Crypto markets in 2025 are a different beast from just a year ago. With the meteoric rise of AI trading agents, the landscape for arbitrage and market making has shifted from manual hustle to algorithmic finesse. The combined market value of AI agents in crypto soared from $4.8 billion to $15.5 billion in the last quarter of 2024 (Ampcome), and the momentum is only intensifying. But what’s really driving this transformation? Let’s dive into how AI trading agents are supercharging arbitrage and market-making strategies for both professionals and DeFi explorers.

AI Trading Agents Arbitrage: Speed, Scale, and Precision

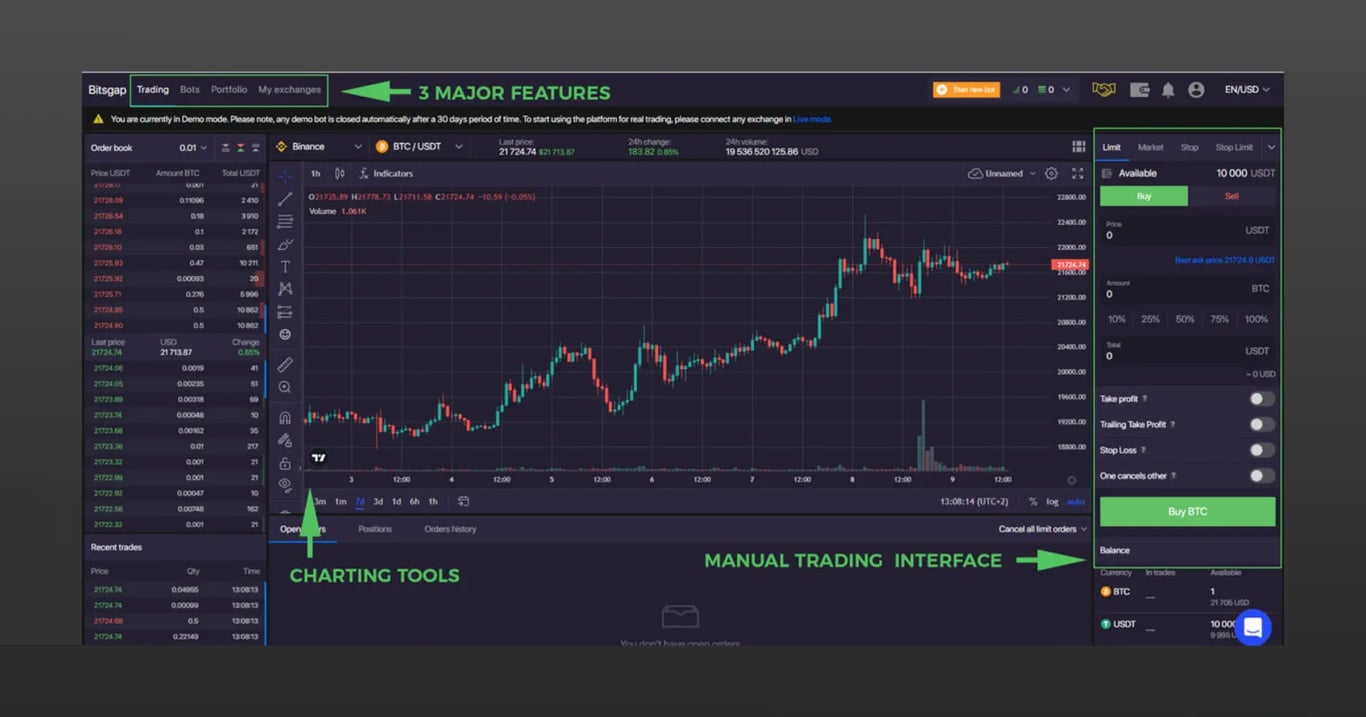

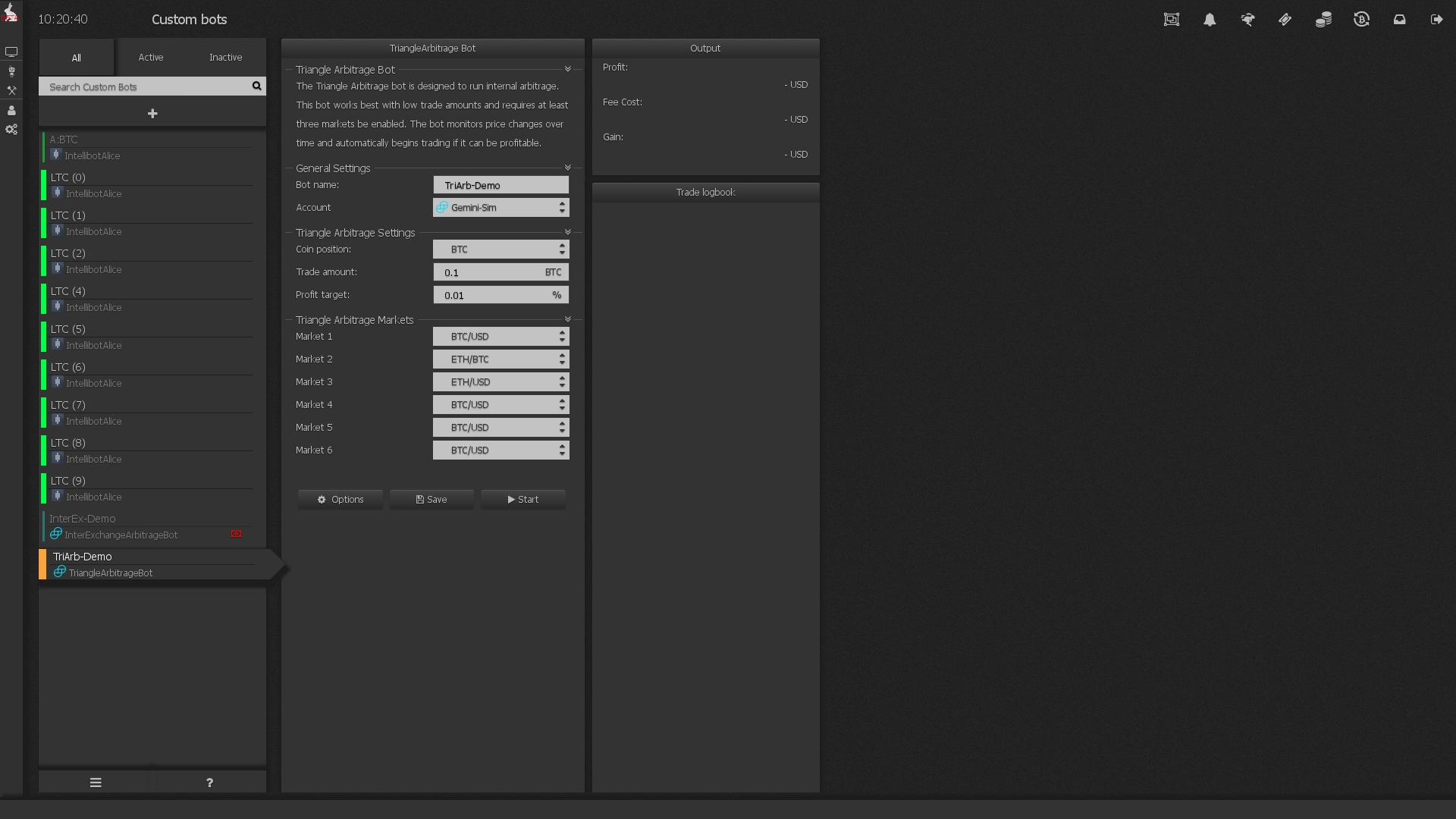

Arbitrage in crypto is all about exploiting price differences for the same asset across different exchanges or trading pairs. In the past, this meant frantically clicking between tabs, hoping to outpace the next trader. Now, with AI trading agents arbitrage strategies, the game is played on a whole new level. Platforms like Bitsgap Quantum reportedly scan over 20,000 arbitrage opportunities across CEXs and DEXs in milliseconds (blog.aiquant.fun), a feat no human could hope to match.

These bots ingest massive streams of price, volume, and liquidity data, instantly identifying fleeting mispricings between venues. With real-time crypto trading automation, execution is nearly instantaneous, ensuring that by the time a human has spotted the gap, the AI has already closed the trade and moved on.

Key Advantages of AI-Powered Arbitrage Bots

-

Lightning-Fast Trade Execution: AI bots like Bitsgap Quantum can analyze thousands of assets and execute arbitrage trades within milliseconds, capturing fleeting price discrepancies across exchanges far faster than any human trader.

