Building a multi-chain AI trading agent has never been more accessible, thanks to the rapid evolution of platforms like CaffeineAI. Whether you’re a developer aiming to deploy autonomous bots across multiple blockchains or a DeFi trader seeking to automate strategies with real-time intelligence, CaffeineAI’s on-chain APIs and agent frameworks open up a new frontier in crypto trading automation. In this step-by-step guide, we’ll break down the essential phases of building your own multi-chain AI trading bot, highlighting practical tools, best practices, and the latest innovations that are revolutionizing automated DeFi trading infrastructure.

Why Multi-Chain Matters for AI Trading Agents

The decentralized finance landscape is inherently fragmented. Liquidity pools, arbitrage opportunities, and price signals often exist simultaneously across Ethereum, Solana, BNB Chain, and emerging networks. A single-chain bot can only exploit a fraction of the market. By contrast, a multi-chain AI trading bot leverages cross-network data and executes trades wherever the edge is greatest, maximizing capital efficiency and risk-adjusted returns.

CaffeineAI stands out by offering on-chain APIs that can be called directly from smart contracts or dApps. This not only reduces latency but also enables seamless integration with decentralized exchanges (DEXs), lending protocols, and even NFT marketplaces across chains. The result? An LLM-powered trading agent capable of adapting to market shifts in real time, without being siloed to one ecosystem.

Setting Up Your Development Environment

Your journey begins with creating an environment conducive to both experimentation and robust deployment. Here’s what you’ll need:

Essential Tools for Building Multi-Chain AI Agents with CaffeineAI

-

CaffeineAI SDK: The official CaffeineAI SDK offers robust APIs for integrating AI agents directly with on-chain protocols, enabling seamless multi-chain trading operations.

-

Python: The Python programming language is widely used for developing AI models and agent logic, thanks to its rich ecosystem of libraries like Pandas, NumPy, and scikit-learn.

