With Bitcoin (BTC) trading at $115,483 and Ethereum (ETH) at $4,465.59 as of September 20,2025, the crypto market is more dynamic than ever. In this landscape, open source AI trading bots have become critical for traders seeking to automate strategies and keep pace with rapid price action. Unlike closed or paid solutions, open source bots offer transparency, flexibility, and the collective intelligence of vibrant developer communities.

The Rise of Open Source AI Trading Agents in Crypto

Open source AI trading bots are no longer a niche tool reserved for coders. Today’s top projects blend sophisticated machine learning with intuitive user interfaces, making algorithmic trading accessible to both seasoned quants and DeFi newcomers. As digital assets like BTC and ETH hit new milestones, these bots empower users to deploy strategies ranging from simple dollar-cost averaging to advanced statistical arbitrage – all without surrendering control to opaque third-party services.

But with dozens of projects on GitHub and beyond, how do you choose the best open source AI trading bot for your needs? Here’s a curated review of the seven most influential options shaping agentic DeFi automation in 2024.

Top 7 Open Source AI Trading Bots for Cryptocurrency in 2024

Top 7 Open Source AI Crypto Trading Bots (2024)

-

Hummingbot is a powerful open-source trading bot that supports both centralized and decentralized exchanges. It enables users to automate strategies like market making and arbitrage, and is known for its active community and robust documentation.

-

Freqtrade is a Python-based, open-source crypto trading bot offering extensive backtesting, strategy optimization, and machine learning integration. It supports all major exchanges and features a user-friendly web interface.

-

Gekko is a lightweight, open-source trading bot that allows users to create, backtest, and execute trading strategies on multiple exchanges. Its simplicity and ease of setup make it a favorite for beginners.

-

OctoBot is designed for both beginners and advanced traders, offering pre-built strategies like DCA and grid bots. Its modular architecture and strong community support make customization easy without coding.

