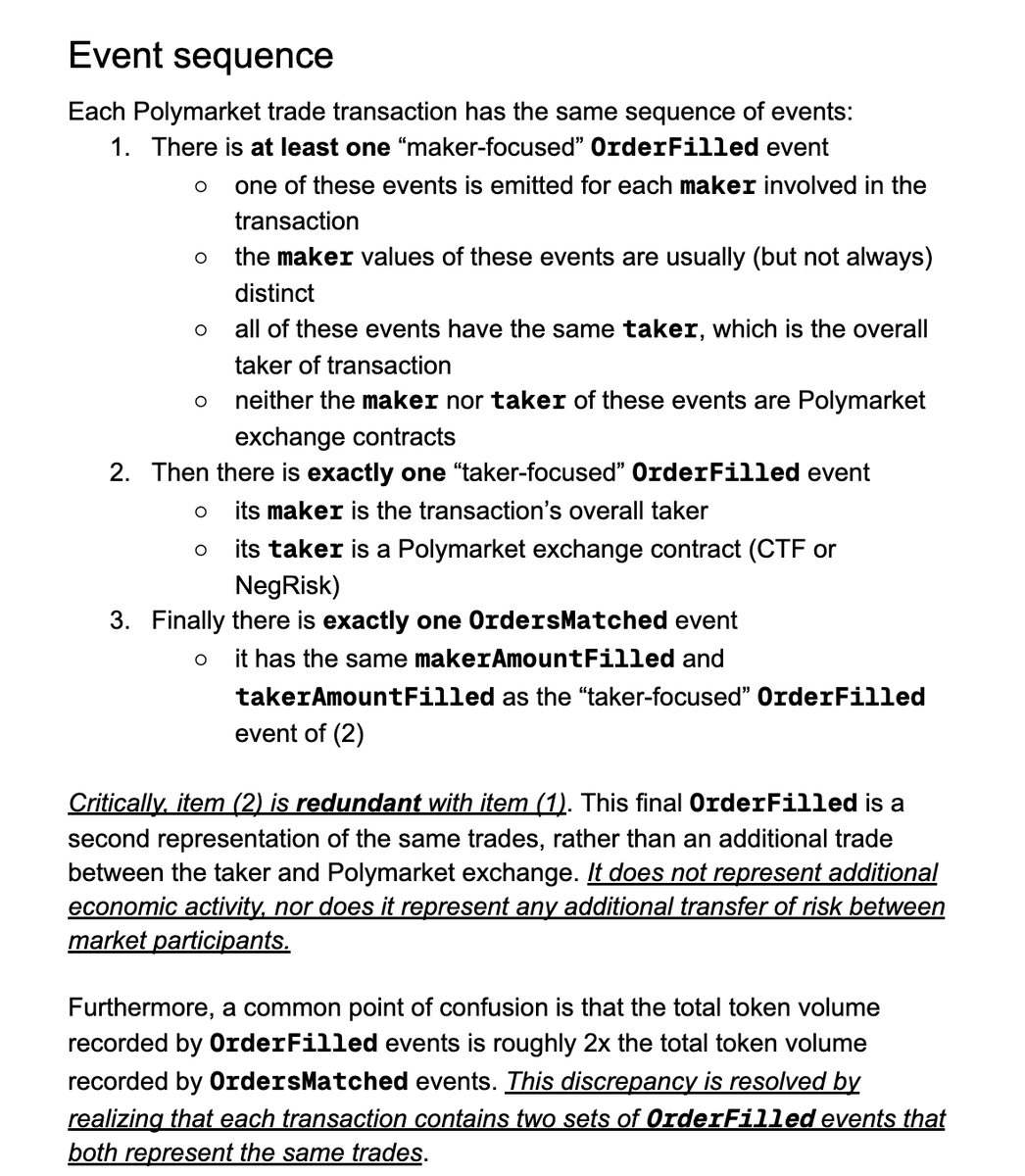

Picture this: Polymarket, the prediction market darling of crypto, buzzing with millions in daily volume as Polymarket AI trading agents swoop in like digital vultures, snatching arbitrage profits before your eyes can blink. But hold up, is it all autonomous bots Polymarket arbitrage glory, or are we swimming in a sea of viral fake stories? In 2026, the line between real edges and manufactured hype has never been blurrier, especially with studies slapping a 25% fake trade label on the action. I’ve dug through the noise, from bot builder confessions on Reddit to Columbia University takedowns, and what emerges is a thrilling yet treacherous playground for AI prediction market bots 2026.

