In the high-stakes arena of cryptocurrency trading, where fortunes shift in seconds, human-trained AI bots have become a siren song for retail traders. Marketed as tireless sentinels guarding portfolios, these tools often crumble under real-world pressures, delivering losses instead of the promised alpha. Their failures stem from fundamental flaws in design and training, exposing traders to risks that no backtest could foresee. As someone who’s navigated multi-asset volatility for nearly two decades, I’ve seen enough bot wreckage to know: steady hands require more than pattern-matching algorithms.

Why Human-Trained AI Bots Fail

-

Overfitting to Historical Data: Bots trained on past market data perform well in backtests but fail in live trading due to inability to generalize to new patterns. Source

-

Inability to Handle Volatility: Sudden market shifts and black swan events overwhelm bots, as they cannot adapt to rapid, unforeseen changes. Source

-

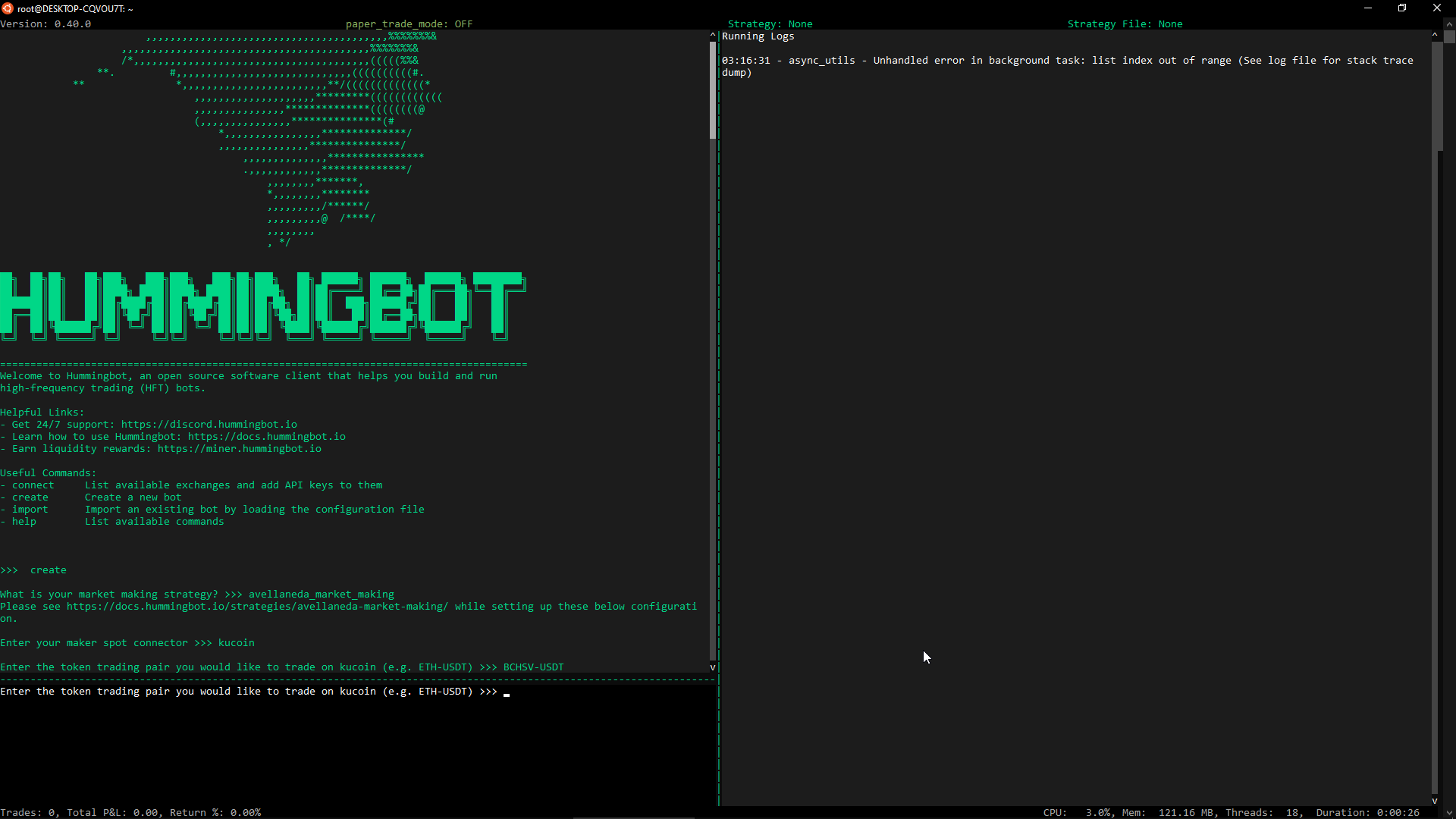

Technical Glitches & Failures: Bugs, coding errors, and poor programming cause incorrect trades and substantial losses. Source

-

Lack of Real-Time Adaptability: Bots fail to adjust strategies amid live market changes or unexpected events. Source

