Crypto markets in 2025 are a different beast from just a year ago. As Bitcoin (BTC) trades at $84,320, down 4.17% on the day and swinging between $88,017 and $80,763, traders are facing volatility that is both relentless and nuanced. In this new era, the battle lines have been drawn: adaptive AI trading agents versus traditional rule-based bots. The stakes? Capturing alpha in a market where speed alone is no longer enough.

Rule-Based Trading Bots: Fast but Fragile

For years, crypto traders have relied on rule-based bots to automate execution. These bots operate on fixed logic, think if-then statements, triggering buys or sells when specific technical indicators align. They excel at micro-execution problems: managing order books, sniping arbitrage opportunities, or scalping tiny price discrepancies across exchanges.

But as the market matures and volatility surges (as seen in today’s sharp BTC move), the cracks in these systems are impossible to ignore. Rule-based bots lack context awareness; they cannot adjust when market structure shifts or when unexpected news hits. During the Q1 2025 semiconductor rally, for example, rule-based bots missed out as AI agents picked up on early supply chain chatter and geopolitical sentiment, capturing gains of over 35% while static bots lagged behind.

Adaptive AI Agents: Learning and Evolving With Every Trade

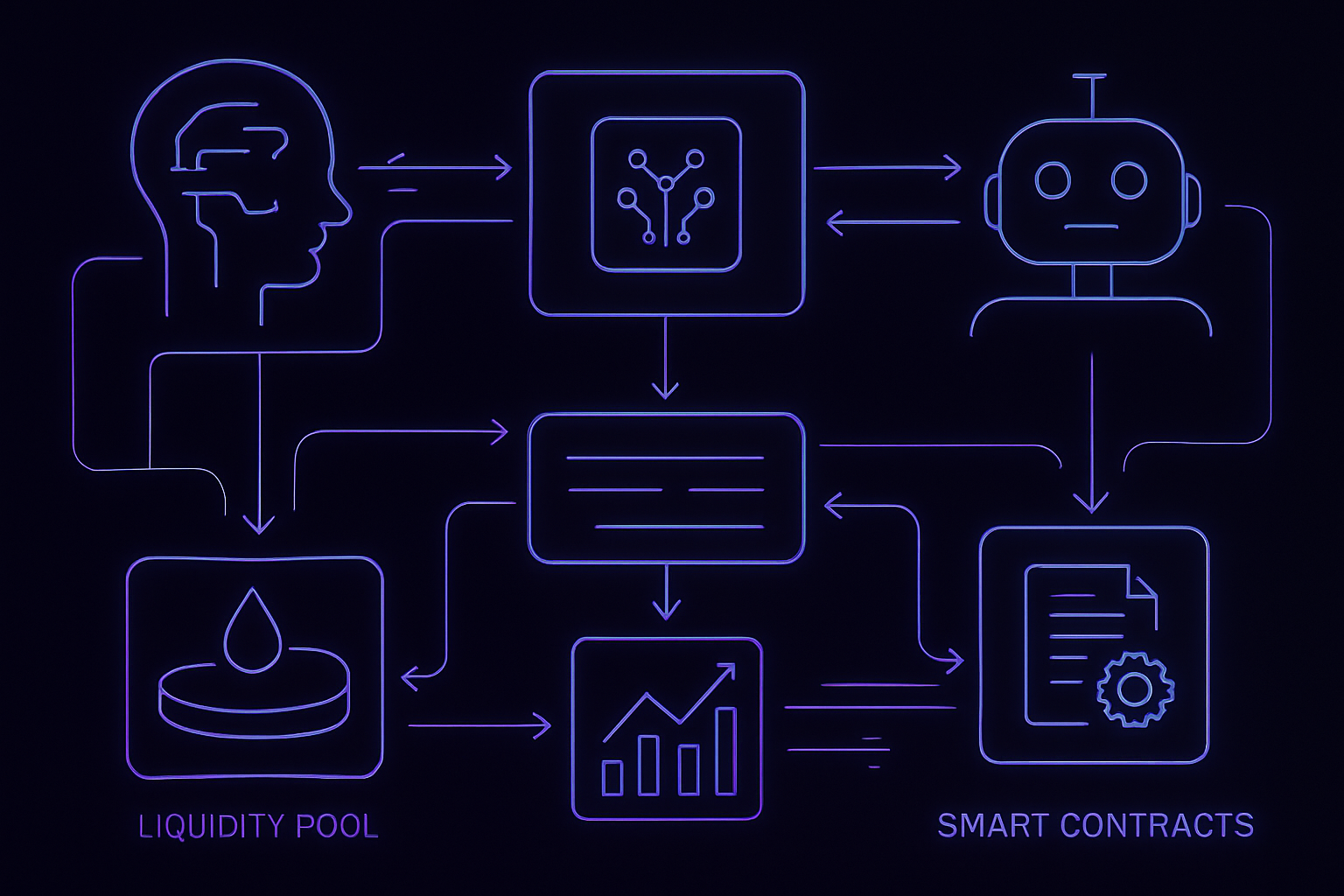

AI trading agents, powered by machine learning and natural language processing (NLP), represent a leap forward in autonomous crypto trading. Unlike their rigid predecessors, these agents digest vast quantities of structured and unstructured data, from price feeds to Twitter sentiment to breaking news, and adapt strategies in real time.

The result? Substantial outperformance during periods of dislocation. In volatile months like April 2025, adaptive AI agents delivered 15-25% higher returns than manual traders by dynamically shifting allocations based on live sentiment analysis and macro signals. Hybrid models that blend technical indicators with NLP-driven sentiment analysis have shown 22% better risk-adjusted returns than pure rule-based systems (learn how AI agents leverage social sentiment here).