-

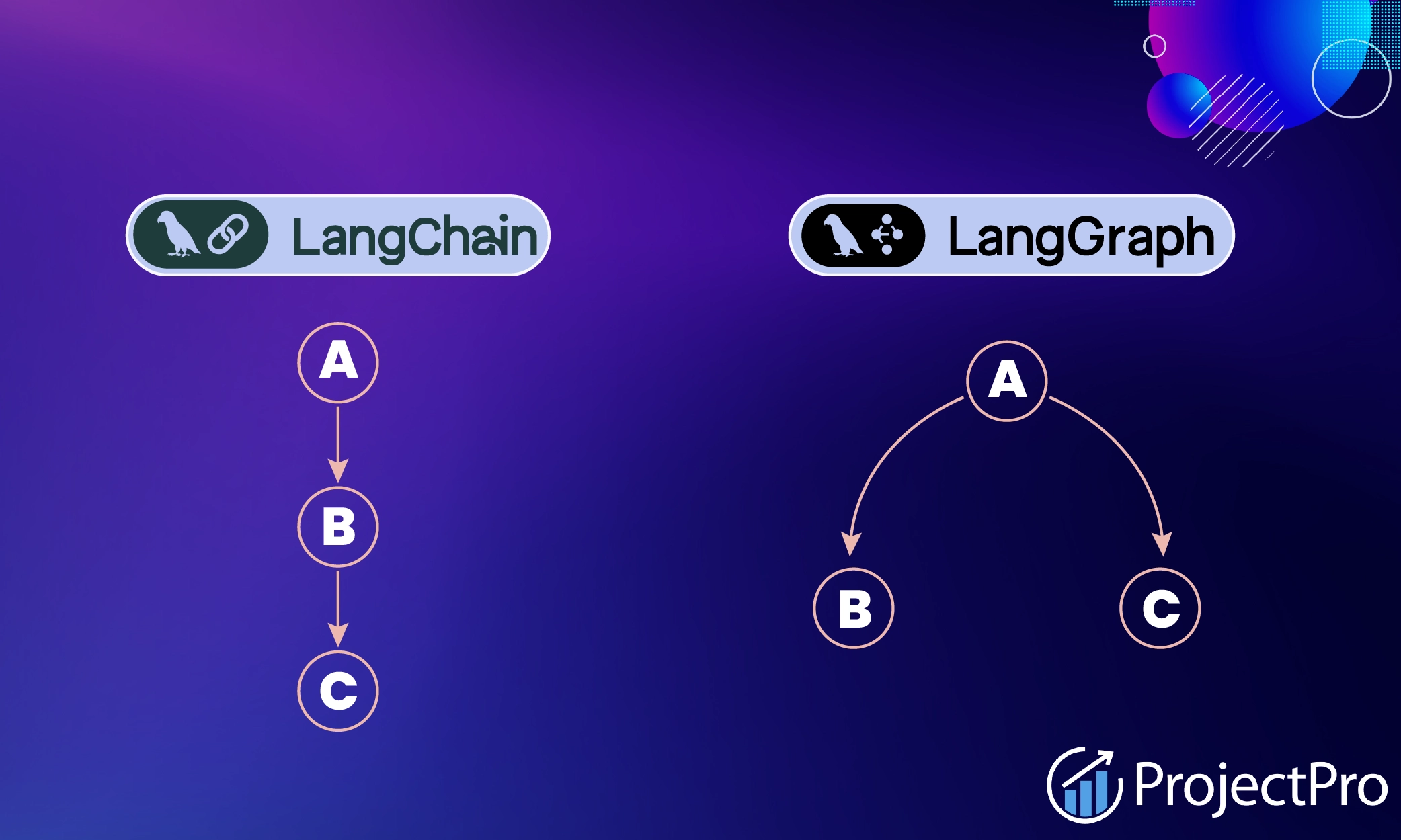

LangGraph by LangChain: LangGraph is a framework for designing, mapping, and managing complex AI agent workflows, making it easier to build modular, multi-agent systems.

-

Binance API: The Binance API provides real-time market data and trading capabilities, essential for executing trades across major crypto assets.

-

MetaMask: MetaMask is a trusted crypto wallet and gateway for interacting with multiple blockchain networks, crucial for managing agent transactions and on-chain deployments.

-

Node.js: Node.js enables efficient backend development for agent orchestration, smart contract interaction, and real-time data processing in multi-chain environments.

-

Docker: Docker containers ensure consistent development and deployment environments for AI agents, reducing compatibility issues across systems.

