Imagine Bitcoin holding steady at $89,923.00 amid whispers of the next bull leg, while autonomous bots on Hyperliquid silently execute futures trades with precision that humans can only dream of. As we hit January 2026, reinforcement learning crypto trading isn’t just hype; it’s delivering real edges in the chaotic world of decentralized futures. Hyperliquid, with its lightning-fast orderbook and deep liquidity, has become the playground for these AI crypto futures bots, turning raw market data into profitable strategies without a single human click.

What excites me most? These Hyperliquid trading bots aren’t rigid rule-followers. Powered by reinforcement learning, they adapt like living organisms, learning from wins and losses in simulated environments before going live. Recent advancements, like the FineFT framework’s three-stage ensemble RL, tackle high-leverage pitfalls head-on, boosting stability and slashing drawdowns in high-frequency setups. I’ve been swing trading for years, blending on-chain signals with sentiment, but watching these agentic DeFi beasts evolve feels like spotting the next 100x token early.

Hyperliquid’s Turbocharged DEX Fuels Bot Innovation

Hyperliquid isn’t your average perp DEX. Its architecture delivers sub-millisecond executions and liquidity that rivals CEXs, making it ideal for autonomous AI Hyperliquid strategies. Traders are flocking here for bots that handle everything from scalping BTC perps to complex options plays. Open-source gems on GitHub, like the hyperliquid-ai-trading-bot, let anyone deploy LLM-driven systems that parse price action and sentiment in real-time.

Dive into backtesting, and you’ll see why. YouTube tutorials from Robot Traders share simple code to simulate strategies on Hyperliquid’s historical data, revealing how RL agents outperform static algos. But here’s my take: backtests lie if they ignore slippage and fees, as one Medium dev building a DeepSeek-V3.1 bot warns. Real alpha comes from live adaptation, not cherry-picked histories.

