In 2025, the world of decentralized finance (DeFi) is being fundamentally reshaped by the rise of AI trading agents. These autonomous, data-driven bots have moved far beyond simple rule-based automation. Today’s leading AI agents analyze real-time blockchain data, execute trades, optimize yield farming strategies, and rebalance portfolios around the clock, no human intervention required. As a result, investors are experiencing a new era of autonomous DeFi portfolio management, where complex financial decisions unfold at machine speed and scale.

The Rise of Autonomous DeFi Portfolio Management

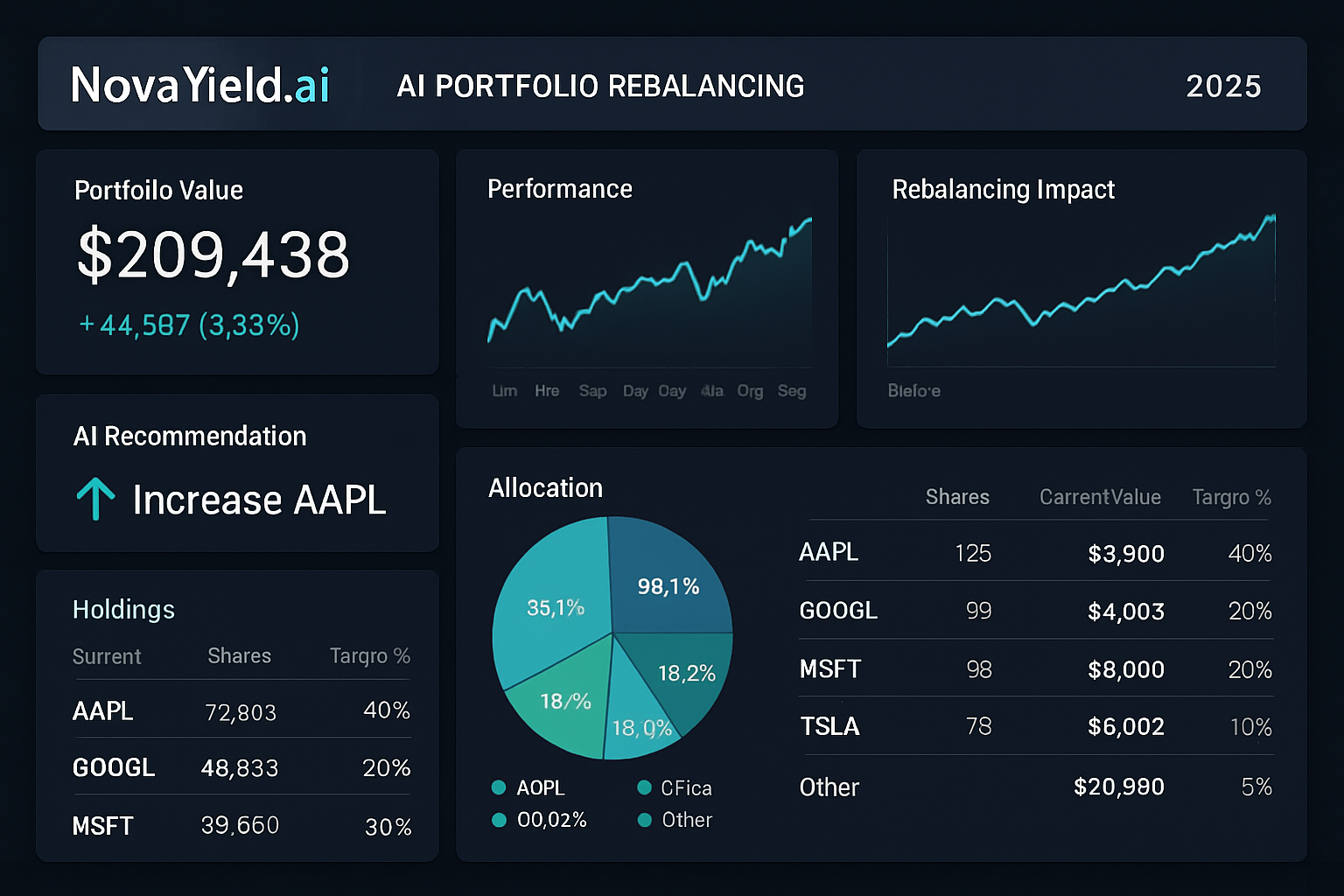

24/7 market activity has always defined crypto trading. But in 2025, it’s not just humans trying to keep up with global volatility, it’s AI trading agents for DeFi that never sleep. Platforms like NovaYield. ai now deploy advanced machine learning models to monitor dozens of protocols across Ethereum, Solana, and Base simultaneously. These agents rapidly identify arbitrage opportunities, shift allocations to optimize yield, and manage risk exposure based on live on-chain analytics.

