The world of decentralized finance has always thrived on innovation, but 2024 marks a turning point: agentic DeFi is rapidly automating what was once the exclusive domain of seasoned yield farmers. Forget the days of laboriously hopping between protocols and manually bridging assets across chains. Today, AI trading agents are quietly capturing over $20M TVL and reshaping how users, novices and pros alike, approach multi-chain yield strategies.

How Agentic DeFi Agents Are Changing the Yield Game

So, what exactly is an agentic DeFi AI agent? Picture a self-governing bot that not only scans dozens of protocols for the best APYs, but also executes cross-chain transactions and manages risk in real time, without you lifting a finger. These agents leverage interoperability layers like LayerZero and Axelar, enabling them to move assets frictionlessly between Ethereum, BNB Chain, and emerging L2s to chase the most lucrative yields.

Unlike traditional DeFi bots, which are often limited to single-chain or static strategies, today’s DeFi agents 2024 are context-aware and adaptive. They monitor on-chain data, protocol health, and even market sentiment to make split-second decisions. The result? Smarter capital allocation and a dramatic reduction in missed opportunities or exposure to protocol risk.

Inside the Multi-Agent AI Architecture: The Brains Behind Automation

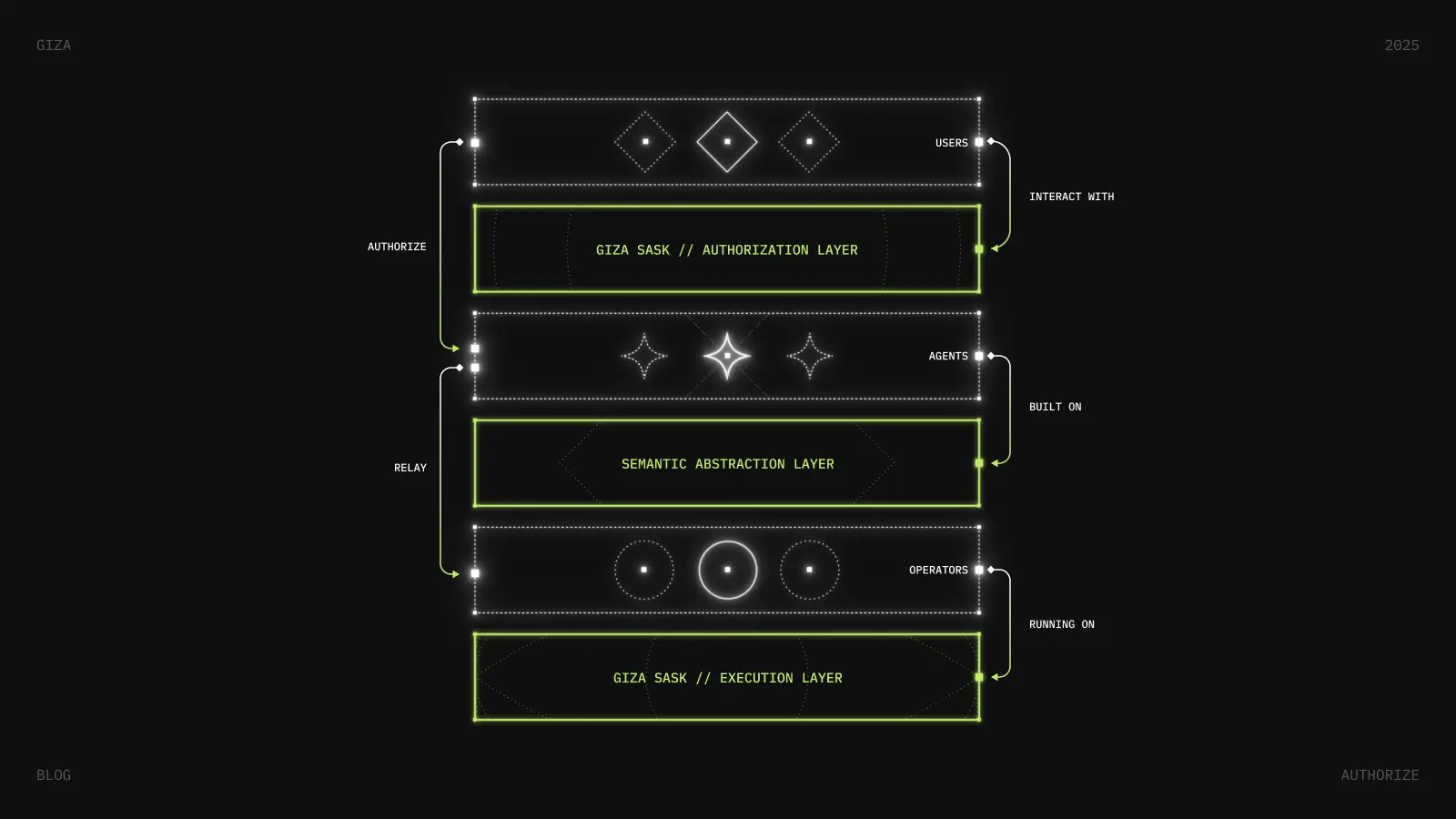

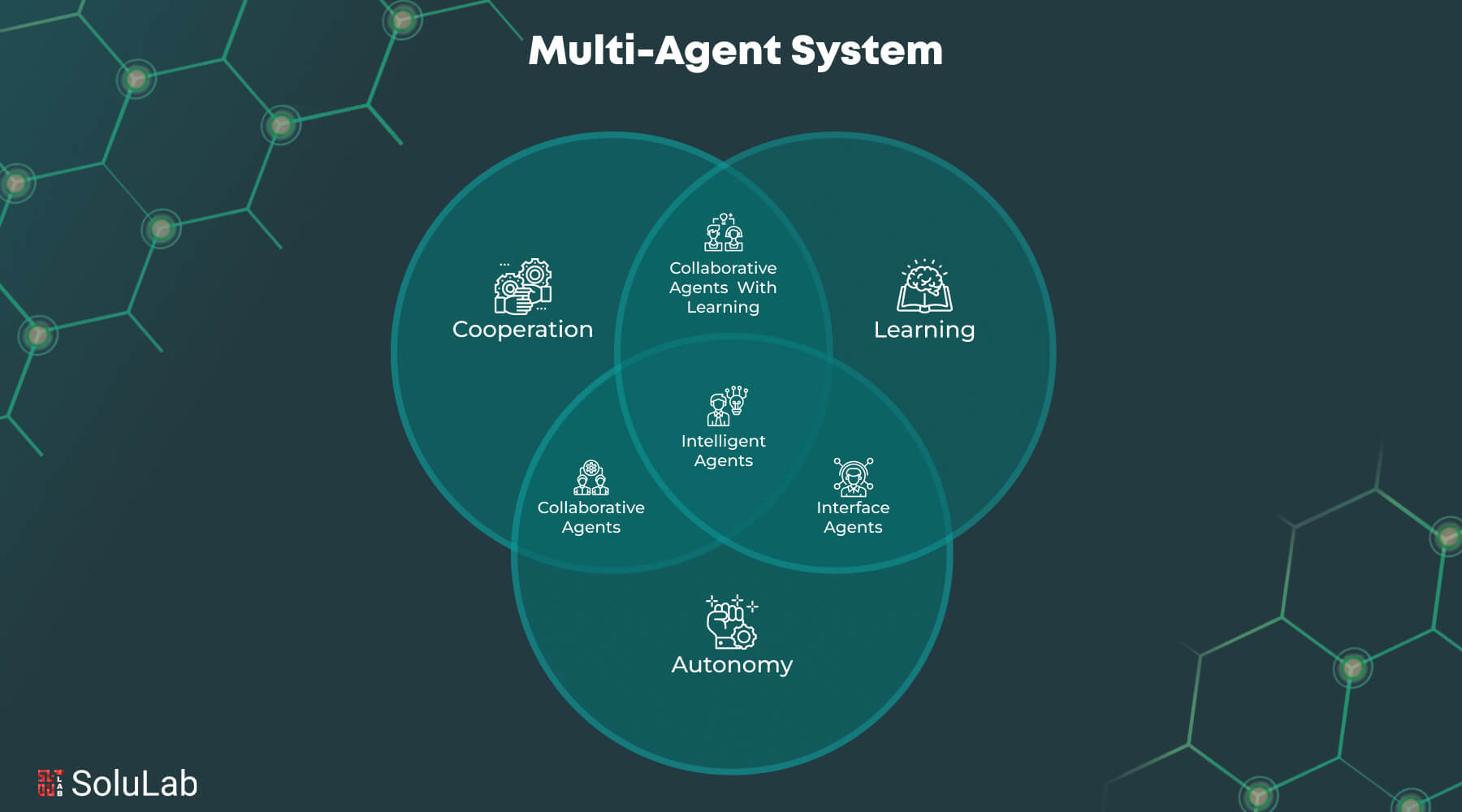

At the heart of this revolution is a multi-agent AI architecture. Rather than relying on a single monolithic system, developers now deploy swarms of specialized agents, each with its own role. Some monitor yield rates across lending protocols like Aave and Compound, while others handle bridging and liquidity routing. Still more are tasked with risk management, ready to pull funds at the first sign of smart contract exploits or abnormal volatility.

