Imagine building a crypto trading bot that can hunt down yield opportunities, execute cross-chain swaps, and rebalance your DeFi portfolio, all without ever touching a line of code. In 2025, this scenario isn’t just possible; it’s the new normal. The rise of AI trading agents and no-code platforms is transforming how traders and DeFi enthusiasts automate complex strategies across multiple blockchains, making advanced AI crypto portfolio management accessible to everyone.

AI Trading Agents: The Engine Behind Cross-Chain DeFi Automation

At their core, AI trading agents are intelligent systems designed to analyze real-time market data, predict trends, and autonomously execute trades or manage assets. What sets today’s agentic DeFi tools apart is their ability to function across various blockchain ecosystems, think Ethereum, Solana, SUI, and beyond, without requiring users to code or manually bridge assets.

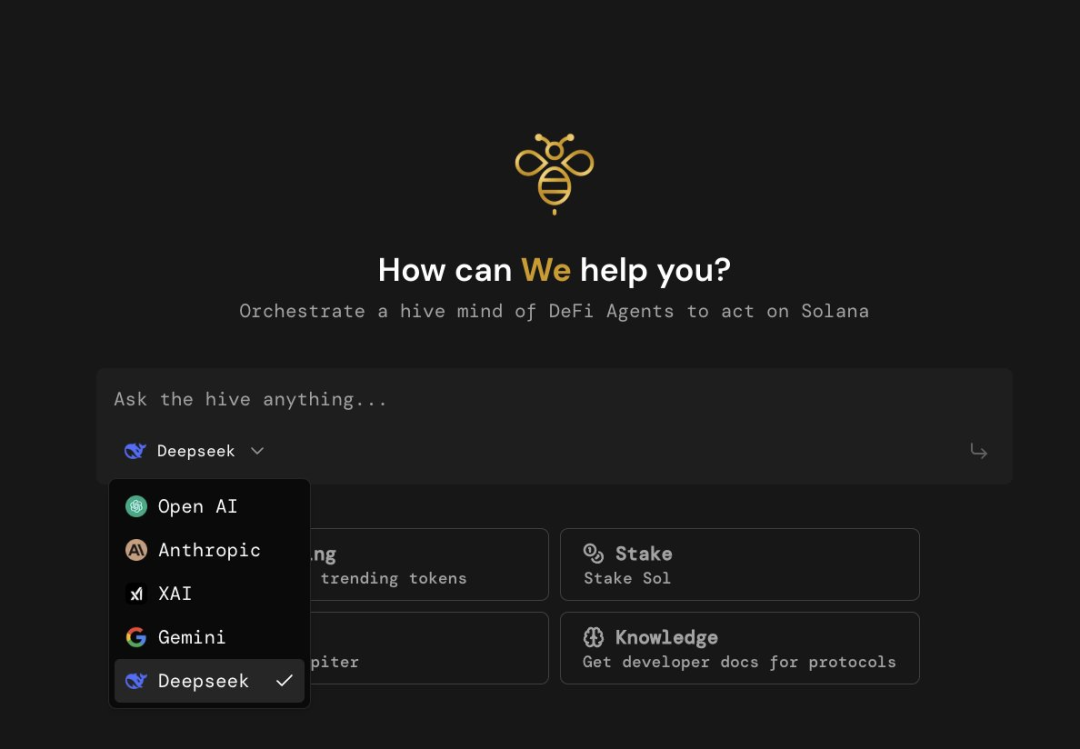

No-code platforms like Nexgent AI, Xade Finance, Cod3x, aiSUI, and Agentics are leading this revolution by offering intuitive drag-and-drop interfaces or natural language prompts. Users simply define their risk parameters, choose strategies (like automated yield farming or DeFi arbitrage bots), and let the AI agent handle the rest, monitoring liquidity pools, swapping tokens across chains, or reallocating assets for optimal returns.

No-Code Platforms: Democratizing Advanced DeFi Strategies

The biggest barrier in decentralized finance used to be technical complexity. Now, with no-code DeFi strategies powered by AI agents, even non-programmers can deploy sophisticated automated workflows. Here’s how these platforms make it possible:

Top No-Code AI Trading Agent Platforms for Cross-Chain DeFi

-

Nexgent AI: Build intelligent DeFi agents on Solana with over 100 customizable risk parameters, real-time on-chain data analysis, and sandboxed trade simulations. Integrates with Discord and Telegram for instant signal alerts.

