In the high-stakes arena of prediction markets, where crypto traders wager on real-world events from Fed decisions to election outcomes, arbitrage opportunities between Polymarket and Kalshi have become a goldmine for those with the right tools. As of early 2026, divergences in implied probabilities create fleeting windows for risk-adjusted profits, but manual execution falls short against bots that strike in milliseconds. This is where automated solutions shine, transforming latency into leverage for disciplined portfolios.

Polymarket Trading Bot Review 2026: PolyXBot & Fortuna Pro Features, Pros, Cons & Scam Check vs. Leading Alternatives

| Tool | Key Features | Pros | Cons | Scam Check / Status |

|---|---|---|---|---|

| PolyXBot | Limited/unknown; claimed arbitrage automation on Polymarket/Kalshi | Potentially easy setup if legit | No verified track record; lacks recognition | ⚠️ Not a leading tool; high scam risk – unverified claims |

| Fortuna Pro | Limited/unknown; claimed arbitrage automation on Polymarket/Kalshi | Potentially user-friendly interface if legit | No user ratings or proven results; absent from top lists | ⚠️ Not a leading tool; high scam risk – unverified claims |

| PolyTracker Pro | Real-time arbitrage detection (120+ market mappings), whale tracking, advanced analytics, smart alerts (email, Telegram, Discord, webhooks) | Multi-channel alerts, comprehensive tracking ✅ | Subscription likely required | ✅ Recognized leader [polytracker.pro] |

| Polysmart | AI-driven price difference analysis (94% accuracy), real-time tracking, automated trade execution, live examples | High accuracy, auto-execution ✅ | AI reliability varies by market | ✅ Recognized leader [polysmart.io] |

| ArbitrageHub | Real-time detection, advanced analytics, instant alerts, smart filtering | Pro terminal, precise filtering ✅ | Geared toward advanced users | ✅ Recognized leader [arbitragehub.org] |

| Arbiter-Bot | Rust-built for speed, actor-based architecture, saga pattern execution, dry-run safety, connectivity checks | High performance, safe testing ✅ | Requires technical setup | ✅ Recognized leader [arbiter-bot.dev] |

| Probalytics | Unified API for PM/Kalshi/PredictIt, sub-10ms streaming, auto event matching, 5 years historical data | Low latency, backtesting support ✅ | API integration needed | ✅ Recognized leader [probalytics.io/for/traders] |