-

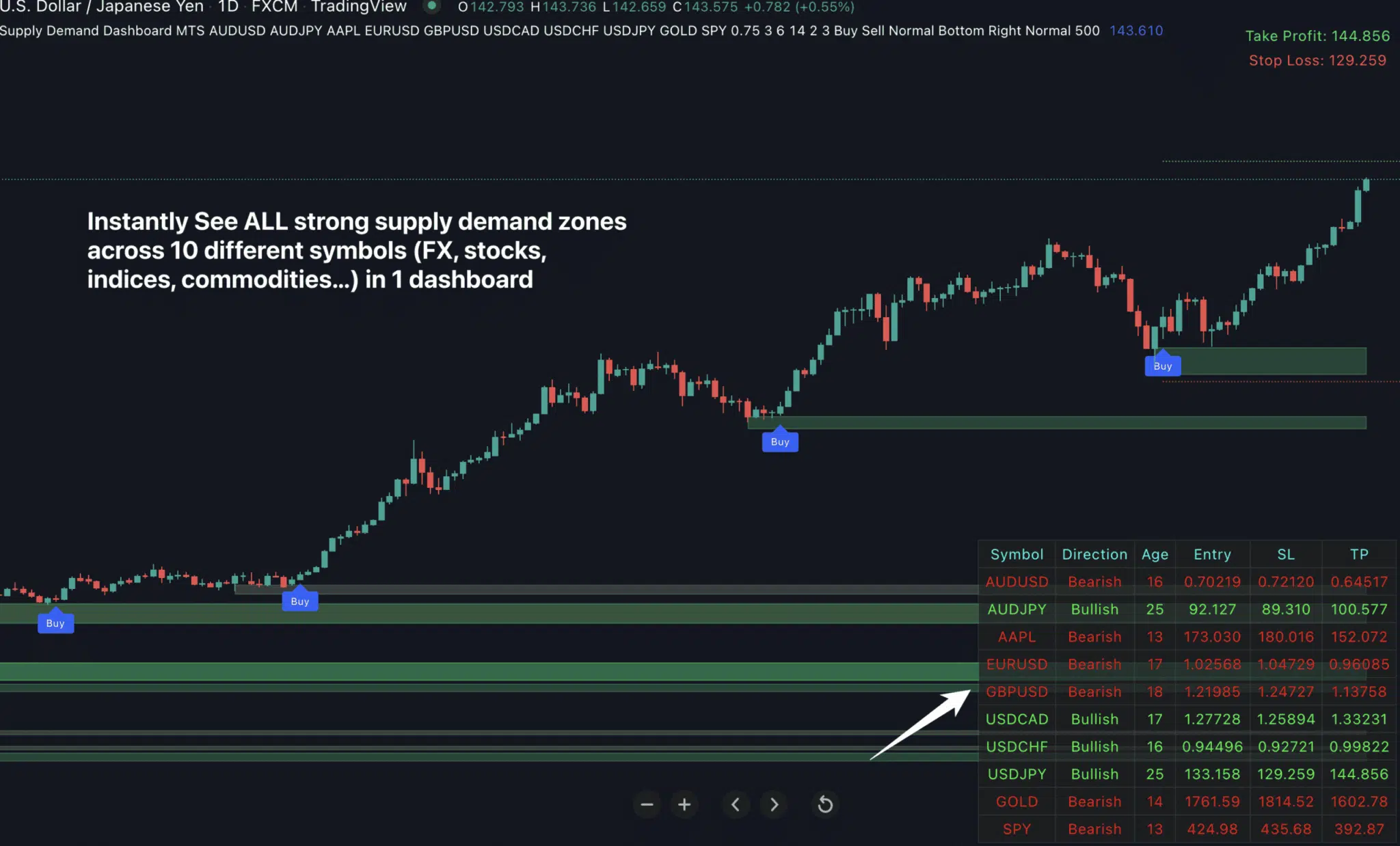

TradingView: TradingView offers advanced charting tools and market analysis integrations, which can be leveraged for AI-driven trading strategies.

Key steps include:

- Install Node. js and Python: Most open-source AI agents are built using these languages for their extensive library support.

- Create wallet credentials: Secure wallets on each target chain (e. g. , MetaMask for EVM chains, Phantom for Solana).

- Access CaffeineAI’s SDK and API keys: Sign up on their portal to obtain your developer credentials.

