Managing a DeFi portfolio across multiple blockchains used to feel like spinning plates, juggling protocols, wallets, and yield strategies on Ethereum, Arbitrum, Polygon, and beyond. In 2025, this landscape has changed dramatically. Thanks to the rise of AI DeFi agents, cross-chain portfolio management is now smarter, more secure, and refreshingly simple, even for users without deep technical expertise.

The Rise of AI Agents in Cross-Chain DeFi

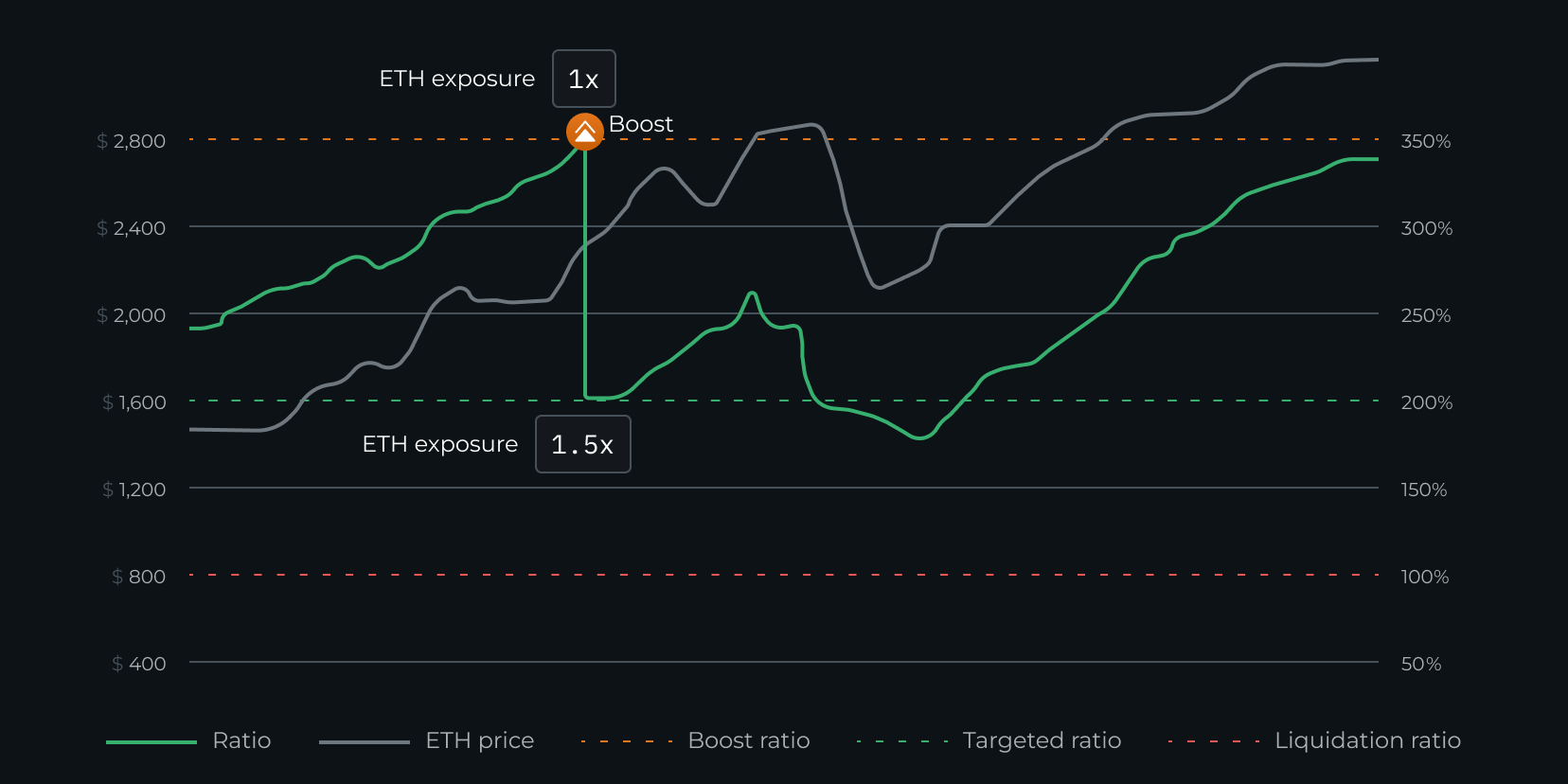

Let’s get real: the old way of doing DeFi was powerful but fragmented. Each chain had its own quirks and opportunities; moving capital meant high fees and constant vigilance. Enter DeFiSaver’s AI Portfolio Manager, a platform that’s become synonymous with next-gen DeFi automation in 2025. This advanced tool leverages AI agents to manage your assets seamlessly across Ethereum, Arbitrum, and Polygon, all in real time.

