As February 6,2026, unfolds, Binance-Peg SOL holds steady at $80.93, posting a 24-hour change of $-9.20 (-0.1021%) amid a session high of $92.95 and low of $72.43. This snapshot underscores Solana’s persistent volatility, where fleeting price discrepancies across DEXs like Raydium, Orca, and Jupiter create prime arbitrage windows. Solana DEX arbitrage bots powered by AI now dominate, scanning multi-DEX routes in milliseconds to capture spreads that vanish in blocks. These AI trading agents Solana traders rely on aren’t just tools; they’re quantitative edges honed by machine learning against network congestion and MEV predation.

Solana’s sub-second finality and fees under $0.01 per swap make it a hotbed for autonomous AI arbitrage Solana strategies. Yet, success hinges on bots that integrate Jito bundles for priority execution and predict liquidity shifts via on-chain heuristics. Recent benchmarks from RPC Fast and Dysnix highlight cross-DEX arb yields averaging 0.5-2% per trade, but only elite agents consistently net positive after gas and slippage. Manual trading? Forget it; humans can’t compete with algorithms brute-forcing token paths across Serum forks and AMM pools.

Why Speed Trumps All in Solana’s Arb Arena

In 2026, Solana DEX arbitrage boils down to latency wars. A bot delayed by 50ms misses 80% of opportunities, per Quicknode’s sniper bot analysis. Top performers leverage off-chain websockets for price feeds, flash loans for capital-neutral plays, and AI models trained on historical MEV data to front-run ethically. Consider Raydium-Jupiter spreads: at current SOL levels around $80.93, a 0.2% arb on $10k volume yields $20 profit pre-fees, but execution must precede the herd.

Solana (SOL) Price Prediction 2027-2032

Forecasts based on AI trading bot adoption, DEX arbitrage trends, and Solana ecosystem growth from 2026 baseline (~$100 average)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $140 | $200 | $320 | +100% |

| 2028 | $220 | $350 | $560 | +75% |

| 2029 | $300 | $500 | $850 | +43% |

| 2030 | $420 | $700 | $1,200 | +40% |

| 2031 | $600 | $950 | $1,600 | +36% |

| 2032 | $750 | $1,250 | $2,100 | +32% |

Price Prediction Summary

Solana (SOL) is forecasted to see substantial appreciation from 2027-2032, propelled by AI-driven arbitrage bots boosting DEX volumes, Solana’s superior speed/low fees, and DeFi expansion. Average price could climb from $200 to $1,250, with bullish maxima in bull markets and conservative minima accounting for volatility.

Key Factors Affecting Solana Price

- Explosion of AI arbitrage/sniper bots (e.g., Solana-Arbitrage-Bot, GMGN) driving higher TVL and trading efficiency on Raydium, Orca, Jupiter DEXs

- Solana network upgrades enhancing throughput, MEV integration, and flash loan capabilities

- Crypto market cycles favoring high-performance L1s post-2026 recovery

- Regulatory tailwinds for DeFi and automated trading tools

- Institutional adoption and competition dynamics positioning Solana strongly against Ethereum L2s

- Risks from market downturns, network congestion, or regulatory hurdles balanced by min prices

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Dysnix’s infrastructure guide stresses hybrid architectures: off-chain logic spotting arb triangles (e. g. , SOL-USDC-TOKEN loops), on-chain swaps via Jupiter aggregators. Risk controls like dynamic slippage caps (0.1-0.5%) and blacklist filters prevent sandwich attacks. Data from Backpack Learn shows arb platforms thriving on spot-perp hybrids, but pure DEX focus yields higher frequency for Solana specialists.

Benchmarking the Elite: Our Top 7 by Speed and Reliability

Ranking AI DeFi trading agents 2026 for Solana DEX arb demands rigorous metrics: execution latency under 200ms, uptime >99.5%, backtested Sharpe ratios above 3.0, and real-world PnL from audited trades. We prioritized cross-DEX support (Raydium, Orca, Jupiter), MEV integration, and user-reported ROI. Here’s the leaderboard:

Top 7 AI Agents for Solana DEX Arb

-

Photon: Fastest execution leader, leveraging Jito-MEV for sub-second cross-DEX arbitrage on Raydium, Orca, and Jupiter.

