AI-powered trading bots have become the cornerstone of modern DeFi yield farming, empowering both newcomers and advanced investors to maximize returns with minimal manual oversight. As the decentralized finance landscape matures in 2024, automation is no longer a luxury but a necessity for navigating rapid market shifts and complex protocols. The best AI crypto bots for yield farming combine intelligent decision-making, robust risk controls, and seamless integration across DeFi ecosystems, delivering consistent results even as volatility spikes.

Why AI Trading Bots Are Essential for DeFi Yield Farming in 2024

The explosive growth of DeFi has unlocked lucrative yield opportunities, but it has also introduced unprecedented complexity. Manual strategies often fail to keep pace with real-time APY changes, impermanent loss risks, and shifting liquidity incentives. AI-driven DeFi portfolio management bridges this gap by analyzing on-chain data, predicting trends, and executing trades or reallocations 24/7, freeing users from constant monitoring.

This new generation of autonomous DeFi yield optimization tools leverages machine learning to:

- Identify high-yield pools as soon as they emerge

- Dynamically rebalance assets based on market signals

- Mitigate risks like rug pulls and impermanent loss

- Compound returns automatically for exponential growth

The Top 5 AI-Powered Trading Bots for Automated DeFi Yield Farming in 2024

After a rigorous review of performance metrics, security audits, and user feedback, we’ve curated the definitive list of the top 5 AI-powered trading bots for automated DeFi yield farming in 2024. Each stands out for its unique approach to automation, transparency, and reliability.

Top 5 AI-Powered DeFi Yield Farming Bots in 2024

-

Unibot: Unibot is a leading DeFi trading bot renowned for its lightning-fast execution and deep integration with decentralized exchanges (DEXs) like Uniswap. With over $994.93M in lifetime trading volume, it offers advanced automation, copy trading, and portfolio management tools for maximizing yield with minimal manual effort.

-

WunderTrading AI Bot: WunderTrading’s AI Bot leverages statistical arbitrage and machine learning to automate trading strategies across multiple DeFi protocols. It enables users to diversify portfolios, manage risk, and benefit from real-time AI-driven signals, making it a strategic tool for both novice and experienced yield farmers.

-

Harvest Finance Auto-Compounder: Harvest Finance offers an auto-compounder that automatically harvests and reinvests yield farming rewards across supported pools. Its AI-powered optimization algorithms help users maximize returns while minimizing gas fees and manual intervention, all within a secure, audited platform.

-

Yearn Finance Vaults (yVaults): Yearn Finance’s yVaults are smart, automated strategies that deploy user funds into the most profitable DeFi opportunities. Powered by community-developed AI and automation, yVaults optimize yield, manage risk, and auto-compound earnings for hands-off DeFi investing.

-

Autonio NIOX Trading Suite: The Autonio NIOX Trading Suite delivers a comprehensive set of AI-powered DeFi trading tools, including automated market making, yield optimization, and portfolio analytics. Its intuitive interface and robust automation make it a popular choice for both professional and retail DeFi users.