This relentless automation is democratizing access to sophisticated strategies that were once reserved for institutional desks. Retail investors can now tap into agentic DeFi solutions that continuously rebalance their assets in response to market volatility, no coding or constant screen-watching required.

Key Players Redefining Crypto Trading Bots in 2025

The competitive landscape for AI-powered DeFi management is fierce. Three platforms stand out for their innovation and user adoption:

- Coinrule: Known for its intuitive no-code interface, Coinrule integrated deep learning modules in 2025 that enable real-time adaptation to shifting market patterns. Its rule-based engine now leverages AI pattern recognition, meaning users can automate complex strategies without writing a single line of code.

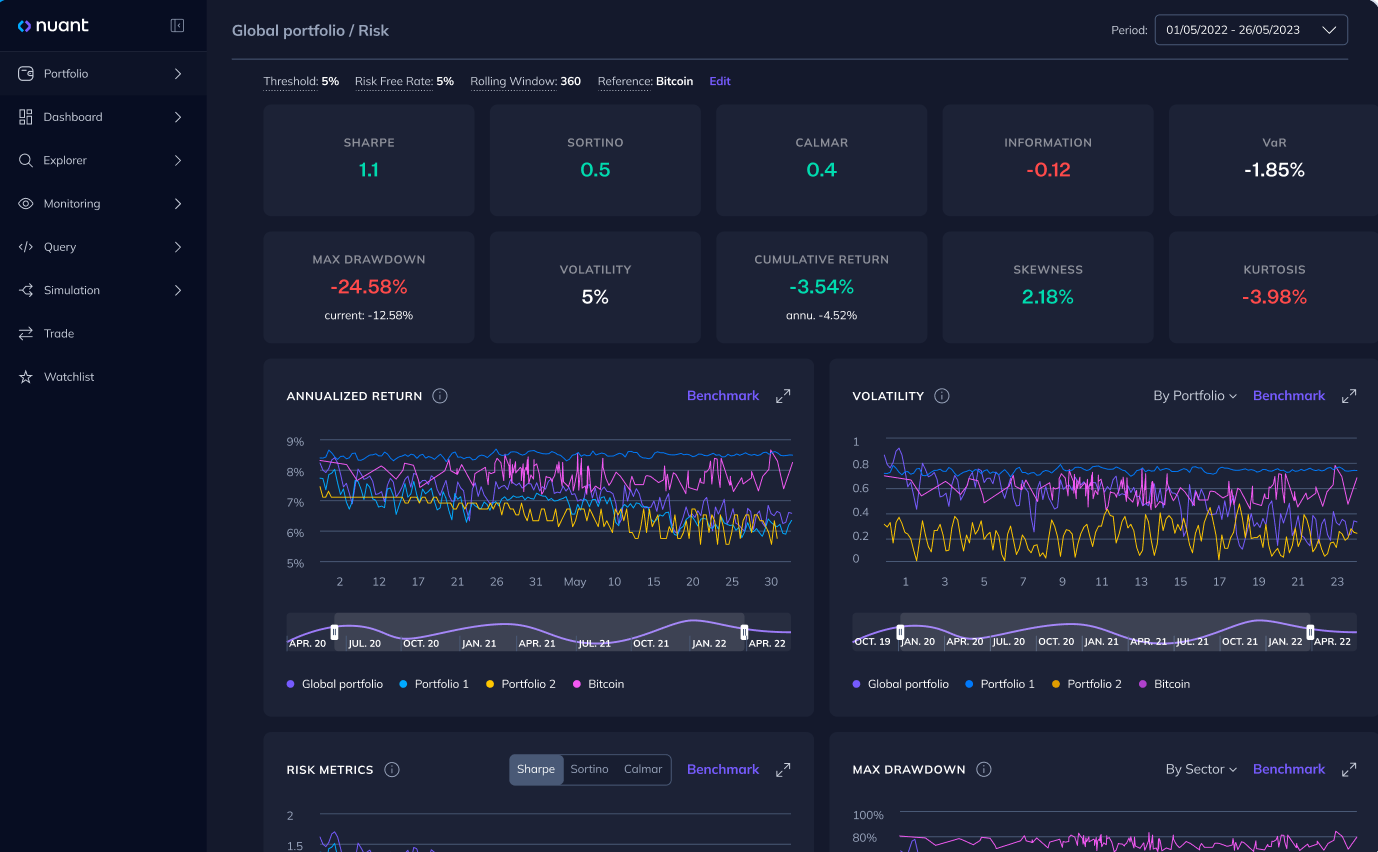

- Quadency: Quadency’s proprietary machine learning algorithms aggregate assets across both centralized and decentralized platforms. The platform offers unified performance tracking plus automated rebalancing, all visualized through a sleek portfolio-level analytics dashboard.

