Automating your personal crypto trading strategy with AI bots is no longer the exclusive domain of hedge funds or quant shops. Retail traders now have access to advanced tools that can transform a manual strategy into an autonomous trading system, operating 24/7 and free from emotional bias. But beneath the marketing gloss, there are real technical hurdles, genuine risks, and a non-trivial learning curve. Let’s break down what it actually takes to automate your crypto trading in today’s market, where Bitcoin (BTC) currently trades at $113,565.00.

AI Trading Bots: What Are They Really Doing?

AI trading bots are more than just scripts that buy low and sell high. At their core, these bots leverage machine learning models or rule-based algorithms to process market data, detect patterns, and execute trades on your behalf. The top platforms, like Cryptohopper, Stoic AI, and 3Commas, offer varying degrees of sophistication and automation. For beginners aiming to automate their crypto trading strategy, these platforms provide a relatively low barrier to entry but don’t expect miracles out of the box.

It’s important to understand that while AI can enhance trade execution and reduce reaction times, no bot is immune to market anomalies or black swan events. As one seasoned trader quipped:

Key Components Needed for Your Automated Crypto Bot

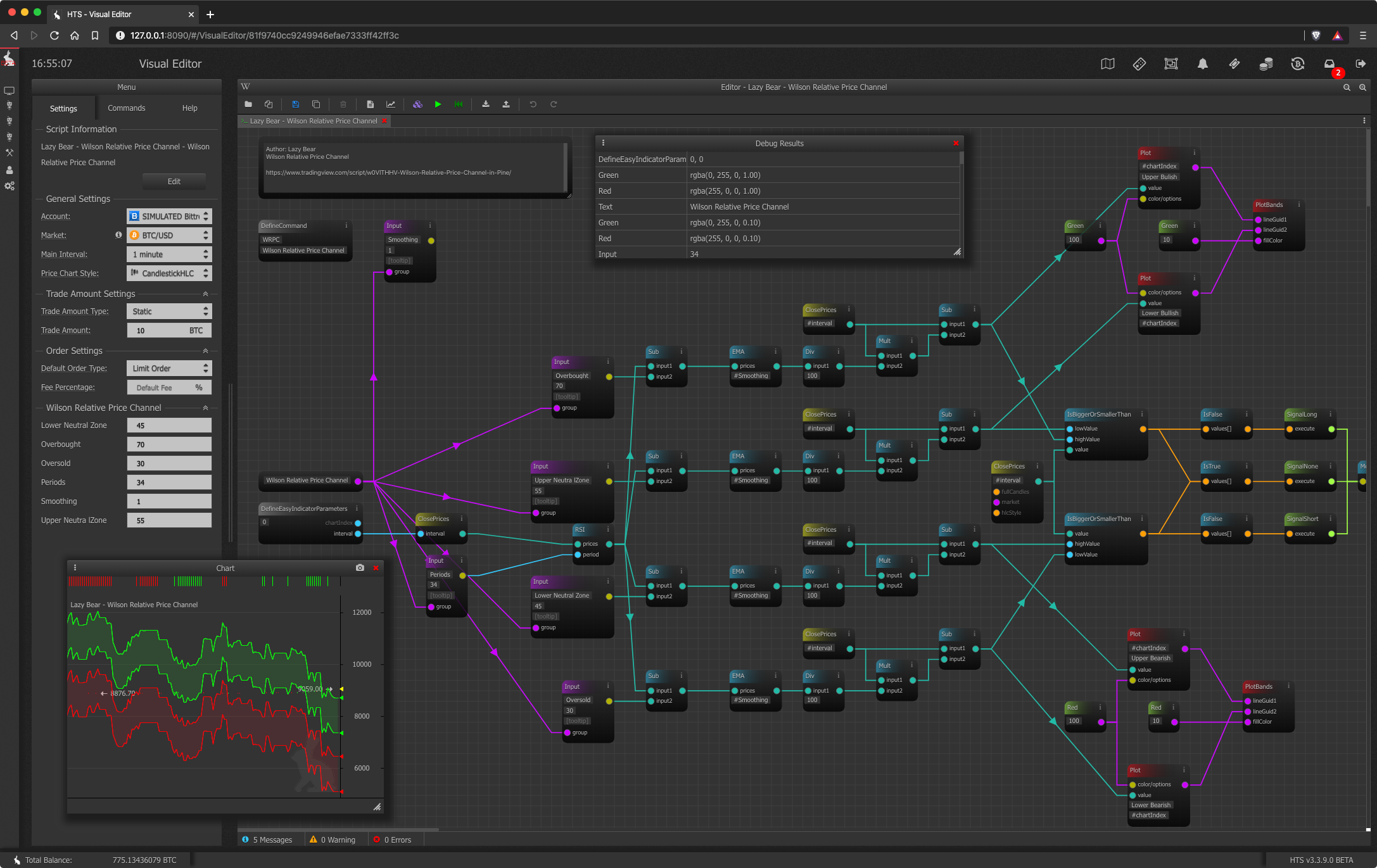

According to recent research (CoinsBench), building an effective AI crypto trading bot requires four interconnected layers:

- Data Acquisition Layer: Fetches real-time prices, order books, and sentiment data from exchanges.

- Signal Generation Layer: Applies your chosen strategy, be it trend following or mean reversion, to generate actionable signals.

- Execution Layer: Translates signals into API calls that place orders with minimal slippage.

- Risk Management Layer: Enforces stop-losses, take-profits, position sizing rules, and diversification logic.

If you want to build your own custom bot in Python, you’ll need proficiency across all four layers, not just coding skills but also statistical intuition and a healthy dose of skepticism about backtest results.

Selecting the Right Platform: Subscription vs DIY

The fastest route for most beginners is using a subscription-based service or marketplace for bots. Platforms like Cryptohopper (cloud-based automation), Stoic AI (passive quant strategies), and 3Commas (customizable bot creation) dominate this space. They integrate via API with major exchanges so you can turn your manual strategy into a trading bot with minimal code, or none at all.