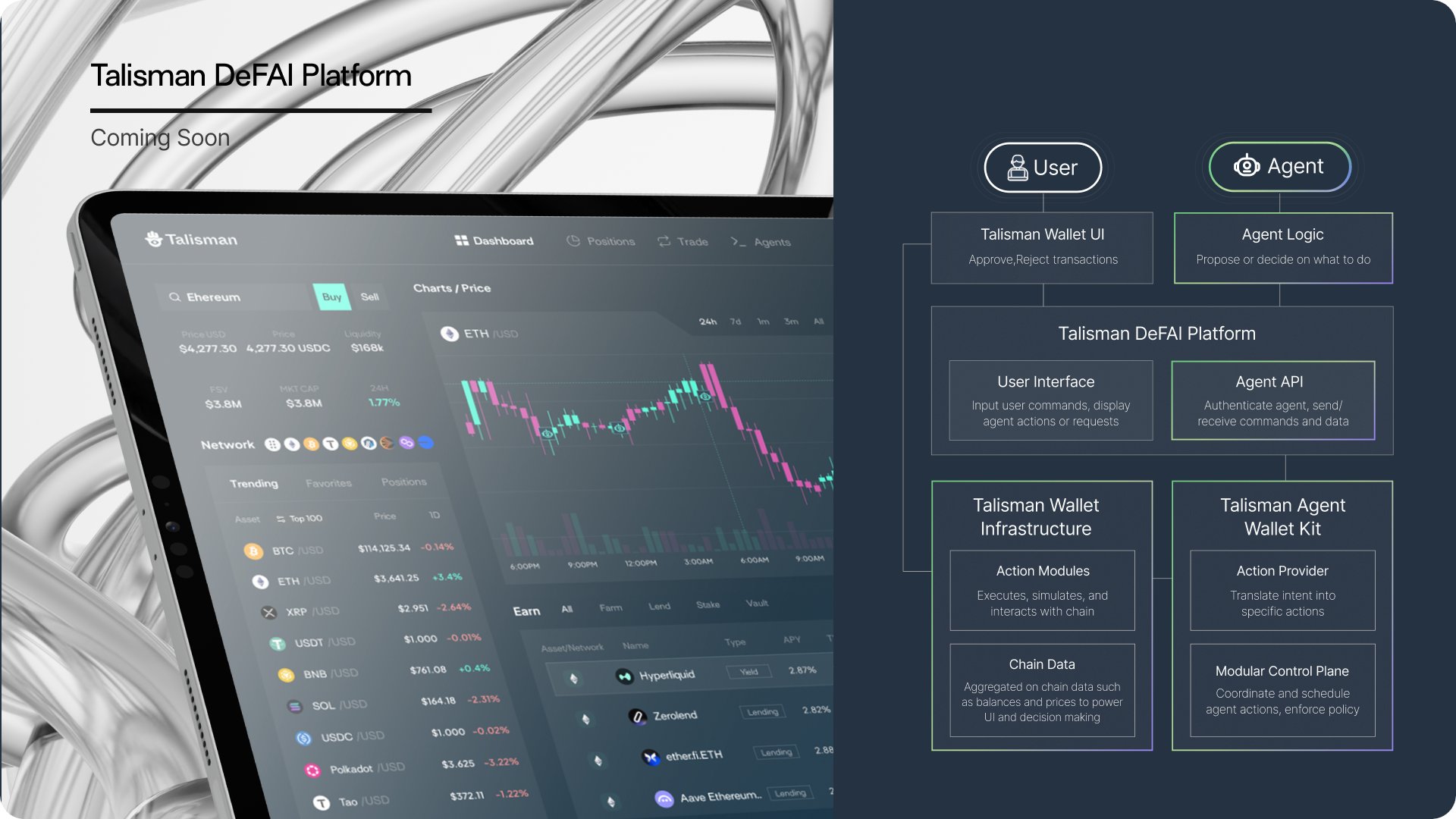

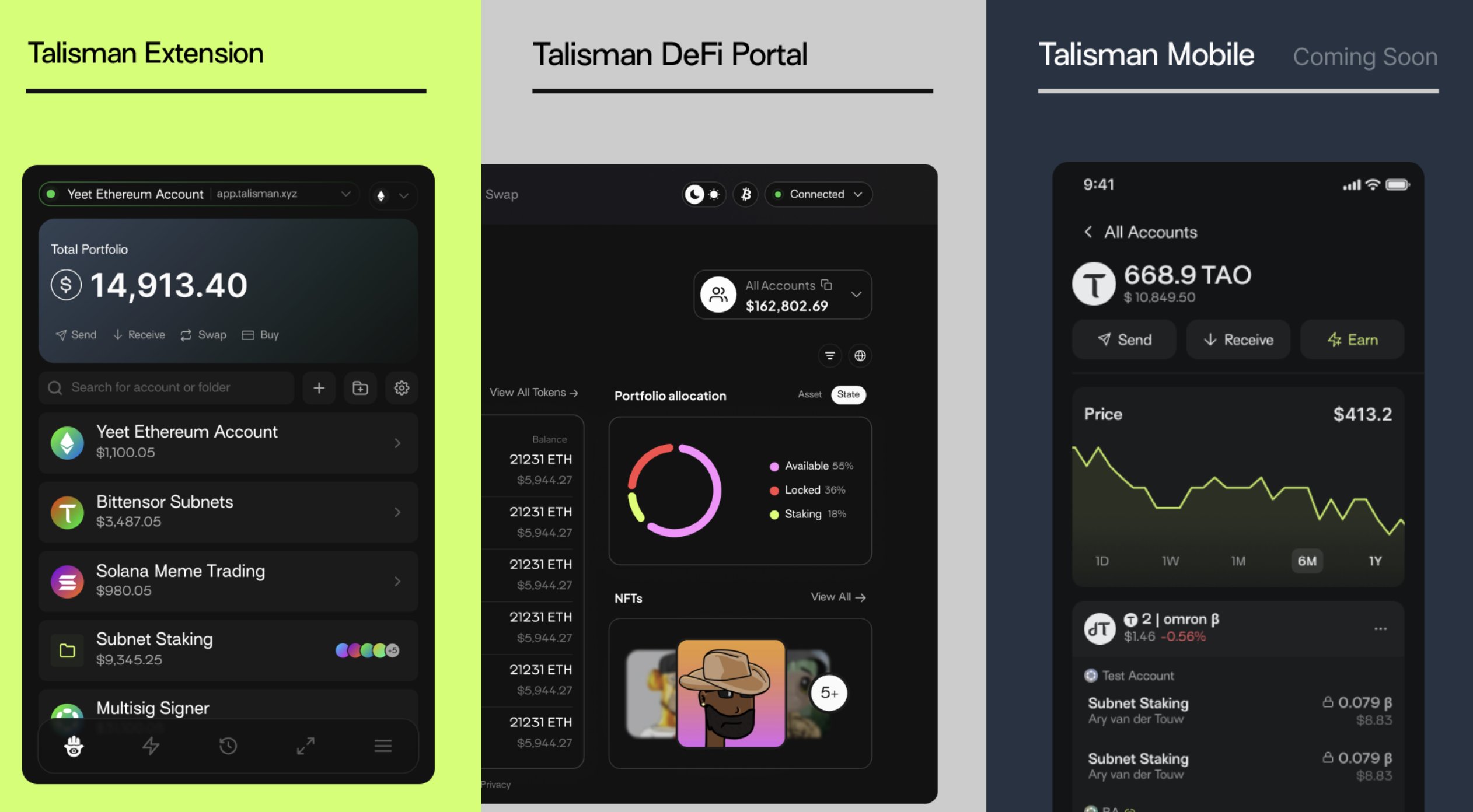

Take Giza ARMA on the Base network: this intelligent agent is built for stablecoin cross-protocol yield optimization, supporting Aave, Morpho, Compound, and Moonwell. It autonomously rebalances positions and compounds earnings, all while executing on-chain in a fully transparent manner. Similarly, Talisman Wallet has transformed itself from a passive storage solution into an active portfolio management hub by embedding AI agents directly into the user experience. Now, anyone can automate complex cross-chain strategies with just a few taps.

Top DeFi AI Agents for Cross-Chain Yield in 2024

-

Giza ARMA: Deployed on the Base network, ARMA is an intelligent agent focused on stablecoin cross-protocol yield optimization. It supports leading lending