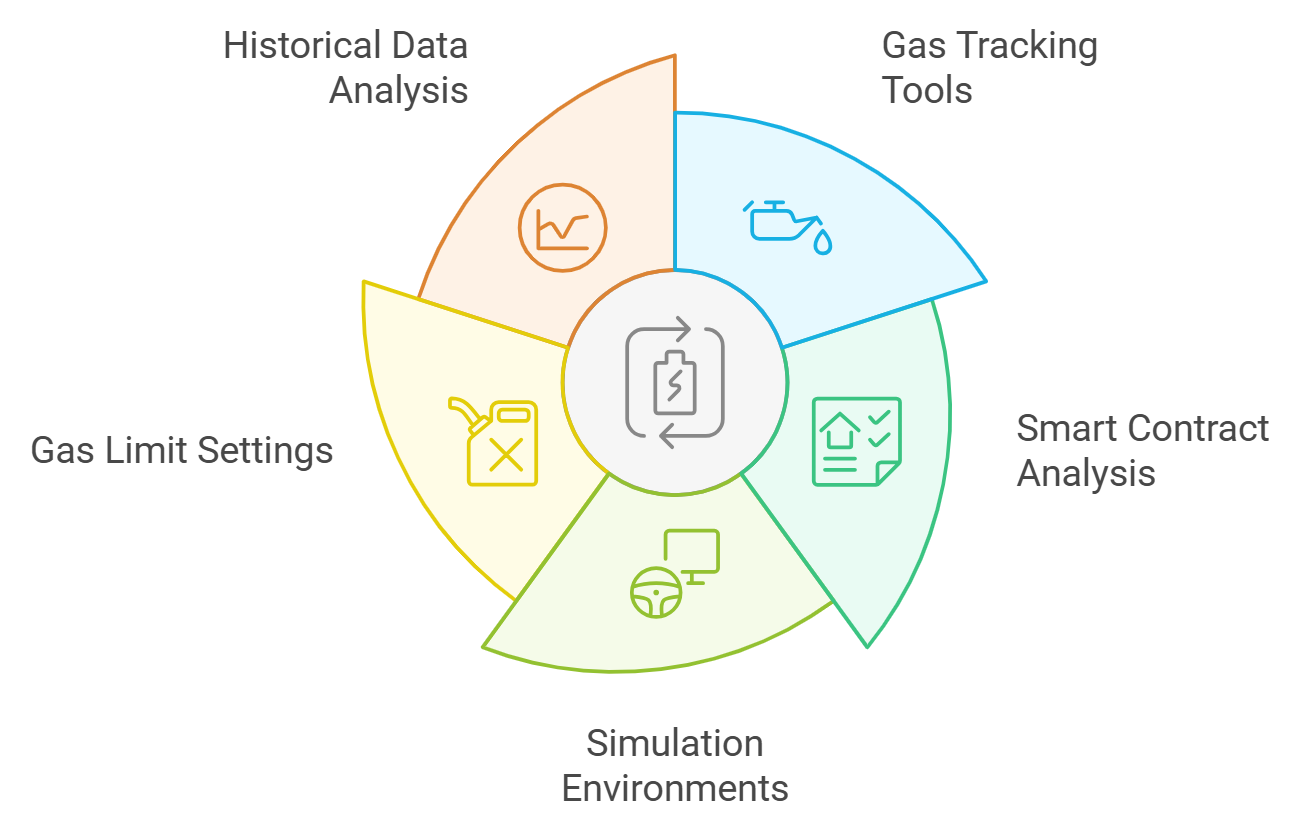

Gas Fee Optimization Algorithms for Maximum Net Yield

High network fees remain a major challenge on chains like Ethereum. Even with attractive APYs, excessive gas costs can erode net returns, especially when frequently reallocating liquidity or compounding rewards. Modern DeFi automation tools incorporate gas fee optimization algorithms that analyze network congestion in real time. These bots dynamically schedule transactions for periods of lower gas prices or batch multiple actions into single transactions.

This approach not only maximizes net yield but also ensures that your strategy remains cost-effective regardless of chain activity levels. For those deploying capital at scale or operating on high-fee networks, this feature alone can make the difference between positive and negative ROI over time.

The Evolution of Portfolio Rebalancing and Compounding with AI

Manual portfolio rebalancing is both time-consuming and error-prone in fast-moving DeFi markets. Today’s best AI crypto trading bots offer continuous portfolio rebalancing based on live APY shifts, token price movements, and evolving risk parameters. By keeping your capital allocated to the most efficient strategies at all times, these agents help you stay ahead of both market trends and competitors who rely on static allocation models.