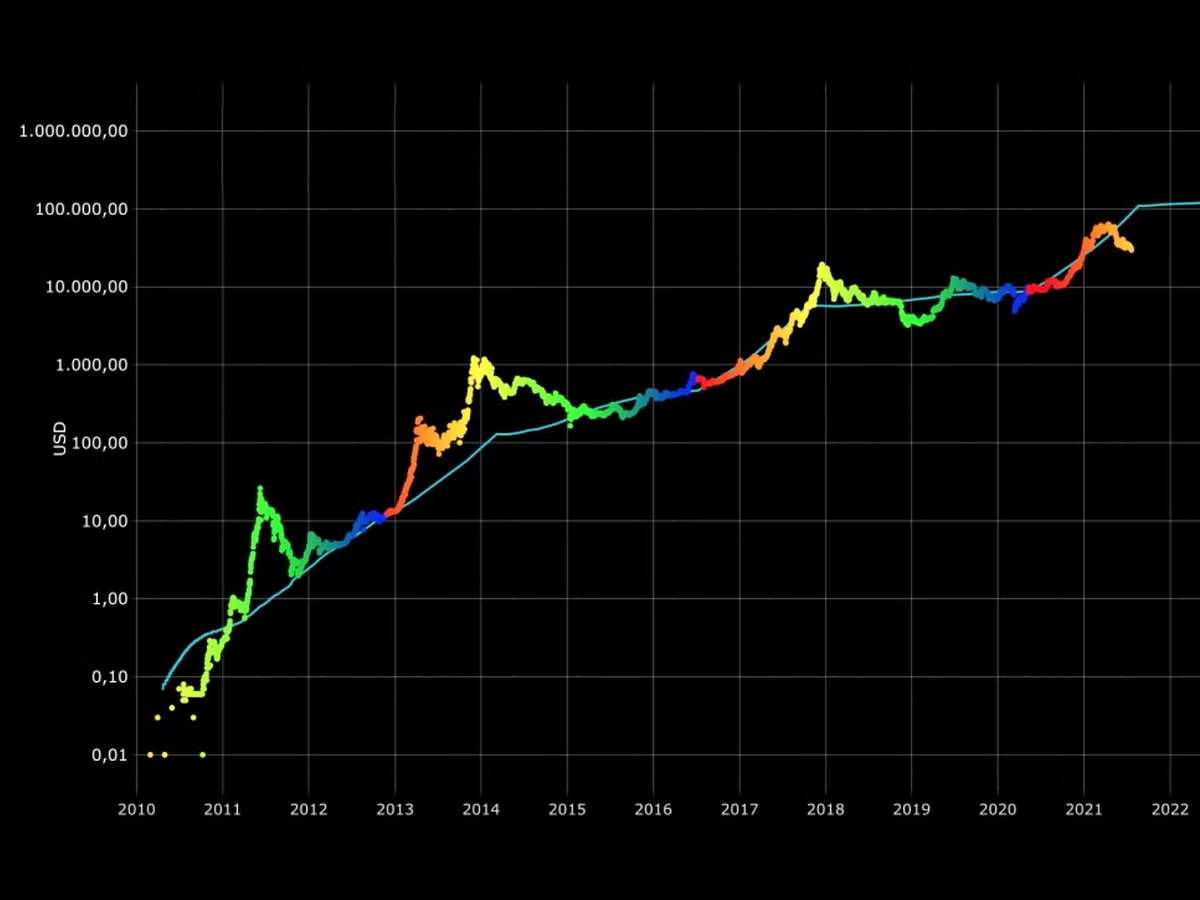

Consider the core issue plaguing these systems: an overdependence on historical datasets. Developers fine-tune models on past price action, volume spikes, and sentiment signals, crafting bots that shine in simulations. But live markets don’t replay history verbatim. Overfitting locks these bots into rigid patterns, blind to novel catalysts like regulatory shocks or flash crashes. Research underscores this; bots excelling in backtests falter when regimes shift, as unseen variances erode edges built on yesterday’s noise.

The Trap of Static Strategies in Dynamic Markets

Human-trained bots operate on predefined rules, akin to a chess engine stuck in opening theory amid midgame chaos. They scan indicators like RSI or moving averages, execute when thresholds hit, and pray for continuity. Yet crypto’s 24/7 trading alpha demands constant vigilance. Sudden liquidity droughts cause slippage, amplifying losses on illiquid altcoins. Market impact from large orders further distorts executions, a blind spot for models ignoring order book depth.

Unlike traditional bots that follow static, rule-based scripts, AI agents can adapt, analyzing on-chain and off-chain signals to refine their strategies.

Technical frailties compound the mess. Coding errors trigger rogue trades; API downtimes halt operations mid-volley. Without self-correction, a single bug cascades into portfolio evisceration. I’ve reviewed post-mortems where bots doubled down on losing positions due to misfired stop-losses, turning minor dips into routs.

Volatility’s Brutal Test for Rigid Algorithms

Crypto markets thrive on unpredictability, from whale manipulations to geopolitical tremors. Human-trained bots, tethered to training epochs, buckle here. Black swan events like exchange hacks or macro pivots expose their lack of adaptability. They can’t pivot from momentum chasing to mean reversion without retraining, a luxury absent in real time. Fraudsters exploit this hype too, peddling overoptimized scams that vaporize capital once promotions fade.