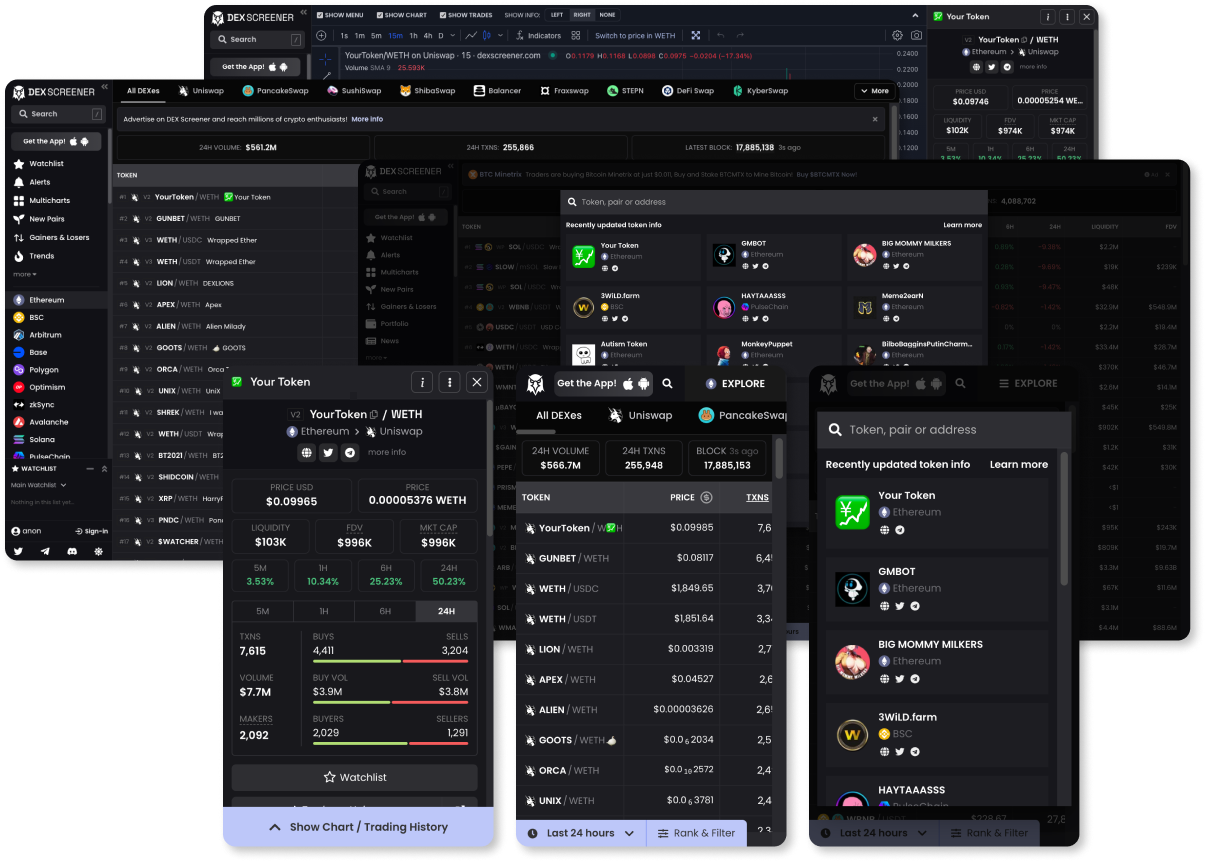

- Select your data sources: Integrate with DEX screener APIs oracles (for live order book data), price feeds, and historical datasets.

This foundation allows you to prototype strategies locally before deploying them as on-chain agents via CaffeineAI’s infrastructure.

Coding Your First Multi-Chain Trading Strategy

The core advantage of CaffeineAI lies in its ability to abstract away much of the blockchain-specific complexity. Using their SDKs and pre-built modules, you can focus on strategy logic rather than low-level protocol quirks. For example:

- Arbitrage bots: Simultaneously monitor token prices across Uniswap (Ethereum), PancakeSwap (BNB Chain), and Raydium (Solana) to capture price discrepancies within seconds.

- Lending/borrowing agents: Automatically rebalance positions based on yield rates across Aave, Compound, or Solend.

- NFT sweepers: Aggregate floor prices from OpenSea and Magic Eden to execute cross-market flips powered by predictive models.

The backbone of these strategies is robust integration with live market data feeds, something that CaffeineAI streamlines through unified endpoints. For advanced users, plugging in custom LLM models enables context-aware decision making: think sentiment analysis from Twitter feeds or predictive volatility forecasting using historical price action.

Navigating Live Deployment and Risk Controls

No automated system is complete without rigorous risk management protocols. Before going live:

- Test your agent in simulated environments using historical data replay features built into most SDKs.

- Set up granular stop-losses and circuit breakers based on real-time volatility thresholds.