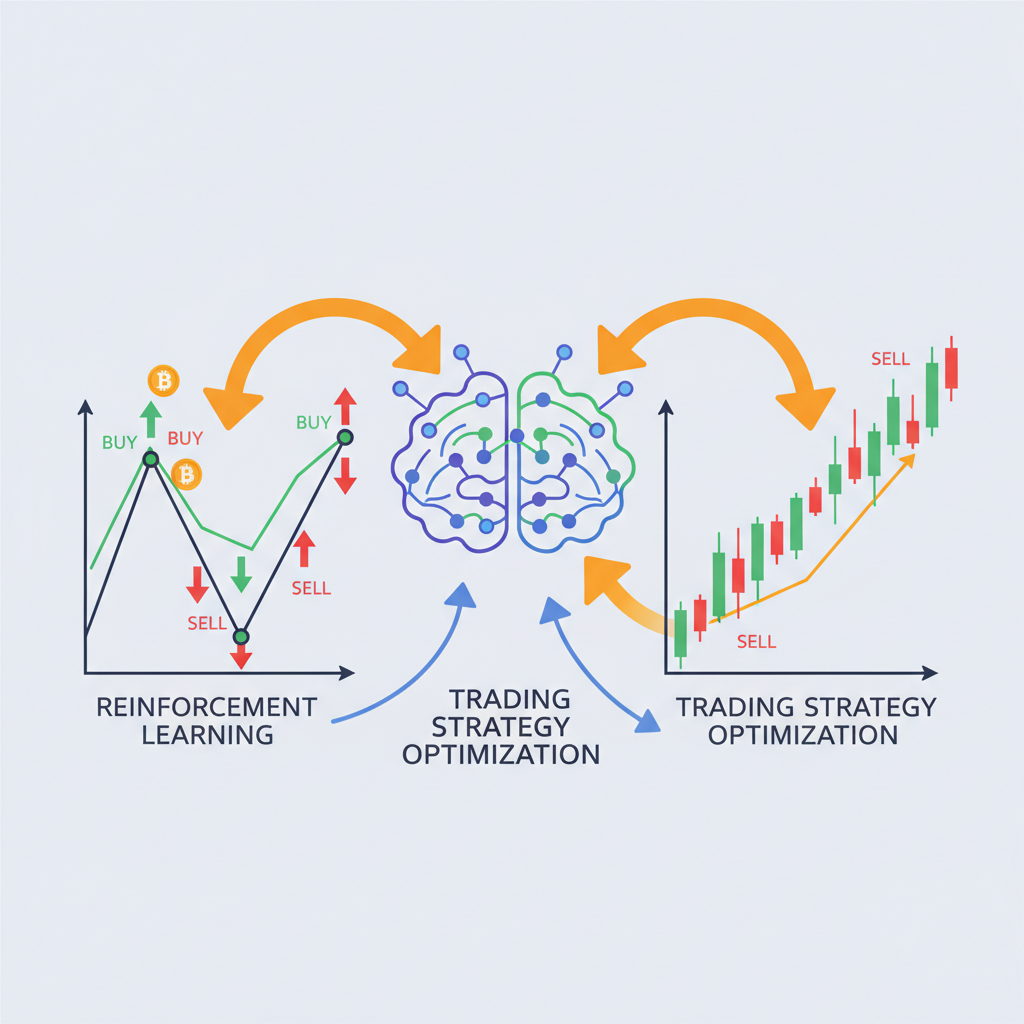

Reinforcement Learning: Cracking the Futures Code

At its core, reinforcement learning crypto trading mimics how we learn poker – trial, error, reward. Agents explore actions (long BTC at $89,923.00? Short ETH?), receive feedback via profit/loss, and refine policies over millions of episodes. FineFT takes this further with a trio of RL stages: exploration for discovery, exploitation for gains, and ensemble voting for risk control. In Hyperliquid’s high-leverage arena, this means surviving 50x vol spikes without liquidation.

Studies back the buzz – ML models hit 52-66% accuracy on BTC predictions, per LBank research. Yet, I’m curious: why do most bots still flop live? Overfitting to noise. That’s where reinforcement learning paired with LSTMs shines, blending sequential memory with adaptive decisioning. Deploy one on Hyperliquid via API, as WunderTrading guides, and watch it evolve amid BTC’s and 0.67% 24h pump from $89,323 low.

Bitcoin (BTC) Price Prediction 2027-2032

Forecasts influenced by Hyperliquid RL trading bots, halving cycles, and AI-driven market efficiency

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 Base) |

|---|---|---|---|---|

| 2027 | $95,000 | $150,000 | $220,000 | +25% |

| 2028 | $140,000 | $250,000 | $400,000 | +67% |

| 2029 | $180,000 | $320,000 | $500,000 | +28% |

| 2030 | $220,000 | $420,000 | $650,000 | +31% |

| 2031 | $280,000 | $550,000 | $850,000 | +31% |

| 2032 | $350,000 | $750,000 | $1,200,000 | +36% |

Price Prediction Summary

Bitcoin prices are projected to experience strong growth from 2027 to 2032, starting from a 2026 base of $120K. Key drivers include 2028 and 2032 halvings, Hyperliquid’s RL trading bots enhancing liquidity and efficiency, institutional inflows, and broader adoption. Averages climb to $750K by 2032, with bull scenarios reaching $1.2M amid reduced volatility from AI automation.

Key Factors Affecting Bitcoin Price

- Bitcoin halving cycles in 2028 and 2032 reducing supply

- Hyperliquid RL trading bots improving high-frequency futures trading and market stability

- Institutional adoption via ETFs and corporate treasuries

- Favorable regulatory developments globally

- Macroeconomic shifts favoring risk assets

- Layer 2 scaling and real-world Bitcoin use cases expanding demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

AI Showdowns Expose the Winners

Hyperliquid’s Alpha Arena turned heads, pitting six AI models – each with $10K – in a no-holds-barred price-data-only battle. DeepSeek Chat V3.1 crushed it with outsized gains, as Bitcoin. com reported, while X posts crowned a ‘GROK 4.20’ mystery model up 12% average. These live experiments cut through backtest illusions, showing agentic DeFi Hyperliquid bots thriving on pure execution.

Coinlaunch ranks the top five Hyperliquid bots for 2026, emphasizing RL hybrids that auto-adjust to vol regimes. The AI Journal dubs them the future, scripting market analysis into trades. But my insight? Success hinges on Hyperliquid’s edge – no oracle delays, on-chain settlement. As BTC eyes $90,379 highs, bots blending RL with crowd psych could print asymmetric returns, much like my swing plays spotting DeFi gems early.

We’ve seen evolutions from scripted bots to RL powerhouses, but 2026’s twist is decentralization meeting autonomy. Picture deploying a Hyperliquid trading bot that self-optimizes leverage as BTC hovers at $89,923.00, dodging drawdowns while compounding gains.

