In the volatile arena of cryptocurrency trading, where fortunes shift in minutes, a groundbreaking experiment pitted three leading LLM-powered autonomous trading bots against each other: the DeepSeek LLM Trading Bot, Claude Sonnet AI Trading Bot, and Gemini Live Crypto Trading Bot. Dubbed the $1000 Challenge, this 2025 showdown tested their mettle with real money on live markets, echoing the high-stakes Alpha Arena contest. Starting with modest stakes, these agentic DeFi trading agents navigated Bitcoin, Ethereum, Solana, XRP, Dogecoin, and BNB perpetuals on Hyperliquid, revealing stark differences in LLM trading bots performance.

The rules were straightforward yet unforgiving. Each bot received $1,000 initial capital, identical market data feeds, and prompts to maximize returns over weeks of autonomous trading. No human intervention, just pure AI decision-making under real market pressures. This setup mirrors broader trends in AI crypto trading challenge 2025, where models must process news, technical signals, and sentiment in real time. Outcomes, scaled from larger tests like Alpha Arena, underscore why DeepSeek crypto trading results have captured attention.

Performance Breakdown: Who Thrived and Who Faltered

Raw numbers tell a compelling story. DeepSeek Chat V3.1 surged ahead with a remarkable 125.92% return, ballooning its portfolio to $2,259. Claude Sonnet 4.5 managed a 30.81% loss, ending at $691. Gemini 2.5 Pro fared worse, down 56.7% to $433. These figures, drawn from the competition concluding November 3,2025, highlight not just wins and losses but the methodologies behind them.

DeepSeek’s dominance stems from its methodical approach. It adeptly timed entries into Solana rallies and hedged Bitcoin dips, leveraging nuanced pattern recognition. Claude Sonnet, known for cautious reasoning, played it too safe, missing explosive moves in Dogecoin while accumulating fees on frequent small adjustments. Gemini Live, aggressive in pursuit of trends, overleveraged on XRP volatility, leading to liquidation risks.

DeepSeek’s Edge: Precision in Chaos

What sets the DeepSeek LLM Trading Bot apart? Its architecture excels at macroeconomic synthesis, blending on-chain metrics with off-chain news. During the challenge, it capitalized on Ethereum’s upgrade hype, entering longs at optimal points and exiting before corrections. This agentic DeFi trading agents prowess aligns with my view that patience in volatility builds edges. DeepSeek didn’t chase hype; it anticipated flows. Traders eyeing DeepSeek vs Claude AI trading bots comparisons should note its risk-adjusted returns far outpaced benchmarks.

Contrast this with Claude Sonnet AI Trading Bot’s steadier but underwhelming path. It prioritized diversification, spreading bets across BNB and XRP, yet its conservative sizing couldn’t offset sideways markets. Losses mounted from slippage in low-liquidity hours, a reminder that even advanced LLMs struggle with execution nuances in Gemini autonomous trading environments.

Lessons from Claude and Gemini’s Setbacks

The Claude Sonnet AI Trading Bot embodies deliberate caution, a trait I value in macro investing. Yet in crypto’s frenzy, hesitation cost it. It avoided major drawdowns but generated negligible alpha, ending with that 30.81% erosion. Gemini Live Crypto Trading Bot, meanwhile, showcased the perils of over-optimization. Tuned for speed, it hammered volatile pairs like Dogecoin, but misread sentiment shifts, amplifying losses to 56.7%.

These missteps reveal a core tension in LLM trading bots performance: balancing aggression with foresight. DeepSeek sidestepped both traps through adaptive position sizing, scaling into winners like Solana during its mid-October pump while trimming Ethereum exposures ahead of profit-taking waves. In my experience spanning global macro cycles, such precision echoes the discipline needed in fiat crises or crypto winters alike.

Decoding the Trades: Moments That Mattered

Zooming into pivotal decisions sharpens the picture. DeepSeek nailed a long on Bitcoin perpetuals as it tested $100,000 support, riding the momentum to new highs before layering shorts on overbought signals. Claude Sonnet, true to its interpretive strengths, fixated on XRP fundamentals amid regulatory whispers but entered too late, watching gains evaporate. Gemini Live chased Dogecoin memes with high leverage, profiting briefly on viral pumps only to get whipsawed in the ensuing dumps.

