Automated yield farming has become a cornerstone of DeFi trading bots in 2024, empowering investors to capitalize on high-yield opportunities with minimal manual intervention. As decentralized finance protocols mature, the sophistication of AI trading agents and automation platforms is transforming crypto portfolio management, making advanced strategies accessible to both institutional and retail users. This article spotlights the top five DeFi trading bots that are redefining automated yield farming, each selected for their proven performance, robust security, and seamless integration with leading DeFi ecosystems.

Why Automated Yield Farming Matters in 2024

The current DeFi landscape is marked by fierce competition for yield and rapidly changing market conditions. Manual yield farming can be time-consuming and error-prone, often requiring constant monitoring across multiple protocols. Automated DeFi tools leverage smart contracts and AI-driven algorithms to optimize returns by reallocating funds, compounding rewards, and minimizing risks such as impermanent loss or adverse price movements. According to recent data, bots like Unibot have processed over $994.93M in DEX trading volume, underscoring the scale at which automation now operates (see full stats).

“Let data drive your edge. “: Evan Mercer

The Top 5 DeFi Trading Bots for Automated Yield Farming

Top 5 DeFi Trading Bots for Automated Yield Farming

-

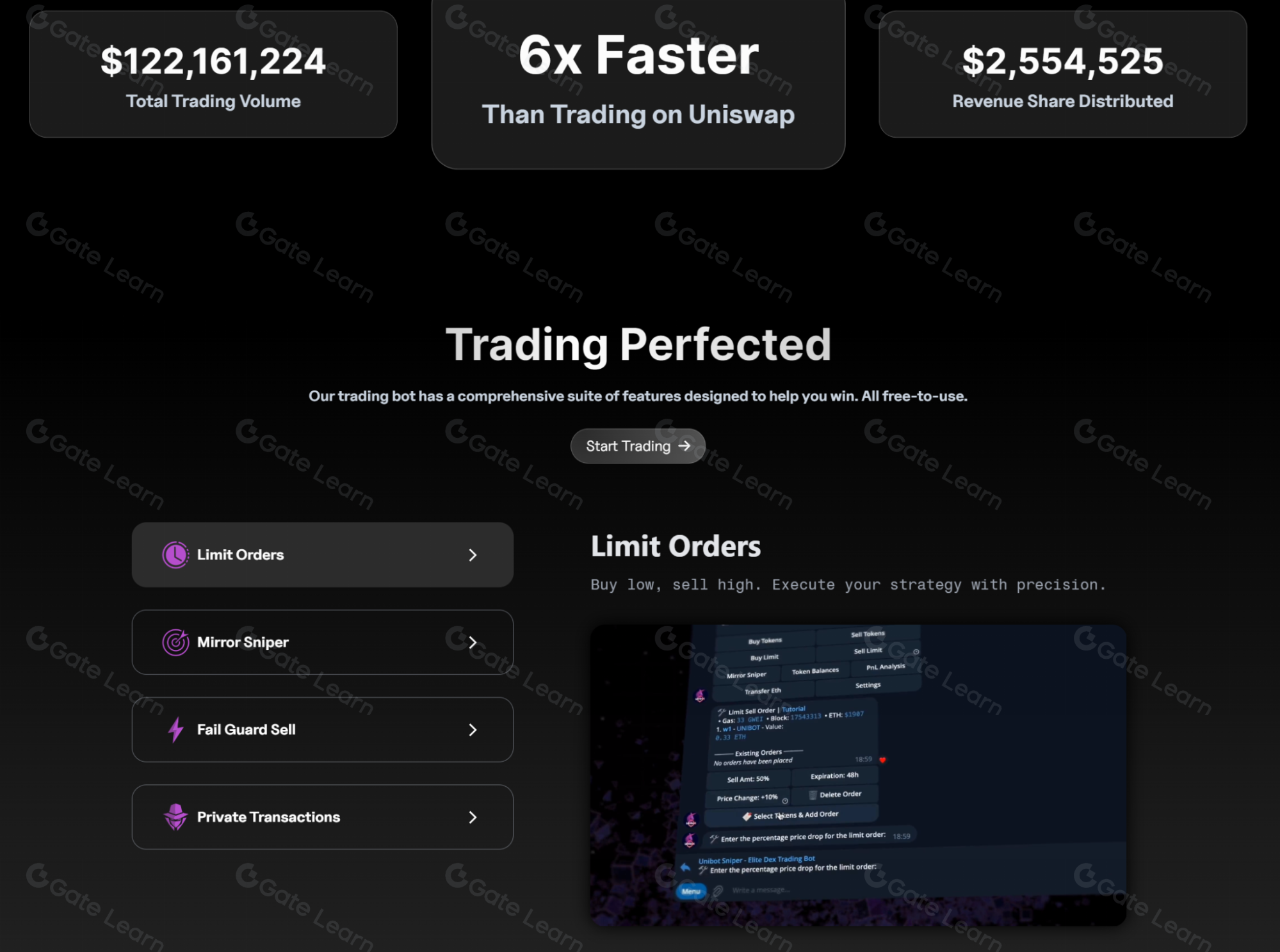

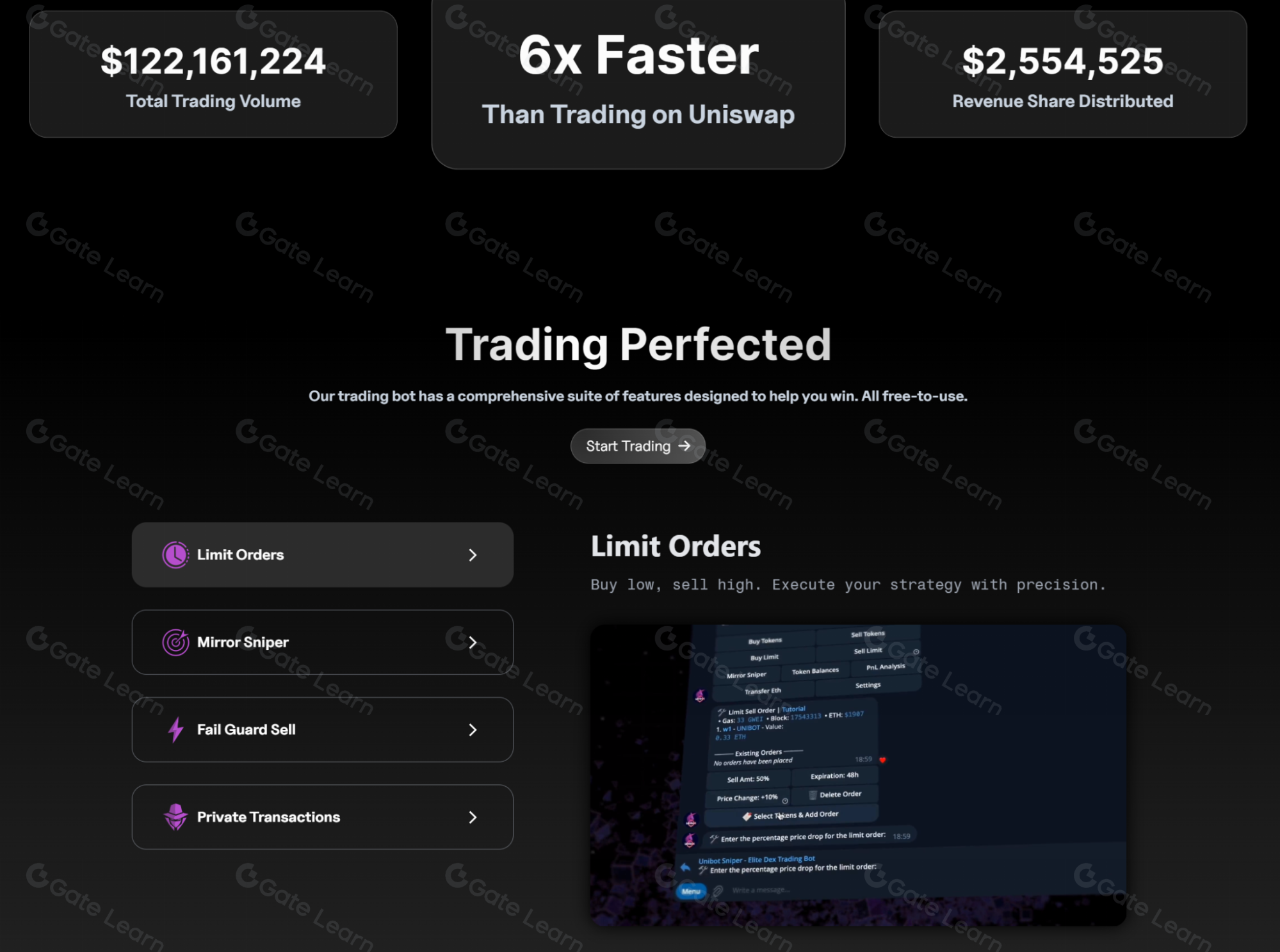

Unibot: Unibot is a leading DeFi trading bot that enables users to automate yield farming and token swaps directly on decentralized exchanges (DEXs). With over $994.93M in lifetime trading volume, Unibot is recognized for its user-friendly interface, rapid trade execution, and advanced risk management tools.

