Imagine turning a simple conversation with an AI into a Polymarket trading bot that racks up 345 wins and just 26 losses – a staggering 93% win rate – all without writing a single line of code. That’s exactly what trader sharbel did, chatting iteratively with an AI agent to build a powerhouse on Polymarket’s prediction markets. No Python, no Stack Overflow, just natural language prompts guiding the bot to spot edges in events like elections, crypto prices, and even weather outcomes. If you’ve ever dreamed of automating your trades on Polymarket but shied away from coding, Claude AI changes everything. Welcome to the era of no-code Polymarket trading bots that anyone can build.

Polymarket’s Hidden Edges Waiting for Your Bot

Polymarket isn’t just another exchange; it’s a prediction market where real money bets on real-world outcomes create inefficiencies ripe for exploitation. Take the weather trading bots quietly banking $24,000 by arbitraging forecasts against market odds. Or consider the wallet ‘0x8dxd’ that transformed $313 into roughly $438,000 in a month, boasting a 98% win rate. These aren’t flukes – they’re proof of smart, automated strategies crushing it.

Copy trading bots mirror top wallets, like the Telegram bot tracking Polymarket winners and copying bets instantly. Then there’s arbitrage plays with tools like Moltbot, flipping $500 into $106K at 95% win rates. Even short-term plays on 15-minute BTC up/down markets show promise, though pitfalls exist – one trader lost 37.81% learning the ropes. Platforms like PredictEngine and HolyPoly now offer visual builders and edge analytics, but why pay when Claude can craft your custom Claude AI Polymarket bot for free?