-

Xade Finance: Deploy AI-driven cross-chain trading agents for automated swaps, liquidity pooling, and real-time market data. Features a mobile-first, no-code launcher and seamless cross-chain smart contract execution.

-

Cod3x: Automate DeFi tasks like lending, borrowing, staking, and asset management using personalized AI agents. The intuitive no-code interface understands user intent for streamlined financial automation.

-

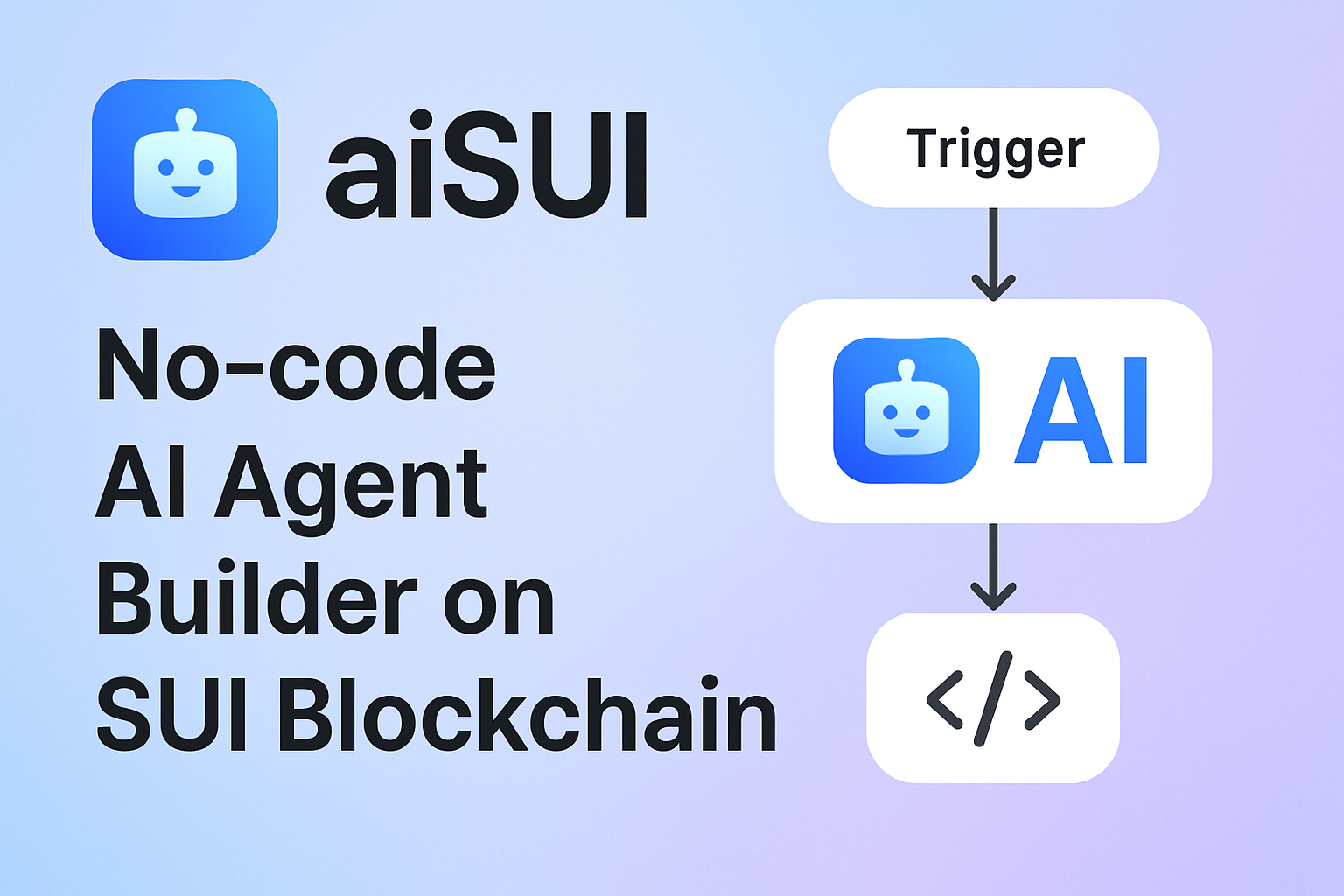

aiSUI: Create AI agents on the SUI blockchain using visual drag-and-drop tools and prebuilt templates. Supports cross-chain data integration and includes a comprehensive DeFi automation toolkit.

