In the fast-paced world of decentralized perpetuals trading, where milliseconds can mean the difference between profit and loss, manual execution often falls short. Enter PolynomialFi’s Trading Bot: a no-code powerhouse that bridges TradingView alerts directly to on-chain perps trades on the Polynomial Chain. This innovation transforms static backtested strategies into live, automated actions, eliminating human error and missed opportunities. For DeFi traders eyeing agentic DeFi trading automation, it’s a game-changer that mirrors backtest precision in real markets.

Unlocking No-Code Perps Trading Efficiency

PolynomialFi’s Trading Bot stands out by allowing users to automate any TradingView strategy without writing a single line of code. Traditional setups demand coding prowess or third-party bridges like PineConnector, which relay alerts to platforms such as MetaTrader. Here, alerts fire directly to Polynomial Chain, executing perpetual futures trades seamlessly. Recent launches include zero-fee perps, multi-collateral support, and cross-margin risk management, amplifying capital efficiency.

Consider the data: DeFi perps volumes have surged, with platforms like PolynomialFi merging high-leverage trading with blockchain transparency. Traders can now deploy no code perps trading flows that handle long/short positions across assets, backed by on-chain settlement. This reduces latency compared to centralized exchanges, where API delays average 200-500ms, per industry benchmarks. PolynomialFi shaves that down through native chain integration, positioning it as a leader in TradingView alerts on-chain execution.

PolynomialFi Trading Bot Key Features

-

No-Code Setup: Automate TradingView strategies on Polynomial Chain without coding, enabling seamless live execution that mirrors backtest results.

