Automated portfolio rebalancing is no longer a theoretical edge reserved for institutional desks. It’s a practical, everyday reality for crypto traders and DeFi investors who want to keep their portfolios aligned with their risk appetite and market objectives, without the drag of manual intervention or emotional bias. As digital assets continue to evolve, so do the tools designed to manage them. AI trading agents now stand at the forefront of this evolution, delivering precision, discipline, and adaptability that human hands can’t match.

Why Manual Rebalancing Fails in Dynamic Crypto Markets

Traditional portfolio rebalancing requires periodic reviews and trade execution based on static schedules or arbitrary thresholds. This approach is not only labor-intensive but also dangerously slow in volatile crypto markets where prices can swing 10% in minutes. The result? Missed opportunities, excessive risk exposure, and emotional decision-making that erodes returns.

AI trading agents eliminate these pitfalls by continuously monitoring allocations, market conditions, and asset correlations. They execute trades at optimal moments, often within seconds of detecting drift from your target allocation, ensuring your portfolio stays on track with your investment thesis and risk controls.

How AI Trading Agents Automate Crypto Portfolio Rebalancing

The core advantage of AI portfolio rebalancing crypto solutions is their ability to process massive volumes of real-time data while learning from past outcomes. Platforms like SmartDiversifyPro, Taskade’s Portfolio Rebalancer, and Panorad AI leverage machine learning models to:

- Continuously analyze market data: Price movements, volatility spikes, liquidity shifts, and macroeconomic signals are all factored into the agent’s decision-making process.

- Dynamically adjust allocations: When your crypto holdings deviate from predetermined targets (for example, Bitcoin surging while altcoins lag), the agent autonomously executes trades to restore balance.

- Minimize risk and transaction costs: Advanced algorithms optimize trade timing and sizing to reduce slippage and fees, crucial in fragmented crypto markets.

- Enforce discipline: By removing emotion from the equation, AI agents help you stick to a rules-based strategy regardless of market noise or FOMO-driven swings.

This level of automation is not just about convenience, it’s about survival in a market where speed and discipline define winners.