Let’s get real. Polymarket isn’t your grandma’s betting pool anymore. It’s a hyper-efficient info machine where prices on everything from election odds to crypto ETF approvals shift in milliseconds. Enter the bots: sleek, relentless, and raking in millions by pouncing on latency gaps and cross-market mispricings. Reports from Yahoo Finance and MEXC paint a vivid picture provides arbitrage bots dominate Polymarket, leaving human traders in the dust. These aren’t clunky scripts; they’re AI beasts monitoring order flow, liquidity wobbles, and real-time news feeds, courtesy of outfits like PredictEngine and PolyBrainZ.

Arbitrage Kings: How Real Bots Are Winning Big in 2026

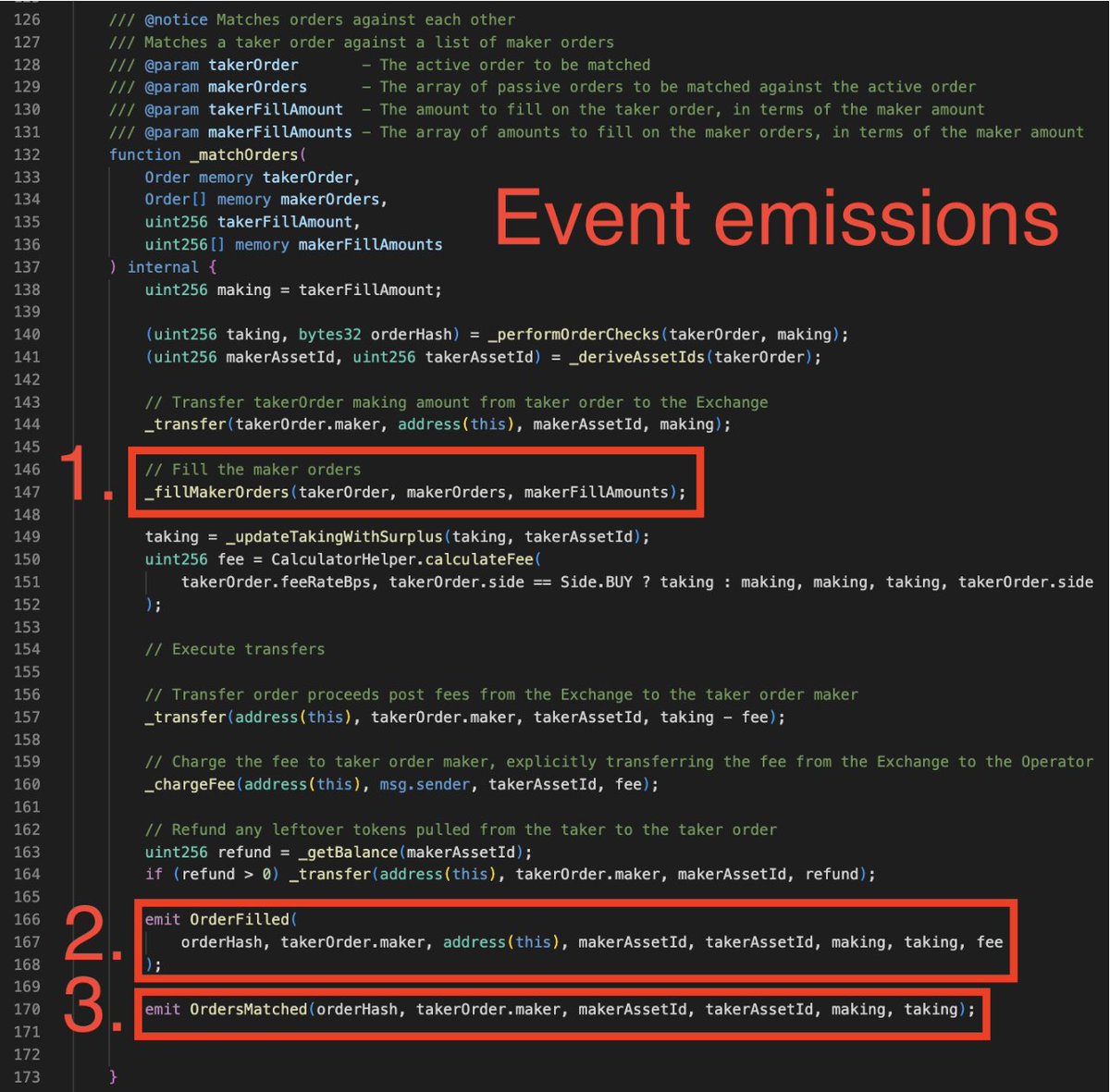

Curious what makes these real Polymarket trading bots tick? It’s all about speed and smarts. QuantVPS breaks it down: AI refines strategies by tracking price shifts across Polymarket and rivals like Kalshi, spotting arb ops where odds diverge from reality. Structural plays shine too, think UMA oracle disputes or ambiguous market resolutions that bots game with precision. One Medium playbook nails it: edge flows from data access and understanding Polymarket’s quirks, not just brute force.

I’ve swing traded enough DeFi edges to know pure arb is rare gold. A Reddit dev tested four strategies and confessed: markets are way more efficient than expected. Yet bots persist, capturing millions as per recent reports. Platforms like Polysmart automate this, blending on-chain analytics with sentiment scrapes. Energetically speaking, it’s exhilarating, humans can’t compete on execution, but we can spot the setups bots miss.