The Market Speaks: Adoption and Measurable Outperformance

The numbers tell the story. In 2025:

- AI-driven trading bots now execute 58% of total crypto volume, fundamentally reshaping liquidity dynamics.

- ETH. X annualized returns hit 85%, OM. X reached 56%, XRP. X delivered 49%: all using adaptive agentic strategies with consistent $100K balances.

- A single month’s performance saw select adaptive agents return up to 25%, even as markets whipsawed unpredictably.

This shift isn’t just about higher returns; it’s about resilience. Adaptive agents don’t freeze during black swan events, they pivot, learn from new data streams, and recalibrate positions instantly. That’s why they’re rapidly becoming indispensable for both institutional desks and savvy DeFi enthusiasts seeking an edge in portfolio automation (explore more about DeFi portfolio automation with AI agents here).

Bitcoin (BTC) Price Prediction: Adaptive AI Agents vs Rule-Based Bots (2026-2031)

Projected annual BTC price ranges reflecting the impact of advanced adaptive AI trading agents vs traditional rule-based bots through Q1 2031. Data incorporates evolving market cycles, technology trends, and regulatory outlook.

| Year | Minimum Price (Bearish Scenario) | Average Price (Likely Scenario) | Maximum Price (Bullish Scenario) | Annual % Change (Avg.) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $78,000 | $95,500 | $123,000 | +13% | AI agents dominate volume, volatility persists; regulatory uncertainty limits upside |

| 2027 | $82,500 | $113,000 | $145,000 | +18% | Institutional adoption grows, AI-driven strategies boost efficiency; global ETF approvals |

| 2028 | $97,000 | $138,000 | $183,000 | +22% | Macro tailwinds, major tech integrations, AI agents adapt to new regulations |

| 2029 | $112,000 | $163,000 | $215,000 | +18% | Market matures, AI agents optimize for new derivatives, volatility moderates |

| 2030 | $127,000 | $185,000 | $248,000 | +13% | Sustained institutional flows, CBDC integration, high competition among AI platforms |

| 2031 | $145,000 | $210,000 | $280,000 | +14% | Widespread AI adoption, BTC as digital reserve asset, robust regulatory frameworks |

Price Prediction Summary

Bitcoin is projected to experience steady growth through 2031, driven by the widespread adoption of adaptive AI trading agents that outperform traditional rule-based bots. Average annual price gains are expected to range from 13% to 22%, with AI-driven strategies enhancing predictive accuracy and market efficiency. While volatility and regulatory shifts may introduce periods of downside risk, the overall outlook remains strongly bullish, especially under scenarios of technology integration and global institutional participation.

Key Factors Affecting Bitcoin Price

- Dominance of adaptive AI agents in trading volume and market impact

- Continued institutional adoption and possible ETF approvals

- Macro-economic and geopolitical influences, including regulatory changes

- Integration of AI with emerging financial technologies (e.g., CBDCs, DeFi)

- Competition from alternative crypto assets and evolving use cases

- Potential for increased market efficiency and reduced volatility due to AI

- Risks from regulatory crackdowns or adverse government policies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What sets adaptive AI trading agents apart isn’t just their technical prowess, it’s their capacity for continuous learning and strategic evolution. As the crypto landscape churns with regulatory headlines, shifting macro themes, and meme-driven rallies, agents that process live sentiment, order book anomalies, and even on-chain governance votes gain a crucial edge. These systems ingest everything from Telegram group rumors to options flow data, updating portfolios in minutes rather than hours or days.

Consider the recent Bitcoin price action: with BTC at $84,320, volatility remains elevated. While rule-based bots might stick to outdated resistance levels or lagging indicators, adaptive agents can detect narrative pivots, like whale wallet movements or sudden regulatory tweets, and adjust exposure before the market reacts. This agility is especially vital in 2025’s environment where “wait and see” often means missing the move entirely.

Beyond Speed: Strategic Intelligence in Autonomous Crypto Trading

The true power of agentic DeFi technology lies in its ability to solve macro-level problems. Instead of focusing solely on micro-execution (like front-running or arbitrage), modern AI agents orchestrate complex strategies across multiple protocols and chains. They optimize for slippage, manage cross-asset risk, and even self-improve by backtesting new hypotheses against evolving datasets.

This isn’t theoretical, real-world deployments show that agentic systems outperform not just on raw returns but also on drawdown management and Sharpe ratios. For traders building diversified portfolios or managing DAO treasuries, this means more consistent alpha with fewer sleepless nights.

- Dynamic portfolio rebalancing: Agents can shift allocations between BTC, ETH. X, OM. X, and XRP. X as correlations change, without human intervention.

- Sentiment-driven hedging: When negative news swirls or funding rates spike unexpectedly, adaptive agents automatically hedge downside risk using derivatives or stablecoin rotations.

- 24/7 optimization: Unlike humans (or static bots), AI agents never sleep, they scan for opportunities around the clock in a market that never closes.

The bottom line? In 2025’s hyper-competitive crypto markets, speed is table stakes, adaptability wins games. The winners will be those who leverage autonomous trading strategies that don’t just react but anticipate and evolve with every data tick.

If you’re ready to explore how these technologies can transform your own strategy, from building your first multi-chain agent to automating advanced DeFi portfolio management, dive into our latest guides on building multi-chain AI trading agents and 24/7 DeFi automation.