DeFi is evolving at warp speed, but for most users, the complexity of yield farming, cross-chain swaps, and risk management can feel like piloting a starship without a manual. Enter Infinit Labs’ AI agents: a curated swarm of intelligent bots built to automate decentralized finance across multiple blockchains, no code, no sleepless nights, no missed opportunities. With Ethereum (ETH) currently trading at $4,119.77, the stakes for efficient portfolio management have never been higher.

Agentic DeFi Automation: The Rise of Specialized AI Agents

The heart of Infinit Labs’ innovation is its Agent Swarm: over 20 specialized AI agents working in concert to streamline DeFi from research to execution. But three core agents stand out as the pillars of automated portfolio management: Yield Agent, Insight Agent, and Mindshare Agent. Each one tackles a distinct challenge in DeFi, yield optimization, market data analysis, and sentiment tracking, empowering users to act with precision across chains.

Meet Infinit Labs’ Core AI Agents for DeFi Automation

-

Yield Agent: Automates yield farming and asset optimization across multiple chains. This agent continuously scans DeFi protocols to identify the best yield opportunities for your portfolio, reallocating assets to maximize returns—all while keeping your assets non-custodial and under your control.

-

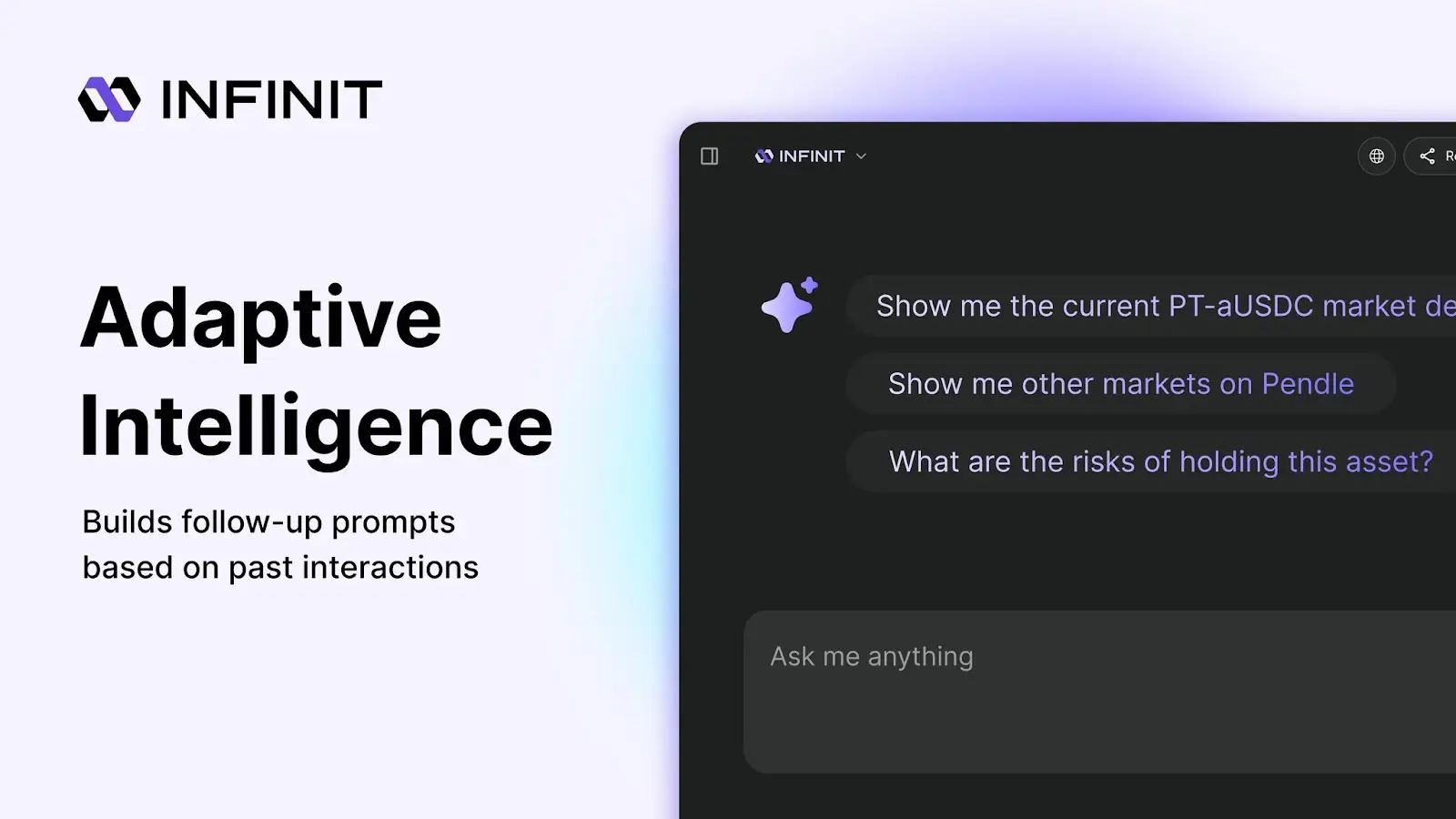

Insight Agent: Delivers real-time, cross-chain analytics and actionable insights. The Insight Agent analyzes on-chain data, market trends, and your portfolio’s performance to recommend strategies tailored to your risk profile and goals, simplifying complex DeFi decisions with AI-powered clarity.

-

Mindshare Agent: Tracks sentiment and emerging trends across the DeFi ecosystem. Mindshare Agent aggregates social signals, research, and community sentiment to inform users of new opportunities and risks, helping you stay ahead in the fast-moving DeFi landscape.