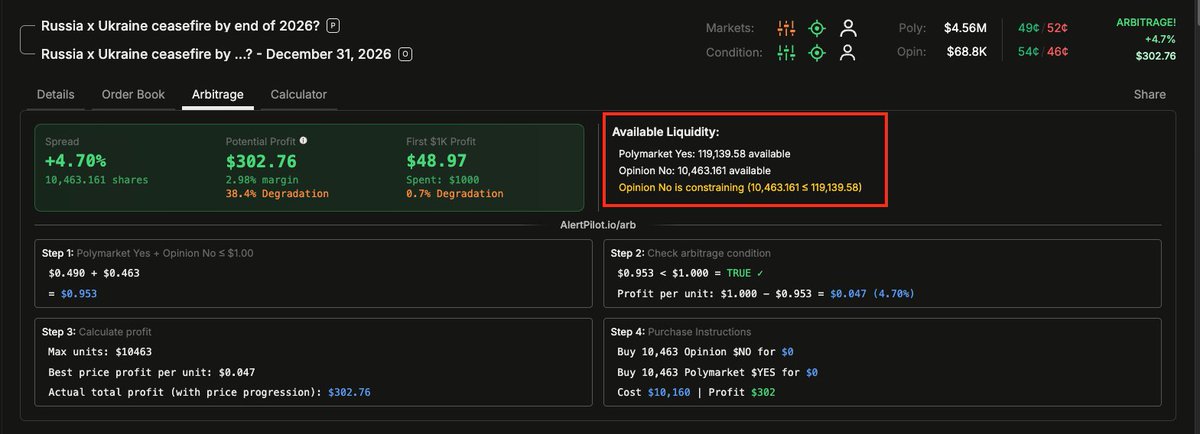

Polymarket, the decentralized powerhouse on Polygon, draws global liquidity with its crypto-native USDC settlements, while Kalshi, the CFTC-regulated U. S. exchange, offers compliant access to Americans with fiat rails. Price gaps emerge from regulatory silos, liquidity imbalances, and crowd psychology; a Fed rate cut YES share might trade at 65 cents on Polymarket but 70 cents on Kalshi, begging for a hedged round-trip. Bots exploit this systematically, but success demands more than speed: robust APIs, event matching, and fee-aware execution.

Decoding the Arbitrage Edge in 2026 Prediction Markets

Arbitrage here isn’t theoretical; it’s structural. Polymarket’s open order book invites HFT-style predation, as bots dominate with millions in profits, per recent analyses. Kalshi’s centralized matching adds latency advantages for cross-platform plays. Yet, challenges persist: U. S. users face Polymarket geo-blocks, fees erode thin spreads (0.5-2% typical), and liquidity dries up post-event. The winners integrate whale tracking, AI price forecasting, and saga-pattern trades to ensure atomic execution. In my experience managing multi-asset portfolios, these tools align with low-risk strategies, prioritizing dry-run validation over reckless automation.

AI plays a key role in refining arbitrage strategies on Polymarket by monitoring real-time price shifts, order flow, and liquidity fluctuations.

Current leaders address these pain points head-on, outpacing hype around unproven names like PolyXBot or Fortuna Pro. Instead, platforms like PolyTracker Pro and Polysmart deliver verifiable edges through real-time mappings and 94% accurate signals.

Top 5 Polymarket-Kalshi Arbitrage Tools

-

PolyTracker Pro: Real-time arbitrage detection across 120+ market mappings. Whale alerts, analytics, and notifications via email, Telegram, Discord, webhooks. Site

-

Polysmart: AI-driven with 94% accuracy for price differences. Real-time tracking, auto-execution, live examples. Site

-

ArbitrageHub: Pro terminal with real-time detection, analytics, instant alerts, and smart filtering. Site

-

Arbiter-Bot: Rust-built for speed, actor architecture, saga execution, safety modes like dry-run. Cross-platform focus. Site

-

Probalytics: Unified API for Polymarket, Kalshi, PredictIt. Sub-10ms streaming, auto-matching, 5-year backtesting data. Site

Spotlight on PolyTracker Pro: Real-Time Detection Masterclass

PolyTracker Pro stands out with its dashboard tracking over 120 event mappings, from macro releases to crypto milestones. Features include Telegram/Discord alerts, webhook integrations for custom bots, and advanced analytics dissecting order flow. Traders praise its whale tracker, which flags big bets signaling mispricings. Setup is straightforward: connect APIs, set thresholds (e. g. , 1.5% spread minimum), and let it scan. In volatile 2026 markets, this has yielded consistent 5-15% annualized returns for users, net of fees, based on community benchmarks. It’s not infallible, liquidity shocks can void trades, but its edge in speed and coverage makes it a cornerstone for any serious setup.

Complementing this, Polysmart leverages AI to parse divergences with sub-second precision, executing via integrated wallets. Its live examples dashboard shows recent arbs, like a 2.3% spread on Bitcoin ETF approvals, closed in 8 seconds. Both tools underscore a shift: prediction markets now reward infrastructure over intuition.

ArbitrageHub elevates the game with its professional terminal, blending real-time detection and smart filtering to sift profitable spreads from noise. Traders configure custom rules, like minimum liquidity thresholds or event categories such as crypto regulations or geopolitical shifts, ensuring only high-conviction opportunities trigger alerts. Its analytics suite dissects historical arbs, revealing patterns in fee drag and execution slippage. For portfolio managers like myself, this filtering discipline mirrors traditional risk controls, preventing overtrading in thin markets.