The Dark Side: Wash Trading and Inflated Volumes Exposed

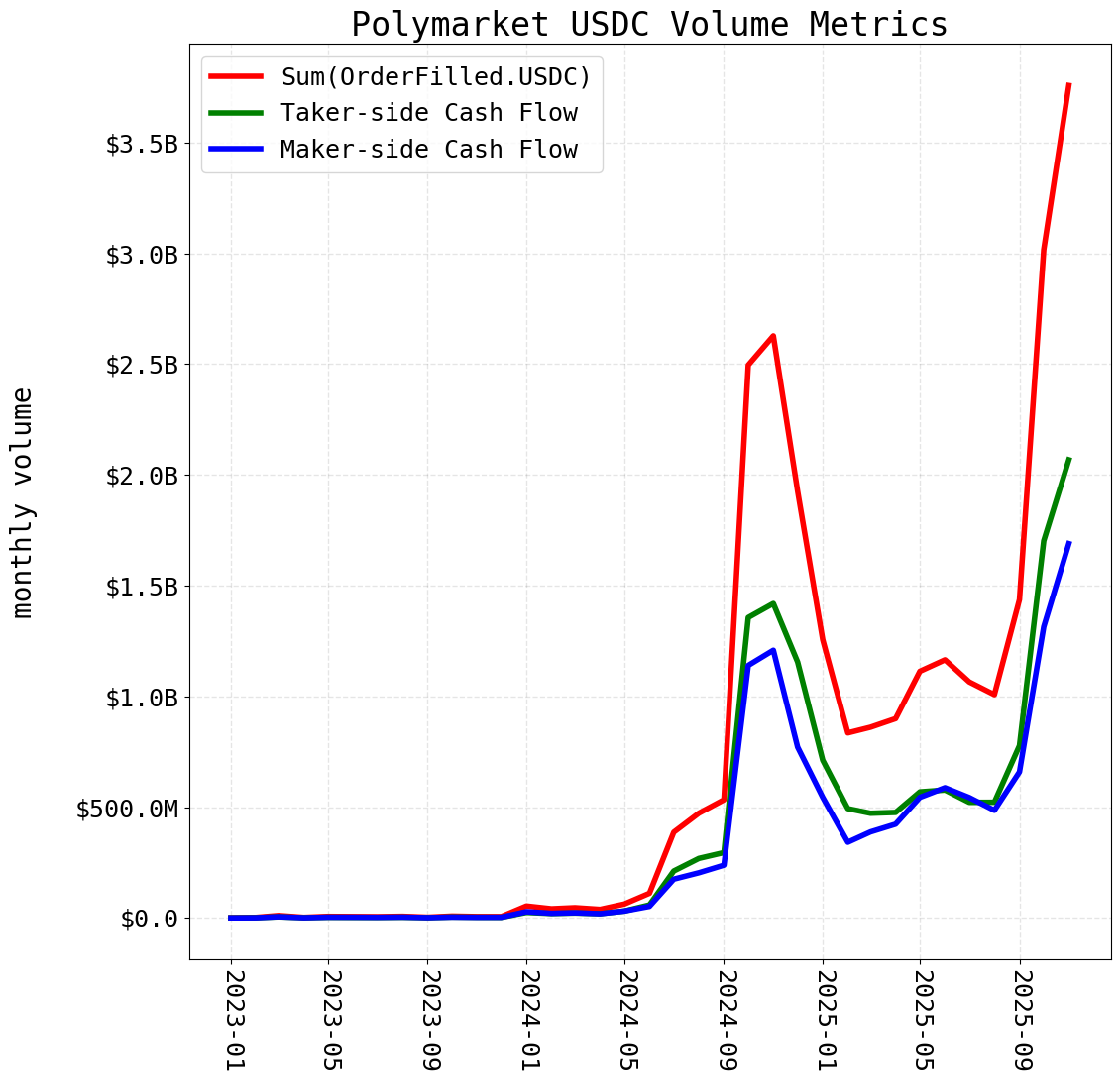

But here’s the insightful gut punch: not all that glitters is profit. A Columbia University study dropped in late 2025, revealing around a quarter of Polymarket trades as fake, wash trading where players swap contracts with themselves to pump volume. Spikes hit 60% in December 2024, per Gizmodo coverage. Trustpilot reviews echo the frustration: Polymarket allegedly juices bots and dispute fees via UMA, with intentionally vague markets ensuring house edges.

This isn’t isolated drama. Viral stories hype AI bot scam fears, like YouTube reviews questioning new platforms’ legitimacy. Yet user chatter suggests some deliver. The real scam? Misinformation floods, from bogus immigration stats to election hype, amplified by prediction markets chasing engagement. Axios called it out: Polymarket and Kalshi peddle unverified claims, blurring truth and trades.

