In the rapidly evolving world of decentralized finance, AI trading agents are no longer theoretical. They are actively reshaping the mechanics of automated yield farming, promising smarter capital allocation and hands-off DeFi participation. With Ethereum (ETH) currently priced at $4,190.91, and protocols like Aave ($274.61), Compound ($41.37), and yearn. finance ($5,297.17) forming the backbone of yield strategies, the stakes for optimizing returns have never been higher.

From Manual Yield Hopping to Autonomous Agents

Traditional yield farming required users to constantly monitor APYs across protocols, manually migrate funds, and stay vigilant against smart contract vulnerabilities or shifting market dynamics. This approach was not just time-consuming; it was also inefficient for most retail participants and highly error-prone. The emergence of AI-powered DeFi automation is upending this paradigm.

Platforms like Yay-Agent by Yala, dForce’s AI yield aggregators, and Infinit Labs’ One-Click Agentic DeFi are at the forefront of this shift. They use machine learning models to process on-chain data in real time, dynamically reallocate assets across pools based on risk-adjusted returns, and even simulate outcomes before executing transactions.

The Mechanics: How AI Agents Optimize Yield Farming

The core advantage of these agentic DeFi tools is their ability to ingest massive streams of protocol data, APYs, liquidity flows, volatility indices, and synthesize actionable strategies without human bias or fatigue.

