Just a year ago, DeFi yield farming demanded constant attention, spreadsheets, and nerves of steel. In 2024, the game has changed: autonomous trading agents are quietly reshaping how both retail and pro traders hunt for yield. These AI-powered bots don’t sleep, don’t get emotional, and don’t miss a rebalancing window. Instead, they’re scanning dozens of protocols in real time, shifting funds across chains, and squeezing every last bit of APY from an increasingly competitive market.

The Shift from Manual to Machine-Driven Yield Farming

Before the rise of AI crypto trading solutions, yield farming was a hands-on hustle. You’d manually bridge assets to new chains, monitor Telegram for protocol updates, and hope you weren’t too late to catch the next double-digit APY opportunity. This approach was not just time-consuming but also prone to human error, missed opportunities, failed transactions, and exposure to sudden impermanent loss.

Enter the era of DeFi yield farming bots. Modern autonomous agents like those powering Arma Agents have demonstrated explosive growth, Total Value Locked (TVL) soared from $200,000 to $11,200,000 in just seven months. These bots automate the entire workflow: from real-time yield scouting and portfolio rebalancing to sophisticated risk management.

“AI agents are no longer a futuristic concept, they’re the backbone of DeFi’s new yield optimization meta. ”

How Autonomous Agents Actually Work in DeFi

So, what’s happening under the hood? Today’s AI DeFi automation leverages on-chain data, predictive analytics, and smart contract integrations to make split-second decisions. Here’s what sets them apart:

