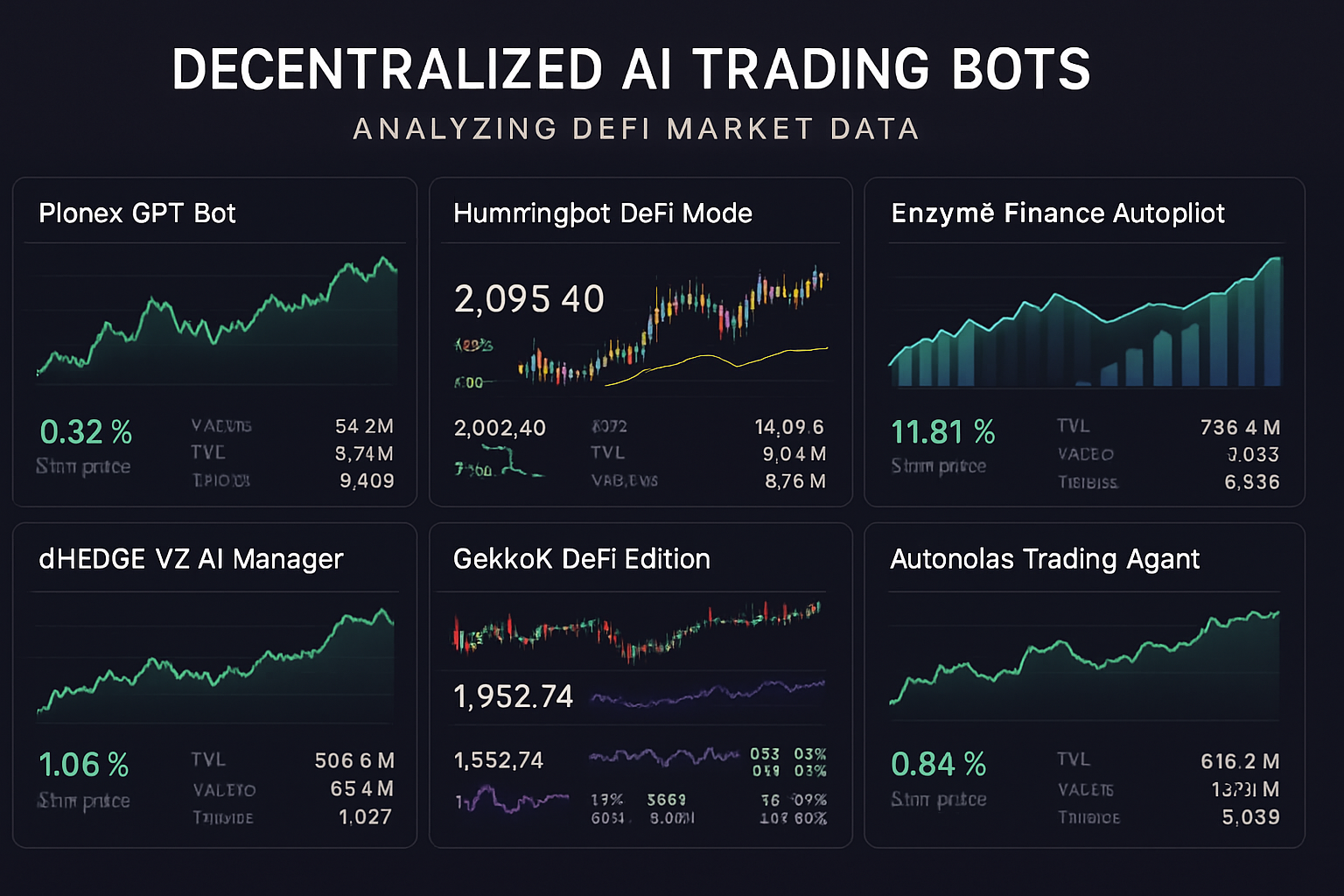

Decentralized AI trading bots have become essential for serious DeFi portfolio management in 2025. With market volatility persisting and on-chain activity at all-time highs, the demand for intelligent, autonomous agents is surging. The right bot can mean the difference between outperforming the market and getting left behind. But with dozens of options crowding the space, which decentralized AI trading bots truly deliver disciplined, actionable results for DeFi investors?