Top AI Yield Farming Agents in 2025

-

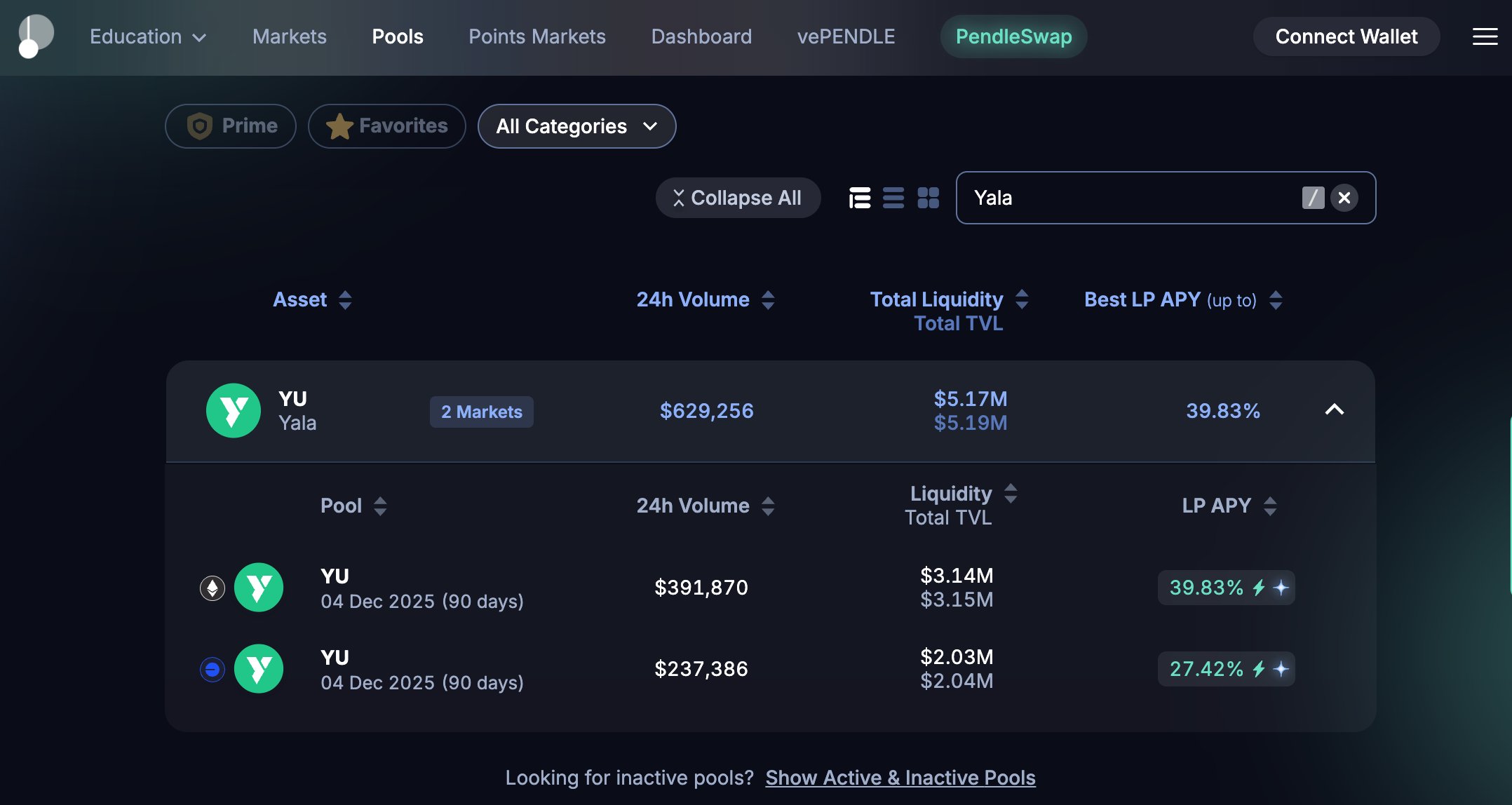

Yay-Agent by Yala: Built on Coinbase’s AgentKit and powered by Deepseek, Yay-Agent enables users to optimize yield farming through a chat interface. It delivers real-time on-chain data analysis, personalized risk management, and cross-chain asset management for streamlined DeFi participation.