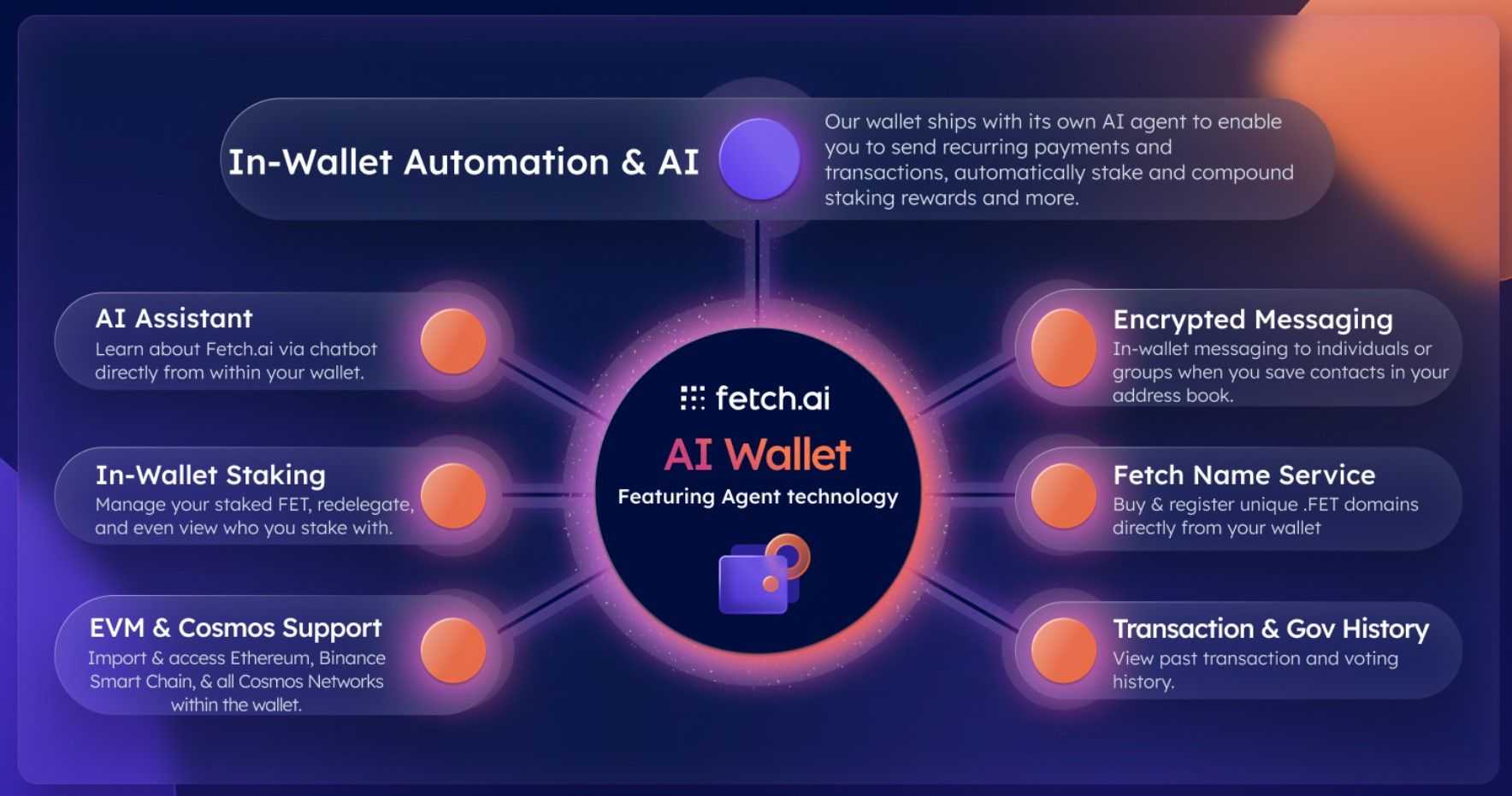

- Fetch. ai: Fetch. ai deploys truly autonomous agents capable of optimizing gas fees, executing trades across multiple DEXs, and managing risk dynamically. As part of the ASI Alliance, Fetch. ai’s ecosystem is pushing the boundaries on what agentic crypto infrastructure can achieve.

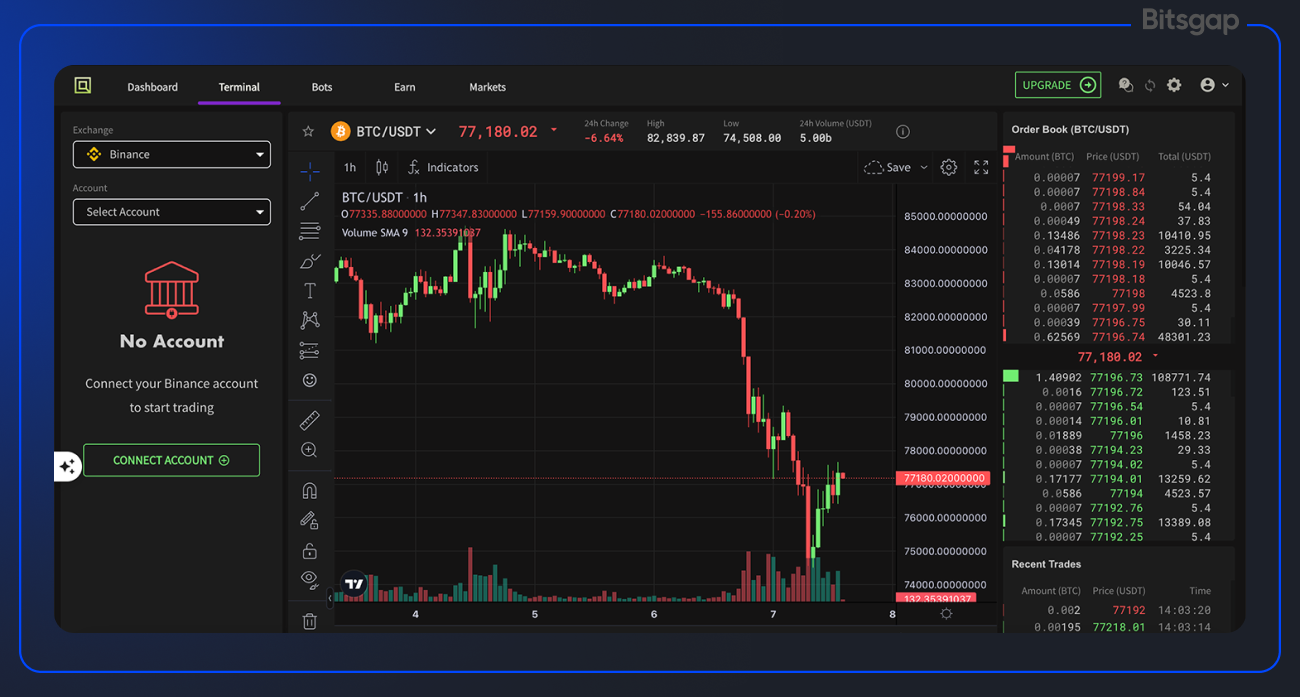

Together, these solutions are setting new standards for real-time on-chain analytics trading, cross-chain interoperability, and hands-off portfolio optimization.

The Mechanics: How Do AI Agents Actually Work?

Beneath the hood, today’s top AI trading agents ingest massive amounts of blockchain data, from price feeds and liquidity pools to social sentiment signals, and process this information using deep neural networks or reinforcement learning algorithms. The result? Bots that can spot emerging trends before they hit mainstream dashboards.

A typical workflow might look like this: an agent detects increased volatility on Solana-based assets via real-time analytics; it then reallocates funds from underperforming Ethereum pools into higher-yield Solana protocols; finally, it auto-adjusts position sizes based on pre-set risk parameters, all within seconds. This level of automation not only boosts efficiency but also minimizes emotional decision-making and reduces slippage during fast-moving markets.