What makes this truly revolutionary? The AI Portfolio Manager doesn’t just automate basic tasks; it actively reallocates assets for optimal yield, balances risk exposure based on live market data, and adapts strategies as conditions change. The result: users enjoy hyper-personalized portfolio management with minimal manual intervention.

How Automated Multi-Chain Yield Routing Works

One core innovation powering this leap is the Automated Multi-Chain Yield Routing Workflow. Here’s how it works:

- Continuous Scanning: Smart contract-based AI agents monitor liquidity pools and lending protocols across all connected blockchains, 24/7.

- Autonomous Reallocation: When a better APY pops up on another chain or protocol, funds are reallocated automatically, no need for manual swaps or bridging.

- User-Friendly Experience: Investors set their risk preferences once; the system does the rest, optimizing returns while minimizing complexity.

This level of automation isn’t just about convenience, it’s about unlocking new efficiencies that simply weren’t possible before. By eliminating human lag time and emotional bias, these workflows help both seasoned traders and newcomers maximize their earning potential across ecosystems.

Pushing Security Forward: ZKP-Based Transaction Privacy

Sophisticated automation is only half the story. With cross-chain activity comes heightened privacy concerns, especially as DeFi grows more mainstream. That’s where Zero-Knowledge Proof (ZKP)-Based Transaction Privacy comes into play. Integrated directly into leading AI trading agent workflows in 2025, ZKPs enable transactions to be verified without exposing sensitive user data or trading strategies on-chain.

This cryptographic layer means you can rebalance portfolios or route capital between chains with confidence that your activity remains private, even as your assets move transparently through decentralized networks. For anyone serious about security (and let’s face it: who isn’t?), this is a game-changer for safe cross-chain investing.

The Impact: Smarter Portfolios for Everyone

The convergence of these innovations isn’t just theoretical, it’s already reshaping how people interact with decentralized finance platforms today. By combining advanced automation tools like DeFiSaver’s AI Portfolio Manager with robust privacy features such as ZKP-based workflows, investors gain unprecedented control over their assets without sacrificing security or performance.

If you’re curious about how these systems work under the hood, or want to see real-world use cases, check out our deep dive on how cross-chain AI agents automate DeFi strategies.

What’s truly empowering is that these tools are democratizing access to complex DeFi strategies. You no longer need to be a quant or Solidity developer to benefit from cross-chain yield optimization or advanced risk balancing. Platforms like DeFiSaver have abstracted away the technical heavy lifting, letting users focus on setting their goals and preferences while the AI handles the rest.

Behind the scenes, the Automated Multi-Chain Yield Routing Workflow is quietly revolutionizing returns for thousands of users. By leveraging smart contract-based AI agents, it continuously hunts for the best yields and liquidity opportunities across Ethereum, Arbitrum, and Polygon. When it detects a new opportunity, say, a sudden APY spike on a lending protocol, it can instantly reallocate funds, capturing value in real time without exposing users to unnecessary bridging risks or manual errors. This is especially powerful in volatile markets where speed and precision are everything.

Top AI-Powered Cross-Chain DeFi Automation Tools (2025)

