The landscape of decentralized finance (DeFi) trading is undergoing a seismic shift, as agentic AI trading systems rapidly outpace the static bots of yesterday. In 2025, on-chain DeFi agents are no longer just tools for automating simple buy-sell triggers; they are becoming fully autonomous decision-makers capable of adaptive strategy, real-time risk management, and cross-chain execution. This evolution is not merely incremental. It marks a fundamental change in how market participants harness technology to manage risk and pursue yield across the ever-expanding crypto ecosystem.

From Static Trading Bots to Adaptive Agents

Traditional crypto trading bots were rule-bound executors: they followed pre-programmed scripts, such as buying Ethereum when its price dipped below a certain threshold or rebalancing a portfolio at set intervals. These bots offered automation but lacked the ability to adapt to rapidly changing market conditions or learn from new data. As a result, their performance was often hampered during periods of volatility or unexpected events.

Agentic AI trading agents represent a leap forward. Unlike their predecessors, these systems leverage advanced machine learning and reinforcement learning techniques to analyze vast amounts of on-chain and off-chain data in real time. For example, while an old-school bot might trigger an action when Bitcoin hits $119,440.00 (the current price as of October 2,2025), an agentic AI would also consider liquidity flows, protocol health metrics, sentiment analysis, and even macroeconomic signals before executing trades or reallocating assets.

