AI-powered crypto trading bots have become an essential tool for investors seeking to automate portfolio rebalancing and optimize returns in the fast-evolving DeFi landscape. As of October 2025, platforms like Pionex, 3Commas, Bitsgap, Cryptohopper, Coinrule, Hummingbot, and Shrimpy stand out for their advanced AI algorithms, customizable rebalancing strategies, and seamless integration with major exchanges. These bots are not just about automation, they are about data-driven risk management and maximizing efficiency in crypto portfolio management.

Why Automated Portfolio Rebalancing Matters in 2024

Crypto markets are notorious for their volatility, with asset prices swinging dramatically in minutes. Manual portfolio rebalancing is not only time-consuming but also prone to human error and emotional bias. Automated portfolio rebalancing bots leverage AI to continuously monitor market conditions, execute trades, and maintain your target allocation, whether you’re holding Bitcoin, Ethereum, or a diversified basket of altcoins.

The benefits are tangible: reduced risk exposure, consistent adherence to your investment strategy, and the ability to capitalize on market inefficiencies. With AI crypto trading bots, you can set predefined rules or let machine learning models adapt allocations based on real-time data, freeing you from constant screen-watching.

Top 7 AI Crypto Trading Bots for Automated Portfolio Rebalancing in 2024

Top 7 AI Crypto Trading Bots for Portfolio Rebalancing

-

Pionex: Offers 16 free built-in trading bots, including a dedicated rebalancing bot for maintaining desired asset allocations. With low trading fees of 0.05%, Pionex is known for its efficiency and user-friendly interface. Supports major exchanges and is ideal for both beginners and advanced users.

-

3Commas: Features AI-enhanced Grid and DCA bots for various market conditions, plus a SmartTrade terminal for manual strategy adjustments. Supports over 14 exchanges including Binance and Coinbase. Pricing starts at $29 per month.

-

Bitsgap: Known for its grid, DCA, arbitrage, and portfolio rebalancing tools. Bitsgap processes millions of trades and integrates with leading exchanges. Its intuitive dashboard and robust analytics make it a favorite for active traders.

-

Cryptohopper: A cloud-based platform with AI modules for automated trading using technical indicators and external signals. Users can create or purchase strategies from the marketplace. Supports major exchanges and offers a free tier, with paid plans starting at $19 per month.