-

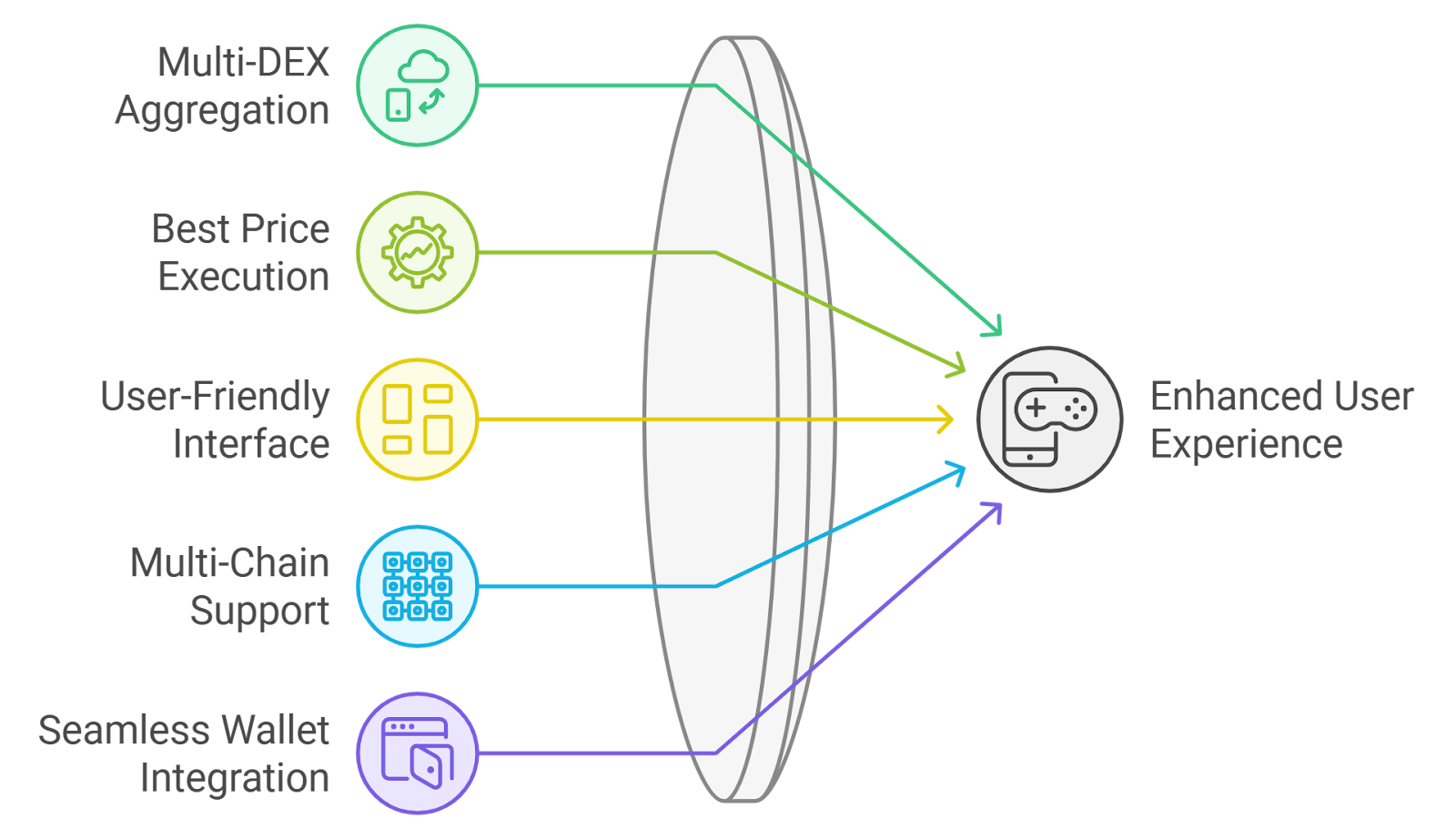

DeFiSaver’s AI Portfolio Manager: An advanced cross-chain DeFi platform leveraging AI agents to automate asset allocation, risk balancing, and yield optimization across Ethereum, Arbitrum, and Polygon in real time. It empowers users to maximize returns while minimizing manual effort and risk exposure.

-

Automated Multi-Chain Yield Routing Workflow: This workflow uses smart contract-based AI agents to continuously scan liquidity pools and lending protocols across multiple blockchains. It autonomously reallocates funds for optimal APY, offering seamless, hands-off portfolio growth.

-

Zero-Knowledge Proof (ZKP)-Based Transaction Privacy: By integrating ZKP cryptography into AI trading agent workflows, this innovation ensures transaction privacy and secure cross-chain operations. It protects user data while enabling efficient, confidential portfolio rebalancing.

Security-conscious investors will especially appreciate ZKP-based privacy features. Integrating Zero-Knowledge Proof cryptography into AI trading agent workflows means you can execute sophisticated strategies without broadcasting your every move to the world. This not only protects your alpha but also shields you from targeted attacks or front-running, an ever-present risk in open DeFi ecosystems.

The result? We’re seeing a surge in both institutional and retail adoption of AI-powered portfolio management tools. Investors who once found cross-chain DeFi intimidating are now able to diversify with confidence, automate their earning strategies, and sleep soundly knowing their transactions are both optimized and private.

Looking Ahead: The Future of AI Agents in Cross-Chain DeFi

The momentum behind AI DeFi agents in 2025 shows no sign of slowing down. As more protocols adopt automated multi-chain workflows and privacy-preserving tech like ZKPs, we’re moving toward an era where sophisticated portfolio management is accessible to anyone with a wallet, not just whales or coders.

This shift isn’t just about maximizing APY; it’s about giving people more agency over their finances while minimizing friction and risk. As platforms continue to innovate on automation, security, and user experience, expect even more seamless integrations, think one-click cross-chain swaps or fully autonomous rebalancing tailored by your personal risk profile.

If you’re ready to explore hands-off portfolio management or want tips on optimizing your own multi-chain setup using today’s best AI crypto trading solutions, don’t miss our comprehensive guide on how AI-powered DeFi agents automate cross-chain yield farming and portfolio management.

The future is bright for decentralized investors, with smarter bots managing the grind behind the scenes, you’re free to focus on strategy, community, or simply enjoying life outside the charts. That’s financial empowerment done right.