Why Decentralized AI Trading Bots Dominate DeFi Portfolio Management in 2025

Traditional automated trading tools simply can’t keep pace with today’s agentic DeFi environment. In 2025, the best AI crypto trading bots are not just plug-and-play, they’re built to analyze on-chain data in real time, adapt to evolving liquidity conditions, and execute cross-protocol strategies with zero downtime. Security is paramount: decentralized bots operate transparently on-chain, reducing counterparty risk and improving auditability for every trade.

The following list highlights seven standout platforms that exemplify these advances. Each has earned its place through innovation in automation, robust AI-driven decision making, and seamless integration with leading DeFi protocols.

Top 7 Decentralized AI Trading Bots for DeFi in 2025

-

Pionex GPT Bot: Pionex’s GPT Bot leverages advanced AI algorithms to automate trading strategies across DeFi protocols. Its GPT-powered engine analyzes on-chain data and market sentiment, enabling users to deploy sophisticated, adaptive trading bots with minimal manual intervention.

-

Hummingbot (DeFi Mode): Hummingbot’s DeFi Mode empowers users to run market making, arbitrage, and liquidity mining strategies directly on decentralized exchanges. Its open-source AI modules adapt to real-time market fluctuations, optimizing trade execution and yield.

-

Enzyme Finance Autopilot: Enzyme Finance’s Autopilot harnesses AI-driven portfolio management for DeFi assets. It automates asset allocation, rebalancing, and risk management, giving users transparency and on-chain control over their diversified portfolios.

-

dHEDGE V2 AI Manager: dHEDGE V2 introduces an AI Manager that autonomously manages DeFi portfolios using machine learning. It continuously monitors market conditions, reallocates assets, and executes trades for optimal performance—all on-chain and non-custodial.

-

GekkoX DeFi Edition: GekkoX DeFi Edition extends the popular open-source Gekko bot into decentralized finance. Its AI modules support custom strategy scripting, automated yield farming, and cross-platform portfolio analytics for DeFi traders.

-

Catalyst by Enigma (DeFi Integration): Catalyst by Enigma integrates AI-powered trading strategies with DeFi protocols. Its platform enables backtesting, live trading, and data-driven strategy optimization, all while maintaining user privacy and decentralization.

-

Autonolas Trading Agent: The Autonolas Trading Agent operates as a decentralized AI agent, autonomously executing trades and managing portfolios across DeFi ecosystems. It interacts with both on-chain and off-chain data sources for informed, real-time decision-making.

Pionex GPT Bot: Automated Precision Meets On-Chain Intelligence

Pionex GPT Bot leads this year’s field with its unique blend of generative AI models and deep liquidity integrations. The bot analyzes market sentiment across multiple blockchains and crafts adaptive strategies tailored to current volatility, without requiring user intervention. Its real differentiator is precision: users can set strict risk controls while leveraging advanced grid and DCA logic that adapts automatically as price action shifts.

If you’re looking to automate spot or futures strategies across DEXs while maintaining full custody of your assets, Pionex GPT Bot delivers a disciplined edge that manual traders simply can’t match.