-

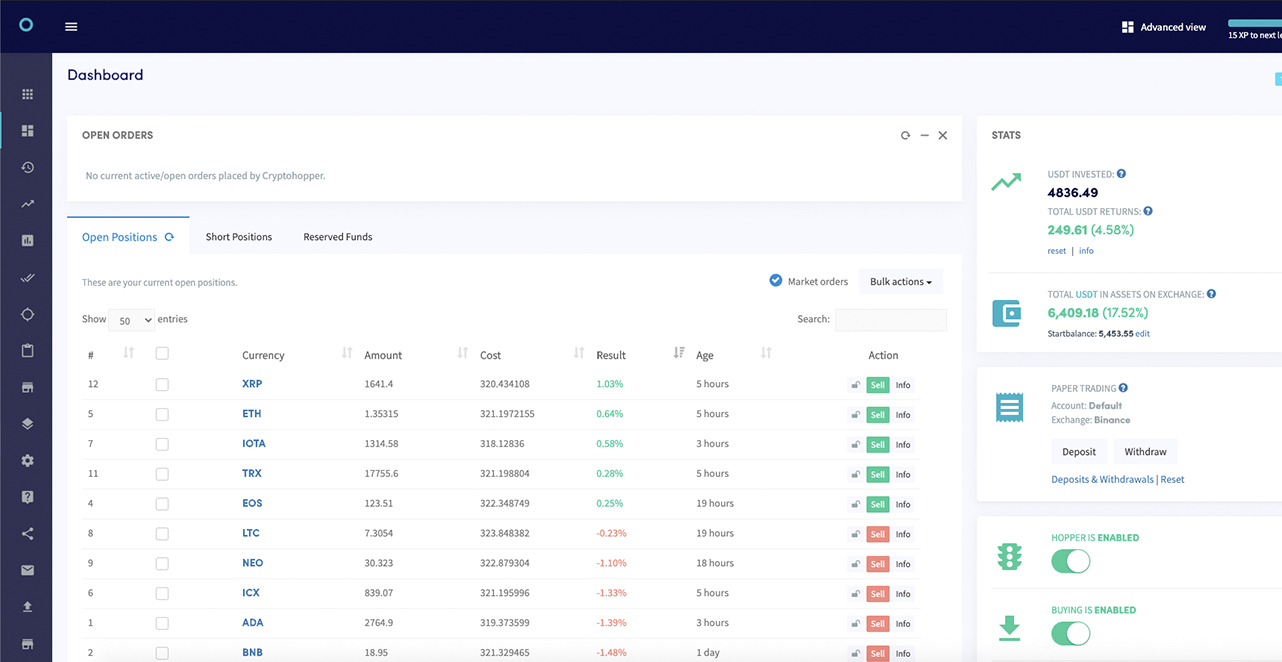

24/7 Market Monitoring: Unlike human traders, AI-powered bots such as Cryptohopper and Pionex operate non-stop, ensuring that no profitable arbitrage opportunity is missed—even during nights, weekends, or global market shifts.