Bot Battles: Real Experiments Versus Hype Machines

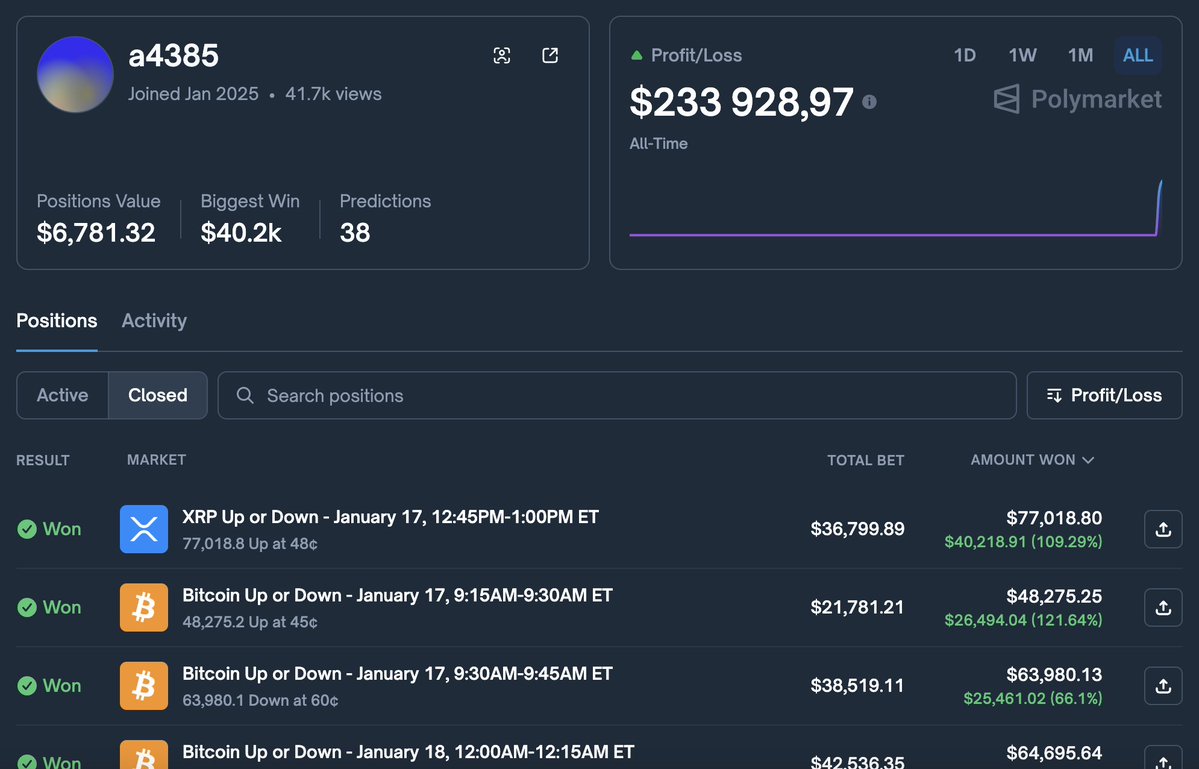

Time to test claims. One bold soul at Startup Fortune handed AI real cash for 46 hours on Polymarket: 140 trades, 13 wins, 24 losses. Raw numbers scream failure, but dig deeper, the bot navigated volatility, snagged niche arbs, and taught volumes about risk sizing. Contrast that with Reddit’s sob story: solid concept, zilch on pure arb. My take? Agentic DeFi Polymarket strategies thrive on hybrids, AI for speed, human insight for context. PolyBrainZ types promise this, but buyer beware amid fake volume fog.

Separating signal from noise means scrutinizing the platforms popping up like mushrooms after rain. PredictEngine leads the pack with its AI-driven arbitrage scanner, cross-referencing Polymarket odds against traditional books and on-chain sentiment. Polysmart takes a swing trader’s angle, automating swing positions on event-driven markets using historical resolution patterns. PolyBrainZ? That’s the wildcard, fusing agentic workflows for multi-market plays, but early user buzz mixes wins with resolution gripes tied to UMA’s oracle drama.

Polygon Technical Analysis Chart

Analysis by Jasmine Calder | Symbol: BINANCE:POLUSDT | Interval: 1D | Drawings: 9

Technical Analysis Summary

On this POLUSDT 1H chart spanning late Jan to mid-Feb 2026, draw a prominent downtrend line connecting the swing high at 0.440 on 2026-02-04T12:00:00Z to the recent low at 0.382 on 2026-02-13T17:00:00Z, using a thick red trend_line to highlight the aggressive bearish channel. Add horizontal_lines at key support 0.360 (strong, green) and resistance 0.420 (moderate, red). Mark the consolidation rectangle from 2026-02-07T00:00:00Z-0.395 to 2026-02-10T00:00:00Z-0.410 with a blue rectangle. Place fib_retracement from the Jan low 0.410 up to Feb high 0.440, targeting 61.8% retrace at 0.420 for bounce potential. Use arrow_mark_down at MACD bearish cross near 2026-02-10T00:00:00Z and callout on volume spike ‘Wash trading volume spike?’ at 2026-02-13T12:00:00Z. Add long_position entry zone at 0.370-0.382 with high risk callout, profit_target at 0.420, stop_loss 0.358. Vertical_line for potential news breakout watch on 2026-02-14.

Risk Assessment: high

Analysis: Volatile crypto swing with bot manipulation risks, but high reward asymmetry on bounce; aligns with my high tolerance

Jasmine Calder’s Recommendation: Scale in longs aggressively at support, target 0.420+; motto: spot the signal before the noise!

