AI trading agents are no longer a speculative edge case in crypto – they are the new baseline. In 2025, with Bitcoin (BTC) priced at $102,114.00, the landscape is dominated by agentic DeFi tools and smart strategy agents capable of parsing market sentiment and executing automated crypto strategies with minimal human intervention. But building and combining these AI agents for robust, automated trading requires more than hype: it demands rigorous system design, platform selection, and an unflinching commitment to backtesting.

What Sets 2025’s AI Trading Agents Apart?

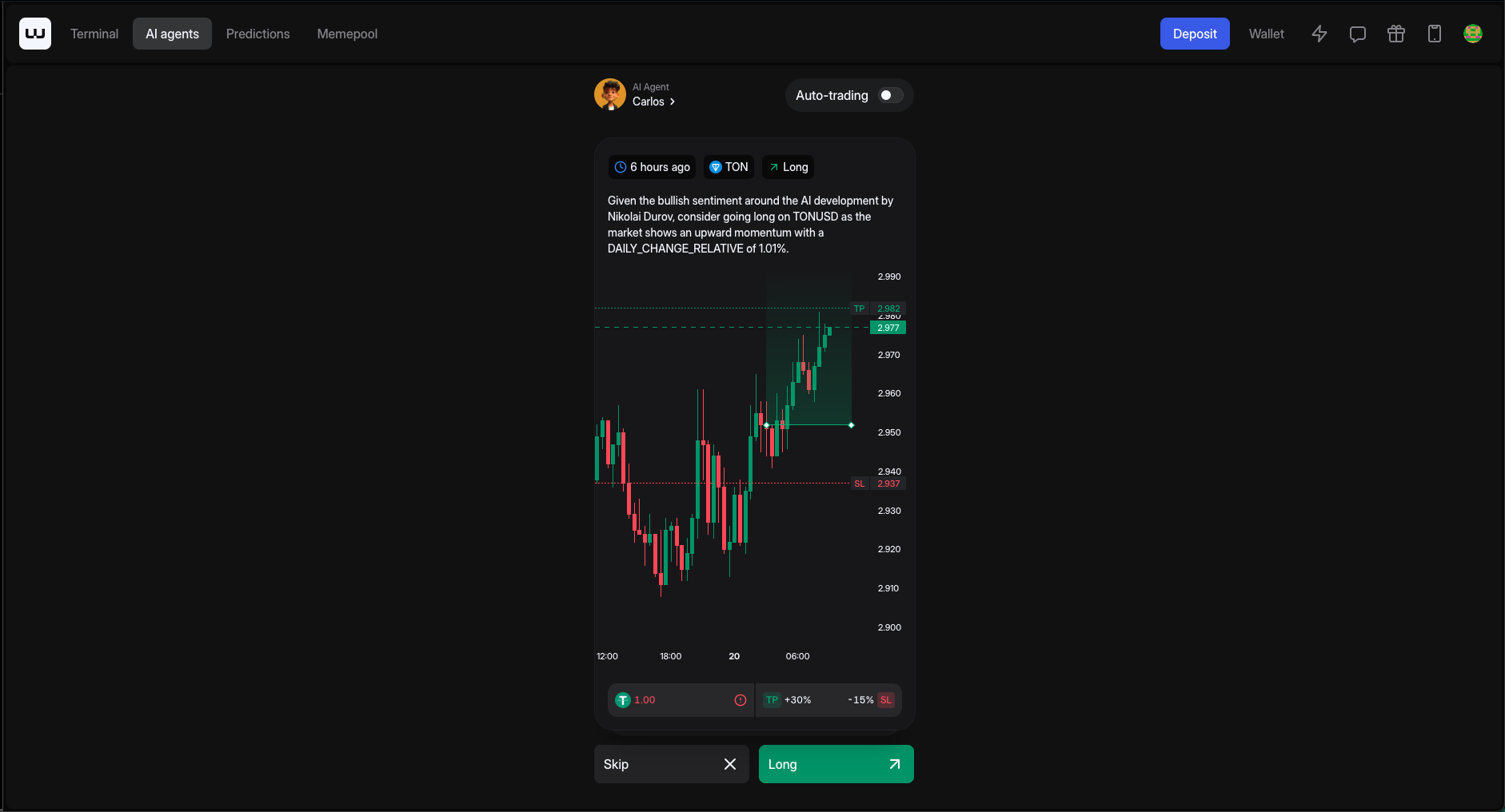

Unlike their pre-2024 ancestors, today’s AI trading agents aren’t just glorified rule-based bots. They integrate machine learning models that adapt to shifting liquidity, cross-chain arbitrage opportunities, and even on-chain sentiment data scraped from social platforms. Platforms like 3Commas, Cryptohopper, and Coinrule have moved beyond simple automation to offer drag-and-drop AI bot builders, adaptive learning modules, and real-time strategy optimization.

The best-performing agents combine technical indicator analysis with NLP-driven social sentiment scoring. For example, Nansen AI’s integration of blockchain analytics with Twitter and Discord trend monitoring has turned reactive trading into proactive positioning – a critical advantage when BTC can swing $3,000 in a single session.

Selecting Your AI Trading Stack: Platforms and Tools

The platform you choose will directly impact your ability to build modular agents or combine multiple strategies into a single workflow. Here are the current leaders for 2025:

- 3Commas: Offers multi-exchange support with AI-driven arbitrage logic and SmartTrade terminals for manual overrides when needed.

- Cryptohopper: Cloud-based; features a visual bot builder that lets you map out complex logic trees using technicals or external signals.

- Coinrule: No-code strategy builder integrating pattern recognition plus adaptive learning from your trade history.

If you’re serious about agentic DeFi tools or want to explore how to automate cross-chain strategies without code, review our guide on no-code AI trading agents for DeFi automation.

The Blueprint: Building Modular and Adaptive Crypto Agents

The process begins with data collection. You’ll need high-quality historical price data (tick-level if possible), volume metrics, order book depth snapshots, and increasingly – social media sentiment streams. The sophistication of your agent will depend on how effectively it synthesizes these disparate data sources into actionable signals.