-

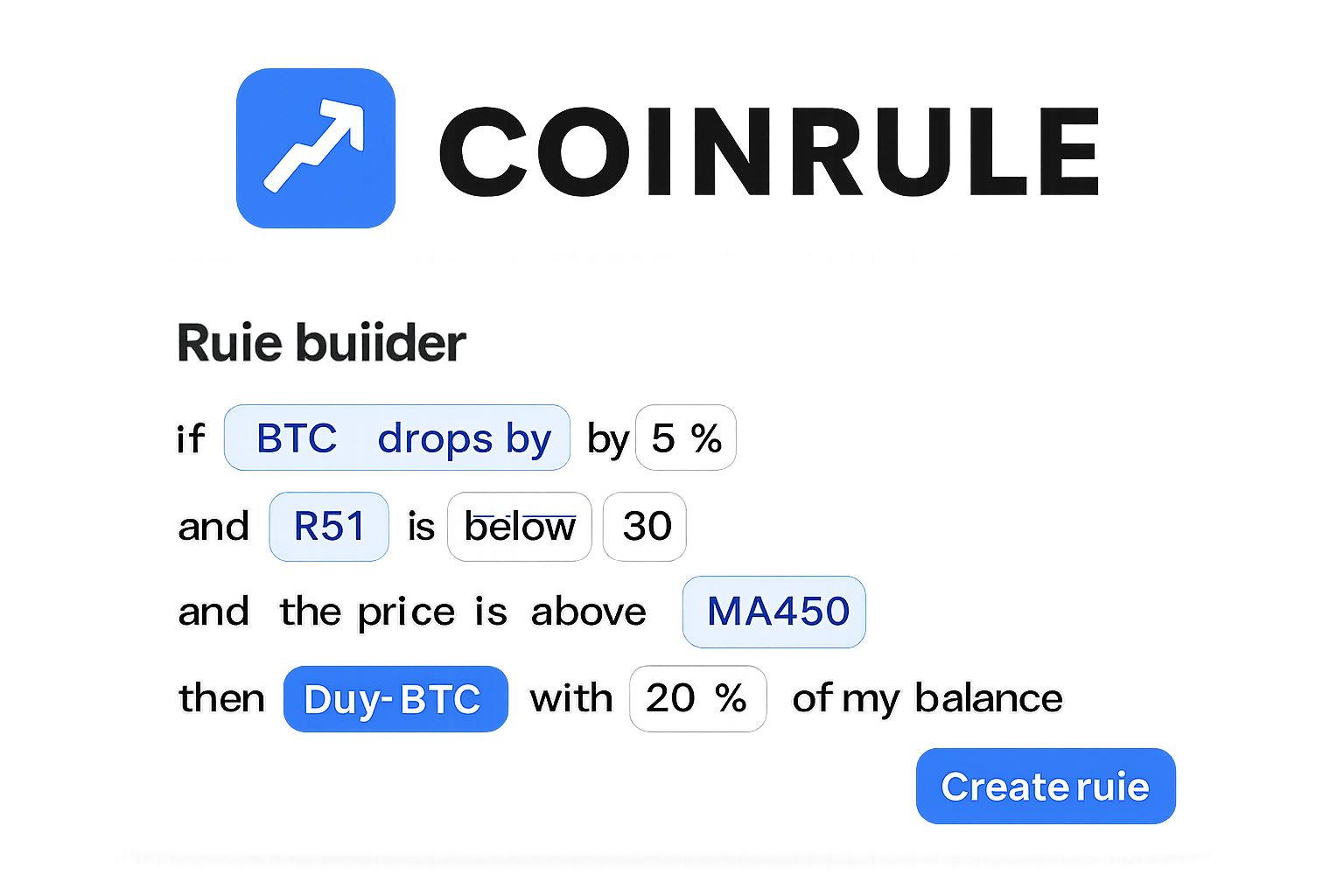

Coinrule: Designed for non-coders, Coinrule provides a no-code strategy builder with over 300 rule templates. Its adaptive learning feature, introduced in 2025, lets bots optimize based on trading history. Supports major exchanges with a free tier and pro plans from $30 per month.

-

Hummingbot: An open-source trading bot popular for customizable strategies and integration with multiple exchanges. Hummingbot’s community-driven development offers advanced features for experienced traders, including support for market making and arbitrage.

