AI-powered crypto trading bots have exploded in popularity, promising automated portfolio management and around-the-clock market engagement. But as more traders hand over execution to algorithms, the question of AI trading bot security moves to the forefront. In a landscape where a single coding flaw or compromised API key can drain accounts in seconds, evaluating the safety of these bots is not optional, it’s fundamental to capital preservation.

Unpacking the Security Risks Facing AI Trading Bots

The promise of autonomous trading comes with its own set of vulnerabilities. Understanding these risks is step one for any trader serious about crypto bot safety. Here’s what you need to watch out for:

Top 5 Security Risks for AI Crypto Trading Bots

-

API Key Exploitation: If a bot’s API keys are compromised, attackers can gain full access to exchange accounts, enabling unauthorized trades and fund withdrawals. Secure key management is essential.

-

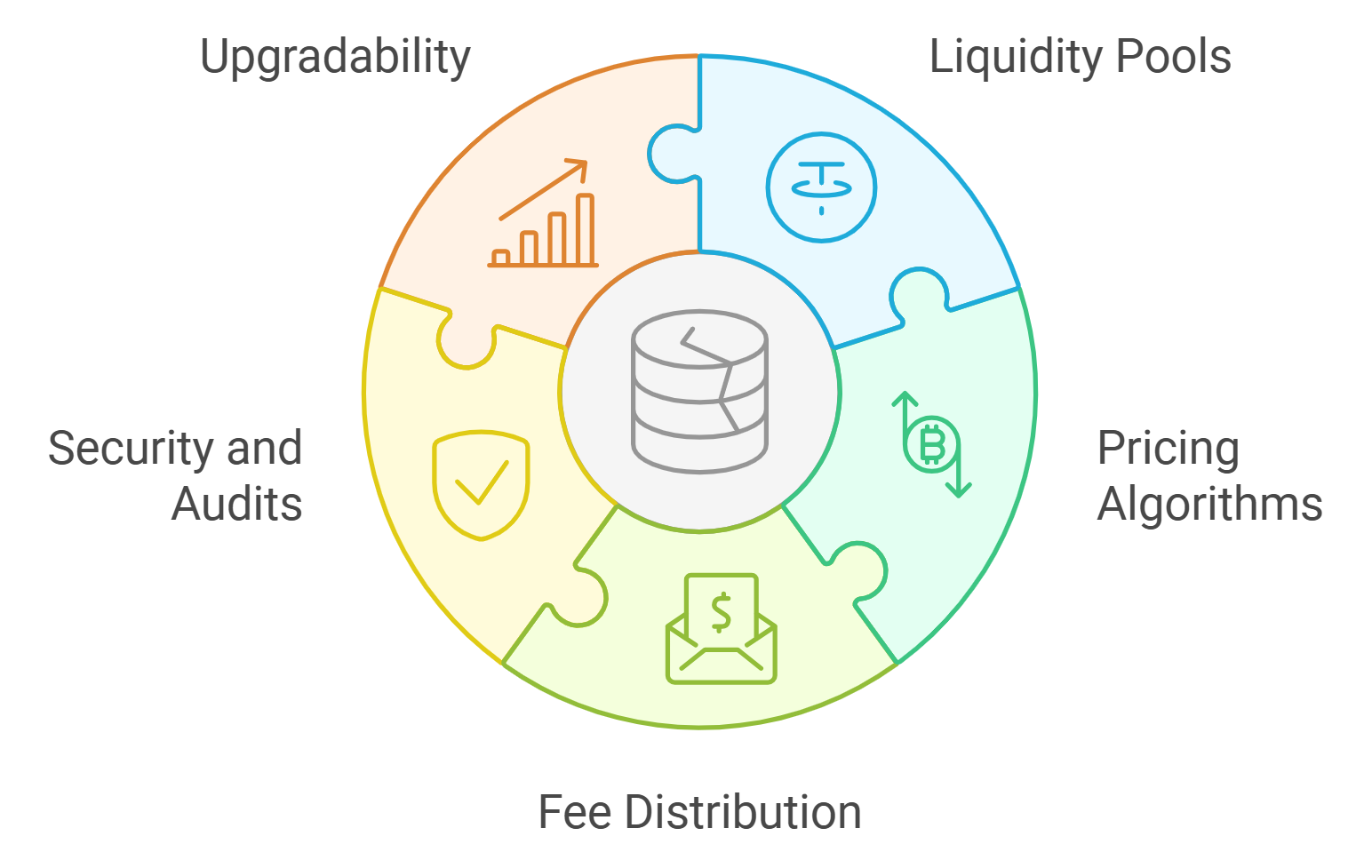

Smart Contract Vulnerabilities: Bots interacting with DeFi platforms may engage with flawed smart contracts, exposing users to exploits and significant financial loss.