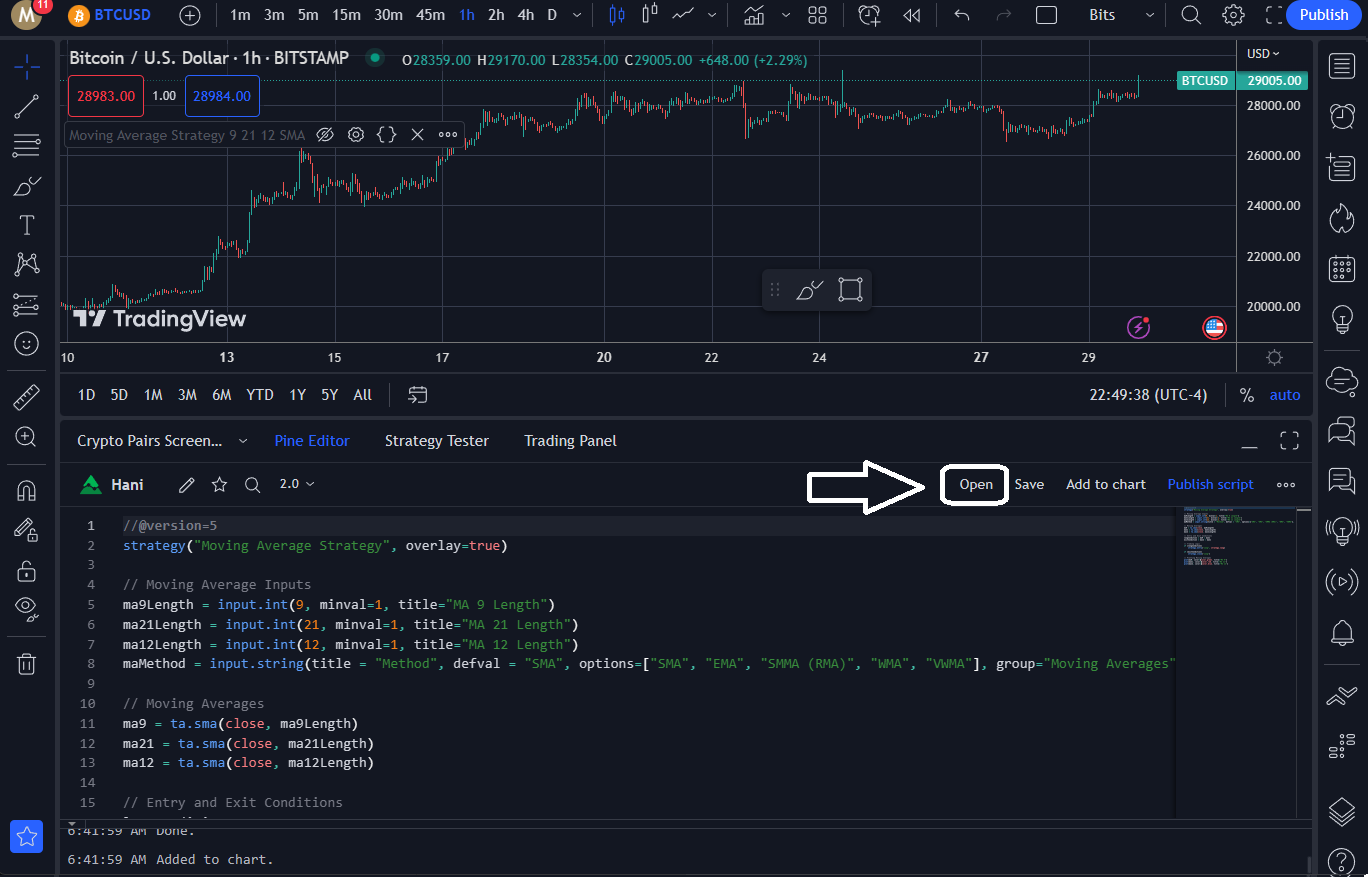

Hummingbot (DeFi Mode): Open-Source Liquidity Engineering

Hummingbot’s DeFi Mode cements its status as a go-to tool for liquidity providers and arbitrageurs alike. Built from the ground up as an open-source project, Hummingbot empowers users to deploy sophisticated market-making algorithms directly onto DEXs, no centralized intermediaries required.

The new AI modules introduced in 2025 let Hummingbot users dynamically adjust spreads based on real-time volatility signals, maximizing yield during periods of heightened activity without exposing portfolios to undue risk. For those who want transparency and customization down to the protocol level, Hummingbot remains a top choice.