-

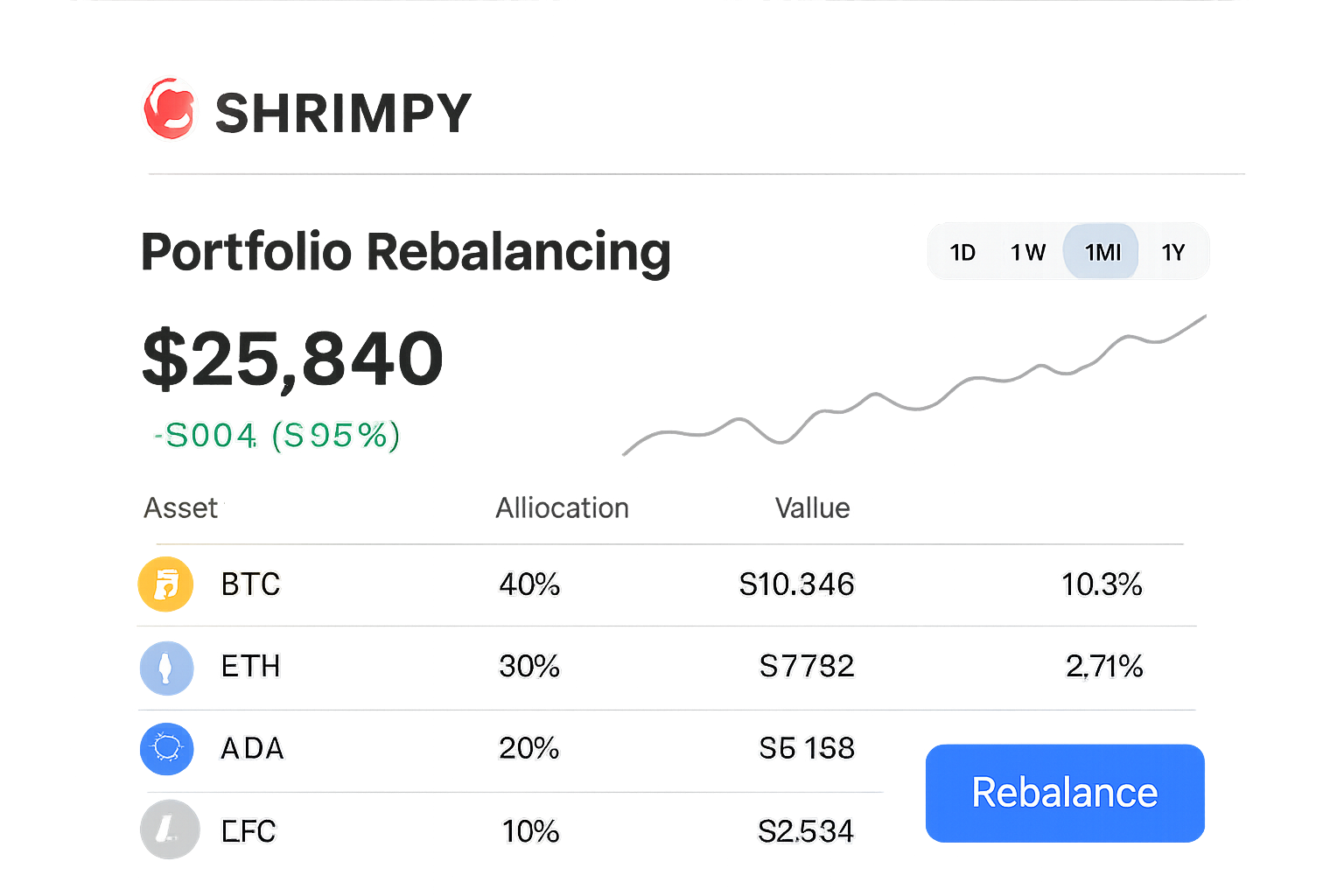

Shrimpy: Specializes in AI-driven portfolio management and rebalancing. Features social trading to follow top traders, and supports exchanges like Binance, Coinbase, Kraken, and HTX. Offers a free plan with premium options at $15 and $63 per month.

Let’s dive into what makes each of these platforms unique for automated portfolio rebalancing:

Pionex: The Free Rebalancing Powerhouse

Pionex stands out with its suite of 16 free built-in trading bots, including a dedicated rebalancing bot. With ultra-low trading fees of 0.05%, Pionex is ideal for cost-conscious investors. The platform’s AI-driven engine ensures that your asset allocations remain on target as prices fluctuate. Pionex’s intuitive interface and robust automation make it a top choice for beginners and seasoned traders alike.

3Commas: Versatile AI-Enhanced Rebalancing

3Commas offers a comprehensive toolkit for automated trading, featuring AI-enhanced Grid and Dollar Cost Averaging (DCA) bots. Its SmartTrade terminal allows for hands-on adjustments when needed, while the platform’s automated rebalancing ensures your portfolio stays aligned with your risk profile. Supporting over 14 major exchanges and starting at $29 per month, 3Commas is a favorite among users seeking both flexibility and depth in their trading strategies.

Bitsgap: Multi-Strategy Automation with AI Insights

Bitsgap has processed millions of trades since its launch, making it a trusted name in crypto automation. Its rebalancing bots work alongside grid and arbitrage tools, offering seamless portfolio management across multiple exchanges. Bitsgap’s AI modules analyze trading history to optimize rebalancing intervals and minimize slippage, helping users extract maximum value from volatile markets.

What to Look for in an AI Trading Agent

When evaluating AI crypto trading bots for portfolio rebalancing, key factors include:

- Supported Exchanges: Ensure the bot integrates with your preferred trading platforms.

- Pricing: From Pionex’s free tier to 3Commas’ $29/month plan, weigh costs against features.

- Strategy Customization: Look for platforms that allow rule-based or AI-optimized strategies.

- Security and Transparency: Choose bots with strong security protocols and transparent performance metrics.

For a deeper dive into how AI agents are transforming automated portfolio management, see our guide on automated portfolio rebalancing with AI trading agents.

Cryptohopper: Cloud-Based AI, Marketplace Strategies

Cryptohopper is a cloud-based bot that leverages AI modules and technical indicators to automate portfolio rebalancing. One of its standout features is the strategy marketplace, where users can purchase or sell pre-built trading strategies. This enables both novice and advanced traders to benefit from proven tactics or deploy custom AI-powered logic. Cryptohopper supports major exchanges and offers a flexible pricing structure: a free tier for basic users and paid plans starting at $19 per month. Its automation capabilities, combined with a robust community, make it a strong contender for those seeking hands-off portfolio optimization.