-

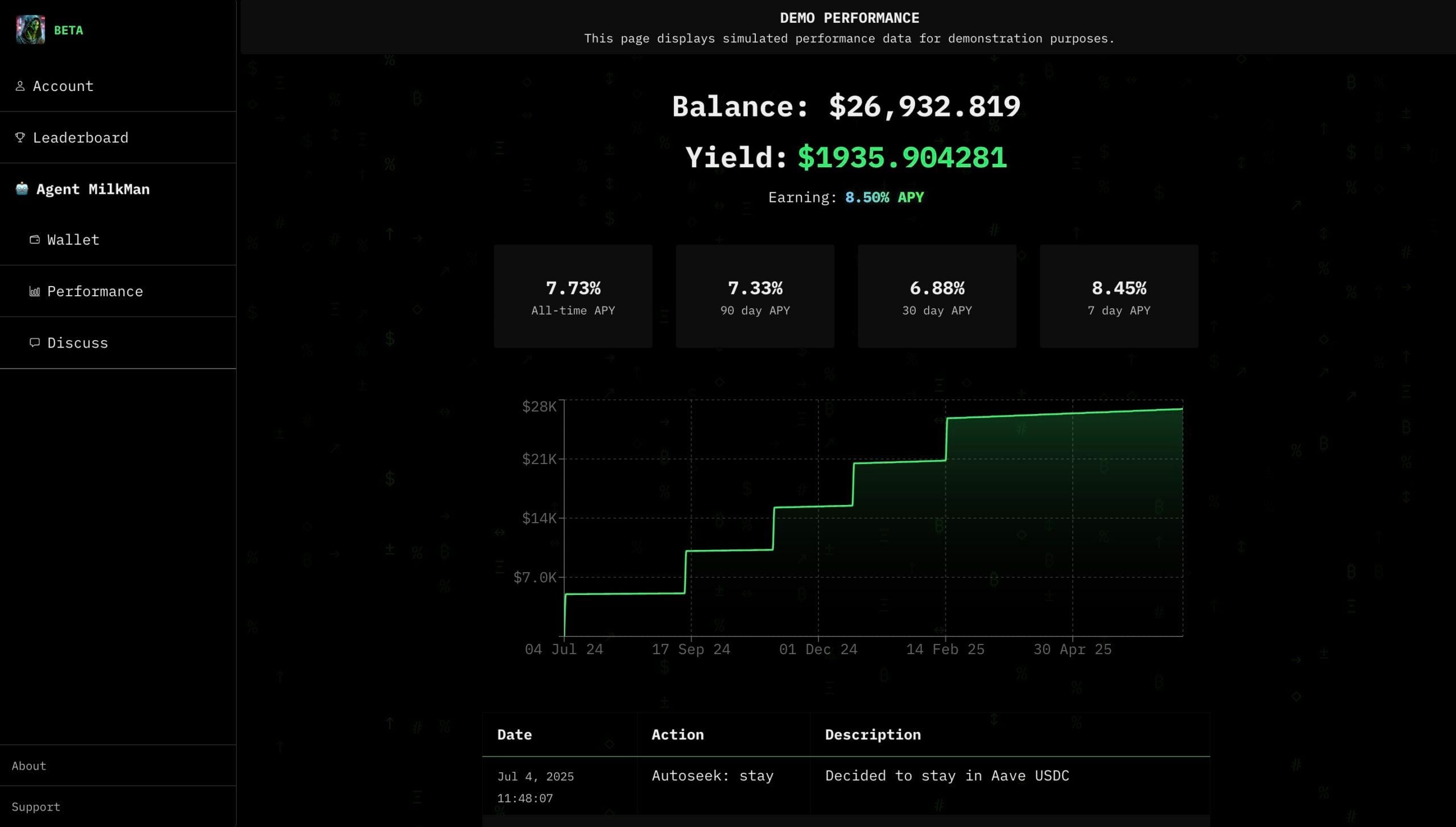

Yield Seeker: This AI agent continuously scans DeFi protocols to find the best stablecoin yields. It automates portfolio management, reallocates funds in real time, and offers risk-adjusted strategies for effortless yield generation.

-

dForce AI Yield Aggregators: dForce’s AI-driven agents autonomously optimize yield farming by analyzing on-chain and off-chain signals. They execute dynamic strategies through smart contracts and improve over time via continuous learning.

-

yearn.finance (YFI) Smart Strategies: Yearn Finance employs AI algorithms to automate yield farming, dynamically reallocating assets for optimal returns. As of September 30, 2025, YFI trades at $5,297.17 (down $107.84, or 1.99%).

