In 2025, agentic DeFi AI agents are no longer a fringe experiment but the driving force behind the next evolution of cross-chain yield farming. These intelligent bots are transforming how liquidity moves across blockchains, optimizing yields in real time, and making decentralized finance (DeFi) accessible to everyone from algorithmic traders to casual crypto holders. The era of manual rebalancing and spreadsheet-driven strategies is fading fast as AI trading agents automate every step – from opportunity scouting to risk management – across an increasingly fragmented blockchain landscape.

From Siloed Chains to Interconnected Yield Networks

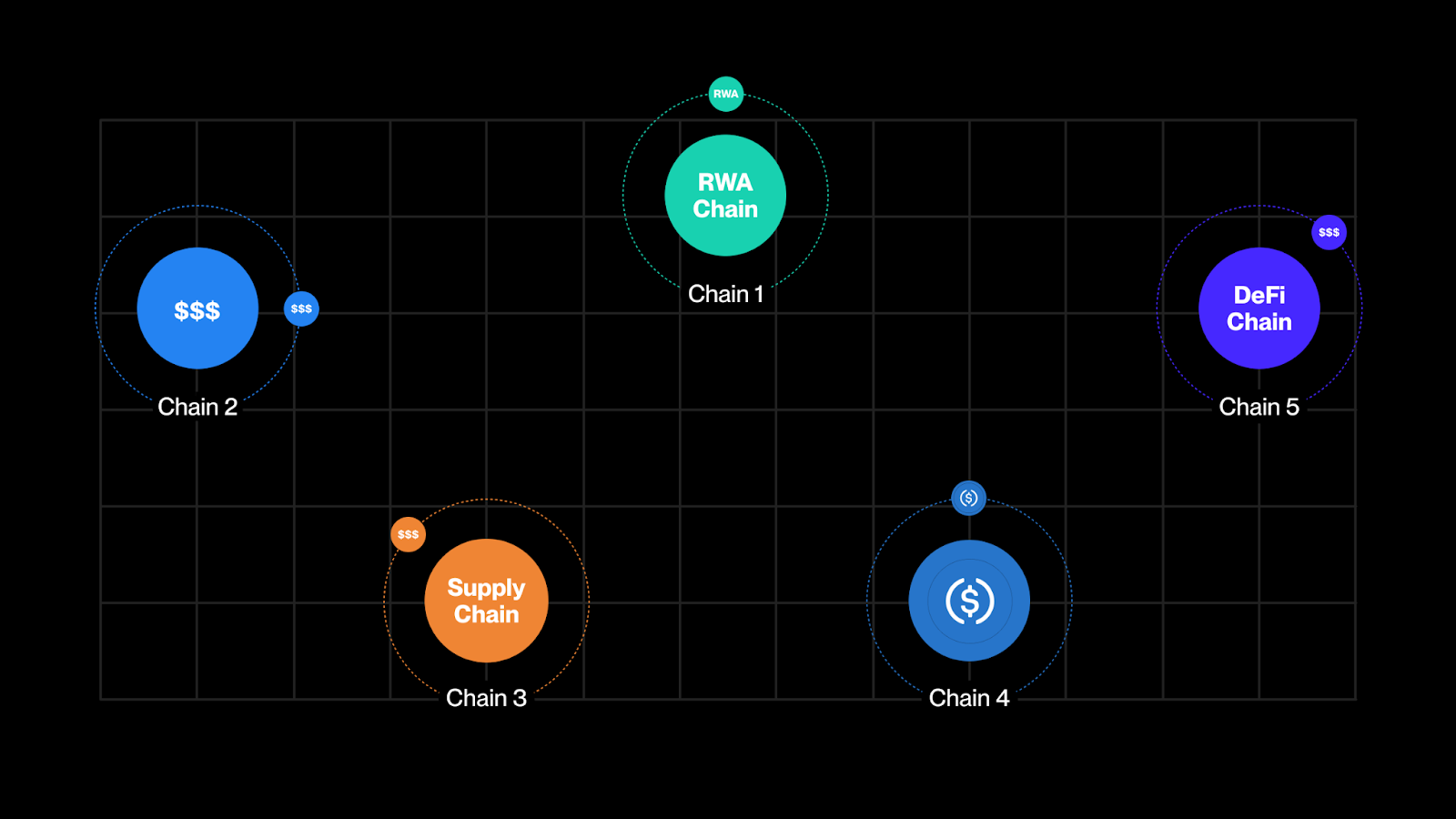

Historically, yield farming was constrained by chain-specific strategies. If you wanted to chase high APYs on Solana or optimize stablecoin returns on Ethereum, you had to bridge assets manually, often incurring high fees and facing substantial risks. In 2025, cross-chain interoperability is being reimagined by agentic DeFi bots that use protocols like LayerZero, Axelar, and Wormhole to seamlessly move liquidity between networks. These agents analyze not just APY differentials but also gas costs, bridge fees, and even impermanent loss risks before executing a move.