Yield Agent: Automating DeFi Yield Optimization Across Chains

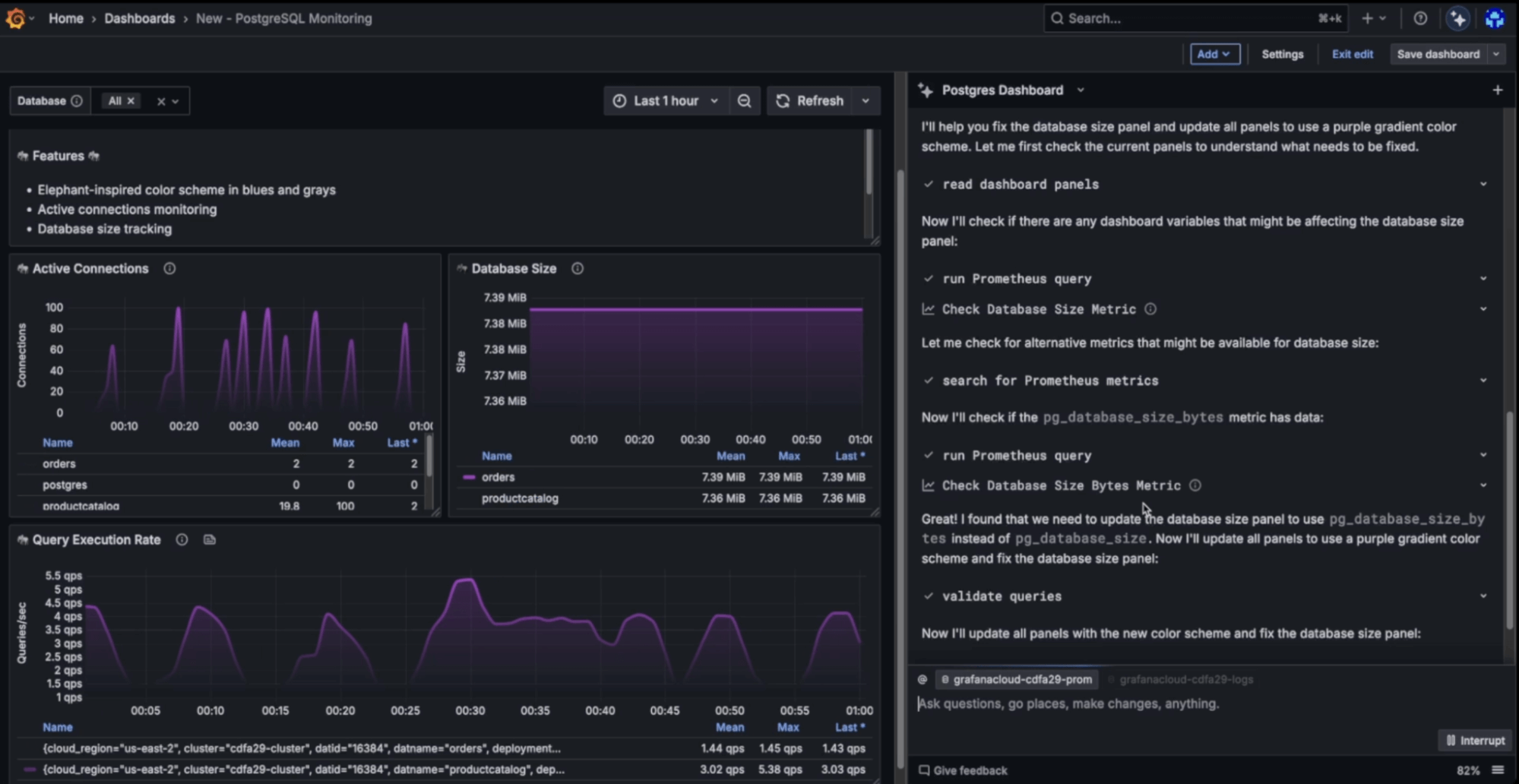

The first stop on our tour is the Yield Agent. This AI-driven assistant scours protocols across Ethereum, Arbitrum, Base, Solana, Mantle, BNB Smart Chain, Optimism, and Sonic, surfacing the highest-yield opportunities tailored to your wallet’s holdings and risk appetite. Imagine asking your dashboard: “How do I earn $1,000 per month on my 1 BTC?” The Yield Agent analyzes current APYs, liquidity conditions, gas fees, even protocol-specific risks, and presents a personalized strategy that you can execute in one click.

No more spreadsheet gymnastics or hopping between dApps. The Yield Agent bundles all steps, from swapping assets to staking or providing liquidity, into a single transaction thanks to technologies like ERC-4337 and EIP-7702. You keep full custody of your assets throughout; all actions are signed directly from your wallet for maximum security.

The result? DeFi yield optimization with institutional-grade automation but total user control, a game-changer for anyone tired of micromanaging farms or missing out on cross-chain opportunities.

Insight Agent: Cross-Chain Market Intelligence Without the Noise

If alpha is your goal but information overload is your enemy, the Insight Agent will be your new best friend. This agent continuously ingests on-chain data from every supported network and distills it into actionable insights tailored to your portfolio. Whether you’re tracking ETH’s move above $4,100 or monitoring liquidity shifts on Solana or Base, Insight Agent highlights trends that matter, and filters out the rest.

The magic lies in context-aware recommendations. Instead of generic alerts (“ETH up 3%!”), Insight Agent might flag an arbitrage window between Arbitrum and Optimism LPs or suggest rebalancing based on emerging protocol incentives, all mapped specifically to your current positions and goals.

Mindshare Agent: Harnessing Market Sentiment for Smarter Moves