-

Agentics: No-code platform for automating Web3 workflows across major Layer 1 and Layer 2 blockchains. Features natural-language agent creation, reusable workflow templates, and interoperability for trading, analytics, and risk monitoring.

Nexgent AI lets users configure over 100 risk parameters on the Solana blockchain and test strategies in a live-simulated environment before deploying real funds. Xade Finance integrates seamless cross-chain swaps and liquidity pools into its mobile-first interface, ideal for those wanting on-the-go control over multi-chain assets. Cod3x takes intent-based automation further by letting users instruct agents in plain English to execute tasks like lending or staking across protocols.

The result? More people can participate in complex strategies such as cross-chain arbitrage or automated yield farming without hiring developers or learning Solidity.

How Cross-Chain Automation Works (and Why It Matters)

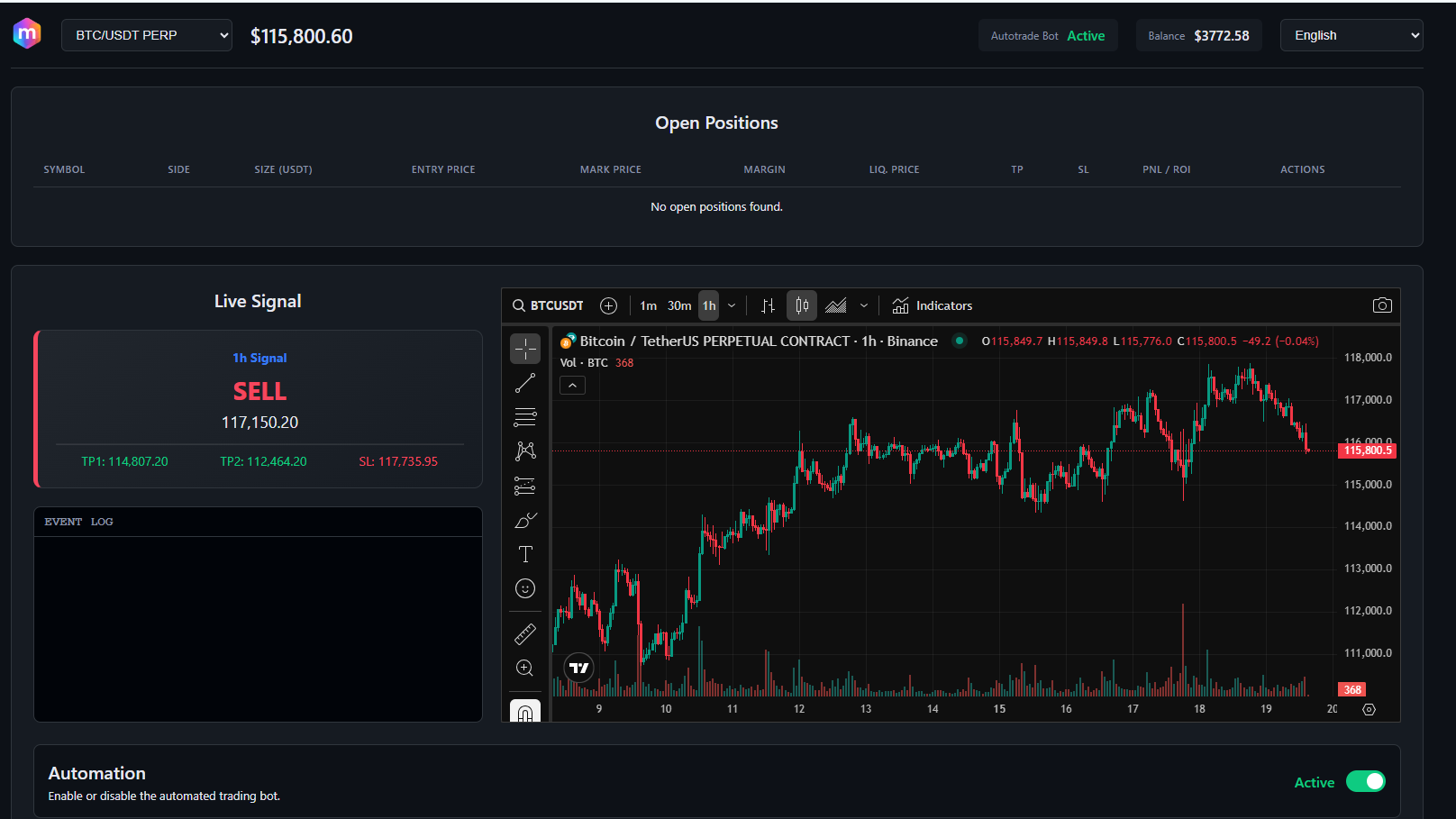

Behind the scenes, these agentic DeFi tools leverage machine learning models that continuously monitor on-chain data, wallet flows, token price action, liquidity shifts, and act instantly when opportunities arise. For example:

- DeFi Arbitrage Bots: Spot price discrepancies between DEXs on different chains and execute simultaneous trades to capture risk-free profits.

- Automated Yield Farming: Move assets between liquidity pools on Solana and Ethereum as APYs fluctuate in real time.

- Risk Management: Enforce strict stop-losses or rebalancing thresholds so your portfolio stays within defined tolerances, even while you sleep.

This level of automation is only possible because today’s platforms support true cross-chain interoperability, and because the agents themselves can process market signals far faster than any human trader could hope to match.

What’s especially compelling is how AI trading agents have evolved to support not just multi-chain execution, but also personalized strategy optimization. Platforms like Nexgent AI and Xade Finance let you fine-tune agent behavior with granular controls, think portfolio rebalancing triggers, custom risk scores, and intent-based commands that adapt as market conditions change. The result is a DeFi toolkit that’s both powerful and approachable, regardless of your technical background.

Real-World Impact: From Passive Income to Pro-Level Arbitrage

AI-powered cross-chain automation isn’t just about convenience; it’s about unlocking new revenue streams and protecting capital in volatile markets. Consider these practical use cases:

- Automated yield farming: Your agent can migrate liquidity between pools on SUI, Solana, or Ethereum based on real-time APY changes, no more chasing yields manually or missing out on spikes.