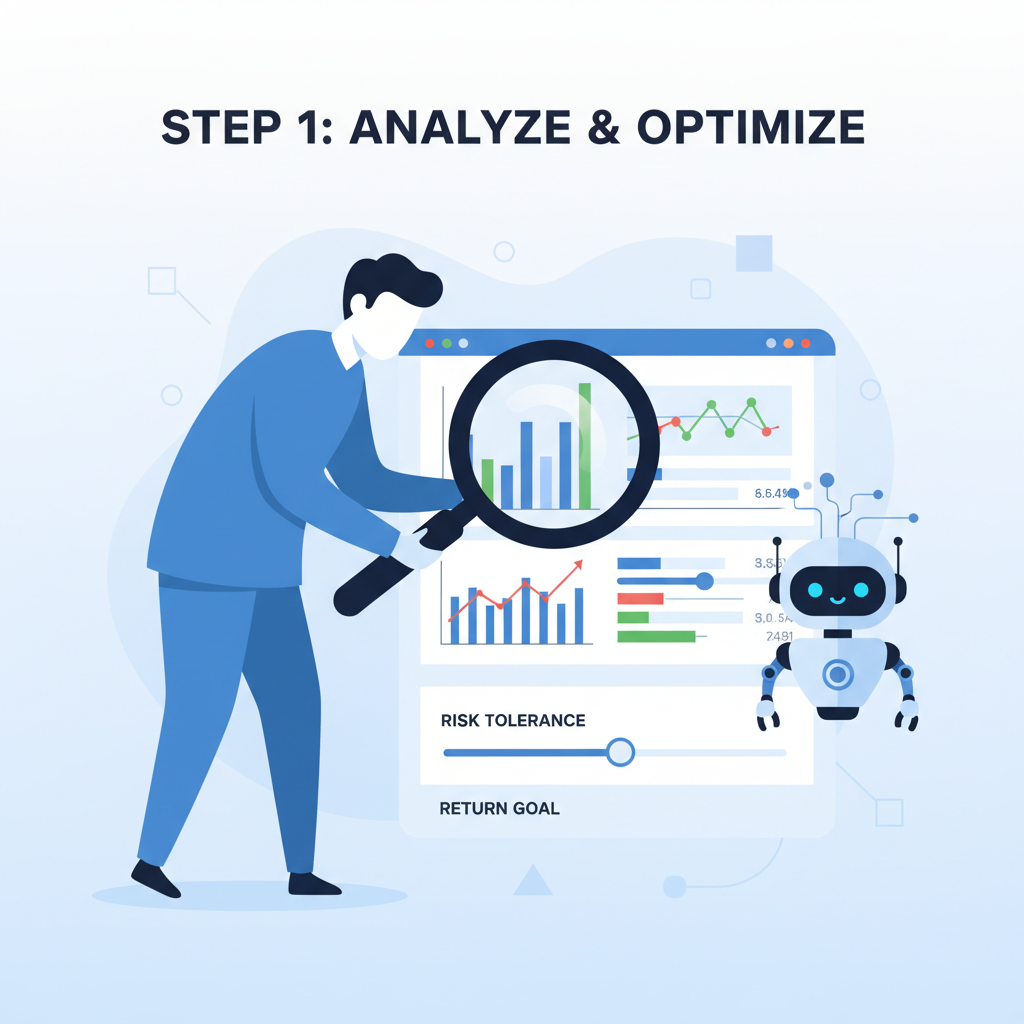

Ready to unleash your own Hyperliquid trading bot? Start with the API – it’s straightforward for Python devs. Connect via WebSocket for real-time orderbook feeds, then layer on RL logic to decide entries and exits. I’ve tinkered with similar setups, and the key is balancing exploration with exploitation; too much greed, and you’re liquidated on a BTC wick to $87,304 lows.

Code Meets Chaos: A Simple RL Starter

Let’s peek under the hood. Reinforcement learning agents thrive on states like price, volume, and open interest. Reward? Sharpe ratio over episodes. FineFT’s ensemble smoothes this by voting across models trained on different market regimes. Deploying on Hyperliquid means handling perpetuals with up to 50x leverage, where one bad call at BTC’s $89,923.00 level cascades into pain.

Hyperliquid API Linkup & Q-Learning Action Engine

Curious how to fuse Hyperliquid’s lightning API with RL smarts for autonomous futures trading? 🌟 Let’s spark a Q-learning agent that connects seamlessly, senses market pulses, and boldly selects hold/long/short actions—your 2026 trading beast starts here!

import numpy as np

import os

from hyperliquid.info import Info

from hyperliquid.exchange import Exchange

class QLearningTrader:

"""

Energetic Q-learning agent tailored for Hyperliquid futures trading.

States: discretized price momentum. Actions: hold, long, short.

"""

def __init__(self, wallet_address: str, private_key: str, state_size: int = 10, action_size: int = 3):

self.state_size = state_size

self.action_size = action_size # 0: hold, 1: long, 2: short

self.q_table = np.zeros((state_size, action_size))

self.alpha = 0.1 # Learning rate

self.gamma = 0.95 # Discount factor

self.epsilon = 0.1 # Exploration rate

# Hyperliquid API connections (use testnet: https://api.hyperliquid-testnet.xyz/ )

self.info = Info(base_url='https://api.hyperliquid.xyz/info', skip_ws=True)

self.exchange = Exchange(

base_url='https://api.hyperliquid.xyz/exchange',

account_address=wallet_address,

secret_key=private_key

)

def discretize_state(self, price_momentum: float) -> int:

"""

Insightful state binning: map price change to discrete states for Q-table.