Autonomous Yield Optimization and Strategy Evolution

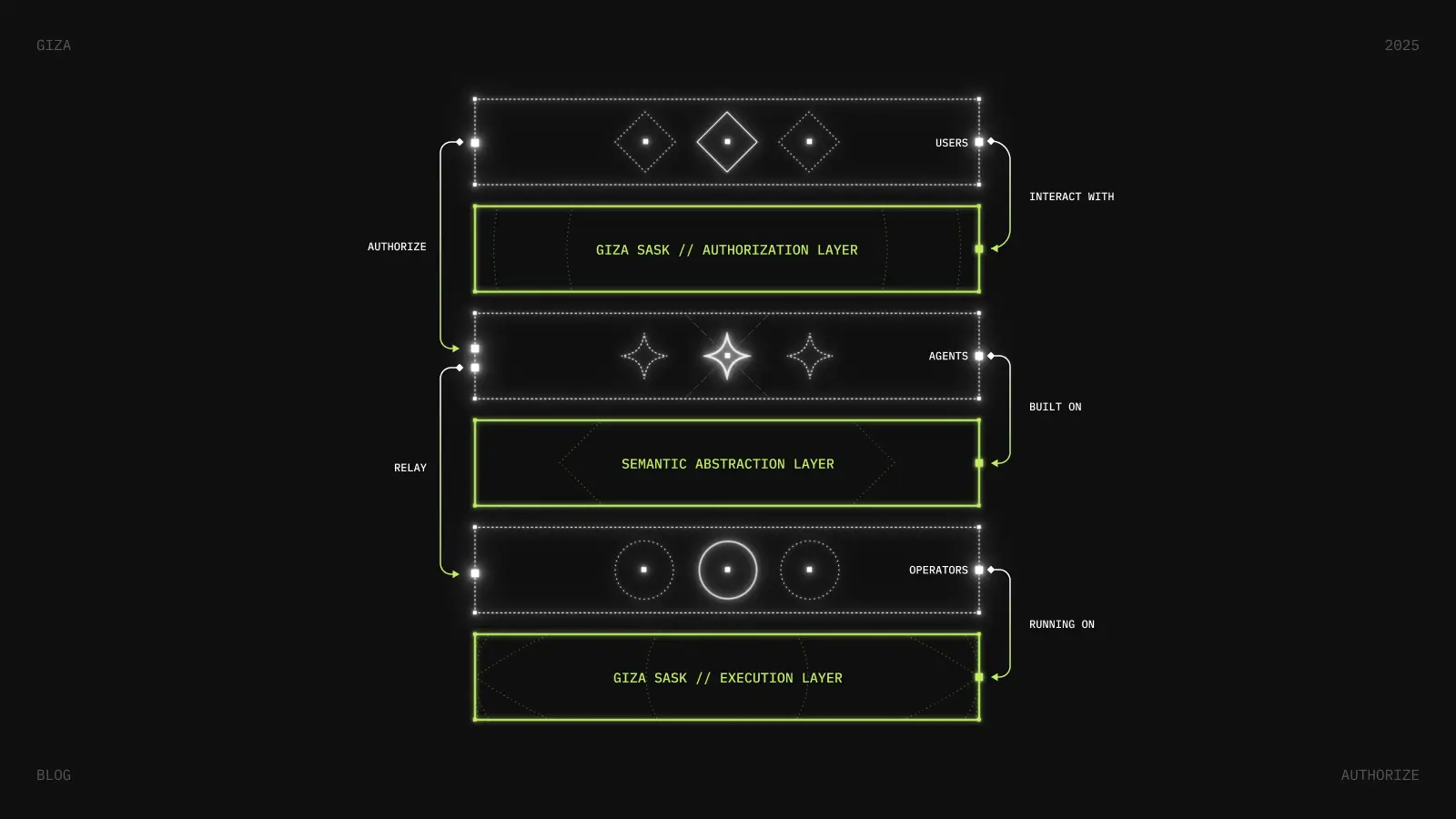

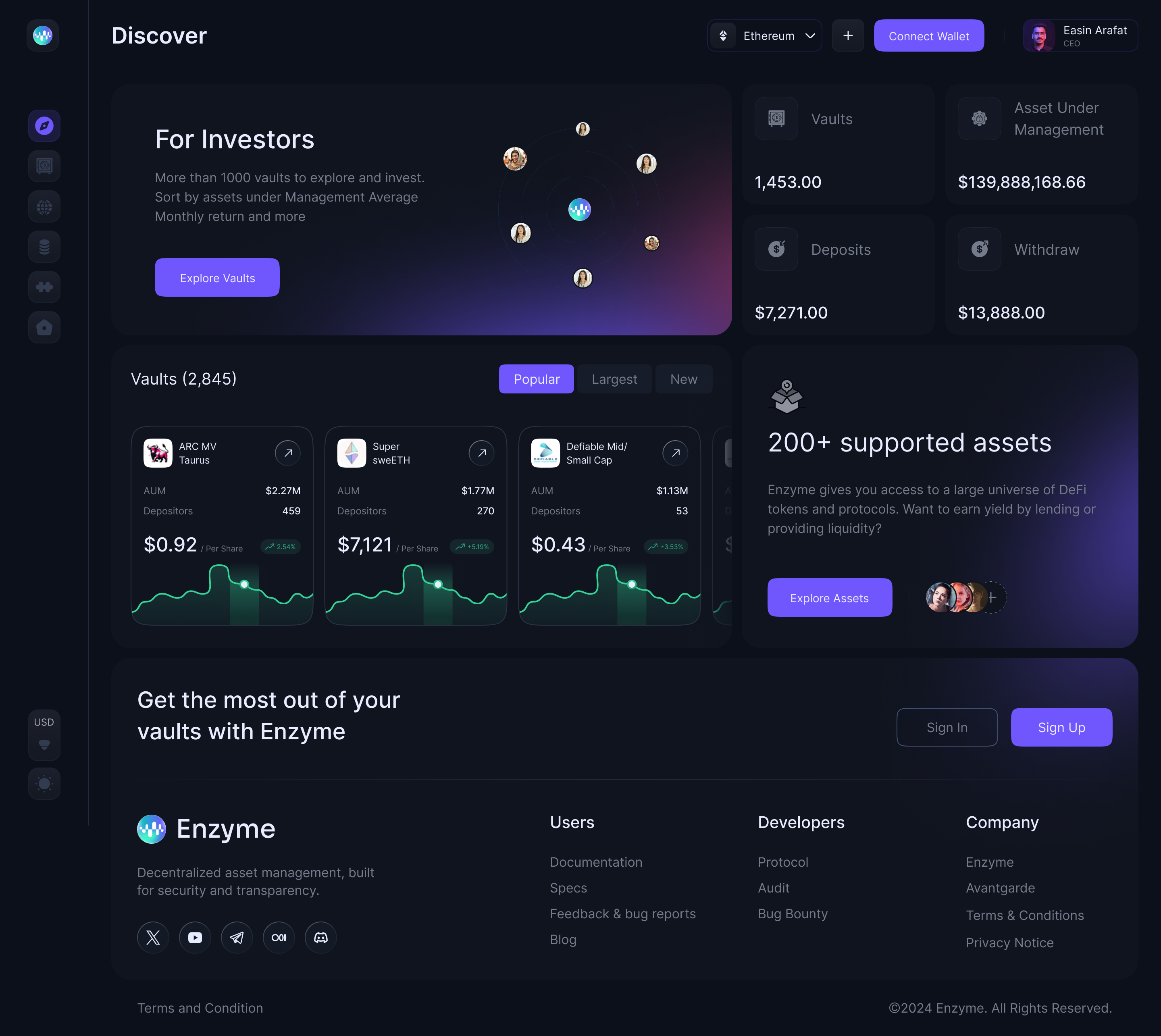

The hallmark feature of today’s autonomous crypto trading bots is their capacity for continuous yield optimization without user intervention. Platforms like DeFiMatrix have pioneered agents that monitor DeFi markets across multiple blockchains, dynamically adapting strategies based on historical performance and live data feeds. These agents can switch between lending protocols, identify optimal liquidity pools for staking Ethereum (currently priced at $4,405.97), or even execute complex cross-chain arbitrage – all autonomously.

A recent case study highlights this transformation: Giza’s ARMA agent on Base blockchain executed 2,400 transactions over a single weekend, moving $2.15 million in value and delivering an 83% yield increase compared to static positions (source). This level of performance would be unattainable with legacy bots that lack adaptive intelligence.

Advanced Risk Management: Beyond Simple Stop-Losses

Risk management has long been a weak point for automated DeFi strategies reliant on fixed logic. Agentic AI changes this paradigm by integrating real-time protocol health monitoring, impermanent loss mitigation strategies, circuit breakers for extreme volatility events, and automatic diversification across assets and protocols (source). Instead of simply setting stop-losses or liquidation thresholds based on price alone – such as exiting ETH if it falls below $4,282.72 – these agents assess protocol-specific risks (like smart contract vulnerabilities), track network congestion metrics, and react instantly to emerging threats.

Ethereum (ETH) Price Prediction 2026-2031

Professional outlook based on 2025 market data, agentic AI integration, and evolving DeFi trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $5,200 | $6,250 | +18% | AI-driven DeFi continues to grow, but volatility remains high; regulatory clarity is moderate |

| 2027 | $4,000 | $6,000 | $7,500 | +15% | Wider agentic AI adoption fuels bullish sentiment, ETH 2.0 scaling boosts DeFi TVL |