-

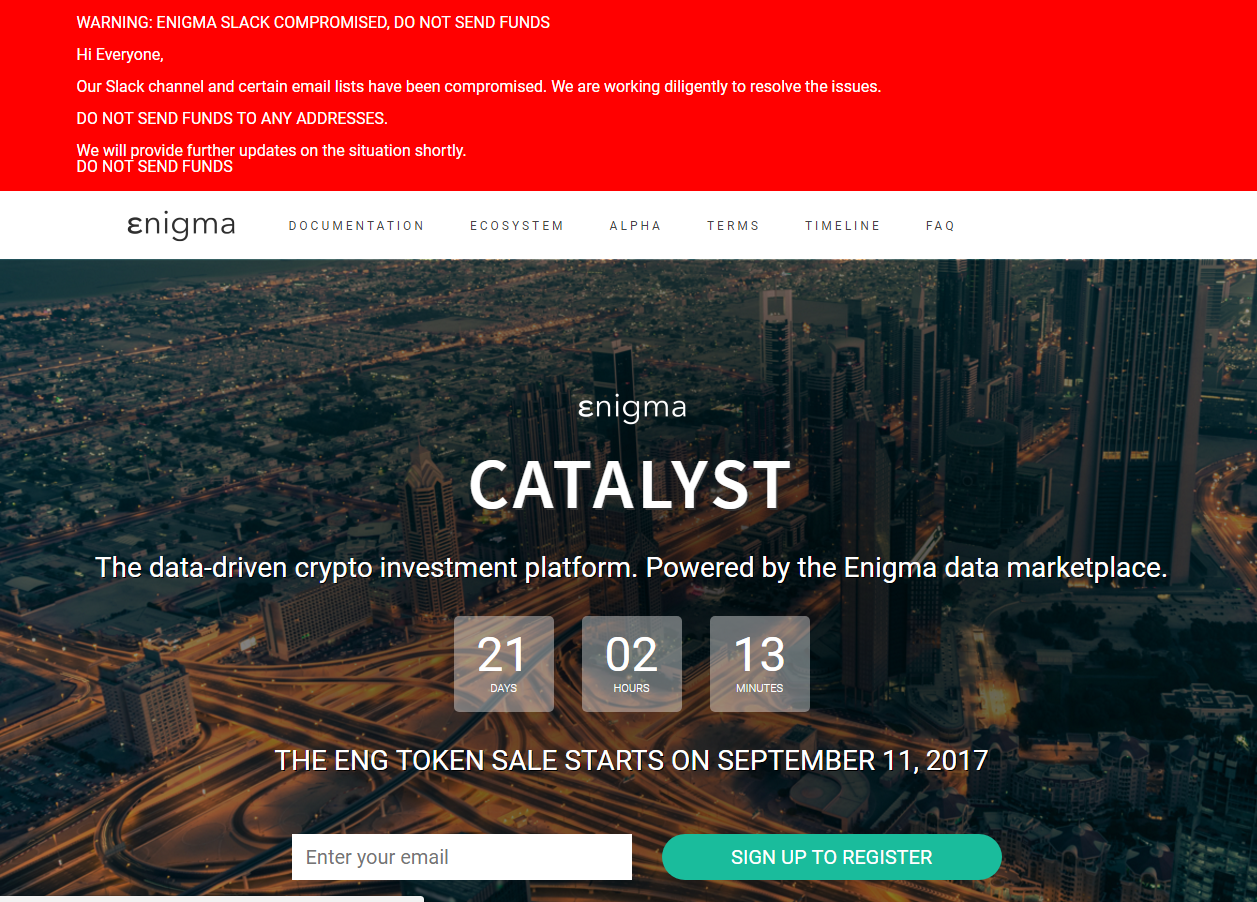

Enigma Catalyst is an open-source algorithmic trading library for crypto-assets, built on Python. It enables data analysis, strategy development, and backtesting, and is widely used in research and quant trading circles.

-

Zenbot is a highly customizable, open-source trading bot built on Node.js and MongoDB. It supports high-frequency trading and allows experienced users to script their own AI-powered strategies.

