Building a multi-chain AI crypto trading agent used to require weeks of complex coding, data wrangling, and DevOps headaches. Today, platforms like CaffeineAI are changing the game, enabling traders and DeFi builders to spin up robust AI-powered bots that operate across multiple blockchains in less than an hour. In this hands-on guide, we’ll walk through the exact steps to get your own automated DeFi trading infrastructure live in just 30 minutes, no advanced AI or blockchain expertise required.

Why Multi-Chain Matters for AI Trading Agents

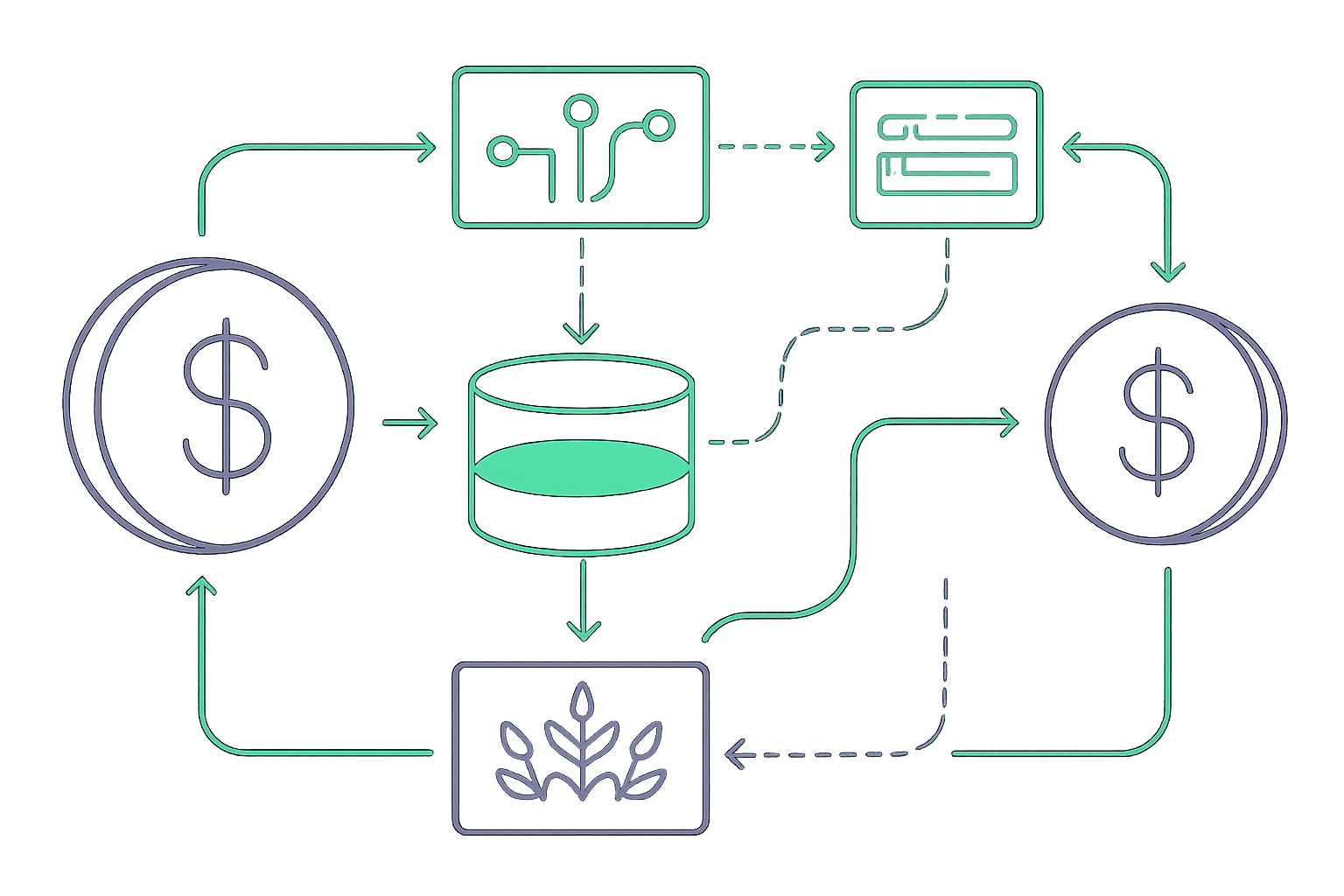

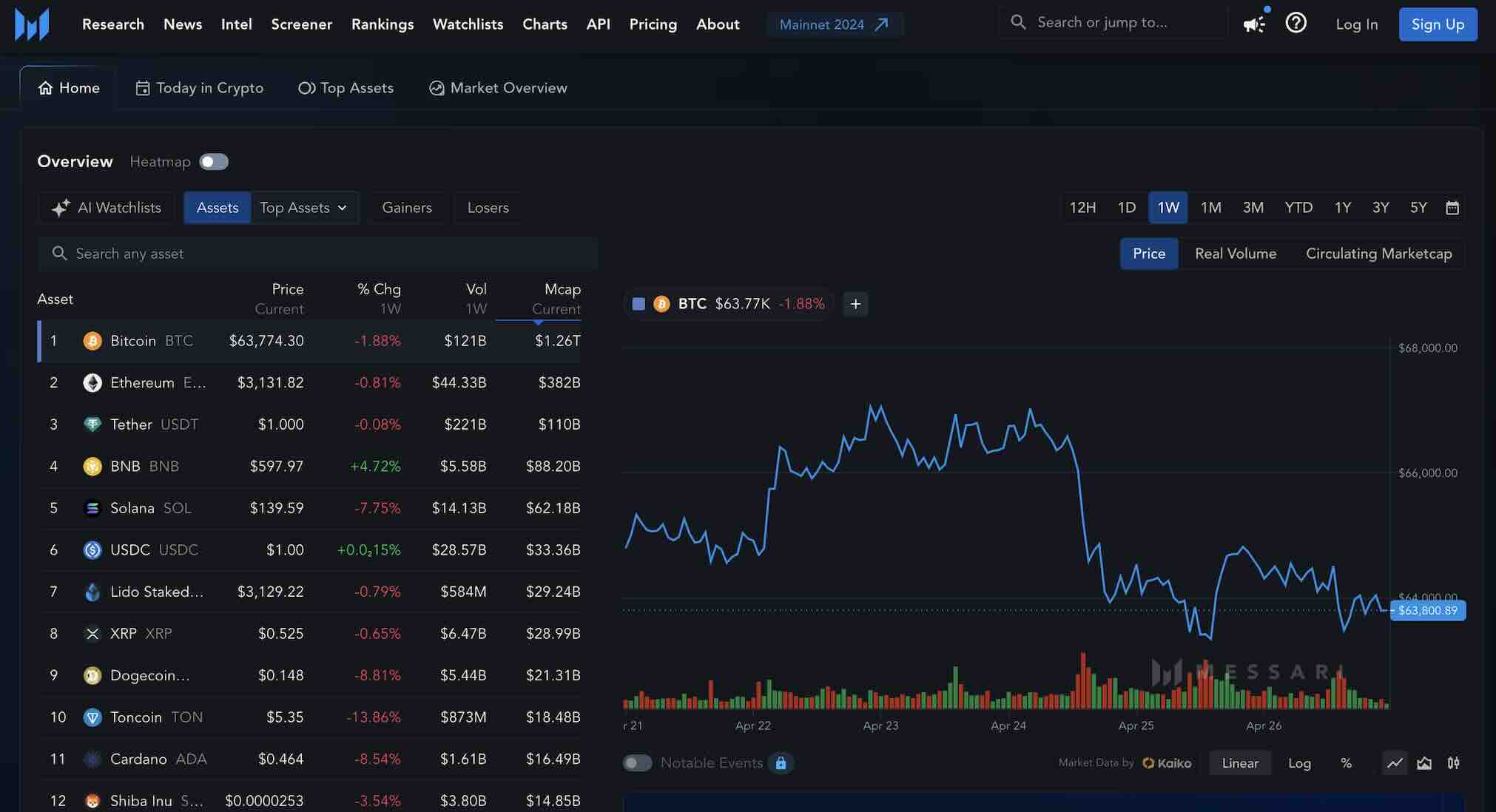

The crypto ecosystem is increasingly fragmented. Liquidity, opportunities, and volatility now exist across Ethereum, BNB Chain, Polygon, Solana, and dozens of emerging L1s and L2s. Relying on a single-chain bot means missing out on arbitrage and alpha scattered across networks. Multi-chain trading agents powered by AI can ingest both on-chain and off-chain data, analyze cross-chain market conditions in real time, and execute trades wherever the best edge exists, all without manual intervention.

CaffeineAI stands out for its rapid deployment capabilities and native support for decentralized protocols, letting you build, train, and deploy agentic bots that straddle both centralized exchanges and DeFi DEXs with minimal friction. The result: smarter risk management, higher win rates, and a portfolio that adapts to market microstructure shifts as they happen.

Essential Tools and Setup: From Zero to Trading Agent in Minutes

Before you write a single line of code, you’ll need to set up a modern development environment that supports both AI model training and blockchain interaction. Here’s a quick checklist to ensure you’re ready:

Once your environment is ready, follow these core steps:

- Install CaffeineAI SDK – Access the official documentation to initialize your project and connect to supported blockchains.

- Connect Data Sources – Integrate both on-chain (block explorer APIs) and off-chain (centralized exchange APIs) market data for a comprehensive trading view.

- Prepare API Keys – Securely store exchange API credentials and wallet keys for automated execution.