If you’re curious about how these systems are built from scratch, including data pipelines and live trading integration, explore our deep dive into AI trading agent architecture for crypto strategies.

As the AI agent ecosystem evolves, a new wave of open-source and modular frameworks is empowering developers and advanced traders to fine-tune agent behavior for even greater edge. With customizable risk controls, dynamic allocation thresholds, and plug-and-play integrations for everything from DEX aggregators to cross-chain bridges, these frameworks are fueling a Cambrian explosion of creative DeFi automation. The result is an environment where both retail users and institutions can deploy highly specialized agents tailored to their unique portfolio goals.

Benefits and Risks: What DeFi Investors Need to Know

For the everyday investor, the advantages of autonomous DeFi portfolio management are clear: 24/7 oversight without burnout, instant response to market catalysts, and the ability to capture fleeting yield opportunities across multiple chains. By leveraging real-time on-chain analytics trading, AI agents minimize manual errors and help users avoid costly emotional trades during periods of volatility.

However, it’s not all upside. The rapid adoption of AI trading agents in 2025 has also surfaced new risks:

- Data reliability: If an agent’s data pipeline ingests corrupted or manipulated information, it could trigger unintended trades or losses.

- Security vulnerabilities: As with any smart contract-based automation, exploits or bugs in agent code can be catastrophic if left unchecked.

- Regulatory uncertainty: With global regulators still catching up to AI-driven DeFi innovation, compliance remains a moving target for both platforms and users.

The best platforms now incorporate advanced monitoring tools and multi-layered fail-safes. For example, some agents include circuit breakers that pause trading during abnormal events or integrate third-party oracle feeds for redundant price verification. These features are crucial for building trust as AI takes on more responsibility in user portfolio management.

The Future: Agentic DeFi as the New Standard

The rise of AI-powered yield optimization in DeFi isn’t just about automating what humans already do – it’s about unlocking entirely new strategies that only machines can execute at scale. In 2025, we’re seeing the first generation of collaborative agent networks: swarms of bots that coordinate trades across Ethereum, Solana, Base, and emerging L2s to maximize aggregate returns while minimizing gas and slippage costs.

This evolution is making once-esoteric strategies – such as cross-chain arbitrage or dynamic stablecoin rebalancing – accessible to anyone with a wallet. And as agents become increasingly composable and interoperable via open standards like ERC-7621 (Autonomous Agent Interface), expect even more seamless integration between protocols and portfolios.

Top Use Cases for AI Trading Agents in DeFi 2025

-

Autonomous Portfolio Rebalancing: AI agents like NovaYield.ai automatically adjust DeFi portfolios in real time, optimizing asset allocation in response to market volatility and maximizing returns without manual intervention.

-

AI-Driven Rule-Based Trading: Platforms such as Coinrule empower users to automate complex trading strategies using AI-enhanced pattern recognition and deep learning modules, adapting instantly to shifting market conditions.

-

Unified Portfolio Analytics & Automation: Quadency leverages proprietary machine learning to aggregate assets across centralized and decentralized platforms, providing unified analytics and automated portfolio management for DeFi users.

-

Decentralized Autonomous Agents: Fetch.ai deploys decentralized AI agents for trading, gas optimization, and risk management, enabling seamless interactions across multiple DeFi protocols.

-

24/7 Yield Farming Optimization: AI agents continuously monitor DeFi protocols to identify and act on the best yield farming opportunities, automatically reallocating assets to maximize APY and reduce risk, all without human oversight.

-

Real-Time Risk Assessment & Mitigation: Advanced AI agents analyze on-chain data and market conditions to detect risks, such as smart contract vulnerabilities or liquidity issues, and execute protective strategies instantly to safeguard user portfolios.

The endgame? A landscape where investors set their risk preferences and capital allocation rules up front while intelligent agents handle every aspect of execution in real time. As more protocols embrace agentic infrastructure, the lines between CeFi efficiency and DeFi transparency continue to blur – putting powerful automated strategies within reach for all participants.

If you’re ready to explore how these breakthroughs can supercharge your own crypto holdings, dive deeper into our guide on AI trading agents for DeFi 2025. The future isn’t just automated; it’s intelligent – driven by agents that never sleep but always adapt.