No DeFi strategy is complete without understanding crowd psychology, and that’s where the Mindshare Agent shines. By aggregating sentiment signals from social feeds (think Crypto Twitter), governance forums, Discords, even on-chain voting patterns, the Mindshare Agent gives you an edge in anticipating market moves before they hit price charts.

This agent doesn’t just regurgitate trending hashtags; it quantifies sentiment shifts around specific protocols or tokens relevant to your holdings. Planning a move into a new farm? Mindshare might warn you if negative buzz is building around its smart contract audit, or spotlight when influential KOLs are accumulating positions you’re eyeing.

Ethereum (ETH) & Infinit Labs (IN) Price Prediction Table (2026-2031)

Professional outlook based on AI-driven DeFi adoption, market cycles, and technological innovation

| Year | ETH Min Price | ETH Avg Price | ETH Max Price | IN Min Price | IN Avg Price | IN Max Price | Key Insights |

|---|---|---|---|---|---|---|---|

| 2026 | $3,500 | $4,400 | $5,600 | $1.10 | $1.80 | $3.20 | ETH consolidates around new DeFi AI utility; IN sees initial post-launch volatility |

| 2027 | $3,900 | $5,100 | $6,900 | $1.35 | $2.30 | $4.10 | DeFi AI mainstreaming boosts both assets; regulatory clarity improves sentiment |

| 2028 | $4,200 | $5,850 | $8,200 | $1.60 | $2.80 | $5.00 | ETH demand rises on cross-chain DeFi; IN adoption grows with new features |

| 2029 | $4,000 | $6,700 | $9,800 | $1.95 | $3.50 | $6.20 | Possible market correction year; robust AI DeFi usage supports recovery |

| 2030 | $4,600 | $7,800 | $11,200 | $2.30 | $4.20 | $7.50 | Next crypto cycle peak; ETH and IN benefit from global DeFi expansion |

| 2031 | $5,200 | $8,900 | $13,500 | $2.80 | $5.10 | $9.00 | Sustained AI DeFi adoption and network effects drive growth |

Price Prediction Summary

Ethereum is projected to benefit from ongoing AI-driven DeFi innovation, with Infinit Labs’ IN token emerging as a key protocol asset. Both assets show progressive growth, with price volatility reflecting crypto market cycles, regulatory shifts, and adoption rates. ETH maintains its leading smart contract platform status, while IN’s value is closely tied to successful AI DeFi agent adoption.