-

Data Manipulation: Bots relying on external data feeds can be misled by manipulated or false information, resulting in poor trading decisions and unexpected losses.

-

Malicious Autonomous Agents: Attackers can hijack or clone AI models to create bots that execute unauthorized trades or exploit vulnerabilities in other systems.

-

Overfitting and Data Bias: AI models trained on biased or insufficient data may perform well in backtests but fail in live markets, leading to unanticipated losses.

API Key Exploitation: Most bots require API keys for exchange access. If these keys are leaked or stored insecurely, attackers can execute unauthorized trades or withdraw funds. The infamous 2023 API breach on a major exchange is proof, security lapses here can be catastrophic. Always use encrypted storage and rotate keys regularly (source).

Smart Contract Vulnerabilities: Bots interacting with DeFi protocols are only as secure as the underlying smart contracts. Poorly audited contracts have led to multi-million dollar exploits in recent years (source). If your bot touches DeFi, demand full transparency on contract audits and upgrade mechanisms.

Data Manipulation and Garbage In, Garbage Out: AI models depend on external data feeds (prices, order books). If that data is manipulated, think flash crashes or spoofing, the bot’s logic can be tricked into making disastrous trades. This is why real-time monitoring and reliable data sources are non-negotiable (source).

The Hidden Dangers: Malicious Agents and Model Bias

The rise of agentic DeFi brings new threats: attackers can hijack or clone AI models to create malicious agents that trade against your interests or exploit system loopholes. Even well-intentioned bots may fall victim to overfitting, where strategies excel in backtests but fail catastrophically in live markets due to biased training data (source). Staying ahead means demanding evidence of robust training practices and ongoing behavioral audits.

Best Practices for Secure AI Trading Agents

If you’re deploying an autonomous agent, or trusting your capital to one, demand discipline at every layer of deployment. Here’s how professional traders approach crypto trading security assessment:

- Secure API Key Management: Never hard-code keys; use encrypted vaults and limit permissions strictly.

- MFA and Access Controls: Two-factor authentication should be standard for both user accounts and critical bot actions.

- Regular Audits and Pen Testing: Commission third-party code reviews and infrastructure tests before each major update.

- Real-Time Monitoring: Deploy systems that alert you instantly to unusual behaviors or failed trades.

- Diversified Risk Protocols: Use stop-losses, capped position sizing, and avoid all-in bets, even if the model says so.

Security is not a one-time checkbox but an ongoing process. Even the most sophisticated AI trading agents require vigilant oversight and continuous improvement. This is especially true as the threat landscape evolves and attackers become more adept at exploiting both technical and behavioral weaknesses in automated systems.

Continuous Monitoring and Behavioral Audits

Don’t assume your bot is safe just because it passed initial tests. Continuous monitoring is essential. Implement real-time logging of all trades, API calls, and system events. Regularly audit these logs for suspicious activity, unexpected withdrawals, unusual trade patterns, or failed authentication attempts can all signal compromise (source). Set up automated alerts for deviations from normal behavior so you can intervene before losses spiral.

Behavioral auditing isn’t just about security; it’s also about strategy integrity. Periodically review your AI agent’s decision-making logic to catch signs of drift or overfitting. If your bot starts making trades that don’t align with its original mandate, investigate immediately. Remember: discipline isn’t just about loss prevention, it’s about maintaining a repeatable edge.

Pro tip: Always keep a manual kill switch accessible, if you see unexplained activity or suspect a breach, be ready to disable trading instantly.