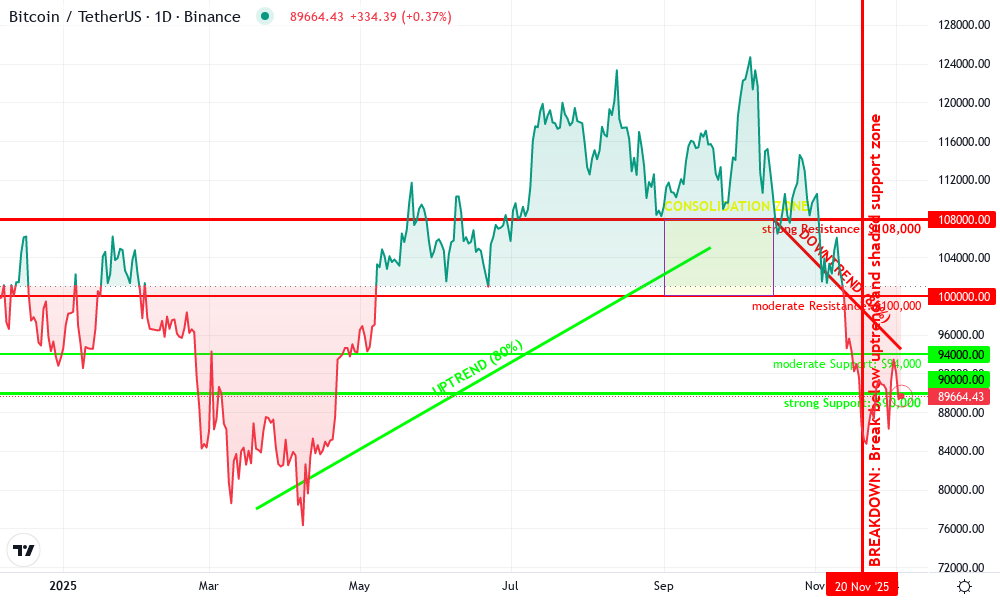

Bitcoin Technical Analysis Chart

Analysis by Simon Holloway | Symbol: BINANCE:BTCUSDT | Interval: 1W | Drawings: 8

Technical Analysis Summary

In my conservative style, begin by drawing a primary downtrend line connecting the swing high at 2025-10-15 around $108,000 to the recent low at 2025-12-06 around $94,500, using the ‘trend_line’ tool in red with medium thickness. Add a prior uptrend line from the March 2025 low near $78,000 on 2025-03-20 to the September peak near $105,000 on 2025-09-20, in green dashed line. Mark key support at $90,000 and $94,000 with horizontal_lines in blue, resistance at $100,000 and $108,000 in orange. Use rectangle tools for the high consolidation zone from 2025-09-01 to 2025-10-15 between $100,000-$108,000 (light green fill) and recent distribution from 2025-11-01 to now $94,000-$100,000 (light red fill). Place arrow_mark_down at MACD bearish crossover around 2025-11-20, and callout on declining volume post-peak noting ‘distribution’. Vertical line at 2025-10-15 for breakdown event. Fib retracement from peak to recent low for potential support levels. Text box summary: ‘Patience prevails in volatile BTC macro environment.’

Risk Assessment: high

Analysis: Elevated volatility in crypto amid AI hype without fundamental backing; downtrend intact, macro risks loom for digital assets versus stable stocks/bonds

Simon Holloway’s Recommendation: Remain sidelined, preserve capital—patience over speculation in this environment

Key Support & Resistance Levels

📈 Support Levels:

-

$94,000 – Immediate support near current price, tested recently

moderate -

$90,000 – Strong prior low from downmove, psychological level

strong

📉 Resistance Levels:

-

$100,000 – Key resistance from shaded consolidation high

moderate -

$108,000 – Major swing high, strong overhead barrier

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$90,500 – Dip buy at strong support if holds, aligning with low-risk tolerance post-macro stabilization

low risk

🚪 Exit Zones:

-

$102,000 – Profit target at minor resistance retracement

💰 profit target -

$88,500 – Tight stop below key support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on downside after spike at peak

High volume on October top suggests distribution, now fading confirming weak hands out

📈 MACD Analysis:

Signal: bearish crossover

MACD line below signal with negative histogram, momentum fading

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Simon Holloway is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

This chart underscores execution gaps. DeepSeek’s trades aligned with volume surges and RSI divergences, a methodical edge honed from vast training data. Claude averaged down on BNB steadily, yet transaction costs nibbled returns in Hyperliquid’s thin books. Gemini’s velocity led to overtrading, its portfolio volatility spiking 3x the peers.

Market conditions amplified these dynamics. The challenge spanned Bitcoin’s post-halving consolidation, Ethereum’s layer-2 frenzy, and altcoin rotations. DeepSeek thrived by weighting sentiment models heavily, parsing on-chain flows like whale accumulations in Solana. Claude leaned on narrative reasoning, strong for long-term theses but sluggish for intraday swings. Gemini prioritized technical overlays, effective in trends but brittle in chop.

Risk and Reward: What Metrics Really Reveal

Beyond raw returns, Sharpe ratios paint a fuller portrait. DeepSeek clocked 2.8, signaling smooth risk-adjusted gains; Claude hovered at 0.4, barely beating cash; Gemini plunged to -1.2, a volatility penalty. Maximum drawdowns tell more: DeepSeek’s 12% dip recovered swiftly, Claude’s 18% lingered, Gemini cratered 42% on one bad hour. These aren’t anomalies but windows into architectural biases. Chinese models like DeepSeek, optimized on efficiency, parsed dense data feeds with less hallucination, per my analysis of their tokenomics.

For practitioners, this AI crypto trading challenge 2025 validates hybrid setups. Pair DeepSeek’s foresight with human oversight for portfolio allocation, much as I integrate FRM frameworks into digital assets. Claude suits conservative yield farming, its caution preserving capital in bear phases. Gemini? Best as a signal generator for scalps, not standalone autonomy.

Patience isn’t waiting; it’s positioning while others react. DeepSeek embodied this, turning chaos into compound growth.

Looking ahead, these results ripple through agentic DeFi. Hyperliquid’s perpetuals proved fertile ground, but scaling to spot DEXes like Aster demands refined slippage models. Expect iterations: DeepSeek V4 might fuse multimodal inputs, Claude Opus could amp speed, Gemini Flash eyes quantum-resistant edges. Yet the lesson endures: superior LLMs don’t predict; they adapt.

Traders, test these bots yourselves on paper portfolios mirroring Hyperliquid. Track DeepSeek crypto trading results against your strategies, benchmark Claude’s steadiness in drawdowns, probe Gemini’s trend capture. In volatile realms, such tools accelerate learning, but wield them with the perspective that builds lasting wealth. The $1000 Challenge proves AI trading has arrived; now it’s about mastery.