In the relentless world of crypto, volatility is the rule, not the exception. As AI-driven trading agents become more sophisticated, so too must our approach to risk management. The days of set-and-forget bots are over; today’s traders need dynamic, multi-layered defense systems to protect portfolios from sudden market swings, agentic missteps, and evolving cyber threats. Let’s peel back the curtain on five advanced risk management techniques that separate seasoned AI risk managers from those just rolling the dice.

Dynamic Stop-Loss and Take-Profit Automation

Forget static stop-losses. Modern AI trading agents deploy dynamic stop-loss and take-profit automation, recalibrating thresholds in real time based on shifting volatility and liquidity conditions. This isn’t just about cutting losses or banking gains at pre-set levels – it’s about using predictive analytics to anticipate where price action could turn against you or when a rally is running out of steam. By integrating machine learning models that monitor order book depth, momentum shifts, and even macro news sentiment, these systems can tighten or relax exit parameters on-the-fly.

This adaptive approach means your bot won’t get whipsawed out during a flash crash nor miss out on extended runs when Bitcoin surges past $100,000. For a deep dive into the mechanics behind automated trade exits, check out this resource.

AI-Driven Position Sizing Based on Volatility Analysis

How much should your AI agent allocate per trade? The answer shouldn’t be a fixed percentage. AI-driven position sizing based on volatility analysis leverages real-time measurements like ATR (Average True Range) or custom ML volatility forecasts to adjust bet sizes dynamically. When markets are calm, your agent can scale up exposure; when turbulence spikes – say during an unexpected regulatory announcement – it automatically dials back risk.

“The most dangerous phrase in trading is ‘this time it’s different. ‘ Adaptive position sizing ensures you never bet too big when uncertainty reigns. “

This technique is particularly potent for traders managing multi-asset portfolios or juggling several strategies simultaneously. It helps prevent catastrophic drawdowns from oversized positions during black swan events – a crucial edge for anyone serious about AI risk management crypto.