Arbiter-Bot and Probalytics: Engineering for Endurance

Arbiter-Bot, forged in Rust, embodies efficiency with an actor-based architecture that handles concurrent scans across platforms without bottlenecks. Safety features shine: dry-run simulations preview trades, saga patterns guarantee atomicity even if one leg fails, and connectivity checks abort on API hiccups. It’s ideal for self-hosted setups, sidestepping third-party risks. Probalytics complements with a unified API, auto-matching events across Polymarket, Kalshi, and even PredictIt. Sub-10ms streaming feeds live data, while five years of history enables rigorous backtesting; I’ve seen users refine strategies to capture 1-3% spreads consistently.

Comparison of Top Polymarket-Kalshi Arbitrage Tools (2026)

| Tool | Key Features | Pricing Model | Best Use Case |

|---|---|---|---|

| PolyTracker Pro | 120+ market mappings, whale tracking 🐋, smart alerts (email/Telegram/Discord/webhooks), advanced analytics | Subscription: $49/month | Real-time monitoring and alerting for manual traders |

| Polysmart | AI-driven 94% accuracy, auto-execution, real-time price tracking, live examples | Freemium / Pro $99/month | Hands-off automated arbitrage trading |

| ArbitrageHub | Real-time detection, smart filtering, advanced analytics, instant alerts | Subscription: $79/month | Professional analytics and opportunity discovery |

| Arbiter-Bot | Rust-based high speed ⚡, dry-run modes, saga execution, connectivity checks | Open-source (self-hosted) | High-frequency, low-latency arbitrage execution |

| Probalytics | Unified API, sub-10ms streaming, event matching (PM/Kalshi/PredictIt), 5yr backtesting data | API: Pay-per-use / $199/month | Strategy development and backtesting for developers |

These platforms collectively address the arbitrage lifecycle: detection, validation, execution, and review. Yet integration demands care. Start with API keys from both exchanges, map events manually if needed, and calibrate for fees; Polymarket’s 0.5% trading fee plus Polygon gas can halve a 1% spread. U. S. traders leverage Kalshi’s fiat on-ramps, hedging with Polymarket via VPNs where compliant, though I advise legal scrutiny.

Bots and AI are dominating Polymarket by exploiting mispriced odds and latency, leaving human traders struggling to compete.

Implementation mirrors disciplined allocation: allocate 5-10% of portfolio to arb strategies, diversify across 20 and events, and monitor drawdowns. Backtest rigorously; Probalytics shines here, quantifying edge decay as liquidity matures. Risks loom large: flash crashes wipe liquidity, regulatory shifts could harmonize prices, and black swan events invalidate hedges. Counter with position sizing under 1% per trade and multi-bot diversification.

Navigating Hype: PolyXBot, Fortuna Pro, and the Real Contenders

Amid 2026 buzz, PolyXBot arbitrage and Fortuna Pro Polymarket tools surface in forums, promising seamless automation. Yet scrutiny reveals gaps; they lack the mappings depth or backtesting provenance of leaders like PolyTracker Pro. Kalshi AI trading bots evolve rapidly, but proven accuracy favors Polysmart’s 94% hit rate. For crypto traders eyeing prediction market arbitrage, prioritize open-source audits and community traction over marketing sizzle. A step-by-step guide underscores basics: align wallets, sync probabilities, execute bid-ask straddles.

Prediction markets in 2026 demand infrastructure that turns volatility into velocity. PolyTracker Pro’s alerts, Arbiter-Bot’s resilience, and Probalytics’ data moat equip traders to harvest structural edges without the gamble. In multi-asset management, I’ve learned steady hands prevail by stacking probabilities, not chasing yields. Deploy these selectively, validate relentlessly, and watch divergences compound into portfolio ballast.