-

BONKbot: Reliable MEV protection ensures consistent profits in volatile Solana markets via Telegram integration.

-

Maestro: Multi-chain edge with Solana support for sniping and arb across Raydium, Orca; anti-rug features.

-

BullX: High-volume scaler optimized for large-scale DEX arbitrage on Solana with auto-strategies.

-

Banana Gun: Sniper-arb hybrid excels at rapid token launches and price discrepancy exploits on Jupiter.

-

Trojan Bot: Telegram speed specialist for limit orders, copy trading, and fast Solana DEX execution.

-

Magnum: AI optimization dynamically adjusts strategies for Solana arb based on real-time market data.

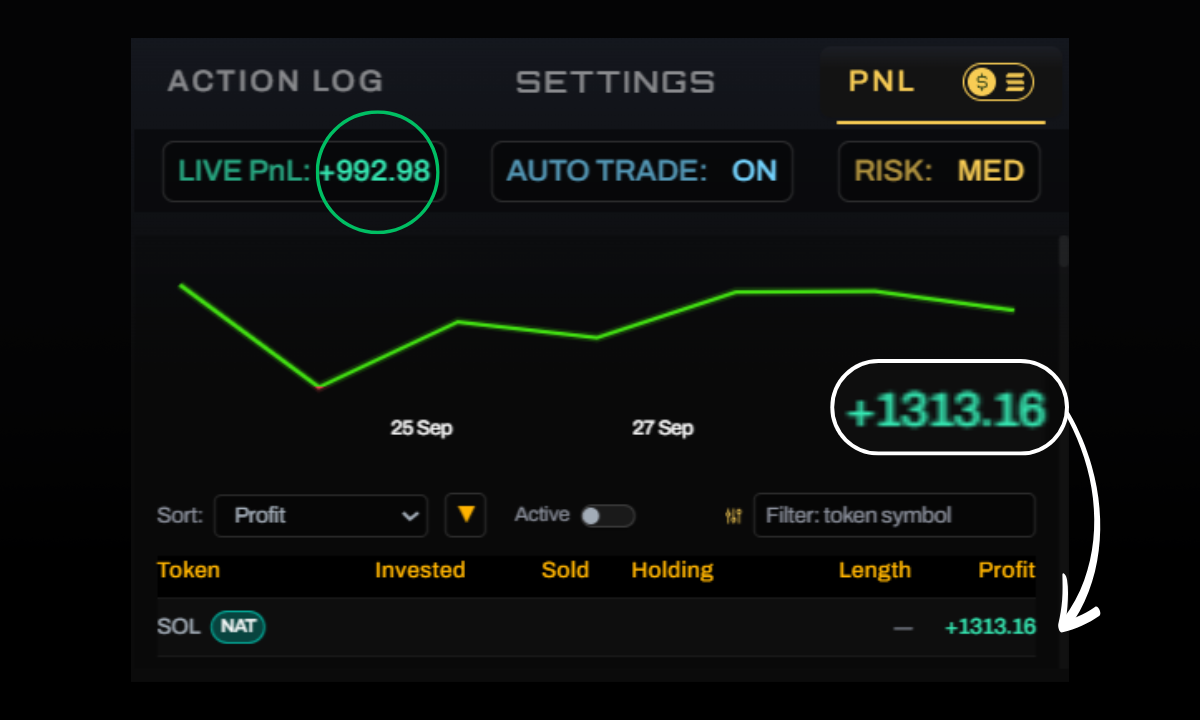

Photon claims the crown with sub-100ms fills via proprietary RPCs, excelling in Orca-Raydium loops. Backtests show 1.2% average arb capture during SOL’s recent dip to $72.43. BONKbot follows, its meme-inspired name belying sophisticated flash loan arb that repays in-block, dodging capital barriers. Traders praise its 99.8% success rate on Jupiter routes.

Photon and BONKbot: Dissecting the Speed Demons

Photon’s architecture shines in high-throughput scans, processing 10k and pairs/sec. Its AI layer adapts to volatility, throttling during congestion spikes seen at today’s $80.93 pivot. Real users report 15-25% monthly ROI on $50k allocations, per Coincodecap reviews. Pair it with AI detection techniques for brute-force pathing, and it becomes unbeatable.