Key Support & Resistance Levels

📈 Support Levels:

-

$0.36 – Strong multi-touch low from recent dump, volume shelf

strong -

$0.382 – Current bounce zone, minor support

moderate

📉 Resistance Levels:

-

$0.42 – Key Feb high retest, fib 61.8%

moderate -

$0.44 – Absolute high, major overhead supply

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$0.382 – Aggressive long entry on support bounce amid low volume downside, high conviction reversal

high risk -

$0.37 – Deeper entry if breaks minor support, scale in for swing

high risk

🚪 Exit Zones:

-

$0.42 – Profit target at resistance confluence

💰 profit target -

$0.358 – Tight stop below key support

🛡️ stop loss -

$0.44 – Stretch target on breakout

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Spikes on downside with anomalies suggesting bot/wash trading per Polymarket studies

Unusual volume on dumps but fading conviction—bullish divergence for reversal

📈 MACD Analysis:

Signal: Bearish crossover but histogram contracting

Momentum fading, potential bullish divergence setup for aggressive longs

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Jasmine Calder is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

These aren’t pie-in-the-sky promises. Real Polymarket AI trading agents lean on verifiable edges: latency arb between Polymarket and Kalshi, liquidity sniping during news dumps, or sentiment divergences scraped from Farcaster and Twitter. But the fake stories? They’re the YouTube thumbnails screaming ‘AI Bot Made Me $10K Overnight’ without backtests or code. Viral hype inflates expectations, then crashes into efficient markets where pure arb evaporates faster than a pump-and-dump token.

Edge Breakdown: Strategies That Actually Stack Up

Digging into the playbook, structural arb reigns supreme. Polymarket’s markets often hinge on ambiguous wording, ripe for UMA disputes that bots predict via NLP models trained on past resolutions. Speed edges come from colocated servers sniffing API latencies, as QuantVPS details. Hybrids shine brightest: AI flags setups, you layer in macro context like regulatory whispers or crowd psychology shifts. My swing trading lens spots this asymmetry; bots crush execution, but humans intuit the black swans.

