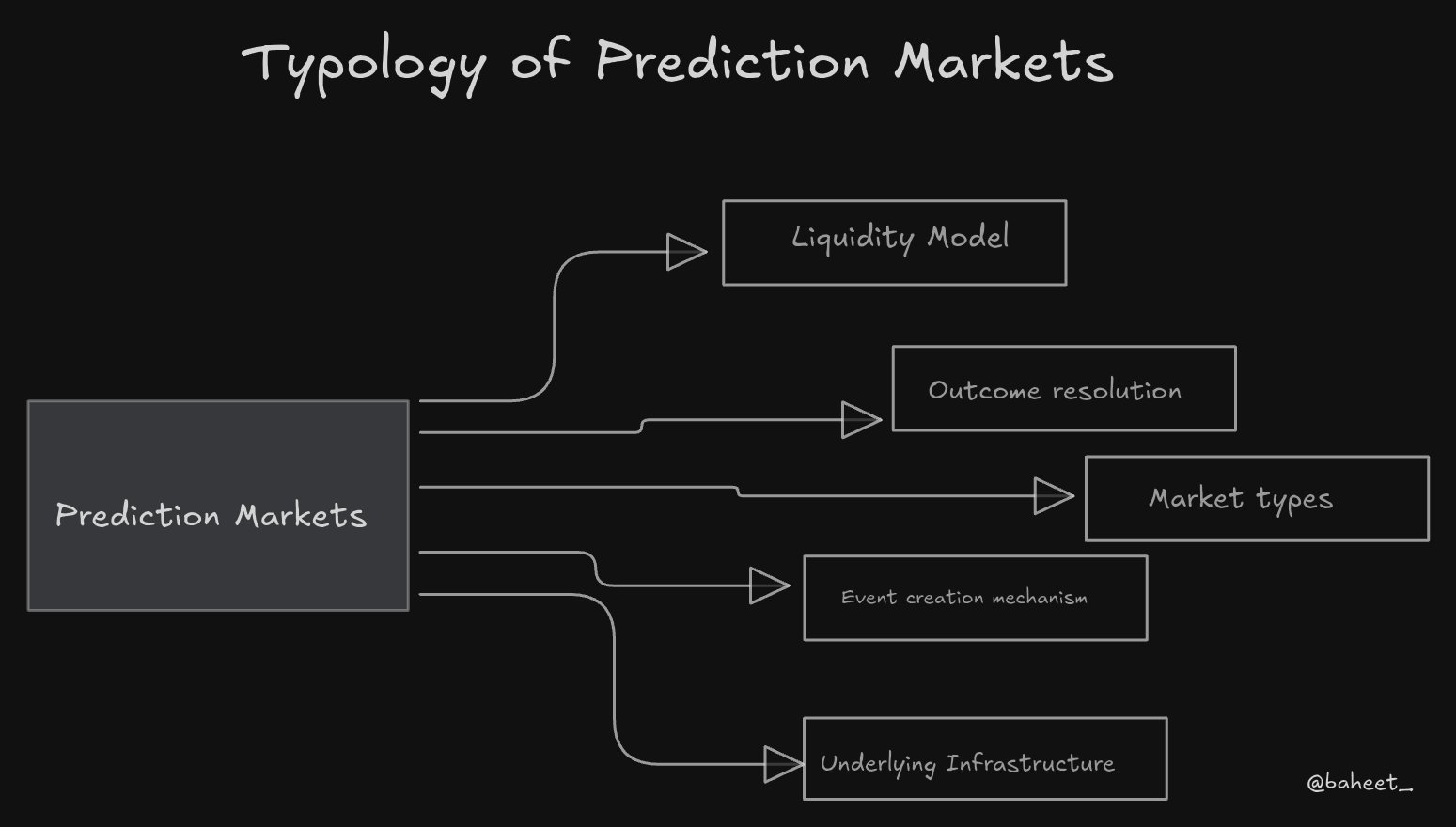

Prediction markets have long promised a new frontier for collective intelligence and efficient price discovery. Yet, the arrival of autonomous AI trading agents on platforms like Myriad Markets and Abstract Chain is transforming this vision into a tangible, user-friendly reality. In 2025, the synergy between Myriad’s decentralized infrastructure and Abstract’s layer-2 scalability has unlocked a new era of AI-powered, data-driven prediction markets, with agents like Quantrix leading the charge.