Key Features of Top Autonomous DeFi Trading Agents in 2024

-

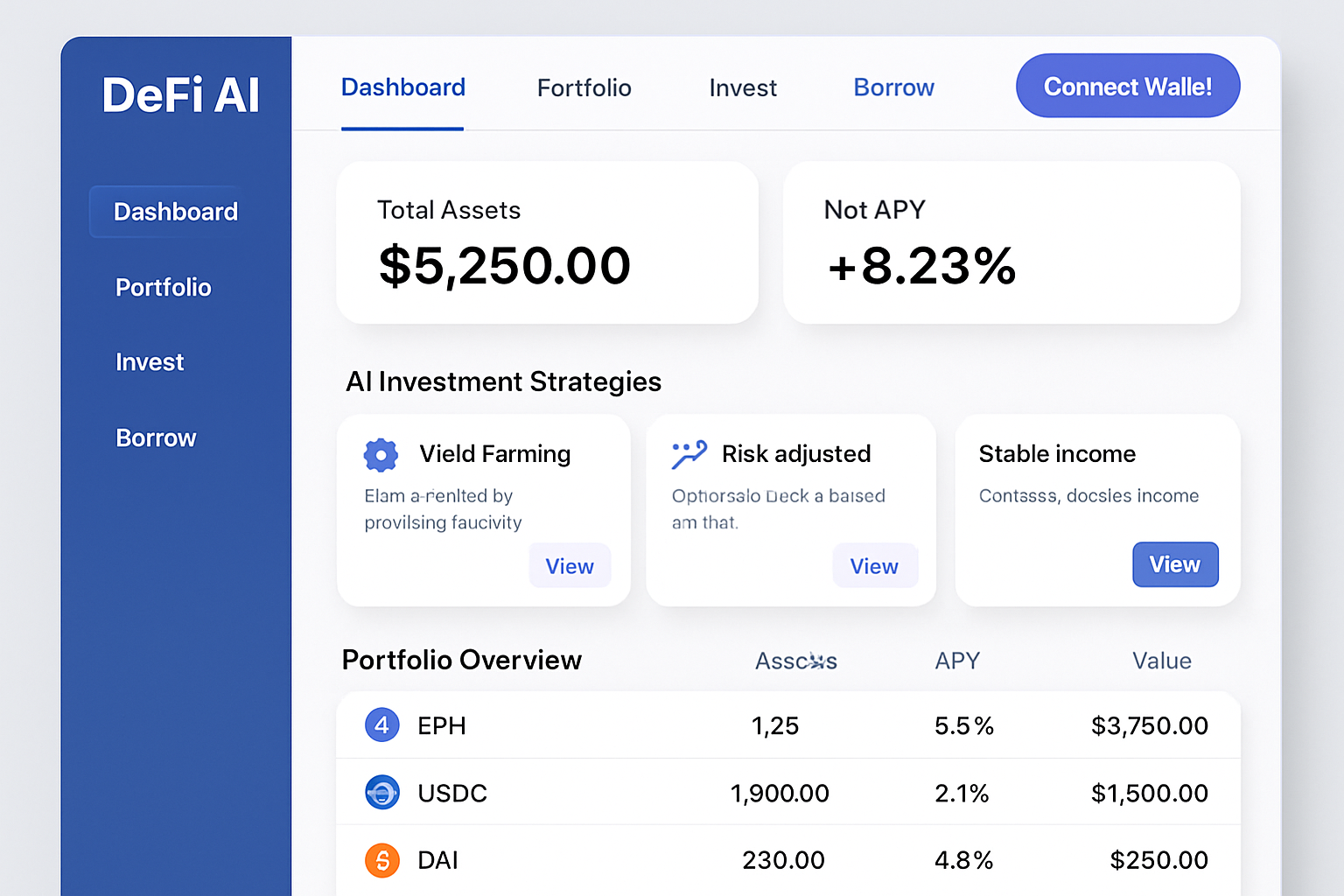

Real-Time Yield Scouting: Leading agents continuously scan dozens of DeFi protocols to identify and capitalize on the most profitable yield farming opportunities, ensuring users access the best returns available at any moment.

-

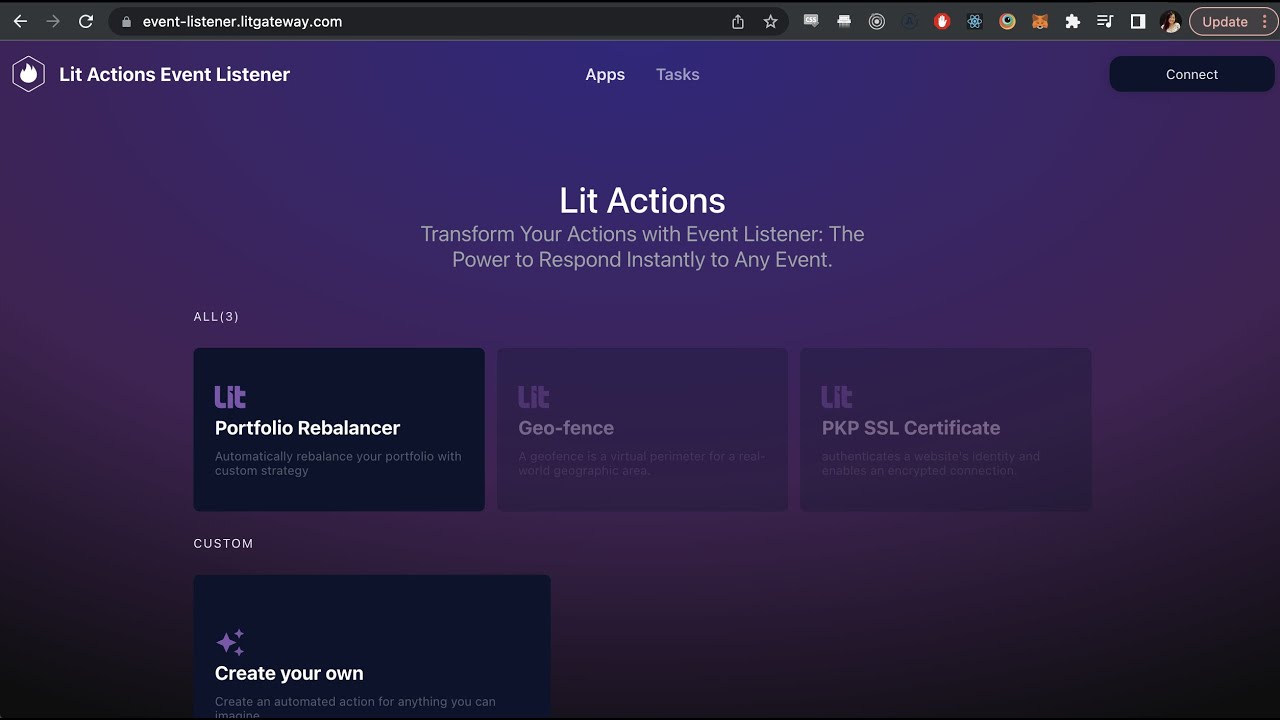

Automated Portfolio Rebalancing: Top trading agents dynamically adjust asset allocations across various pools and platforms, maintaining optimal performance and maximizing yield with minimal manual intervention.

-

Advanced Risk Management: These agents assess market conditions, protocol stability, and smart contract risks in real time, helping users avoid vulnerabilities and minimize potential losses.

-

Auto-Compounding Strategies: Platforms like Beefy Finance offer vaults that automatically reinvest earned rewards, boosting yields through compounding without requiring user action.