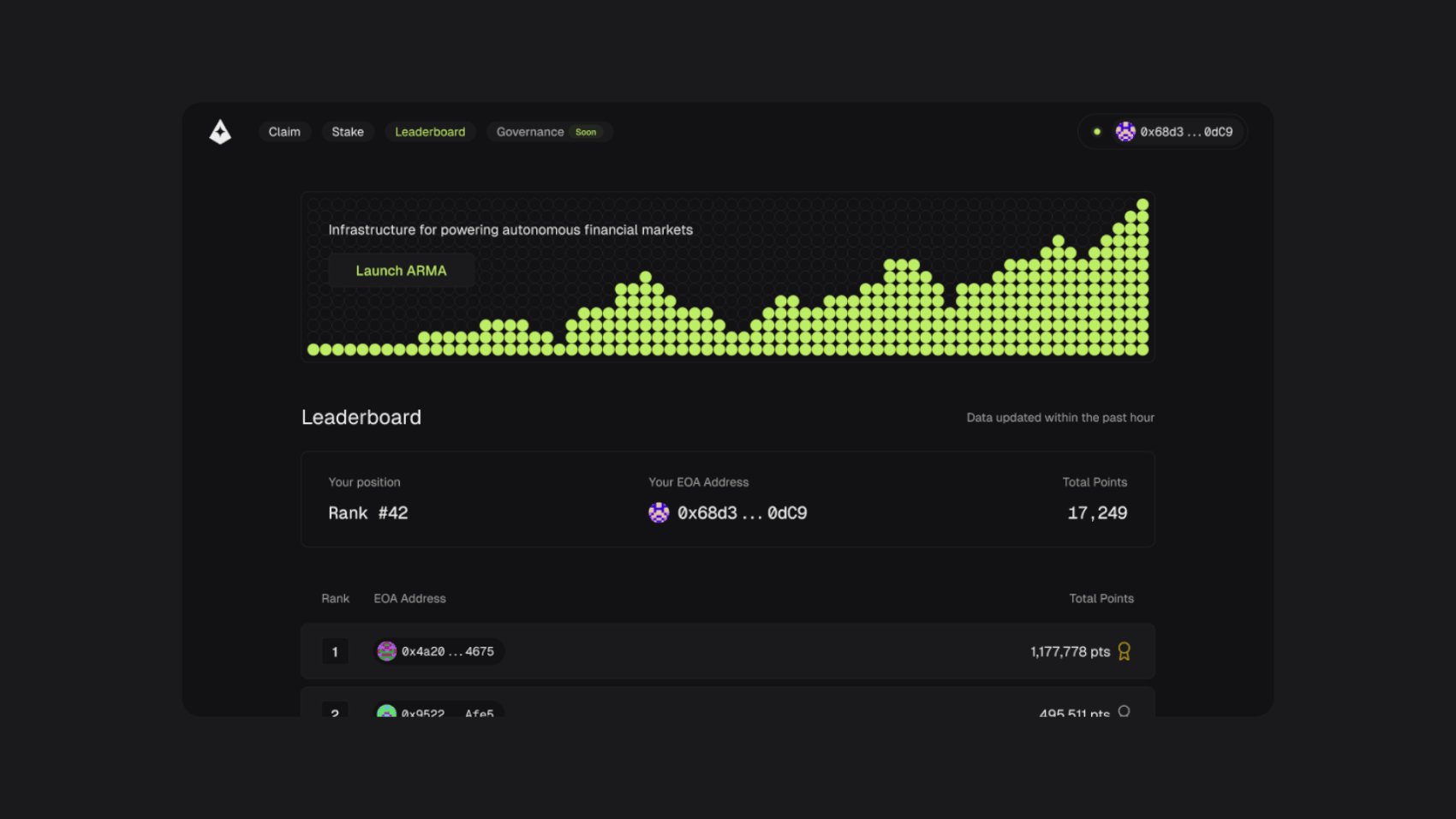

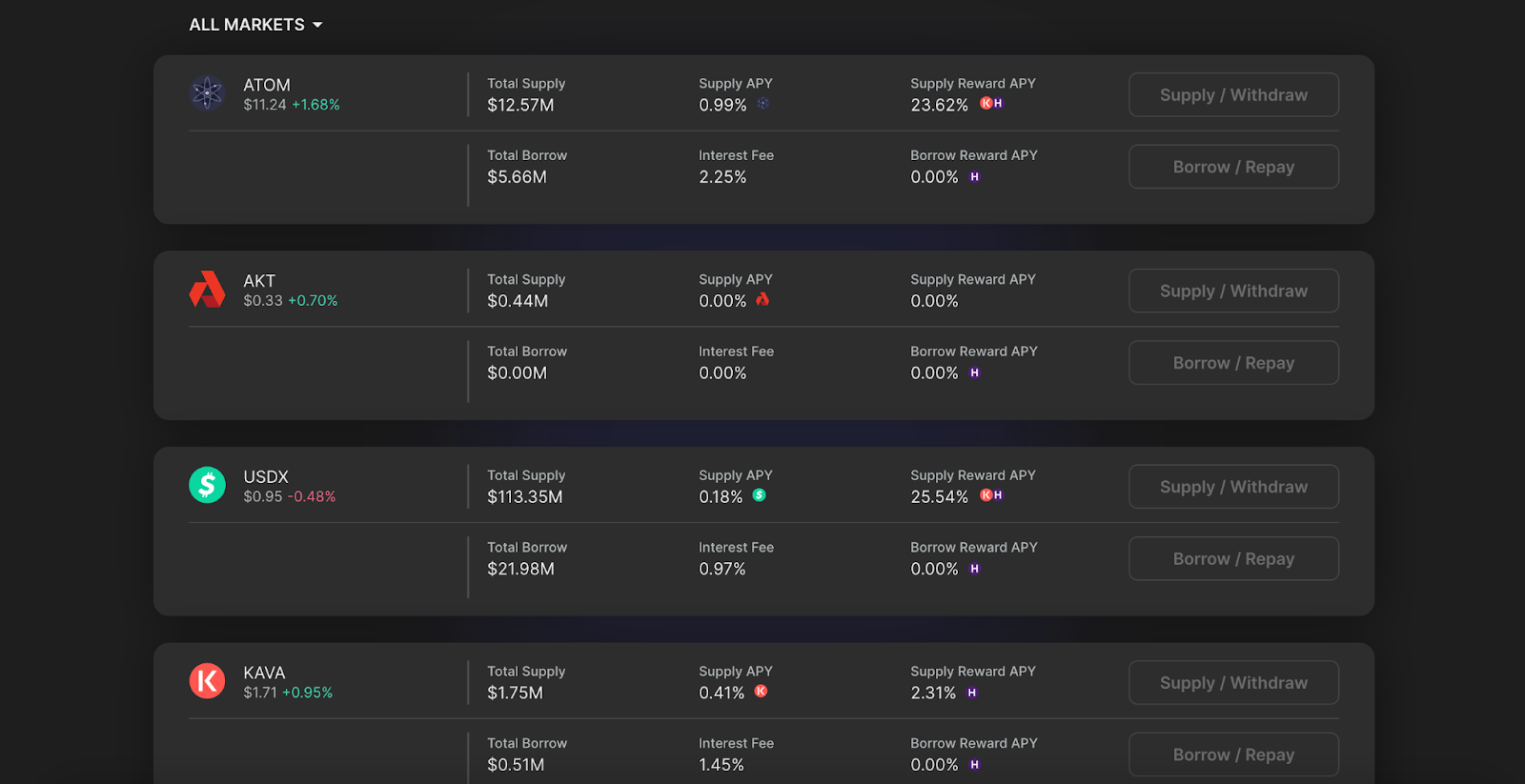

Giza ARMA, for example, has become a staple for stablecoin farmers seeking optimized returns across Aave, Morpho, Compound, and Moonwell. Its autonomous rebalancing engine assesses dozens of variables before shifting capital – all without human intervention. Similarly, Fungi. ag specializes in USDC yield maximization by dynamically reallocating funds based on real-time rates and platform risks.