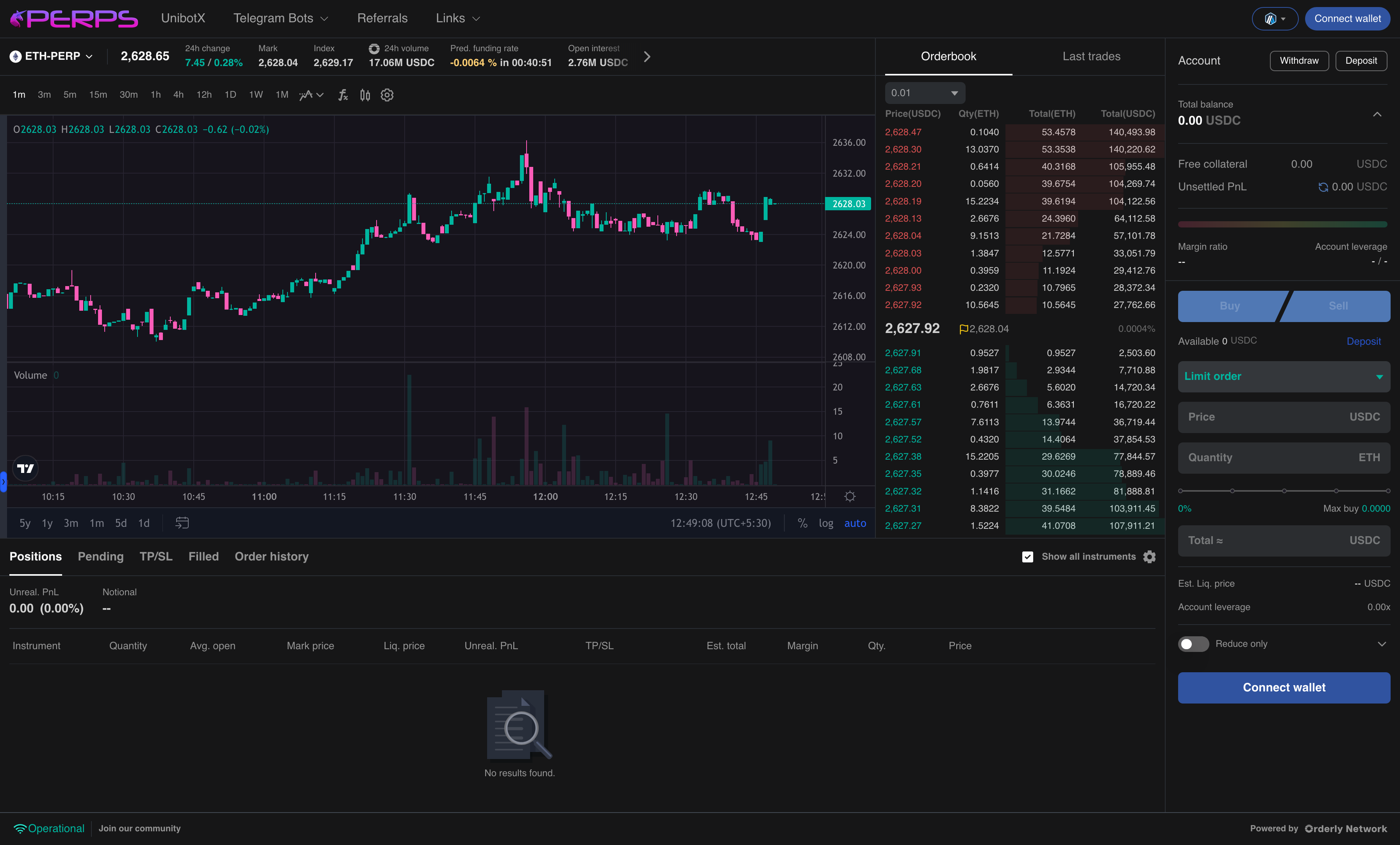

1. Unibot: The DEX Powerhouse With $994.93M in Lifetime Volume

Unibot has cemented its reputation as one of the most reliable DEX trading bots on the market, confidently holding seventh place by lifetime trading volume among all DEX bots at $994.93M. Its intuitive interface allows users to automate token swaps across leading decentralized exchanges (DEXs), optimize gas fees through batching transactions, and leverage advanced sniping features to capture fleeting arbitrage opportunities. Unibot’s robust community support and transparent reporting make it a favorite among active traders seeking an edge in fast-moving markets.