-

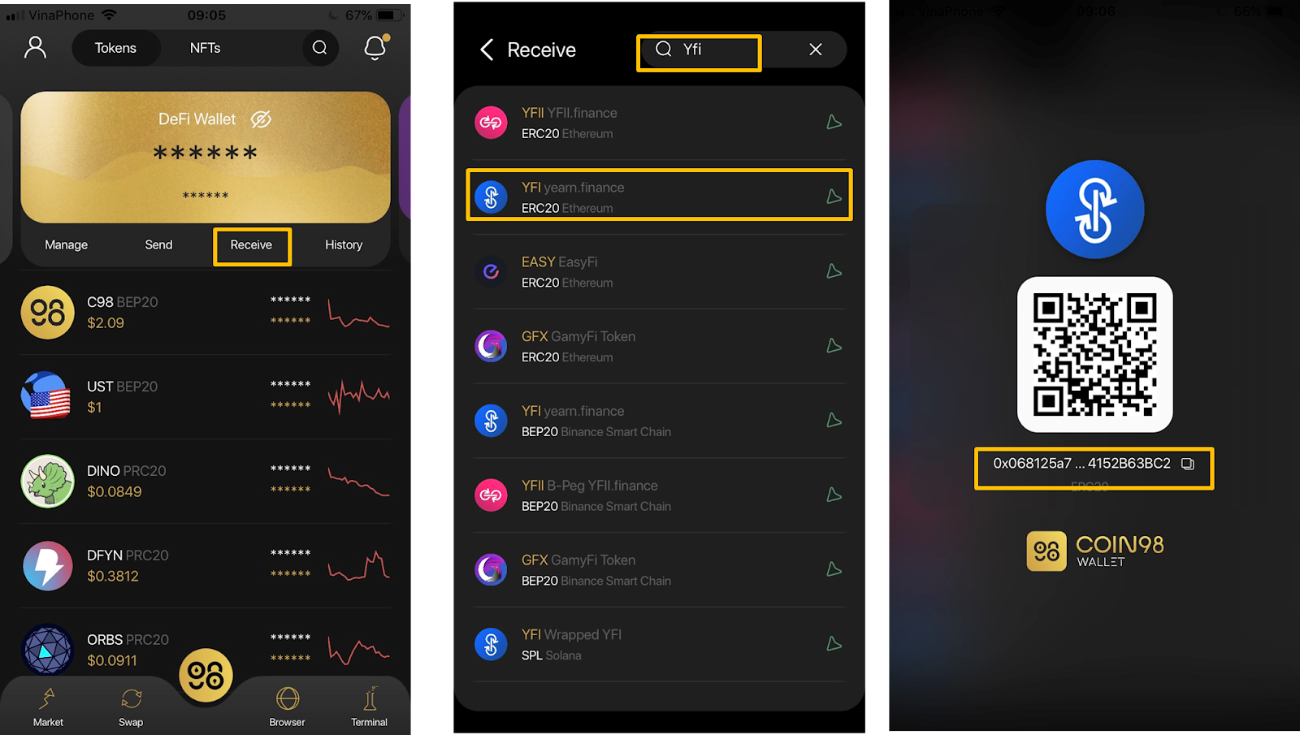

Seamless Cross-Chain Operations: Many leading agents operate across multiple blockchains, allowing users to access yield opportunities on Ethereum, Binance Smart Chain, and more, all from a single interface.

-

User-Friendly Automation Tools: Platforms such as Fetch.ai provide intuitive strategy builders and backtesting features, empowering users to deploy sophisticated trading strategies with ease.

-

Continuous Monitoring & Adaptive Strategies: Autonomous agents work 24/7, adjusting strategies in response to changing market conditions, protocol updates, and new yield opportunities.

-

Integration with Leading Aggregators: Established platforms like Yearn Finance aggregate and automate yield farming strategies, simplifying the process for users and enhancing overall returns.