Building the AI Core: Market Prediction and Sentiment Analysis

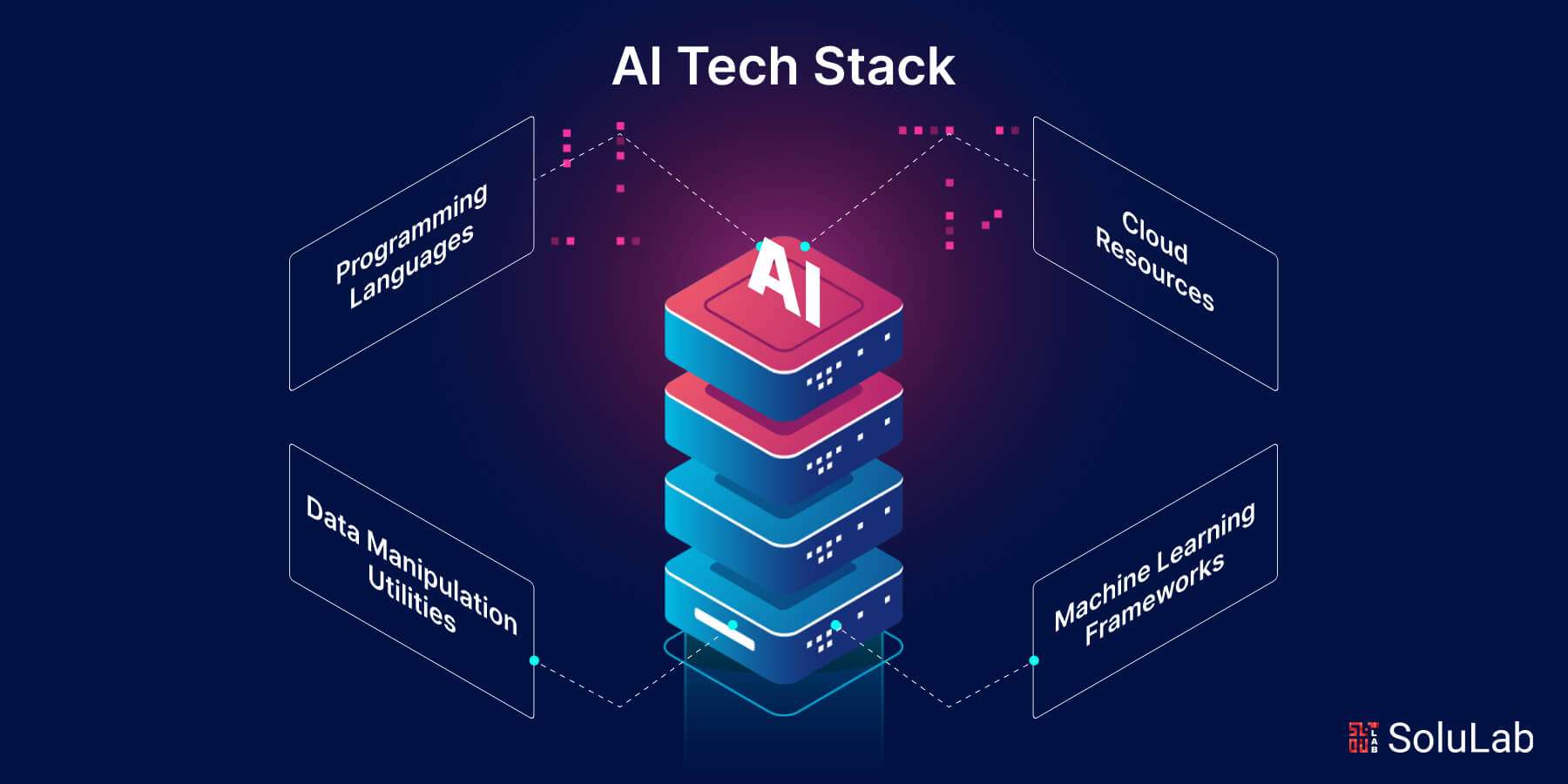

The true power of a multi-chain trading agent lies in its ability to synthesize massive datasets, price feeds, order books, historical trades, and even social sentiment, into actionable predictions. With CaffeineAI’s modular architecture, you can quickly:

Essential ML Models & NLP Techniques for Crypto Prediction

-

Long Short-Term Memory (LSTM) Networks: LSTMs are a type of recurrent neural network (RNN) highly effective for time-series forecasting in crypto markets. Their ability to capture long-term dependencies makes them a popular choice for price trend prediction using historical data.