Actionable Steps to Secure Your AI Crypto Trading Bot

-

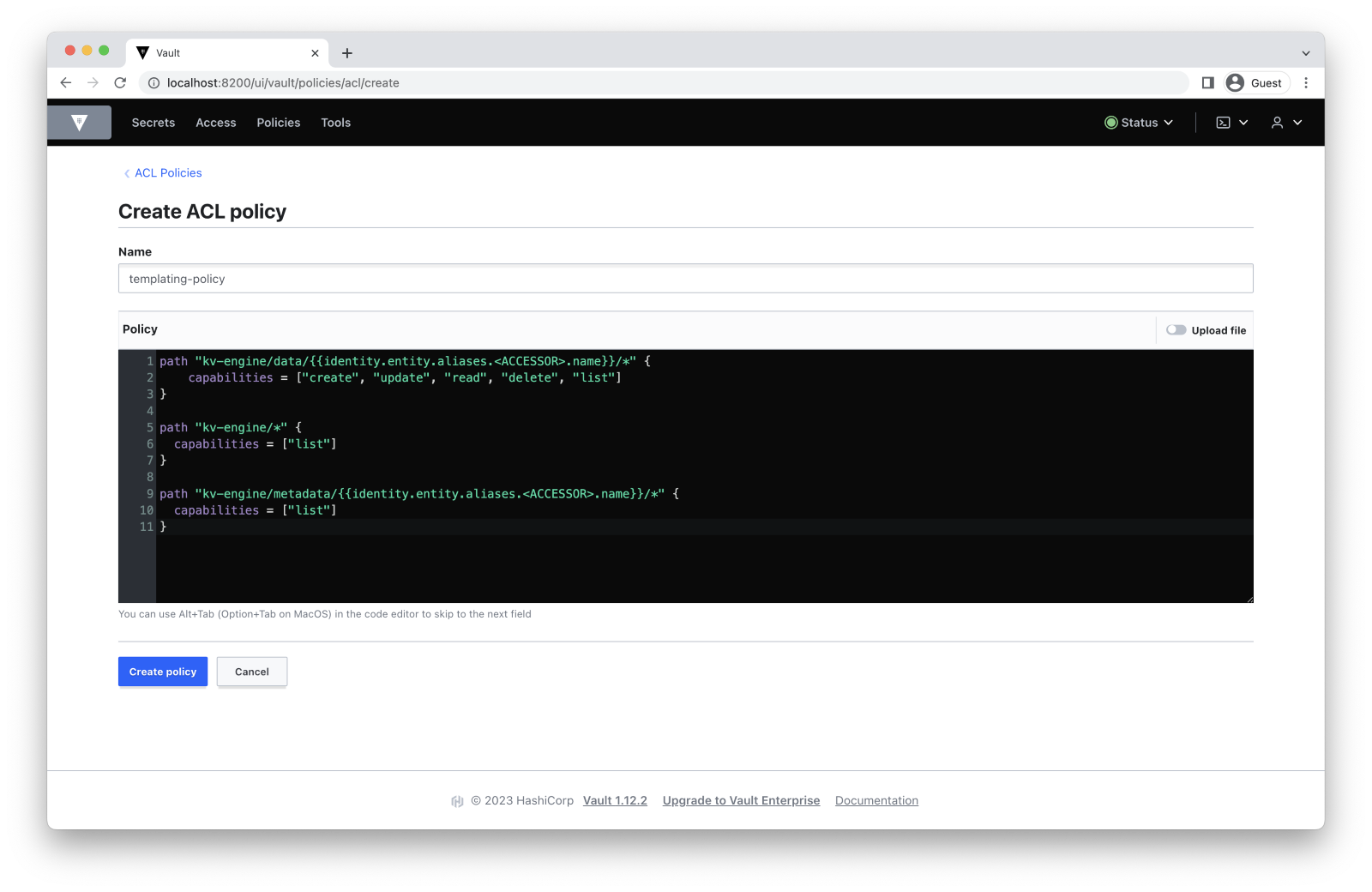

Use Encrypted Storage for API Keys: Secure your exchange API keys with encrypted vaults like HashiCorp Vault or AWS Secrets Manager. Never hard-code keys in your bot’s source code.