-

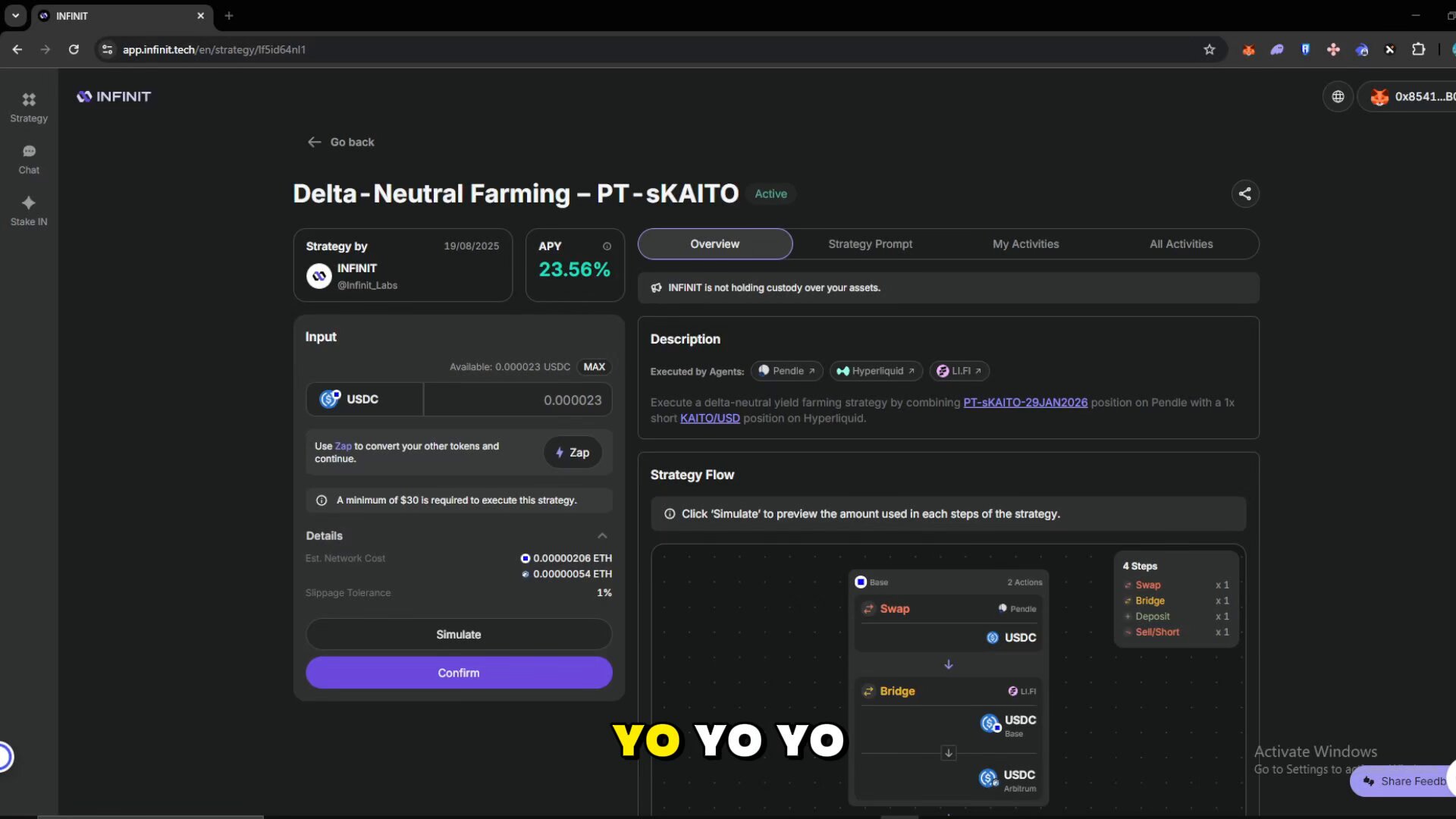

INFINIT One-Click Agentic DeFi: INFINIT leverages specialized AI agents to simplify DeFi strategies. Its latest launch, One-Click Agentic DeFi, allows users to discover, evaluate, and execute transactions across multiple protocols with minimal input.

- Yay-Agent (Yala): Built on Coinbase’s AgentKit framework with Deepseek LLMs, this bot offers a chat-based interface for exploring scenarios and making allocations across multiple blockchains. It factors in user-specific risk tolerances and provides continuous on-chain monitoring.

- Yield Seeker: Designed for stablecoin maximization, it scans hundreds of pools autonomously to identify best-in-class yields while actively managing exposure to impermanent loss or protocol exploits.

- dForce AI Aggregators: These agents leverage both on-chain events (like liquidity migrations) and off-chain sentiment or macro data to formulate dynamic portfolio strategies, learning from each cycle to refine future decisions.

- Infinit Labs One-Click Agents: By abstracting away strategy complexity into a single click, Infinit’s solution democratizes access to sophisticated DeFi opportunities previously reserved for power users or quant teams.

(Read more)

The Real Benefits, and Persistent Skepticism

The promise here is clear: Efficiency gains, round-the-clock execution (no sleep required), and a level playing field for non-technical users. In reality, these agents do deliver measurable improvements in risk-adjusted yields versus manual management, especially as they can react instantly to flash loan attacks or sudden APY spikes that human farmers would likely miss.

