In the high-stakes arena of Solana memecoin trading, where fortunes flip faster than a pump. fun launch, autonomous AI agents have emerged as the sharpest tools for snipers in 2026. With Solana’s SOL trading at $128.22 after a 24-hour dip of $1.80 or -1.38%, the blockchain’s on-chain frenzy shows no signs of cooling. AI bots are driving unprecedented metrics, outpacing even last summer’s memecoin mania, and savvy traders are configuring these agents to snipe launches with precision that manual efforts can’t match.

Why Solana Memecoin Sniping Demands AI Autonomy in 2026

Solana’s DEX ecosystem thrives on speed, but memecoin sniping requires more than raw velocity; it demands intelligence. Traditional bots react to signals, but autonomous AI agents Solana style learn from market patterns, adapt to rug pulls, and execute multi-step strategies without human babysitting. Platforms like GMGN AI and BullX Bot exemplify this shift, blending AI-driven token discovery with real-time risk assessment. GMGN AI, for instance, monitors launches across chains, applies advanced filters for liquidity and holder distribution, and auto-snipes with copy trading overlays. Terminal Trading Bot adds Telegram ease with gas optimization, turning chaotic launches into calculated entries.

Consider the data: Solana’s trading volume, turbocharged by these Solana memecoin sniping bots, hits levels unseen before. Academic work from arXiv underscores the edge, with multi-agent systems using chain-of-thought reasoning nailing 73% precision on high-quality memecoins. That’s not luck; it’s agents dissecting wallet histories and KOL behaviors amid manipulative bot noise.

Key Platforms Powering AI Trading Agents for Memecoins

Diving into the ecosystem, Axiom Trade stands out as an all-in-one powerhouse, while GitHub’s SOLTRADE AI integrates DeFi protocols for seamless on-chain automation. Newer kids like G Trader let you spin up agents via text prompts, democratizing AI trading agents memecoin setups. BullX, backed by pros, offers lightning execution and customizable strategies, perfect for novices scaling to pros.

AI agent tokens add fuel: ai16z’s Marc AIndressen invests DAO-voted picks, and FOMO Token’s launchpad uses bonding curves for fair memecoin ramps. These aren’t gimmicks; they’re battle-tested in Solana’s DEX wars, where DeFi sniping agents 2026 must predict dumps before they hit.