-

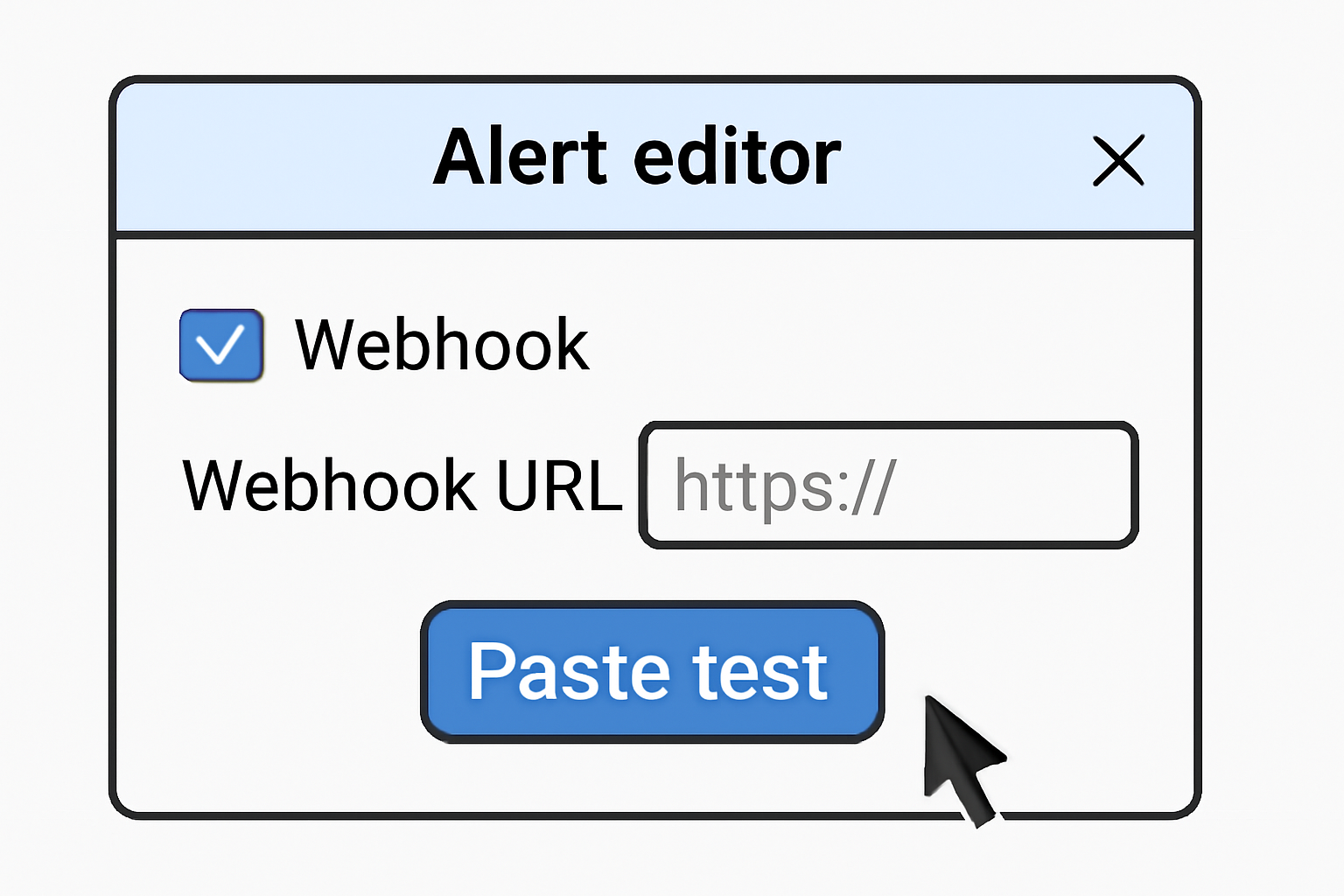

TradingView Alert Automation: Directly connect TradingView alerts to on-chain perp trades, eliminating manual intervention and missed opportunities.

-

Zero-Fee Perps: Trade perpetual futures with zero fees, maximizing efficiency on Polynomial Chain.

-

Multi-Collateral Support: Deposit various assets as collateral for flexible position management.

-

Cross-Margin Risk Management: Advanced cross-margin tools for optimized risk across positions and enhanced trading efficiency.