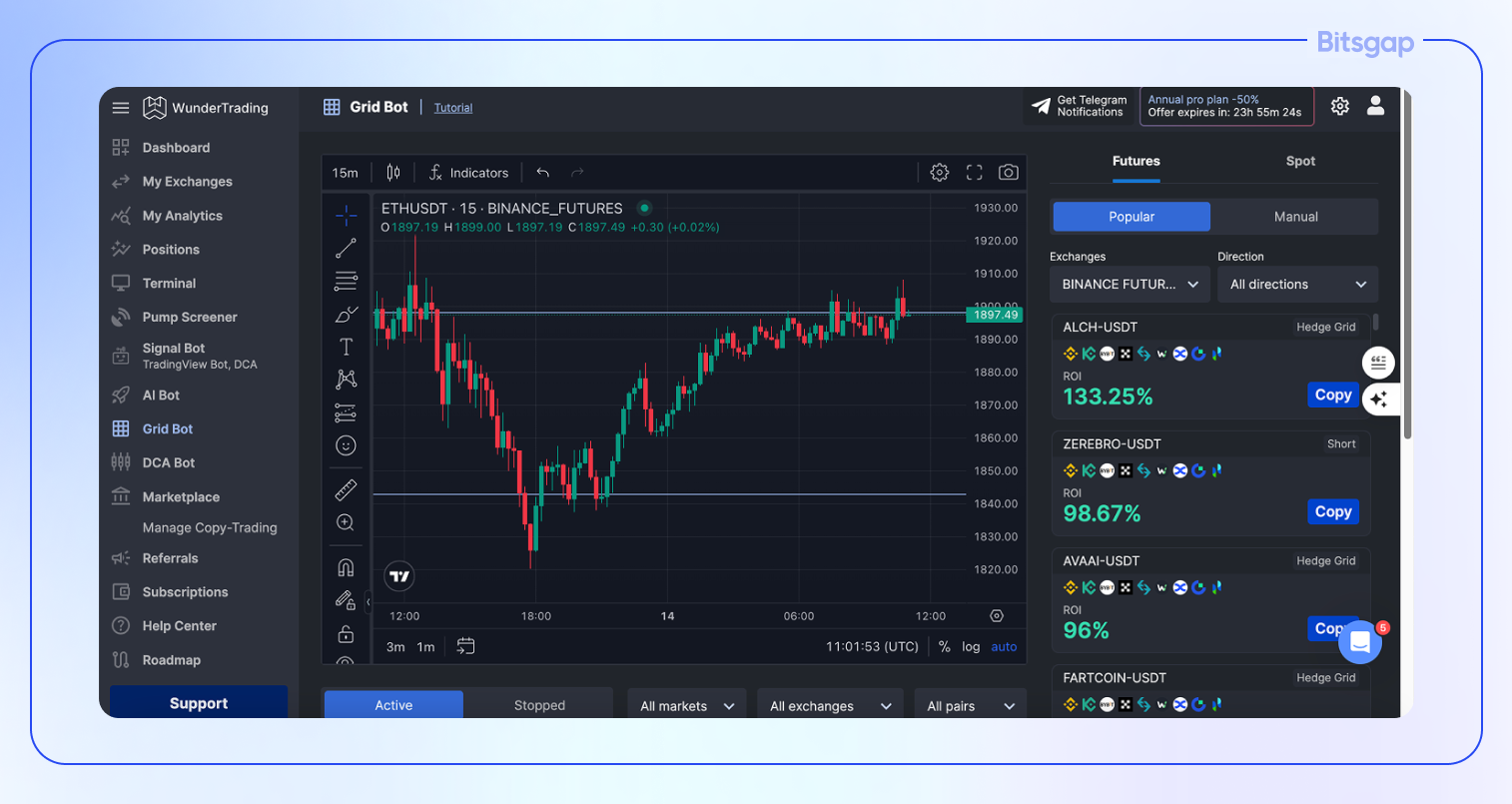

2. WunderTrading AI Bot: Diversified Statistical Arbitrage Engine

The WunderTrading AI Bot brings sophisticated statistical arbitrage strategies to decentralized finance. By continuously monitoring price discrepancies across multiple platforms and asset pairs, it dynamically regulates portfolio composition, ensuring optimal exposure while minimizing risk. Its automated reinvestment engine compounds earnings efficiently without user intervention. For those prioritizing diversification within their automated DeFi trading solutions in 2024, WunderTrading is a standout choice.