-

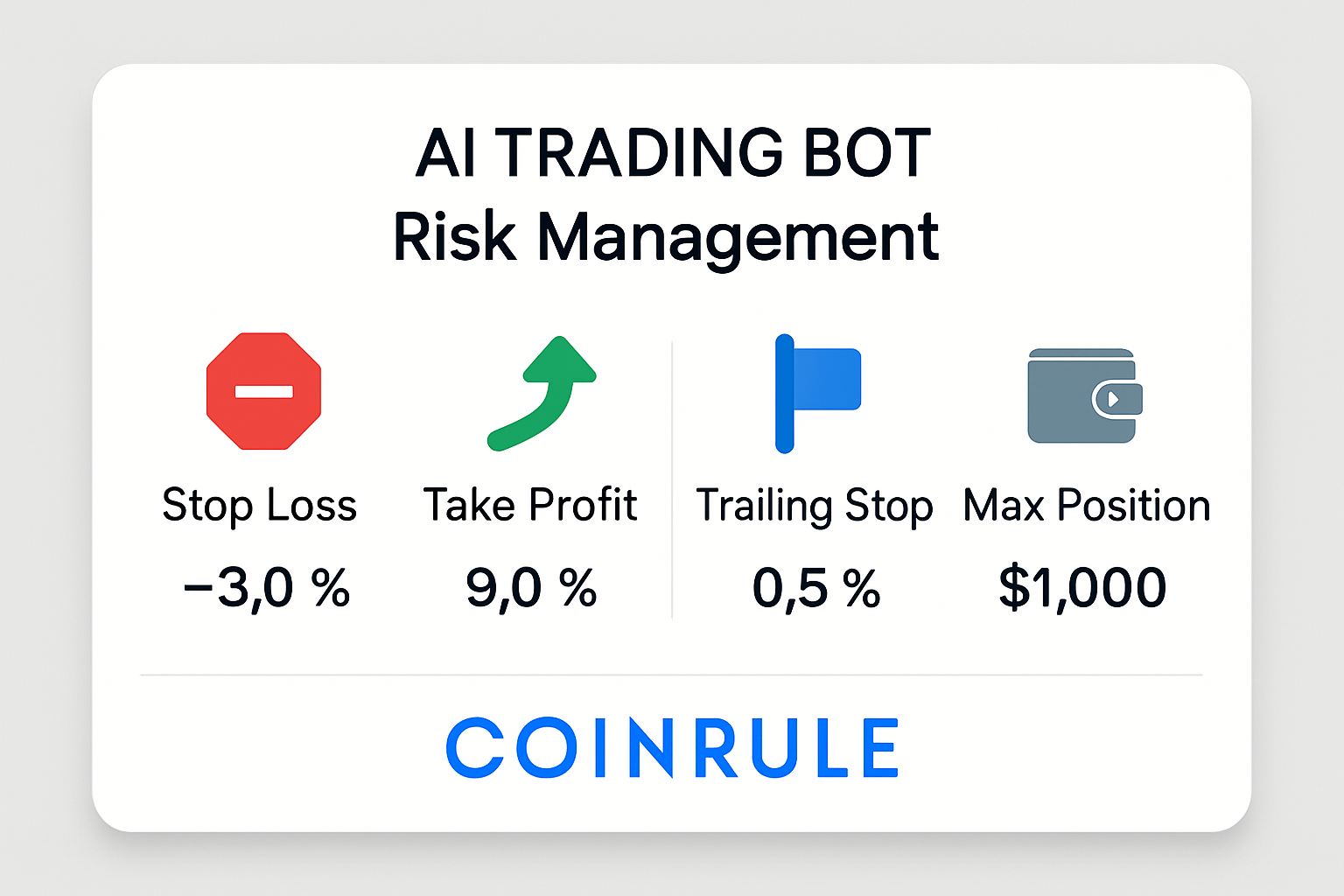

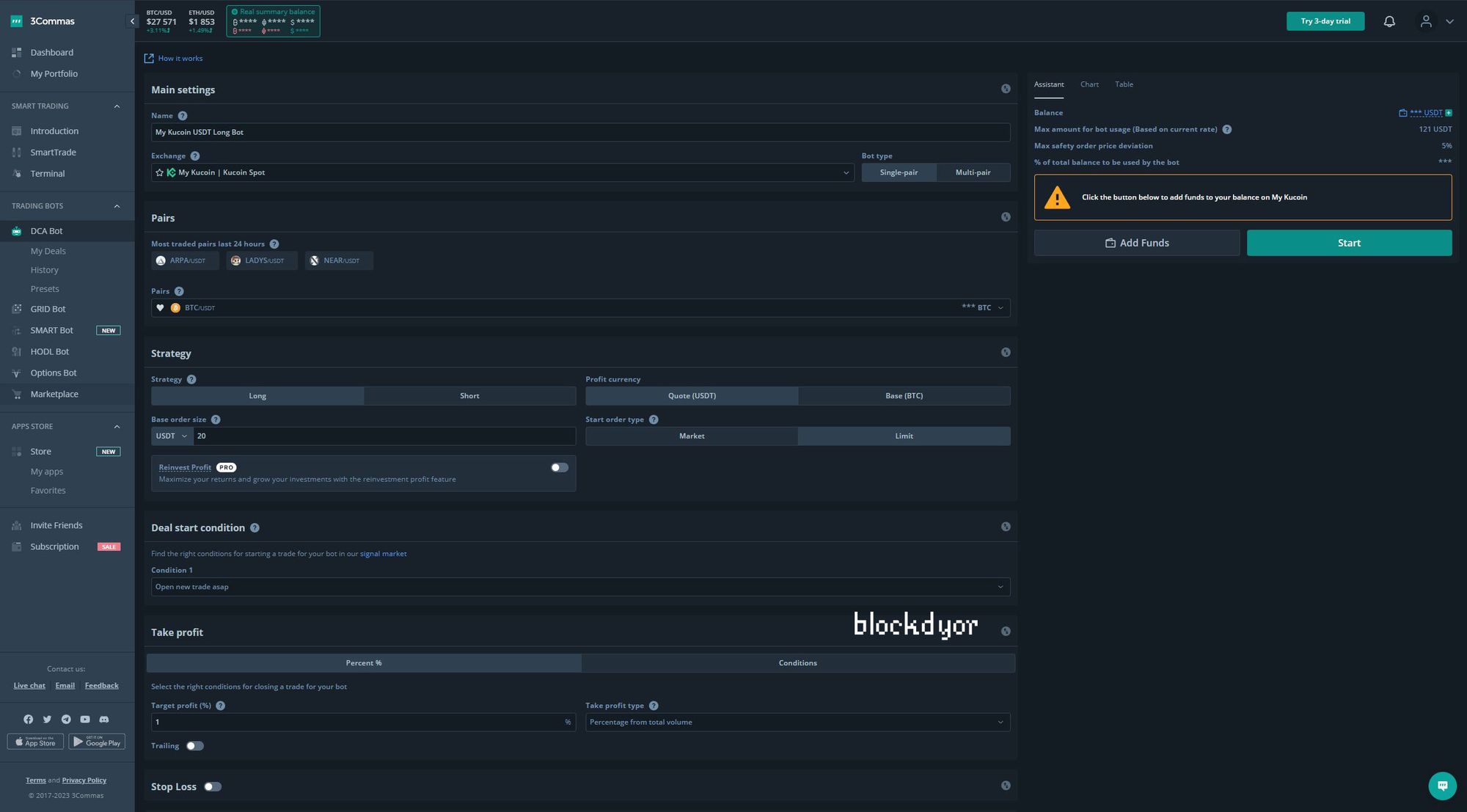

Advanced Risk Management: Leading platforms like 3Commas and HaasOnline integrate sophisticated risk controls, automatically setting stop-losses and profit targets to help minimize losses and lock in gains.

-

Simultaneous Multi-Exchange Trading: Tools like ArbitrageScanner scan and execute trades across dozens of centralized and decentralized exchanges, maximizing arbitrage opportunities and liquidity access.

What’s more, leading bots like ArbitrageScanner (editorially recognized by Golden Owl) now cover over 40 centralized and decentralized exchanges, giving traders unprecedented breadth for automated crypto arbitrage strategies. This isn’t just about speed; it’s about relentless, 24/7 market coverage, with bots never needing sleep or a coffee break.