Ethereum (ETH), Aave (AAVE), and Compound (COMP) Price Predictions 2026-2031

Professional outlook for DeFi assets in the era of AI-driven yield farming (2026-2031)

| Year | Asset | Minimum Price | Average Price | Maximum Price | % Change vs 2025 (Avg) | Scenario Insight |

|---|---|---|---|---|---|---|

| 2026 | ETH | $3,700.00 | $4,550.00 | $5,300.00 | +8.6% | Continued AI integration boosts DeFi activity; moderate bull cycle |

| 2026 | AAVE | $230.00 | $290.00 | $340.00 | +5.6% | Steady growth with DeFi lending platforms seeing increased automation |

| 2026 | COMP | $34.00 | $46.00 | $59.00 | +11.2% | AI yield optimization attracts new users, offset by market volatility |

| 2027 | ETH | $4,200.00 | $5,200.00 | $6,200.00 | +23.9% | Mainstream AI adoption in DeFi; ETH benefits from protocol upgrades |

| 2027 | AAVE | $250.00 | $325.00 | $400.00 | +18.4% | AAVE launches new AI-powered features, increasing TVL |

| 2027 | COMP | $37.00 | $53.00 | $68.00 | +28.2% | Compound expands integrations, but faces new competition |

| 2028 | ETH | $4,700.00 | $5,950.00 | $7,250.00 | +42.0% | Bullish phase driven by ETH 3.0 and wider DeFi adoption |

| 2028 | AAVE | $270.00 | $370.00 | $440.00 | +34.7% | AAVE cements leadership in decentralized lending |

| 2028 | COMP | $40.00 | $60.00 | $80.00 | +45.1% | AI-driven governance reforms attract institutional participation |

| 2029 | ETH | $5,300.00 | $6,800.00 | $8,500.00 | +62.3% | Peak of DeFi/AI synergy; possible regulatory clarity fuels growth |

| 2029 | AAVE | $300.00 | $430.00 | $540.00 | +56.6% | AAVE integrates cross-chain AI agents; market expansion |

| 2029 | COMP | $44.00 | $70.00 | $95.00 | +69.2% | COMP sees resurgence as DeFi composability improves |

| 2030 | ETH | $4,800.00 | $6,000.00 | $7,800.00 | +43.2% | Potential market correction; consolidation after rapid growth |

| 2030 | AAVE | $260.00 | $400.00 | $480.00 | +45.7% | AAVE weathers volatility, retains strong user base |

| 2030 | COMP | $38.00 | $62.00 | $85.00 | +49.9% | Market correction impacts COMP, but fundamentals remain sound |

| 2031 | ETH | $5,200.00 | $6,900.00 | $8,600.00 | +64.6% | Long-term uptrend resumes as DeFi matures |

| 2031 | AAVE | $300.00 | $450.00 | $560.00 | +63.9% | AAVE evolves with AI-powered risk management tools |

| 2031 | COMP | $46.00 | $75.00 | $105.00 | +81.3% | COMP innovates in AI-governed lending protocols |

Price Prediction Summary

Ethereum, Aave, and Compound are positioned for significant growth over the next six years, driven by the integration of AI agents into DeFi yield farming and broader protocol enhancements. Prices are expected to trend upward, with periods of both bullish expansion and healthy corrections. Average price increases from 2025 to 2031 are projected at 64.6% for ETH, 63.9% for AAVE, and 81.3% for COMP, reflecting both the potential and volatility of the sector.

Key Factors Affecting Ethereum Price

- Rapid adoption of AI-powered DeFi protocols and yield farming strategies

- Continued technical upgrades to Ethereum and DeFi protocols

- Growing institutional and retail participation in DeFi

- Regulatory developments impacting DeFi and AI integration

- Market cycles typical to crypto assets (bull/bear phases)

- Expansion of cross-chain and multi-chain DeFi solutions

- Emergence of competing protocols and innovations in yield optimization

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Skeptics will point out that full autonomy brings new risks: model overfitting to historical data (yielding poor performance during regime shifts), black-box decision logic that’s hard to audit on-chain, and potential centralization around a handful of dominant agent frameworks. As always in crypto markets: trust the math, but verify the assumptions baked into each algorithmic agent.

A Snapshot of 2025’s Leading AI Yield Tools

The numbers speak volumes: dForce’s AI aggregators alone have captured over $20 million in TVL since launch (source). Rhea Finance is collaborating with Fraction Ai to blend trading automation with agentic DeFi infrastructure, a move echoed by Infinit Labs’ push toward seamless cross-protocol execution (details here). The landscape is moving fast; only robust backtesting and transparent reporting will separate sustainable innovation from fleeting hype.