Why Claude AI Excels at No-Code Bot Building

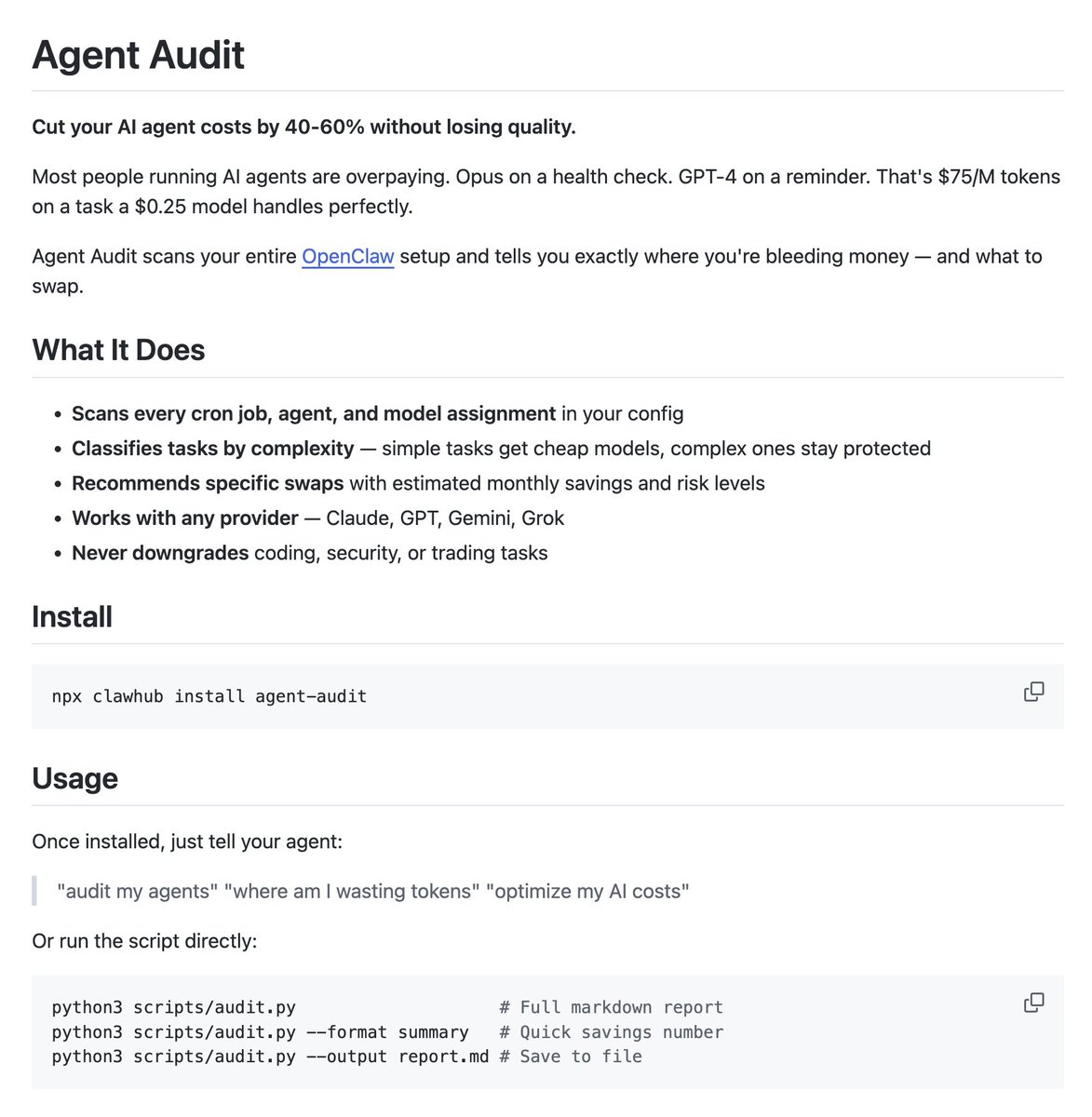

Claude stands out because it’s conversational, handling complex logic through plain English. Forget rigid no-code platforms; tell Claude your strategy – copy top traders, predict BTC moves, or arbitrage weather events – and it generates deployable bots. Users are already vibecoding with prompts like “Claude, build me a profitable Polymarket trading bot. Make no mistakes. ” The result? Zero code trading bot Polymarket setups that iterate fast, adapting to market shifts without dev skills.

What makes it empowering is the control. You define risk parameters, like betting only 1% of bankroll per trade or exiting at 80% probability thresholds. Claude handles API integrations with Polymarket, wallet connections via services like those in HolyPoly’s playbook, and even backtesting against historical data. It’s like having a DeFi strategist whispering strategies tailored to your style.