The Intelligence Layer: Real-Time Decision Making

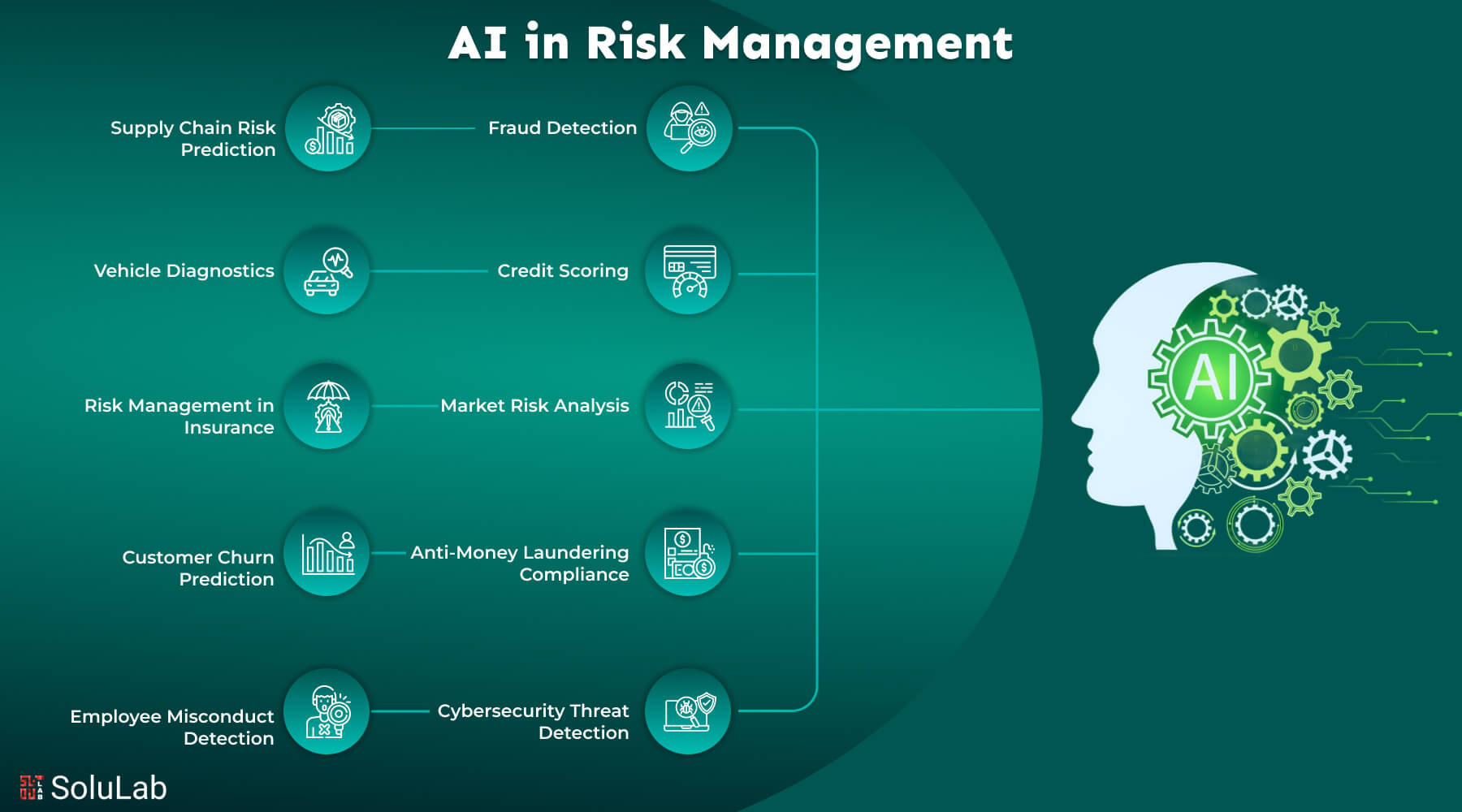

The leap from simple automation to true intelligence sets 2025’s AI agents apart. Powered by advanced machine learning models trained on terabytes of historical DeFi data and live market feeds, these bots can:

- Detect governance attacks or rug pulls in seconds and withdraw funds before losses occur.