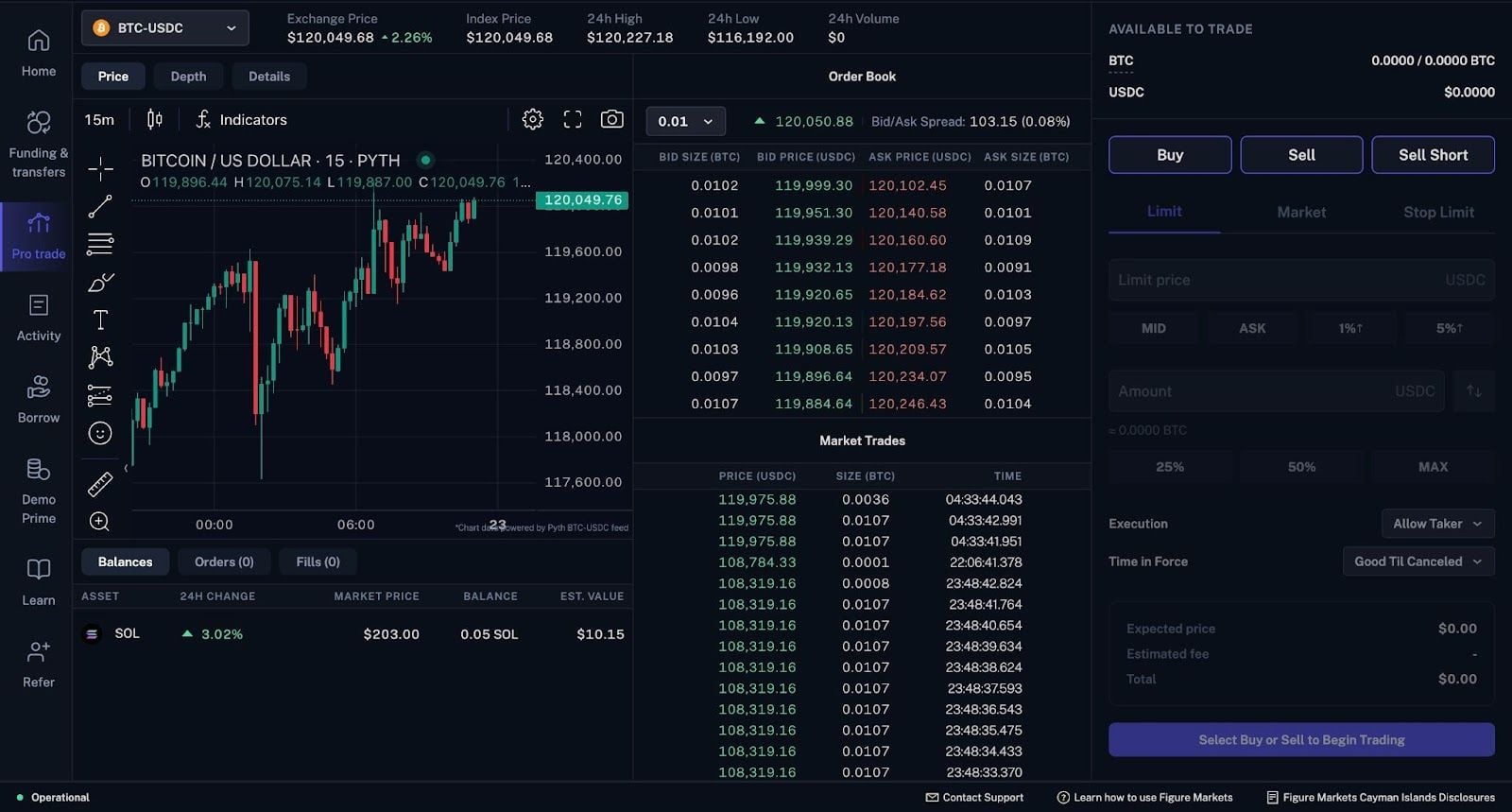

Yet, while the hype around autonomous crypto portfolio management is justified by clear efficiency gains, it is crucial to scrutinize the underlying mechanics and risk models. AI agents are not immune to systemic shocks or smart contract exploits. The recent market volatility, with Ethereum (ETH) at $4,190.91, Aave holding at $274.61, Compound at $41.37, and yearn. finance at $5,297.17, underscores how quickly DeFi environments can shift, testing even the most sophisticated algorithms.