AI Market Making Crypto: Adaptive Liquidity in Action

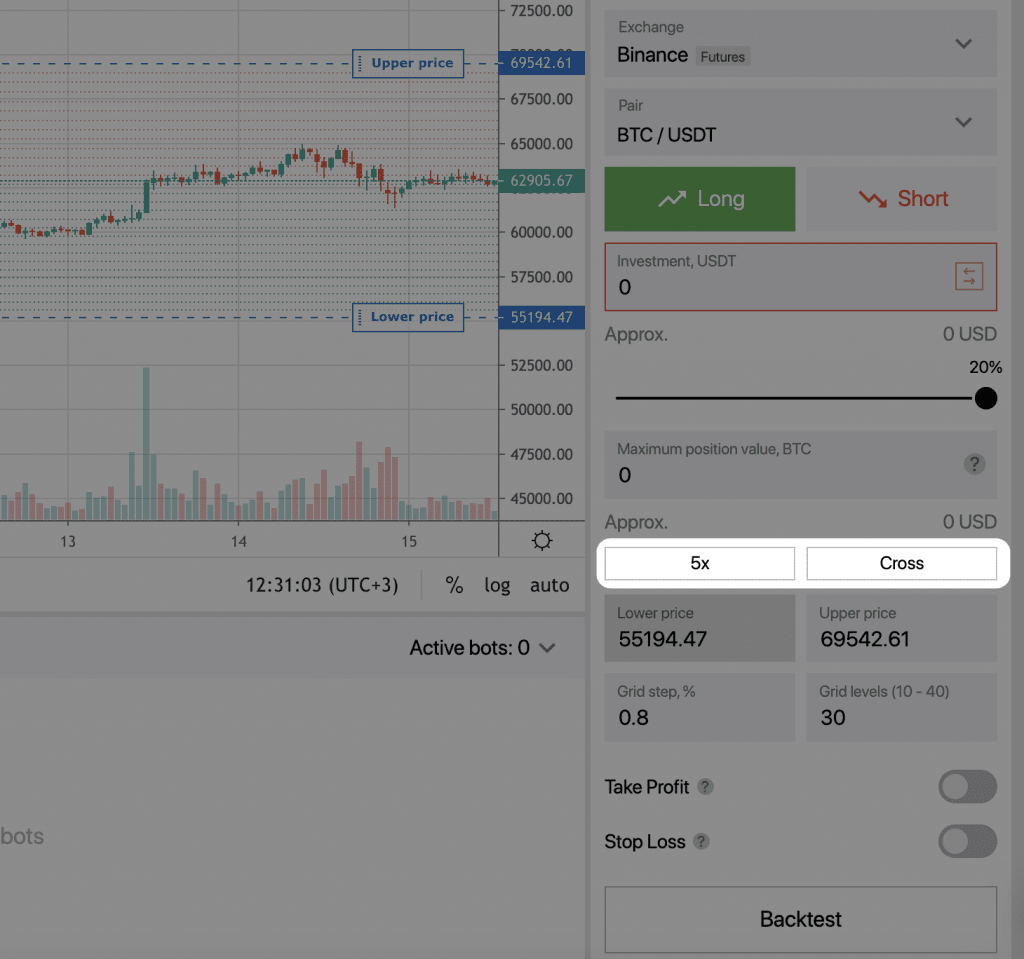

If arbitrage is about exploiting inefficiencies, market making is about creating the conditions for efficient trading. Market makers provide liquidity by continuously quoting buy and sell prices, profiting from the spread. But in the volatile, fragmented world of crypto, manual market making is a high-wire act. Enter AI market making crypto bots: these agents use sophisticated algorithms to dynamically adjust spreads, manage inventory, and respond instantly to volatility spikes.

AI-powered market-making bots can analyze order books, detect shifts in market sentiment, and even predict short-term price movements based on real-time data. This means tighter spreads, deeper liquidity, and a more stable trading environment for all participants. According to ReelMind.ai, these bots are now indispensable for both centralized and decentralized exchanges seeking to maintain robust order books in the face of global 24/7 trading.

Why AI Trading Agents Outperform: Beyond Human Limits

The advantages of AI trading agents aren’t just incremental; they’re transformative. Here’s why:

- Millisecond Execution: AI bots react to arbitrage or liquidity shifts at speeds no human can match (Osiz Technologies).

- 24/7 Market Presence: Crypto never sleeps, and neither do AI bots. Every opportunity is seized, even when human traders are offline.

- Data-Driven Discipline: No emotional trades. Decisions are based on cold hard data, not FOMO or panic.

- Automated Risk Controls: From stop-losses to position sizing, risk management is baked into every trade.