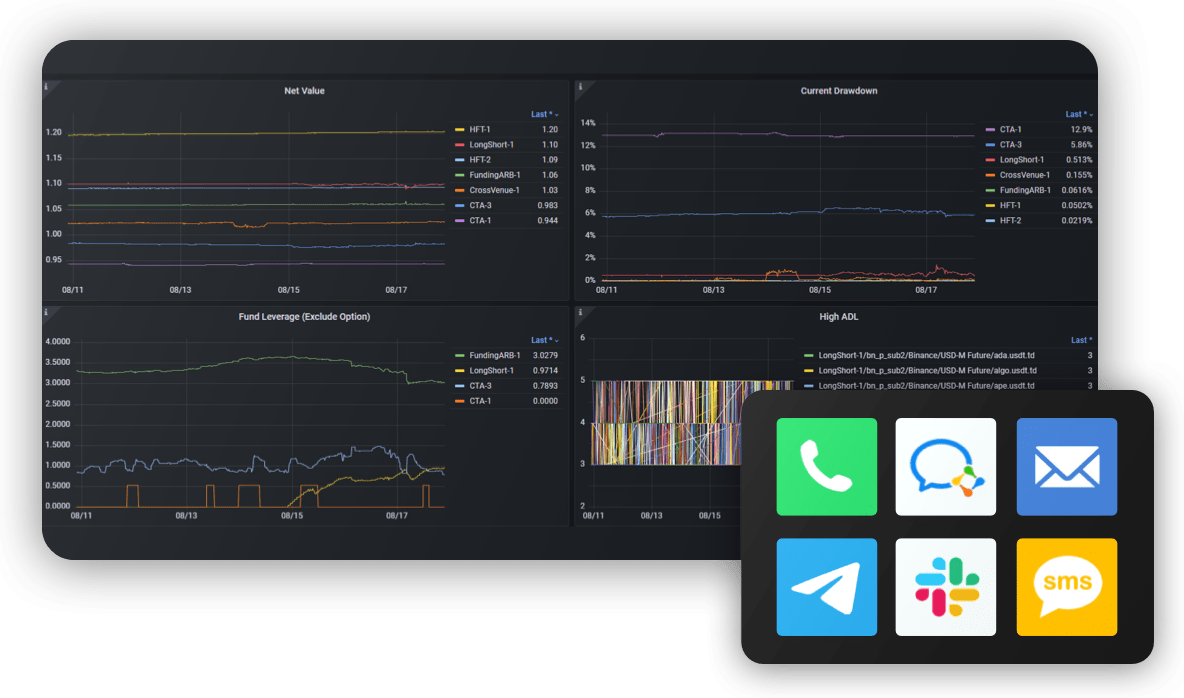

- Utilize logging dashboards provided by CaffeineAI for transparency into every trade execution and model prediction event.

Once your agent has passed simulated stress tests, it’s time to deploy into production. CaffeineAI’s on-chain deployment tools make it straightforward to launch agents on multiple networks, giving you the flexibility to toggle strategies or update models without downtime. Automated DeFi trading infrastructure is only as strong as its monitoring, so leverage CaffeineAI’s real-time analytics and alerting features to stay ahead of unexpected market events.