-

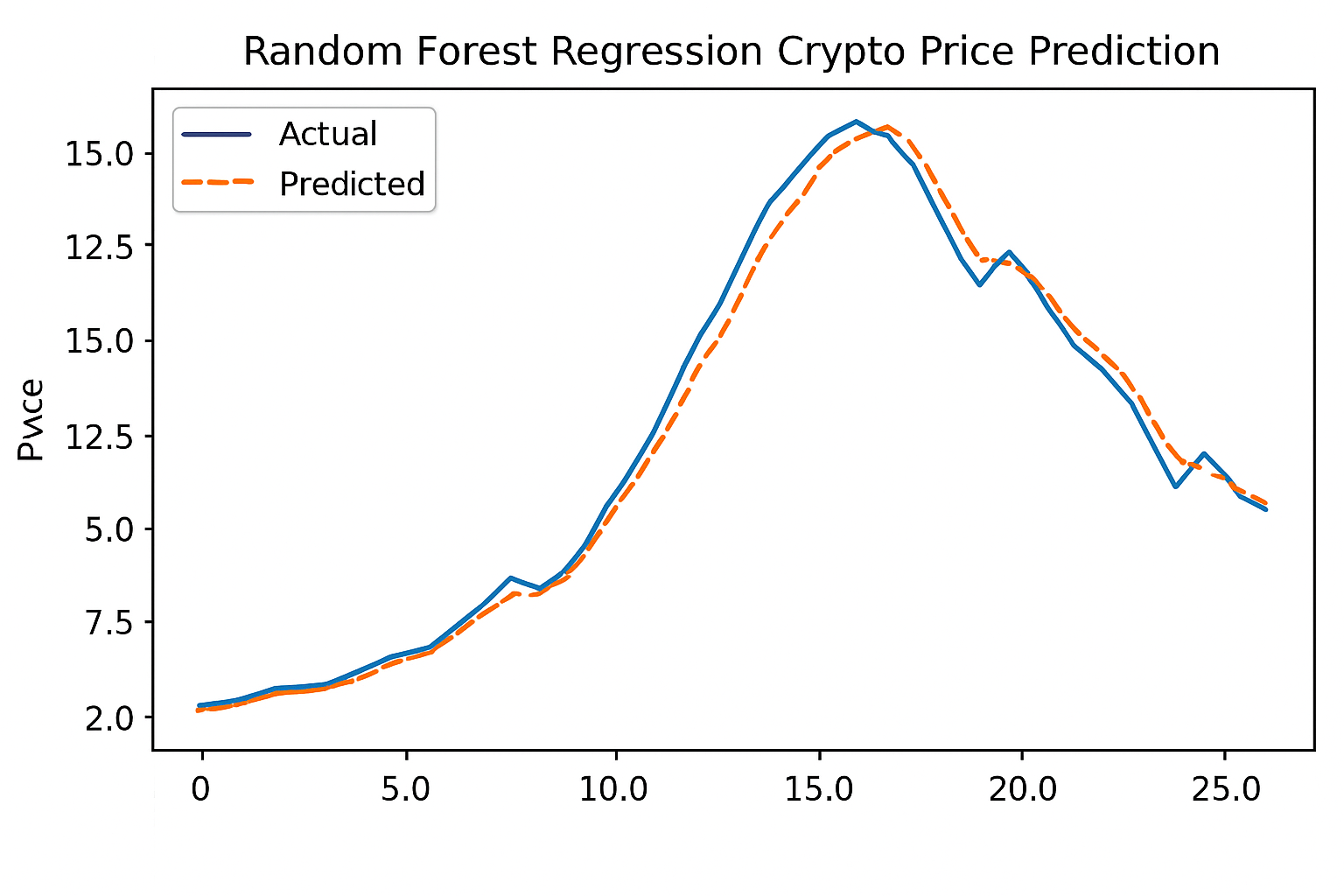

Random Forest Regression: This ensemble learning method is widely used for predicting asset prices and volatility. By aggregating multiple decision trees, Random Forest models can handle noisy crypto market data and improve prediction accuracy.

-

Transformer-Based NLP Models (e.g., BERT, GPT): Models like BERT and GPT are leveraged for natural language processing tasks such as sentiment analysis. These models analyze news, tweets, and social media to extract market sentiment signals that influence crypto prices.

-

Sentiment Analysis with VADER: VADER (Valence Aware Dictionary and sEntiment Reasoner) is a rule-based NLP tool optimized for social media text. It’s frequently used to gauge crypto market sentiment from platforms like Twitter and Reddit.

-

ARIMA (AutoRegressive Integrated Moving Average): ARIMA is a statistical model commonly applied for univariate time-series forecasting in crypto. It helps in modeling and predicting future price movements based on past price data.

For example, you might combine a recurrent neural network trained on historical price data with a transformer-based NLP model that ingests the latest news and Twitter sentiment. This dual-input approach allows your bot to react not only to technical indicators but also to the mood swings that drive short-term crypto volatility.

Integrating Real-Time Data: Cross-Chain Execution and Monitoring

After your AI models are in place, it’s time to hook into live data streams. Leading bots leverage integrations with platforms like Dexscreener for real-time DEX analytics and use WebSocket feeds for millisecond-level updates. The result? Your agent can spot arbitrage opportunities or momentum shifts across chains, sometimes before human traders even notice.

Backtesting is critical: run your strategy against historical data from multiple chains to validate performance. Once satisfied, deploy your agent with automated execution rules and set up dashboards for ongoing monitoring. For a deeper dive into pipeline architecture and implementation details, consult the Chainstack documentation.

With your multi-chain AI trading agent now live, you’re positioned to capture opportunities that single-chain bots simply can’t reach. But the real edge comes from continuous iteration and intelligent automation. Here’s how to maximize your bot’s performance and keep your stack resilient in the face of relentless crypto market evolution.