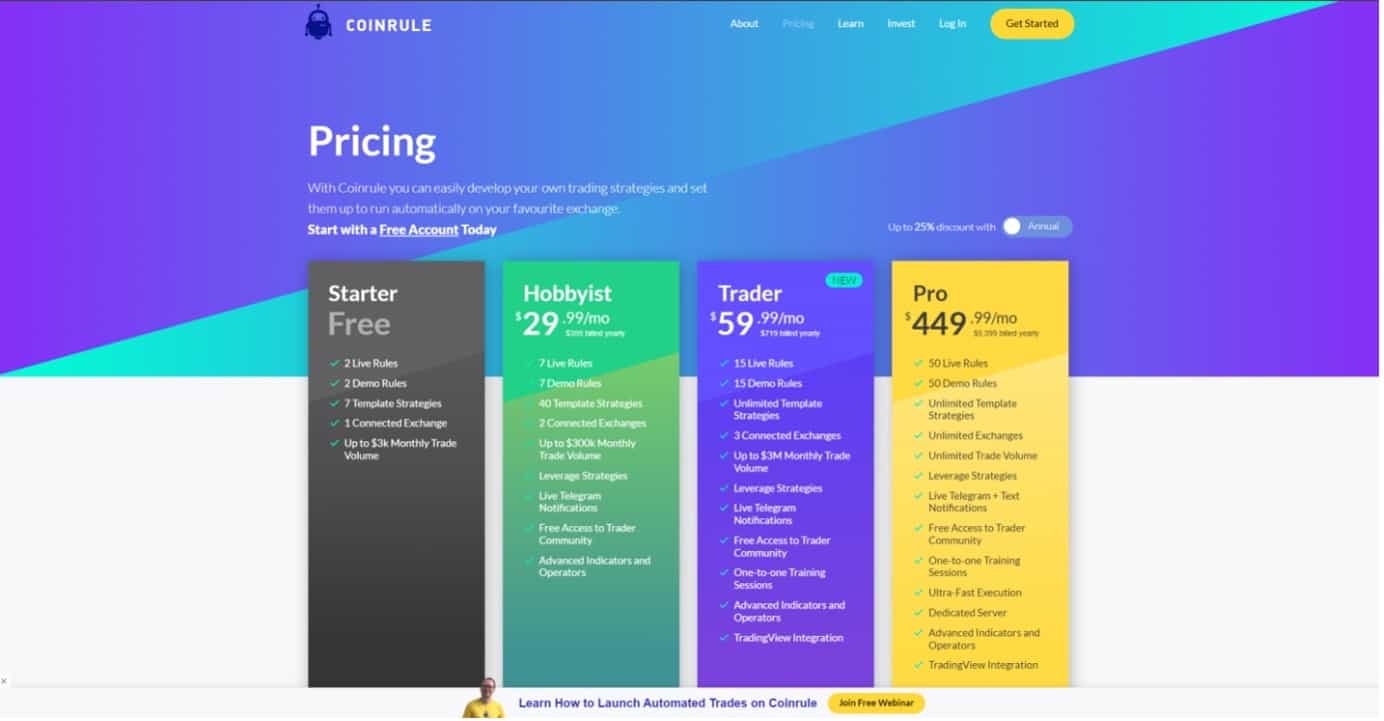

This automation isn’t just for whales or institutions. Today’s best crypto AI trading bots, like Cryptohopper, Coinrule, and Shrimpy, offer user-friendly dashboards, backtesting tools, and customizable strategies for anyone looking to level up their trading game (Coin Bureau).

The real revolution, though, is how these AI trading agents are making once-elite strategies accessible to a wider range of traders. Whether you’re a swing trader chasing micro-arbitrage across CEX/DEX pairs or a liquidity provider seeking to automate your market making, the barriers to entry are falling fast. With intuitive interfaces and plug-and-play integrations, bots like TradeSanta and HaasOnline let users deploy complex strategies with just a few clicks, while still offering granular controls for power users.

Of course, performance is always top of mind. The best AI trading agent performance in 2024 and beyond is measured not just by raw returns, but by risk-adjusted consistency. Bots are now leveraging reinforcement learning and adaptive algorithms to optimize their edge over time, learning from every tick of market data. That means strategies that continually self-improve, spotting new arbitrage patterns, adjusting to shifting liquidity, and even sidestepping emerging risks before they hit the mainstream radar.

Navigating the Challenges: Data, Latency, and Regulation

Yet, as with any technological leap, there are trade-offs. Data latency, especially when hopping between geographically distant exchanges, can erode otherwise razor-thin arbitrage margins. Overfitting remains a risk: bots trained on historical data may flounder when market regimes shift unexpectedly. And with regulators worldwide eyeing algorithmic trading more closely, compliance is now a non-negotiable part of deploying AI-driven strategies (NeuralArb).

Pro tip: Always vet your AI trading agent’s data sources and risk parameters before going live. Real-time monitoring and periodic strategy audits are essential for sustainable performance.

What’s Next for Automated Crypto Arbitrage?

Looking ahead, the convergence of on-chain analytics, cross-exchange interoperability, and real-time machine learning will take AI trading agents arbitrage to new frontiers. Imagine bots that not only exploit price gaps but also analyze mempool data to anticipate large trades before they hit the order book, or agents that coordinate across multiple wallets and protocols to optimize capital efficiency in DeFi yield strategies.

