In the volatile world of Solana perpetuals, where autonomous AI trading agents are turning heads, traders are discovering a smarter path to 24/7 gains. With Binance-Peg SOL hovering at $136.96 after a slight dip of -2.70 (-0.0193%) over the last 24 hours – high of $143.66, low of $136.86 – the perp markets on Solana remain a hotbed for opportunity. Platforms like Vooi. io are leading the charge, letting you deploy Vooi. io trading bots that execute strategies without your constant oversight. These aren’t just scripts; they’re intelligent agents navigating funding rates, basis trades, and cross-chain liquidity with precision.

The Rise of Agentic Trading in Solana Perps

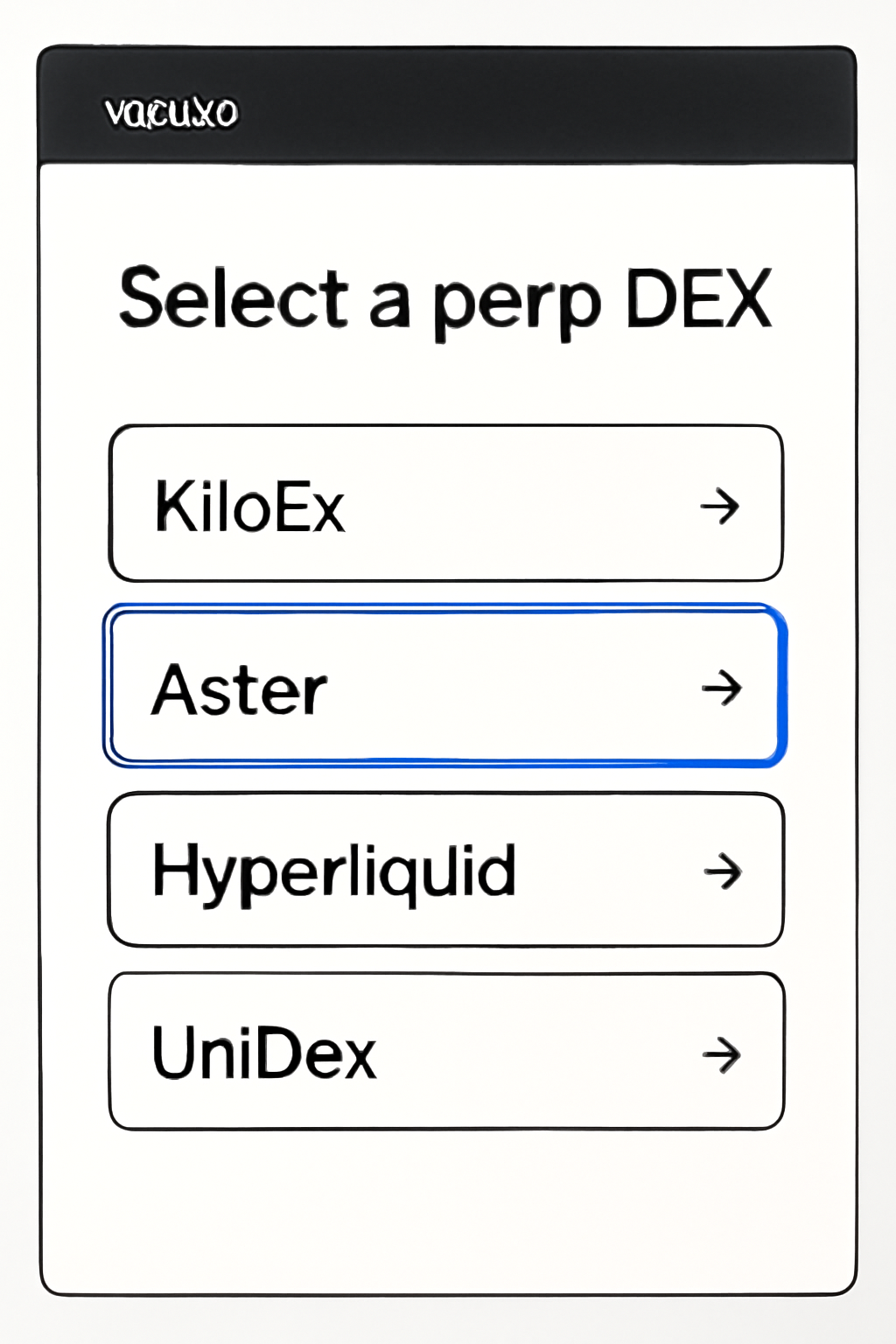

Solana’s speed and low costs make it ideal for agentic trading Solana perps, but manual trading can’t keep up with the 24/7 cycle. Enter AI perps bots in DeFi: they farm funding, arbitrage spot-perp spreads, and maintain tight delta exposure. I’ve seen agents outperform rigid bots by adapting to real-time shifts, like today’s subtle SOL pullback signaling potential mean reversion plays. Vooi. io stands out by aggregating DEXs like KiloEx, Aster, GMX, and Hyperliquid into one terminal – zero gas, one balance, chain abstraction magic.