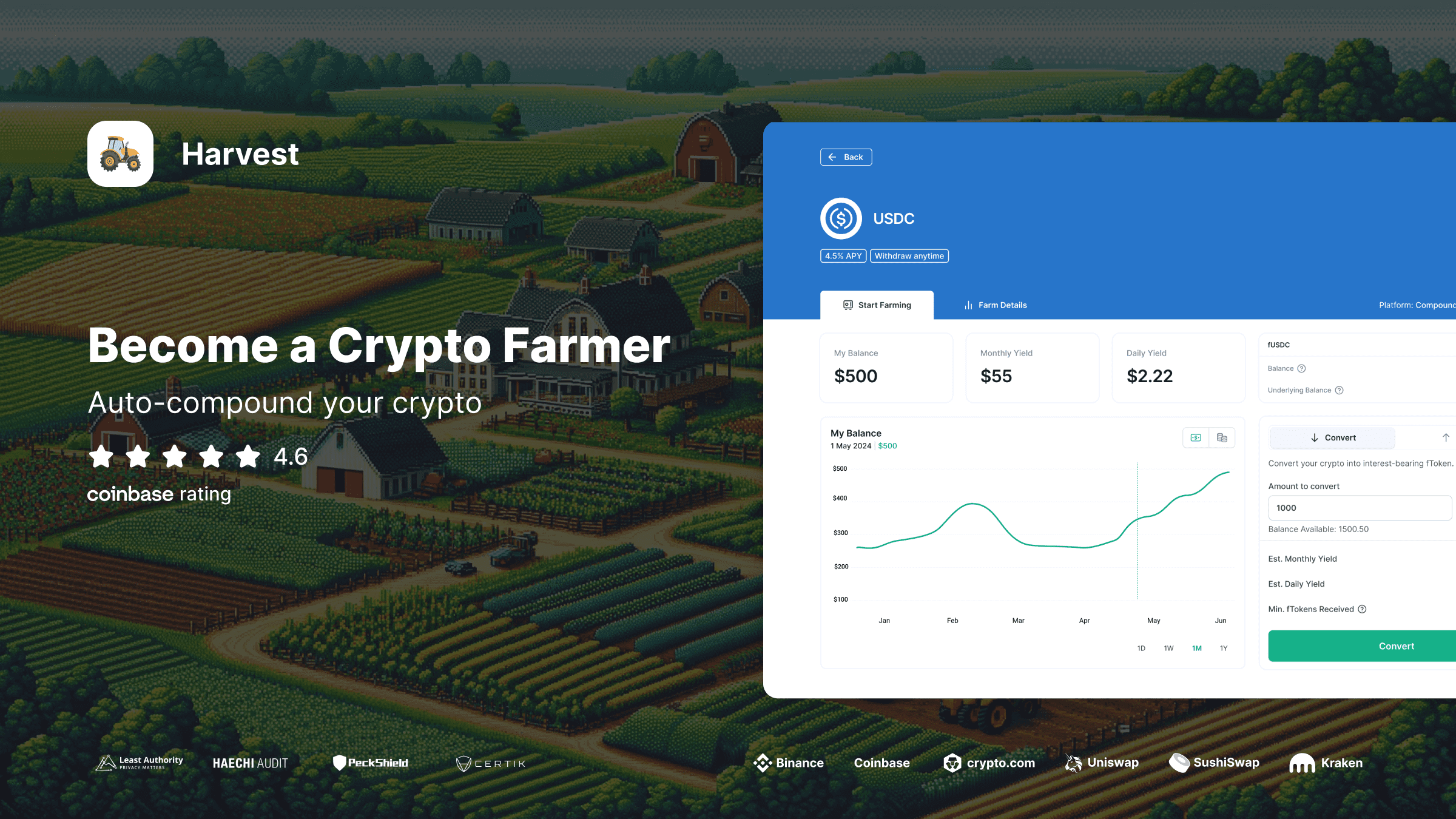

3. Harvest Finance Auto-Compounder: Set-and-Forget Yield Maximization

Harvest Finance’s Auto-Compounder is designed for hands-off investors who want their assets working around the clock. This bot intelligently harvests rewards from supported pools and reinvests them back into those pools at optimal intervals, maximizing compounding effects over time. With rigorous security audits and an active governance community backing its smart contracts, Harvest Finance remains a trusted name among passive income seekers.