Transparency and auditability remain sticking points for institutional adoption. While platforms like dForce and Yay-Agent tout continuous learning and adaptation, most users lack the tools or expertise to verify if these agents are truly maximizing returns net of gas fees, slippage, and risk exposure. For those considering deploying capital into these systems, insist on open-source codebases or third-party audits wherever possible.

What Sets 2025’s Agentic DeFi Tools Apart?

This new generation of AI DeFi tools differentiates itself by offering:

Top AI Yield Farming Agents Outperforming in 2025

-

INFINIT One-Click Agentic DeFi: INFINIT’s platform leverages specialized AI agents to automate yield farming across protocols, offering a seamless, one-click experience. Its agents analyze real-time market data, execute optimal strategies, and rebalance portfolios autonomously—outpacing manual approaches in both speed and efficiency.

-

Yay-Agent by Yala: Built on Coinbase’s AgentKit and powered by Deepseek, Yay-Agent enables users to optimize yield farming through a conversational interface. It delivers real-time on-chain analytics, cross-chain asset management, and personalized risk controls, resulting in consistently higher yields compared to static, manual strategies.

-

Yield Seeker: This AI-powered agent continuously scans DeFi protocols to identify top stablecoin yields, reallocates funds according to market shifts, and applies risk-adjusted strategies. Its automated, data-driven approach reduces human error and maximizes returns, making it a strong outperformer in 2025’s competitive landscape.

-

dForce AI Yield Aggregators: dForce’s AI agents autonomously optimize yield farming by analyzing both on-chain and off-chain signals. Their dynamic strategy formulation and continuous learning capabilities enable superior performance and adaptability, offering a hands-off, high-efficiency solution for yield optimization.

-

yearn.finance (YFI) AI Algorithms: yearn.finance integrates AI-driven algorithms to automate asset allocation and yield optimization. By dynamically reallocating assets based on evolving market conditions, yearn.finance’s strategies have remained competitive, with YFI trading at $5,297.17 as of September 30, 2025.

- Real-time composability: Agents can seamlessly move funds across protocols like Aave and Compound as soon as better yields emerge.

- Personalized optimization: User profiles allow for custom risk tolerances and asset preferences, something manual farmers rarely achieve at scale.

- Cross-chain execution: Infinit Labs’ One-Click Agents now support multi-chain strategies without manual bridging or swaps (see their launch details).

- Continuous monitoring: Automated alerts for protocol exploits or governance changes help mitigate tail risks proactively.

The integration of AI agents in DeFi isn’t just about chasing higher APYs; it’s about building resilient, adaptive portfolios that can weather both bull runs and black swan events with minimal intervention.

Looking Ahead: Caution Meets Innovation

The next phase will likely see deeper integrations between agentic frameworks (like those developed by Rhea Finance in partnership with Fraction Ai) and on-chain insurance protocols, further hedging systemic risk while pushing yield optimization to new heights. However, as TVL grows and more capital flows through these black-box agents, expect increased scrutiny from both regulators and white-hat auditors. The temptation to blindly trust automation is strong; resisting it requires a commitment to transparency, robust backtesting, and ongoing due diligence.

If you’re considering deploying funds into an AI-driven yield aggregator or experimenting with Infinit Labs agents for automated DeFi strategies, start small, and monitor performance versus your own benchmarks. Remember: in agentic DeFi as in all trading, edge comes from understanding both the math behind the model and the assumptions that could break it in a crisis.