Optimizing and Scaling Your Multi-Chain Trading Agent

Don’t treat deployment as the finish line. The top-performing AI crypto trading bots are those that evolve with the market. Start by:

Top 5 Optimization Tactics for AI Multi-Chain Trading Agents

-

Leverage Real-Time On-Chain and Off-Chain Data Aggregation: Integrate data from major blockchains (e.g., Ethereum, Binance Smart Chain) and centralized exchanges like Binance to ensure your AI agent operates with the most current market information. Combining on-chain analytics with off-chain order book data enhances decision-making accuracy.

-

Utilize Advanced Machine Learning Models for Market Prediction: Employ established frameworks such as TensorFlow or PyTorch to train models on historical price data and patterns. Incorporate time-series forecasting and anomaly detection to anticipate market shifts across multiple chains.

-

Implement Sentiment Analysis Using NLP APIs: Integrate natural language processing tools like OpenAI GPT or Google Cloud Natural Language API to analyze news, social media, and community sentiment. This helps the trading agent respond to market-moving events in real time.

-

Automate Strategy Backtesting with Historical Multi-Chain Data: Use platforms such as Backtrader or QuantConnect to rigorously test trading strategies across historical datasets from multiple blockchains and exchanges. This ensures strategies are robust before live deployment.

-

Deploy and Monitor with Robust Infrastructure Tools: Utilize orchestration platforms like Docker for containerization and Grafana for real-time monitoring and alerting. This guarantees high availability and immediate insight into agent performance and anomalies.

Regularly retrain your models with fresh cross-chain data. Update your sentiment analysis pipelines to include emerging social channels and news sources. Monitor slippage, latency, and gas costs on each chain, and adjust execution logic to minimize unnecessary fees. The flexibility of CaffeineAI’s architecture means you can quickly iterate on both the AI and blockchain integration layers.

Security and Risk Management in Automated DeFi Trading

Security is non-negotiable. Multi-chain bots must manage private keys, API credentials, and transaction signing across diverse networks. Use hardware wallets or secure key vaults where possible, and never hardcode sensitive data. Implement circuit breakers that halt trading during anomalous market events or if the bot detects a deviation from expected performance metrics.

For more on best practices, the Prodigal AI Training Program offers in-depth modules on agent safety, data ingestion, and robust model deployment.