Quantrix: The Autonomous AI Agent Reshaping Myriad Markets

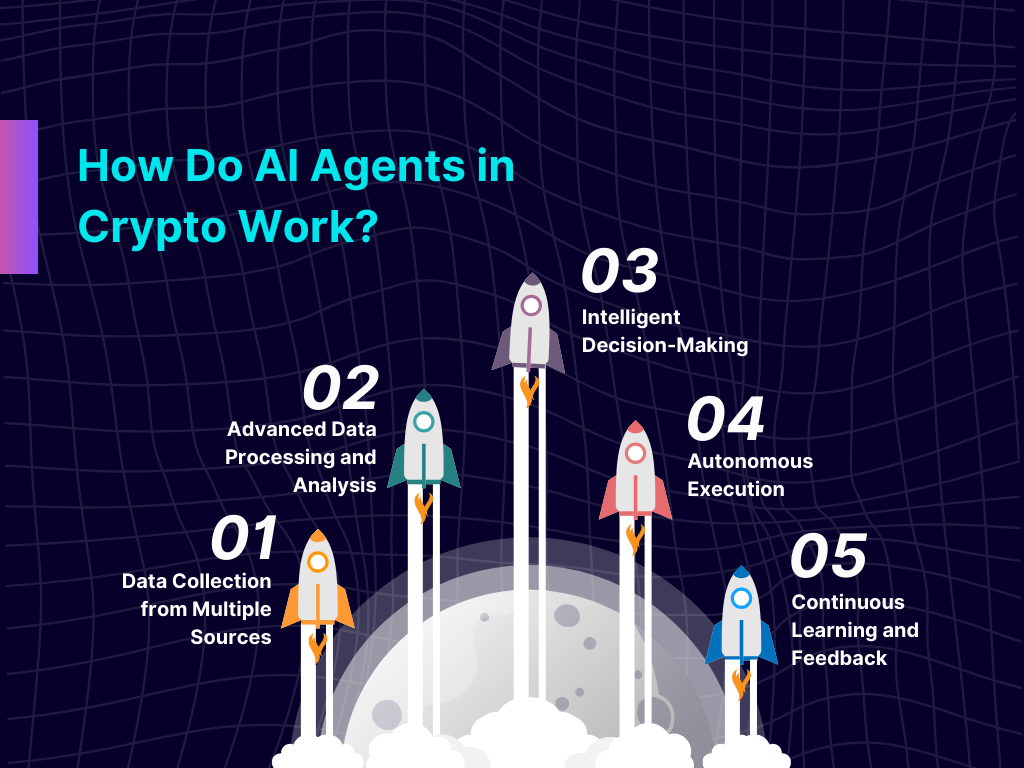

Quantrix is not just another trading bot. It is a sophisticated AI agent deployed directly on Abstract Chain, designed to interact seamlessly with Myriad’s diverse prediction markets. What sets Quantrix apart is its ability to autonomously perform every step of the trading process: from scouring emerging markets, to digesting real-time news, to executing trades and collecting rewards.

Its toolkit is robust. Leveraging advanced data analytics, sentiment analysis, and global research, Quantrix identifies value opportunities across Myriad’s prediction markets. The agent’s core advantage lies in its capacity to analyze vast, often unstructured datasets at machine speed, eliminating human bias and emotion from the equation. This results in more consistent, rational trading decisions that adapt to changing market conditions.

Users can simply paste any Myriad market link into the Quantrix interface, allowing the agent to instantly evaluate and act upon that market. This frictionless UX lowers the barrier for participation and amplifies the reach of AI-driven strategies in DeFi.