Key Factors Affecting Ethereum Price

- Adoption of AI-powered DeFi solutions and cross-chain interoperability

- Ethereum network upgrades (e.g., scaling, new EIPs)

- Regulatory landscape for DeFi and AI technologies

- Competition from other L1/L2s and DeFi platforms

- Macroeconomic conditions affecting risk assets

- Infinit Labs’ ability to drive user and developer engagement

- Tokenomics and incentive structures for IN holders

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Together these three agents form an interconnected toolkit for next-level AI portfolio management in DeFi, automating research, execution, and risk monitoring across every major chain while keeping users firmly in control of their assets.

Learn more about Infinit Labs’ key features here.

With Infinit Labs’ agentic DeFi automation, you’re not just delegating tasks, you’re orchestrating a symphony of AI-driven insights, yield optimization, and real-time sentiment tracking. The synergy between Yield Agent, Insight Agent, and Mindshare Agent is where the platform’s true power emerges. Let’s explore how these agents work together to create an adaptive, self-improving DeFi portfolio experience.

Seamless Coordination: How The Agents Interact for Maximum Impact

What sets Infinit Labs apart is the interoperability of its agents. For example, the Yield Agent might identify a high-APY opportunity on Solana just as the Insight Agent flags an impending liquidity migration from Ethereum to Base. Meanwhile, Mindshare Agent detects surging positive sentiment around a protocol’s upgrade, providing a holistic picture that would take hours (if not days) for a human to assemble.

This cross-agent collaboration means you’re never acting on isolated data points. Instead, your strategies are dynamically updated as new market intelligence and sentiment signals emerge, without you lifting a finger or moving assets off your wallet.

One-Click Strategy Deployment: From Idea to Execution in Seconds

The real magic happens when all three agents feed into Infinit Labs’ signature one-click execution pipeline. Let’s say you want to rebalance into ETH after it surges past $4,100 (now at $4,119.77) while capturing yield on Base and avoiding protocols with negative buzz. The platform bundles every step, swap, stake, LP migration, into a single transaction that you approve from your wallet. No copying contract addresses or worrying about bridge exploits.

This streamlined flow is powered by advanced smart contract standards like ERC-4337 and EIP-7702. You retain non-custodial control at every step; assets never leave your possession unless you sign off on the exact strategy recommended by your personal AI agent swarm.

Creator-Based Ecosystem: Monetize Your Edge

Infinit Labs doesn’t just automate, it incentivizes expertise. Power users can design custom strategies leveraging Yield, Insight, and Mindshare Agents and publish them for others to use. When someone deploys your strategy through the platform’s one-click interface, you earn a share of execution fees, a model that rewards both innovation and community engagement. This opens up new income streams for researchers and KOLs while democratizing access to elite-level DeFi tactics.

Infinit Labs’ Core AI Agents Powering DeFi Creators

-

Yield Agent: Empowers creators to design and automate high-performance yield strategies across multiple blockchains. Creators earn a share of execution fees every time users deploy their strategies, turning expertise into a revenue stream.

-

Insight Agent: Analyzes real-time, cross-chain DeFi market data to surface actionable intelligence. Strategy creators monetize by publishing timely research and analytics, helping users make smarter moves while earning rewards for their insights.

-

Mindshare Agent: Tracks on-chain sentiment and social signals to inform trading and portfolio decisions. Creators can monetize sentiment-driven strategies, earning fees as users tap into crowd wisdom for their DeFi portfolios.

What’s Next? The Future of AI Portfolio Management in DeFi

As Ethereum continues its ascent above $4,100 (current price: $4,119.77) and cross-chain activity heats up across Arbitrum, Solana, Mantle and more, the need for intelligent automation only grows more urgent. With Infinit Labs’ AI agents at your side (and in your wallet), you’re equipped not just to keep pace but to capitalize ahead of the curve.

The days of fragmented dashboards and manual rebalancing are numbered. Whether you’re optimizing yield with precision timing via Yield Agent, outmaneuvering volatility using Insight Agent’s cross-chain analytics or riding early sentiment waves courtesy of Mindshare Agent, you now have an edge previously reserved for institutional desks.

If you’re ready to transform how you manage crypto portfolios across chains with agentic DeFi automation, and want transparency plus total asset sovereignty, Infinit Labs is worth exploring further.

Discover more about how these AI agents can reshape your DeFi experience here.