Measuring Success: Performance Tracking and Real-Time Analytics

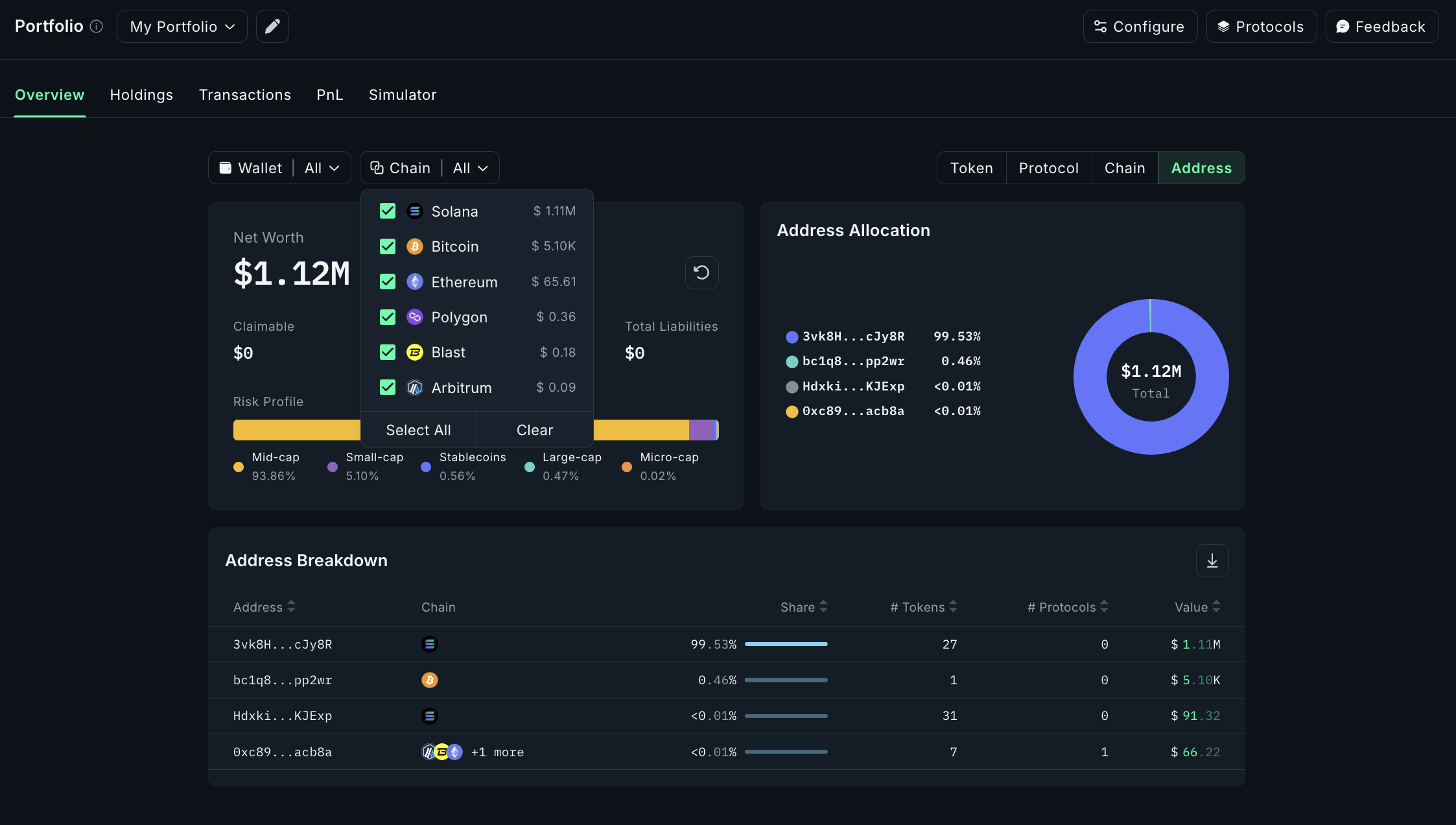

It’s not enough for your agent to trade; it must deliver measurable results. Set up a robust analytics dashboard to track:

- Net P and L by chain and strategy

- Sharpe and Sortino ratios for risk-adjusted returns

- Execution latency and fill rates

- Real-time alerts for slippage, failed transactions, and outlier trades

Review these metrics daily and use them to inform your next round of model tuning or strategy refinement. The most sophisticated agentic DeFi setups even use reinforcement learning to adjust risk parameters on the fly, based on live feedback loops.

Community, Collaboration, and Staying Ahead

The agentic DeFi landscape is moving at breakneck speed. Open-source communities and collaborative research are driving rapid improvements in model accuracy, execution efficiency, and cross-chain interoperability. Join forums, contribute to shared repos, and follow leading projects on GitHub and Twitter to ensure you’re always ahead of the curve.

For those eager to deepen their expertise, the Chainstack documentation remains a goldmine for advanced pipeline strategies, while CaffeineAI’s own resources are continually updated with new SDK features and integration guides.

Key Takeaways for Building Your Own Multi-Chain AI Crypto Trading Agent

- Speed matters: CaffeineAI lets you go from concept to live cross-chain trading in under an hour.

- Data is the edge: Ingest and process both on-chain and off-chain signals for holistic decision-making.

- Iterate relentlessly: The best agents learn, adapt, and improve every day.

As automated DeFi trading infrastructure matures, the winners will be those who combine AI-driven insights with multi-chain agility and a relentless focus on risk management. Whether you’re managing a personal portfolio or building the next generation of decentralized hedge funds, the time to experiment with multi-chain AI agents is now.