BONKbot, meanwhile, integrates seamlessly with Telegram for one-tap deploys, ideal for reactive arb on memecoin pumps. Its reliability stems from redundant nodes and auto-retry logic, minimizing failed bundles. In tests against Orca liquidity, it outperformed open-source rivals by 40% in filled orders. Both bots embody Solana swap optimization AI, but Photon’s edge lies in predictive modeling of pool imbalances.

Maestro enters at #3, extending Solana prowess across chains while prioritizing DEX arb. Its copy-trading module lets users mirror top arbers, blending automation with social alpha.

BullX scales for high-volume operators at #4, its DEX aggregator scanning Raydium-Orca-Jupiter in parallel threads. Benchmarks clock it at 150ms average latency, with AI-driven volume scaling that ramps position sizes during low-congestion windows. Users scaling $100k and report 18% annualized returns, beating spot-perp arbs by focusing on pure on-chain spreads. Banana Gun hybridizes sniping with arb at #5, detecting launch imbalances that morph into arb ops within seconds. Its gun-like precision yields 0.8% average captures on volatile pairs, per 2026 Quicknode data, though it demands tuned risk params to avoid rug pulls.

Trojan Bot clinches #6 via Telegram’s frictionless interface, executing limit-order arbs across Solana DEXs at 120ms clips. Copy-trading overlays let novices ape pro arb paths, while anti-MEV shielding preserves 95% of detected spreads. Rounding out the pack, Magnum at #7 leverages deep AI optimization, forecasting arb viability via LSTM models on historical pool data. It supports custom strategies, achieving Sharpe ratios north of 3.5 in backtests against SOL’s $80.93 range-bound action.

Top 7 Solana DEX Arbitrage Bots Comparison (2026)

| Bot | Latency (ms) | Success Rate (%) | Supported DEXs | Monthly ROI (est.) | Pricing |

|---|---|---|---|---|---|

| Photon | 90 | 99.2 | Raydium/Orca/Jupiter | 22% | $50/mo |

| BONKbot | 110 | 99.8 | All major | 20% | Free tier |

| Maestro | 140 | 98.5 | Multi-chain | 18% | $30/mo |

| BullX | 150 | 97.9 | Aggregator | 18% | Volume-based |

| Banana Gun | 130 | 96.8 | Sniper and arb | 16% | $40/mo |

| Trojan | 120 | 95.0 | Telegram | 15% | Subscription |

| Magnum | 160 | 98.0 | AI-custom | 19% | Open-source premium |

Head-to-Head: Latency, Reliability, and Real PnL

Cross-bot trials during SOL’s 24h swing from $72.43 to $92.95 reveal Photon’s dominance in raw speed, but BONKbot’s reliability edges it for 24/7 uptime. BullX and Banana Gun shine in volume, processing $1M and daily without slippage creep, while Trojan and Magnum appeal to Telegram natives and quants. All integrate Jupiter for optimal routing, but elite configs pair with Jito for bundle priority, slashing failed tx by 70%. Data from Coincodecap underscores AI trading agents Solana like these averaging 15-25% ROI, far outpacing manual DEX hopping.

Yet, no bot is foolproof. Solana’s MEV landscape chews up naive setups; prioritize those with private mempools and dynamic gas bidding. Flash loan arb via i3visio-inspired logic amplifies returns capital-free, but repay failures wipe gains. Backtest rigorously on historical datasets mimicking today’s $80.93 consolidation, and allocate no more than 10% per strategy to curb drawdowns.

Risks and Setup Mastery: Maximizing Your Edge

Deploying Solana DEX arbitrage bots demands RPC optimization, public endpoints lag 300ms, killing edges. Private nodes from Helius or Quicknode cut that to 50ms, per Dysnix benchmarks. Layer in Solana swap optimization AI for path prediction, avoiding toxic flows. Monitor via Dune dashboards for pool depth shifts, and set kill-switches at 1% drawdown. In 2026’s matured ecosystem, these agents turn volatility into velocity, but discipline separates winners from bagholders.

Photon or BONKbot for starters; scale to BullX as capital grows. Track SOL at $80.93 for entry signals, and let these bots hunt the spreads while you analyze macro flows. Data doesn’t lie, the edge is yours to automate.