Overfitting isn’t mere jargon; it’s a statistical pitfall where models memorize noise as signal. Forbes highlights how this specialization to historical quirks leads to brittle performance. DL News echoes the critique: AI falters when conditions evolve, churning false predictions amid manipulation schemes.

Agentic DeFi Agents: Forging True Autonomy

Contrast this with agentic DeFi trading agents, the next evolution in autonomous DeFi bots 2025 demands. These aren’t puppets of past data; they’re proactive entities navigating decentralized ecosystems with intent. Operating on-chain, they interface directly with protocols, swapping, lending, and yielding without centralized intermediaries. Their edge? Continuous learning loops that ingest live feeds: on-chain metrics like TVL shifts, oracle prices, and sentiment from social vectors.

Agentic designs empower multi-step reasoning. Faced with volatility, they don’t freeze; they query, simulate, and act. Picture an agent detecting MEV opportunities, arbitraging across DEXs, or rebalancing yields preemptively. This human-trained AI bots vs agentic mismatch reveals why the latter deliver consistent alpha: they’re built for the now, not the then. Ulam Labs notes their prowess in complex DeFi maneuvers, from portfolio tweaks to fraud detection, all sans human input.

These agents thrive on agentic DeFi trading agents architectures, chaining observations, thoughts, and actions in loops that mimic seasoned trader intuition. They pull from diverse sources: blockchain explorers for liquidity pools, sentiment analyzers scraping X and Discord, even oracle feeds for cross-chain prices. When a protocol upgrade ripples through yields, the agent doesn’t wait for a human prompt; it stress-tests scenarios, hedges exposures, and executes before the herd reacts.