-

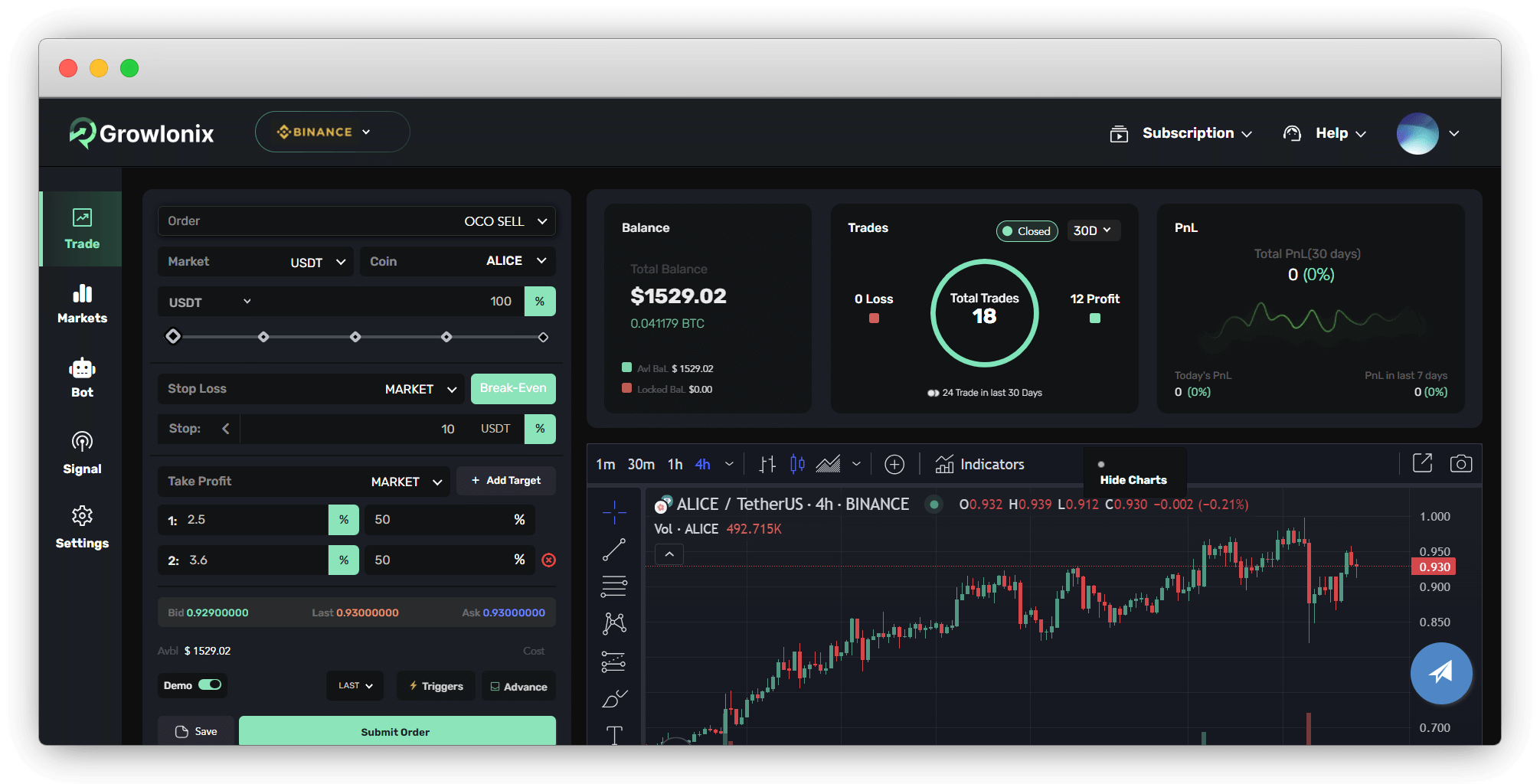

Binance Trading Bot (Python Binance) refers to open-source bots built using the popular python-binance library. These bots automate trading on Binance, offering flexibility for custom AI-driven strategies and integration with Python’s data science tools.