Top Polymarket Bot Strategies 2026

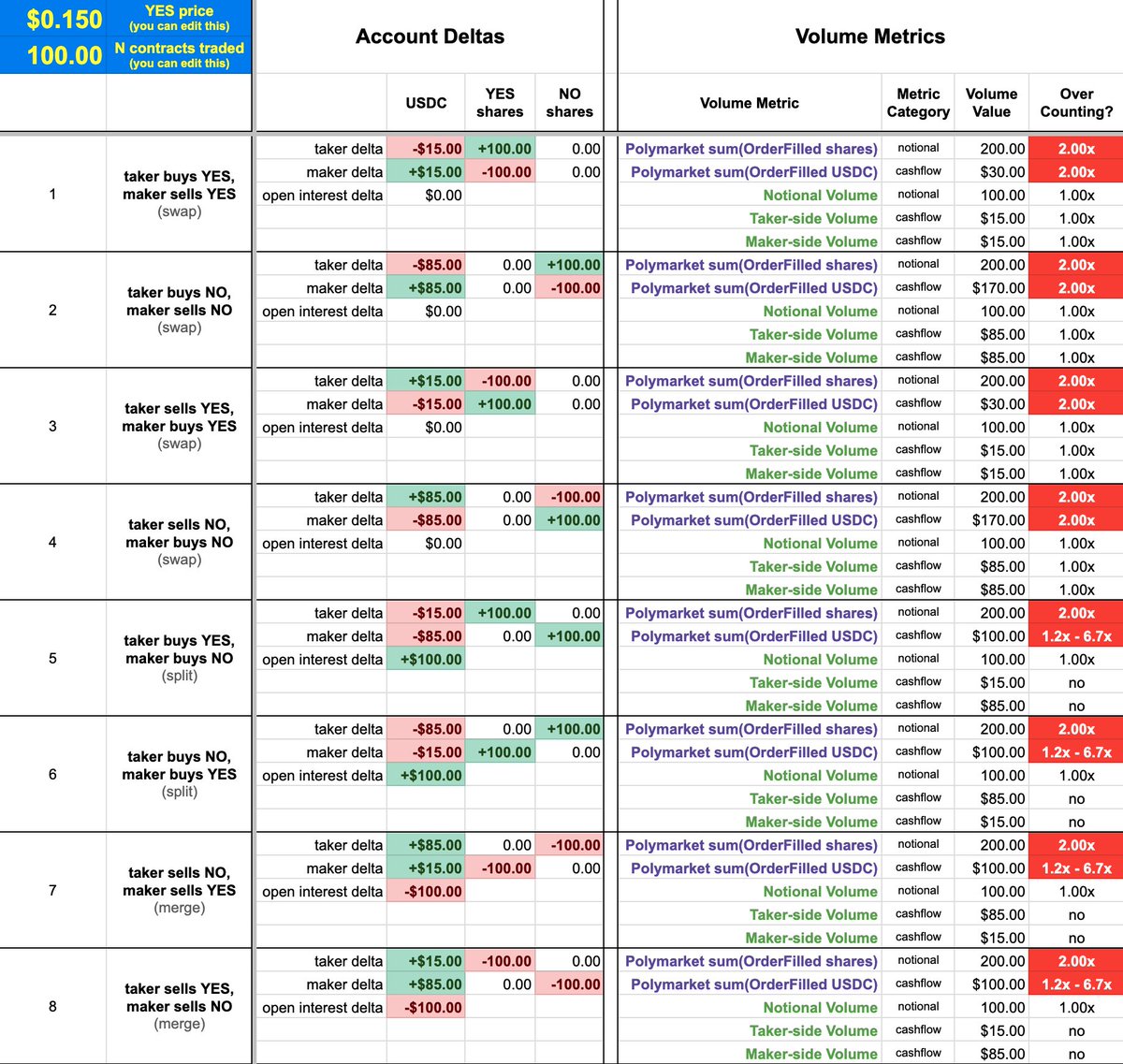

| Strategy | Profit Potential | Challenges | Key Insights |

|---|---|---|---|

| Latency Arbitrage | Millions 💰 | Low rarity (rare opportunities) | Bots exploit mispriced odds and latency, dominating trades; market highly efficient (Yahoo Finance, MEXC, Reddit). |

| Structural Disputes | High edge | Resolution fights ⚠️ | Ambiguous markets resolved via UMA; Polymarket profits from bots and dispute fees (Trustpilot). |

| Cross-Market Arbitrage | Profitable 📈 | Rising efficiency (fewer opportunities) | Arbitrage between Polymarket-Kalshi; AI monitors real-time prices and liquidity (QuantVPS, Medium). |

That Reddit builder’s four-strategy flop? A cautionary tale on over-reliance. Pure arb bombed because markets self-correct in seconds, but blended approaches nabbed niches. The Startup Fortune AI’s 140-trade sprint? Net losses masked selective wins on volatile underdogs, proving bots excel in high-volume grinding over home-run hunting.

Navigating Risks: Fake Volumes, Misinfo, and Bot Pitfalls

Yet risks lurk. Wash trading’s 25% stain, per Columbia’s 2025 bombshell, distorts liquidity signals bots crave. Peaks at 60% volume scream manipulation, eroding trust and inflating false edges. Add Axios-flagged misinfo storms, where bogus claims spike volumes then resolve against the crowd, and you’ve got a minefield. Trustpilot rants nail Polymarket’s alleged bot favoritism via fees and UMA tilts, fueling fake AI bot stories Polymarket skepticism.

Opinion time: ignore the noise, focus on transparency. Legit real Polymarket trading bots publish audited backtests, open-source snippets, and live P and Ls. Scams peddle closed-box black magic. In 2026’s agentic DeFi rush, AI prediction market bots 2026 evolve, but only if platforms like Polymarket clamp down on fakes and sharpen resolutions.

Peering ahead, expect tighter regs and oracle upgrades to squeeze fake volumes, pushing bots toward genuine alpha in niche events. Swing traders like me thrive by riding bot waves with human oversight. The thrill? Spotting that next asymmetric play before bots swarm. Polymarket’s chaos births opportunities; arm yourself with data, dodge the hype, and trade sharp.