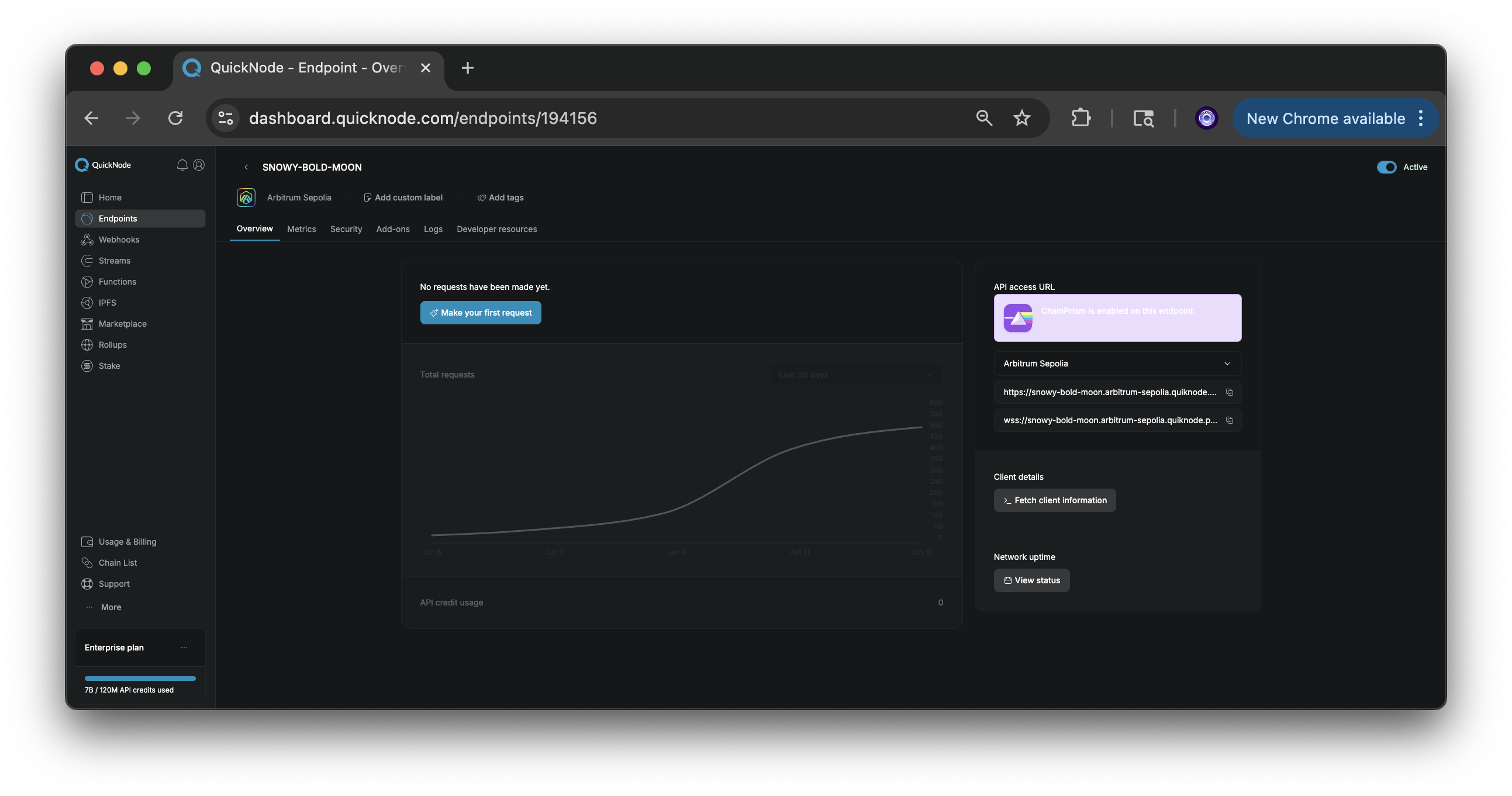

– Real-Time Yield Scouting: Bots scan dozens of protocols, think Yearn Finance, Beefy Finance, and Fetch. ai, identifying pools with the juiciest returns. – Automated Portfolio Rebalancing: Agents dynamically shift allocations to maintain optimal risk-reward ratios as market conditions change. – Continuous Risk Assessment: AI models monitor protocol health and market volatility to avoid rug pulls or exploit risks. – Cross-Chain Execution: The best bots seamlessly move capital between Ethereum, Arbitrum, Solana, and more, capturing fleeting opportunities others miss.

This level of automation is opening doors for those previously sidelined by technical barriers. Even users with minimal DeFi experience can now participate in complex strategies with just a few clicks. For a deeper dive into how these workflows operate in practice, check out our guide on how AI agents automate DeFi yield farming.

Platforms Leading the AI Yield Farming Revolution

The past year has seen a surge in platforms racing to integrate AI-driven automation. Let’s spotlight a few standouts:

- Yearn Finance: The OG yield aggregator, now enhanced with smarter auto-compounding and risk analytics.

- Beefy Finance: Multi-chain vaults that reinvest earnings automatically, compounding returns without user intervention.

- Fetch. ai: Bringing advanced AI modeling to strategy building and backtesting for DeFi portfolios.