-

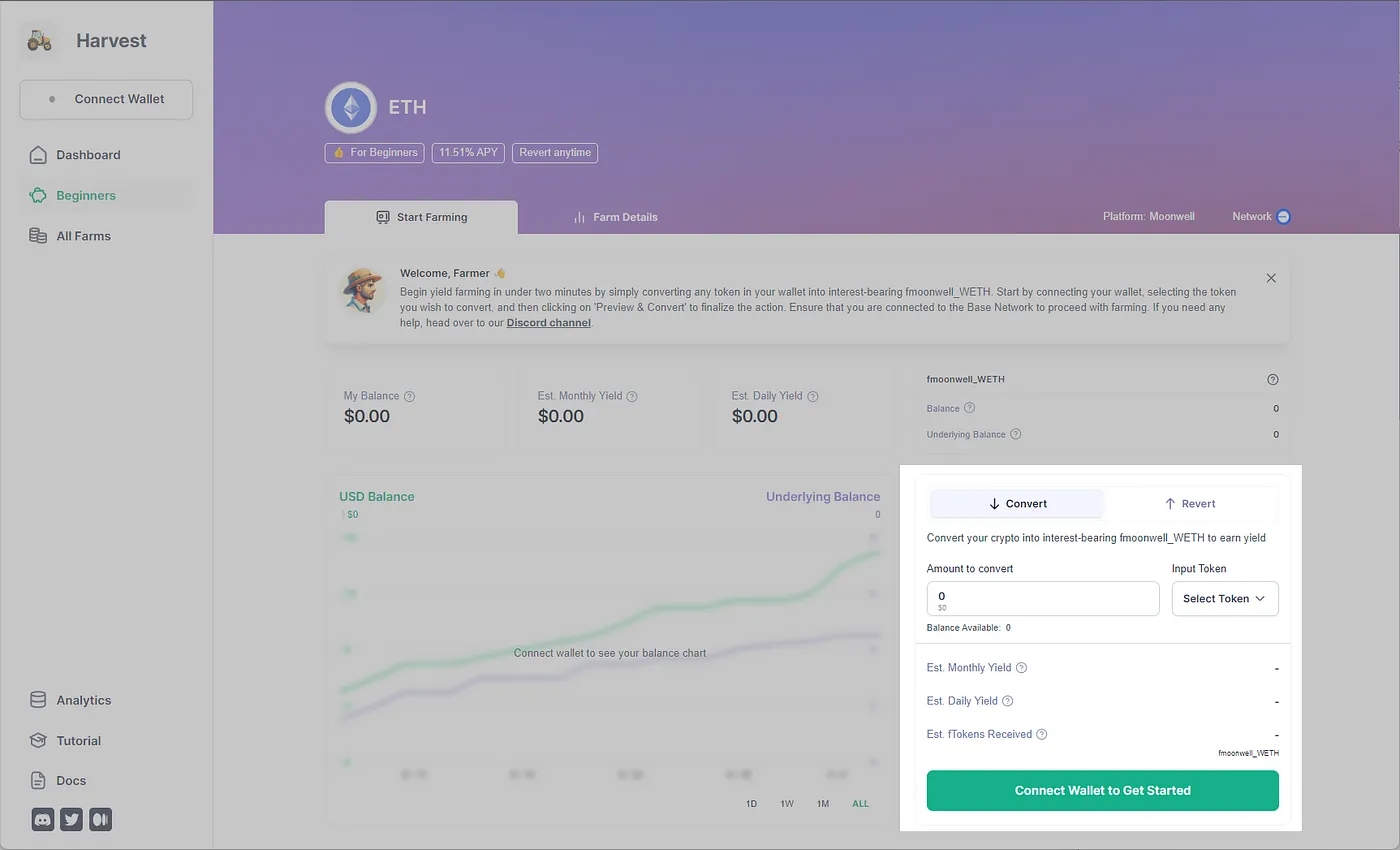

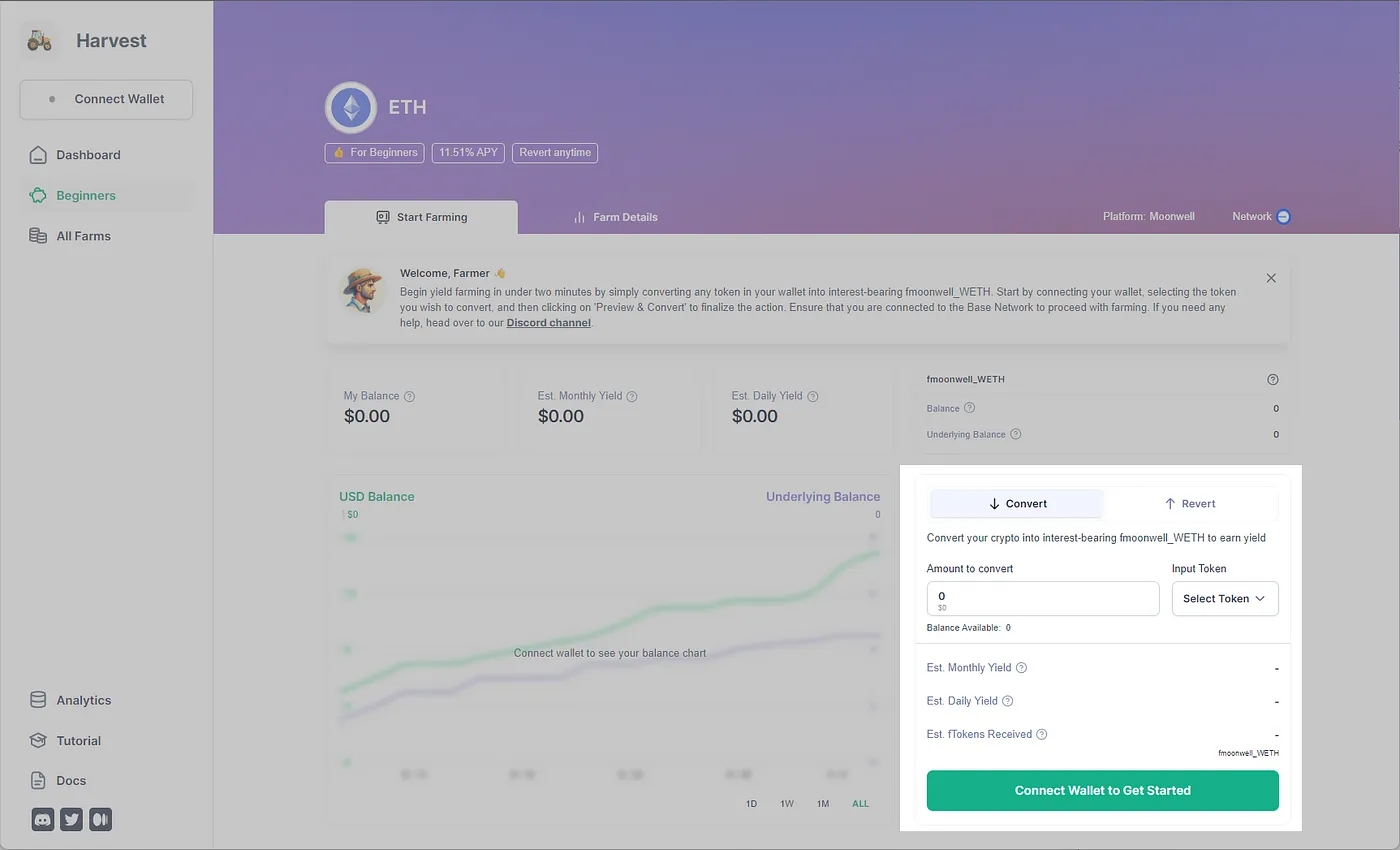

Harvest Finance: Harvest Finance is a yield aggregator that automates the process of finding and optimizing the best farming opportunities across DeFi protocols. Its smart contracts automatically harvest and compound rewards, helping users maximize returns with minimal manual intervention.