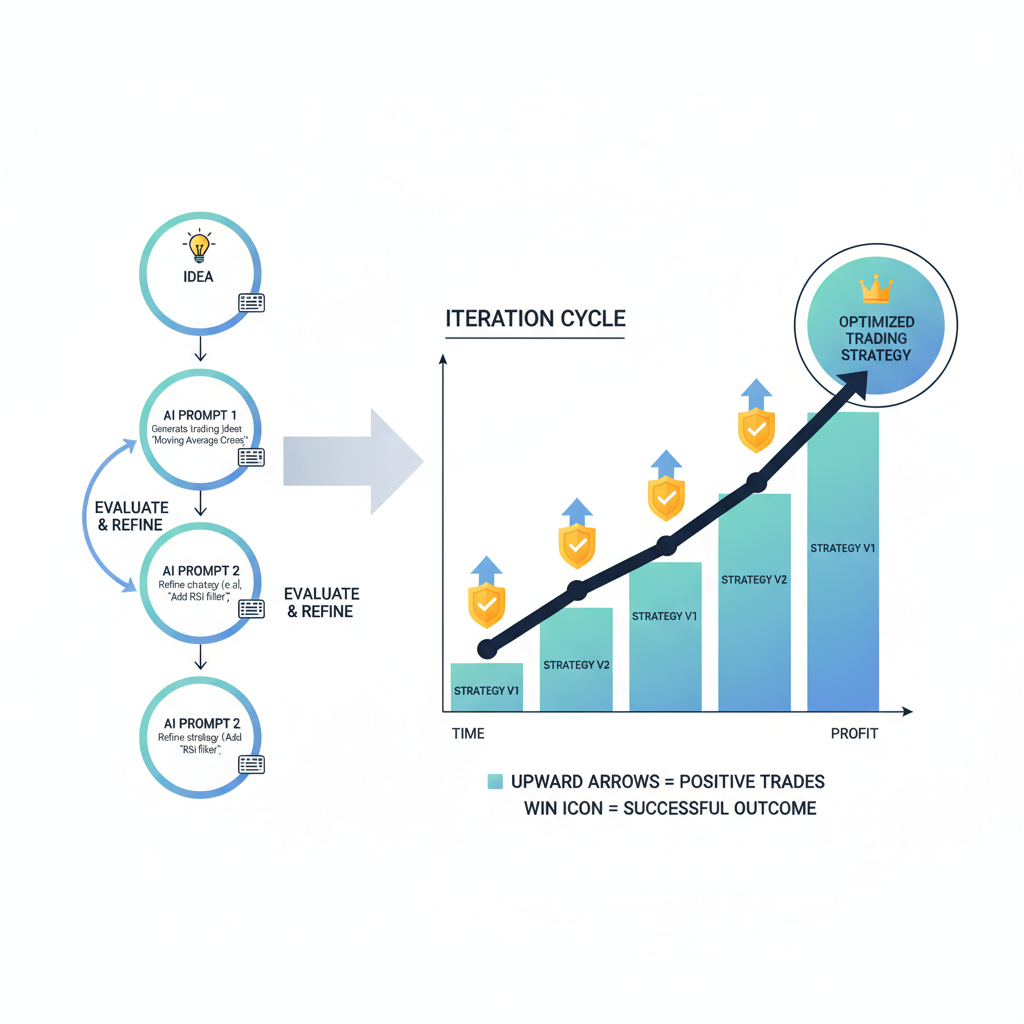

Your First Prompt: Kickstarting the 93% Win Rate Bot

Ready to build? Start with a strong base prompt to Claude: “Design a no-code Polymarket trading bot that copies the top 5 winning wallets from the last 24 hours, filters for markets with over 80% resolution accuracy, and places bets under $50 with a 1.5x minimum ROI potential. Use USDC on Polygon, integrate with my wallet, and include stop-loss at 20% drawdown. “

Claude will output a step-by-step plan, often suggesting Telegram or Discord deployment for notifications. Iterate from there: “Add BTC 15-minute prediction logic using simple momentum from oracles. ” Test on small stakes first, tracking win rates like sharbel’s. This autonomous AI prediction market bot evolves with your feedback, targeting that elusive 93% edge.

Refine by incorporating weather or election niches, where bots have proven deadly accurate. One Dev Genius builder shared every step to replicate $24K gains – Claude can do it cleaner, faster.

But let’s get hands-on. The beauty of this approach lies in its simplicity – you prompt, Claude builds, you deploy and profit.

Core Strategies Your Bot Can Master

Copy trading tops the list for beginners. By mirroring wallets like 0x8dxd’s 98% streak, your polymarket trading bot no code setup captures proven edges without guessing. Feed Claude historical Polymarket data prompts, and it scripts filters for volume, liquidity, and recent win streaks. Pair it with momentum signals for 15-minute BTC markets – bet up if price crossed the 5-period average, down otherwise. Weather arbitrage shines too: bots exploit forecast discrepancies versus crowd odds, quietly stacking gains like that $24K Dev Genius example.

Election markets offer volatility goldmines. Prompt Claude to scan for polls diverging from Polymarket prices, betting the underpriced side. Arbitrage across platforms adds layers – compare odds with traditional books via oracles. My take? Start narrow: one market type, tight risk rules. sharbel’s 93% win rate came from iteration, not complexity. Your Claude AI Polymarket bot learns alongside you, tweaking for 1.2x edges minimum.

Top Polymarket Bot Strategies

| Strategy | Performance | Example | Pros | Cons |

|---|---|---|---|---|

| Copy Trading | 98% win rate | 0x8dxd ($313 → $438,000) | ✅ High win rate 📈 Hands-off |

❌ Whale dependency ⚠️ Copy lag |

| Weather Arb | $24,000 gains | Dev Genius bot | 🌤️ Niche edge 🤖 Automated arb |

📊 Data intensive 🌍 Limited opps |

| BTC 15min | High frequency | Aule Gabriel guide | ⚡ Quick trades 📉 Volatility plays |

🕒 High maintenance ❌ Risk of losses |

| Elections | Poll edges | Poll-based bots | 🗳️ Strong signals 📈 High volume |

📰 News shocks ⏳ Event-driven |

Risks and Safeguards Every Trader Needs

High win rates dazzle, but losses like Mario Alves’ 37.81% remind us: markets shift. Polymarket’s resolution disputes or oracle fails can wipe edges. Claude bots mitigate with dynamic stops – exit if probability flips below 60%, or cap position sizes at 2% bankroll. Backtest rigorously: prompt Claude for simulations on past data, aiming for Sharpe ratios above 2.0. Diversify across 5-10 markets to smooth variance.

Security first. Use burner wallets for testing, enable 2FA, and never hardcode keys – Claude suggests env variables or secure vaults. Monitor via Telegram alerts for every trade. Opinion: over 90% win rates demand discipline, not greed. Scale slowly from $100 stakes, compounding like Moltbot’s $500 to $106K path.

Deployment is straightforward. Claude outputs deployment scripts for Replit or Vercel, hooking into Polymarket’s API. Run 24/7 on a VPS if needed, or trigger via cron jobs. HolyPoly-style analytics? Prompt for dashboards tracking ROI, win streaks, and drawdowns. Users report bots holding 90% and rates post-launch, especially in low-competition niches.

Picture your dashboard lighting up: 50 trades, 47 wins, portfolio doubling monthly. That’s the power of autonomous AI prediction market bot tech in your hands. No gatekeepers, no code barriers – just you, Claude, and Polymarket’s untapped alpha. Experiment boldly, track religiously, and watch your edge compound. The 93% club awaits builders like you.