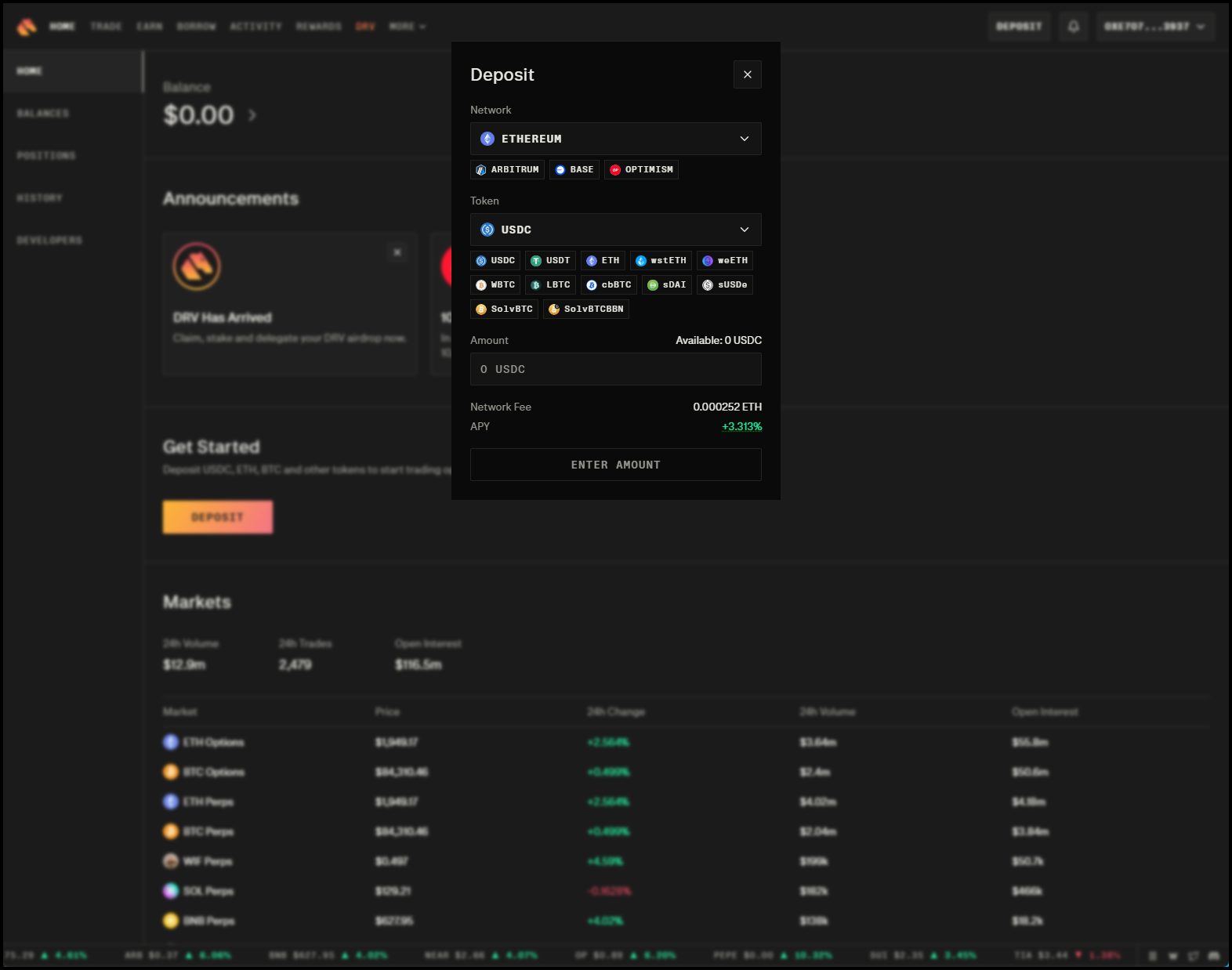

Enzyme Finance Autopilot: Professional-Grade Asset Allocation

Enzyme Finance Autopilot stands out by offering a fully decentralized asset management platform where autonomous AI agents rebalance portfolios according to pre-set mandates or dynamic on-chain signals. The Autopilot module uses machine learning models to forecast risk-adjusted returns across major DeFi protocols, then executes allocation changes without human bias or delay.

This approach isn’t just about automation; it’s about disciplined execution at scale. For DAOs or high-net-worth individuals seeking hands-off portfolio optimization with transparent performance reporting, Enzyme Autopilot sets the standard.