- Dynamically adjust allocation based on shifting market sentiment or macro events.

- Auto-compound rewards, reinvesting profits with precision timing for maximum effect.

This isn’t just about maximizing returns; it’s about safeguarding capital. In the words of one leading protocol developer: “AI agents don’t sleep – they’re always watching for edge cases humans would miss. ” The result? Smarter risk-adjusted yields that outperform even the most attentive manual strategies.

Lowering Barriers: DeFi Automation for All

The promise of DeFi has always been permissionless access to financial opportunity. Yet until recently, the technical complexity kept most users at bay. Agentic DeFi platforms are flipping this script by abstracting away multi-step workflows into simple user objectives like “maximize my stablecoin yield” or “minimize drawdown risk. ” The AI handles the rest – scanning protocols across chains and executing optimal trades autonomously.

This democratization is fueling rapid adoption. As of June 2025, stablecoin-focused AI agents surpassed $20 million in TVL on Base alone. Projects like Virtuals Protocol have introduced marketplaces where anyone can deploy or rent specialized trading agents that operate across multiple blockchains – contributing to an ecosystem now approaching $1 billion in capitalization.

If you’re curious about how these systems work behind the scenes or want actionable steps for deploying your own AI trading agent in cross-chain yield farming workflows, check out our detailed guide here.

With agentic DeFi, what once required deep technical know-how and constant monitoring is now as simple as setting a few preferences. These platforms are not only automating yield farming, they’re making it radically more efficient and less error-prone. AI agents can rebalance portfolios in milliseconds, factor in new governance proposals, and even anticipate network congestion or fee spikes before they impact returns. The result is a new generation of multi-chain portfolio optimization that operates at a speed and scale no human could match.

Top 5 Real-World Use Cases for AI Crypto Trading Bots in Cross-Chain Yield Farming

-

Autonomous Yield Optimization Across Protocols: AI agents like Giza ARMA automatically monitor and reallocate assets among leading DeFi platforms such as Aave, Morpho, Compound, and Moonwell. Their algorithms identify optimal yield opportunities and execute cross-protocol rebalancing and auto-compounding without human intervention.

-

Seamless Cross-Chain Asset Transfers: Advanced bots utilize interoperability protocols like LayerZero, Axelar, and Wormhole to move assets between blockchains (e.g., Ethereum, Solana, Cosmos). This enables users to capture the best yields available across diverse DeFi ecosystems, maximizing returns.

-

Real-Time Risk Detection and Mitigation: AI agents are programmed to identify threats such as governance attacks, rug pulls, or de-pegging events. They can swiftly withdraw funds and reallocate assets to safer platforms, protecting user capital and maintaining portfolio stability.

-

Automated Stablecoin Yield Farming: Platforms like Fungi.ag deploy AI agents to optimize USDC yield farming. These bots dynamically shift funds between protocols based on real-time yield rates, fees, and risk profiles, ensuring the highest possible returns for stablecoin holders.