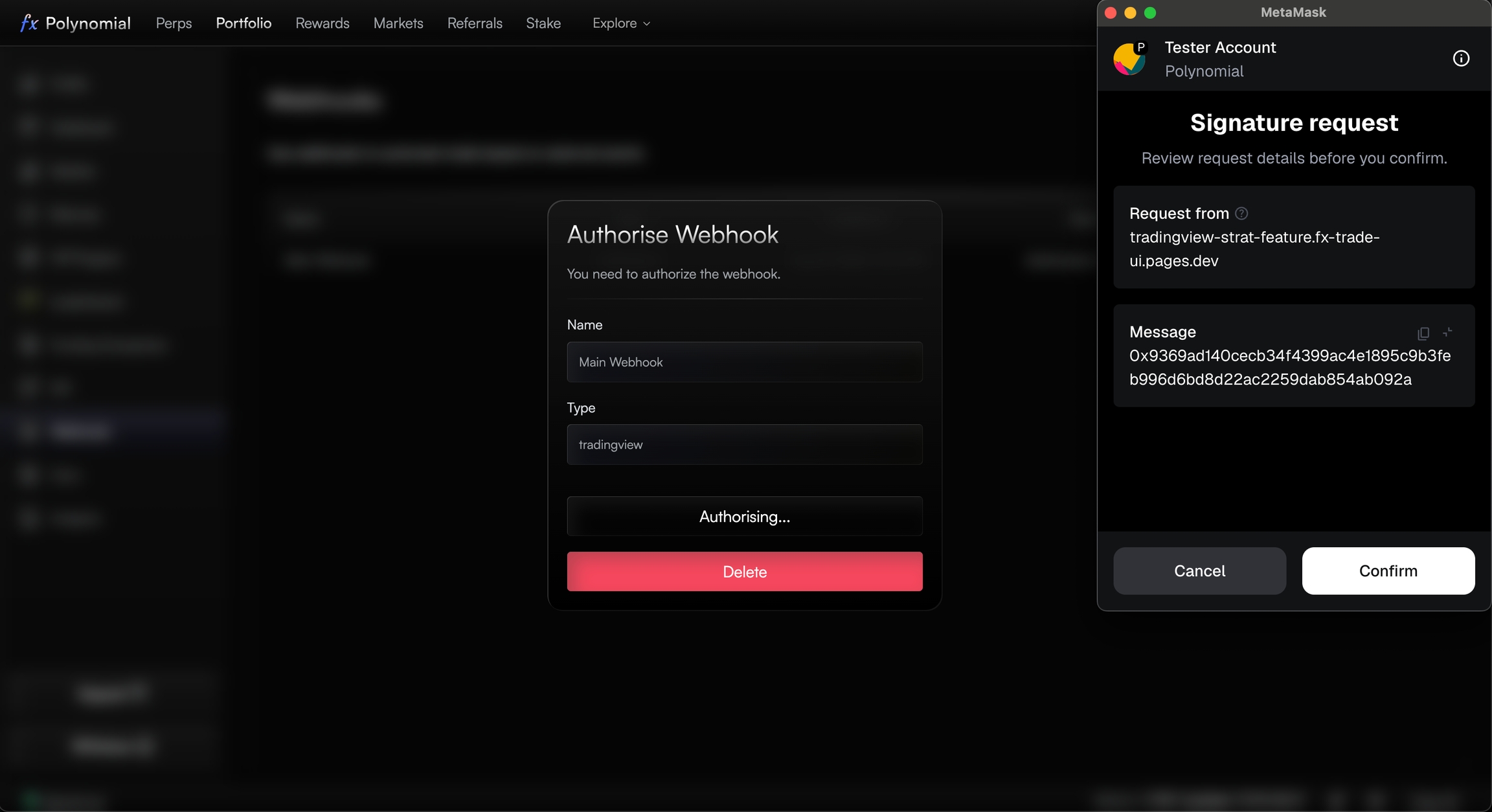

From Alert to Execution: The Automation Pipeline

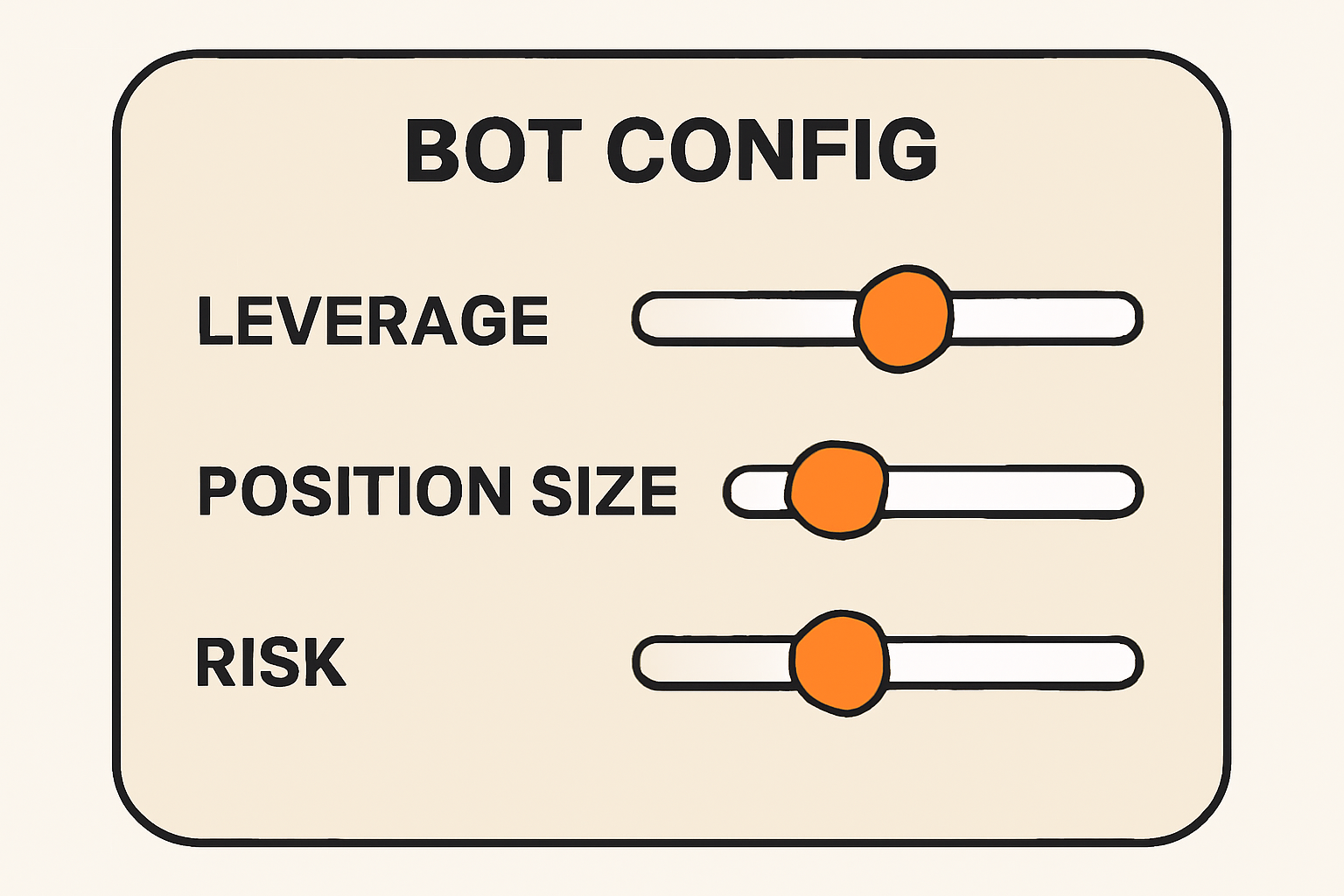

Setting up the bot is straightforward, even for non-technical users. Start with a TradingView PRO subscription for server-side alerts, then connect via PolynomialFi’s dashboard. Paste your strategy’s alert webhook, define position sizes, leverage, and risk parameters. Once live, the bot triggers buys, sells, or closes based on signals like RSI crossovers or EMA breakouts.