Emerging Trends in AI-Powered Crypto Trading

-

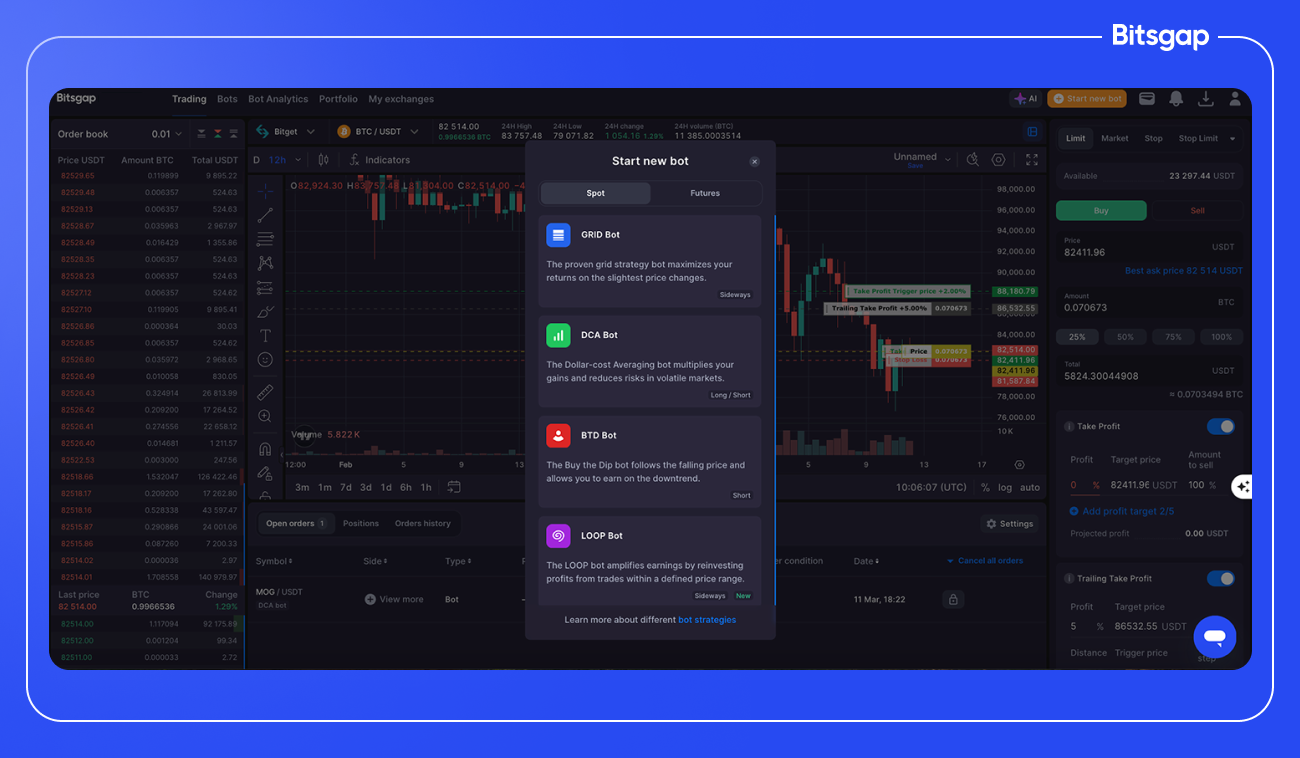

Integration of Multi-Exchange Arbitrage Bots: Platforms like Bitsgap Quantum are enabling AI agents to scan and execute arbitrage across dozens of centralized and decentralized exchanges, identifying thousands of opportunities in milliseconds.

-

Adaptive Market Making with AI: Leading bots such as Cryptohopper and Pionex are leveraging AI to dynamically adjust spreads, manage inventory, and respond to real-time volatility, enhancing liquidity and stability.

-

24/7 Autonomous Trading: AI trading agents like HaasOnline and TradeSanta operate continuously, ensuring opportunities are never missed—even during off-peak hours.

-

On-Chain Arbitrage and Analysis: Tools like ArbitrageScanner are expanding AI’s reach to on-chain data, scanning both centralized and decentralized exchanges for price discrepancies and actionable insights.

-

Regulatory-Aware AI Trading Systems: As compliance becomes critical, platforms are integrating AI modules to monitor and adjust trading activities in line with evolving global regulations, ensuring sustainable automation.

For traders and liquidity providers willing to experiment and iterate, the rewards are real. The key is to stay curious, keep your strategies nimble, and leverage the latest generation of AI tools without falling prey to hype cycles. Whether you’re deploying crypto market making bots or exploring automated crypto arbitrage strategies, the era of agentic DeFi is only just beginning, and those who adapt fastest will shape the new normal.