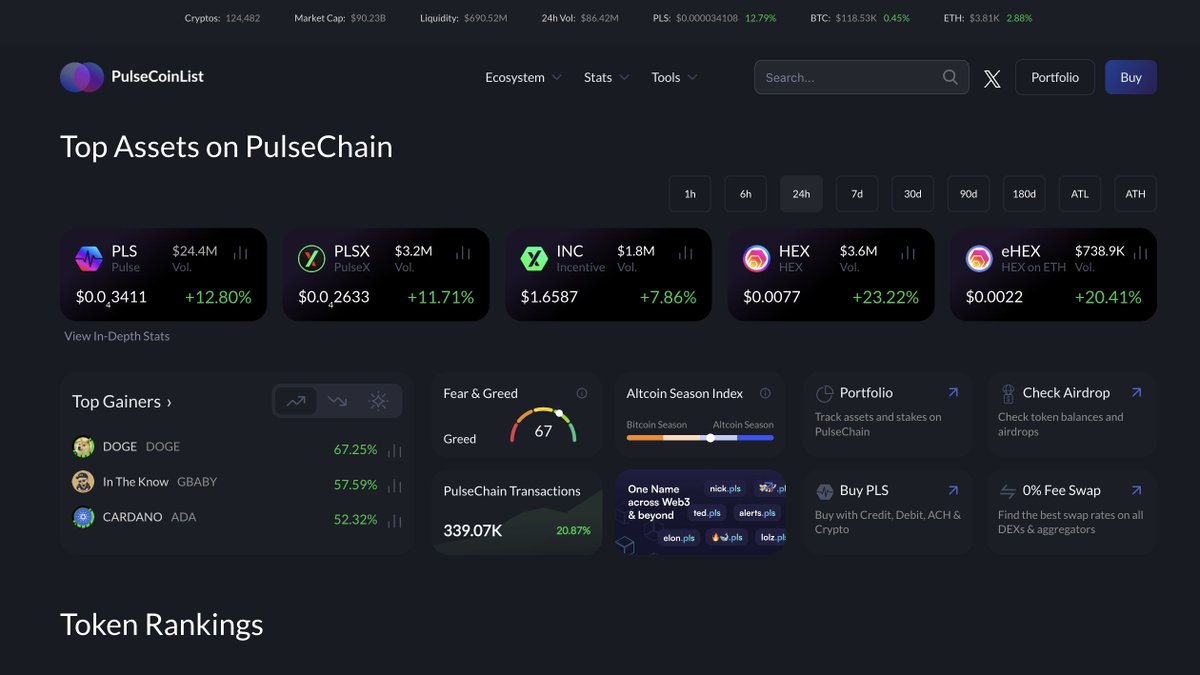

Integrating Dexscreener and Real-Time Data APIs

One of the most powerful features for any multi-chain AI trading bot is seamless access to live market data. By integrating with platforms like Dexscreener, your agent can monitor liquidity, slippage, and price action across hundreds of pools in real time. This enables dynamic strategy adjustment, such as pausing trades during periods of high volatility or routing orders through the most cost-efficient path.

Key Benefits of Dexscreener & Live Data Feeds in CaffeineAI

-

Real-Time Market Insights: Integrating Dexscreener provides your CaffeineAI agent with up-to-the-second price, volume, and liquidity data across multiple decentralized exchanges, enabling more accurate and timely trading decisions.

-

Enhanced Multi-Chain Coverage: Live data feeds allow your agent to monitor and analyze assets across various blockchain networks, ensuring comprehensive market coverage and seamless multi-chain trading strategies.

-

Automated Strategy Adaptation: Access to continuous, live market data empowers AI agents to dynamically adjust trading strategies based on the latest trends, volatility, and liquidity shifts, reducing manual intervention and improving performance.

-

Improved Risk Management: Real-time alerts and analytics from integrated data feeds help your agent identify unusual market movements or potential risks instantly, allowing for proactive risk mitigation.

-

Seamless Integration with CaffeineAI APIs: Dexscreener and live data feeds can be directly accessed via CaffeineAI’s on-chain APIs, enabling developers to build responsive, data-driven trading agents within smart contracts and dApps.

For those looking to push the frontier further, connecting sentiment analysis modules or on-chain anomaly detectors can give your agent an edge in anticipating market swings before they become obvious on price charts.

Best Practices for Scaling and Security

As you scale up from a single-agent prototype to a swarm of autonomous bots, operational resilience becomes critical. Here are some best practices:

- Decentralize execution: Distribute agents across different cloud regions or nodes to minimize single points of failure.

- Rotate keys regularly: Periodically update API keys and wallet credentials to mitigate risk from potential breaches.

- Audit smart contracts: Run formal verification tools on any custom logic deployed via CaffeineAI’s APIs.

- Monitor gas usage: Optimize transaction batching and fee estimation for cost efficiency across chains.

This layered approach ensures your automated DeFi trading infrastructure remains robust, even as trading volumes spike or network conditions shift unexpectedly.

Community Insights: Learning from Builders

The multi-chain AI trading space is evolving rapidly, with new frameworks and best practices emerging almost weekly. Engaging with the broader builder community, whether through Discord channels, Twitter spaces, or hackathons, can accelerate your learning curve. Many developers share open-source code snippets, troubleshooting tips, and live demos that can save you hours (or days) when debugging complex cross-chain logic.

The future of crypto portfolio management will be shaped by these collaborative efforts. Whether you’re iterating on a simple arbitrage script or architecting an LLM-powered agent swarm, leveraging resources like CaffeineAI’s tutorial series puts you at the forefront of decentralized automation. As always in DeFi: experiment boldly, but deploy cautiously, and let volatility become your opportunity engine.