In-Depth Look: Features That Set These Bots Apart

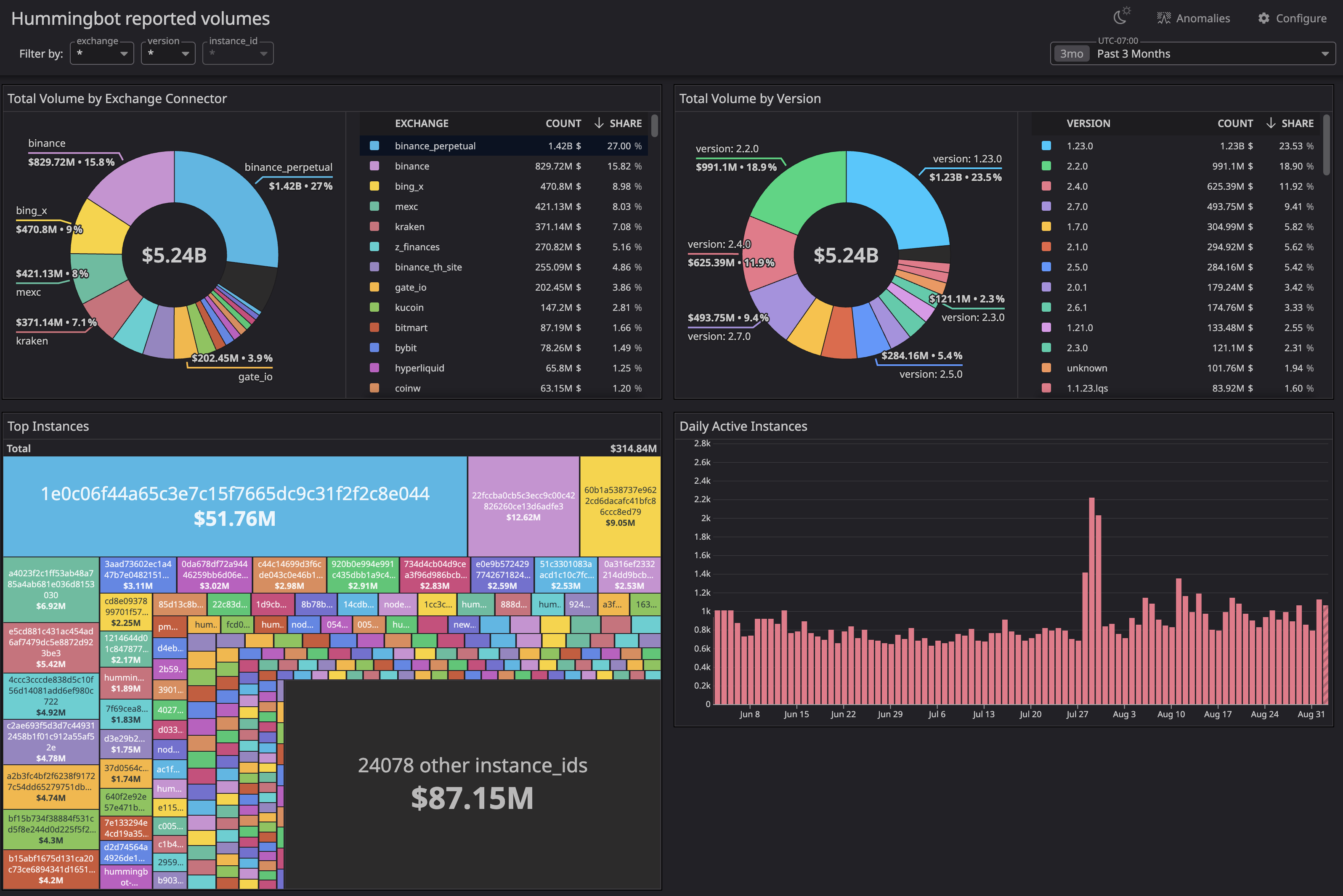

1. Hummingbot: Famed for its liquidity mining capabilities and seamless integration with both centralized and decentralized exchanges. Hummingbot lets users run custom strategies or tap into prebuilt templates for market making and arbitrage. It boasts a robust plugin architecture and active community support. Read more about Hummingbot’s features here.