| 2028 | $4,750 | $7,200 | $9,000 | +20% | Mainstream institutional adoption of DeFi, ETH faces competition from L2s and alt L1s |

| 2029 | $5,500 | $8,300 | $11,500 | +15% | Global regulations stabilize, agentic AI becomes standard for portfolio management |

| 2030 | $6,000 | $9,700 | $13,250 | +17% | Cross-chain DeFi matures, ETH remains dominant settlement layer, AI agents drive volume |

| 2031 | $7,000 | $11,200 | $15,500 | +15% | AI-powered DeFi fully integrated; ETH faces strong but manageable competition, robust ecosystem |

Price Prediction Summary

Ethereum is poised for significant growth from 2026 to 2031, driven by the proliferation of agentic AI in DeFi trading, increasing on-chain activity, and continued technological innovation. While volatility and competition persist, ETH’s role as a foundational DeFi asset and its integration with advanced AI agents suggest a positive long-term price trajectory. Average prices are projected to rise steadily, with bullish scenarios pushing highs above $15,000 by 2031.

Key Factors Affecting Ethereum Price

- Adoption and maturation of agentic AI in DeFi trading (yield optimization, risk management, cross-chain arbitrage)

- Technological upgrades (Ethereum scaling, L2 integration, interoperability)

- Regulatory developments and global acceptance of DeFi protocols

- Institutional and mainstream investor participation

- Competition from alternative L1s and L2s (Solana, Base, etc.)

- Macro market cycles and crypto-specific bull/bear trends

- ETH’s evolving utility as a gas token and settlement layer for DeFi/AI applications

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

User Control Meets Full Autonomy

The best on-chain DeFi agents blend autonomy with transparency and user-defined constraints. Users can set parameters around acceptable risk levels or pause agent activity during periods of uncertainty while still benefiting from automated optimization in normal conditions (source). Every action taken by these agents is logged on-chain with full audit trails and explanatory notes – a significant step forward in building trust around transparent trading bots operating in permissionless environments.