-

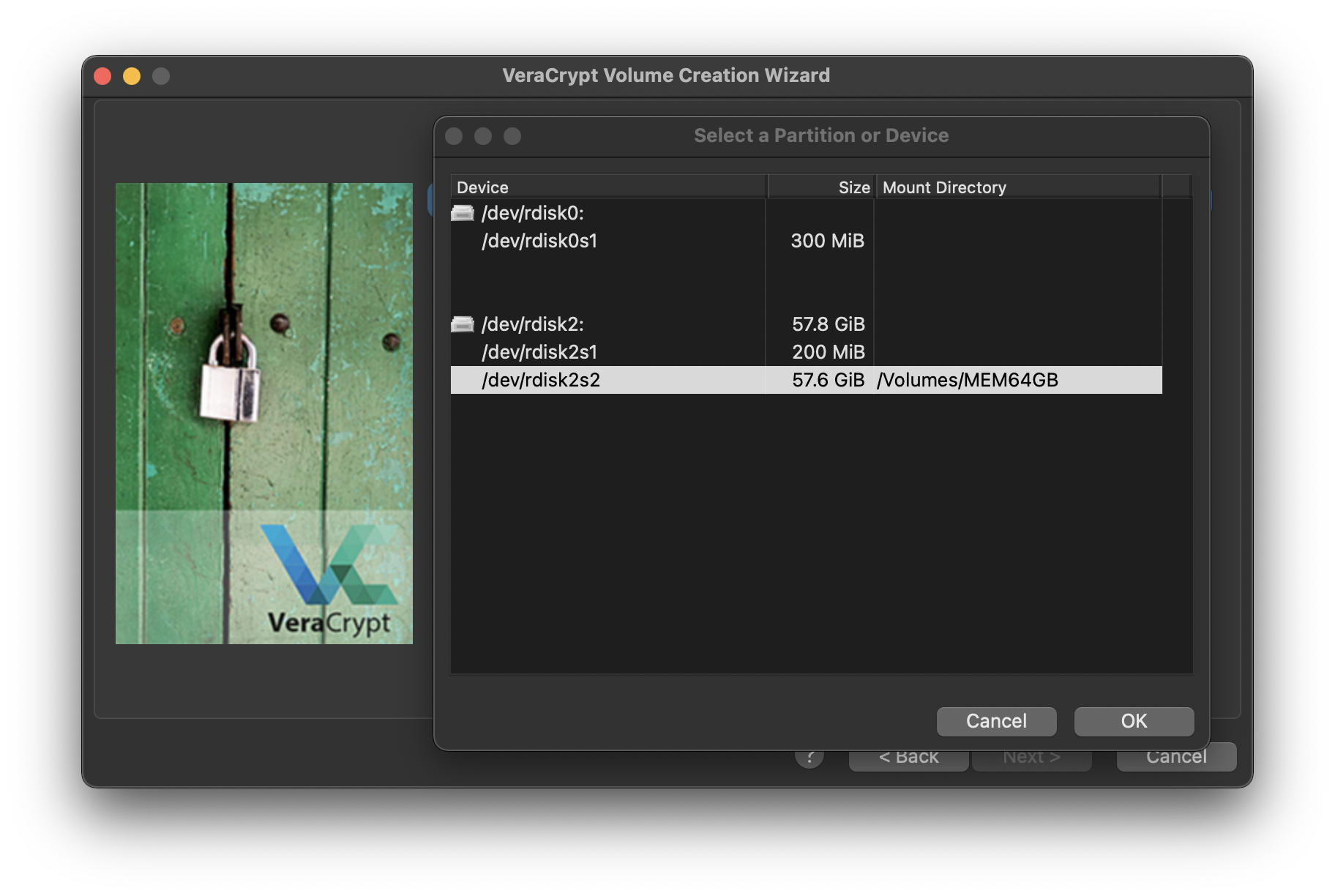

Encrypt Sensitive Data in Transit and at Rest: Use protocols like TLS 1.3 for data transmission and disk encryption tools (e.g., VeraCrypt) to protect stored data.