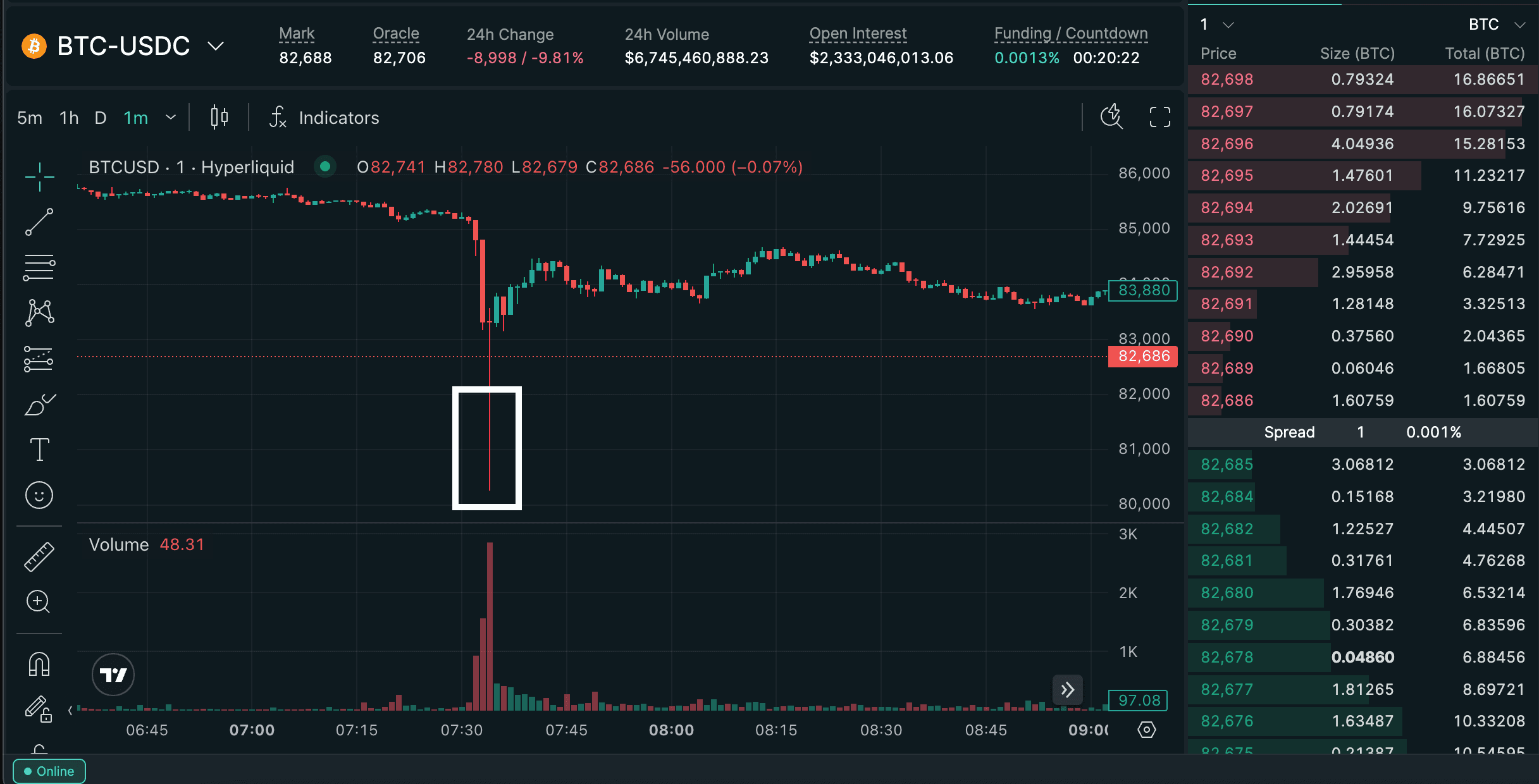

Bitcoin Technical Analysis Chart

Analysis by Miles Whitman | Symbol: BINANCE:BTCUSDT | Interval: 1W | Drawings: 7

Technical Analysis Summary

To annotate this BTCUSDT chart in my conservative style, start with a primary uptrend line from the early 2025 low connecting to the mid-year swing high, using ‘trend_line’ for clarity. Add horizontal lines at key support (90,000) and resistance (100,000) levels. Mark the recent consolidation range with a ‘rectangle’ from late October to now. Use ‘fib_retracement’ from the July peak to current low for pullback levels. Place ‘text’ labels for S/R descriptions, ‘callout’ for volume spikes, and ‘arrow_mark_up’ for MACD bullish crossover. Vertical line at 2025-12-01 for current context. Keep it minimalistic—steady hands avoid clutter.