-

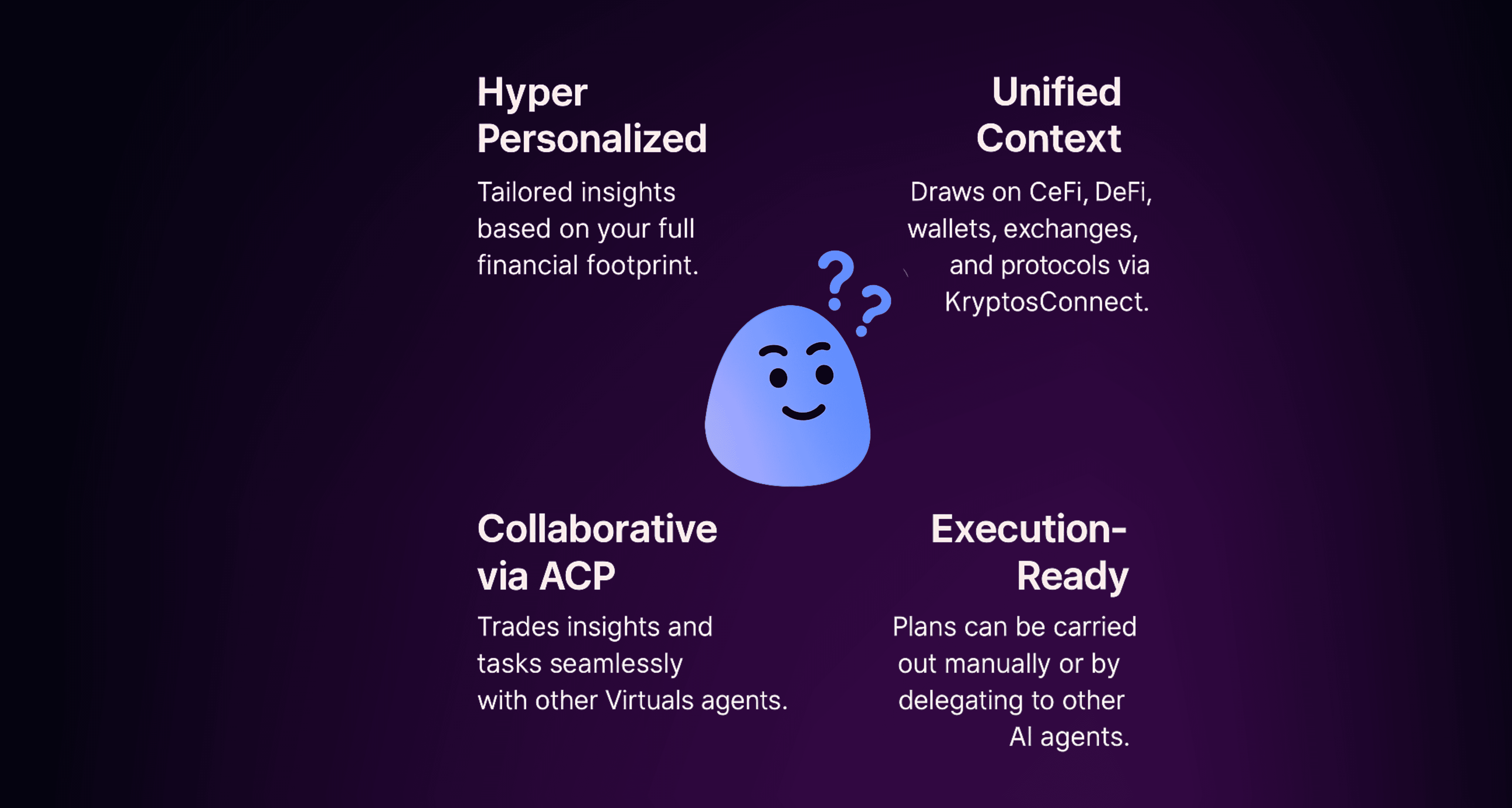

User-Friendly DeFi Access and Portfolio Management: Protocols such as Virtuals Protocol allow users to create and tokenize AI agents for automated trading and cross-chain portfolio management. This lowers the technical barrier, enabling both retail and institutional investors to benefit from sophisticated DeFi strategies.

Security remains paramount in this new landscape. The best AI trading agents are built with robust fail-safes, on-chain transparency, and continuous auditing to ensure user funds remain protected, even during black swan events. Many leading protocols now publish live analytics dashboards, letting users monitor their agent’s decisions and performance in real time.

What’s Next for Agentic DeFi?

The pace of innovation shows no signs of slowing. As more blockchains embrace interoperability standards, expect even greater liquidity mobility, and sharper competition among AI agents to deliver the best yields with the lowest risk. We’re also seeing the rise of agent marketplaces, where users can customize or subscribe to specialist bots for everything from stablecoin farming to advanced options strategies.

For institutions, these advancements open up new frontiers: automated treasuries that optimize capital 24/7 across dozens of protocols; insurance DAOs that dynamically hedge against protocol exploits; and composable DeFi stacks where AI agents interact seamlessly with both on- and off-chain data feeds.

The takeaway? Agentic DeFi isn’t just a tech upgrade, it’s an accessibility revolution. By abstracting away complexity while enhancing security and returns, AI-powered trading agents are setting a new standard for what’s possible in decentralized finance. Whether you’re an experienced trader seeking alpha or a first-time user looking for passive income, 2025’s cross-chain yield farming landscape is now truly open to all.

Ready to dive deeper into practical strategies? Explore our expert walkthroughs on how AI agents optimize DeFi yield farming or learn step-by-step how to automate your own cross-chain strategies.