Core Configuration Principles for Your First AI Sniper Agent

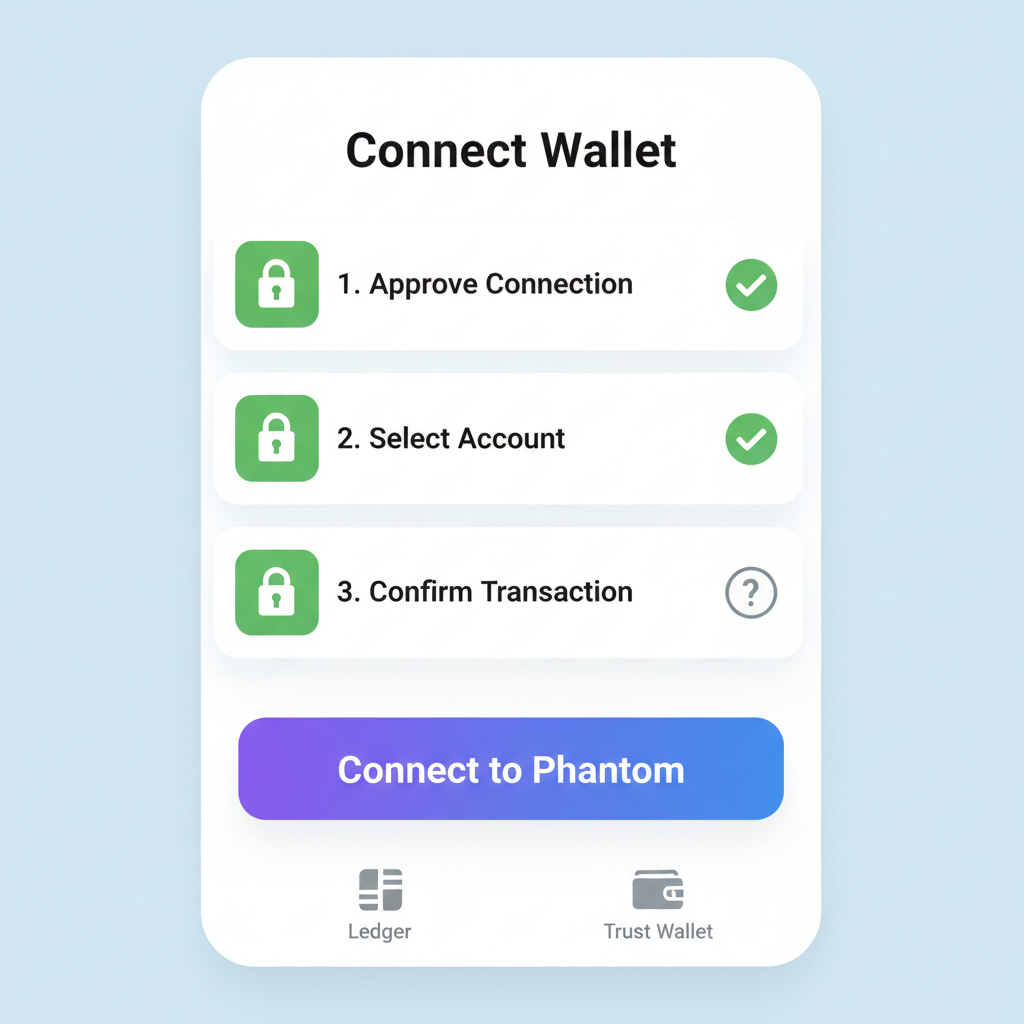

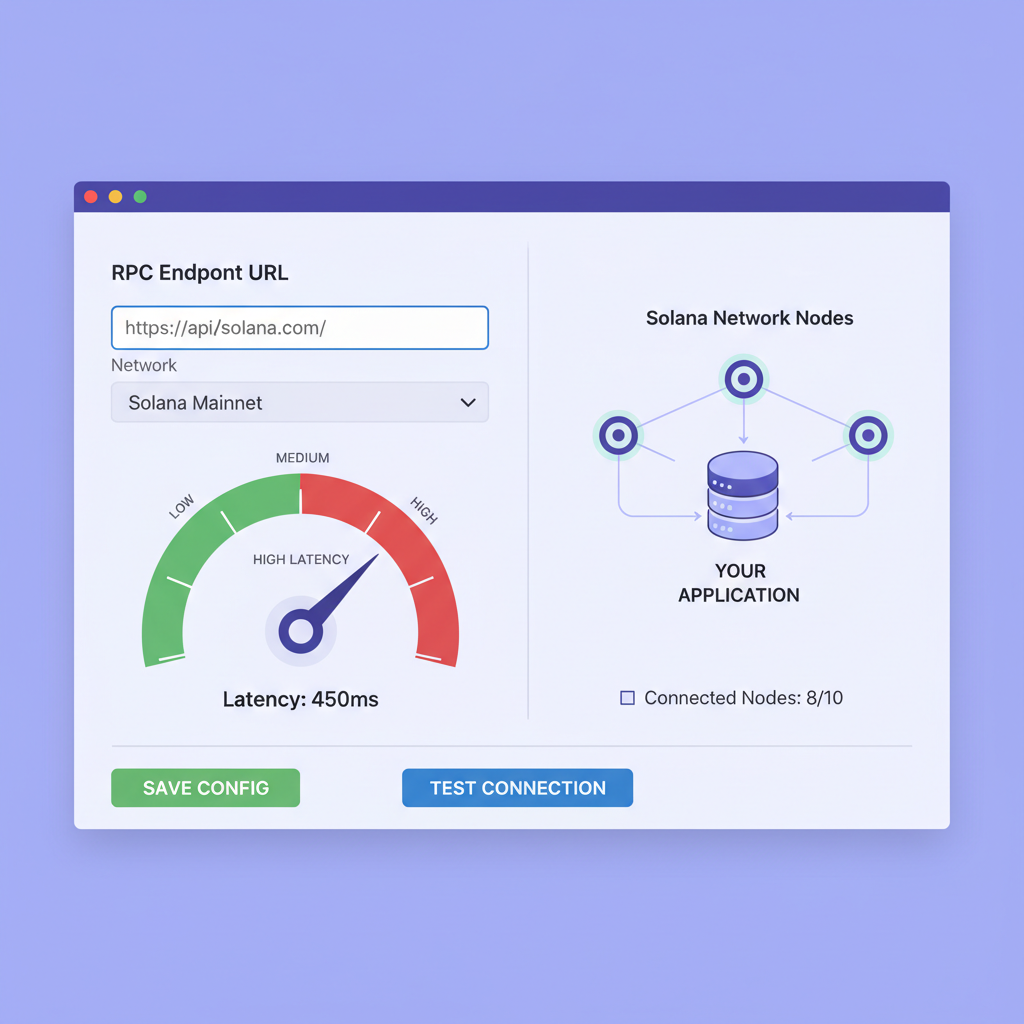

Configuring your agent starts with architecture: prioritize dedicated RPC endpoints for slot timing, as RPC Fast’s guide emphasizes. Aim for sub-400ms latency to front-run launches on Raydium or Jupiter. Set parameters around liquidity thresholds, say 10 SOL min, and social sentiment scores via integrated APIs.

For autonomy, infuse chain-of-thought prompts: “Scan Pump. fun for new pairs, evaluate dev wallet age, holder count >50 in first minute, then snipe 0.5 SOL if volume spikes 5x. ” Backtest against 2025 data to refine. Tools like ElizaOS power agents that self-improve, analyzing past snipes to tweak bribe levels dynamically.

Solana (SOL) Price Prediction 2027-2032

Bullish predictions driven by autonomous AI agents, sniper bots, and memecoin trading boom, starting from $128.22 baseline in early 2026

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $115.00 | $220.00 | $380.00 | +72% |

| 2028 | $200.00 | $380.00 | $650.00 | +73% |

| 2029 | $320.00 | $620.00 | $1,050.00 | +63% |

| 2030 | $500.00 | $950.00 | $1,600.00 | +53% |

| 2031 | $700.00 | $1,350.00 | $2,200.00 | +42% |

| 2032 | $950.00 | $1,850.00 | $3,100.00 | +37% |

Price Prediction Summary

Solana (SOL) is forecasted to experience substantial growth from 2027 to 2032, fueled by the integration of AI agents and sniper bots revolutionizing memecoin trading. Average prices are projected to rise from $220 in 2027 to $1,850 by 2032, reflecting bullish market cycles, ecosystem expansion, and technological superiority, though subject to volatility and external risks.