Comparing Core Features Across Leading Bots

While each platform brings unique strengths to the table, they share core attributes essential for modern DeFi portfolio management:

- On-chain integration: Direct execution on DEXs ensures transparency and self-custody

- AI-driven strategy adaptation: Machine learning modules optimize trades based on evolving conditions

- User-defined risk controls: Advanced settings keep capital preservation front-and-center

The next section will dive into dHEDGE V2 AI Manager, GekkoX DeFi Edition, Catalyst by Enigma (DeFi Integration), and Autonolas Trading Agent, each bringing their own innovations to autonomous trading agents in DeFi.

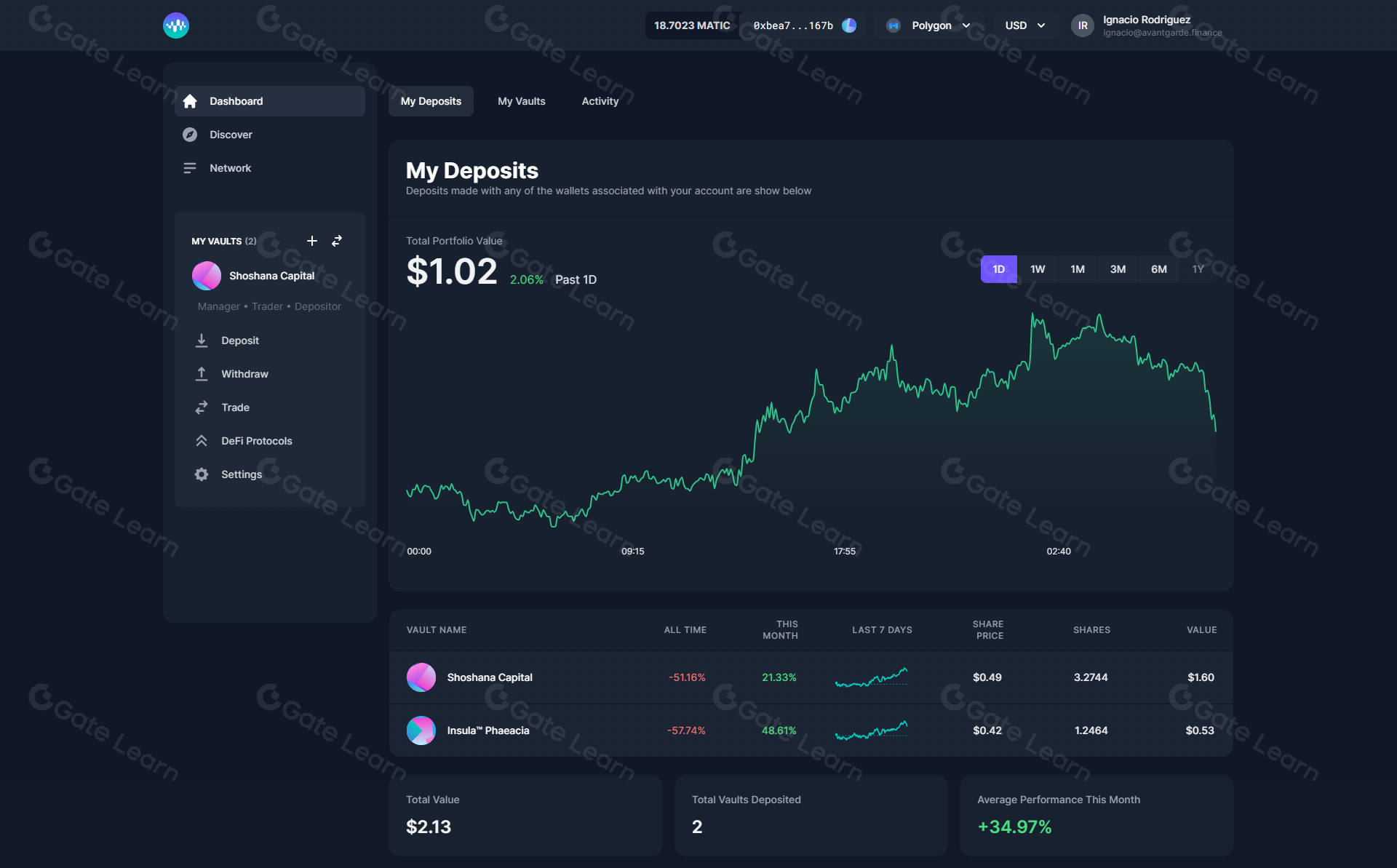

dHEDGE V2 AI Manager: On-Chain Asset Management with Adaptive Intelligence

dHEDGE V2 AI Manager delivers a truly decentralized experience for DeFi portfolio management. This platform leverages advanced AI models to monitor on-chain metrics, rebalance assets, and minimize drawdowns without off-chain dependencies. Its permissionless structure means anyone can launch or follow an AI-powered vault, delegating capital to proven strategies with full transparency. The latest V2 upgrade introduces risk-aware allocation and real-time anomaly detection, giving users a disciplined edge even in turbulent markets. For investors who demand both autonomy and robust oversight, dHEDGE’s AI Manager is a force multiplier.

GekkoX DeFi Edition: Customizable Automation for Advanced Users

GekkoX DeFi Edition takes open-source trading automation to the next level. It’s built for power users who want granular control over every parameter, from strategy logic to execution timing, without sacrificing the benefits of decentralized infrastructure. The DeFi Edition integrates AI modules that learn from historical on-chain data, enabling bots to adapt tactics as liquidity and volatility shift across protocols. Its modular architecture allows for seamless integration with new DEXs or yield platforms as they emerge, ensuring your automation stack stays ahead of the curve. If you’re not afraid to get your hands dirty tuning parameters for maximum alpha, GekkoX is one of the most flexible tools available.

Catalyst by Enigma (DeFi Integration): AI-Driven Strategy Backtesting and Live Execution