What unites these platforms is their relentless focus on efficiency. Automated systems execute trades faster than any human could, while their user-friendly dashboards lower the learning curve for newcomers. For those curious about which bots are outperforming in 2024, see our curated list of the best AI-powered trading bots for automated DeFi yield farming.

The Broader Impact: Efficiency, Accessibility, and Smarter Risk Management

It’s not just about squeezing out higher yields, the rise of autonomous trading agents is fundamentally changing who can participate in DeFi and how capital flows through the ecosystem. With bots handling everything from opportunity discovery to risk mitigation, users are freed from the grind of manual management. This democratization is drawing in new capital and making DeFi more robust against market shocks.

But it’s not all plug-and-play perfection, understanding the nuances of each bot’s strategy and underlying protocol risk is still key to long-term success. As AI agents continue to evolve, expect even more sophisticated tools that blend on-chain analytics with off-chain sentiment data, making yield farming more dynamic than ever.

One of the most exciting shifts in 2024 is the rise of agentic DeFi: where autonomous trading agents not only execute trades, but also learn, adapt, and optimize strategies in real time. This new breed of bots is already reshaping how users approach yield farming, from small-scale farmers to institutional capital allocators.

Real-World Results: Yield Optimization at Scale

Let’s talk outcomes. The numbers speak for themselves: Arma Agents’ TVL explosion from $200,000 to $11,200,000 is just the tip of the iceberg. Across the ecosystem, platforms embracing AI-driven automation are reporting faster reaction times to yield fluctuations and fewer missed opportunities. For example, Yearn Finance’s updated vaults now auto-rotate assets between pools as soon as APYs shift, while Beefy Finance’s multi-chain vaults reinvest earnings with near-zero delay.

These improvements aren’t just about maximizing returns, they’re also about managing risk in increasingly complex DeFi environments. Bots can instantly exit unstable protocols or rebalance away from pools showing early signs of impermanent loss. This kind of agility is nearly impossible to achieve manually, especially as the number of protocols and chains multiplies.

What’s Next for DeFi Yield Farming Bots?

The next wave of AI crypto trading solutions promises even deeper integration with both on-chain and off-chain data. Imagine bots that not only track APYs and TVL but also monitor social sentiment, governance proposals, and even developer activity to anticipate protocol upgrades or risks before they’re reflected in the price.

We’re already seeing early versions of this in platforms like Fetch. ai, where strategy builders can backtest against historical data and tweak parameters based on live market conditions. As the infrastructure matures, expect more customizable bots, where users can fine-tune risk tolerance or plug in their own data feeds with minimal code.

For those eager to get started or level up their automation game, our step-by-step guide on how to automate DeFi yield farming with AI trading agents covers everything from wallet setup to strategy selection.

Top Benefits of Autonomous Trading Agents in DeFi Yield Farming

-

Real-Time Yield Scouting: Autonomous trading agents continuously scan dozens of DeFi protocols to identify and seize the most lucrative yield farming opportunities, maximizing returns without manual intervention.

-

Automated Portfolio Rebalancing: These agents dynamically adjust asset allocations across platforms like Yearn Finance and Beefy Finance, ensuring optimal performance and compounding yields efficiently.

-

Advanced Risk Management: By analyzing market conditions and protocol stability in real time, AI agents help mitigate risks from volatility and smart contract vulnerabilities, offering safer yield farming experiences.

-

Increased Efficiency and Speed: Automated systems execute trades and manage assets far faster and more accurately than manual processes, reducing missed opportunities and human error.

-

Enhanced Accessibility for All Users: Platforms like Fetch.ai and Beefy Finance provide user-friendly interfaces, enabling even non-technical users to participate in sophisticated yield farming strategies.

Risks and Considerations: Staying Smart in an Automated Era

Of course, automation isn’t a silver bullet. While bots reduce manual errors and can respond faster than humans, they’re still only as good as their code and data sources. Bugs, smart contract exploits, or black swan events can still impact even the most advanced AI agents. It’s crucial to stay informed about the protocols your bots interact with and to use platforms that prioritize transparency and security audits.

Another emerging consideration is the potential for bot-driven strategies to crowd into the same pools, compressing yields or triggering new types of on-chain competition. Staying ahead may mean diversifying across several AI agents or experimenting with niche strategies less likely to be saturated.

Ultimately, the rise of autonomous trading agents marks a new era for DeFi, one where efficiency, accessibility, and smart risk management are within reach for everyone. Whether you’re a hands-off investor or a strategy tinkerer, the tools are here to help you farm smarter in 2024 and beyond.