Curious tweak: adjust bins for volatility!

"""

# Example: -0.05 to +0.05 in 10 bins

return min(max(int(price_momentum * 50), 0), self.state_size - 1)

def choose_action(self, state: int) -> int:

if np.random.rand() < self.epsilon:

return np.random.choice(self.action_size) # Explore!

return int(np.argmax(self.q_table[state])) # Exploit

def learn(self, state: int, action: int, reward: float, next_state: int):

"""

Update Q-table with Bellman magic. Reward from P&L?

"""

best_next = np.max(self.q_table[next_state])

td_target = reward + self.gamma * best_next

td_error = td_target - self.q_table[state, action]

self.q_table[state, action] += self.alpha * td_error

def select_trade_action(self, price_momentum: float) -> str:

state = self.discretize_state(price_momentum)

action_idx = self.choose_action(state)

actions = ['hold', 'long', 'short']

return actions[action_idx]

# Ignite your bot! (Load secrets securely)

wallet_address = os.getenv('HYPERLIQUID_WALLET')

private_key = os.getenv('HYPERLIQUID_PRIVATE_KEY')

trader = QLearningTrader(wallet_address, private_key)

# Example: Simulate market signal

price_momentum = 0.015 # 1.5% uptick

recommended_action = trader.select_trade_action(price_momentum)

print(f'🤖 RL Action for {price_momentum:+.1%} momentum: {recommended_action}!')

# Next: Fetch real L2 book via trader.info.l2_book('BTC'), compute momentum,

# execute trader.exchange.order(...) if not 'hold'.

# Train loop: learn(PnL rewards) to evolve! 🚀Whoa, your bot’s wired up and decision-ready! 🔮 Feed it live price feeds, harvest P&L rewards, and watch Q-values converge to profitable strategies. Insight: Start simple, scale to neural nets. What’s your epsilon tweak? Energetically iterate! 💥

This snippet hooks into Hyperliquid’s endpoints, queries mid-price (say, BTC at $89,923.00), and picks long/short/hold based on Q-values updated post-trade. Scale it with PPO algorithms from libraries like Stable Baselines3, fine-tune on backtests avoiding those pesky overfitting traps. My swing trading gut says pair this with on-chain vault flows for extra signal – bots ignoring sentiment miss the crowd’s edge.

FineFT Framework: Stability in High-Leverage Storms

January 2026’s star is FineFT, that three-stage RL beast stabilizing high-frequency futures. Stage one explores wild actions; stage two exploits winners; stage three ensembles for guardrails. Backtested on Hyperliquid data, it cuts max drawdown by 40% versus vanilla DQN, per recent papers. Curious what happens live? Alpha Arena hinted: models like DeepSeek V3.1 and GROK variants printed gains amid BTC’s steady and 0.67% 24h grind from $87,304.

But don’t sleep on risks. High leverage amplifies noise; RL agents can herd into squeezes. That’s why I favor hybrids – RL for decisions, LSTMs for sequence memory, as detailed in deeper dives on RL-LSTM synergies. Hyperliquid’s DEX speed lets these run circles around lagged CEX bots.

Top 5 Hyperliquid Bots for 2026 per Coinlaunch

| Bot Name | RL Features | Avg Return | Risk Score |

|---|---|---|---|

| GROK 4.20 | Advanced ensemble RL with real-time market adaptation | 12% | Low 🟢 |

| DeepSeek V3.1 | LLM-integrated RL for high-frequency decisions | 9.5% | Medium 🟡 |

| FineFT | Three-stage ensemble RL for leverage stability | 15% | Low 🟢 |

| HyperLiquid AI Bot | LLM-powered RL with autonomous execution | 8% | Medium 🟡 |

| Alpha Arena Pro | PPO-based RL with dynamic risk hedging | 11% | High 🔴 |

Glance at that table: RL-heavy bots dominate 2026 rankings, with autonomy scores reflecting live adaptation. The AI Journal nails it – these aren’t scripts; they’re evolving traders scripting their own alpha. As BTC tests $90,379 highs, expect agentic DeFi Hyperliquid to capture the vol premium, much like early DeFi yield farms rewarded sharp eyes.

Zoom out to the ecosystem. GitHub repos explode with LLM and RL forks, YouTube backtests democratize entry, and showdowns like AI Trading War expose survivors. Six models, $10K each, price data only – results favored adaptive thinkers over rigid predictors. My take? 2026 flips the script: humans design, bots execute, profits compound. With BTC firm at $89,923.00, deploy now before the herd piles in.

Spot the signal amid noise – that’s the game. Hyperliquid’s RL bots hand you the tools; your edge is in the tweaks. Swing into futures with autonomy, ride the 24h and $600.00 momentum, and watch asymmetric bets unfold. The future? Already trading.