This unification solves DeFi’s fragmentation headache. Traders flip between Arbitrum perps and Solana spots seamlessly, capturing 15-25% better execution prices per community buzz. As a strategist blending traditional and digital assets, I appreciate how Vooi. io’s non-custodial setup keeps you in control while agents handle the grind.

Vooi. io’s AI Agents: Built for Resilient Strategies

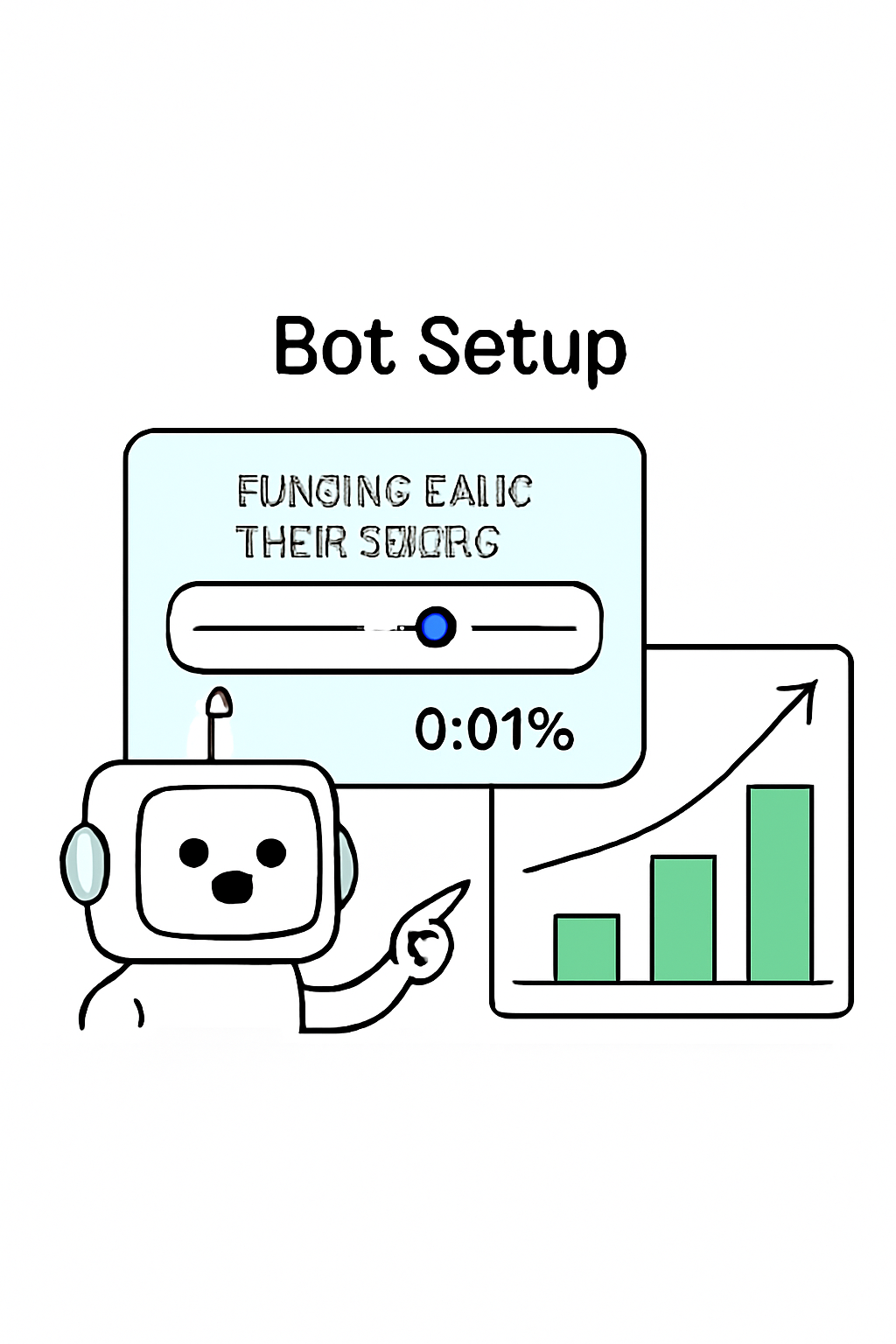

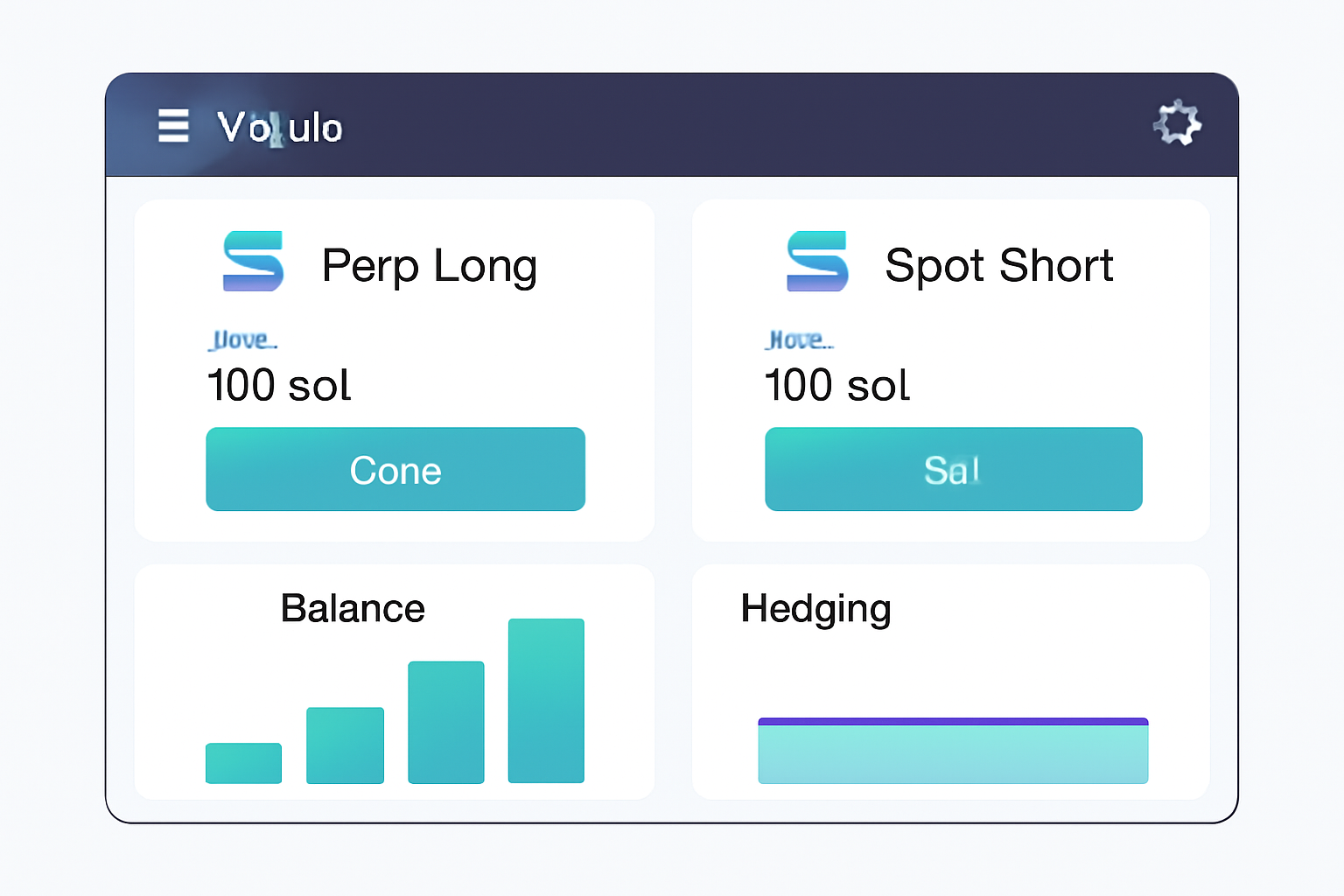

What sets 24/7 crypto trading agents on Vooi. io apart? Their smarts. These bots monitor markets across crypto, RWAs, stocks, even game assets, deploying tactics like funding rate farming or basis trades. Goal: exploit perp-spot divergences while hedging delta. The trick lies in dynamic risk parameters – stop losses, position sizing tied to volatility – ensuring survival in downturns.

Picture this: SOL at $136.96, perps showing positive funding. An agent shorts perps, longs spot via Jupiter, pockets the yield. Vooi V2’s CEX-grade UX powers this with gasless trades, no bridges. Community chatter highlights $1M and volumes on external perps, points pools rewarding early adopters. My take? In uncertain times, diversify via agents; they thrive where humans tire.

Solana (SOL) Price Prediction 2026-2031

Forecasts in the Context of AI Trading Agents and Perpetual Futures on Vooi.io

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $130 | $160 | $210 | +14% |

| 2027 | $155 | $220 | $320 | +38% |

| 2028 | $200 | $300 | $450 | +36% |

| 2029 | $260 | $410 | $620 | +37% |

| 2030 | $350 | $550 | $830 | +34% |

| 2031 | $450 | $720 | $1,100 | +31% |

Price Prediction Summary

Solana (SOL) faces short-term bearish pressure dipping to $130 in 2026 but rebounds strongly to an average of $160, driven by perp trading momentum and AI agents on Vooi.io. Long-term outlook is bullish, with average prices reaching $720 by 2031 amid DeFi growth, market cycles, and ecosystem expansions, representing over 5x growth from 2025 levels.