-

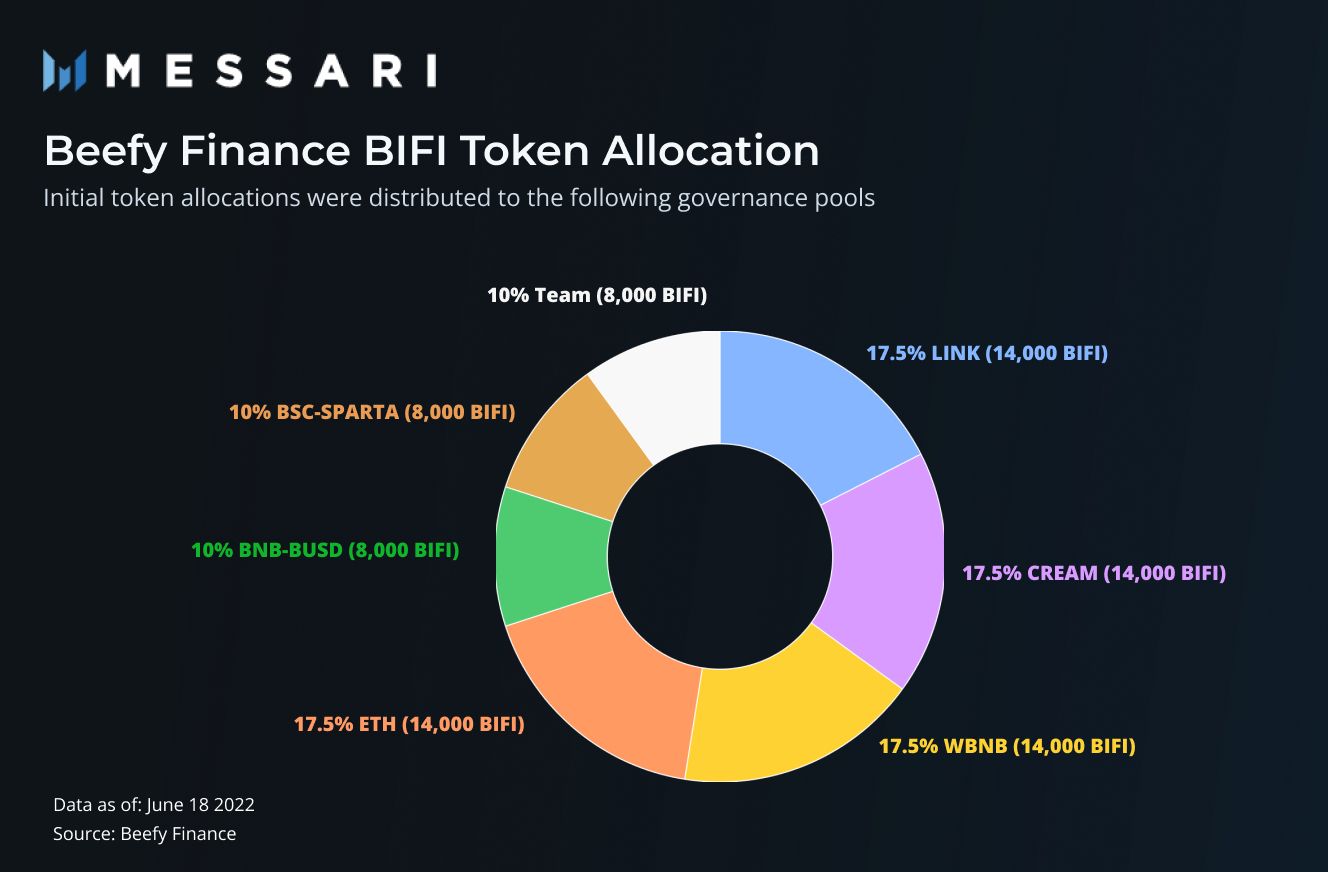

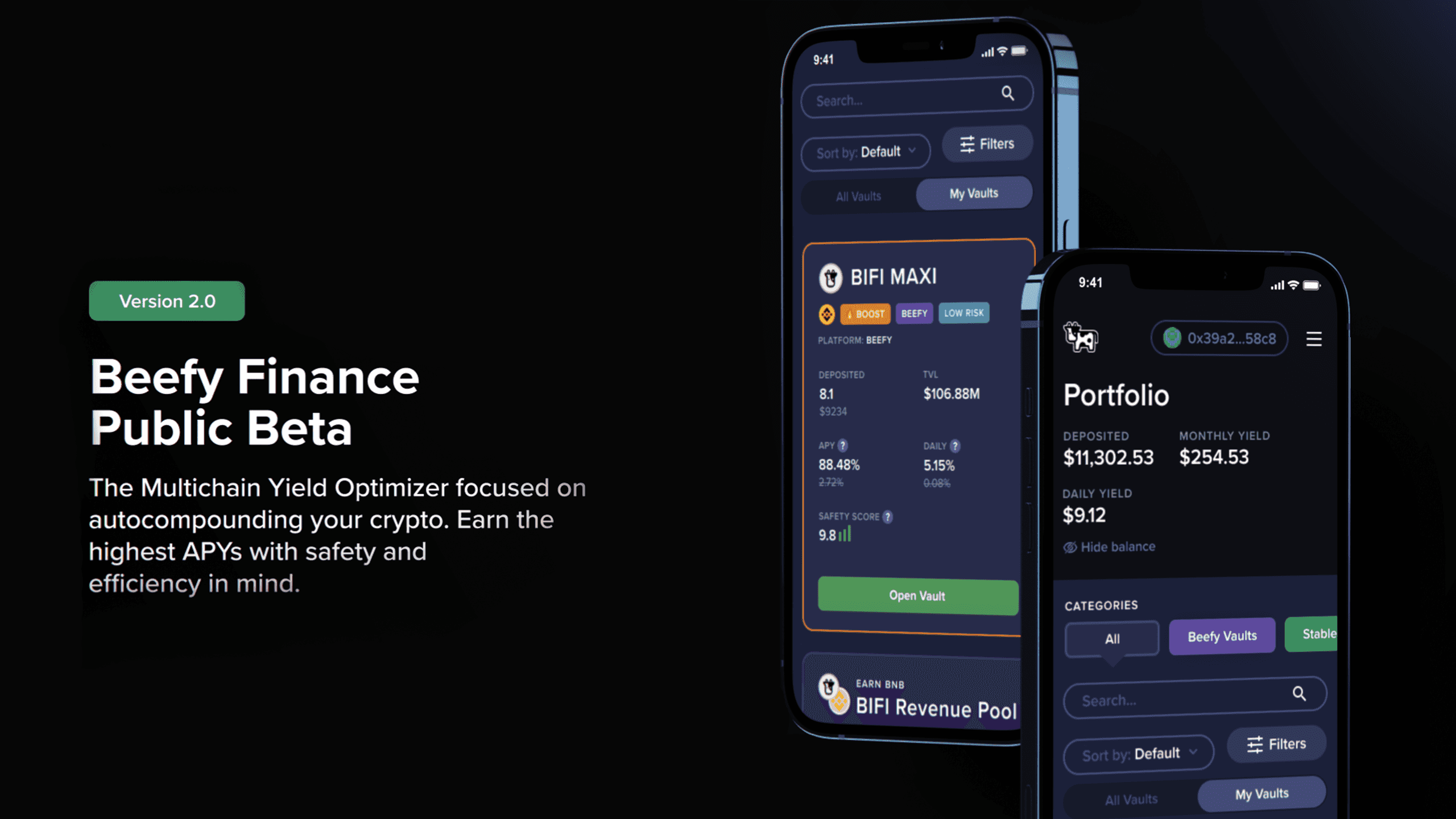

Beefy Finance: Beefy Finance is a multi-chain yield optimizer that offers automated vault strategies for a wide range of DeFi assets. Its vaults use advanced algorithms to compound yields efficiently, and the platform is known for supporting numerous blockchains and providing transparent performance metrics.