Risk Assessment: medium

Analysis: BTC’s uptrend intact but short-term volatility from 95k pullback warrants caution; AI bot failures highlight need for disciplined, non-automated entries

Miles Whitman’s Recommendation: Hold core position, add conservatively at support with tight stops—steady hands prevail

Key Support & Resistance Levels

📈 Support Levels:

-

$90,000 – Strong psychological and prior swing low support, aligns with 0.618 fib retracement

strong -

$92,000 – Intermediate support from late Oct consolidation base

moderate

📉 Resistance Levels:

-

$100,000 – Key round number resistance, recent rejection zone

strong -

$105,000 – Minor resistance from early Nov highs

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$92,000 – Dip buy at moderate support with volume confirmation, low-risk for conservative allocation

low risk -

$90,000 – Strong support entry if breached higher, but only with bullish reversal candle

medium risk

🚪 Exit Zones:

-

$105,000 – Initial profit target at minor resistance

💰 profit target -

$105,000 – Trailing stop above recent swing high

🛡️ stop loss -

$88,000 – Hard stop below strong support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on pullback lows, suggesting accumulation

Volume profile shows higher lows during correction, supportive of uptrend resumption

📈 MACD Analysis:

Signal: Bullish divergence

MACD line rising above signal with histogram expansion, classic low-risk buy signal

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Miles Whitman is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

This autonomy extends to risk management. Agents monitor for anomalies like unusual whale transfers or smart contract vulnerabilities, pausing trades or shifting to stables preemptively. Quytech underscores their role in fraud detection, scanning for pump-and-dump signatures invisible to threshold-based bots.

24/7 Alpha in Action: Multi-Chain Mastery

Delivering 24/7 crypto trading alpha means conquering time zones and chain silos. Agentic DeFi agents orchestrate across Ethereum, Solana, and beyond, arbitraging yield gaps or liquidity premiums instantaneously. Imagine an agent spotting a 2% arb between Uniswap and Raydium; it swaps, bridges, and unwraps in seconds, netting fees while humans sleep. LinkedIn’s Ben Bilski predicts this obsoletes signal groups, as agents rebalance autonomously, factoring gas fees, slippage, and impermanent loss in holistic strategies.

Key Differences Between Human-Trained AI Crypto Trading Bots and Agentic DeFi Agents

| Feature | Human-Trained Bots | Agentic Agents |

|---|---|---|

| Adaptability | Low: Struggle with market volatility, black swan events, and real-time changes | High: Adapt to real-time conditions via on-chain/off-chain signals and continuous learning |

| Overfitting Risk | High: Overly reliant on historical data, fails in live markets | Low: Avoids overfitting through ongoing adaptation and new data integration |

| Execution Speed | Moderate: Prone to slippage, liquidity issues, and technical failures | Ultra-fast: 24/7 autonomous execution of complex trades without delays |

| Alpha Generation | Inconsistent: Performs well in backtests but fails to deliver reliable returns | Consistent: Generates 24/7 alpha via adaptive DeFi strategies and autonomous decision-making |

Yet autonomy invites scrutiny. Wikipedia flags agentic AI’s pitfalls: liability gray zones if rogue actions tank funds, cyber vulnerabilities from exposed keys, and ethical quandaries over opaque decisions. CCN warns of manipulation susceptibility, where adversarial inputs fool even adaptive models. My counsel? Deploy with guardrails – multi-sig approvals for high-value moves, audited codebases, and diversified agent fleets. No system is infallible, but agentic designs minimize human error’s deadliest foe.

For traders eyeing the upgrade, start small. Test agents on low-stakes pools, monitor logs, and scale as conviction builds. Platforms are maturing; agentic DeFi protocols now simplify deployment, blending no-code interfaces with pro-grade tooling. Pair them with DEX integrations for seamless execution, as detailed in guides on AI bot-DEX fusion.

The migration from brittle bots to resilient agents marks DeFi’s maturation. In volatile arenas, true alpha favors the adaptive, not the scripted. As markets fractalize further, those wielding autonomous DeFi bots 2025 will navigate the storm, compounding edges while others chase ghosts of past cycles. Steady hands, now augmented, indeed win.