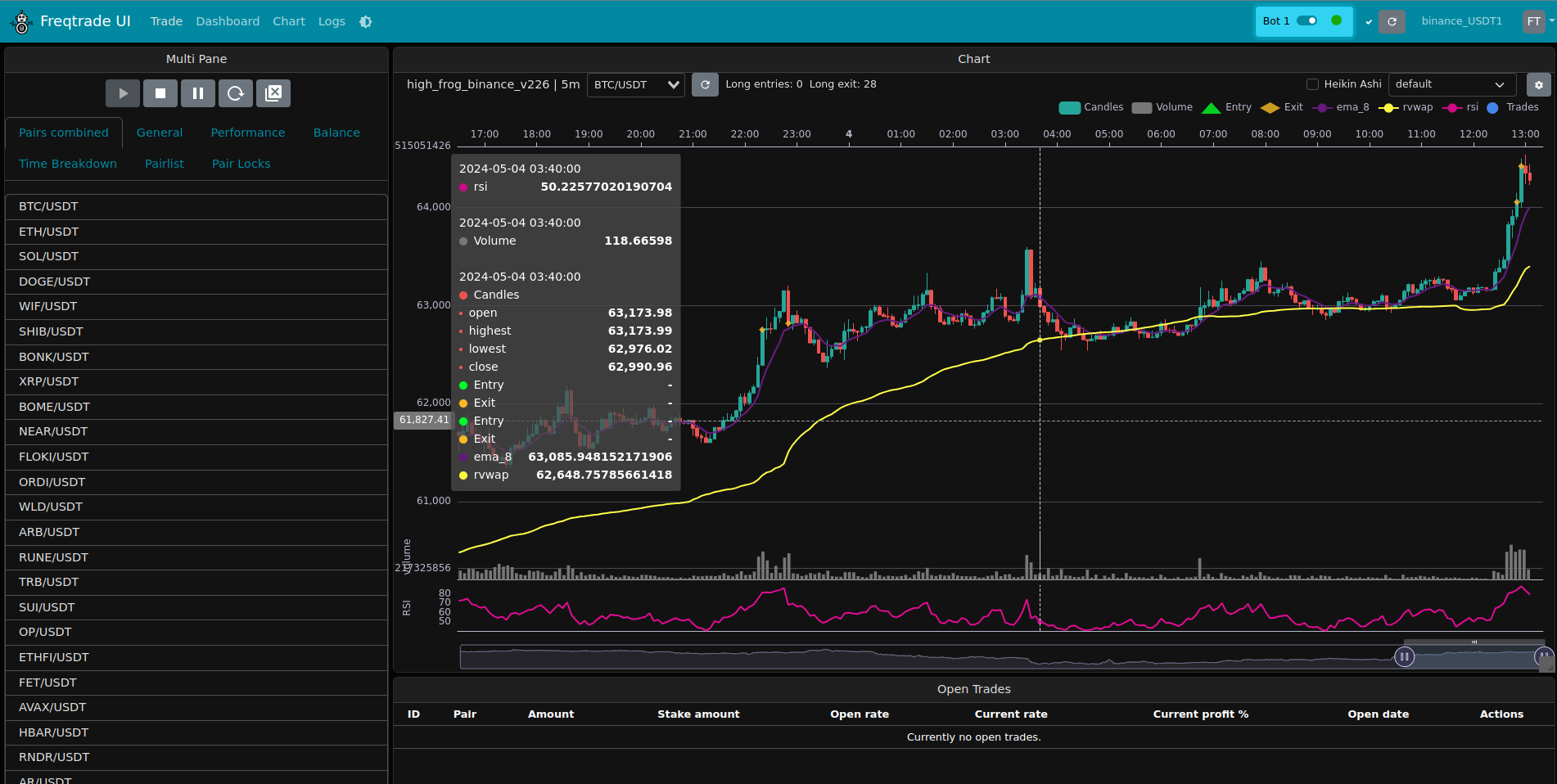

2. Freqtrade: Written in Python and celebrated for its modularity, Freqtrade supports all major exchanges via API keys. Its standout features include extensive backtesting tools, built-in strategy optimization (including machine learning), and real-time Telegram/webUI controls – perfect for traders who demand transparency without sacrificing performance. Explore Freqtrade’s capabilities here.

3. Gekko: One of the earliest open source crypto bots on the scene, Gekko remains popular thanks to its simplicity and reliability. While it doesn’t support high-frequency trading or leverage out-of-the-box machine learning models like some competitors, Gekko’s plugin system makes it easy to customize indicators or connect to external prediction engines.