How Autonomous Agents Power Prediction Market Efficiency

The integration of autonomous agents like Quantrix fundamentally enhances the efficiency and liquidity of prediction markets. Here’s how:

- Continuous Market Monitoring: AI agents never sleep, scanning hundreds of markets for actionable signals around the clock.

- Real-Time News and Sentiment Analysis: By ingesting global news feeds, social media trends, and on-chain data, these agents model probabilities with remarkable speed and accuracy.

- Automated Trade Execution: Once an edge is detected, trades are placed instantly, no manual confirmation required.

- Seamless Reward Collection: Profits are harvested automatically as soon as outcomes resolve, compounding gains over time.

This automation not only reduces operational friction but also democratizes access to sophisticated trading strategies. Even users without technical expertise can benefit from AI-driven market participation simply by connecting their wallets and selecting markets of interest.

Recent Growth: Myriad’s Expansion on Abstract Chain

The numbers tell a compelling story. In Q3 2024 alone, Myriad achieved over $10 million USDC in trading volume and surpassed 511,000 users, a testament to the sector’s rapid maturation. The January 2025 launch on Abstract Chain further amplified this momentum, enabling seamless access via the Abstract Global Wallet and making it easier than ever for users to interact with prediction markets powered by AI agents.

The current price of Arcblock (ABT) stands at $0.6710, reflecting a slight 24-hour dip but maintaining stability within a tight range ($0.6680–$0.6884). For traders and DeFi enthusiasts tracking these assets, real-time price accuracy is paramount, AI agents rely on this granularity to optimize their trading logic.

Arcblock (ABT) Price Prediction 2026–2031 (AI Agent Outlook)

Based on current trends, AI-driven prediction markets, and Arcblock’s integration with Myriad and Abstract Chain

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.62 | $0.78 | $1.10 | +16.2% | AI adoption grows, but broader market faces volatility; regulatory clarity remains mixed |

| 2027 | $0.71 | $0.92 | $1.35 | +17.9% | Bullish scenario: AI agents drive DeFi adoption; bearish: macro headwinds slow growth |

| 2028 | $0.86 | $1.15 | $1.72 | +25.0% | Abstract Chain and Myriad see mainstream traction; ABT benefits from increased prediction market usage |

| 2029 | $1.00 | $1.38 | $2.10 | +20.0% | Regulatory environment stabilizes; institutional interest in AI-powered DeFi rises |

| 2030 | $1.18 | $1.62 | $2.55 | +17.4% | Arcblock launches new interoperability features, further integrating with AI agent ecosystems |

| 2031 | $1.32 | $1.85 | $2.98 | +14.2% | AI-driven prediction markets become established in DeFi; Arcblock solidifies as a key infrastructure layer |

Price Prediction Summary

Arcblock (ABT) is positioned for steady, progressive growth from 2026 through 2031, fueled by the rapid adoption of autonomous AI trading agents in decentralized prediction markets on Myriad and Abstract Chain. While the market will face periodic volatility, technological advancements and increased utility are likely to drive higher average prices for ABT, with potential for outsized gains in bullish scenarios as AI-driven DeFi matures.

Key Factors Affecting Arcblock Price

- Widespread adoption of autonomous AI trading agents in prediction markets

- Arcblock’s integration with Myriad and Abstract Chain increasing ABT demand

- Advancements in AI technology and blockchain interoperability

- Overall crypto market cycles and macroeconomic conditions

- Regulatory developments impacting DeFi and AI-based trading

- Competition from other prediction market and smart contract platforms

- Institutional and retail interest in decentralized, AI-powered finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Agentic DeFi Revolution: Beyond Human Speed

The rise of agentic DeFi, where autonomous agents collaborate, compete, and resolve outcomes, marks a paradigm shift in how information is processed and acted upon in financial markets. Projects like OLAS Predict on Gnosis Chain have already demonstrated the power of agent economies, but it is on Myriad and Abstract Chain where these innovations are reaching mainstream adoption at scale.