Strategy formulation is next. Are you targeting mean reversion on high-liquidity pairs? Cross-chain arbitrage? Momentum breakouts triggered by whale wallet activity? Each objective demands tailored feature engineering and model selection – think LSTM networks for sequence prediction or reinforcement learning for adaptive allocation across volatile assets like ETH or SOL.

No matter how compelling your backtest results look, skepticism is warranted until you’ve stress-tested across regime shifts (e. g. , post-halving volatility spikes). Platforms offering robust backtesting frameworks let you simulate slippage, latency effects, and cascading liquidation risks at current market conditions (BTC $102,114.00). Never trust the headline ROI; scrutinize drawdowns and tail risk exposure before deploying capital.

Bitcoin (BTC) Price Prediction Table: 2026-2031 (AI Trading Agents Era)

Professional BTC price predictions based on advanced agentic trading models, market cycles, and 2025 AI-driven automation trends.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $110,000 | $145,000 | +7.7% | Potential mid-cycle correction as post-halving hype subsides and regulatory clarity emerges. AI agents stabilize volatility but macro conditions may weigh. |

| 2027 | $98,000 | $124,000 | $170,000 | +12.7% | Renewed institutional adoption and improved AI agent strategies fuel gradual recovery. Expansion in DeFi and tokenized assets supports bullish sentiment. |

| 2028 | $110,000 | $140,000 | $200,000 | +12.9% | Bullish market cycle returns as AI-driven trading matures; widespread adoption in payments and asset management. Regulatory harmonization in US/EU boosts confidence. |

| 2029 | $125,000 | $162,000 | $235,000 | +15.7% | Global macro tailwinds and further integration of multi-agent systems in trading. Increased competition from CBDCs but Bitcoin’s unique value proposition remains strong. |

| 2030 | $145,000 | $188,000 | $275,000 | +16.0% | Next Bitcoin halving and strong AI/automation infrastructure drive market optimism. Institutional and sovereign wealth inflows rise, pushing new all-time highs. |

| 2031 | $165,000 | $210,000 | $320,000 | +11.7% | Mature agentic trading ecosystem brings relative price stability. Bitcoin potentially recognized as a reserve asset in select economies; increased mainstream adoption. |

Price Prediction Summary

Bitcoin is projected to experience steady growth from 2026 to 2031, fueled by the integration of advanced AI trading agents, increasing institutional adoption, and technological innovations. While short-term corrections are likely, the broader trend remains bullish with periodic volatility. Maximum price scenarios reflect strong market cycles and expanding use cases, while minimums factor in regulatory risks and macroeconomic downturns.