Key Factors Affecting Solana Price

- Proliferation of AI sniper bots (e.g., GMGN AI, BullX, Terminal) boosting trading volumes

- Autonomous AI agents enabling efficient memecoin sniping and DeFi automation

- Solana’s high TPS, low fees attracting memecoin and trading activity

- Market cycles aligned with Bitcoin halvings and altcoin seasons

- Regulatory developments favoring DeFi and AI crypto innovations

- Competition from L1/L2 chains and potential network stability improvements

- Macro factors: institutional inflows, global adoption, and economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Security layers are non-negotiable; use burner wallets, MEV protection, and simulation modes. I’ve seen agents configured this way turn $100 into five figures on a single viral meme, but only with disciplined risk caps at 2% per trade. Next, we’ll layer in advanced prompts and multi-agent orchestration for 2026 dominance.

Layering in advanced prompts elevates your agent from reactive sniper to predictive powerhouse. Forget rigid scripts; craft prompts that mimic a seasoned trader’s intuition. For Solana DEX AI automation, instruct your agent: “Monitor Raydium launches every slot, cross-reference with GMGN AI filters for rug risk under 5%, simulate bribe impact on priority fee, then execute if projected ROI exceeds 3x within 10 minutes. ” This chain-of-thought approach, validated by arXiv’s multi-agent research, boosts precision to 70% on KOL wallet tracking.