Top Beginner-Friendly AI Crypto Trading Bot Platforms

-

Cryptohopper: A widely used, cloud-based AI trading bot platform offering automated strategy execution, portfolio management, and social trading. Supports integration with major exchanges and provides backtesting and paper trading features, making it accessible for beginners.

-

3Commas: Known for its intuitive dashboard and customizable trading bots, 3Commas supports automated trading, smart trading terminals, and advanced risk management tools. It offers demo trading, strategy backtesting, and integration with multiple leading crypto exchanges.

-

Stoic AI by Cindicator: Designed for simplicity, Stoic AI provides automated portfolio management using AI-driven strategies. It is tailored for users seeking passive, long-term investment solutions with minimal manual intervention.

-

Botsfolio: A beginner-focused platform that automates crypto trading based on risk profiles and investment goals. Botsfolio does not require coding skills and offers a variety of pre-built strategies for different market conditions.

-

Cryptorobotics: Offers AI-powered trading bots with demo and live trading options. Features include algorithmic trading, backtesting, and a user-friendly interface suitable for novices. Supports multiple exchanges and provides educational resources.

If you’re technically inclined or want full control over logic and data sources, you can develop your own solution from scratch using open-source libraries or scripting environments like Pine Script on TradingView. Just remember: every shortcut you take increases the risk of hidden errors, and as Reddit users often lament, there’s no such thing as “set-and-forget” consistency in live markets.

The Importance of Backtesting and Risk Controls

No matter which platform you choose or how clever your algorithm seems in theory, rigorous backtesting against historical data is non-negotiable. This step exposes weaknesses in your strategy before real capital is at risk, and helps avoid the most common mistakes when deploying an AI trading bot for beginners. For detailed backtesting workflows tailored for DeFi markets see this guide.

Avoid overfitting, the classic pitfall where a model performs flawlessly on past data but collapses when faced with new market conditions. Use out-of-sample testing periods and never trust a backtest result unless you understand every assumption behind it.