-

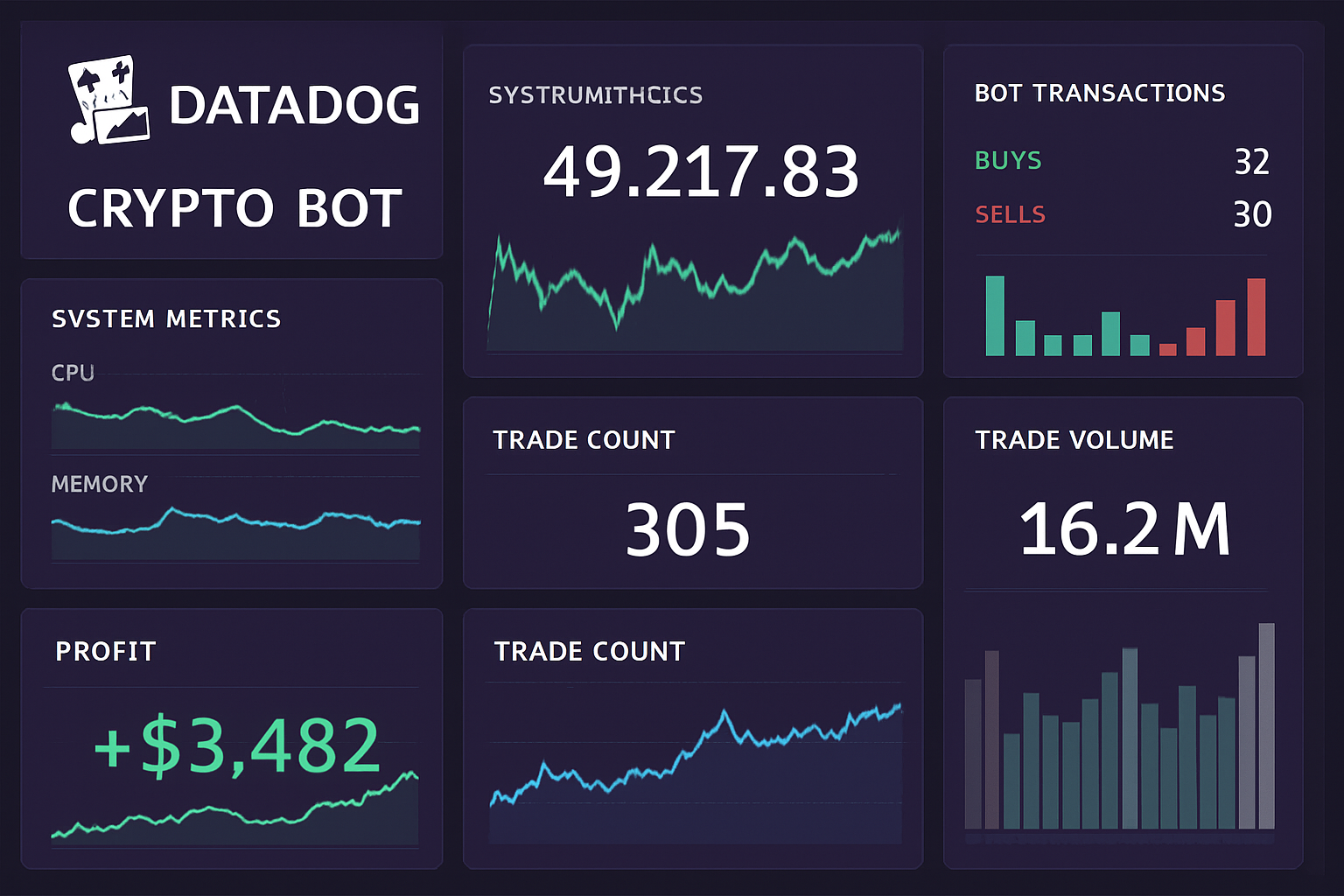

Monitor Bot Activity in Real Time: Deploy monitoring solutions such as Datadog or Prometheus to detect suspicious behavior and respond swiftly to anomalies.

-

Comply with Regulatory Standards: Ensure your bot and data handling practices align with regulations like GDPR and CCPA to protect user privacy and maintain transparency.

-

Harden Server Security: Host your bot on reputable cloud platforms (e.g., AWS, Google Cloud), configure firewalls, and enforce strong authentication to minimize attack surfaces.