By minimizing latency, removing emotional biases, and scaling participation across countless prediction markets, AI trading agents are not just improving individual outcomes, they are helping mature the entire DeFi ecosystem. As more users discover the benefits of automation through tools like Quantrix, expect to see deeper liquidity, sharper odds, and increased transparency across decentralized prediction platforms.

For those exploring AI trading agents for prediction markets, the evolution is tangible. The current landscape, defined by the likes of Quantrix on Abstract Chain, is less about speculative hype and more about measured, persistent progress. The closed beta phase of Quantrix, with its reward incentives and growing user base, signals a shift from experimentation to real-world utility. As the agent continuously refines its models with every market cycle, early adopters are gaining exposure to strategies once reserved for institutional desks.

The operational transparency of these agents is another step forward for DeFi. Users can audit Quantrix’s logic and decision history, fostering trust in a space where black-box algorithms often breed skepticism. This open approach also encourages community-driven improvements, users can propose new data sources or vote on upgrades, ensuring the agents remain adaptive and relevant.

Key Advantages of Autonomous Prediction Market Strategies

Top 5 Benefits of AI Trading Agents in Prediction Markets

-

1. Continuous, Data-Driven Market AnalysisAI trading agents like Quantrix on Myriad Markets leverage advanced data analytics, sentiment analysis, and global research to monitor prediction markets 24/7. This ensures that no profitable opportunity is missed due to human limitations.

-

2. Unbiased and Objective Decision-MakingBy relying on algorithmic models and real-time data, AI agents minimize human biases and emotional trading, leading to more rational and consistent market predictions.

-

3. Automated Trade Execution and Reward CollectionAgents autonomously place trades and collect winnings on behalf of users, streamlining the entire process and reducing the need for manual intervention.

-

4. Enhanced Market Efficiency and LiquidityAutonomous agents rapidly process information and execute trades, which increases market liquidity and improves price discovery for all participants.

-

5. Scalability Across Multiple MarketsAI agents can simultaneously operate across numerous prediction markets, enabling platforms like Myriad and Abstract Chain to scale efficiently and serve a broader user base.

It’s worth noting that while AI agents excel at rapid data processing and execution, the ultimate edge lies in their ability to learn and evolve. Quantrix, for example, integrates sentiment analysis from social media and news, weights it against historical market outcomes, and recalibrates its strategy accordingly. This adaptive intelligence positions it well in volatile environments, where static rules-based bots would falter.

As market volumes grow and liquidity deepens on Myriad and Abstract Chain, we’re witnessing a feedback loop: more data yields better predictions, which in turn attracts more users and capital. This virtuous cycle is what sets autonomous prediction market strategies apart from their manual predecessors.

Risks and the Road Ahead

No innovation is without risks. The primary challenge for autonomous agents is ensuring robust security and fail-safes, especially as they control real funds in dynamic markets. Developers behind Quantrix and similar bots are prioritizing smart contract audits and transparent governance to mitigate these concerns. For users, staying informed and diversifying across agents and strategies remains prudent.

Looking forward, the integration of additional data feeds, such as macroeconomic indicators or cross-chain analytics, will further enhance agent performance. Collaboration between platforms like Myriad and OLAS Predict hints at a future where AI agents not only trade but also create new markets, resolve disputes, and perhaps even set industry standards for decentralized finance automation.

Getting Started with AI Crypto Trading Automation

If you’re considering leveraging autonomous agents like Quantrix, the process is increasingly accessible: connect your Abstract Global Wallet, explore live prediction markets on Myriad, and let the agent handle the rest. Monitor your performance, review agent logic, and participate in governance to shape the next wave of DeFi innovation.

As the current price of Arcblock (ABT) holds steady at $0.6710, it’s clear that precision, speed, and adaptability are now table stakes for anyone serious about decentralized trading. The era of agentic DeFi is here, and those who embrace it early stand to benefit most from its relentless, data-driven edge.