Together with automated compounding strategies, where tools like Yearn Vaults or Beefy Finance harvest rewards at optimal intervals using AI triggers, the result is true hands-off yield maximization tailored to your unique risk profile.

Let’s break down how these advanced AI-powered strategies are shaping the future of DeFi yield farming, and what you need to know to deploy them effectively in 2024 and beyond.

Five Advanced Strategies for Automated DeFi Yield Farming

5 Advanced AI Strategies for DeFi Yield Farming

-

Leverage AI Agents for Cross-Chain Yield Optimization: Deploy autonomous trading bots like Fetch.ai or Morpheus to scan multiple DeFi protocols (e.g., Aave, Curve, Uniswap) across chains such as Ethereum, Arbitrum, and BNB Chain. These agents reallocate liquidity in real-time to the highest-yielding pools, ensuring capital is always working at peak efficiency.

-

Automate Risk Management with Machine Learning Models: Use AI agents equipped with predictive analytics—such as Hive AI on Solana—to monitor market volatility and protocol health. These agents can automatically withdraw or rebalance funds when smart contract risks or de-pegging events are detected, helping to safeguard your assets.

-

Utilize Gas Fee Optimization Algorithms: Implement bots that analyze network congestion and dynamically schedule transactions for optimal gas costs. This strategy is especially valuable on high-fee networks like Ethereum, maximizing your net yield by reducing unnecessary expenses.

-

Integrate AI-Powered Portfolio Rebalancing: Set up trading agents to continuously rebalance your DeFi portfolio based on changing APYs, token prices, and risk parameters. This ensures your capital is always allocated to the most efficient strategies, adapting automatically to evolving market conditions.

-

Employ Automated Compounding Strategies: Use DeFi automation tools such as Yearn Vaults or Beefy Finance, enhanced with AI triggers, to harvest and reinvest rewards at optimal intervals. This compounds your returns without the need for manual intervention, streamlining the yield farming process.

1. Leverage AI Agents for Cross-Chain Yield Optimization: The days of being limited to a single blockchain or protocol are over. Autonomous bots like Fetch. ai and Morpheus have unlocked the ability to scan, analyze, and reallocate liquidity across multiple chains, Ethereum, Arbitrum, BNB Chain, at machine speed. By doing so, they ensure your assets are always working in the highest-yielding pools available at any given moment. This cross-chain agility also acts as a hedge against network-specific risks or congestion events.

2. Automate Risk Management with Machine Learning Models: Safety is paramount in DeFi, where protocol exploits and market shocks can wipe out gains in minutes. Hive AI on Solana exemplifies how machine learning-driven agents can constantly monitor both macro and micro risk factors, tracking everything from sudden TVL drops to real-time audit feeds. These agents can trigger instant withdrawals or rebalance into safer protocols automatically, providing a layer of protection that’s simply not possible through manual monitoring.

3. Utilize Gas Fee Optimization Algorithms: On networks like Ethereum, gas fees are an ever-present concern for active yield farmers. Modern bots integrate gas optimization logic that tracks network congestion and schedules transactions when fees are lowest, or batches multiple actions into one transaction to save costs. This means your net APY remains high even after accounting for operational expenses, a crucial edge for both small-scale farmers and institutional allocators.

4. Integrate AI-Powered Portfolio Rebalancing: Market conditions change rapidly; so should your portfolio allocations. By setting up trading agents to continuously rebalance based on live APY data, token volatility, and personal risk parameters, you ensure every dollar is put to its most efficient use at all times. This dynamic approach outperforms static allocation models that quickly become outdated as yields shift across protocols.

5. Employ Automated Compounding Strategies: The compounding effect is one of the most powerful forces in finance, but only if executed consistently and optimally. Platforms like Yearn Vaults or Beefy Finance now deploy AI triggers that harvest rewards precisely when it’s most advantageous (factoring in gas costs and reward schedules), then automatically reinvest them into the yield strategy of your choice. The result: maximum returns without the need for constant manual intervention.

The Bottom Line: Smarter Yield Farming With Less Effort

The integration of AI trading agents for yield farming has fundamentally changed what’s possible in automated DeFi yield farming. Whether you’re seeking higher returns through cross-chain optimization or peace of mind via automated risk management, today’s leading AI crypto trading bots offer solutions tailored for every type of investor.

The landscape will continue to evolve rapidly as new platforms emerge and existing tools mature, yet the principles outlined above remain foundational for anyone serious about maximizing their crypto portfolio optimization with minimal hands-on oversight.