-

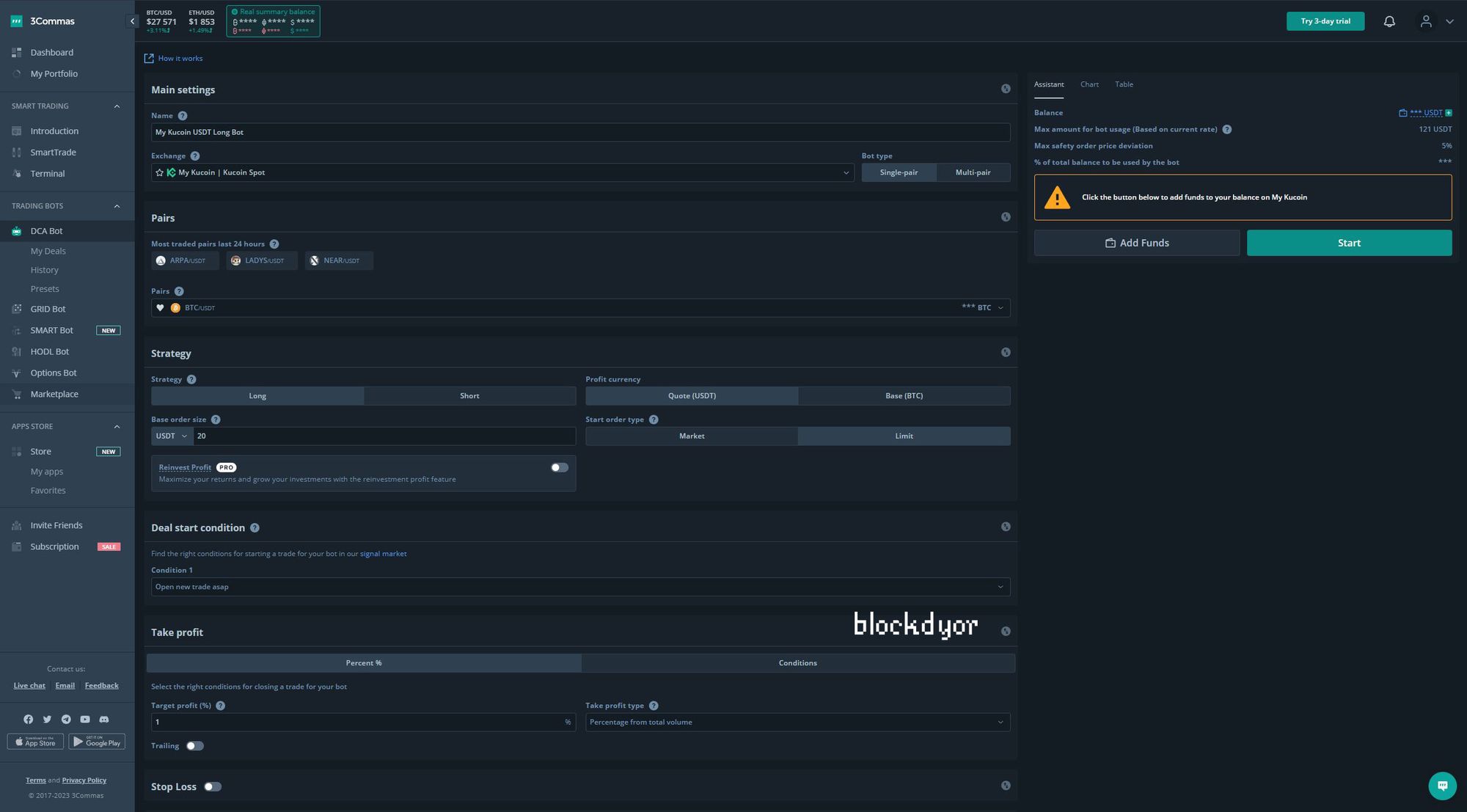

Implement Robust Risk Management: Use features like stop-loss orders and position sizing on platforms such as 3Commas to limit potential losses and diversify your trading strategies.

Regulatory Compliance and Data Privacy

The regulatory environment for AI-driven crypto trading is tightening globally. Adhering to GDPR, CCPA, and other data privacy standards isn’t optional if you want to operate at scale or attract institutional capital (source). Ensure your bot encrypts sensitive data both in transit and at rest. Be transparent with users about what data is collected, how it’s used, and how long it’s stored.

Infrastructure Hardening

Your bot’s server environment is as critical as its codebase. Use hardened operating systems, configure strict firewall rules, and restrict SSH access to trusted IPs only (source). Enforce strong password policies and multi-factor authentication on all admin interfaces. Regularly update dependencies to patch emerging vulnerabilities before they’re exploited in the wild.

Risk Management: The Last Line of Defense

No matter how robust your security stack is, risk management protocols are non-negotiable for capital preservation. Configure stop-loss orders on every strategy, never let an algorithm run without predefined downside limits. Diversify across strategies and assets; never let one model control more than a set percentage of total capital (source).

Discipline outperforms luck, every time.

Key Takeaways for Secure AI Trading Bot Deployment

- Treat API keys like cash: Encrypt them, limit permissions, rotate often.

- Avoid unvetted DeFi contracts: Demand transparency on audits before connecting bots.

- Aggressively monitor agent behavior: Real-time logs plus alerts are mandatory.

- Punish undisciplined risk-taking: Enforce stop-losses and position sizing rules programmatically.

- Pursue regulatory compliance: Encrypt user data and document privacy practices thoroughly.