Solana Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:SOLUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

To annotate this SOLUSDT chart in my balanced technical style, start by drawing a prominent downtrend line connecting the September 2026 high around $240 to the late December 2026/early January 2026 low near $127, using ‘trend_line’ with red color for bearish bias. Add horizontal support at $126.86 (recent 24h low) and resistance at $130.41 (24h high), marked as ‘horizontal_line’ in green and red respectively. Highlight the recent consolidation zone from mid-December 2026 to now as a ‘rectangle’ between $126-$132. Use ‘fib_retracement’ from the major downtrend swing high to low for potential retracement levels. Mark volume decline with ‘callout’ on decreasing bars during downtrend. For MACD, add ‘arrow_mark_down’ at the bearish crossover in November 2026. Place ‘long_position’ entry at $127.50 with stop below $126.50 and profit target at $130.50. Use ‘text’ labels for key insights like ‘Bearish channel intact, watch for volume pickup’. Vertical line at 2026-01-23 for current date.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold with low volume; AI bot activity adds unpredictability.

Market Analyst’s Recommendation: Consider small long on support confirmation, scale out at resistance—aligns with medium risk tolerance.

Key Support & Resistance Levels

📈 Support Levels:

-

$126.86 – Recent 24h low and psychological support, holding firm.

strong -

$125 – Minor swing low from late Dec 2026.

moderate

📉 Resistance Levels:

-

$130.41 – 24h high and near-term resistance.

moderate -

$132 – Upper consolidation boundary.

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$127.5 – Bounce from strong support with potential MACD divergence.

medium risk

🚪 Exit Zones:

-

$130.5 – Near resistance for profit take.

💰 profit target -

$126 – Below key support invalidates long.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: decreasing on downtrend

Volume drying up on declines, suggesting weakening bearish momentum.

📈 MACD Analysis:

Signal: bearish crossover persisting

MACD below zero line, but flattening—watch for bullish divergence.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Multi-agent orchestration takes it further, deploying specialized roles like scout, analyst, and executor. The scout scans Pump. fun for fresh pairs, the analyst vets social hype and dev renunciation, while the executor handles trades with dynamic slippage. Platforms like ElizaOS or GitHub’s SOLTRADE AI make this plug-and-play, letting agents collaborate on-chain. In my experience managing cross-asset portfolios, this setup mirrors a hedge fund team, but at Solana speeds. With SOL steady at $128.22 despite the minor 24-hour dip, these systems thrive in volatile memecoin seas.

Step-by-Step Configuration Blueprint

Once orchestrated, backtesting becomes your truth serum. Replay 2025 launches using historical RPC data, tweaking for metrics like win rate above 60% and max drawdown under 15%. Integrate AI trading agents memecoin with tools like Terminal Trading Bot for Telegram alerts, ensuring you oversee without micromanaging. Customize gas bribes dynamically – low for steady volume, high for contested snipes – and cap position sizes to 1% of portfolio, aligning with my ‘diversify to thrive’ mantra even in high-octane plays.