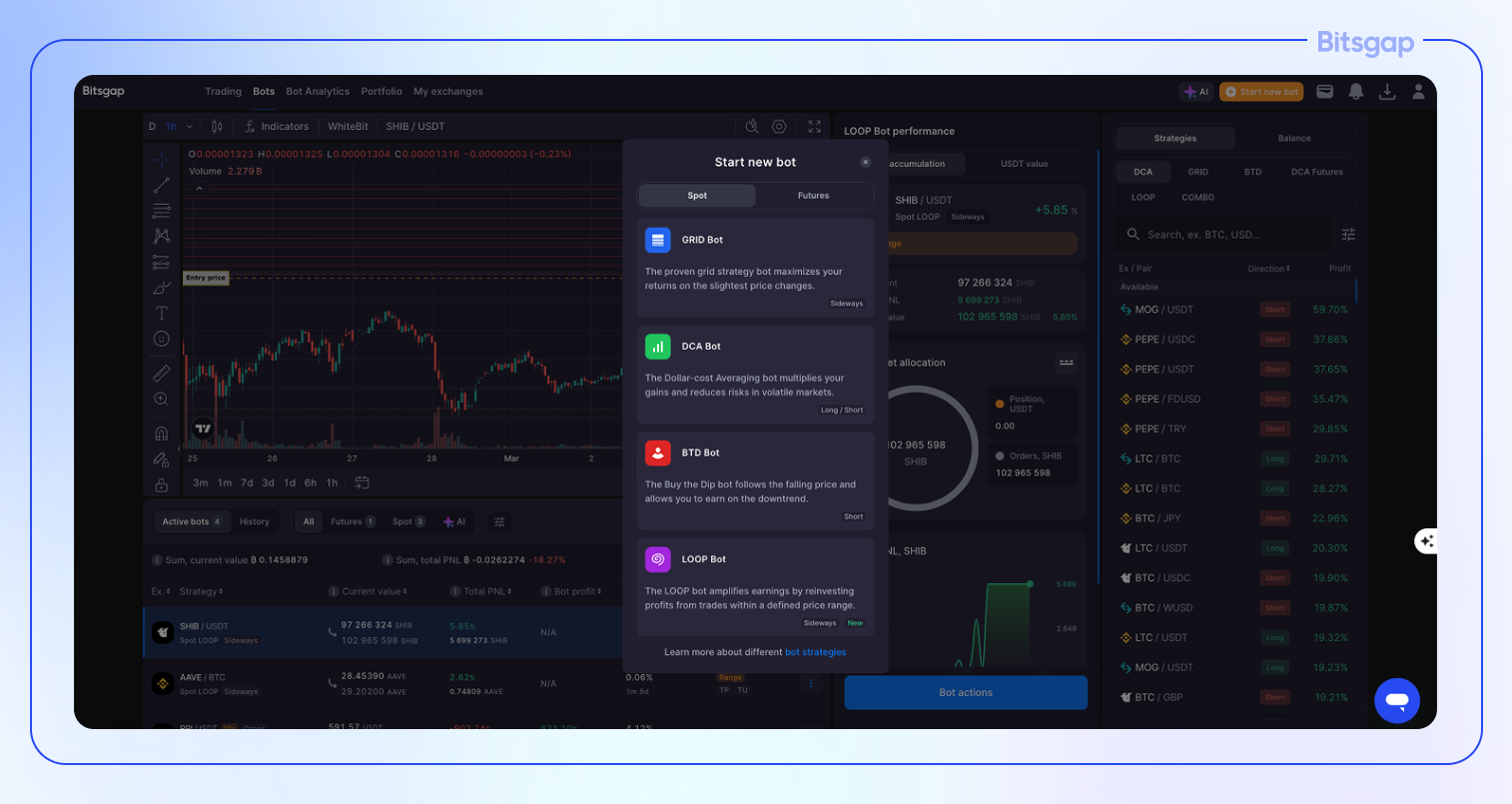

Real-Time Anomaly Detection and Trade Suspension

The holy grail for automated risk strategies? Real-time anomaly detection and trade suspension. Picture this: your bot is humming along when suddenly it detects an uncharacteristic spike in slippage or a pattern that historically precedes exchange outages. Rather than blindly executing trades into chaos, advanced agents can instantly halt activity and alert you for manual review.

Top 5 AI-Powered Crypto Risk Controls

-

AI-Driven Position Sizing Based on Volatility Analysis: Tools such as Token Metrics and QuantConnect use AI to analyze market volatility and adjust trade sizes accordingly, ensuring optimal exposure and reducing risk during turbulent price swings.

-

Real-Time Anomaly Detection and Trade Suspension: Platforms like KuCoin and Cryptohopper employ AI algorithms to monitor for unusual market activity or suspicious trading patterns, automatically pausing trades when anomalies are detected to prevent cascading losses.