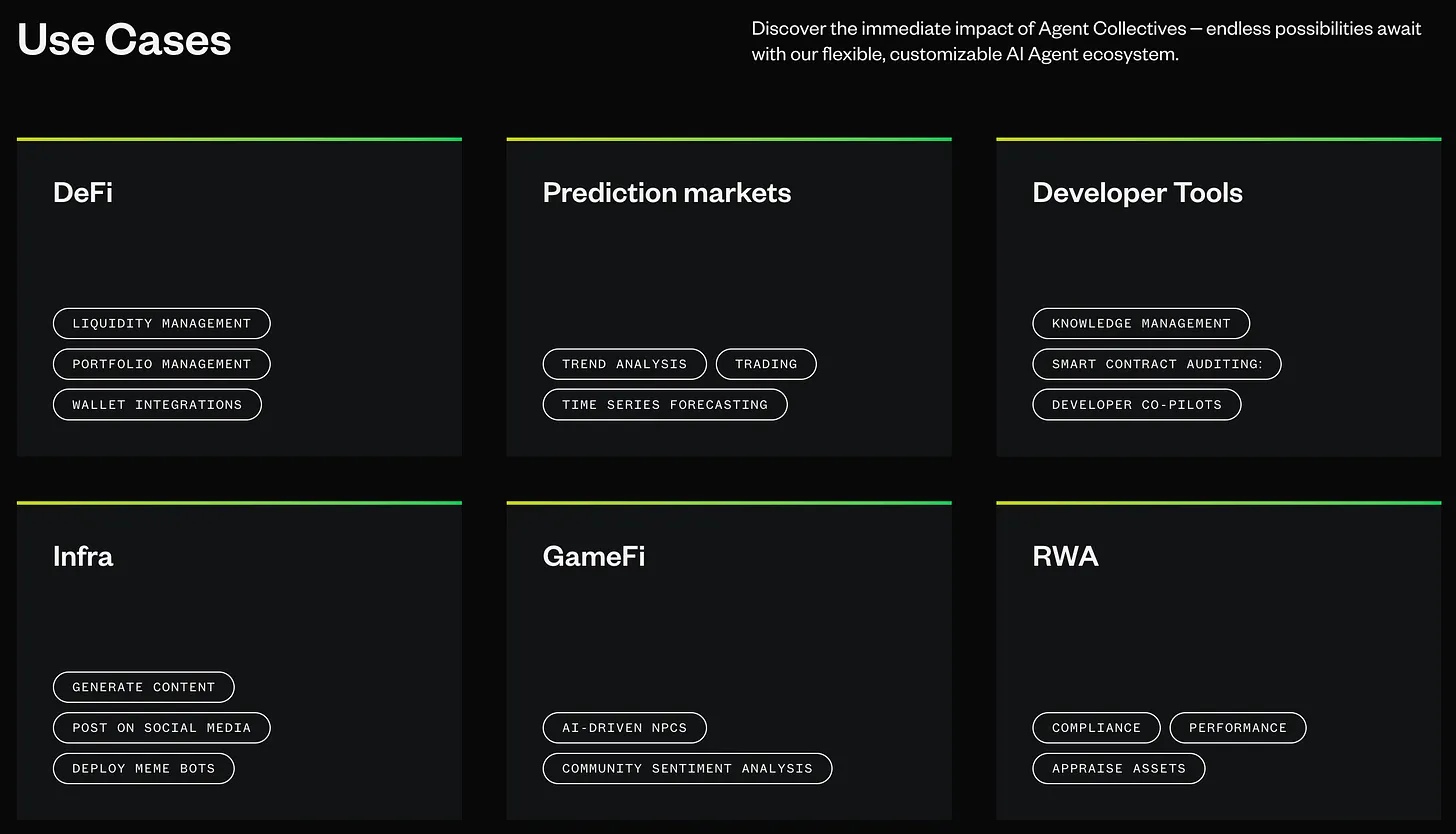

The Top AI-Powered Crypto Portfolio Automation Tools (2025)

Top Features of Leading AI Crypto Rebalancing Bots

-

SmartDiversifyPro: AI-powered trading bot that diversifies portfolios across multiple asset classes, continuously monitors market conditions, and automatically rebalances to maintain optimal risk-return ratios.

-

Taskade’s Portfolio Rebalancer: Deploys an AI agent to track portfolio allocations, recommend adjustments, and automate rebalancing based on user-defined rules for seamless, hands-off management.

-

Panorad AI: Features an Investment Portfolio Rebalancing Agent that analyzes large data sets to generate actionable insights, optimizes allocation, and enhances decision-making for crypto portfolios.

-

Pivolt: Provides AI-driven solutions for automated portfolio realignment using predefined rebalancing models and real-time compliance checks to ensure portfolios stay on target.