The Next Generation of Autonomous Yield Optimization Tools

The sophistication of today’s best AI trading bots for DeFi yield farming lies not only in their algorithms but also in their ability to adapt to evolving market conditions without human bias or fatigue. As we continue exploring these innovations, including Yearn Finance Vaults (yVaults) and Autonio NIOX Trading Suite, you’ll see how agentic automation is redefining what’s possible for crypto portfolio management this year.

4. Yearn Finance Vaults (yVaults): AI-Enhanced Strategies for Sustainable Yield

Yearn Finance’s yVaults have set the gold standard for intelligent, automated yield farming since their inception. In 2024, these vaults are more powerful than ever, leveraging AI to dynamically allocate capital across a curated selection of DeFi strategies. Each yVault aggregates user deposits and routes them through algorithmically optimized protocols, swapping, staking, and compounding rewards to maximize returns while minimizing risks like impermanent loss or protocol exploits. The system’s adaptive logic means users benefit from the latest yield opportunities without having to chase trends or manually rebalance portfolios. For those seeking a truly autonomous DeFi yield optimization experience, yVaults remain a top-tier solution.

5. Autonio NIOX Trading Suite: Customizable AI Bots for Every DeFi Trader

The Autonio NIOX Trading Suite brings flexibility and sophistication to the world of AI trading bots for DeFi yield farming. Designed with both beginners and algorithmic traders in mind, NIOX offers modular tools for building, backtesting, and deploying custom trading strategies powered by machine learning. Its suite includes automated liquidity mining bots, portfolio rebalancers, and arbitrage agents that integrate seamlessly with major DEXs and liquidity pools. The platform’s transparent fee structure and open-source ethos foster trust within its growing user base. For traders who want granular control over their automation, without sacrificing the intelligence of AI-driven insights, Autonio is an essential addition to any DeFi toolkit.

Choosing the Right AI Bot for Your Yield Farming Goals

Selecting the best bot depends on your risk tolerance, desired level of involvement, and preferred protocols. Unibot excels at active trading on DEXs with high volume; WunderTrading AI Bot shines in statistical arbitrage; Harvest Finance Auto-Compounder is ideal for set-and-forget compounding; Yearn yVaults offer diversified hands-off optimization; Autonio NIOX provides deep customization for advanced users.

| Bot Name | Best For | Key Feature | Security |

|---|---|---|---|

| Unibot | DEX trading and sniping | $994.93M volume Advanced automation |

KYC-free Transparent reporting |

| WunderTrading AI Bot | Diversified arbitrage portfolios | Statistical arbitrage Auto-reinvestment |

Audited smart contracts Risk controls |

| Harvest Finance Auto-Compounder | Passive investors Compounding yields |

Automated reward harvesting Set-and-forget simplicity |

Rigorous audits Active governance community |

| Yearn Finance Vaults (yVaults) | Diversified hands-off farming | AI-enhanced strategy allocation Adaptive logic |

Battled-tested contracts Open-source transparency |

| Autonio NIOX Trading Suite | Tinkerers and algo traders Custom strategies |

No-code builder Backtesting tools and ML insights |

Open-source modules Community-driven security reviews |

The key advantage of adopting these solutions is not just about chasing higher APYs, it’s about building resilient portfolios that can weather market volatility while capturing upside efficiently. As always in DeFi, prioritize platforms with transparent codebases, active communities, and regular security audits before allocating significant capital.

If you’re ready to explore even deeper or want expert breakdowns on each platform’s performance metrics and risk profiles, check out our comprehensive guide at /best-ai-crypto-trading-bots-for-automated-defi-yield-farming-in-2024. The future of autonomous crypto investing is here, are you prepared to let your assets work smarter?