-

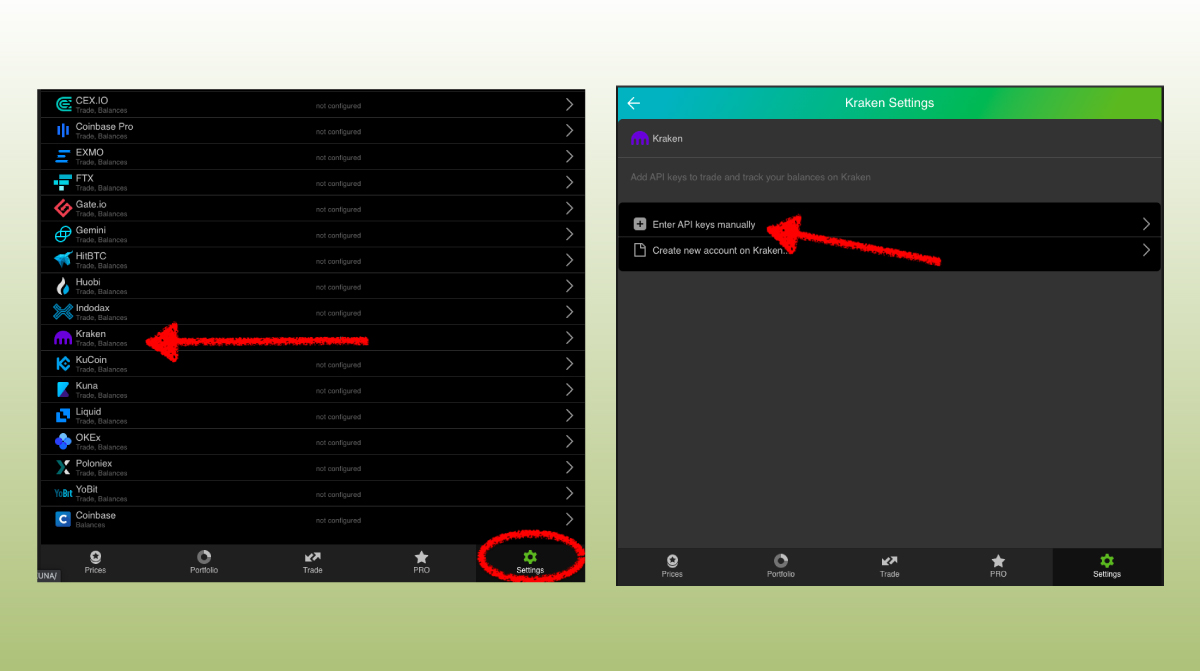

Granular Permission Controls for Trading Agent APIs: Leading exchanges such as Kraken and Coinbase Pro offer detailed API permission settings, allowing users to restrict AI trading agents to only essential functions—significantly reducing the risk of unauthorized actions or breaches.

This isn’t just theory – it’s already being used by top algorithmic desks to dodge cascading liquidations triggered by flash crashes or exploit attempts. For more on how continuous monitoring powers autonomous protection layers in crypto trading agents, see this detailed analysis.

The Next Level: Granular Permission Controls and Automated Diversification

The story doesn’t end here! In the next section we’ll explore how granular permission controls for agent APIs and automated portfolio diversification algorithms round out this robust toolkit for crypto trading agent risk controls.

With the foundation of dynamic exits, adaptive sizing, and anomaly detection in place, two more advanced techniques push AI risk management in crypto to the bleeding edge: granular API permission controls and automated diversification algorithms. These strategies fortify both operational security and structural resilience, ensuring your AI agents don’t just survive volatility, they thrive in it.

Granular Permission Controls for Trading Agent APIs

Every integration point is a potential attack surface. That’s why granular permission controls for trading agent APIs are non-negotiable for serious traders. Instead of granting bots blanket access to all exchange features, savvy operators restrict permissions to the absolute minimum needed: trade execution only, no withdrawal rights, perhaps even limiting trading pairs or order types.

This principle of least privilege is your first line of defense against rogue code, compromised credentials, or accidental fat-fingered trades. If an agent is only allowed to place limit orders on BTC/USDT and nothing else, even a breach can’t drain your entire account or wreak havoc across multiple assets. As Tom Croll points out in his analysis of hidden risks, vigilant permissioning dramatically reduces the blast radius of any single failure.

For teams running multiple bots or strategies on shared infrastructure, granular API controls also enable precise monitoring and forensic auditing, so you always know which agent did what and when.

Automated Portfolio Diversification Algorithms

The last pillar: automated portfolio diversification algorithms. In crypto’s 24/7 battlefield, concentration risk can turn a winning streak into disaster overnight. Modern AI agents deploy diversification logic that goes far beyond simple equal-weighting: they analyze real-time correlations between assets (think BTC/Ethereum decoupling during macro shocks), sector exposures (DeFi vs Layer 1s), and even liquidity regimes.

The result? Your capital is intelligently spread across uncorrelated bets, meaning a sudden Solana outage or meme coin collapse won’t take down your whole portfolio. Some systems even rebalance automatically as new data streams in, using reinforcement learning to optimize allocations amid shifting market microstructures. This approach has been shown to reduce unsystematic risk by up to 50%, according to recent studies on algorithmic crypto trading (see more here).

If you’re aiming for true AI portfolio protection, diversification isn’t just a buzzword, it’s your insurance policy against the unknown unknowns lurking in every new block.

Putting It All Together: The Future of Crypto Trading Agent Risk Controls

So what does a next-gen risk-managed AI trading stack look like?

- Dynamic stop-loss/take-profit automation: Exit trades with surgical precision based on live volatility signals, not static rules.

- AI-driven position sizing via volatility analysis: Scale exposure up or down as uncertainty shifts.

- Real-time anomaly detection and trade suspension: Instantly pause trading when market conditions go off-script.

- Granular API permission controls: Limit bot capabilities to minimize operational risk and enhance auditability.

- Automated diversification algorithms: Spread risk intelligently across uncorrelated assets and strategies, no more all-eggs-in-one-basket disasters.

Together, these techniques offer an edge that’s impossible with manual methods alone, turning every move into a calculated play rather than a roll of the dice. As AI agents become increasingly autonomous and markets ever more unpredictable, embracing these layered defenses isn’t just smart, it’s essential for survival at scale.

If you’re ready to supercharge your crypto trading agent risk controls with these advanced frameworks, or want more technical deep-dives, explore additional resources from Quantified Strategies. Stay curious out there; in this game, robust risk management is the ultimate alpha generator!