-

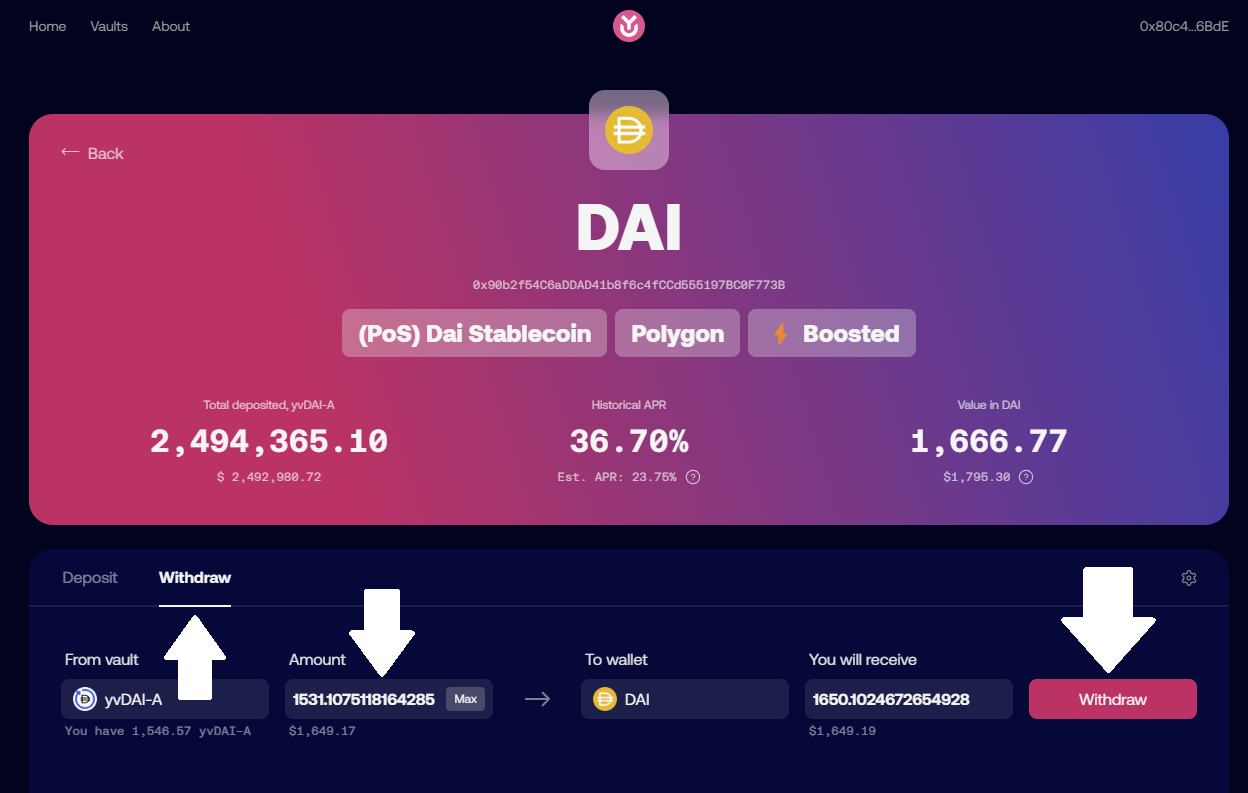

Yearn Finance: Yearn Finance is a pioneer in DeFi automation, offering yVaults that dynamically allocate capital across protocols to optimize yield. Its AI-enhanced strategies automate staking, swapping, and compounding, making it a go-to choice for hands-off yield optimization.

-

Autofarm: Autofarm is a cross-chain yield aggregator that automatically seeks out the highest yielding opportunities for users. It supports a broad selection of DeFi protocols and chains, with a focus on low fees and efficient auto-compounding to maximize net returns.

1. Unibot: High-Volume DEX Trading Automation

Unibot stands out as one of the most active DeFi trading bots by lifetime volume. With over $994.93M processed on decentralized exchanges (DEXs), Unibot automates liquidity provision and yield optimization strategies across major chains. Its user-friendly interface enables both beginners and advanced traders to deploy strategies that automatically rebalance portfolios based on real-time market data.

The bot’s risk management features help mitigate slippage and front-running attacks, key concerns for high-frequency yield farmers in volatile markets.

2. Harvest Finance: Intelligent Yield Aggregation

Harvest Finance automates the process of identifying optimal farming opportunities across multiple protocols. Its AI-driven aggregator scans hundreds of pools to allocate capital where yields are highest while minimizing transaction costs through gas-efficient strategies. Harvest’s vaults automatically compound rewards and rebalance positions as new opportunities arise, making it a favorite among passive investors seeking hands-off growth.

3. Beefy Finance: Multi-Chain Auto-Compounding Vaults

Beefy Finance specializes in auto-compounding vaults that span dozens of blockchains including Ethereum, Binance Smart Chain (BSC), Avalanche, and Polygon. By leveraging smart contract automation, Beefy maximizes returns through frequent compounding while reducing manual intervention risk. Its transparent analytics dashboard provides users with real-time APY tracking and historical performance metrics, crucial for data-driven decision making.

Differentiators: What Sets These Bots Apart?

The best DeFi trading bots for automated yield farming in 2024 share several core strengths:

- AI-Powered Strategy Optimization: Harnessing machine learning to adapt to evolving market conditions.

- Diversification Across Protocols: Spreading risk by allocating assets across multiple chains and pools.

- User-Centric Design: Intuitive dashboards with transparent analytics for informed decision-making.

- Bespoke Risk Controls: Features like stop-losses, slippage protections, and impermanent loss mitigation tools.

This convergence of AI automation with robust risk frameworks is enabling even novice users to participate confidently in complex DeFi ecosystems.