protocols like Aave, Morpho, Compound, and Moonwell, offering features such as cross-protocol rebalancing and automatic compounding for maximized returns.

-

Talisman Wallet AI Agents: Talisman has integrated AI agents directly into its wallet, transforming it into an active portfolio management tool. Users can automate cross-chain yield strategies and access DeFi opportunities on multiple networks without manual intervention.

-

DefiMatrix AI Agents: DefiMatrix offers agentic AI that autonomously monitors protocols, reallocates assets, and manages risk in real time. It leverages interoperability protocols like LayerZero and Axelar to facilitate seamless cross-chain yield optimization for users.

-

Moralis Money AI: Moralis Money has introduced AI-powered agents that analyze on-chain data and automate yield farming strategies across multiple blockchains. The platform helps users discover high-yield opportunities and manage risk efficiently.

-

Yearn Finance V3 AI Agents: Yearn Finance has rolled out AI-driven strategy modules in its V3 upgrade, enabling automated cross-chain yield optimization and dynamic rebalancing across supported protocols, making advanced DeFi strategies accessible to a wider audience.

Why Cross-Chain Yield Automation Matters in 2024

The explosion of new blockchains and DeFi protocols has made yield farming more lucrative, but also more complex, than ever before. Manual portfolio management is no longer feasible for most users. Enter cross-chain yield automation: by letting AI agents handle everything from asset bridging to risk mitigation, users gain access to higher yields, better capital efficiency, and enhanced security.