Bitcoin (BTC) Price Prediction 2026-2031

Professional BTC Price Forecasts Based on $113,565 Baseline (2025) and AI/Automation Trends

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $125,000 | $162,000 | +10% | Continued adoption of AI trading bots; moderate regulatory clarity; possible post-halving retracement |

| 2027 | $110,000 | $140,000 | $185,000 | +12% | Institutional adoption grows; improved scalability; global ETF approvals |

| 2028 | $125,000 | $165,000 | $215,000 | +18% | Next Bitcoin halving; AI-driven trading dominance; increased global crypto integration |

| 2029 | $140,000 | $190,000 | $250,000 | +15% | Higher mainstream adoption; enhanced security via AI; potential for stricter regulations |

| 2030 | $135,000 | $210,000 | $290,000 | +11% | Wider use as a store of value; possible regulatory headwinds in major economies |

| 2031 | $120,000 | $225,000 | $330,000 | +7% | Market matures; competition from CBDCs; Bitcoin remains digital gold, but volatility persists |

Price Prediction Summary

Bitcoin is projected to continue its long-term uptrend, driven by increasing adoption, technological advancements (especially in AI and automation), and growing institutional interest. While volatility and regulatory uncertainty remain, the integration of AI trading bots may help smooth market inefficiencies, supporting a gradual appreciation in BTC’s average price. Both bullish and bearish scenarios are possible, as reflected in the price ranges.

Key Factors Affecting Bitcoin Price

- AI and automation in trading: Increased use of AI bots could enhance market efficiency and liquidity.

- Regulatory landscape: Global regulatory developments (ETFs, taxation, CBDCs) can significantly impact price.

- Market cycles: Bitcoin’s halving events, adoption rates, and macroeconomic cycles drive price movements.

- Institutional and retail adoption: Growth in institutional investment and broader retail participation.

- Competition: Emergence of alternative digital assets and central bank digital currencies (CBDCs).

- Technological improvements: Advances in network scalability, security, and privacy features.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Once your strategy passes the backtest phase, resist the urge to immediately deploy it with full capital. Start small. Use paper trading or a demo account to ensure your bot behaves as expected in real-time, live markets. Even the best models can behave unpredictably when exposed to slippage, latency, or sudden liquidity shocks, especially in a market where Bitcoin is currently priced at $113,565.00.

Common Mistakes When Turning Manual Strategies Into Bots

Automating your strategy isn’t as simple as translating your trading rules into code. Many beginners fall into classic traps that can quickly erode capital:

Over-optimization is rampant, tweaking parameters until historical performance looks perfect but future results disappoint. Ignoring exchange-specific quirks, such as API rate limits or minimum order sizes, can also cripple a bot in production. And never underestimate the risk of technical failures: API outages, internet disruptions, or even software bugs can lead to unexpected positions or losses.

If you’re using off-the-shelf bots from marketplaces or subscription services, scrutinize their documentation and update logs. Many platforms tout proprietary algorithms but offer little transparency about risk controls or edge-case handling. Always ask: “What happens if the market gaps 10% overnight?” If the answer isn’t clear, reconsider your trust in that system.

Improving Your AI Trading Bot Over Time

No automated system should be static. Markets evolve quickly, what worked when BTC was below $100,000 may no longer be effective now that we’re firmly above that threshold at $113,565.00. Regular monitoring and iterative improvement are essential.

Review trade logs weekly for anomalies or drift from expected performance metrics. Adjust risk parameters as volatility shifts or as your portfolio grows. For those ready to push further, consider integrating alternative data sources (on-chain analytics, funding rates) and more advanced ML models, but remember that complexity introduces new failure modes.

If you want deeper technical insights on integrating AI bots with decentralized exchanges (DEXs), check out our practical guide on connecting trading agents directly to DEX protocols. This can unlock new opportunities for arbitrage and liquidity provision beyond traditional centralized exchanges.

The Reality Check: Autonomous Trading for Retail Investors

The allure of fully autonomous trading is strong, set up a bot, let it run 24/7, and watch profits roll in while you sleep. The reality is less glamorous. Even the most sophisticated AI systems can’t eliminate market risk or guarantee consistent returns (as echoed by many users on r/learnmachinelearning who’ve tried Botsfolio and similar services).

Stay skeptical of marketing hype. If a platform promises “guaranteed profits” with minimal oversight, walk away. Effective automation requires ongoing vigilance and adaptation, not blind faith in algorithms.

Trust the math, not the myth.

Ultimately, automating your crypto trading strategy with AI bots is about leveraging technology for efficiency, not replacing human judgment entirely. Start simple, iterate methodically, and never stop questioning both your models and their results.