4. Yearn Finance: AI-Enhanced Vault Strategies

Yearn Finance remains a dominant force in automated yield optimization. Its yVaults use AI-enhanced strategies to dynamically allocate user funds across the highest-yielding DeFi protocols. By automating complex operations such as reward harvesting, swapping, and reinvestment, Yearn minimizes manual oversight while maximizing compounded returns. Notably, Yearn’s vaults are continuously updated by a community of strategists and developers, ensuring that capital is always working in the most efficient manner possible. For users prioritizing security and transparency, Yearn’s open-source approach and extensive audits provide peace of mind in a rapidly evolving market.

5. Autofarm: Cross-Chain Yield Aggregation

Autofarm distinguishes itself with seamless cross-chain support and an aggressive focus on gas optimization. By automatically routing funds to the most lucrative pools across blockchains like BSC, Polygon, and Fantom, Autofarm delivers consistently high APYs with minimal transaction costs. Its smart contracts aggregate yields from multiple protocols, compounding rewards efficiently while reducing user exposure to price swings or impermanent loss. The platform’s analytics suite empowers users to monitor real-time performance metrics and compare vault strategies side-by-side.

Key Feature Comparison: Top 5 DeFi Trading Bots (2024)

-

Unibot: Telegram-integrated DeFi trading bot offering fast swaps, MEV protection, and portfolio management directly from chat. Notably, Unibot ranks 7th by lifetime trading volume among all DEX trading bots, with over $994.93M in volume. Features include wallet tracking, copy trading, and automated sniping for new token launches.

-

Harvest Finance: Automated yield aggregator that optimizes returns by finding and reallocating user funds to the highest-yielding DeFi strategies. Harvest simplifies yield farming through vaults, auto-compounding, and gas fee optimization, supporting a wide range of assets and protocols.

-

Beefy Finance: Multi-chain yield optimizer supporting dozens of blockchains. Beefy offers automated vaults that maximize yield via compounding and strategic asset allocation. It is recognized for its transparent performance stats, security audits, and community-driven governance.

-

Yearn Finance: AI-enhanced vault strategies that dynamically allocate capital across DeFi protocols. Yearn automates swapping, staking, and compounding to maximize risk-adjusted returns, with a strong focus on security and hands-off portfolio management.

-

Autofarm: Cross-chain yield aggregator providing automated compounding and fee optimization. Autofarm supports multiple blockchains and DeFi protocols, offering users a streamlined interface to maximize APY and minimize manual intervention.

Best Practices for Using DeFi Trading Bots in 2024

While automated yield farming offers compelling advantages, prudent investors should follow best practices to safeguard capital:

- Diversify Across Bots: Spread assets among several platforms such as Unibot or Beefy Finance to mitigate protocol-specific risks.

- Monitor Smart Contract Audits: Prioritize bots with regular third-party audits, Yearn Finance and Harvest Finance lead here.

- Stay Informed on Platform Upgrades: Join community channels for real-time updates on strategy shifts or vault migrations.

- Assess Fee Structures: Compare performance fees and gas optimizations, Autofarm excels at minimizing costs through aggregation.

The landscape is dynamic; proactive research remains crucial as new AI trading agents emerge and existing ones evolve their models.

How These Bots Shape the Future of Crypto Portfolio Management

The integration of AI-driven automation into DeFi isn’t just about convenience, it’s fundamentally changing how portfolios are managed at scale. Platforms like Unibot have already processed over $994.93M, demonstrating institutional-grade throughput for retail users (see full stats here). Automated rebalancing, real-time risk controls, and adaptive yield strategies mean even passive investors can outperform traditional manual approaches.

This shift is also lowering barriers for entry into complex protocols like Yearn or Harvest by abstracting away technical hurdles. As bots like Beefy Finance expand multi-chain support and Autofarm refines cross-protocol routing algorithms, expect even greater efficiency gains in the coming year.

Final Thoughts: Navigating the Next Wave of DeFi Automation

The top five DeFi trading bots, Unibot, Harvest Finance, Beefy Finance, Yearn Finance, and Autofarm, represent the cutting edge of automated yield farming in 2024. Each blends robust security with advanced AI optimization to empower both new entrants and seasoned traders alike. For those seeking a data-driven edge in crypto portfolio management this year, adopting these tools can unlock new levels of efficiency and returns, with risk controls built into every layer.

Dive deeper into strategy guides or compare detailed stats by visiting our resource hub on AI-powered DeFi trading bots for automated yield farming.