Key Factors Affecting Solana Price

- Rapid adoption of autonomous AI trading agents on Vooi.io for Solana perps

- Explosion in perp DEX volumes via integrations like KiloEx and Aster on VOOI V2

- Solana’s scalability advantages fueling DeFi, RWAs, and cross-chain trading

- Crypto market bull cycles post-2025 halving and macroeconomic recovery

- Regulatory clarity boosting institutional inflows into Solana ecosystem

- Technological upgrades enhancing TPS and reducing costs for high-frequency trading

- Competition dynamics favoring Solana’s momentum in apps, memes, and AI-driven strategies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Getting Started: Configuring Your Vooi. io Bot[/h2>

Deployment is straightforward, empowering even mid-level traders. Connect your Solana wallet to app. vooi. io or pro. vooi. io for advanced tools. Select a perp DEX – say, Hyperliquid for depth. Now, craft your agent: define entry triggers (e. g. , RSI oversold below 30), leverage caps at 5x, trailing stops at 1%.

- Fund Unified Balance: Deposit USDC or SOL; abstraction handles cross-chain.

- Set Strategy Archetype: Funding farmer, basis trader, or momentum chaser.

- Tune Parameters: Max drawdown 5%, rebalance hourly.

Activate, and watch it run autonomously. Security? Non-custodial, keys stay yours. I’ve tested similar setups; they cut emotional trades, stacking small edges into compounding wins. With Vooi eyeing V3 AI upgrades, now’s prime time to experiment on these AI perps bots DeFi frontiers.

In DeFi’s $100B and perp arena, routing like Vooi’s yields real alpha – not hype.

That edge compounds over time, especially with SOL’s current stability at $136.96, where subtle funding shifts create ripe setups for autonomous AI trading agents Solana style.

Mastering Risk in the Agent Era

Resilience defines winning strategies, and Vooi. io’s bots shine here. Volatility spikes? Agents dynamically scale positions, capping leverage at prudent levels like 3-5x amid SOL’s 24-hour range from $136.86 to $143.66. I’ve managed portfolios through crypto winters; emotional overrides kill returns, but these 24/7 crypto trading agents enforce discipline. Set max drawdown alerts at 3-5%, and pair with diversification across RWAs or indices for ballast.

Overlook these, and a mean reversion gone wrong turns gains to dust. Community volumes topping $1M on integrated perps like Hyperliquid underscore the stakes; bots must adapt faster than humans, scanning multi-venue liquidity for optimal fills.

Unlocking Alpha: Proven Agent Archetypes

Beyond basics, tailor agents to Solana’s perp ecosystem. Funding farmers thrive when rates flip positive, as hinted in today’s SOL dip. Basis traders exploit spot-perp gaps via Jupiter swaps, keeping delta neutral. Momentum chasers? They ride breakouts, trailing stops locking profits. On Vooi. io, chain abstraction lets one agent juggle KiloEx shorts and Aster longs, gasless and seamless.

Opinion: Pure momentum bots falter in ranges, but hybrids blending funding arb with vol filters dominate. Test on pro. vooi. io’s sim mode first; backtests reveal edges invisible to the eye.

This archetype pockets yields passively, ideal for SOL at $136.96 where perps hint at premium decay. Early Vooi adopters via Telegram minis and NFT boosts are stacking points; integrate that with bots for layered rewards.

Real-World Edges and Community Pulse

Traders report 15-25% better execs versus fragmented DEXs, per X threads. Imagine: Arbitrum perps to Solana spots in seconds, no bridges. V2’s unification crushes CEX UX myths, while V3 teases deeper AI. I’ve diversified client allocations here, blending 20% agentic perps with stables; drawdowns halved versus spot holding.

Yet, no silver bullet. Black swans like flash crashes demand kill switches. Monitor via app. vooi. io dashboards; tweak hourly on vol surges. With DeFi perps eclipsing $100B, Vooi. io positions you at the nexus of AI and liquidity.

Agents don’t predict; they position strategically, turning SOL’s $136.96 consolidation into quiet accumulation.

Scale thoughtfully: start small, iterate on logs. As markets evolve, these Vooi. io trading bots evolve too, farming edges humans miss. Blend with spot holds for true resilience. In my 11 years steering assets, this agentic shift echoes quant funds’ rise; DeFi democratizes it. Deploy now, diversify to thrive, and let bots guard your 24/7 frontier.