Coinrule: No-Code Adaptive Automation

Coinrule democratizes automated trading with its intuitive no-code strategy builder. In 2025, Coinrule introduced adaptive learning, allowing bots to refine their rebalancing logic in real time based on your trading history. Over 300 rule templates provide a launching pad for both beginners and power users. Coinrule’s free tier enables experimentation without upfront costs, while pro plans start at $30 per month. Its focus on usability and AI-driven optimization makes it an excellent choice for investors who want granular control without writing code.

Hummingbot: Open-Source DeFi Rebalancing

Hummingbot distinguishes itself as an open-source framework tailored for algorithmic trading and liquidity provision. Its modular architecture allows for deep customization of rebalancing strategies, ideal for technically-inclined users or DeFi power traders. Hummingbot’s growing library of connectors supports major centralized and decentralized exchanges. The bot’s transparency appeals to those who want full visibility into their automation logic, and the active community regularly contributes new AI-driven modules for advanced portfolio management.

Shrimpy: Social Trading Meets Smart Rebalancing

Shrimpy is purpose-built for portfolio management, offering sophisticated AI-driven rebalancing tools alongside unique social trading features. Users can follow top-performing portfolios or share their own strategies with the community. Shrimpy’s automation engine supports all major exchanges and ensures your target allocations are maintained, even during periods of extreme volatility. With a free plan and premium tiers at $15 and $63 per month, Shrimpy delivers flexibility for both casual investors and active traders seeking data-backed rebalancing.

Feature Comparison Table

Side-by-Side Comparison of Top AI Crypto Trading Bots for Automated Portfolio Rebalancing (2024/2025)

| Bot Name | Pricing | Supported Exchanges | AI Features | Unique Selling Points |

|---|---|---|---|---|

| Pionex | Free (0.05% trading fee) | Binance, Coinbase, Kraken, more | AI-powered rebalancing, 16 free built-in bots | All-in-one exchange & bot platform, low fees, beginner-friendly |

| 3Commas | From $29/month | 14+ major exchanges incl. Binance, Coinbase | AI-enhanced Grid & DCA bots, SmartTrade terminal | Advanced automation, manual trade options, strategy marketplace |

| Bitsgap | From $29/month (free trial available) | 30+ exchanges incl. Binance, Kraken, Coinbase | AI-powered portfolio rebalancing, Grid & DCA bots | Multi-exchange trading, arbitrage tools, advanced analytics |

| Cryptohopper | Free tier, paid from $19/month | Major exchanges incl. Binance, Coinbase, Kraken | AI modules, technical indicator automation, external signal integration | Marketplace for strategies, cloud-based, customizable bots |

| Coinrule | Free tier, Pro from $30/month | Major exchanges incl. Binance, Coinbase, Kraken | No-code AI strategy builder, adaptive learning (2025) | 300+ rule templates, user-friendly, no coding required |

| Hummingbot | Free (open source) | Binance, Coinbase, KuCoin, more | Custom AI strategies via scripting, supports market making | Highly customizable, open source, ideal for developers |

| Shrimpy | Free (limited), Premium $15–$63/month | Binance, Coinbase, Kraken, HTX, more | AI-driven portfolio rebalancing, social trading | Copy top traders, automated rebalancing, portfolio analytics |

Pro Tip: For most users in 2024-2025, combining the strengths of multiple bots, such as Pionex’s low fees with Shrimpy’s social strategies or Hummingbot’s DeFi integrations, can yield optimal results. Always monitor how each bot interacts with your portfolio size and risk profile.

Maximizing Results with AI Trading Agents

To get the most out of automated portfolio rebalancing:

- Regularly review your allocation targets to reflect changing market conditions and personal risk tolerance.

- Leverage backtesting features (available on platforms like 3Commas and Bitsgap) to validate your AI-driven strategies before deploying real capital.

- Stay informed about new integrations or AI model upgrades, these can dramatically improve rebalancing precision over time.

The landscape of AI crypto trading bots for automated portfolio rebalancing is more robust than ever. Whether you prioritize cost efficiency (Pionex), advanced customization (Hummingbot), social insights (Shrimpy), or no-code simplicity (Coinrule), there is a solution tailored to your needs. As always, let data, not emotion, drive your decision-making in the dynamic world of DeFi trading solutions.