Catalyst by Enigma remains a favorite among quant-minded DeFi traders in 2025 thanks to its robust backtesting engine and seamless on-chain deployment. The new DeFi Integration suite lets users test complex AI-driven strategies against historical DEX data before deploying live capital, an essential step for disciplined risk management. Catalyst’s agents can now interact directly with leading AMMs and lending protocols, executing cross-asset arbitrage or yield farming strategies at machine speed. For data-driven investors who refuse to rely on black-box automation, Catalyst offers transparency and flexibility in equal measure.

Autonolas Trading Agent: Autonomous Agents for Next-Gen DeFi Automation

Autonolas Trading Agent sits at the frontier of agentic finance, enabling fully autonomous bots that interact with both on-chain and off-chain signals. These agents aren’t limited to simple trade execution; they can negotiate liquidity deals, participate in governance votes, or coordinate with other bots in real time. 2025’s iteration brings upgraded multi-agent collaboration features and enhanced privacy-preserving computation, making Autonolas ideal for DAOs or funds seeking scalable automation without compromising security or decentralization principles.

Choosing the Best AI Bot for Your DeFi Portfolio Strategy

Ultimately, selecting the right decentralized AI trading bot depends on your risk tolerance, technical skillset, and portfolio objectives:

- If you want plug-and-play simplicity with strong guardrails: Pionex GPT Bot or Enzyme Finance Autopilot.

- For hands-on customization and open-source ethos: Hummingbot (DeFi Mode), GekkoX DeFi Edition, or Catalyst by Enigma.

- If you need institutional-grade asset management: dHEDGE V2 AI Manager.

- For cutting-edge autonomous agent frameworks: Autonolas Trading Agent.

The era of set-and-forget crypto investing is over; disciplined use of these tools is what separates consistent winners from short-term speculators in today’s agentic DeFi landscape.

Which decentralized AI trading bot do you trust most for managing your DeFi portfolio in 2025?

With so many advanced AI-powered trading bots now available for DeFi portfolio management, we’re curious: which of these top decentralized bots do you trust the most to optimize your crypto investments this year?

If you’re ready to explore deeper into how these autonomous agents are transforming crypto portfolio management, and how you can deploy them effectively, see our detailed guide here: How AI Trading Agents Are Transforming DeFi Portfolio Automation in 2025.