-

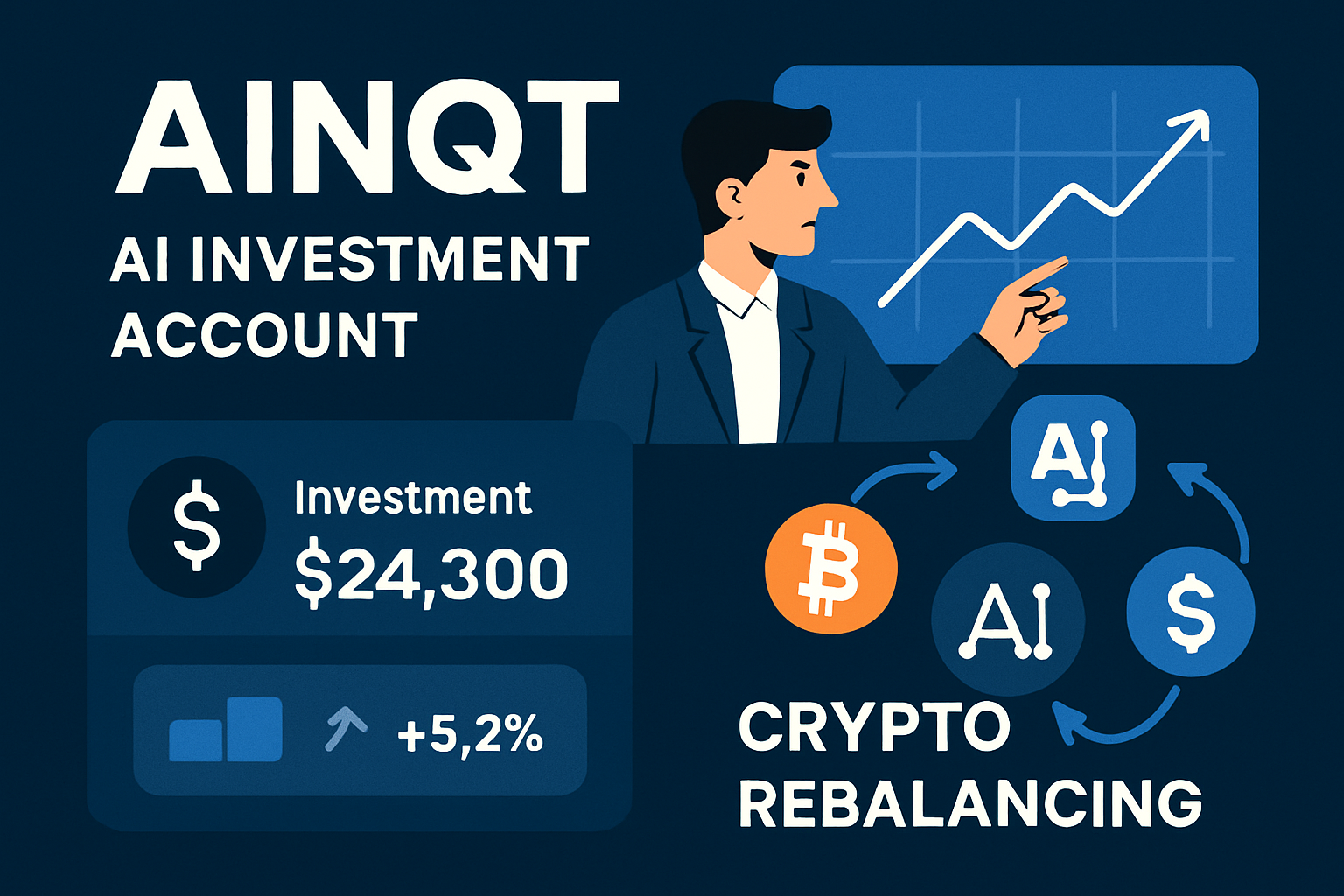

AINQT: Offers an AI-powered investment account with custom global asset allocation, dynamic rebalancing, and 24/7 automated monitoring to swiftly respond to market shifts.

The current landscape offers several robust automated crypto rebalancing bots tailored for both retail investors and professionals:

- SmartDiversifyPro: Diversifies across multiple asset classes using real-time analytics; maintains optimal risk-return ratios through continuous monitoring.

- Taskade’s Portfolio Rebalancer: User-defined criteria drive automated adjustments; integrates seamlessly with DeFi wallets for hands-free execution.

- Panorad AI: Employs data-driven insights for smarter allocation decisions; ideal for those seeking advanced customization options.

- Pivolt: Offers real-time compliance checks alongside predefined models, vital for regulated environments or institutional mandates.

- AINQT: Delivers dynamic global asset allocation with round-the-clock monitoring; reacts instantly to major price moves or volatility events.

If you’re serious about capital preservation as much as outperformance, a philosophy I live by, these tools are non-negotiable additions to your arsenal. They don’t just automate tasks; they enforce discipline at scale across every account you manage.

AI Trading Agent Portfolio Management: What Sets It Apart?

There’s a fundamental distinction between simple automation and genuine AI trading agent portfolio management. While traditional bots follow static rules or fixed time intervals, AI-driven agents learn and adapt. They incorporate not only price action but also cross-market correlations, order book depth, and even on-chain analytics to anticipate market regime shifts. This means a well-trained AI agent can proactively rebalance ahead of volatility clusters or sector rotations, something no static script can match.

Take AINQT, for example. Its platform leverages 24/7 monitoring and dynamic rebalancing to respond instantly to macro news or liquidity shocks. Similarly, SmartDiversifyPro ensures portfolios remain diversified, even when individual asset prices decouple from historical norms. This is the edge AI brings: not just following the market but actively managing risk as conditions change in real time.

Reducing Emotional Bias and Increasing Compliance

One of the most overlooked benefits of automated crypto rebalancing bots is their power to eliminate hesitation and emotional bias. Academic research shows that AI-backed prompts can boost compliance with rebalancing strategies by up to 40%. When an agent signals it’s time to act, or simply executes the trade for you, there’s no room for second-guessing or FOMO-driven detours.

This discipline is critical in crypto, where swings are brutal and the temptation to override your plan is ever-present. By outsourcing execution to an unemotional agent, you stick to your risk controls every cycle, no matter how noisy the headlines get.

The Role of Predictive Analytics in Crypto Portfolio Automation

The latest generation of AI agents doesn’t just react, they predict. Using advanced machine learning models, they forecast potential portfolio drift based on volatility forecasts and liquidity flows. Platforms like Panorad AI analyze massive data sets for predictive signals, so your allocation can be adjusted before a small deviation snowballs into major risk exposure.

This proactive approach is what separates modern crypto portfolio automation from yesterday’s passive strategies. You’re not just maintaining balance, you’re actively optimizing for returns while keeping drawdowns in check.

How to Integrate Automated Rebalancing into Your Crypto Strategy

Ready to deploy automated rebalancing? Start by defining your allocation targets and risk parameters, think in terms of maximum drawdown tolerance rather than arbitrary percentages. Evaluate platforms like Taskade’s Portfolio Rebalancer, Pivolt, or AINQT based on their transparency, customization options, and integration with your preferred exchanges or DeFi wallets.

Monitor performance metrics regularly but resist the urge to tinker unless your investment thesis changes materially. The whole point is disciplined execution, let your agent do its job while you focus on strategy refinement rather than day-to-day trade management.

What’s Next for Automated Crypto Portfolio Management?

The future points toward even greater autonomy: multi-agent systems that collaborate across asset classes; reinforcement learning models that optimize not just for returns but also tax efficiency; and seamless integration with lending protocols or yield farms for holistic wealth management.

If you want staying power in digital markets, don’t rely on luck, or outdated manual processes. Embrace automation where it matters most: protecting capital, enforcing discipline, and letting proven algorithms work around the clock so you don’t have to.