The Next Generation: Customization and Community Power

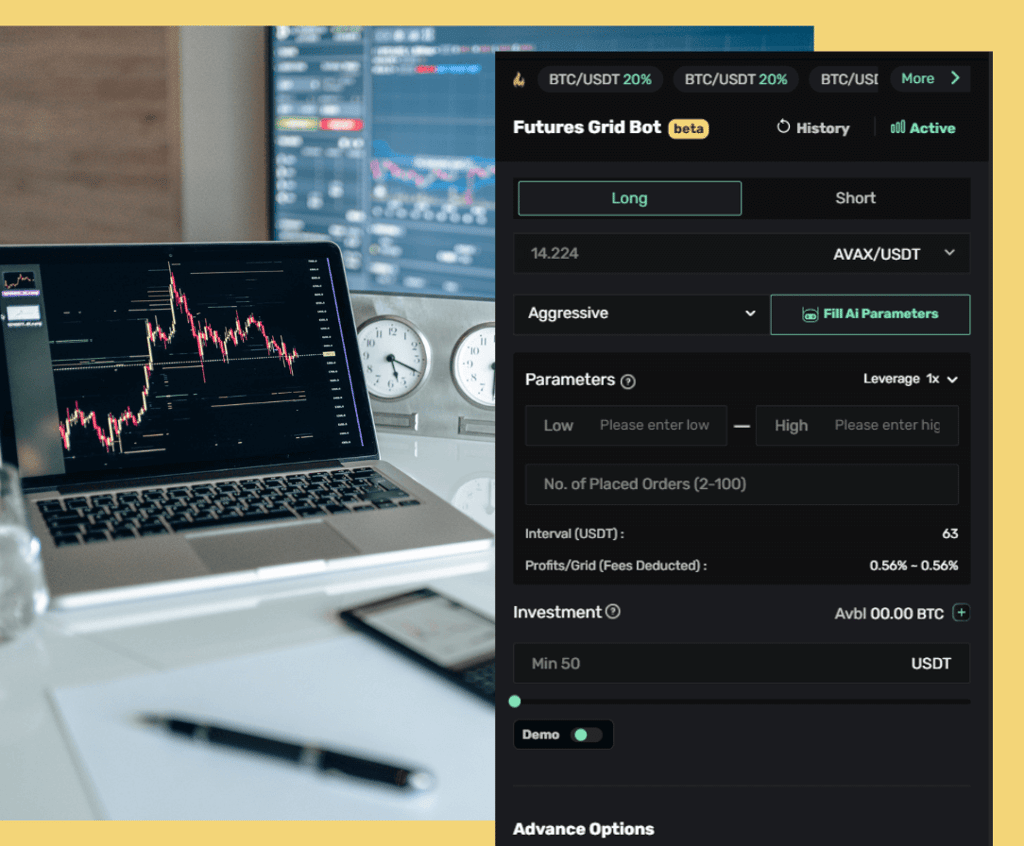

4. OctoBot: Designed with accessibility in mind, OctoBot lets users deploy DCA or grid strategies without writing code while also supporting custom bot creation through a visual interface. Its transparent development model ensures regular updates based on community feedback.

5. Enigma Catalyst: Focused on quantitative research and backtesting for digital assets, Catalyst gives data scientists a Python-based environment to design complex strategies using historical data feeds – ideal for those who want to test cutting-edge ML models before live deployment.

6. Zenbot: Built on Node. js/MongoDB for maximum scalability and customization potential. Zenbot stands out among power users who prefer scripting their own logic from scratch while leveraging built-in simulation tools.

7. Binance Trading Bot (Python Binance): This community-driven project leverages the official Binance API library to enable everything from simple spot trades to advanced order management directly through Python scripts – great for those focused exclusively on Binance markets.

Each of these bots brings a unique philosophy to agentic DeFi automation. For example, Hummingbot’s liquidity mining modules have made it a favorite among traders seeking passive yield, while Freqtrade’s machine learning integration appeals to those building adaptive, data-driven strategies. Meanwhile, the enduring appeal of Gekko and Zenbot lies in their simplicity and hackability, qualities that continue to attract both hobbyists and professionals in 2024.

The open source ethos doesn’t just mean free code; it means rapid iteration and collective problem-solving. The OctoBot community, for instance, regularly crowdsources new strategy modules and bug fixes via Discord and GitHub. Similarly, Enigma Catalyst’s forum is a hotbed for sharing alpha-generating research pipelines and benchmarking ML models on historical crypto datasets.

Security and transparency are also central reasons why traders flock to these platforms. Open repositories allow anyone to audit code for vulnerabilities or hidden fees, an important safeguard in the often opaque world of crypto trading software. With frequent updates and peer-reviewed pull requests, projects like Freqtrade and Hummingbot set the standard for responsible bot development.

Real-World Performance: How These Bots Stack Up in 2025’s Volatile Markets

The surge in Bitcoin to $115,483 has put every trading algorithm to the test. Bots with robust backtesting suites (like Freqtrade and Catalyst) have proven especially valuable as traders seek strategies that can adapt to sudden volatility spikes or regime shifts across BTC, ETH ($4,465.59), BNB, XRP, and ADA.

User experience matters too. OctoBot’s no-code interface lowers the barrier for newcomers looking to automate grid or DCA strategies on exchanges like Binance, without ever touching a command line. For Python aficionados focused on Binance alone, the Binance Trading Bot (Python Binance) remains a go-to choice due to its deep integration with Binance API endpoints and strong support from both Binance’s docs and open source contributors.

Choosing the Right Open Source AI Trading Agent for You

Your ideal bot depends on your technical skill set, risk tolerance, exchange preferences, and appetite for experimentation. If you’re after plug-and-play liquidity mining or arbitrage across CEXs/DEXs, Hummingbot or Freqtrade are excellent starting points. Quant researchers may gravitate toward Enigma Catalyst for its research-first approach; tinkerers might prefer Zenbot or Gekko’s minimalist frameworks; while beginners can get started fast with OctoBot’s visual tools or Python Binance scripts tailored specifically for the world’s largest exchange.

The future of crypto trading is agentic, driven by transparent algorithms that learn from real market conditions as prices break new ground. As Bitcoin holds above $115,000 and Ethereum continues its climb past $4,400 this September 2025, these seven open source AI bots stand out as powerful allies in navigating volatility with confidence, and turning uncertainty into opportunity.