Key Factors Affecting Bitcoin Price

- AI trading agent adoption and improvements leading to more efficient markets and reduced volatility.

- Regulatory developments in major economies (US, EU, Asia) impacting institutional participation and retail confidence.

- Next Bitcoin halving event (2030), historically a catalyst for price appreciation.

- Increased integration of Bitcoin into DeFi, tokenization, and cross-chain protocols.

- Potential competition from central bank digital currencies (CBDCs) and other blockchain innovations.

- Macroeconomic trends such as inflation, global liquidity, and shifts in monetary policy.

- Market sentiment cycles, including the impact of new all-time highs and correction phases.

- Security, scalability, and continued network upgrades (e.g., Lightning Network, sidechains).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Merging Multiple Agents: Smarter Than the Sum of Their Parts?

This year’s paradigm shift isn’t just about smarter individual bots – it’s about orchestrating ensembles of specialized agents within unified crypto automation workflows. By combining trend-following modules with mean-reversion scalpers or cross-exchange arbitrageurs under one risk-managed portfolio layer, traders can diversify attack vectors while smoothing equity curves.

The most advanced setups incorporate inter-agent communication protocols (think TradingGroup’s self-reflective multi-agent system), allowing modules to share insights or dynamically reallocate capital based on evolving market regimes. Centralized dashboards now enable real-time oversight across dozens of deployed agents – but beware: complexity compounds operational risk if not monitored rigorously.

Even the most sophisticated AI agent stack is only as good as its weakest risk control. In 2025, with Bitcoin’s price locked at $102,114.00, automated crypto strategies must be engineered with dynamic guardrails. Modern agents are expected to enforce stop-losses, trailing exits, and position sizing in response to real-time volatility. Some platforms integrate on-chain risk signals, like sudden TVL drops in DeFi pools or anomalous gas spikes, to trigger circuit breakers before losses spiral.

Compliance is another non-negotiable layer. As regulators scrutinize algorithmic trading in digital assets, leading protocols have started embedding zero-knowledge proofs and on-chain auditability directly into agent workflows. This ensures both privacy and provable adherence to anti-money laundering (AML) rules, a requirement for any serious institutional capital entering the space.

Iterate Relentlessly: Continuous Improvement Is Mandatory

No AI trading agent remains optimal for long. Market microstructure evolves; new data sources emerge; adversarial actors adapt their tactics. The best practitioners treat every deployment as a learning loop: agents are retrained on fresh data, strategies are refactored after drawdowns, and performance metrics are benchmarked against live P and L, not just backtest fantasy.

Feedback loops are increasingly automated. Agents now log not just trade outcomes but also the rationale behind each decision, enabling post-mortem analysis when edge erodes or unexpected losses occur. Some even leverage federated learning, sharing anonymized learnings across user bases to accelerate collective strategy evolution without leaking proprietary alpha.

What’s Next? Smarter Agents, Smarter Traders

The direction of travel is clear: agentic DeFi tools will become more interoperable, composable, and context-aware. Expect tighter integrations between on-chain analytics and off-chain sentiment feeds; more granular control over risk parameters; and seamless migration of strategies across centralized exchanges and DEXs alike.

If you’re looking to push further into multi-agent orchestration or want hands-on frameworks for rapid prototyping, explore our deep dive on deploying multi-chain AI trading agents. For those prioritizing speed over code complexity, see our guide to no-code AI agent monetization in DeFi automation.

But remember: while the technology has never been more accessible or powerful, the burden of proof remains on you, the builder or trader, to validate every claim with hard data and disciplined execution. The market will punish complacency faster than ever before.

Trust the math, not the myth. In 2025’s crypto markets, where volatility can erase months of gains in minutes, AI trading agents are your edge only if you wield them with rigor and skepticism.