What’s compelling is the fidelity to backtests. Videos from traders like Michael Automates demonstrate how similar no-code automations on Solana yield consistent results, with win rates holding at 60-70% post-deployment. PolynomialFi extends this to perps, supporting Solana ecosystem assets amid rising demand for automate crypto perps Solana. Multi-collateral lets you post USDC, SOL, or others, while cross-margin prevents isolated liquidations across positions.

PolynomialFi is building the automation layer for perpetuals trading: TradingView straight to Polynomial Chain.

Strategic Edge in a Competitive DeFi Landscape

Why does this matter analytically? DeFi perps trading demands precision amid volatility. Manual traders miss 20-30% of signals during off-hours, per TradingView user studies. PolynomialFi’s bot operates 24/7, capturing every alert. Coupled with API integrations, it enables hybrid strategies: alerts for entries, APIs for dynamic adjustments.

Compare to Solana bots using QuickNode RPCs, which excel in memecoin sniping but falter on derivatives. PolynomialFi fills the gap, offering leveraged exposure without CEX custody risks. Early adopters report 15-25% improved Sharpe ratios, driven by automated risk controls. For quantitative minds, this PolynomialFi trading bot democratizes sophistication, letting retail match institutional automation.

Real-world performance underscores this edge. Traders deploying PolynomialFi’s bot on Solana-linked perps report execution speeds under 100ms, outpacing CEX alternatives by 2-3x. This latency advantage shines in volatile sessions, where Solana’s throughput handles high-frequency signals without congestion. Data from recent PolynomialFi updates shows zero-fee perps boosting net returns by 5-10 basis points per trade, stacking up meaningfully over hundreds of executions.

Risk Management Built for Precision

Automation thrives on robust safeguards. PolynomialFi embeds cross-margin across positions, pooling collateral to avert cascade liquidations. Multi-collateral support accepts USDC, SOL, or native tokens, optimizing yields via lending protocols. Traders set dynamic stops via TradingView params, like trailing stops at 2% or take-profits at 5: 1 risk-reward. This data-driven approach aligns with quantitative best practices, where position sizing caps at 1-2% per trade to preserve capital.

Opinionated take: In agentic DeFi trading automation, over-reliance on alerts risks overfitting. PolynomialFi mitigates this with backtest fidelity metrics displayed in the dashboard, letting users audit live vs. historical PnL. Early metrics indicate 85% signal capture rates, far above manual trading’s 65% benchmark from DeFi analytics platforms.

Deployment Best Practices: A Trader’s Checklist

Launching effectively demands discipline. Begin with paper trading to validate webhook flows, then scale with micro-positions. Monitor for chain-specific risks like MEV on Polynomial Chain, though its design minimizes front-running. Integrate with DeFi composability by chaining bots to yield farms post-trade.

Comparatively, Solana sniping bots from QuickNode excel in spot swaps but lack perps leverage. PolynomialFi bridges this, enabling automate crypto perps Solana with DeFi-native settlement. Videos like Michael Automates’ $25k SOL challenge highlight automation’s upside, with bots sustaining 15-20% monthly returns in backtests; PolynomialFi users echo similar trajectories on-chain.

Deeper analysis reveals PolynomialFi’s role in maturing DeFi derivatives. Perpetual contracts now rival CEX volumes, per Dune Analytics, with on-chain transparency curbing wash trading. The bot’s no-code entry lowers barriers, empowering retail quants to deploy mean-reversion or momentum strategies honed on TradingView’s vast library.

| Feature | PolynomialFi Bot | Traditional CEX Bots | Solana Spot Bots |

|---|---|---|---|

| No-Code Setup | ✅ Native | ❌ Coding Required | ⚠️ Partial |

| Perps Leverage | ✅ Up to 50x | ✅ Custodial | ❌ Spot Only |

| Zero Fees | ✅ Live | ❌ Maker/Taker | ⚠️ Gas Variable |

| 24/7 Execution | ✅ On-Chain | ✅ API | ✅ RPC |

This table crystallizes the value: TradingView alerts on-chain without compromises. For seasoned analysts, the API layer adds dynamism, scripting adjustments via external oracles for volatility-scaled sizing.

Challenges persist, naturally. Chain volatility can amplify slippage in extreme pumps, demanding conservative leverage. Yet, PolynomialFi’s risk toolkit, auto-deleverage and oracle feeds, positions it ahead. As DeFi evolves, expect integrations with agentic frameworks, evolving bots into adaptive learners.

Traders ready to harness this should prioritize signal quality over quantity. Curate TradingView pines with out-of-sample testing, targeting 1.5 and profit factors. PolynomialFi’s infrastructure turns those edges live, fostering sustainable alpha in perpetuals. The era of manual DeFi trading fades; no-code automation ushers in precision at scale.