- DeFi arbitrage bots: When a token trades at a premium on one chain versus another, the bot executes atomic swaps to capture the spread instantly.

- Portfolio hedging: Agents monitor wallet flows and price action to rebalance into stablecoins or alternative assets when volatility surges.

This isn’t theoretical. Traders are already using no-code agents to outperform manual strategies, sometimes even while they sleep. As one user noted on social media, “My AI bot caught an arbitrage spread I would’ve missed overnight. ”

Are you currently using any no-code AI trading bots for DeFi strategies?

No-code AI trading agents are making it easier than ever to automate DeFi strategies across multiple blockchains—no coding skills required. Platforms like Nexgent AI, Xade Finance, Cod3x, aiSUI, and Agentics are leading the way. We’d love to know:

Security and Transparency: Do No-Code AI Bots Reduce Risk?

No-code platforms are built with security in mind, often running agents in sandboxed environments before live deployment. This means you can simulate strategies using virtual funds, minimizing the risk of costly errors. Plus, leading solutions like Nexgent AI offer real-time alerts via Discord or Telegram so you’re always in the loop when your agent acts on your behalf.

The transparency of open-source smart contracts and auditable agent logs further boosts trust, essential for anyone automating significant capital across chains. Still, it’s crucial to vet each platform’s security practices and understand their risk management features before committing real funds.

Getting Started: Building Your First Cross-Chain AI Trading Agent

If you’re ready to experiment with agentic DeFi tools yourself, here’s a high-level roadmap:

Most platforms offer free trials or testnets so you can configure strategies without risking capital. Start small, define clear goals (yield farming vs arbitrage), set your risk parameters conservatively, and monitor early results closely before scaling up.

The Future of Automated Crypto Portfolio Management

The convergence of cross-chain interoperability and no-code AI automation is leveling the playing field for retail traders and institutions alike. As these tools mature, with smarter agents, richer data feeds, and broader protocol integrations, we’ll see even more sophisticated automated strategies become accessible at the click of a button.

The bottom line? If you want sharper entries, passive income streams, or pro-level portfolio management without hiring a developer or learning Solidity from scratch, the future is already here. The only question left: How will you put your first agent to work?