Transparency is not just a buzzword in the agentic AI era, it’s a core feature underpinning user trust and regulatory compliance. Modern adaptive trading agents provide granular, on-chain audit trails that allow users to review every trade, strategy shift, and risk mitigation maneuver. This level of explainability is especially important for institutional investors and sophisticated DeFi users seeking hedge fund strategies within decentralized markets. It also means retail traders can confidently delegate portfolio management to AI while retaining oversight through real-time dashboards and customizable reporting tools.

Cross-Chain Arbitrage and Liquidity Optimization

One of the most disruptive capabilities unlocked by autonomous crypto trading bots in 2025 is seamless cross-chain arbitrage. By constantly scanning liquidity pools across Ethereum (currently at $4,405.97), Base, and emerging L2s, agentic AI can identify fleeting price discrepancies, executing trades in milliseconds to capture risk-adjusted returns that static bots routinely miss. Liquidity optimization goes hand-in-hand: agents rebalance assets across protocols to maximize yield, factoring in gas costs, slippage, and evolving APYs.

“The rise of agentic AI means your portfolio can move capital from an underperforming lending pool on Ethereum directly into a higher-yield vault on another chain, without you lifting a finger. “

Key Benefits of Adaptive AI Agents in DeFi Trading

-

Continuous Yield Optimization: Adaptive AI agents, such as those on DeFiMatrix, autonomously monitor multiple chains and dynamically adjust strategies to maximize yield. This proactive management ensures portfolios are always aligned with the best market opportunities, eliminating the need for constant user intervention.

-

Superior Trading Performance: Platforms like Giza’s ARMA have demonstrated an 83% increase in yield on DeFi lending markets versus static bots. These agents efficiently execute thousands of trades, swiftly capitalizing on market fluctuations for improved returns.

-

Advanced Risk Management: Modern AI agents integrate real-time protocol health checks, automated diversification, impermanent loss mitigation, and volatility circuit breakers. These intelligent safeguards help protect portfolios from sudden market shifts and systemic risks.

-

Cross-Chain Arbitrage and Liquidity Optimization: Adaptive agents autonomously identify price discrepancies across blockchains and execute cross-chain trades, while reallocating assets to pools with higher yields. This maximizes returns and enhances overall portfolio efficiency.

-

User Control and Transparency: Despite their autonomy, AI agents like those on DeFiMatrix allow users to set parameters, pause activity, and audit every on-chain action. Transparent reporting and real-time decision explanations ensure users maintain oversight and trust.

Performance Metrics: Real-World Results from Agentic AI

The data-driven edge provided by these systems is now measurable at scale. For example, Giza’s ARMA agent did not just outperform static bots by executing more trades; it demonstrated nuanced decision-making, timing entries and exits based on live protocol health checks and sentiment signals. In today’s market, where Bitcoin stands at $119,440.00, these agents are uniquely positioned to exploit volatility spikes or capitalize on new yield opportunities as they arise.

Users are increasingly leveraging advanced DeFi backtesting frameworks, allowing them to simulate how an agent would have performed under historical market conditions before deploying real capital. This empowers both retail traders and institutional allocators to optimize parameters for their unique risk profiles.

Challenges Ahead: Security and Evolving Best Practices

Despite their promise, adaptive trading agents introduce new risks that must be managed proactively. Malicious smart contracts or flash loan exploits could still threaten even the smartest bots if security best practices are not rigorously followed. Developers are responding with multi-layered threat detection systems and ongoing audits, but users should remain vigilant about setting appropriate permissions and regularly reviewing agent actions.

The competitive landscape is also intensifying as open-source frameworks democratize access to powerful agentic AI models. Expect rapid innovation, but also increased scrutiny, as more capital flows into autonomous systems managing billions in total value locked (TVL).

The Road Ahead for Agentic AI Trading in DeFi

The integration of agentic AI trading into DeFi marks a pivotal moment for digital finance. With Ethereum at $4,405.97 and Bitcoin at $119,440.00 as of October 2,2025, the stakes have never been higher, or the opportunities richer, for those able to harness adaptive intelligence at scale.

As these technologies mature, expect even greater synergy between user intent and machine execution, where portfolios are managed around the clock with minimal intervention but maximum transparency. Whether you’re seeking smarter yield generation or robust risk controls rivaling traditional hedge funds, adaptive on-chain DeFi agents are poised to become indispensable tools for the next era of crypto investing.