Code Snippet: Prompting Your Agent for Precision Sniping

Python Solana Memecoin Sniper: Liquidity Checks & Auto-Sell Agent

To empower your autonomous AI agent with precise Solana memecoin sniping capabilities, here’s a strategic Python blueprint. This script leverages Solana RPC for real-time liquidity validation, executes targeted buys, and deploys intelligent auto-sell logic to lock in profits—essential for 2026’s high-velocity markets. Customize thresholds and integrate with price oracles like Birdeye for production readiness.

```python

import asyncio

import json

from solana.rpc.async_api import AsyncClient

from solana.rpc.commitment import Confirmed

from solders.pubkey import Pubkey

from solders.keypair import Keypair

from solders.system_program import transfer, TransferParams

import base58

# Configuration

RPC_URL = "https://api.mainnet-beta.solana.com" # Use a fast RPC like Helius for production

WALLET_PRIVATE_KEY = base58.b58decode("YOUR_PRIVATE_KEY_HERE") # Secure this!

WALLET = Keypair.from_bytes(WALLET_PRIVATE_KEY)

LIQUIDITY_THRESHOLD = 10000 # Minimum liquidity in SOL

PROFIT_MULTIPLIER = 2.0 # Auto-sell at 2x profit

async def get_pool_liquidity(client: AsyncClient, pool_mint: str) -> float:

"""Check liquidity in the memecoin pool using Raydium or similar. Simplified example."""

# In practice, query Raydium AMM account or use Birdeye API

# This is a placeholder RPC call - adapt to actual pool structure

pool_pubkey = Pubkey.from_string(pool_mint)

resp = await client.get_account_info(pool_pubkey, commitment=Confirmed)

if resp.value is None:

return 0.0

# Parse liquidity from account data (base58 decoded, offsets depend on program)

data = resp.value.data

liquidity_sol = float(int.from_bytes(data[64:72], 'little')) / 1e9 # Example parsing

return liquidity_sol

async def execute_buy_swap(client: AsyncClient, memecoin_mint: str, buy_amount_sol: float):

"""Execute buy swap via Jupiter or Raydium. Simplified - use Jupiter API in production."""

# Placeholder for Jupiter swap quote and transaction

print(f"Executing buy swap for {memecoin_mint} with {buy_amount_sol} SOL")

# tx = build_jupiter_swap_tx(...)

# sig = await client.send_transaction(tx, WALLET)

# return sig

return "mock_tx_signature"

async def monitor_and_auto_sell(client: AsyncClient, memecoin_mint: str, entry_price: float):

"""Monitor position and auto-sell at profit target."""

while True:

# Get current price (use Birdeye or Dexscreener API)

current_price = await get_current_price(memecoin_mint) # Implement this

if current_price >= entry_price * PROFIT_MULTIPLIER:

print(f"Auto-selling at {PROFIT_MULTIPLIER}x profit!")

# execute_sell_swap()

break

await asyncio.sleep(5)

async def snipe_memecoin(memecoin_mint: str, buy_amount_sol: float = 0.1):

"""Main sniping function with liquidity check and auto-sell."""

client = AsyncClient(RPC_URL)

# Step 1: Liquidity check

liquidity = await get_pool_liquidity(client, memecoin_mint)

if liquidity < LIQUIDITY_THRESHOLD:

print(f"Insufficient liquidity: {liquidity} SOL. Skipping.")

return

print(f"Liquidity OK: {liquidity} SOL. Proceeding to snipe {memecoin_mint}")

# Step 2: Buy

entry_price = await get_current_price(memecoin_mint) # Implement price fetch

tx_sig = await execute_buy_swap(client, memecoin_mint, buy_amount_sol)

print(f"Buy executed: {tx_sig}")

# Step 3: Auto-sell task

asyncio.create_task(monitor_and_auto_sell(client, memecoin_mint, entry_price))

# Placeholder functions - implement with real APIs

async def get_current_price(mint: str) -> float:

return 0.001 # Mock

# Usage: Integrate into your AI agent's prompt/loop

# asyncio.run(snipe_memecoin("NewMemecoinMintAddressHere"))

```This modular design allows your AI to make data-driven decisions swiftly. Strategically, backtest on devnet, secure your RPC endpoint (e.g., Helius), and layer in rug-pull detection for defense. You’re now equipped to dominate memecoin launches—trade smart, stay vigilant!

Security isn’t optional; it’s the moat. Route trades through private mempools to dodge sandwich attacks, rotate burner wallets post-snipe, and enable simulation trades during low-volume hours. BullX Bot’s real-time analytics shine here, flagging anomalies like sudden dev sells. I’ve configured agents that navigated last year’s rug epidemics unscathed, preserving capital for the next 100x moonshot.

Looking ahead, as Solana’s on-chain metrics soar – fueled by these DeFi sniping agents 2026 – expect deeper integrations with AI agent tokens like ai16z. Marc AIndressen’s DAO-driven picks could inform your snipers, blending community wisdom with machine learning. FOMO Token’s bonding curves offer safer entry ramps, reducing front-run risks.

Yet, sniping isn’t gambling; it’s strategic asymmetry. Pair it with long-term SOL holds at $128.22, hedging against the 24-hour low of $126.86. Platforms like Axiom Trade and G Trader lower barriers, but success hinges on iterative refinement. Start small, learn from each cycle, and watch your agent evolve into a portfolio sentinel. In Solana’s memecoin coliseum, the autonomous edge isn’t just advantage – it’s survival. Diversify your tactics, thrive amid the chaos.