Most importantly, these advances are democratizing DeFi. With prompt-based DeFi interfaces and one-click automation, even users with zero coding experience can deploy sophisticated multi-chain yield strategies. The impact? A new era of accessible, efficient, and secure decentralized finance, driven by agentic AI.

But the story doesn’t end with convenience. The rise of DeFi AI automation is also rewriting what’s possible for portfolio growth and risk-adjusted returns. AI trading agents are now able to tap into micro-yield opportunities that humans would overlook, think flash-loan arbitrage, fleeting liquidity mining programs, or sudden APY spikes on lesser-known protocols. By constantly scanning the entire DeFi landscape, these agents can reallocate capital in seconds, squeezing every last drop of yield from a rapidly evolving ecosystem.

Security is another frontier where agentic DeFi shines. With exploits and rug pulls still a persistent threat, real-time risk monitoring isn’t just a nice-to-have, it’s essential. Agents are programmed to recognize suspicious on-chain patterns, sudden drops in protocol TVL, or governance changes that could signal trouble. When a threat is detected, they can instantly withdraw funds or rebalance exposure, no more waking up to drained wallets after a late-night exploit.

Prompt-Based DeFi: The Next Leap in User Experience

One of the most exciting trends is prompt-based DeFi: users simply describe their desired outcome provides “maximize stablecoin yield across Ethereum and BNB Chain, minimize risk”: and the AI agents handle the rest. This natural language interface is lowering the barrier for newcomers and making advanced yield strategies accessible to all. Platforms like Infinit_Labs and Plasma are pioneering these one-click DeFi experiences, where users can deploy, monitor, and adjust strategies with minimal friction.

It’s not just about ease of use. Multi-chain yield strategies powered by agentic AI are fundamentally changing how capital flows through DeFi. By making it simple to move assets wherever yields are best, without manual bridging or complex transaction signing, these agents are flattening the playing field between whales and smaller investors. The result? More distributed liquidity, healthier protocols, and a more robust DeFi ecosystem overall.

What’s Next for DeFi Agents in 2025?

As we look toward 2025, the pace of innovation is only accelerating. Expect to see:

Top DeFi AI Agent Trends to Watch in 2025

-

Multi-Agent Architectures for Personalized DeFi: AI agents are evolving into collaborative networks, leveraging on-chain data and user behavior to deliver highly personalized yield strategies across multiple blockchains.

-

Seamless Cross-Chain Yield Automation: Platforms like Giza ARMA are pioneering autonomous agents that rebalance assets and optimize yields across protocols such as Aave, Morpho, Compound, and Moonwell, all without manual bridging.

-

AI-Integrated Wallets for Active Portfolio Management: Wallets like Talisman now embed AI agents, transforming them into active managers that automate cross-chain strategies and simplify DeFi for mainstream users.

-

Real-Time Risk Detection and Autonomous Defense: AI agents are increasingly tasked with monitoring protocol vulnerabilities and market volatility, executing instant defensive actions to protect user assets.

-

Lowering Barriers to Complex DeFi Participation: The rise of agentic AI is democratizing access, enabling users without technical expertise to tap into sophisticated, automated yield strategies.

-

Enhanced Security and Fraud Mitigation: Agentic AI systems are being deployed to autonomously detect, respond to, and mitigate security threats and fraud in near real-time, boosting user confidence in DeFi.

Already, new agentic models are integrating social sentiment analysis, off-chain price feeds, and even user-specific preferences to tailor strategies in real time. Imagine an AI agent that not only optimizes for yield, but also aligns with your personal risk tolerance and preferred blockchains, true personalized finance at scale.

For those eager to dive deeper into automated yield farming and see these agents in action, check out our guide on how to use AI trading agents for automated DeFi yield farming in 2024.

Agentic DeFi isn’t just a trend, it’s a tectonic shift in how crypto portfolios are managed. With $20M TVL already under autonomous management and new agents launching daily, the future of DeFi is automated, adaptive, and open to all.